Monthly Cash Flow Tracker for E-Commerce Stores

A

Monthly Cash Flow Tracker for E-Commerce Stores document is a financial tool designed to monitor and record all cash inflows and outflows within an online retail business on a monthly basis. It helps store owners maintain a clear view of their liquidity, enabling better budgeting, forecasting, and decision-making. By accurately tracking revenues and expenses, this document ensures that the business can manage operational costs efficiently and avoid cash shortages.

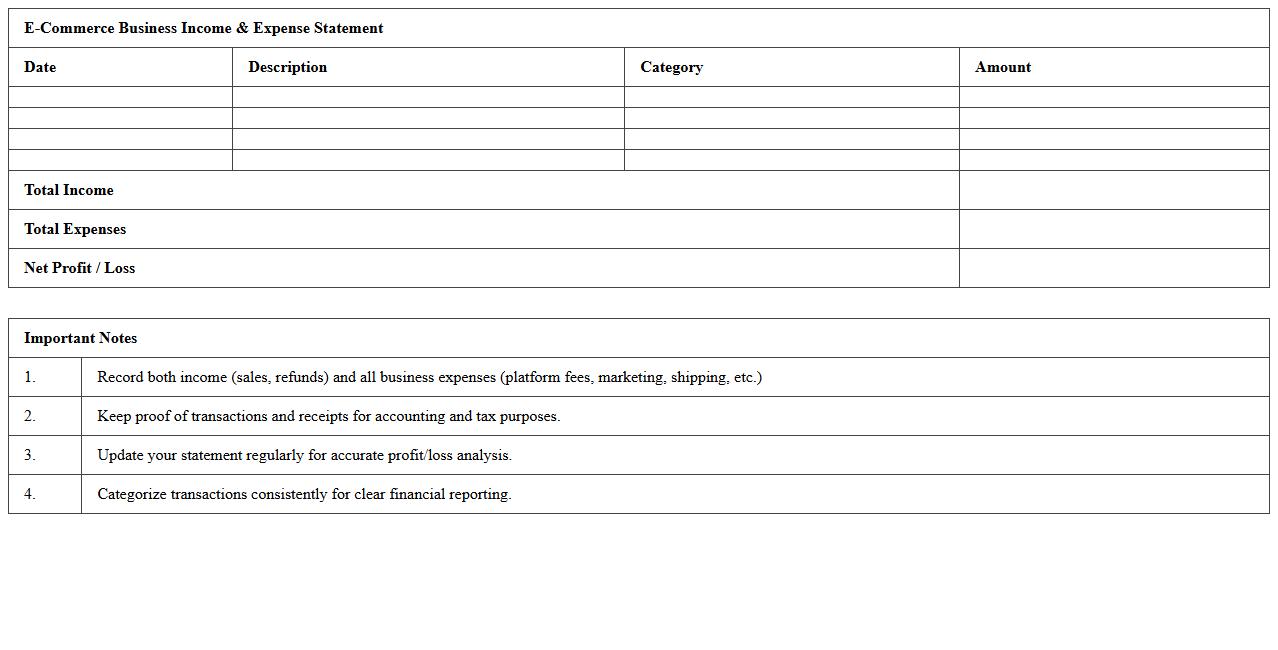

E-Commerce Business Income & Expense Statement

The

E-Commerce Business Income & Expense Statement document itemizes all revenue streams and operational costs, providing a comprehensive financial overview for online retail businesses. This statement is crucial for tracking profitability, managing budgets, and preparing accurate tax filings. Entrepreneurs and accountants use it to identify trends, control expenses, and make informed strategic decisions that enhance financial performance.

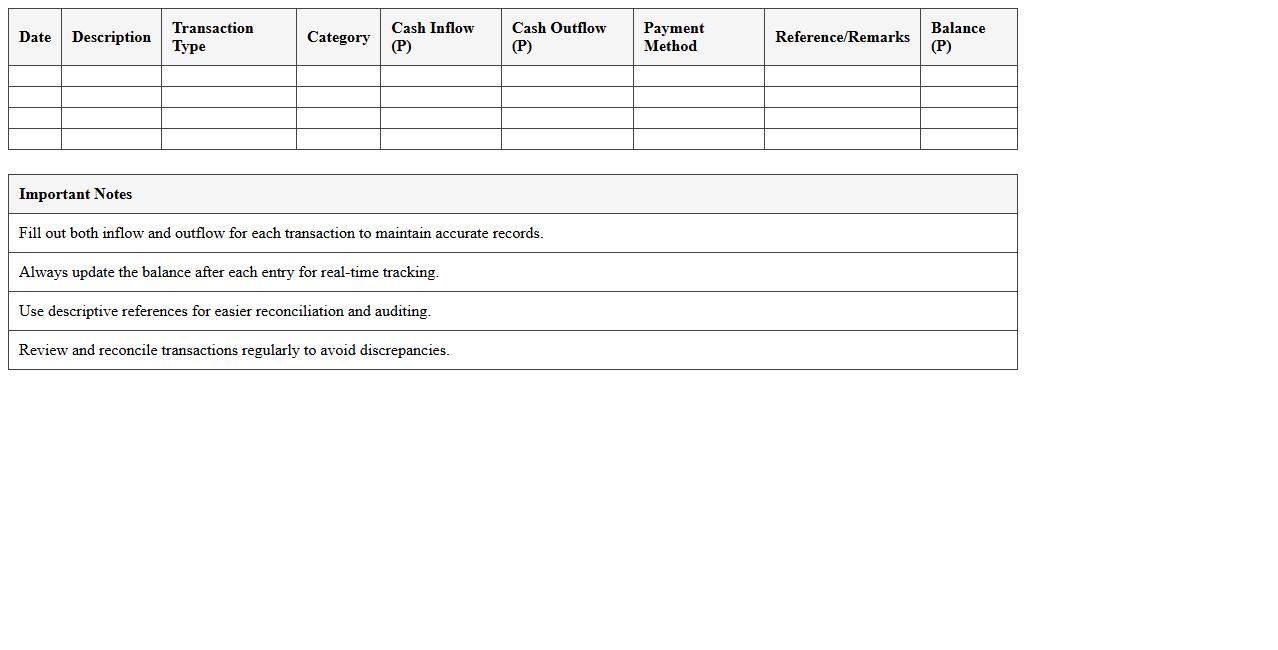

Online Store Cash Inflow and Outflow Sheet

An

Online Store Cash Inflow and Outflow Sheet document tracks all incoming revenues and outgoing expenses related to an online business, providing a clear overview of financial transactions. This sheet helps in monitoring cash flow, managing budgets, and identifying trends in sales and expenditures, crucial for maintaining profitability. By analyzing this document, store owners can make informed decisions on inventory, marketing strategies, and operational costs.

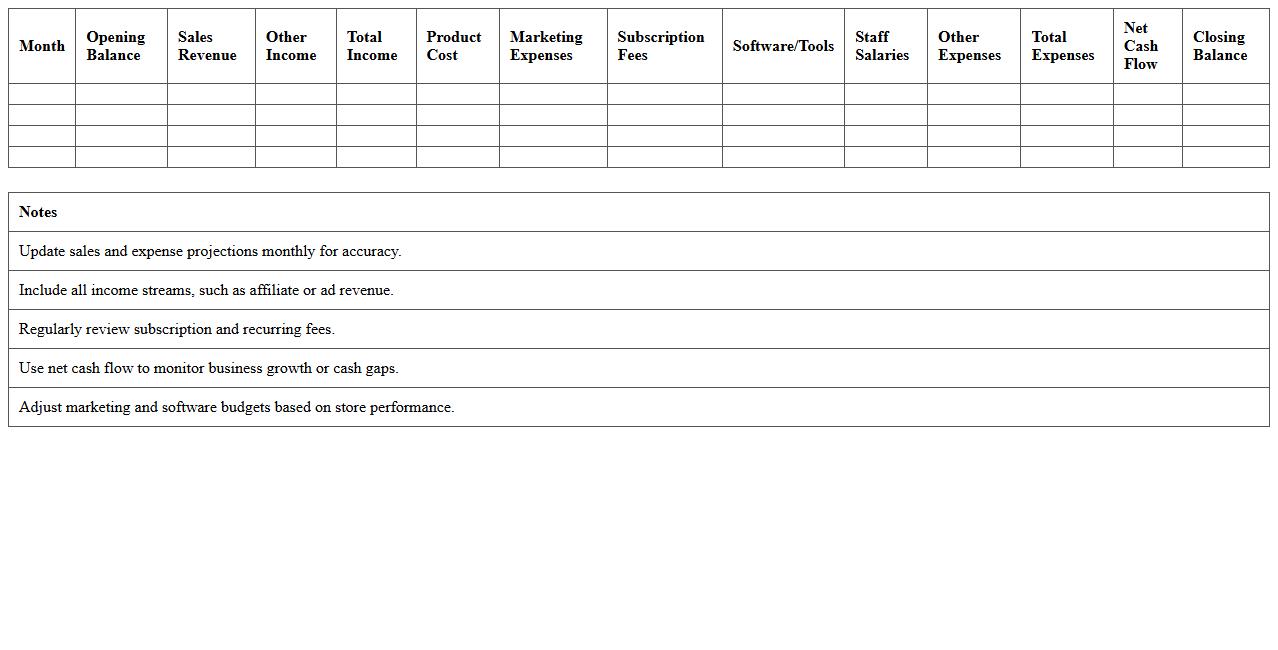

Digital Store Cash Flow Forecast Spreadsheet

A

Digital Store Cash Flow Forecast Spreadsheet is a financial tool designed to project incoming and outgoing cash flows within an online retail business, enabling accurate tracking of revenue, expenses, and net cash position over time. This document helps business owners anticipate periods of cash surplus or shortfall, ensuring better budget management, timely payments, and strategic planning for inventory purchases or marketing campaigns. By providing clear visibility into future cash movements, it supports informed decision-making to maintain liquidity and sustain growth.

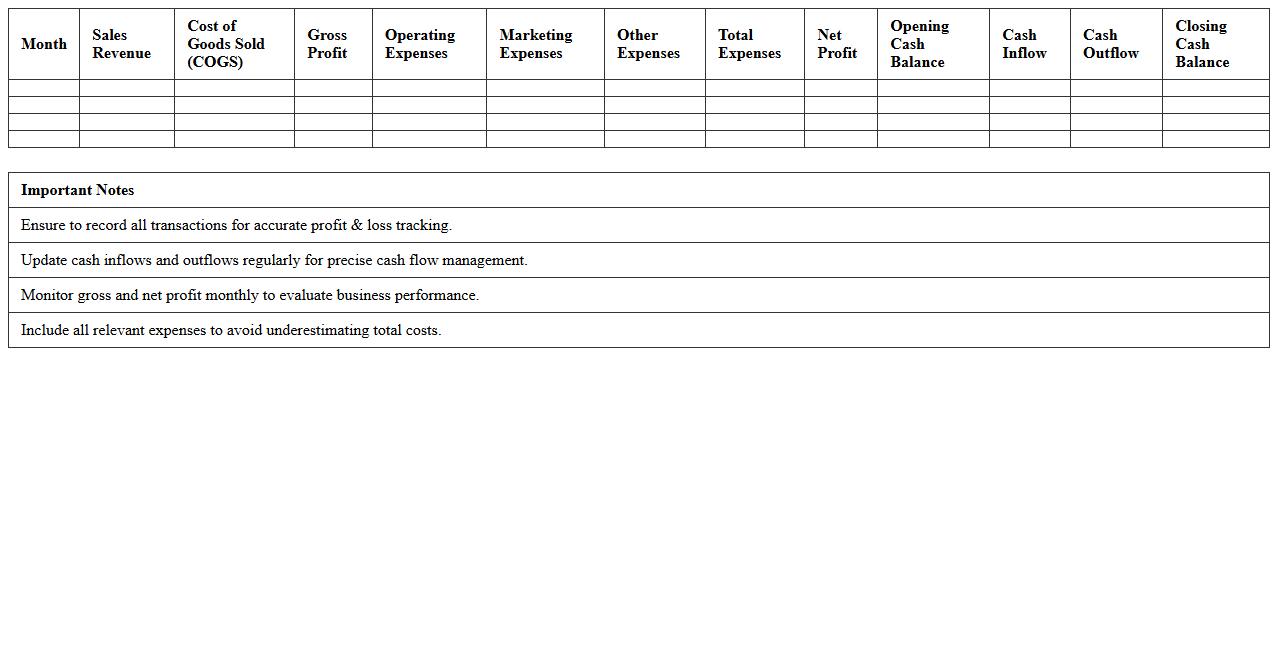

E-Commerce Profit & Loss and Cash Flow Excel

The

E-Commerce Profit & Loss and Cash Flow Excel document is a financial tool designed to track revenue, expenses, and cash movement specifically for online businesses. It helps entrepreneurs and managers analyze profitability and manage liquidity by providing clear visualizations of income, costs, and cash flow trends. This document supports informed decision-making, budget planning, and financial forecasting critical to sustaining e-commerce growth.

Cash Movement Log for E-Commerce Operations

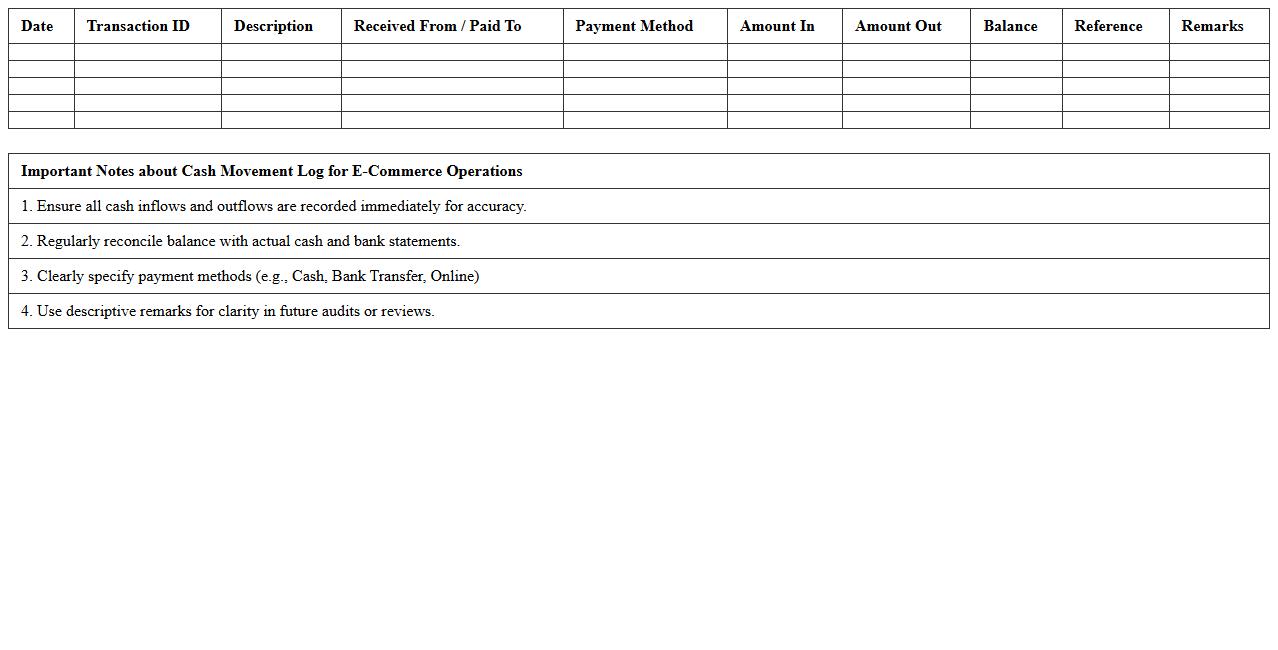

The

Cash Movement Log for E-Commerce Operations is a detailed record tracking all cash transactions within the business, including sales, refunds, and petty cash usage. This document helps maintain accurate financial accountability, identify discrepancies, and streamline cash handling processes. By ensuring transparency and facilitating audits, it supports efficient cash flow management and operational control.

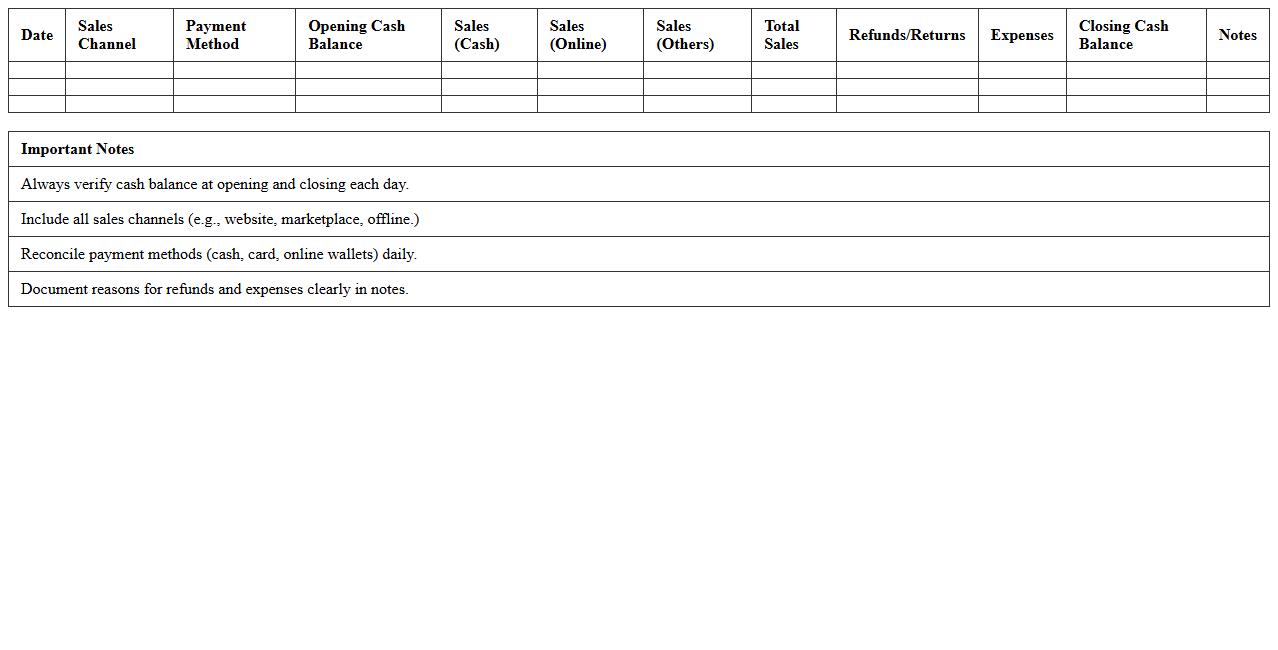

E-Commerce Daily Cash Flow Summary Template

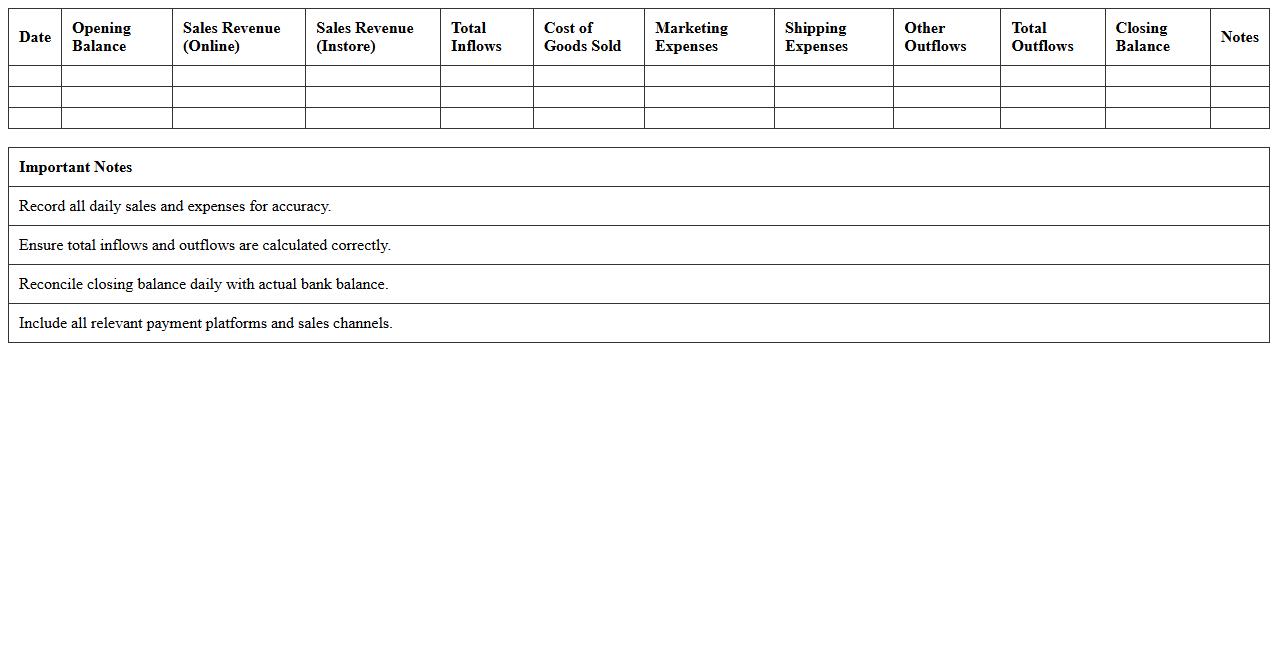

The

E-Commerce Daily Cash Flow Summary Template is a financial document designed to track daily inflows and outflows of cash specifically for online retail businesses. This template helps entrepreneurs monitor sales revenue, expenses, and net cash position in real-time, facilitating accurate financial analysis and budgeting. By using this summary, businesses can optimize liquidity management, identify cash flow trends, and make informed decisions to maintain a healthy financial status.

Online Retailer Financial Flow Statement Sheet

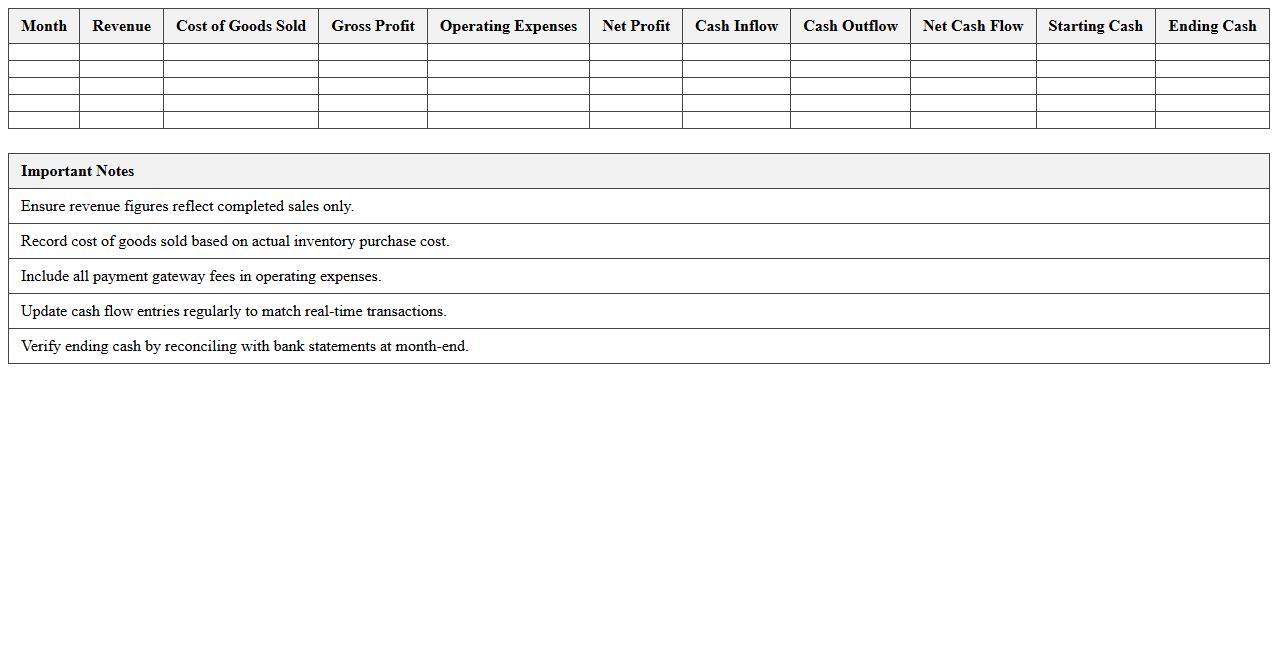

The

Online Retailer Financial Flow Statement Sheet document tracks the movement of money within an e-commerce business, detailing cash inflows from sales, outflows for expenses, and overall liquidity status. It provides critical insights into operational efficiency, enabling better cash management and forecasting for inventory purchasing and marketing investments. Using this statement helps online retailers maintain financial stability, optimize spending, and identify growth opportunities by clearly presenting sources and uses of funds.

Quarterly Cash Flow Analysis for E-Commerce

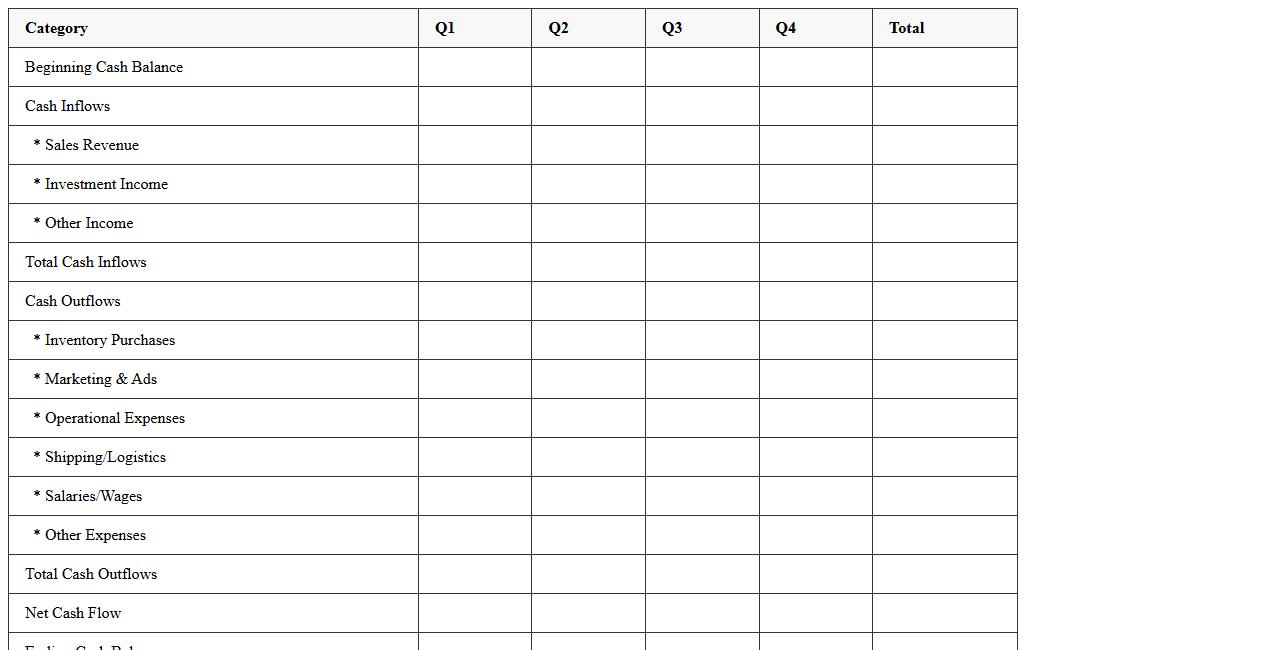

Quarterly Cash Flow Analysis for E-Commerce documents track the inflow and outflow of cash over a three-month period, highlighting operational efficiency and financial health. This

financial report helps businesses identify trends in revenue, expenses, and profit margins, enabling informed decisions on inventory management and marketing strategies. Regular analysis supports improved budgeting, ensuring sustainable growth and liquidity in the competitive e-commerce market.

Simple E-Commerce Store Cash Breakdown Worksheet

The

Simple E-Commerce Store Cash Breakdown Worksheet document itemizes daily cash inflows and outflows, providing a clear financial snapshot for online store owners. This structured overview helps track sales revenue, expenses, and cash on hand, facilitating accurate record-keeping and budgeting. Using this worksheet enhances financial transparency and supports better decision-making for e-commerce business growth.

How to automate SKU-level cash flow tracking in an Excel Cash Flow Statement for e-commerce sales?

To automate SKU-level cash flow tracking, use Excel's SUMIFS function to aggregate sales by each SKU across different time periods. Implement data validation and drop-down lists to easily select SKUs and view their individual cash flow data. Additionally, leverage PivotTables for dynamic summary and analysis of SKU-specific cash inflows and outflows.

What Excel formulas best capture payment gateway fees in e-commerce cash flows?

Use the formula =Sale_Amount * Payment_Gateway_Fee_Rate to dynamically calculate fees deducted by payment gateways per transaction. Incorporate fixed fee components by adding constants, e.g., =Sale_Amount * Fee_Percentage + Fixed_Fee. This method ensures precise deduction of fees directly within your cash flow model for accurate net revenue tracking.

How to integrate refund and return rates into Cash Flow Statement projections in Excel?

In Excel, model refund and return impacts by creating formulas that subtract the product of return rates and sales from gross cash inflows. Use historical return percentages within your forecasts to adjust future cash flow projections accordingly. Adding scenario analysis with Excel's Data Table feature helps estimate varying refund effects on overall cash flow.

Which Excel template features are essential for tracking inventory financing in e-commerce cash flow?

Effective templates must include sections for inventory purchase costs, loan repayment schedules, and financing interest calculations to track inventory financing accurately. Incorporating drop-down selectors for financing terms and conditional formatting highlights loan payment statuses. Built-in charts summarizing financing impact aid visibility on overall cash flow health.

How can you visualize seasonality impacts on cash flow for an online store using Excel charts?

Use Excel's line and column charts to display monthly or quarterly cash flow, highlighting seasonal patterns over multiple years. Applying slicers with PivotCharts enables interactive filtering by product categories or SKUs to compare seasonal trends. Combining trendlines and moving averages adds predictive power to detect and visualize cyclical cash flow fluctuations effectively.