The Dividends Paid Statement Excel Template for Public Companies provides a structured format to accurately track dividend distributions over time. This template simplifies financial reporting by organizing payment dates, amounts, and shareholder information in a clear, easy-to-use spreadsheet. It enhances transparency and ensures compliance with regulatory requirements for public companies.

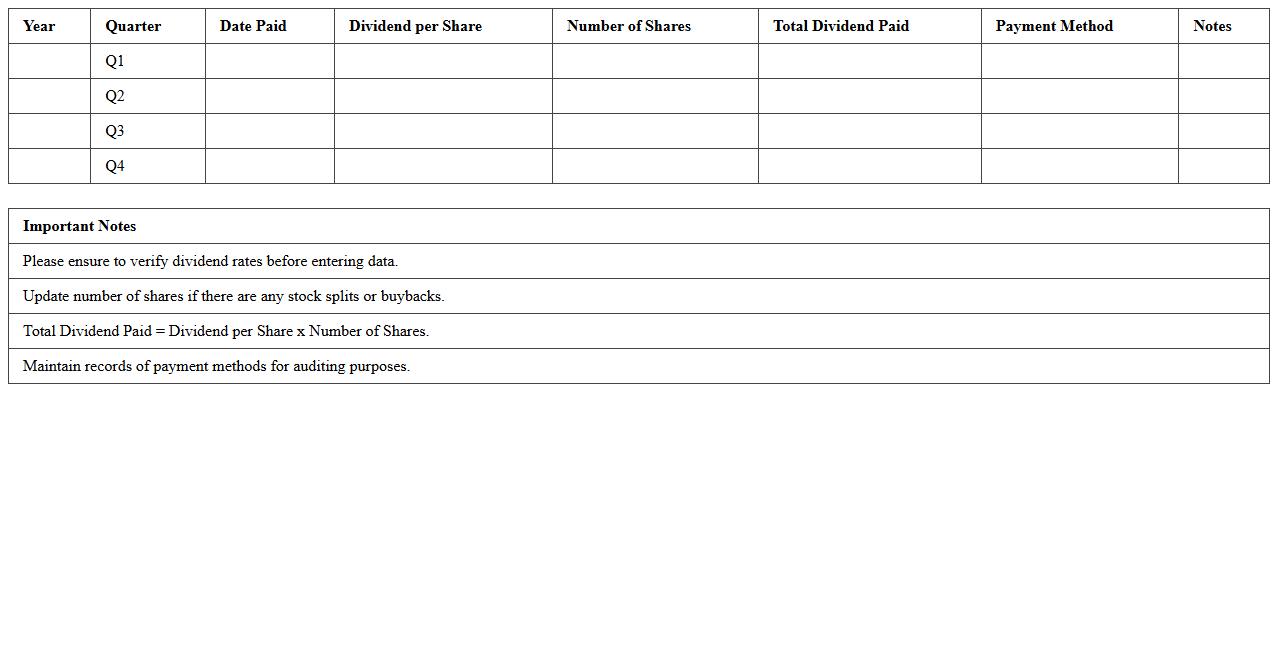

Quarterly Dividends Paid Statement Excel Template

The

Quarterly Dividends Paid Statement Excel Template is a structured financial document designed to track and summarize dividend payments made to shareholders every quarter. It helps investors and financial managers monitor dividend income, analyze payment trends, and ensure accurate record-keeping for tax and investment purposes. Utilizing this template improves financial transparency and aids in strategic decision-making by providing clear, organized data on dividend distributions.

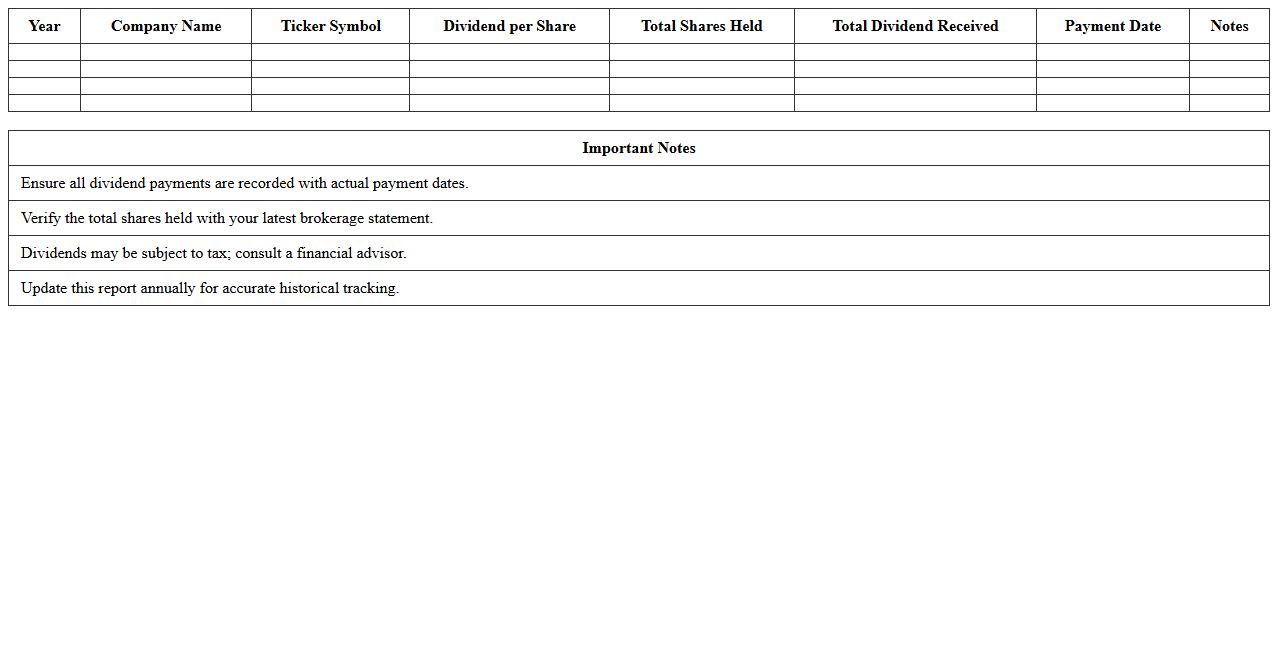

Annual Dividend Payment Report Excel Sheet

An

Annual Dividend Payment Report Excel Sheet document tracks and summarizes dividend payments made by companies to shareholders over a fiscal year, providing detailed data on amounts, payment dates, and shareholder distributions. This report helps investors analyze dividend trends, assess income reliability, and make informed investment decisions based on historical dividend performance. Financial analysts and portfolio managers use the sheet to monitor cash flow from investments and evaluate the financial health of dividend-paying entities.

Historical Dividend Payments Tracker Excel

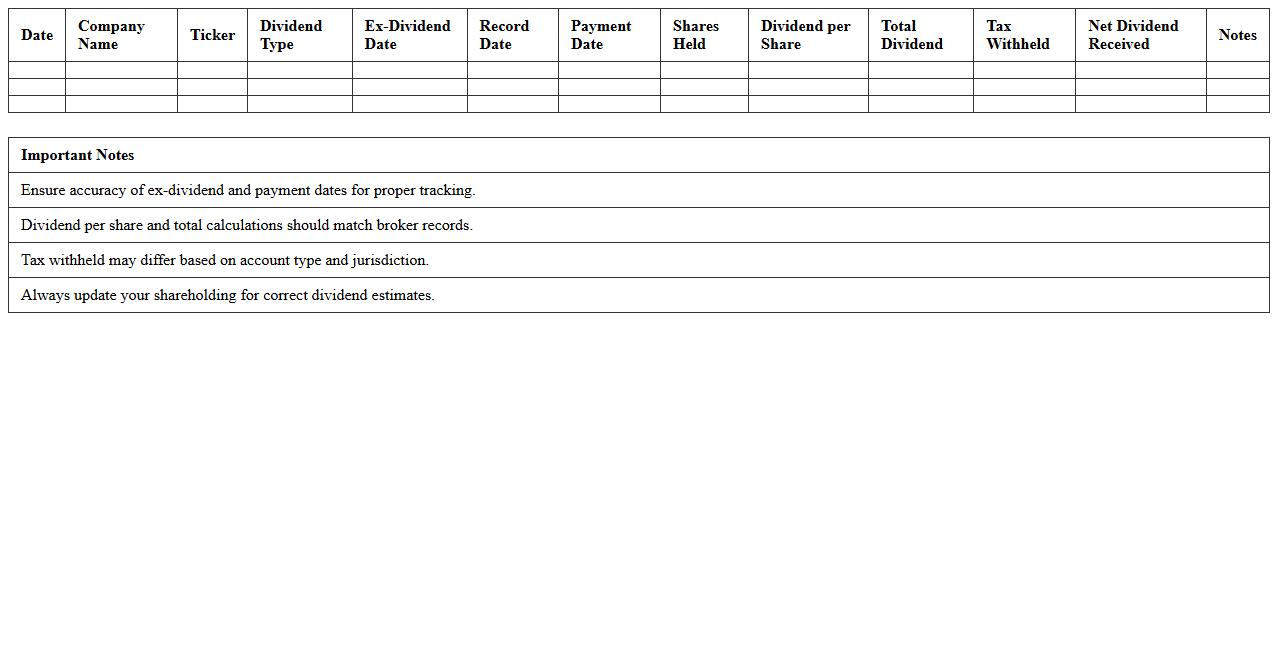

The

Historical Dividend Payments Tracker Excel is a comprehensive tool designed to record and analyze past dividend distributions from various stocks, providing a clear view of dividend trends over time. It enables investors to assess the consistency and growth of dividend payments, helping in making informed decisions about portfolio income stability and future yield projections. By organizing dividend data systematically, the tracker supports strategic financial planning and enhances dividend investment strategies.

Dividend Distribution Schedule Excel Template

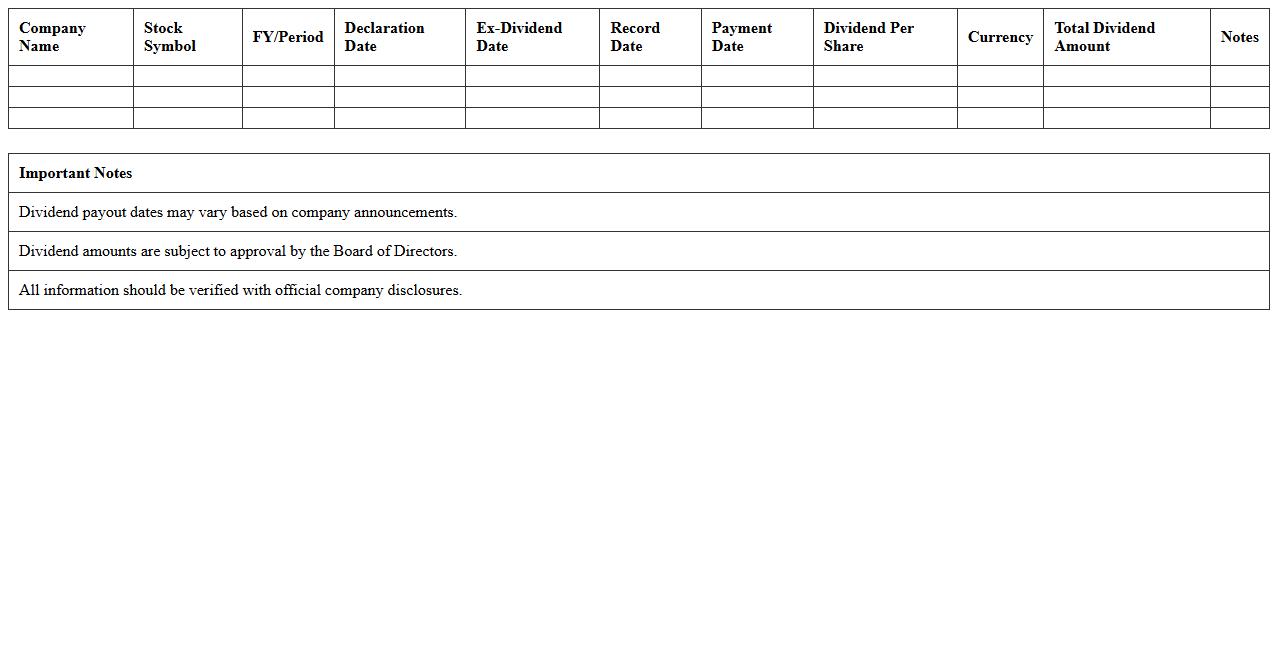

A

Dividend Distribution Schedule Excel Template document is a structured spreadsheet designed to help businesses plan, track, and manage dividend payouts to shareholders efficiently. It organizes critical financial data such as dividend amounts, payment dates, and shareholder details, ensuring timely and accurate distribution. Utilizing this template enhances transparency, simplifies financial reporting, and supports compliance with corporate governance standards.

Public Company Dividend Payout Statement XLS

A

Public Company Dividend Payout Statement XLS document provides a detailed breakdown of dividend distributions made by publicly traded companies to their shareholders, including dates, amounts, and payout ratios. This spreadsheet format allows investors and analysts to efficiently track dividend history, assess company profitability, and make informed investment decisions based on dividend performance trends. Access to this data supports portfolio management and financial planning by revealing consistent income streams and potential growth indicators.

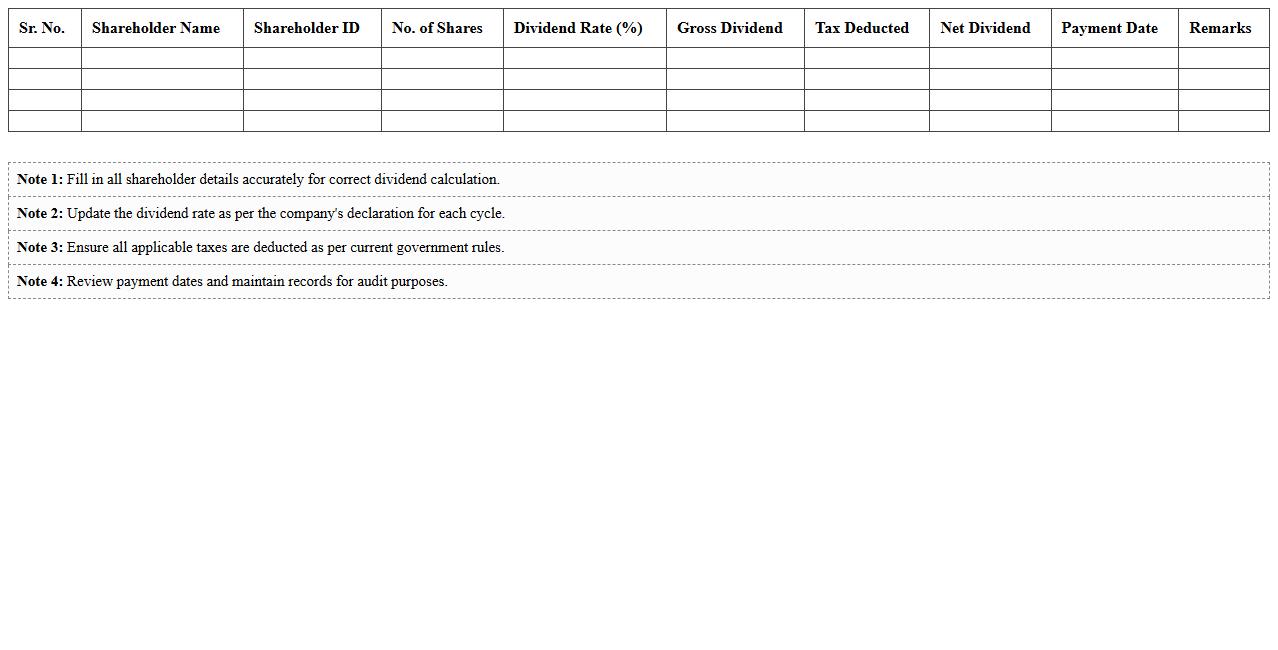

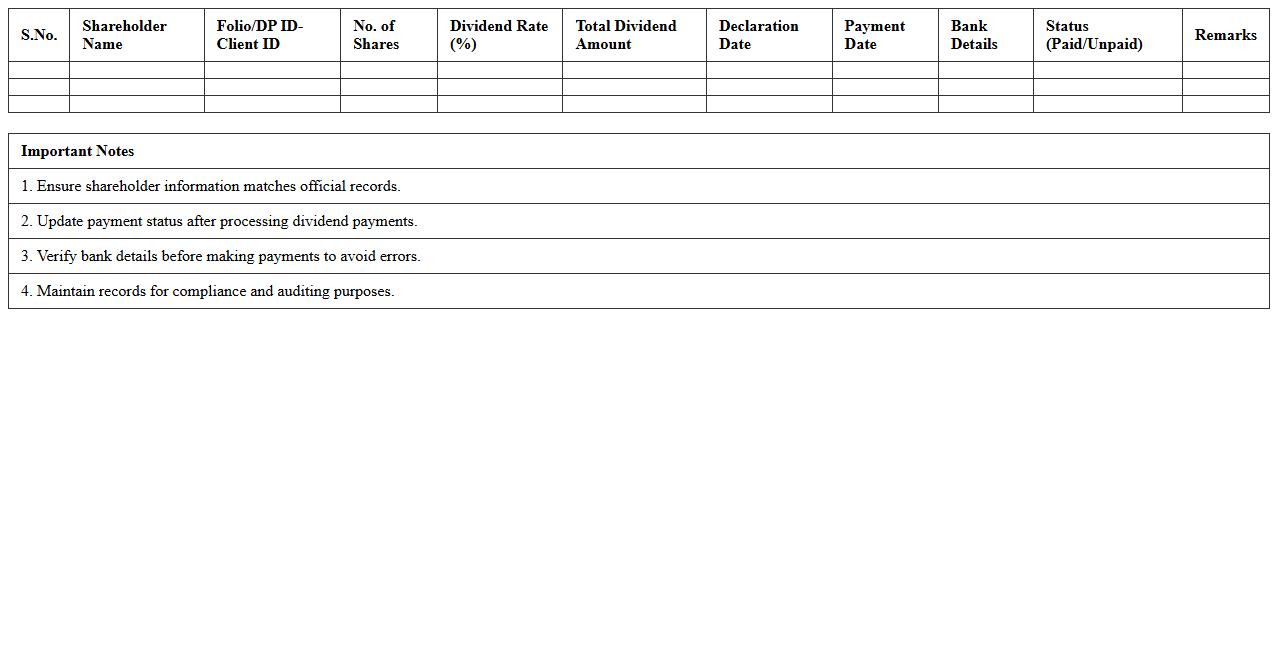

Shareholder Dividend Record Excel Sheet

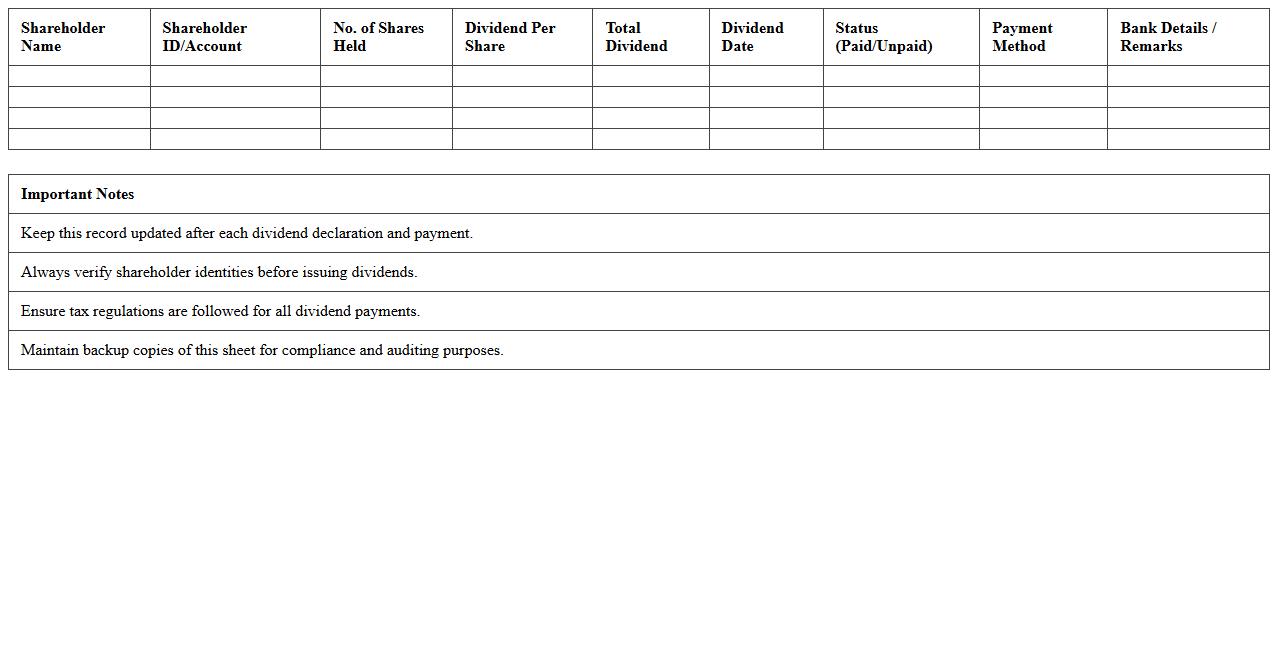

A

Shareholder Dividend Record Excel Sheet is a detailed spreadsheet used to track dividend payments made to shareholders over time, including payment dates, amounts, and shareholder details. This document helps maintain accurate financial records, simplifies dividend distribution management, and ensures compliance with regulatory requirements. It is valuable for shareholders, accountants, and company management to monitor dividend history and plan future payouts effectively.

Corporate Dividend Payment Ledger Excel

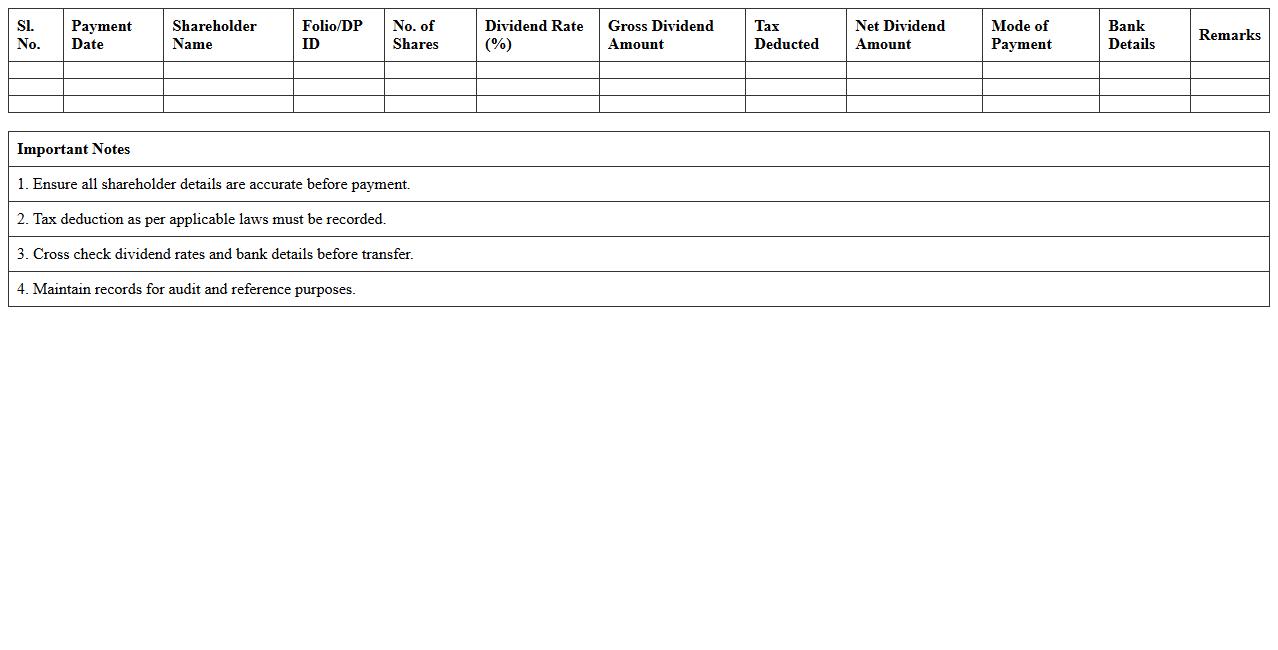

A

Corporate Dividend Payment Ledger Excel document is a detailed spreadsheet used to track and record dividend payments made to shareholders over specific periods. It helps businesses maintain accurate financial records, monitor dividend distributions, and ensure compliance with corporate governance standards. This ledger streamlines dividend management, enhances transparency, and supports efficient auditing and reporting processes.

Dividend Payment Analysis Excel Template

The

Dividend Payment Analysis Excel Template is a comprehensive tool designed to track and analyze dividend payments from various investments efficiently. It helps investors monitor payout dates, amounts, and growth trends, enabling informed decisions to maximize income streams. By organizing dividend data systematically, it simplifies portfolio management and enhances financial planning accuracy.

Cash Dividends Paid Summary Excel Sheet

The

Cash Dividends Paid Summary Excel Sheet is a financial document that consolidates details of cash dividends distributed by a company to its shareholders. It helps investors and financial analysts track dividend payment history, amounts, and dates, providing insights into a company's profitability and shareholder return policy. This summary sheet enhances decision-making by offering a clear, organized view of dividend trends and cash flow impacts.

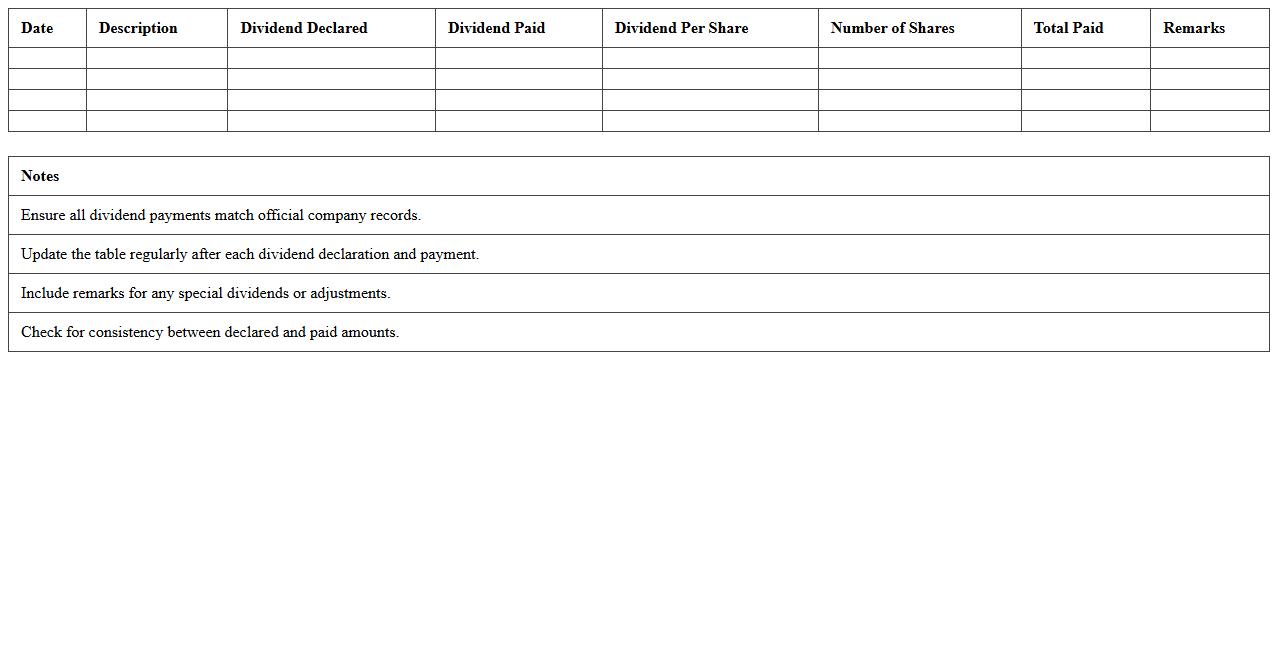

Dividend Declaration and Payment Statement Excel

A

Dividend Declaration and Payment Statement Excel document is a tool used to record and track the declaration date, payment date, dividend per share, and total dividend amount for shareholders. It helps organizations maintain accurate financial records, ensuring transparency and timely communication with investors about dividend distributions. This document streamlines dividend management, aids in compliance with corporate governance standards, and supports financial analysis and reporting processes.

How to automate Dividends Paid Statement updates in Excel for public companies using VBA?

Automating Dividends Paid Statement updates in Excel can be achieved using VBA macros to streamline data entry and processing. By writing VBA scripts, you can pull dividend information from reliable sources and update your worksheets dynamically. This automation reduces manual errors and ensures timely updates for public companies.

What Excel formulas best track ex-dividend and payment dates for public company reporting?

Using DATE and IF functions allows effective tracking of ex-dividend and payment dates in Excel. The combination of VLOOKUP or INDEX-MATCH helps retrieve corresponding dividend dates from datasets. Conditional formatting can also highlight upcoming ex-dividend or payment deadlines.

How to reconcile discrepancies in dividends paid data using Excel pivot tables?

Excel pivot tables enable quick summarization and cross-verification of dividend payment records to identify inconsistencies. By grouping data by company, date, and amount, you can pinpoint discrepancies in dividend reporting. Applying filters and slicers enhances the reconciliation process by focusing on specific data subsets.

Which Excel templates support multi-currency dividends reporting for global public companies?

Multi-currency dividend reporting requires Excel templates with built-in currency conversion features and dynamic exchange rate updates. Templates supporting Power Query integration allow importing current forex rates, ensuring accurate dividend valuations. Such templates facilitate seamless aggregation by currency for global public companies.

How to integrate SEC filing data into an Excel Dividends Paid Statement for audit compliance?

Integrating SEC filing data into Excel involves importing structured data formats like XML or CSV from the SEC's EDGAR database. Automated data extraction techniques, including VBA or Power Query, ensure that dividends data aligns with official filings for audit compliance. Proper linkage between SEC data and internal records strengthens transparency and accuracy.

More Statement Excel Templates