The Retained Earnings Statement Excel Template for Corporations streamlines the process of tracking accumulated profits and distributions over fiscal periods. This template is designed to help businesses accurately calculate retained earnings by incorporating net income, dividends, and prior earnings. Corporations benefit from its user-friendly format, enabling efficient financial reporting and decision-making.

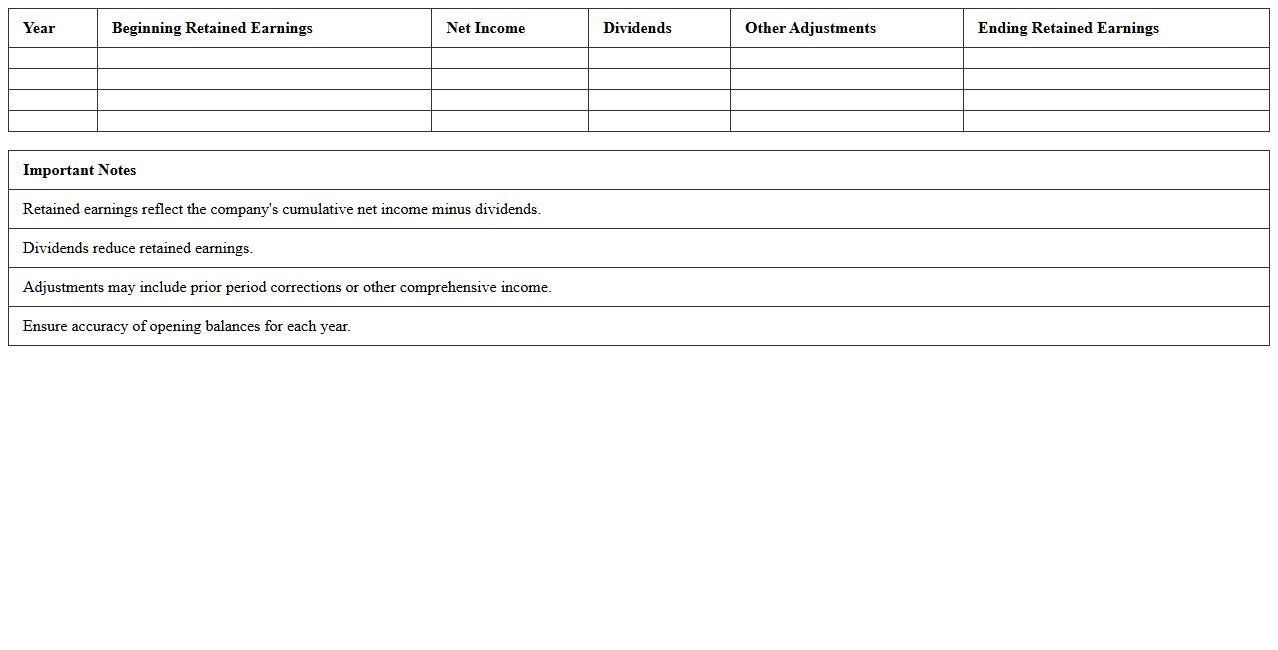

Annual Retained Earnings Statement Excel Template

The

Annual Retained Earnings Statement Excel Template document is a financial tool designed to track a company's retained earnings over a fiscal year, detailing net income, dividends paid, and adjustments. It allows businesses to visualize changes in equity, facilitating accurate financial reporting and decision-making. Utilizing this template helps streamline accounting processes, improve accuracy, and support strategic planning by providing clear insights into profit reinvestment.

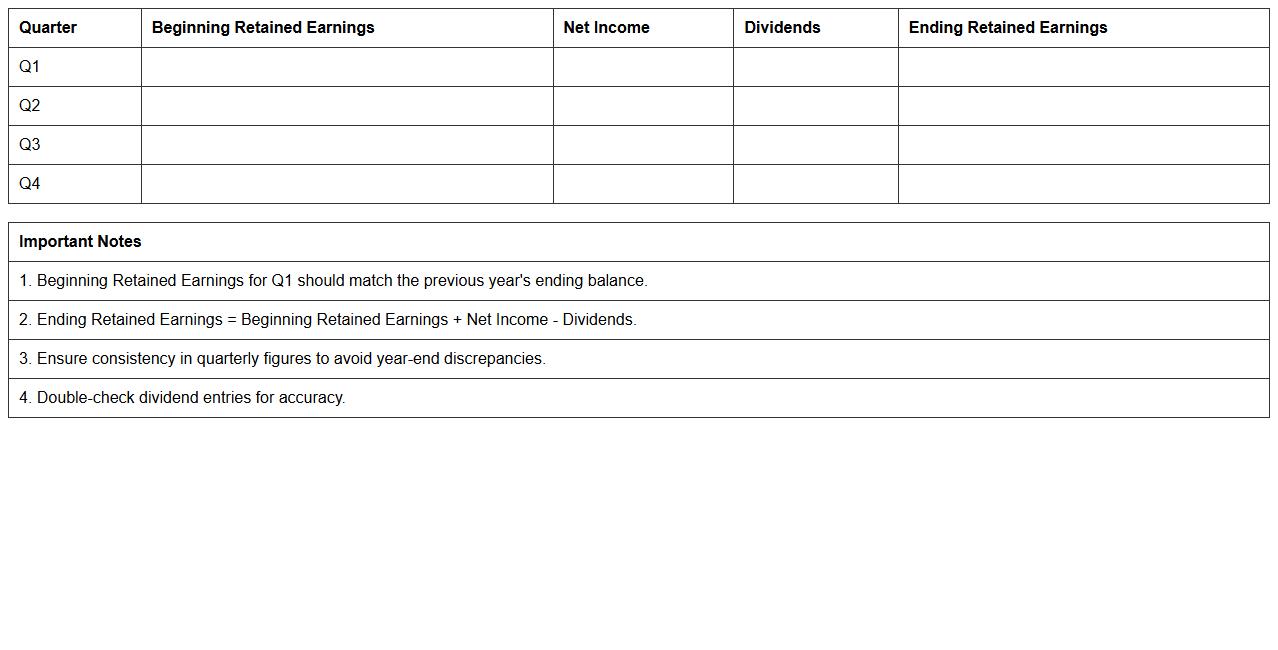

Quarterly Retained Earnings Report Sheet

The

Quarterly Retained Earnings Report Sheet is a financial document that tracks a company's retained earnings over a specific quarter, showing the accumulated profits reinvested in the business after dividends are paid. It provides valuable insights into the company's profitability trends, operational efficiency, and financial stability. Businesses and investors use this report to assess growth potential and make informed decisions about reinvestment and dividend distribution strategies.

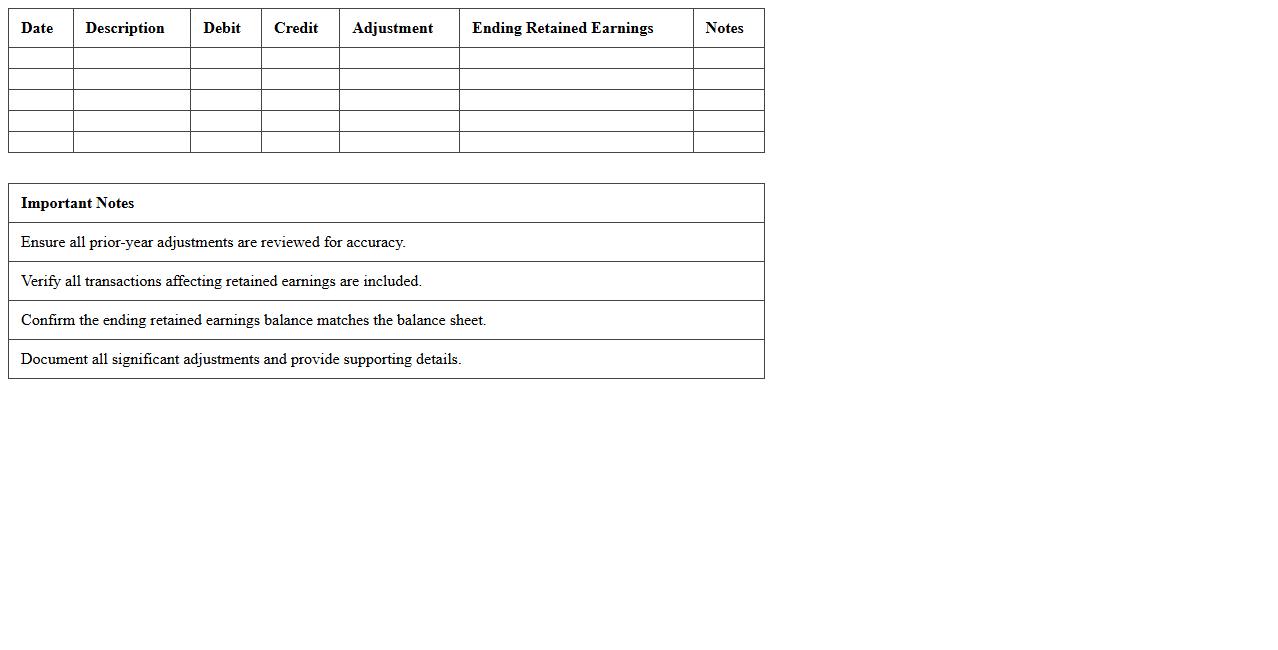

Year-End Retained Earnings Reconciliation Excel

The

Year-End Retained Earnings Reconciliation Excel document systematically tracks adjustments between beginning and ending retained earnings for a fiscal year, ensuring accuracy in financial reporting. It helps identify discrepancies by reconciling net income, dividends, and prior period adjustments, providing a clear audit trail. This tool is essential for accountants and financial analysts to maintain compliance with accounting standards and support transparent shareholder communications.

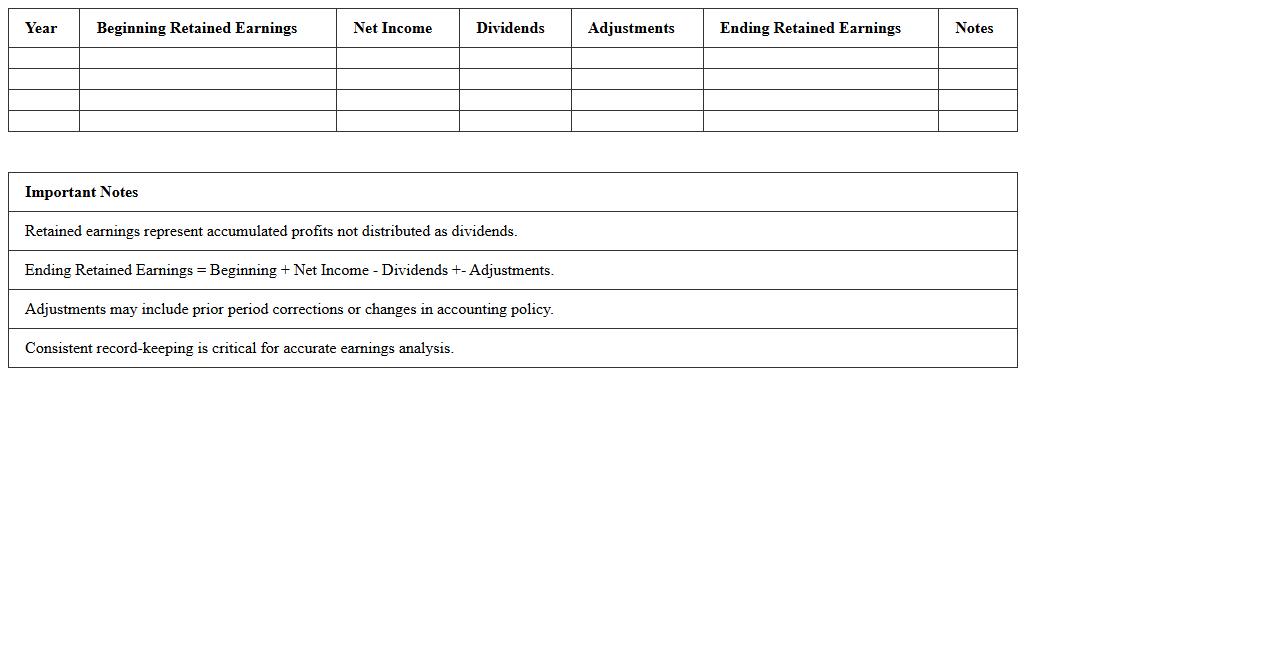

Corporation Retained Earnings Analysis Spreadsheet

The

Corporation Retained Earnings Analysis Spreadsheet document tracks and summarizes a company's retained earnings over specific periods, providing clear insights into profit reinvestment versus dividend distribution. This tool enables stakeholders to assess financial health, monitor growth trends, and make informed decisions regarding capital allocation. Utilizing this spreadsheet helps ensure transparency and aids in long-term strategic planning for enhanced corporate value.

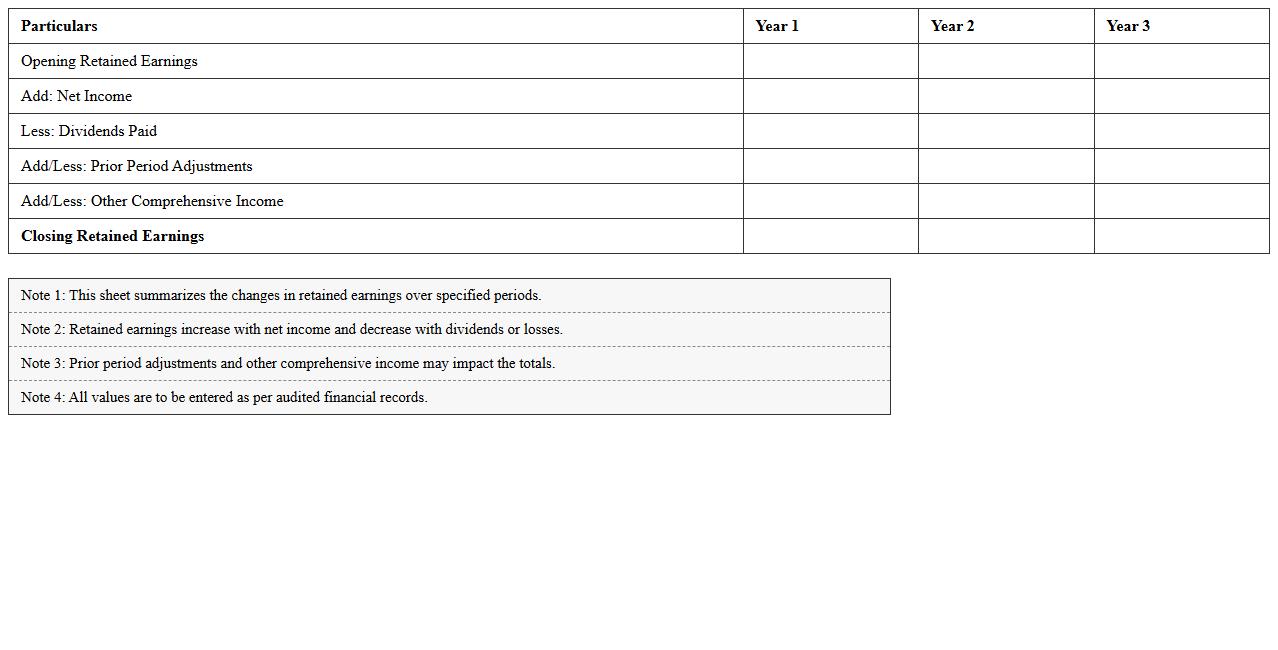

Multi-Year Retained Earnings Tracking Template

A

Multi-Year Retained Earnings Tracking Template document enables businesses to systematically monitor and analyze retained earnings across multiple fiscal years, providing clear insights into accumulated profits and reinvestments. It offers a structured format to compare year-over-year changes, aiding in financial planning, decision-making, and reporting accuracy. This template is essential for maintaining transparent records, facilitating compliance with accounting standards, and supporting strategic growth initiatives.

Retained Earnings Rollforward Statement Excel

A

Retained Earnings Rollforward Statement Excel document tracks changes in a company's retained earnings over a specific period, detailing adjustments from net income, dividends, and other equity movements. This tool enables financial analysts and accountants to clearly visualize the progression of retained earnings, helping ensure accuracy in financial reporting and seamless reconciliation of shareholders' equity. Its structured layout simplifies audit processes and supports strategic decision-making by providing insight into profit retention policies and dividend distribution impacts.

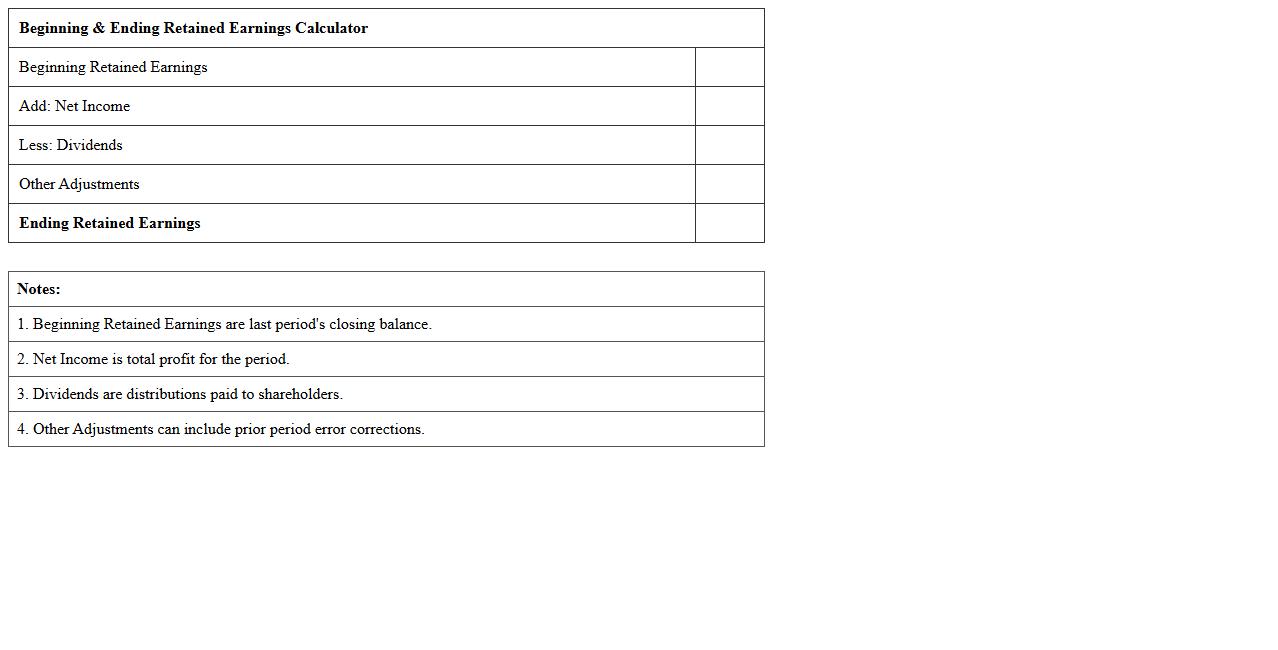

Beginning & Ending Retained Earnings Calculator

The

Beginning & Ending Retained Earnings Calculator document helps accurately determine the retained earnings balance at the start and end of an accounting period by analyzing net income, dividends, and previous retained earnings. This tool is essential for financial reporting, ensuring precise equity tracking on the balance sheet and aiding in informed decision-making for investors and management. By simplifying complex calculations, it enhances efficiency and reduces errors in financial statement preparation.

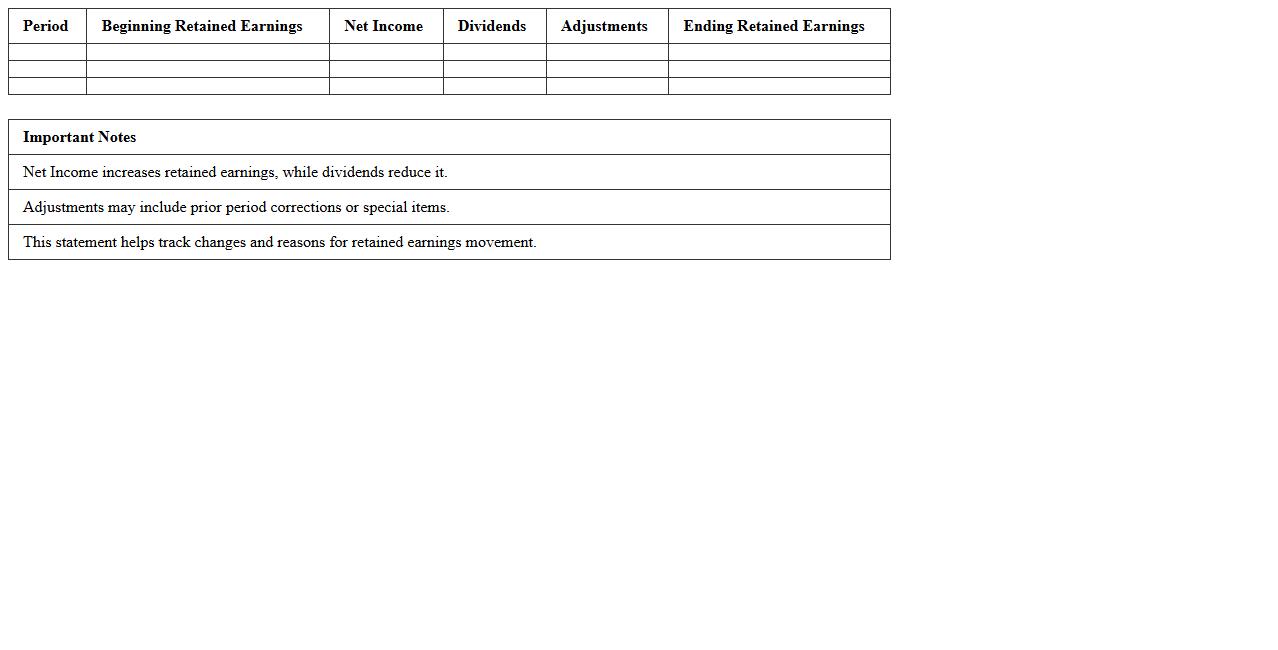

Statement of Changes in Retained Earnings Sheet

The

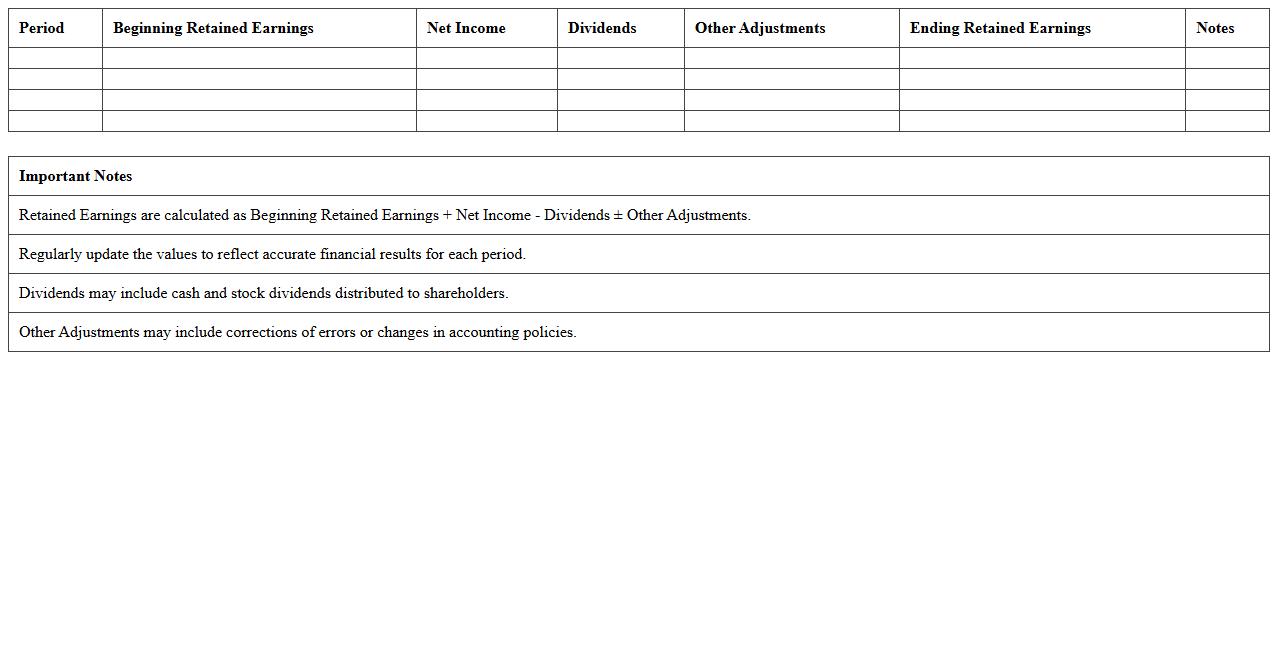

Statement of Changes in Retained Earnings is a financial document that details the movement in retained earnings over a specific period, showing net income, dividends paid, and other adjustments. This statement is useful for investors and management to understand how profits are being reinvested in the business or distributed as dividends. It provides insight into the company's profitability and dividend policy, aiding in making informed financial decisions.

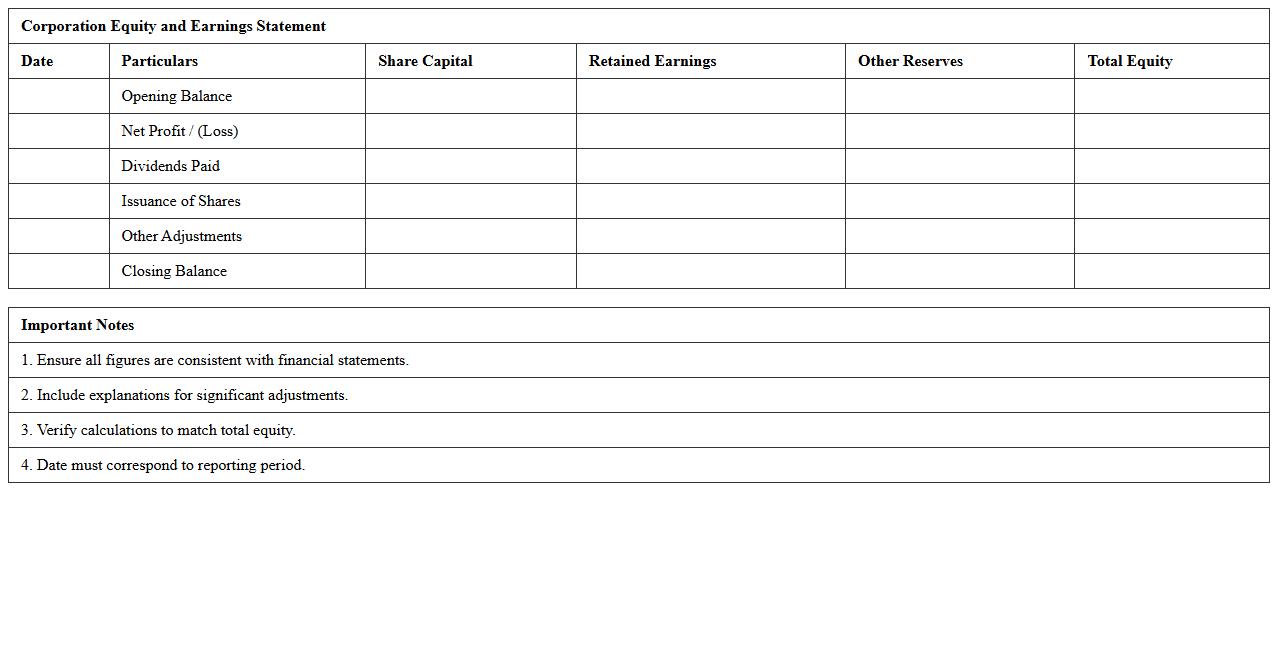

Corporation Equity and Earnings Statement Template

A

Corporation Equity and Earnings Statement Template is a structured financial document that summarizes a company's equity changes and earnings performance over a specific period. It helps stakeholders track shareholder equity, retained earnings, dividends, and net income to assess the financial health and profitability of the corporation. Using this template streamlines reporting, ensures accuracy in financial analysis, and supports informed decision-making for investors and management.

Periodic Retained Earnings Summary Excel

The

Periodic Retained Earnings Summary Excel document consolidates a company's retained earnings over specific intervals, allowing for clear tracking of profit reinvestment and dividend distributions. This spreadsheet enhances financial analysis by organizing earnings data chronologically, facilitating easier comparisons of growth and profitability across periods. Its structured format supports better decision-making by providing insights into equity changes and helping forecast future financial stability.

How to automate beginning retained earnings calculations in an Excel statement for corporations?

To automate beginning retained earnings calculations, use a reference formula that links to the prior year's ending retained earnings cell. Incorporate Excel functions like =SUM() or =IF() to adjust for net income and dividends automatically. This setup ensures your financial statements update seamlessly with each new data entry.

What advanced Excel formulas can track prior period adjustments in retained earnings?

Advanced Excel formulas such as =OFFSET(), =INDEX(), and =MATCH() can dynamically locate and adjust prior period entries in retained earnings. Utilizing these with =SUMIFS() helps aggregate adjustments accurately. Conditional formulas and data validation improve tracking prior period adjustments without manual errors.

How to structure linked financial statements in Excel for dynamic retained earnings updates?

Structure linked financial statements by creating separate sheets for the income statement, balance sheet, and retained earnings statement. Use cell references and formulas like =IFERROR() to ensure dynamic updates across all sheets. This interlinked architecture enables real-time retained earnings adjustments based on current financial inputs.

What Excel templates support multi-entity consolidated retained earnings statements?

Excel templates designed for multi-entity consolidation often include pre-built modules for intercompany eliminations and non-controlling interests to streamline retained earnings consolidation. Look for templates with structured tables and pivot tables to manage multiple entities efficiently. These templates enable robust financial reporting across complex corporate groups.

How to visualize dividends payouts' impact on retained earnings using Excel charts?

Create line or bar charts in Excel to graphically represent the relationship between dividend payouts and retained earnings over time. Use dynamic ranges and data labels to highlight key fluctuations and trends. Combining charts with slicers allows interactive exploration of how dividends affect retained earnings.

More Statement Excel Templates