The Comprehensive Income Statement Excel Template for Investment Portfolios provides a detailed overview of all income and expenses related to investments, enabling precise tracking of portfolio performance. It allows users to categorize dividends, interest, capital gains, and losses systematically, facilitating accurate financial analysis and reporting. Designed for ease of use, this template enhances decision-making by presenting clear, organized financial data in a customizable Excel format.

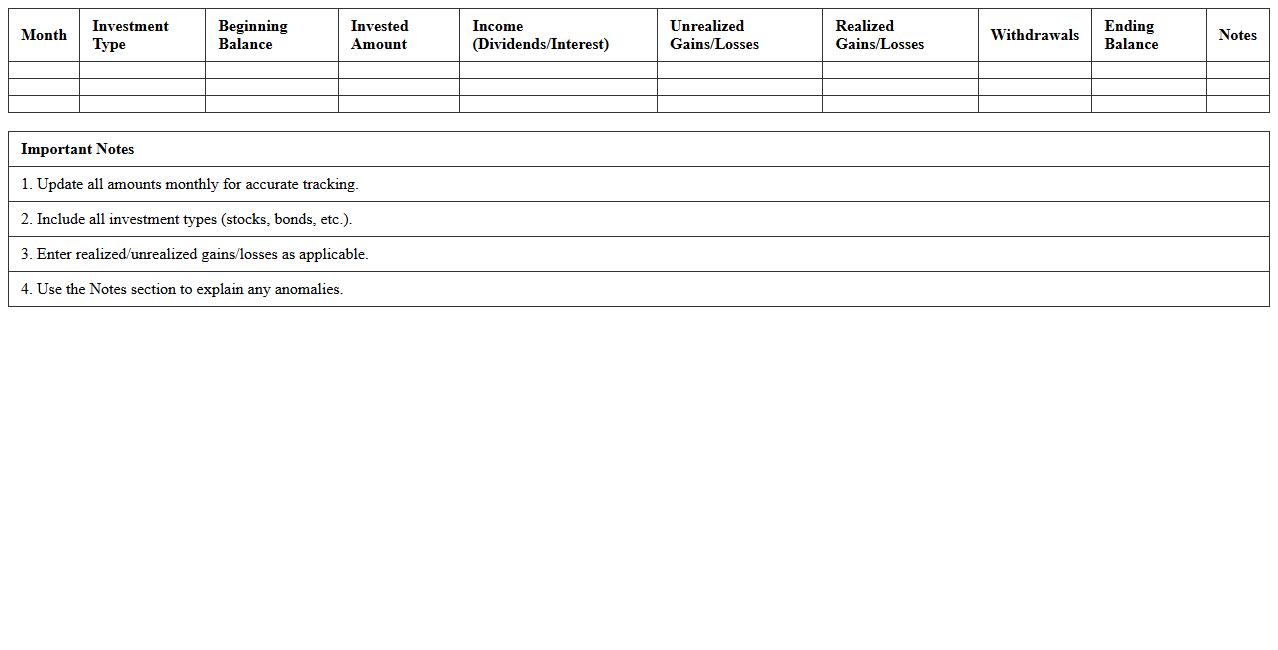

Monthly Investment Portfolio Income Statement Template

A

Monthly Investment Portfolio Income Statement Template is a structured document designed to track and summarize income generated from various investments, including dividends, interest, and capital gains, on a monthly basis. It provides a clear overview of portfolio performance, helping investors monitor cash flow, assess profitability, and make informed decisions regarding asset allocation. Utilizing this template enhances financial management by ensuring organized records and facilitating timely analysis of investment returns.

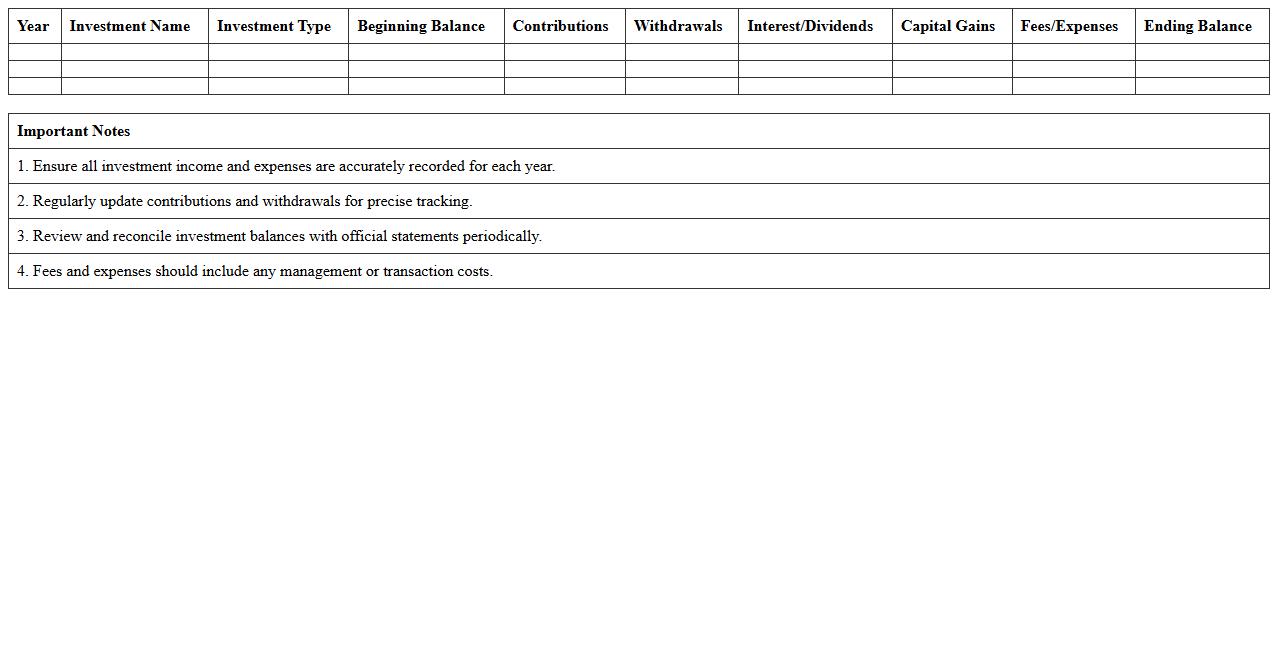

Yearly Comprehensive Investment Income Statement Spreadsheet

A

Yearly Comprehensive Investment Income Statement Spreadsheet is a detailed financial document that tracks and summarizes all income generated from investments over a year, including dividends, interest, capital gains, and other relevant revenue streams. It serves as an essential tool for investors and financial analysts to monitor performance, manage tax liabilities, and make informed decisions about portfolio adjustments. By organizing complex income data into an accessible format, this spreadsheet enhances transparency and supports strategic financial planning.

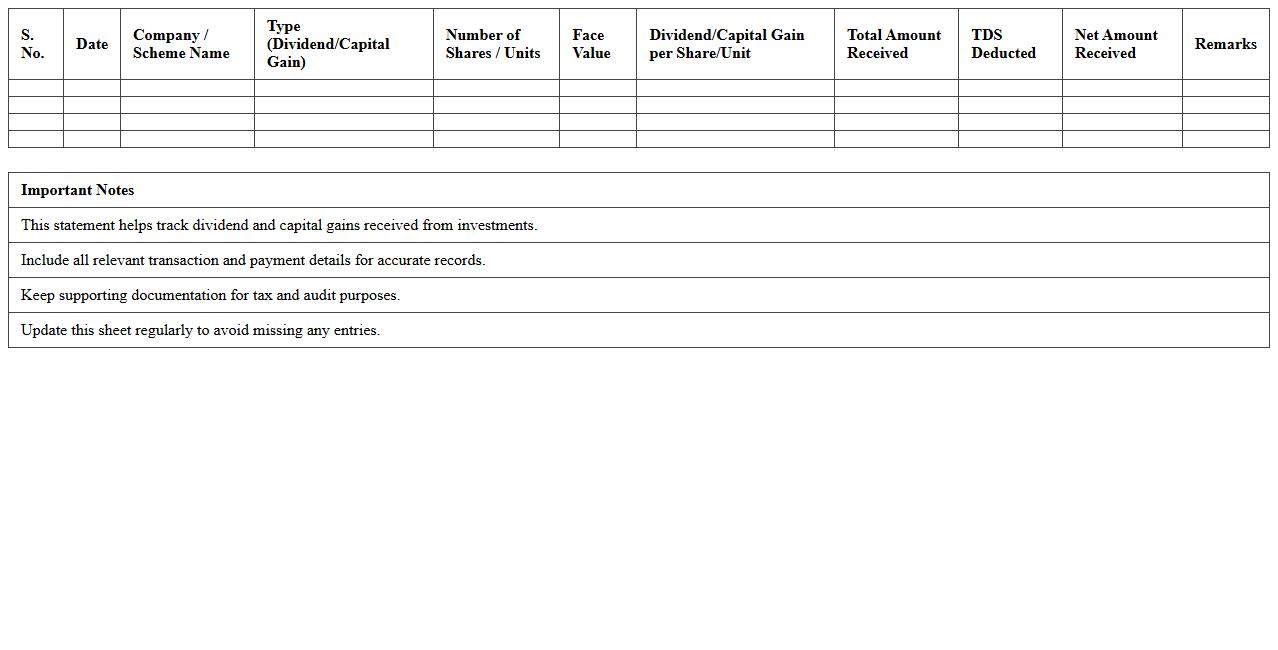

Dividend and Capital Gains Statement Excel Sheet

A

Dividend and Capital Gains Statement Excel Sheet is a detailed financial document that records income from dividends and profits from the sale of investments, such as stocks or mutual funds. It helps investors track their earnings, calculate tax liabilities accurately, and analyze portfolio performance over time. Using this Excel sheet streamlines financial management by providing organized, easily accessible data for effective decision-making and tax reporting.

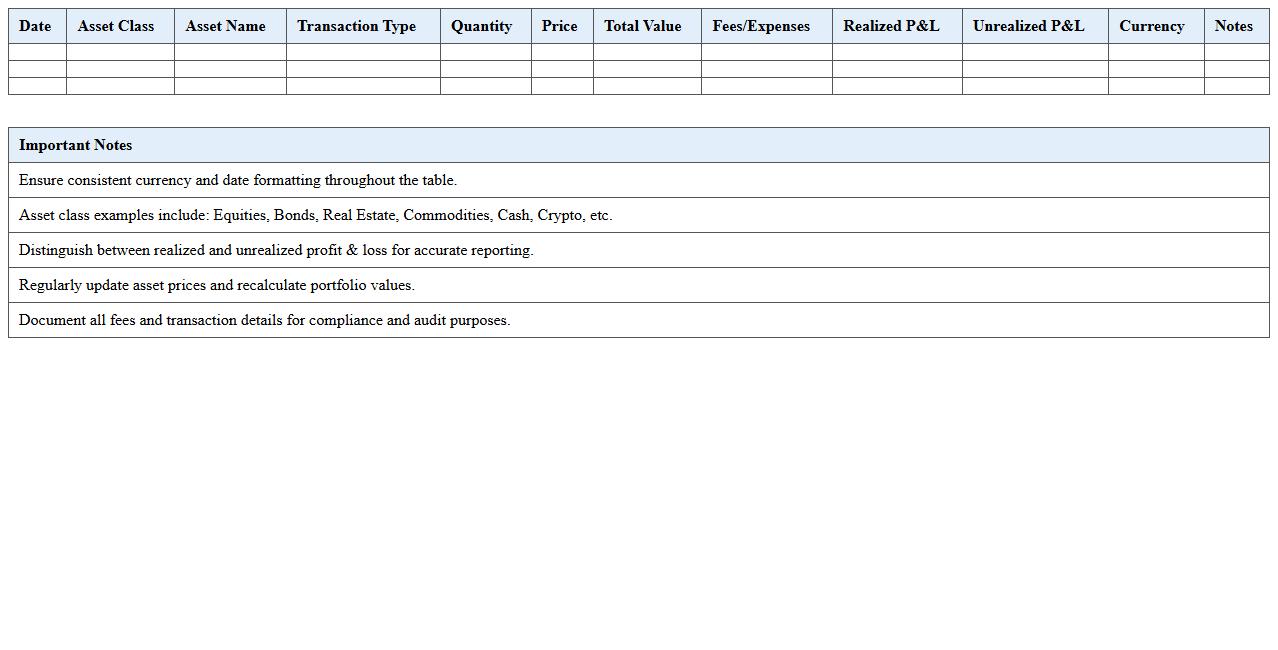

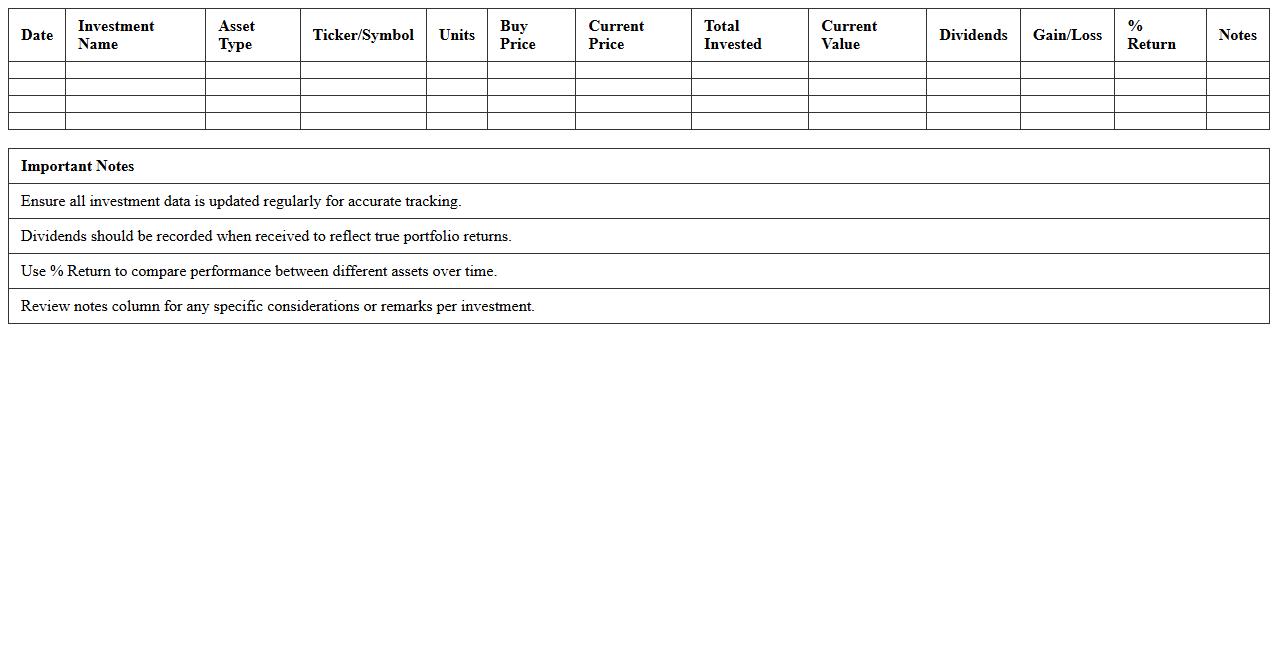

Multi-Asset Portfolio Comprehensive Profit & Loss Excel Template

The

Multi-Asset Portfolio Comprehensive Profit & Loss Excel Template is a powerful financial tool designed to track and analyze the performance of diverse investment assets in one consolidated report. It enables users to monitor gains, losses, dividends, and fees across stocks, bonds, commodities, and other instruments, providing detailed insights into portfolio profitability. This template improves decision-making by offering clear visualization and accuracy in profit and loss calculations, essential for portfolio optimization and risk management.

Investment Portfolio Quarterly Income Tracking Worksheet

The

Investment Portfolio Quarterly Income Tracking Worksheet document is a financial tool designed to monitor and record income generated from various investments each quarter. It helps investors systematically track dividends, interest payments, and capital gains, providing clear insights into the performance and cash flow of their portfolio. Using this worksheet enables better decision-making by identifying income trends and ensuring alignment with financial goals.

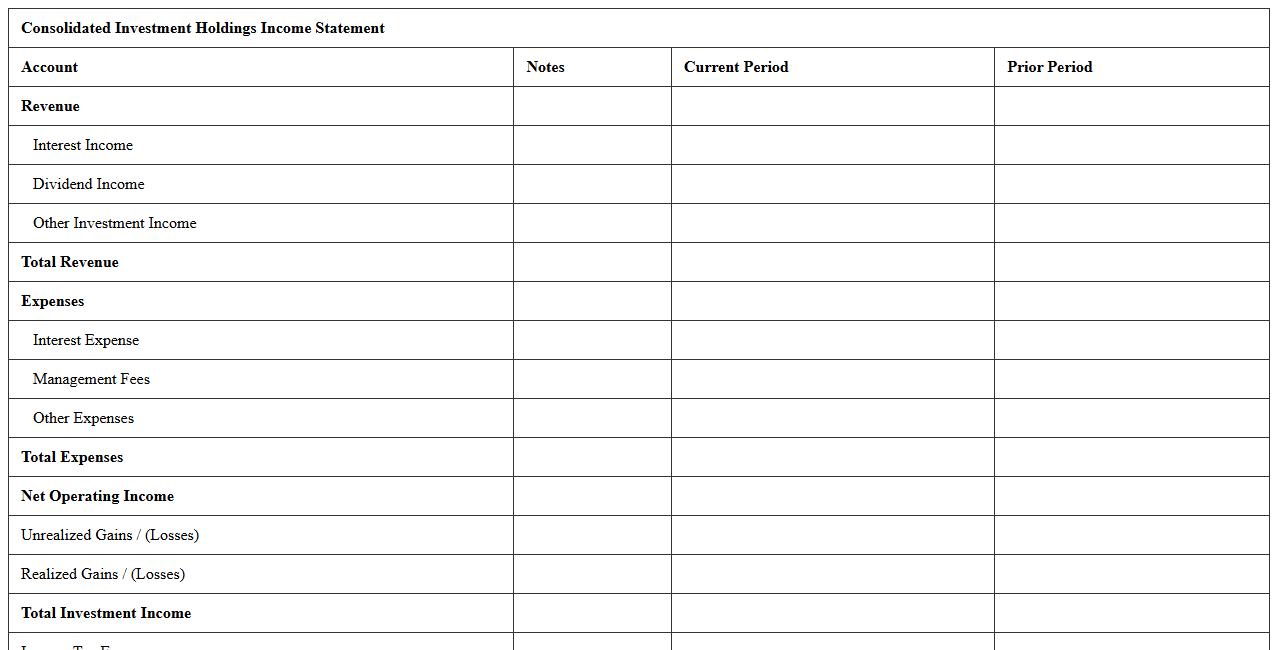

Consolidated Investment Holdings Income Statement Template

The

Consolidated Investment Holdings Income Statement Template document provides a structured format to summarize the financial performance of multiple investment entities under one umbrella, capturing revenues, expenses, and net income efficiently. This template aids investors, analysts, and management in evaluating overall profitability and operational trends across diverse holdings, ensuring clear visibility and consistency for financial reporting. Utilizing this document streamlines decision-making, budget planning, and compliance with accounting standards by presenting consolidated financial data in an organized, easy-to-analyze format.

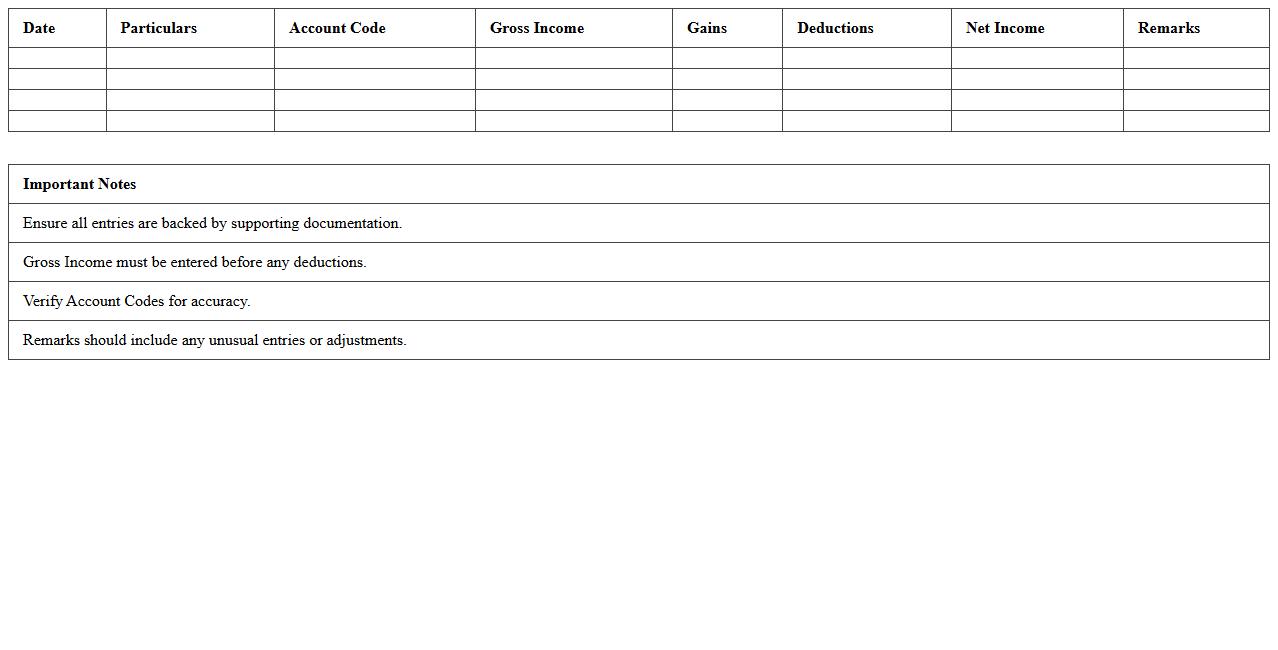

Detailed Comprehensive Gains & Income Report Excel Format

The

Detailed Comprehensive Gains & Income Report Excel Format is a structured financial document designed to track, analyze, and summarize various sources of income and capital gains with precision. This format allows users to organize data efficiently, facilitating accurate reporting for tax purposes or financial planning. By providing clear insights into profit and income streams, it helps individuals and businesses optimize their tax liabilities and make informed economic decisions.

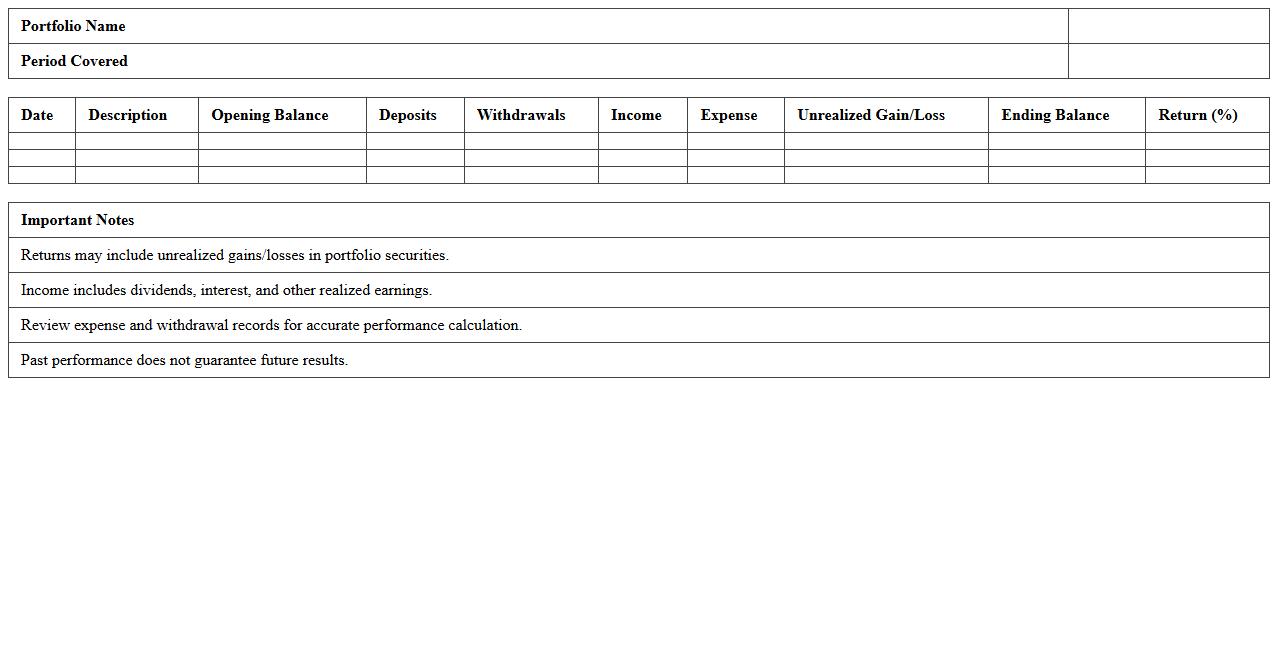

Financial Performance Statement for Investment Portfolios Excel

A

Financial Performance Statement for Investment Portfolios Excel document provides a detailed analysis of returns, risks, and asset allocations for various investments over specific periods. It helps investors track portfolio growth, compare performance against benchmarks, and identify areas of underperformance. Using this tool enhances decision-making by offering clear insights into investment efficiency and overall financial health.

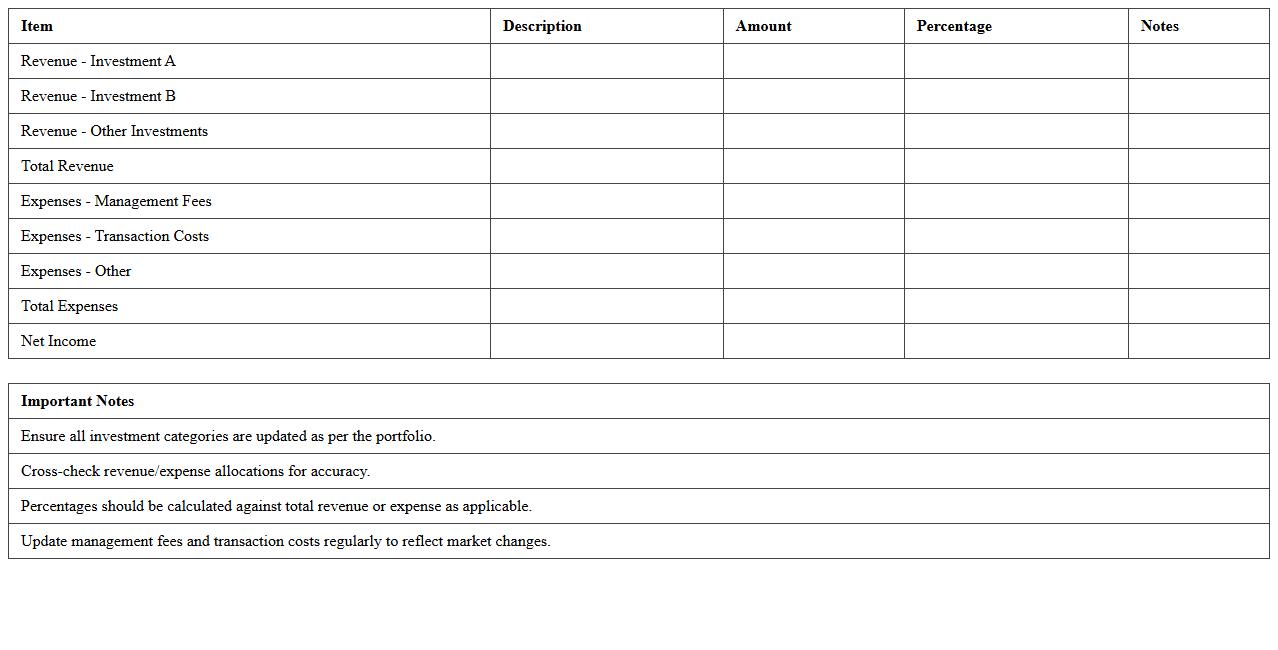

Breakdown Income Statement for Diversified Investments Spreadsheet

A

Breakdown Income Statement for Diversified Investments Spreadsheet document provides a detailed financial overview by categorizing income and expenses across multiple investment sources. It enables investors to analyze the profitability and performance of each investment type separately, facilitating informed decision-making and strategic portfolio adjustments. By clearly presenting revenue streams and cost elements, this document helps optimize returns and manage financial risks effectively.

Personal Investment Portfolio Earnings Statement Excel Sheet

A

Personal Investment Portfolio Earnings Statement Excel Sheet document is a detailed financial tool that tracks and summarizes the earnings generated from various investment assets such as stocks, bonds, mutual funds, and dividends. It helps investors monitor returns, analyze performance trends, and make informed decisions to optimize their portfolio growth. By providing clear visibility into income streams and capital gains, this Excel sheet enables effective financial planning and risk management.

How do I categorize unrealized gains in a comprehensive income statement Excel template for investment portfolios?

In a comprehensive income statement Excel template, unrealized gains should be recorded under Other Comprehensive Income (OCI) to reflect gains not yet realized through sales. Proper categorization ensures accurate financial reporting and analysis of investment performance. Use clearly labeled columns, such as "Unrealized Gains," for easy reference and data manipulation.

What Excel formulas help track dividend income across multiple investment assets?

To track dividend income from multiple assets, use the SUMIF or SUMIFS function to total dividends by asset or date. For example, =SUMIF(asset_range, "AssetName", dividend_range) quickly aggregates dividends per asset. Incorporate dynamic ranges with table structures to automate updates as new dividend data is added.

How can I automate OCI (Other Comprehensive Income) adjustments for foreign currency investments in Excel?

Automate OCI adjustments for foreign currency investments using Excel's currency conversion formulas combined with exchange rate lookups. Implement VLOOKUP or INDEX/MATCH to fetch current rates, then multiply investment values to reflect updated foreign currency gains or losses. Set up conditional formatting to flag significant changes for review.

Which pivot table setup best visualizes asset class performance on a comprehensive income statement spreadsheet?

Create a pivot table with asset class as rows, performance metrics such as returns and income as values, and time periods or portfolios as columns. This layout highlights comparative results across classes and temporal trends effectively. Utilize slicers to filter by dates or specific assets, enhancing interactive data exploration.

How do I reconcile realized vs. unrealized investment returns in a portfolio spreadsheet?

To reconcile realized versus unrealized returns, create separate columns distinguishing gains finalized through sales from current market valuations. Use formulas to sum each category, ensuring total returns reflect both realized profits and potential value changes. Incorporate a summary section comparing these figures for comprehensive portfolio performance insights.

More Statement Excel Templates