The Expense Tracking Dashboard Excel Template for Consultants provides a comprehensive and easy-to-use tool for monitoring and managing business expenses. It offers customizable categories, detailed visual reports, and real-time data analysis to help consultants maintain financial control and optimize budgeting. This template enhances accuracy and efficiency in tracking expenses throughout projects.

Monthly Expense Tracker Excel for Consultants

The

Monthly Expense Tracker Excel for Consultants is a comprehensive tool designed to efficiently record and categorize all business-related expenses on a monthly basis. It helps consultants maintain clear financial records, monitor spending patterns, and simplify tax preparation by organizing costs into relevant categories. By using this document, consultants can optimize budgeting, improve cash flow management, and ensure accurate reimbursement claims.

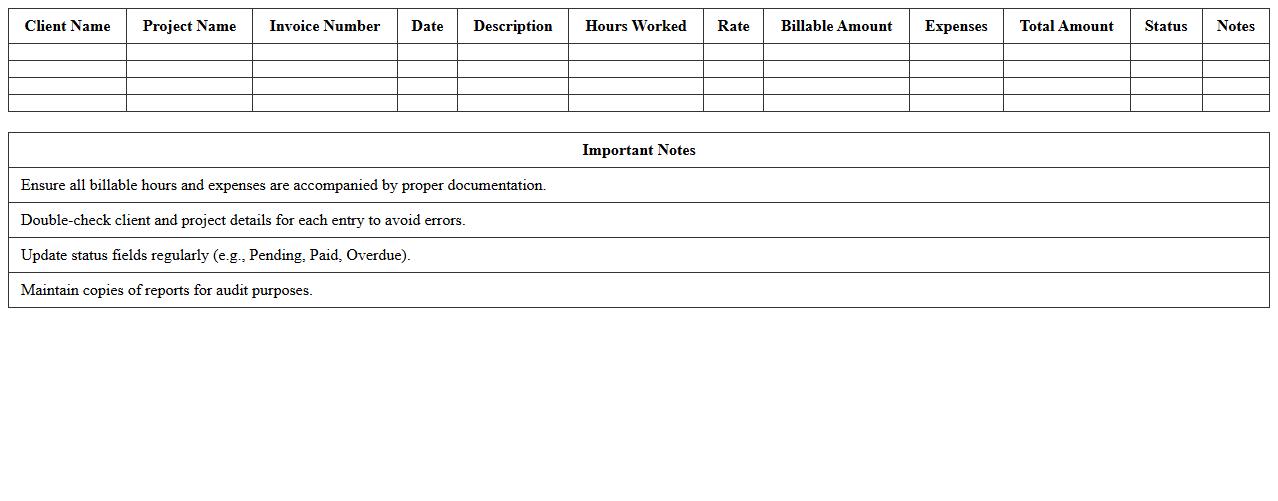

Client Billing & Expense Report Template

The

Client Billing & Expense Report Template is a structured document designed to track and itemize client-related charges and associated expenses in a clear and organized manner. This template streamlines the billing process, ensuring accurate invoicing and comprehensive expense tracking, which helps in maintaining transparency and financial accountability. Using this report enhances project profitability analysis and supports efficient financial management by providing a detailed overview of client costs and reimbursements.

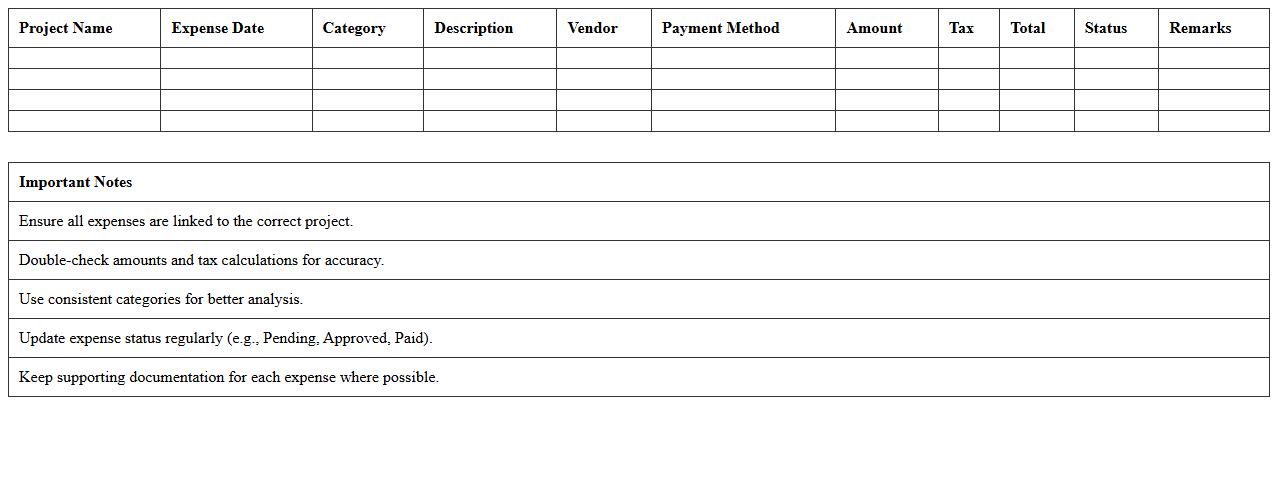

Project-Based Expense Management Spreadsheet

A

Project-Based Expense Management Spreadsheet is a detailed document designed to track and categorize all project-related costs systematically. It helps organizations monitor budgets, control expenses, and ensure accurate financial reporting by providing real-time visibility into spending. This tool enhances decision-making by highlighting cost overruns and enabling efficient allocation of resources across different project phases.

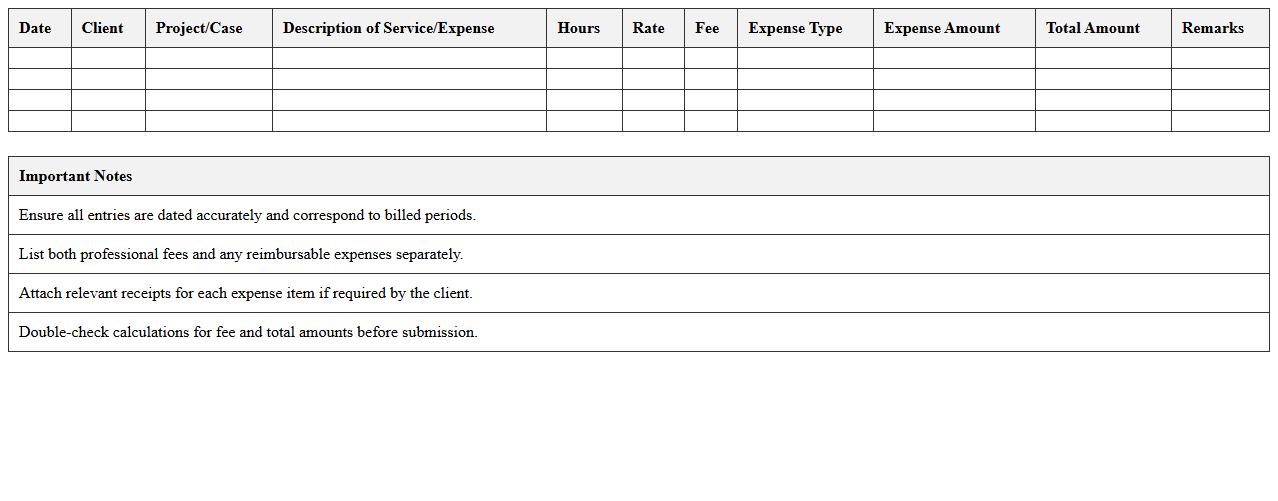

Professional Fee and Expense Log Sheet

A

Professional Fee and Expense Log Sheet is a detailed document used to record and track fees charged by professionals along with related expenses during a project or service engagement. It helps maintain accurate financial records, ensures transparency in billing, and simplifies expense reimbursement processes. This log sheet is crucial for budgeting, auditing, and analyzing the cost-effectiveness of professional services over time.

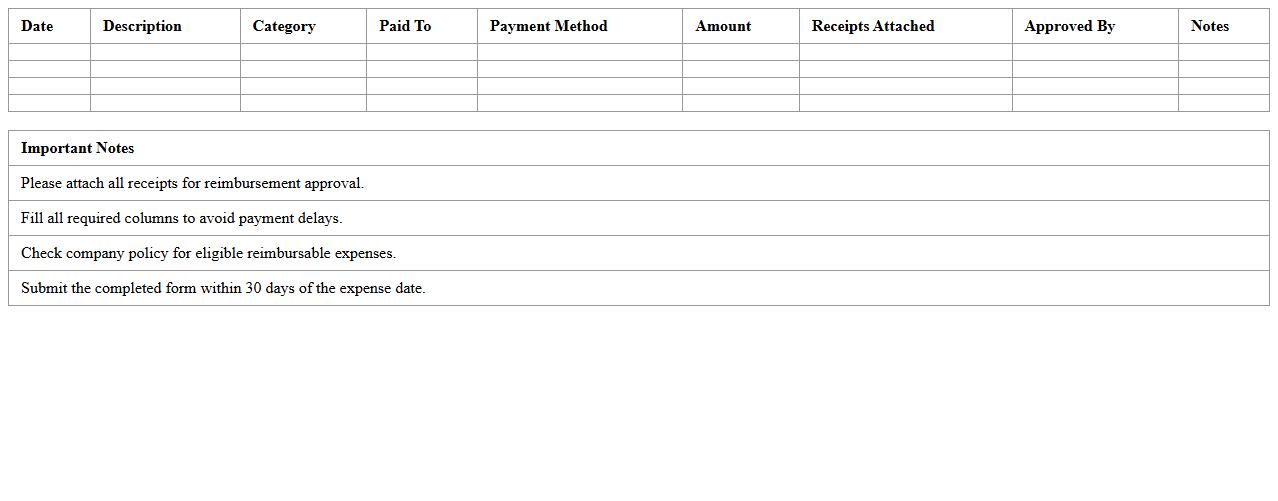

Reimbursable Expense Record Excel Template

The

Reimbursable Expense Record Excel Template document is a structured spreadsheet designed to track and manage expenses that employees or contractors incur on behalf of a company, which are eligible for reimbursement. It helps maintain accurate records by categorizing expenses, dates, amounts, and approval statuses, ensuring compliance with company policies. This template streamlines the reimbursement process, enhances financial transparency, and simplifies accounting by providing clear documentation for audits and budget management.

Business Travel Expense Tracker for Consultants

A

Business Travel Expense Tracker for Consultants is a specialized document designed to record and monitor all travel-related costs incurred during consulting assignments. It helps in categorizing expenses such as transportation, accommodation, meals, and incidental charges, ensuring accurate reimbursement and budget management. Utilizing this tracker enhances financial transparency, simplifies expense reporting, and improves overall cost control for consulting projects.

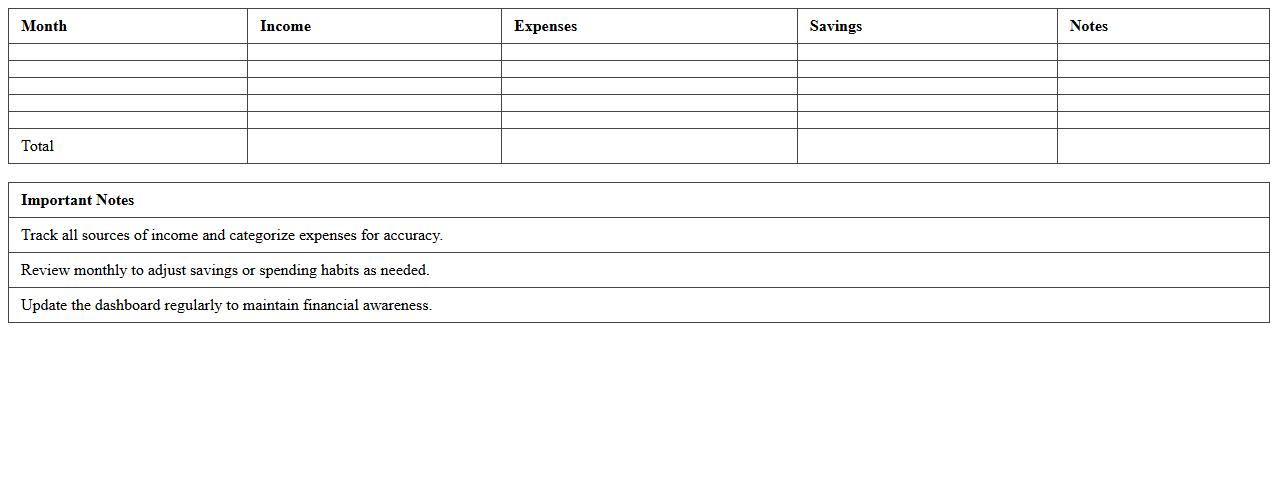

Income & Expense Summary Dashboard Excel

The

Income & Expense Summary Dashboard Excel document provides a visual and organized overview of financial data, including revenues, costs, and net profit. It simplifies financial tracking by consolidating multiple income and expense categories into interactive charts and summaries, enabling quick analysis of cash flow and budgeting effectiveness. This tool is essential for individuals and businesses aiming to maintain financial control and make informed decisions based on up-to-date fiscal insights.

Consultancy Invoice and Expense Tracker Sheet

A

Consultancy Invoice and Expense Tracker Sheet is a comprehensive document designed to record and manage consultancy fees, expenses, and payment statuses in one place. It helps consultants maintain accurate financial records, monitor cash flow, and streamline invoicing processes for efficient project management. This tool ensures timely billing, expense reimbursement, and enhances overall financial transparency and accountability.

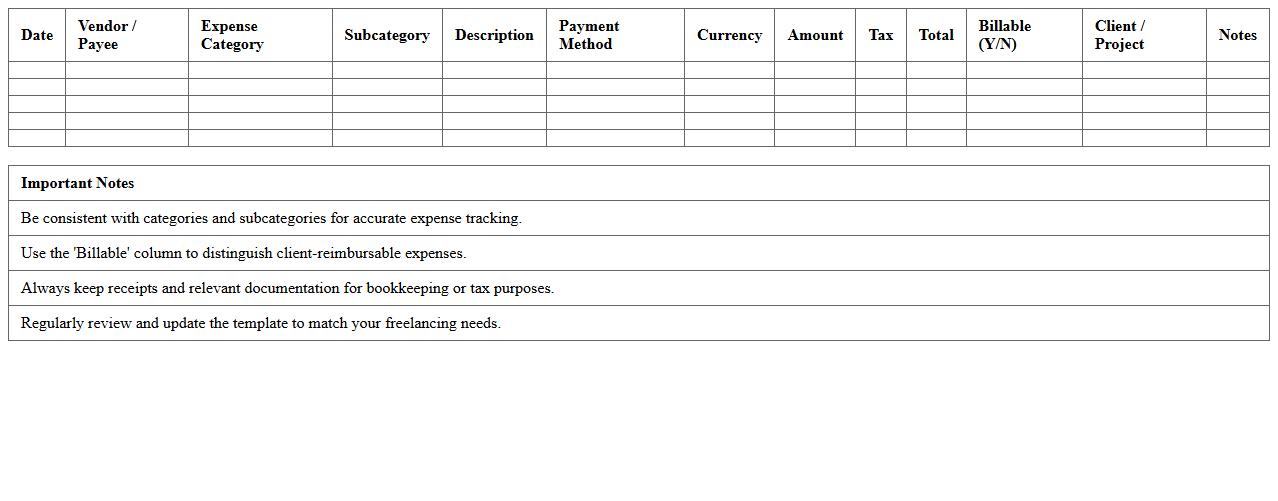

Detailed Expense Categorization Template for Freelancers

A

Detailed Expense Categorization Template for Freelancers is a structured document that organizes all business-related expenses into specific categories such as travel, software subscriptions, office supplies, and client meetings. This template helps freelancers track and manage their finances accurately, ensuring efficient budgeting and simplifying tax preparation by clearly separating deductible expenses. Using such a categorized approach enhances financial clarity and supports better decision-making for sustainable freelance business growth.

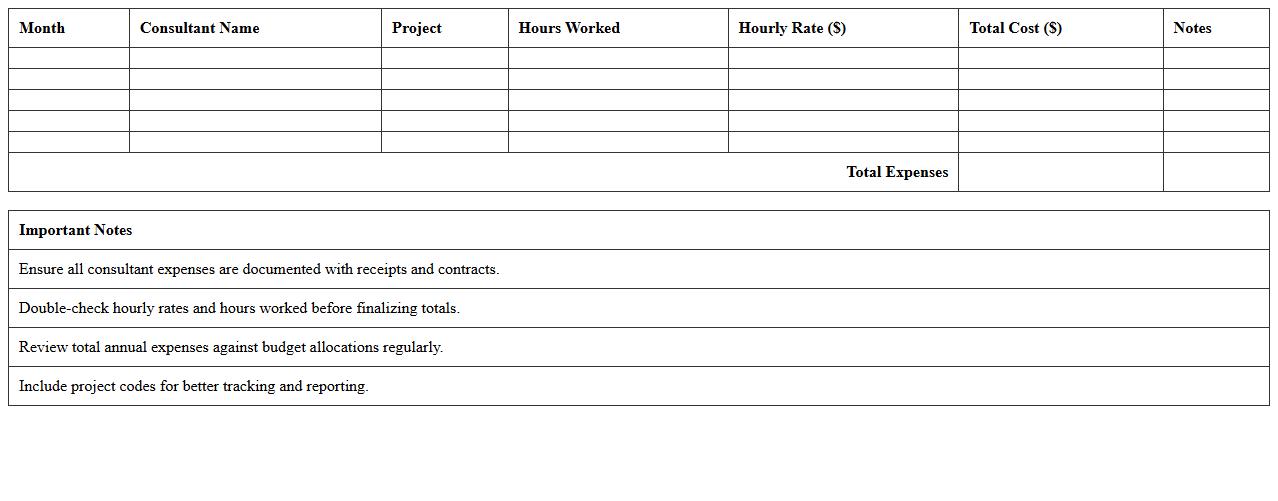

Annual Consulting Expenses Analysis Excel

The

Annual Consulting Expenses Analysis Excel document is a comprehensive tool designed to track and evaluate consulting costs over a fiscal year, enabling detailed insights into expenditure patterns. By organizing data systematically, it assists businesses in identifying cost-saving opportunities and optimizing budget allocation for consulting services. This analysis supports strategic decision-making by highlighting trends, comparing expenses against benchmarks, and ensuring fiscal accountability.

How can consultants automate recurring expense entries in the dashboard?

Consultants can automate recurring expense entries by setting up scheduled Excel macros or using built-in automation tools like Power Query. This allows for consistent data import and automatic updates to the expense dashboard. Integrating with cloud services ensures that the recurring expenses refresh in real-time with minimal manual input.

What custom formulas optimize project-based expense allocation?

Using custom formulas such as SUMIFS and ARRAYFORMULA helps allocate expenses specifically to projects based on defined criteria. Incorporating dynamic named ranges with INDEX MATCH improves flexibility in handling variable data sizes. This setup provides accurate and automated distribution of expenses to each project budget.

How can receipt images be linked directly to line items in Excel?

Receipt images can be embedded or hyperlinked in Excel cells next to corresponding expense line items. Using the Insert Hyperlink function or VBA code allows direct access to receipt files stored locally or in cloud storage. This creates a transparent and easily auditable expense tracking system.

What pivot table setup best summarizes billable vs. non-billable expenses?

Setting up a pivot table with Expense Type in rows and Sum of Amount in values fields categorizes billable and non-billable expenses. Adding filters for date ranges and projects enables focused analysis on expense distribution. This concise summary supports better financial decision-making and client billing clarity.

How to integrate mileage logs for travel reimbursements within the same sheet?

Mileage logs can be integrated using a dedicated table with columns for date, miles traveled, and rate per mile linked to the main expense sheet. Employing formulas like SUMPRODUCT automatically calculates total reimbursements based on logged mileage. This seamless integration streamlines travel expense reimbursement management within a unified dashboard.

More Dashboard Excel Templates

![]()