The Financial KPI Dashboard Excel Template for Small Business provides an intuitive way to track key financial metrics such as revenue, expenses, and profit margins. This customizable template allows business owners to visualize cash flow trends and monitor financial health with clear charts and tables. It simplifies data analysis, helping small businesses make informed decisions and improve overall financial performance.

Revenue Growth Tracker Excel Template

Revenue Growth Tracker Excel Template is a powerful tool designed to monitor and analyze the increase in a company's income over specific periods. This

template enables businesses to visualize trends, set financial goals, and identify areas for improvement by consolidating sales data into intuitive charts and reports. Using this document helps optimize decision-making and supports strategic planning to drive consistent revenue expansion.

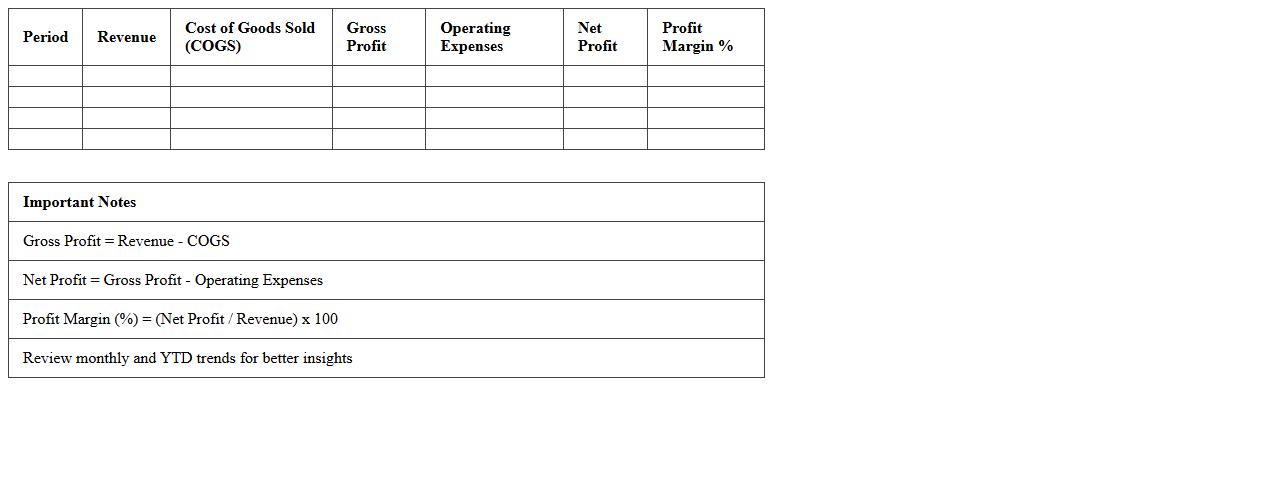

Profit and Loss Statement Dashboard

A

Profit and Loss Statement Dashboard is a comprehensive financial report that visually summarizes an organization's revenues, expenses, and net income over a specific period. This dashboard enhances decision-making by providing real-time insights into financial performance, identifying trends, and highlighting areas that require cost control or revenue growth. Businesses utilize this document to monitor profitability, optimize resource allocation, and strategize for sustainable financial health.

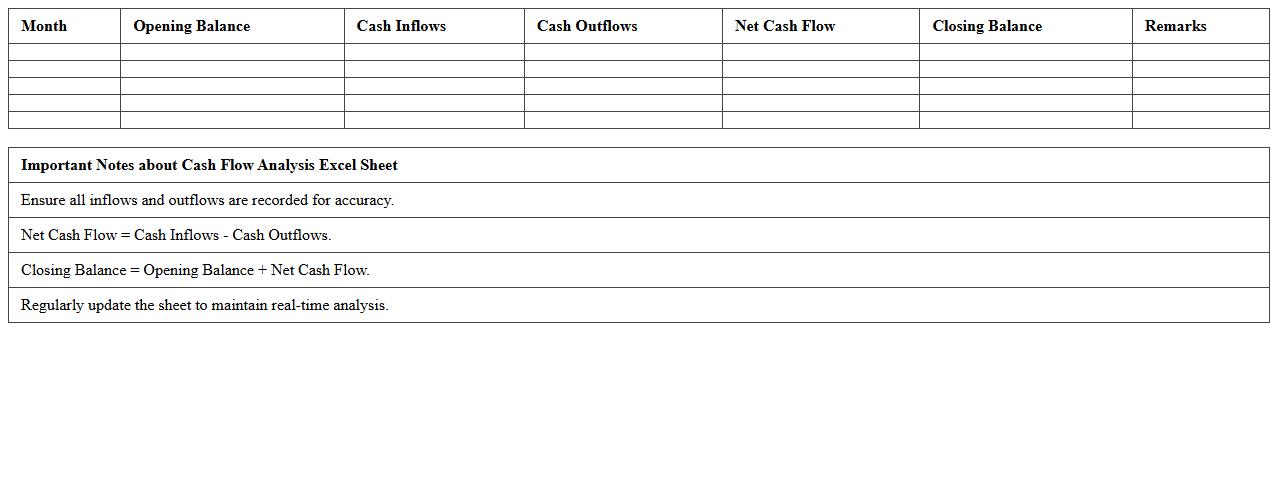

Cash Flow Analysis Excel Sheet

A

Cash Flow Analysis Excel Sheet is a financial tool designed to track and evaluate the inflows and outflows of cash within a business or personal budget. This document helps in forecasting cash availability, ensuring that expenses are managed effectively, and identifying potential liquidity issues before they arise. Utilizing this sheet allows for improved financial planning, decision-making, and maintaining a healthy cash position.

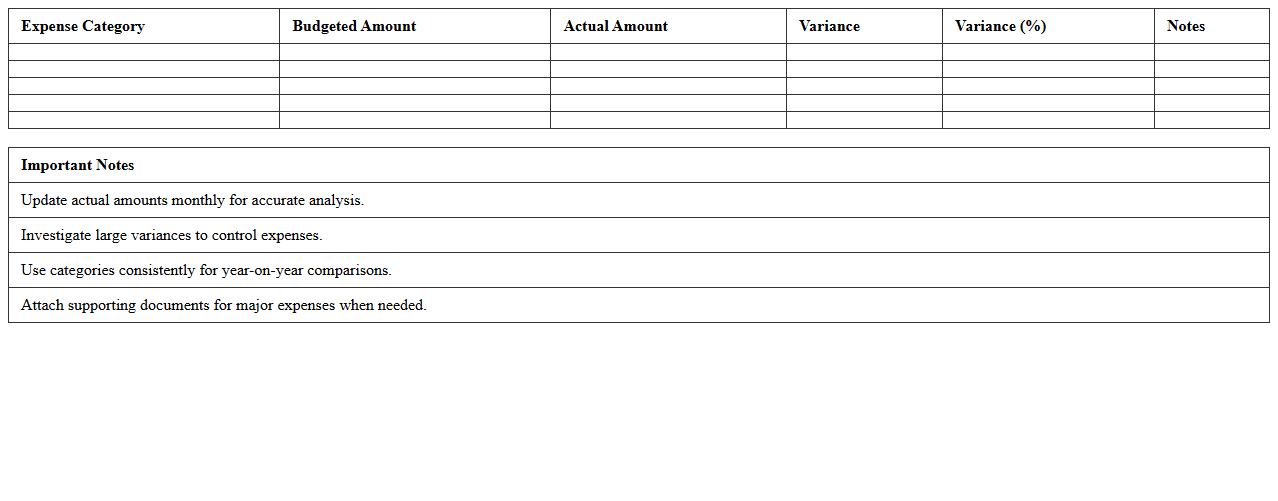

Expense Breakdown KPI Dashboard

The

Expense Breakdown KPI Dashboard document visualizes detailed expense categories and tracks spending patterns across various departments, enabling efficient financial management. It helps identify cost-saving opportunities by highlighting areas with excessive expenditures and supports informed decision-making through real-time expense analysis. Leveraging key performance indicators, this dashboard ensures budget adherence and improves overall organizational financial health.

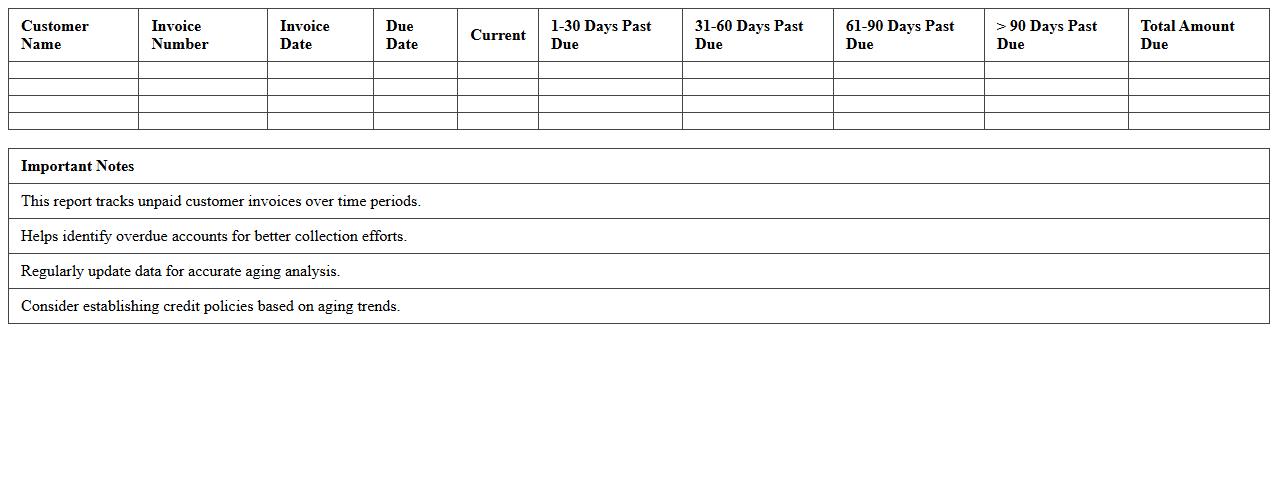

Accounts Receivable Aging Report Template

The

Accounts Receivable Aging Report Template is a financial document that organizes outstanding customer invoices based on the length of time they have been unpaid, typically categorized into 30, 60, 90, and 120-day periods. This template helps businesses monitor overdue payments, assess customer credit risk, and improve cash flow management by prioritizing collections. Using this report enables efficient tracking of receivables, reducing bad debts and enhancing overall financial health.

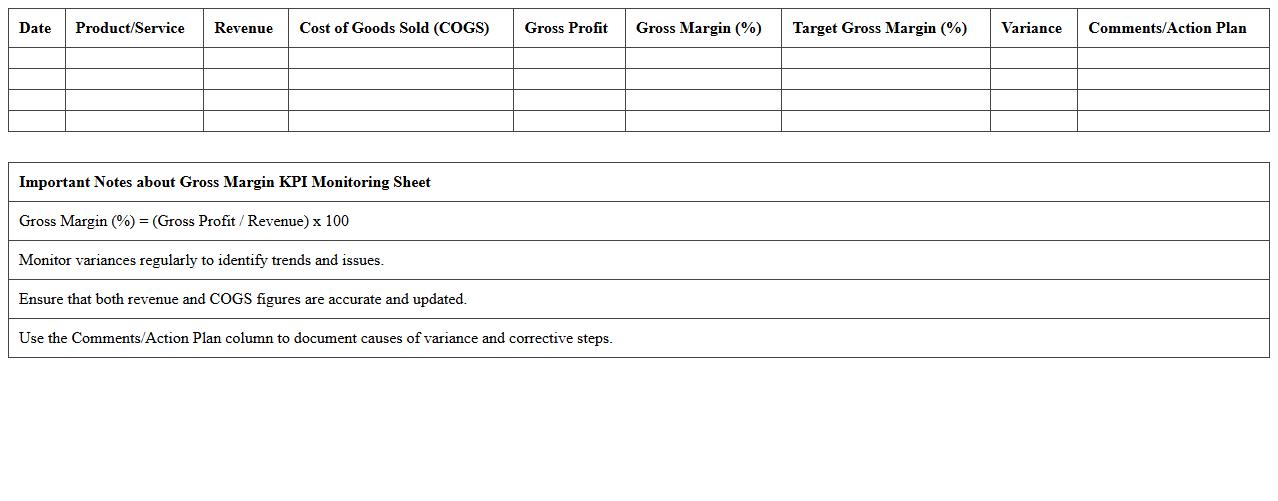

Gross Margin KPI Monitoring Sheet

The

Gross Margin KPI Monitoring Sheet is a financial document designed to track and analyze a company's gross margin performance over time, highlighting profitability by comparing revenue against the cost of goods sold. It provides a clear overview of key performance indicators (KPIs) related to gross margin, enabling businesses to identify trends, detect inefficiencies, and make informed decisions to optimize profit margins. By regularly reviewing this sheet, companies can enhance financial planning, improve cost control, and drive sustainable growth.

Small Business Budget Tracking Excel Template

The

Small Business Budget Tracking Excel Template is a comprehensive tool designed to help businesses monitor income, expenses, and cash flow efficiently. By organizing financial data in a clear, customizable format, it enables entrepreneurs to make informed decisions, optimize spending, and increase profitability. This template also facilitates accurate forecasting and financial reporting, ensuring better control over budget management.

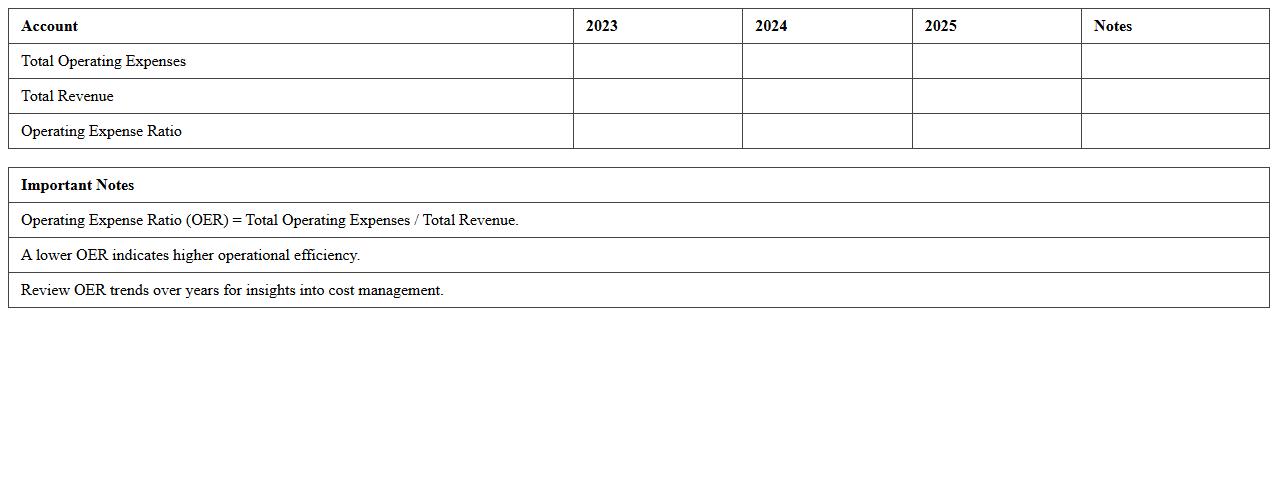

Operating Expense Ratio Dashboard

The

Operating Expense Ratio Dashboard document provides a visual representation of a company's operating expenses relative to its revenue, enabling quick assessment of cost efficiency. It helps stakeholders identify trends, compare performance across periods, and pinpoint areas where expense management can be improved. By tracking this ratio consistently, businesses can make informed decisions to optimize operational costs and enhance profitability.

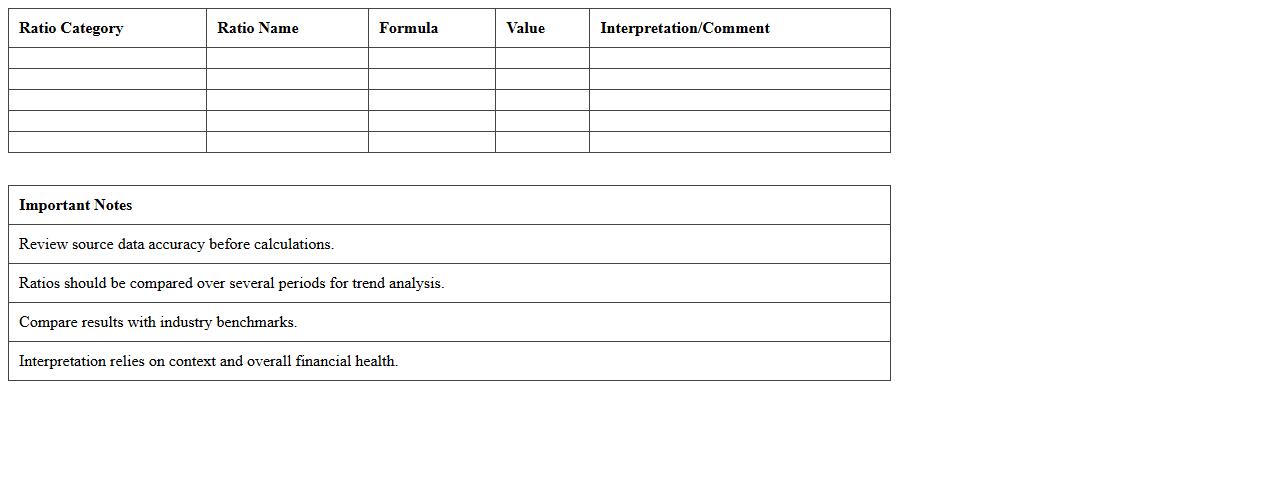

Financial Ratio Analysis Excel Template

A

Financial Ratio Analysis Excel Template document is a pre-designed spreadsheet that automates the calculation and presentation of key financial ratios, such as liquidity, profitability, and solvency ratios. This template enhances decision-making by providing clear insights into a company's financial health and operational efficiency through organized and accurate data analysis. Users benefit from time-saving features, consistent formatting, and the ability to easily compare financial performance across different periods or companies.

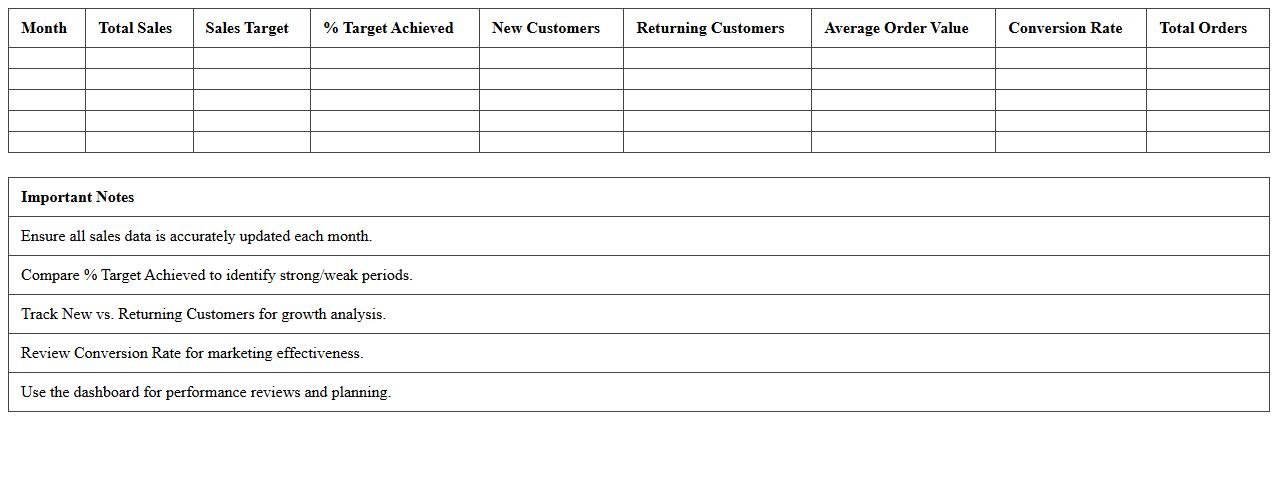

Monthly Sales Performance KPI Dashboard

The

Monthly Sales Performance KPI Dashboard document tracks key sales metrics such as revenue, conversion rates, and individual sales team members' performance, providing a comprehensive view of monthly progress. It enables businesses to identify trends, spot opportunities for growth, and address challenges promptly through data-driven insights. This dashboard streamlines decision-making by highlighting areas needing improvement and ensuring alignment with sales targets.

Which KPIs are most essential for small business financial dashboards in Excel?

The most essential KPIs for small business financial dashboards include revenue growth, net profit margin, and operating cash flow. Tracking accounts receivable turnover and current ratio provides insights into liquidity and efficiency. These metrics enable businesses to monitor financial health and make informed decisions.

How can you automate monthly financial report generation using Excel formulas?

You can automate monthly reports using Excel formulas like SUMIFS, INDIRECT, and dynamic named ranges to pull data for specific periods. Combining formulas with PivotTables allows for quick data summarization and updates. Automating these processes reduces manual errors and saves time on repetitive tasks.

What Excel templates effectively track cash flow and profit margins for small businesses?

Templates featuring cash flow statements and profit margin calculators are highly effective for small businesses. These templates often include predefined formulas for tracking income, expenses, and profitability ratios. Customizable templates ensure that businesses can adapt the tracking to their unique financial structure.

How do you visually represent ROI and expense ratios in a dashboard letter?

Visual representation of ROI and expense ratios in dashboards is best achieved using charts like bar graphs, pie charts, and gauge indicators. Conditional formatting and data bars highlight key values for quick interpretation. These visual tools facilitate easier communication of complex financial data.

What data validation techniques ensure accuracy in Excel-based financial KPI letters?

Implementing data validation rules such as drop-down lists, range limits, and error alerts maintains data integrity in financial KPI letters. Using consistent data formats and cross-verification with formulas ensures precision. These techniques prevent entry errors and improve overall report reliability.

More Dashboard Excel Templates