The Equity Statement Excel Template for Real Estate Firms is a powerful tool designed to streamline the tracking and management of ownership interests and investments within property portfolios. It offers clear visualization of equity distributions, capital contributions, and profit sharing among stakeholders, enhancing financial transparency. Customizable features allow real estate firms to efficiently monitor equity changes and generate accurate reports for informed decision-making.

Equity Statement Tracker for Real Estate Investments

The

Equity Statement Tracker for Real Estate Investments is a comprehensive document that records all equity contributions, distributions, and ownership changes over time, providing a clear financial snapshot. It helps investors monitor their capital growth, assess returns, and make informed decisions regarding future investments. This tool ensures transparency and accuracy in tracking ownership interests and financial performance within real estate portfolios.

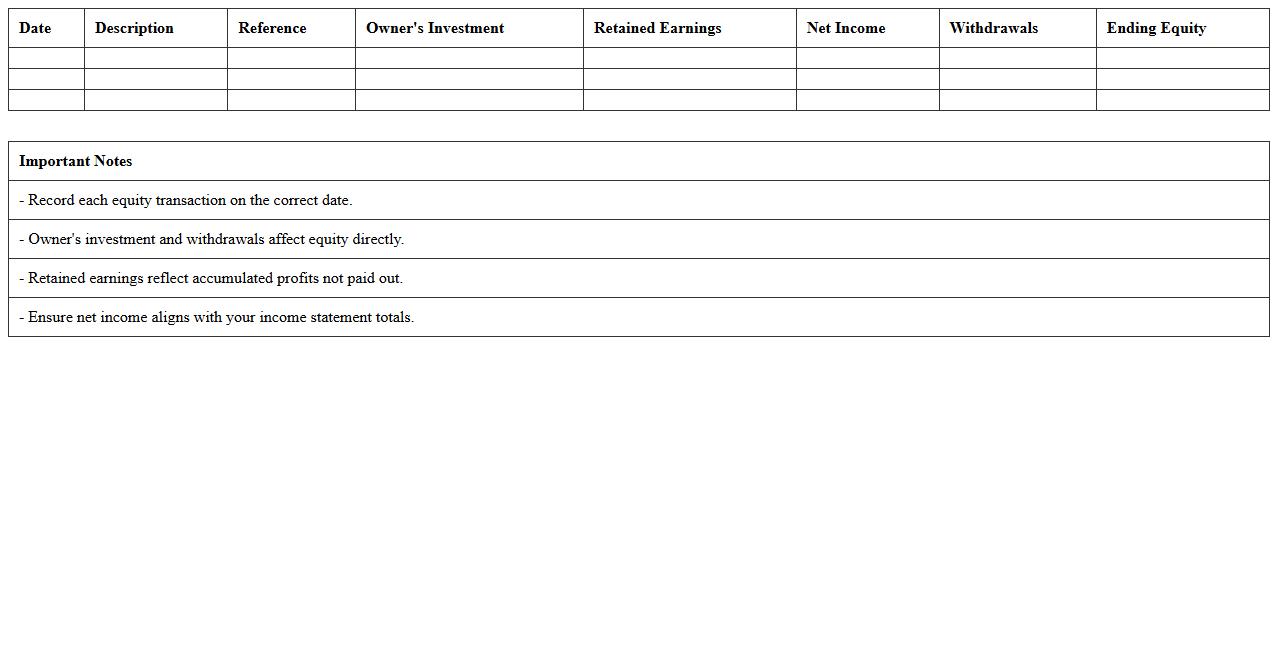

Monthly Equity Statement Excel Template

A

Monthly Equity Statement Excel Template is a structured document designed to track and summarize changes in equity accounts over a specific period. It provides a clear overview of capital contributions, withdrawals, retained earnings, and net income, facilitating accurate financial analysis and strategic planning. Using this template enhances transparency, supports compliance, and improves decision-making by organizing complex equity data into an accessible format.

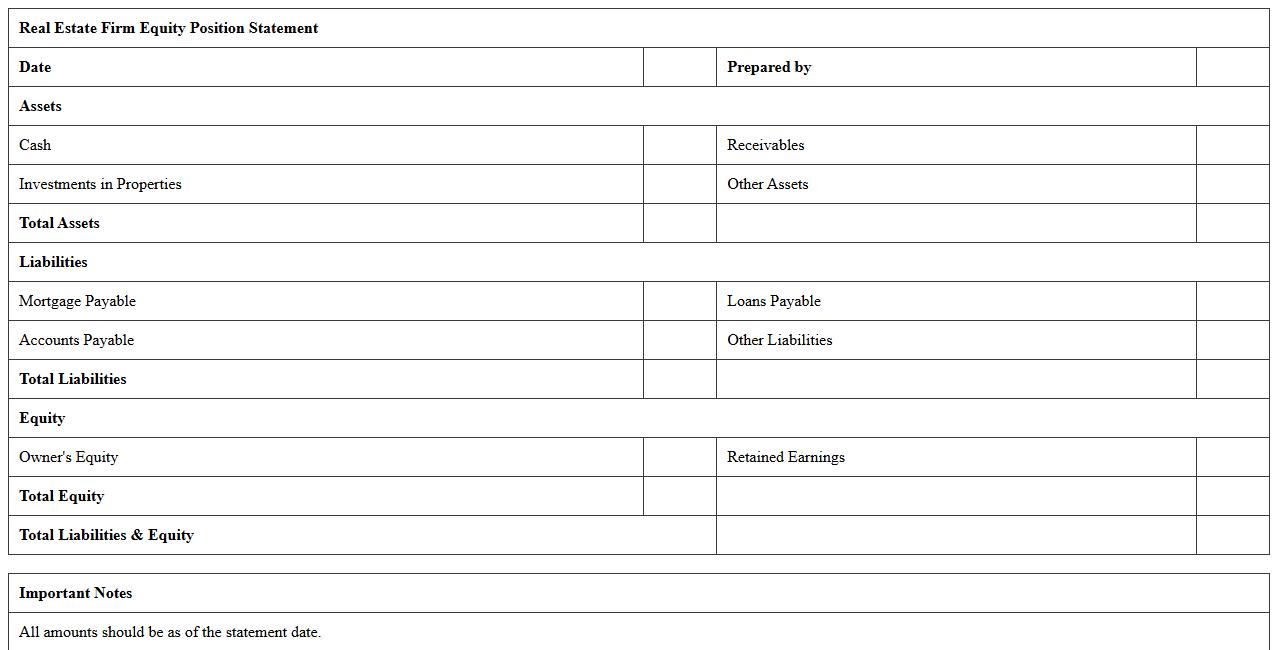

Real Estate Firm Equity Position Statement

A

Real Estate Firm Equity Position Statement is a detailed document outlining a company's ownership interests, equity stakes, and financial commitments within real estate projects. It provides clarity on the distribution of equity among partners, the value of investments, and any outstanding liabilities, enabling accurate assessment of a firm's financial health and investment potential. This document is essential for investors, lenders, and stakeholders to make informed decisions regarding funding, partnership, and risk management in real estate ventures.

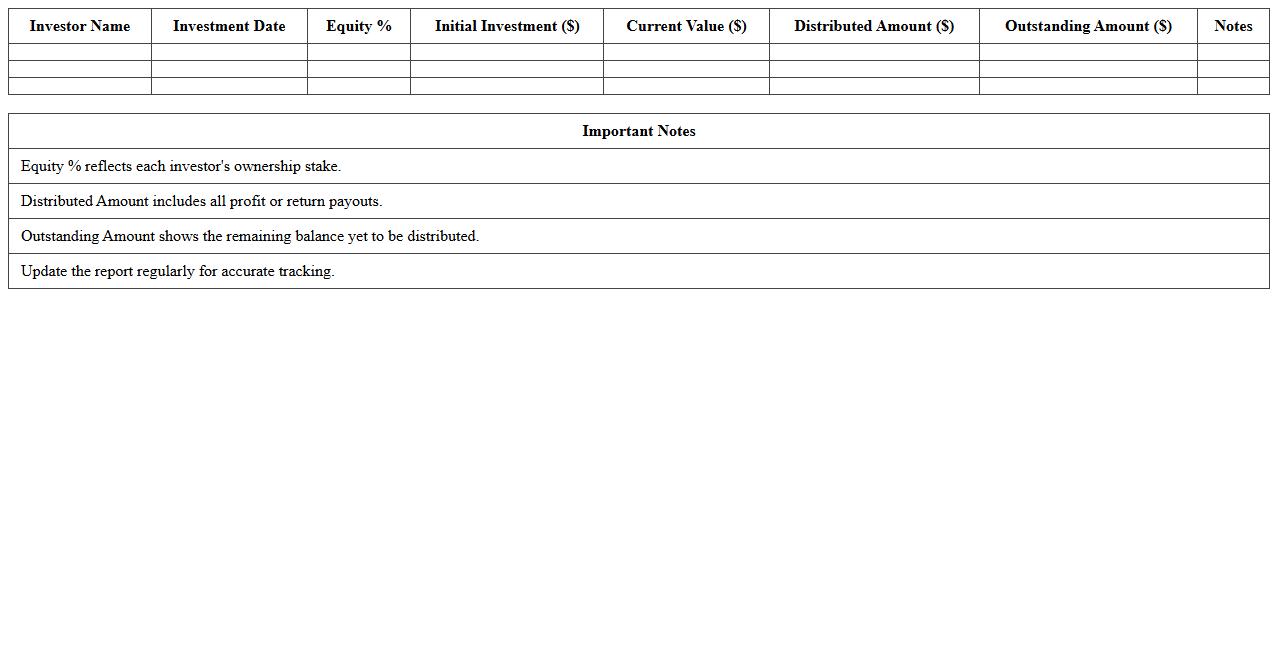

Investor Equity Distribution Report

The

Investor Equity Distribution Report details the allocation of profits or losses among equity holders in a company or investment fund, providing transparency and accountability in financial management. This report helps investors track their returns, assess the performance of their investments, and make informed decisions regarding portfolio adjustments. Accurate equity distribution data supports regulatory compliance and enhances trust between the company and its stakeholders.

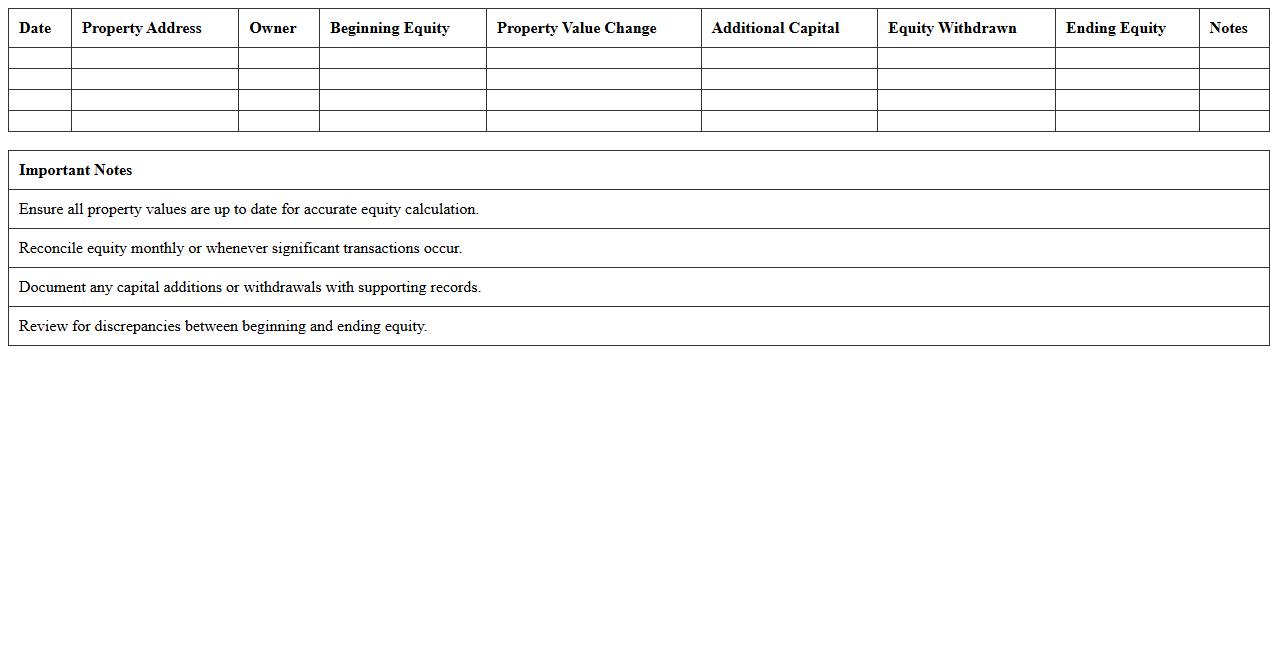

Property Equity Reconciliation Spreadsheet

A

Property Equity Reconciliation Spreadsheet document systematically tracks and verifies the equity value changes in real estate assets by comparing recorded data with actual transactions and market valuations. This tool is essential for accurately assessing ownership stakes, ensuring financial records align with current property worth, and identifying discrepancies early to prevent accounting errors. Utilizing this spreadsheet enhances transparency and supports informed decision-making in property investment and management.

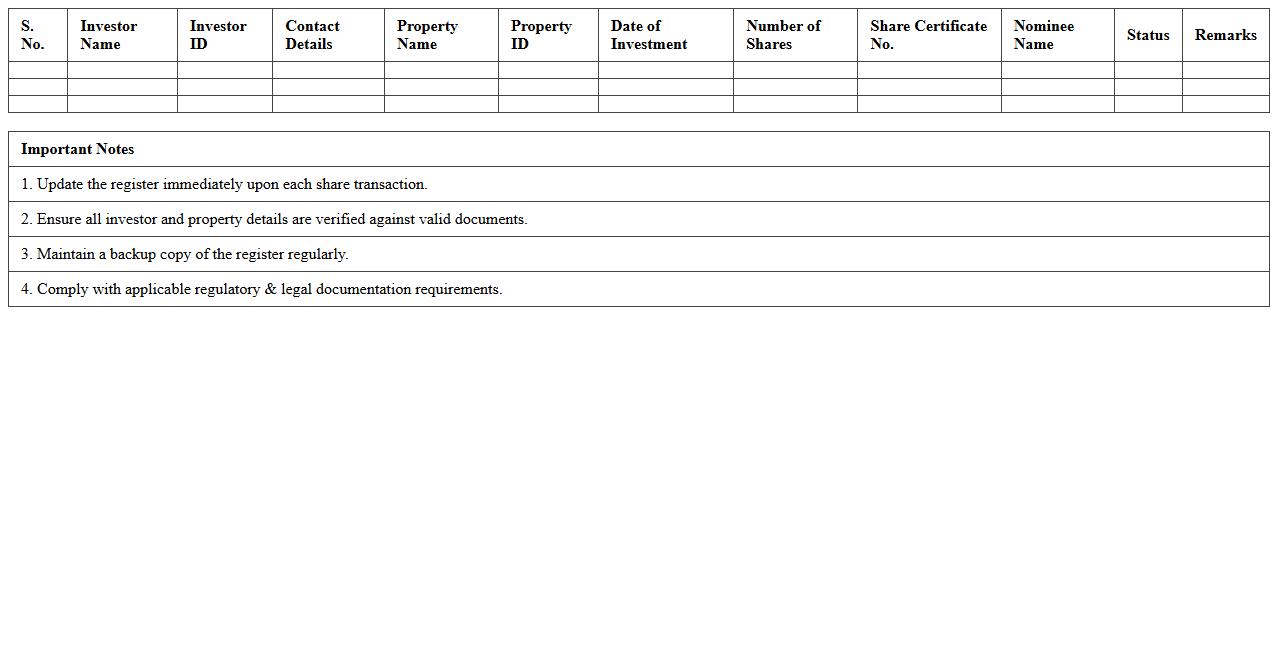

Equity Share Register for Real Estate Portfolios

The

Equity Share Register for Real Estate Portfolios is a detailed record of ownership interests in property assets, tracking shares held by investors or stakeholders. This register provides critical transparency in the distribution of equity, enabling accurate calculation of ownership percentages and facilitating efficient management of investor rights and dividends. It is essential for maintaining legal compliance, supporting audit processes, and ensuring clear communication among shareholders in real estate investment ventures.

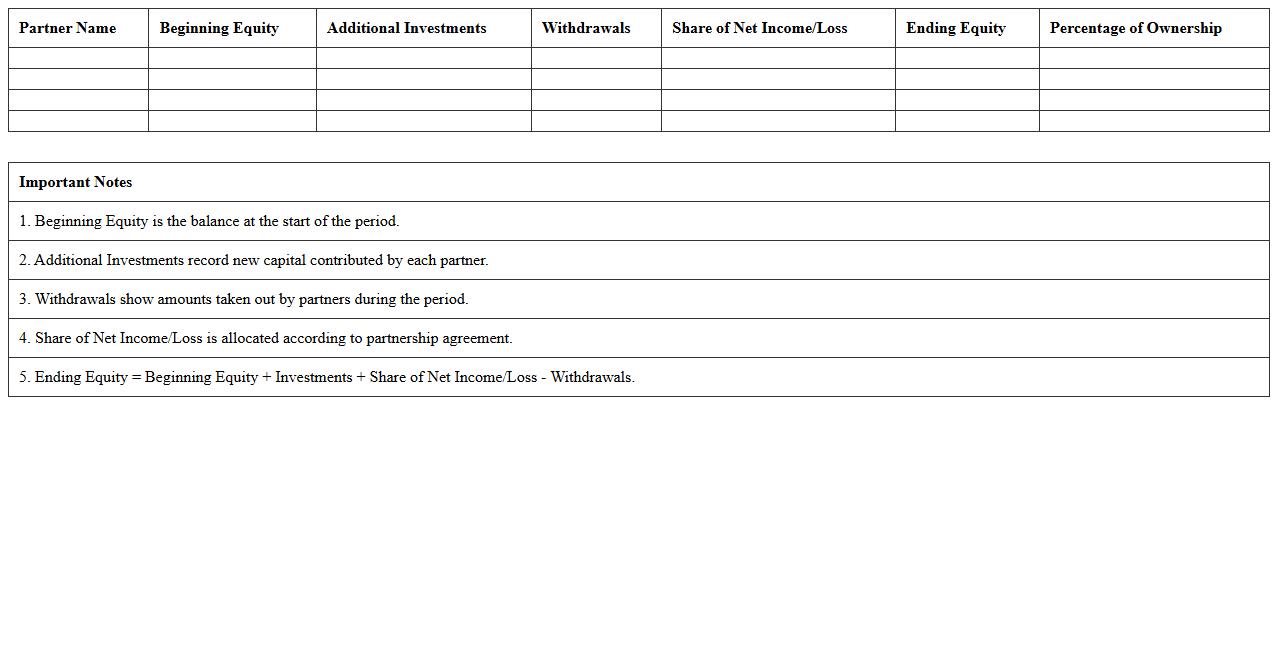

Real Estate Firm Partner Equity Statement

A

Real Estate Firm Partner Equity Statement document details the ownership interests and changes in equity among partners within a real estate firm, including contributions, distributions, and share of profits or losses. This statement is essential for tracking each partner's financial stake and ensuring transparent allocation of income and liabilities. It helps partners make informed decisions regarding profit sharing and investment strategies by providing a clear record of equity positions over time.

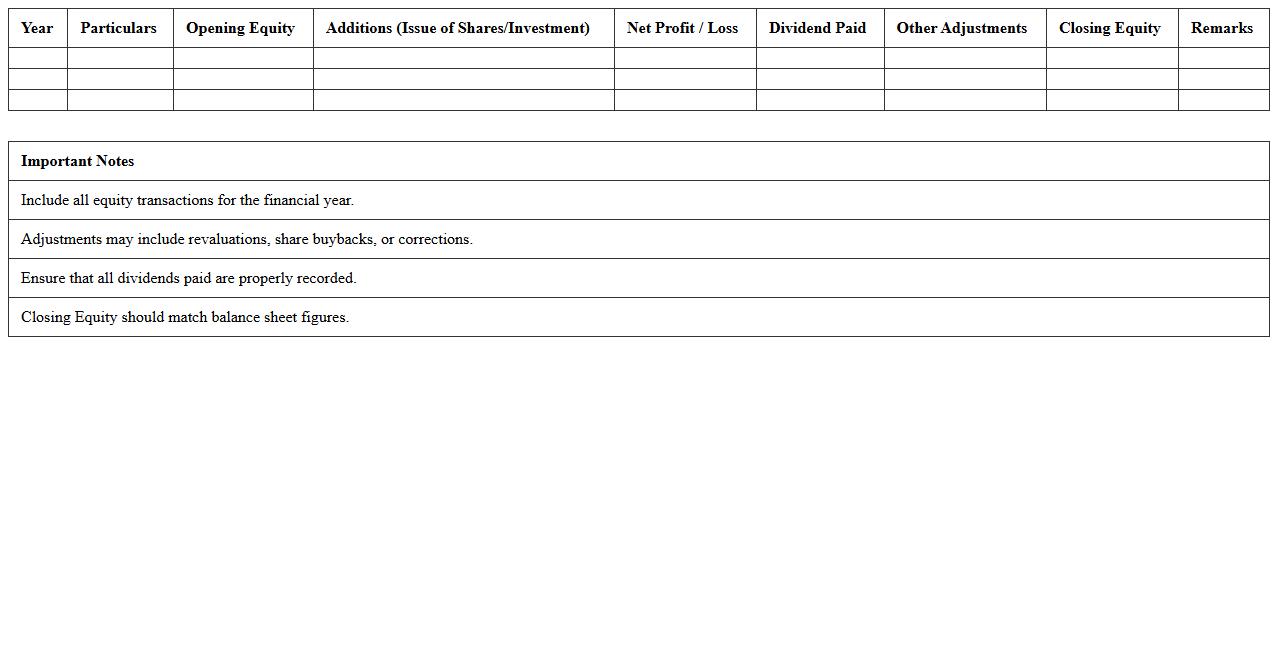

Annual Equity Statement for Real Estate Companies

The

Annual Equity Statement for real estate companies provides a detailed summary of the company's equity changes over a fiscal year, including retained earnings, shareholder contributions, and distributions. This document is essential for investors and stakeholders to assess the financial health, growth, and capital structure of the company. By offering transparency on equity fluctuations, it aids in making informed decisions about investments and strategic planning.

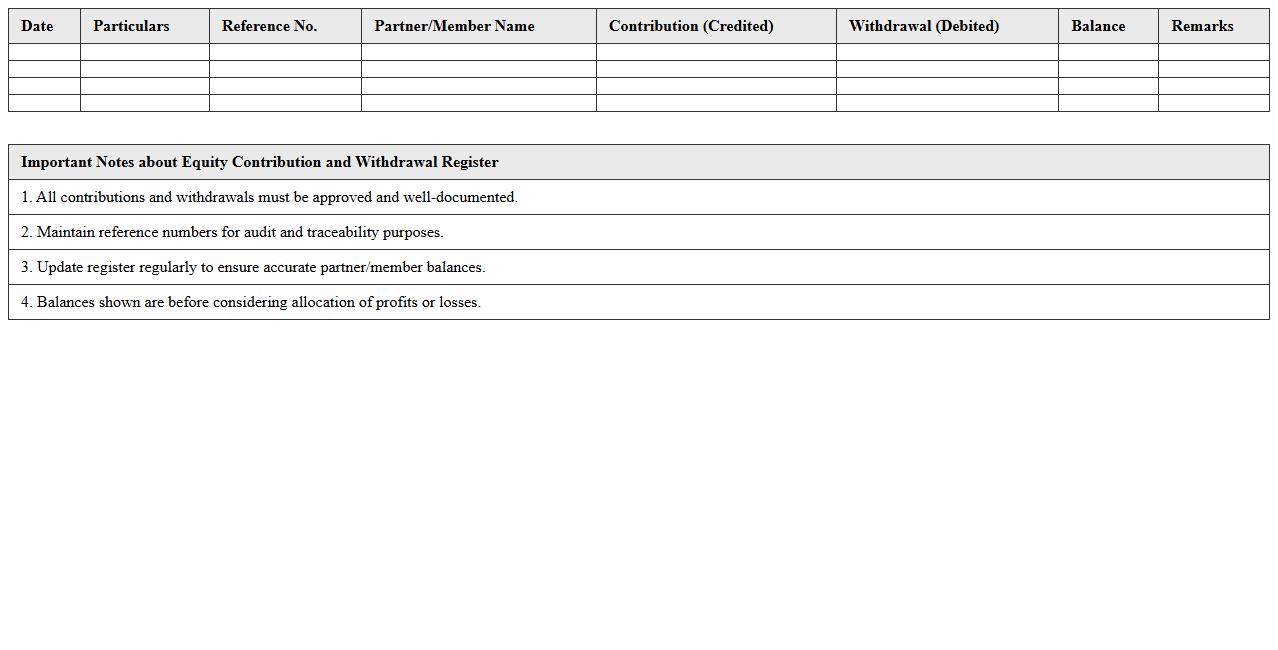

Equity Contribution and Withdrawal Register

The

Equity Contribution and Withdrawal Register is a crucial financial document that records all instances of equity injections and withdrawals by shareholders or owners in a company. It helps maintain transparency in ownership changes and tracks the inflow and outflow of capital, ensuring accurate accounting and regulatory compliance. This register is useful for investors, auditors, and management to monitor shareholder equity, assess financial health, and support strategic decision-making.

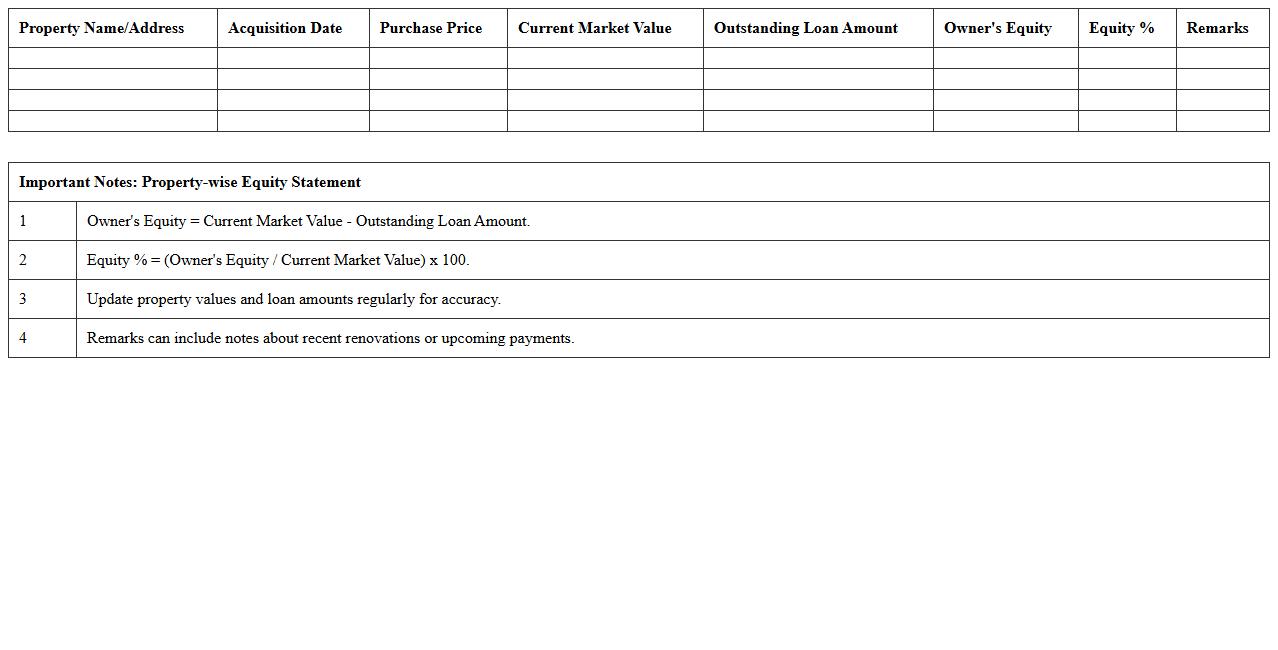

Property-wise Equity Statement Excel Sheet

The

Property-wise Equity Statement Excel Sheet document is a detailed financial tool that tracks the equity invested in various properties, breaking down ownership percentages, contributions, and returns. This sheet helps real estate investors and property managers monitor investment performance, calculate net gains, and ensure accurate record-keeping across multiple assets. By providing a clear summary of property-specific equity data, it enables informed decision-making and efficient financial management.

How does the Equity Statement Excel template handle multiple property investments for real estate firms?

The Equity Statement Excel template organizes multiple property investments by creating separate columns or sections for each asset. This allows firms to track individual property contributions, earnings, and equity changes efficiently. The template consolidates data to provide a comprehensive view of the firm's overall equity position across all properties.

What formulas are best for tracking capital contributions and withdrawals in real estate equity statements?

The most effective formulas for tracking capital contributions and withdrawals include SUMIF and SUMIFS, which aggregate transactions based on criteria such as investor or property. Additionally, IF statements help categorize entries as either contributions or withdrawals, ensuring accurate ledger management. These formulas maintain real-time updates and facilitate clear audit trails within the equity statement.

Can the Excel equity statement automatically update member ownership percentages after each transaction?

Yes, the template can automatically update member ownership percentages using dynamic formulas that recalculate equity stakes post-transaction. By leveraging percentage calculations tied to total capital accounts, it ensures ownership reflects the latest contributions and distributions. This automation allows real-time, precise ownership tracking without manual recalculations.

How to customize the template for different distribution waterfalls in real estate partnerships?

Customizing the template for various distribution waterfalls involves setting up tiered calculation sections that reflect the priority and percentages of distributions. Using nested IF or CHOOSE formulas, the template can allocate cash flows according to agreed partner terms. This flexibility supports complex profit-sharing models and ensures accurate and compliant equity reporting.

What data validation checks are essential for minimizing input errors in real estate equity statements?

Essential data validation checks include restricting input types with drop-down lists, setting value ranges for amounts, and using conditional formatting to highlight anomalies. These controls prevent invalid entries like negative contributions or unsupported dates, ensuring data integrity. Implementing error alerts and consistency checks boosts the reliability of real estate equity statements.

More Statement Excel Templates