The VAT Statement Excel Template for Retail Businesses streamlines tax reporting by organizing sales and purchase data efficiently. It enables accurate calculation of VAT liabilities and input tax credits, ensuring compliance with tax regulations. This template simplifies financial management, saving time and reducing errors during VAT filing.

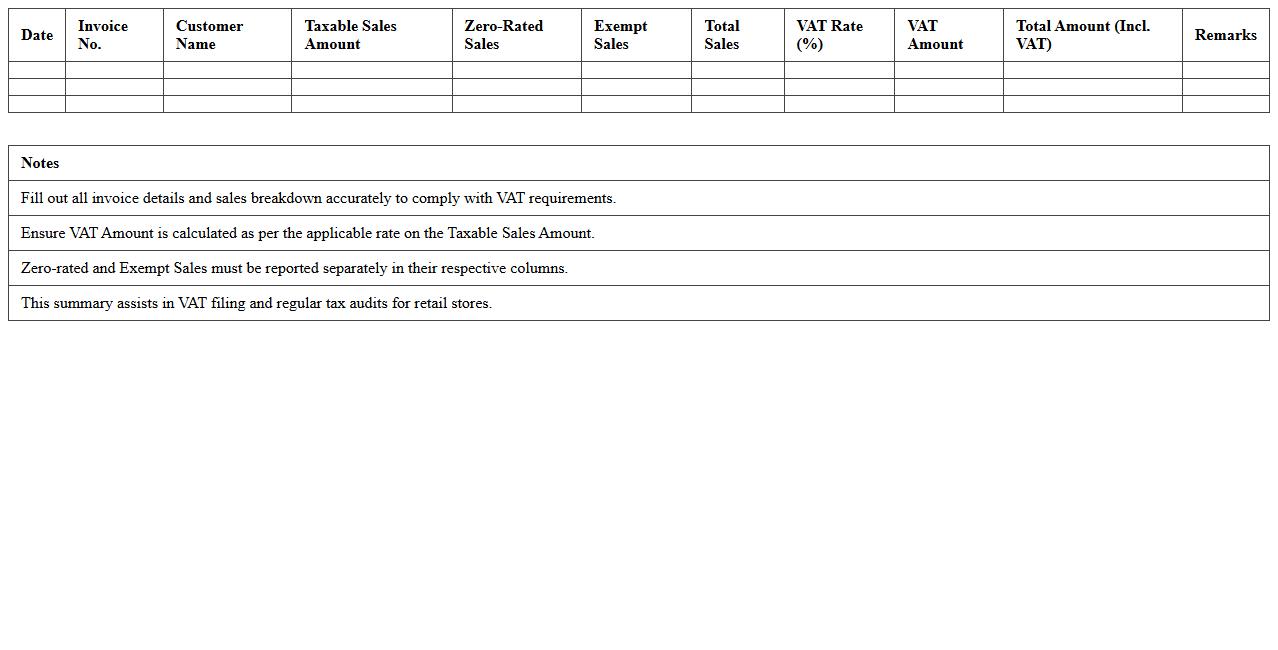

VAT Summary Report Excel Template for Retail Stores

The

VAT Summary Report Excel Template for Retail Stores is a structured spreadsheet designed to consolidate and summarize all Value Added Tax (VAT) transactions within a retail environment. It helps businesses accurately track VAT collected on sales and VAT paid on purchases, ensuring compliance with tax regulations and simplifying the audit process. This template streamlines financial reporting by providing clear, organized data that supports timely VAT submissions and improves overall tax management efficiency.

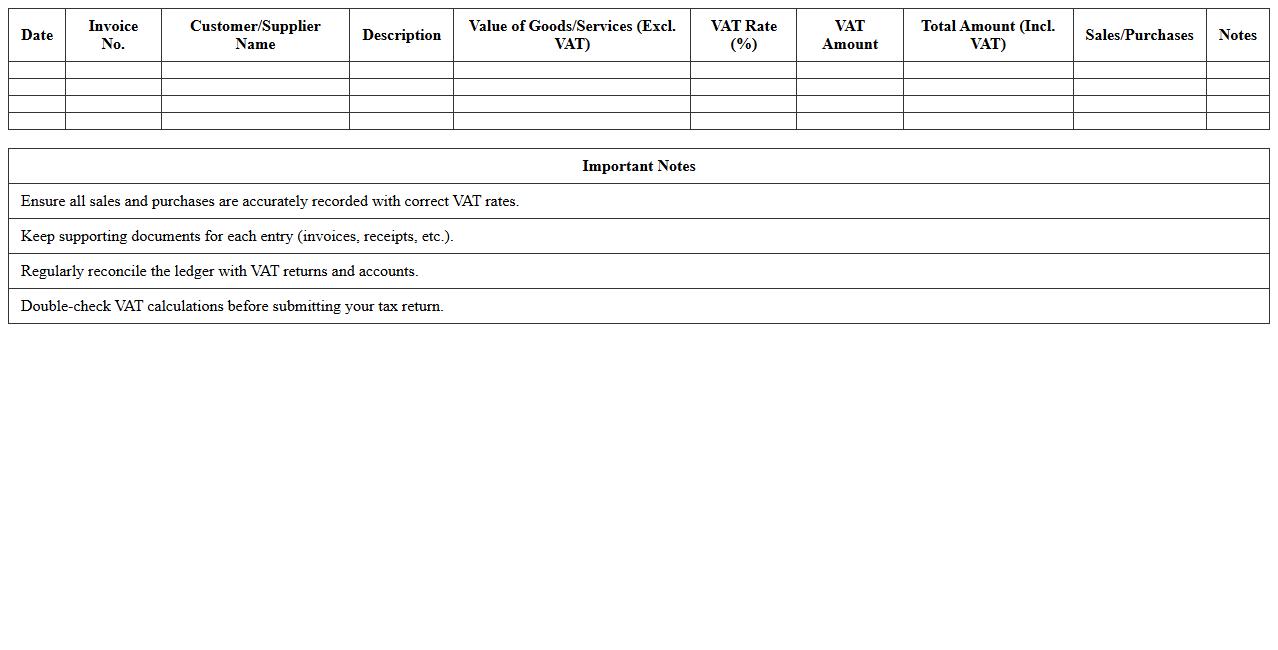

Retail VAT Sales & Purchases Ledger Spreadsheet

The

Retail VAT Sales & Purchases Ledger Spreadsheet document is a detailed record-keeping tool designed to track all sales and purchase transactions subject to Value Added Tax (VAT) in retail businesses. It helps ensure accurate VAT calculations, compliance with tax regulations, and simplifies the preparation of VAT returns by consolidating data in a structured format. Utilizing this spreadsheet enhances financial management, reduces errors in tax reporting, and facilitates efficient audit trails for business operations.

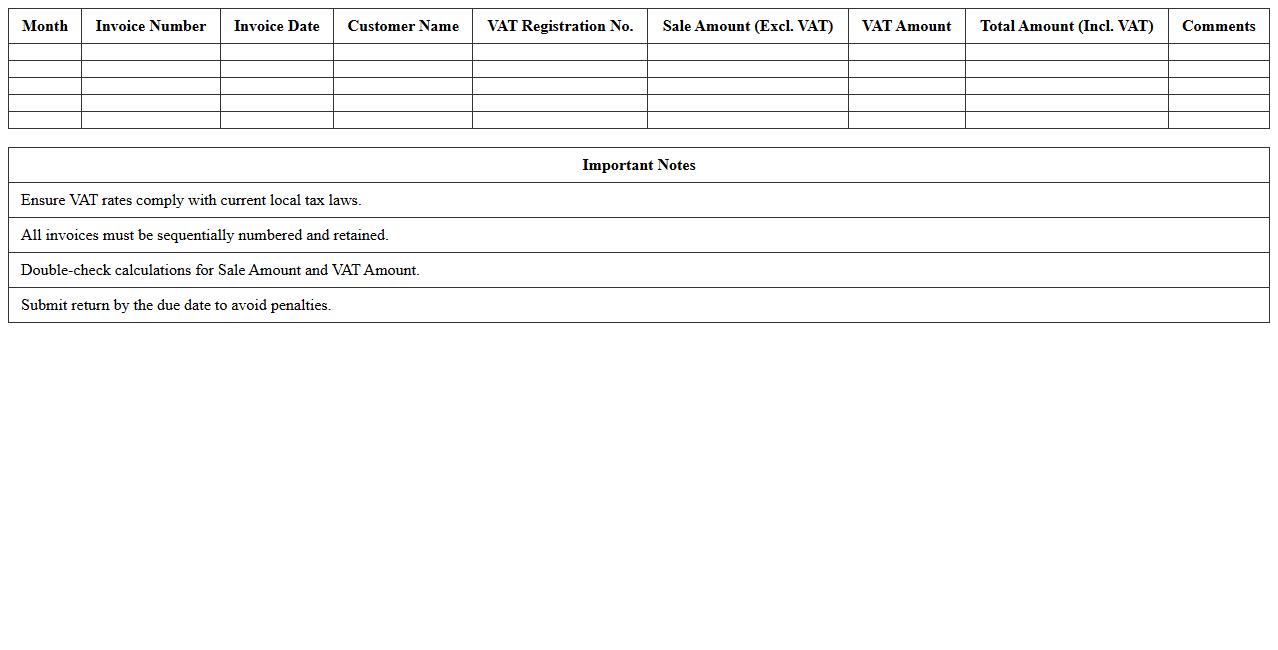

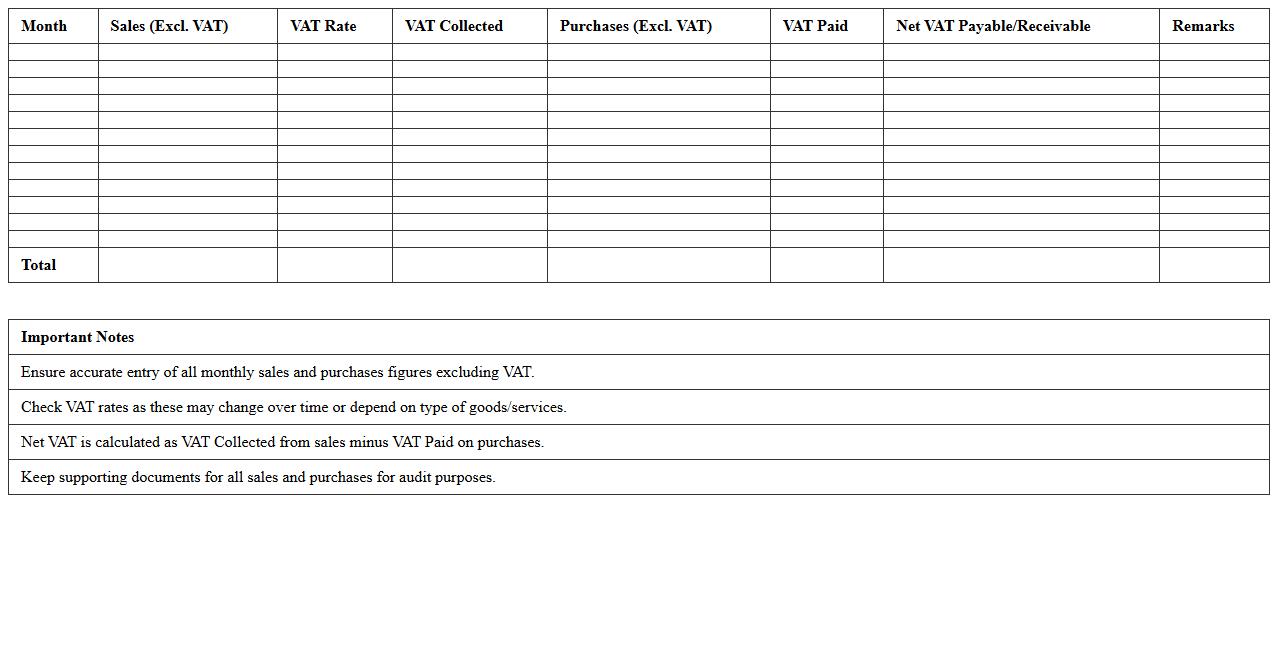

Monthly VAT Return Statement Template for Retailers

A

Monthly VAT Return Statement Template for Retailers is a structured document designed to help retailers accurately report their Value Added Tax (VAT) liabilities and input tax credits on a monthly basis. It streamlines the calculation and declaration of VAT collected from sales and VAT paid on purchases, ensuring compliance with tax authorities and minimizing errors. Using this template improves financial record-keeping, facilitates timely submission to tax agencies, and aids in efficient VAT management for retail businesses.

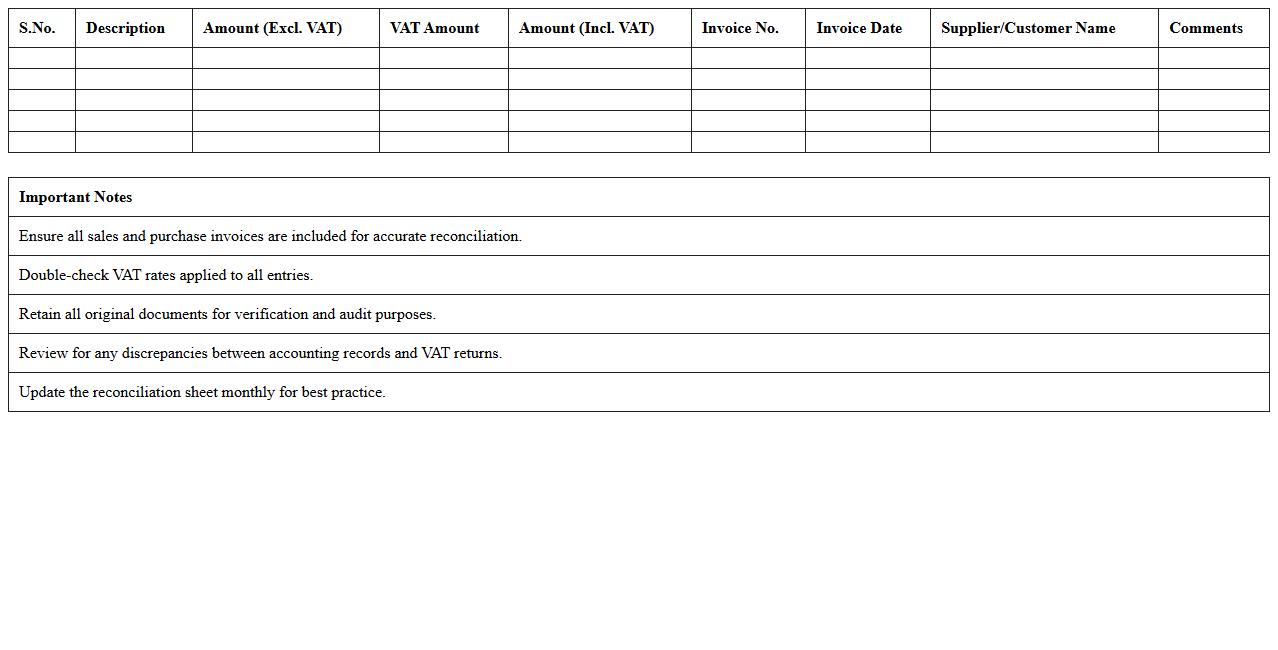

Retail Business VAT Reconciliation Excel Sheet

The

Retail Business VAT Reconciliation Excel Sheet document is a specialized tool designed to accurately track and match VAT collected on sales with VAT paid on purchases. It helps businesses identify discrepancies, ensure compliance with tax regulations, and streamline the VAT reporting process. Using this sheet reduces errors, saves time during audits, and provides a clear financial overview essential for effective tax management.

Input & Output VAT Tracking Excel Template for Retail

The

Input & Output VAT Tracking Excel Template for Retail is a specialized tool designed to accurately monitor and record Value Added Tax transactions for retail businesses. It helps streamline VAT calculations by categorizing input VAT paid on purchases and output VAT collected on sales, ensuring compliance with tax regulations and simplifying bookkeeping processes. Retailers benefit from improved financial accuracy, easier tax report generation, and enhanced cash flow management through this efficient VAT tracking solution.

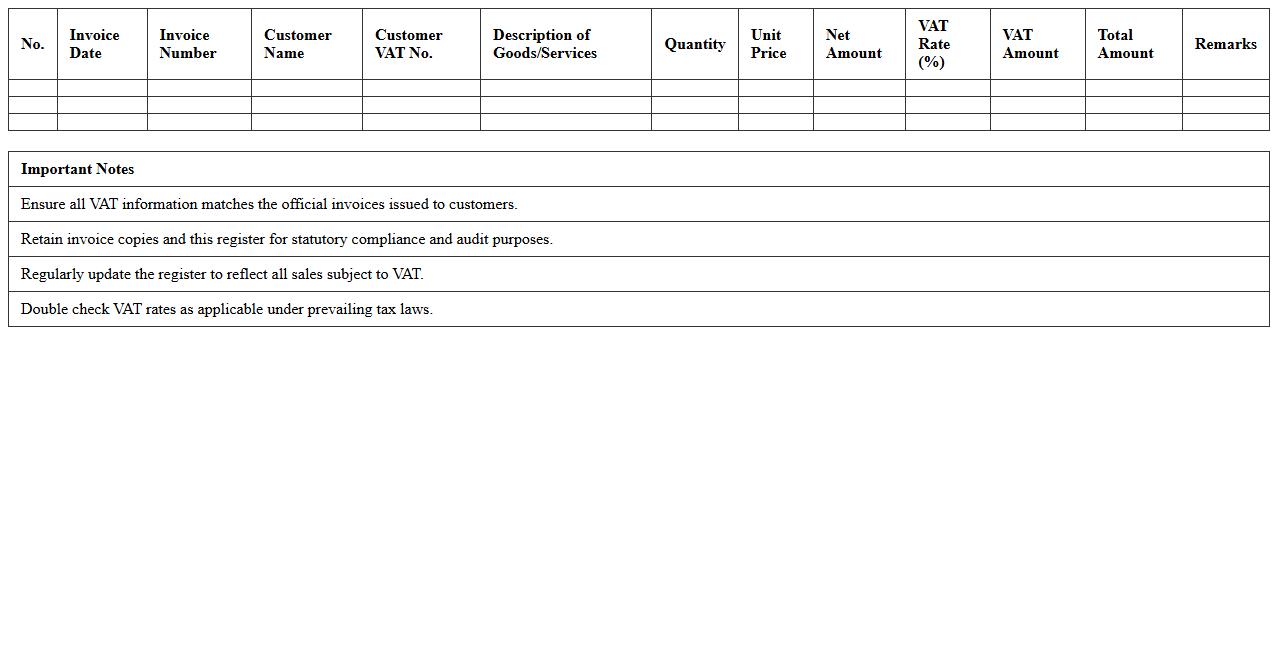

Detailed VAT Invoice Register for Retail Businesses

The

Detailed VAT Invoice Register for retail businesses is a comprehensive record that tracks all VAT-related sales and purchase invoices, ensuring accurate tax reporting and compliance. This document helps businesses monitor input and output VAT, simplifies audit processes, and supports timely VAT return submissions. By maintaining a detailed register, retailers can minimize errors, avoid penalties, and optimize their tax management strategies effectively.

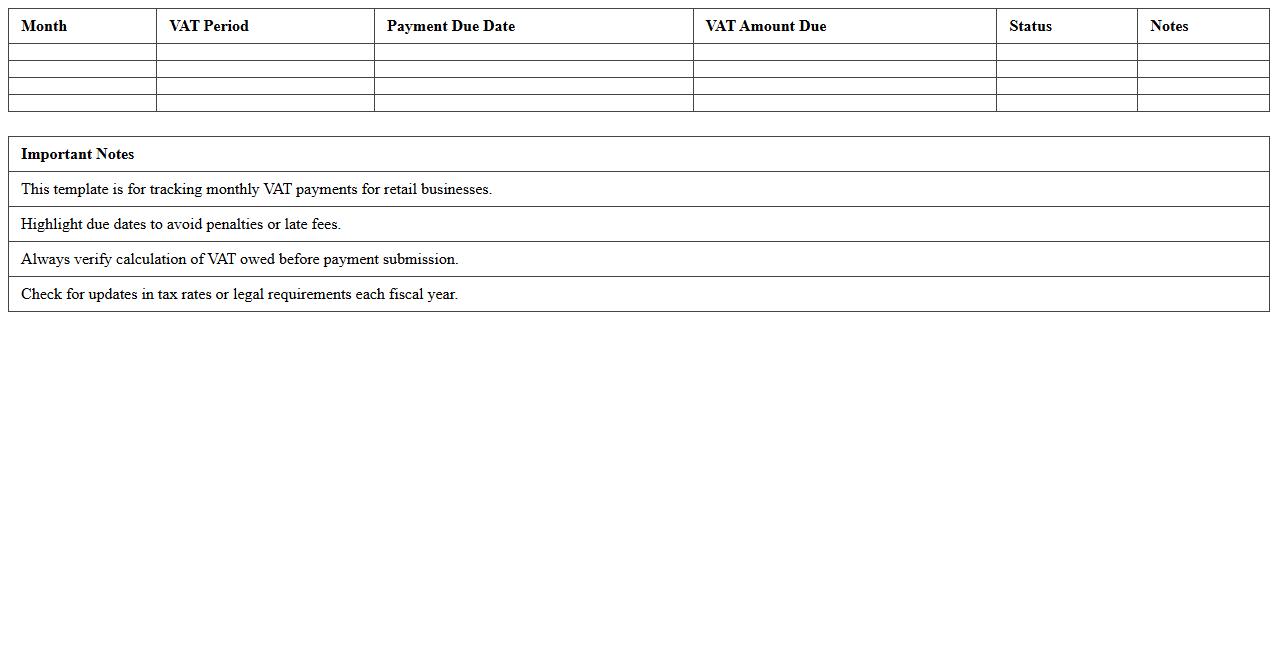

Retail VAT Payment Calendar Excel Template

The

Retail VAT Payment Calendar Excel Template is a specialized spreadsheet designed to help retail businesses track and manage their Value Added Tax (VAT) payment deadlines efficiently. It organizes key payment dates, VAT filing, and submission schedules in a clear format, reducing the risk of late payments and penalties. Using this template improves VAT compliance, streamlines financial planning, and ensures timely tax submissions for retail operations.

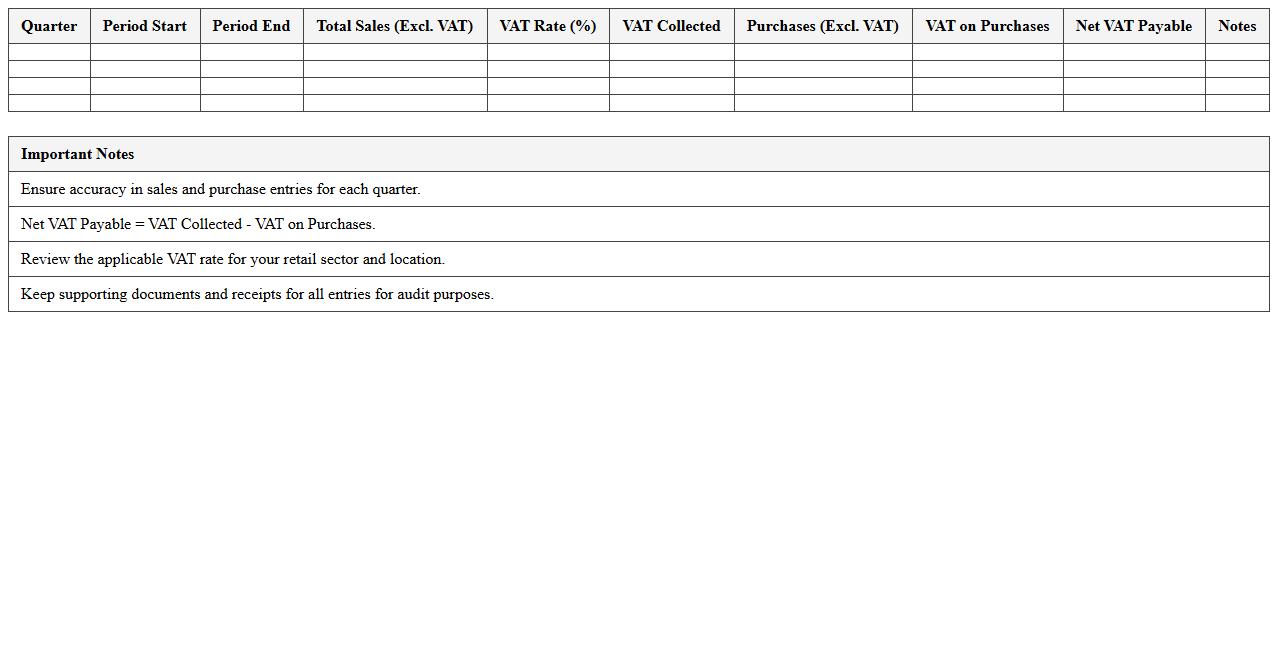

Quarterly VAT Analysis Dashboard for Retailers

The

Quarterly VAT Analysis Dashboard for Retailers document provides a detailed overview of value-added tax transactions, helping businesses track VAT liabilities and refunds accurately over each quarter. It enables retailers to identify trends, discrepancies, and compliance issues quickly, ensuring timely submission of tax returns and minimizing risks of penalties. This dashboard enhances financial transparency and supports strategic decision-making by delivering clear insights into VAT performance across products, regions, and sales channels.

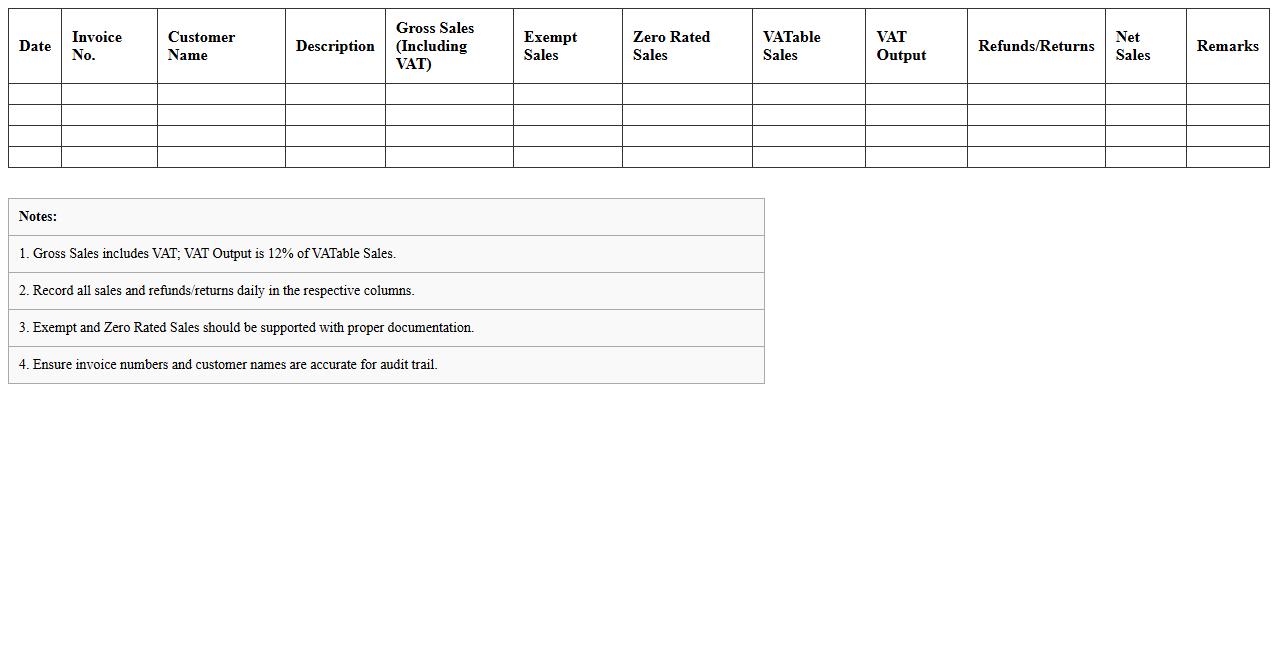

Retail VAT Account Statement Spreadsheet

A

Retail VAT Account Statement Spreadsheet document organizes detailed records of transactions involving Value Added Tax in retail businesses, enabling accurate tracking of VAT collected and paid. It simplifies tax compliance by automatically calculating VAT liabilities and input tax credits, reducing errors and saving time during tax filing. This spreadsheet is essential for maintaining transparent financial records and ensuring efficient VAT management in retail operations.

Annual VAT Summary Report Excel Template for Retail

The

Annual VAT Summary Report Excel Template for Retail document is designed to streamline the tracking and reporting of Value Added Tax (VAT) for retail businesses throughout the fiscal year. It consolidates monthly VAT data into a comprehensive summary, making it easier to review taxable sales, VAT collected, and VAT paid on purchases, ensuring accuracy for tax filings. This template enhances financial transparency and compliance, reducing errors and saving time during the VAT reporting process.

How do I automate VAT calculations for multiple products in the VAT Statement Excel template?

To automate VAT calculations for multiple products, use Excel formulas like SUMPRODUCT combined with an applicable VAT rate column. You can create a dynamic table where each product's price and VAT rate are input separately, allowing the template to calculate VAT automatically. This approach reduces manual errors and speeds up VAT processing.

Which Excel formula best tracks VAT discrepancies in bulk retail invoices?

Using the IF and ABS functions together helps identify VAT discrepancies quickly by comparing expected VAT versus reported VAT. For bulk invoice data, array formulas like SUMIFS also assist in summarizing VAT values by category or invoice. This combined approach ensures accurate reconciliation of VAT inconsistencies efficiently.

How can I map VAT rates by category within the document for diverse retail goods?

Create a separate mapping table that lists each retail category alongside its corresponding VAT rate. Use the VLOOKUP or XLOOKUP function to automatically fetch and apply the right VAT rate for each product based on its category. This strategy maintains consistency and simplifies VAT rate management across varied goods.

What's the most efficient way to consolidate monthly VAT reports in Excel for multi-branch retail?

Combine data from multiple branches into one master sheet using the Power Query feature to automate data import and transformation. Summarize VAT amounts using PivotTables that provide flexible monthly and branch-level reporting. This method delivers a centralized, efficient consolidation of multi-location VAT reports.

How do I ensure the VAT Statement Excel file complies with local e-invoicing requirements?

Review local regulations to understand mandatory e-invoicing standards and data formats required by tax authorities. Customize your VAT Statement template to include all mandatory fields, such as invoice number, tax identification, and electronic signature placeholders. Regularly update your file structure to stay compliant with evolving legal e-invoicing mandates.

More Statement Excel Templates