The Partner Capital Statement Excel Template for Partnerships is designed to streamline the tracking of each partner's equity contributions, withdrawals, and share of profits. This template enhances accuracy and transparency by providing a clear, organized format to monitor capital balances over time. Ideal for partnership accounting, it simplifies financial reporting and supports effective decision-making.

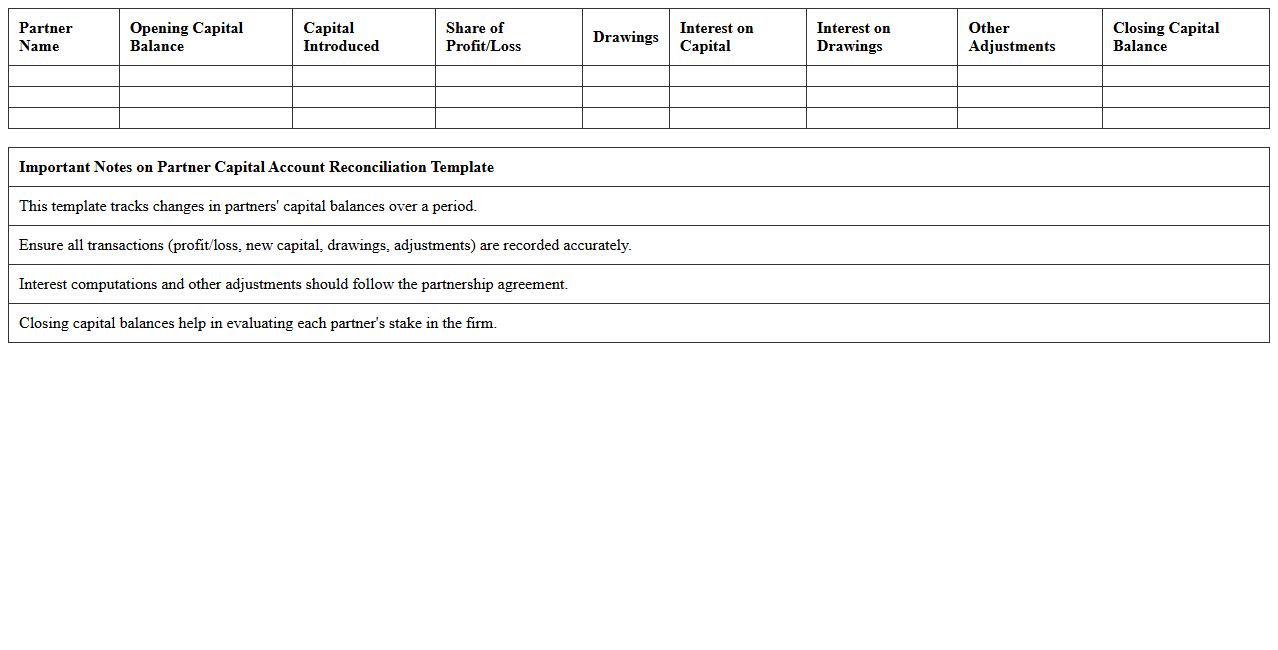

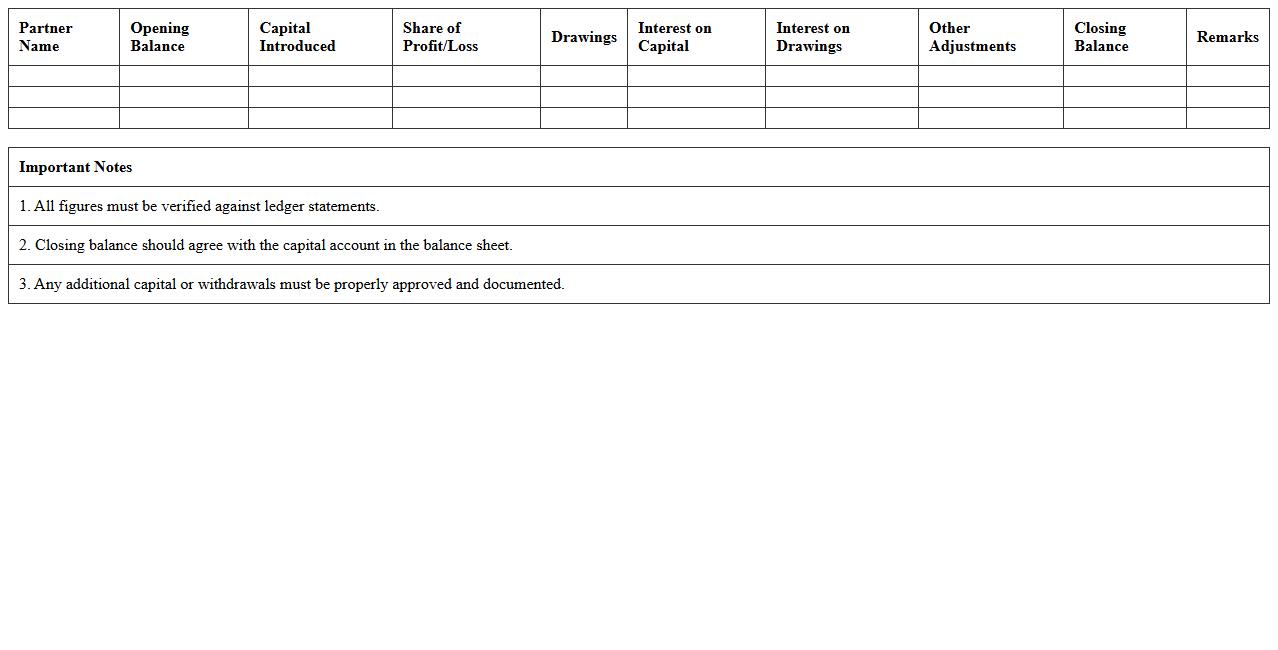

Partner Capital Account Reconciliation Excel Template

The

Partner Capital Account Reconciliation Excel Template is a specialized financial tool designed to track and reconcile the equity contributions, withdrawals, and profit allocations for business partners. This document streamlines the process of ensuring that each partner's capital account accurately reflects their share in the business, reducing errors and enhancing transparency. By using this template, businesses can efficiently manage partner transactions, simplify audit processes, and maintain clear financial records.

Partnership Capital Contribution Tracker Spreadsheet

A

Partnership Capital Contribution Tracker Spreadsheet document records and monitors each partner's financial contributions, ensuring transparency and accuracy in capital accounts. It helps businesses maintain organized records of contributions, withdrawals, and adjustments, facilitating clear communication among partners. This tool is essential for managing equity stakes, preparing financial statements, and resolving potential disputes efficiently.

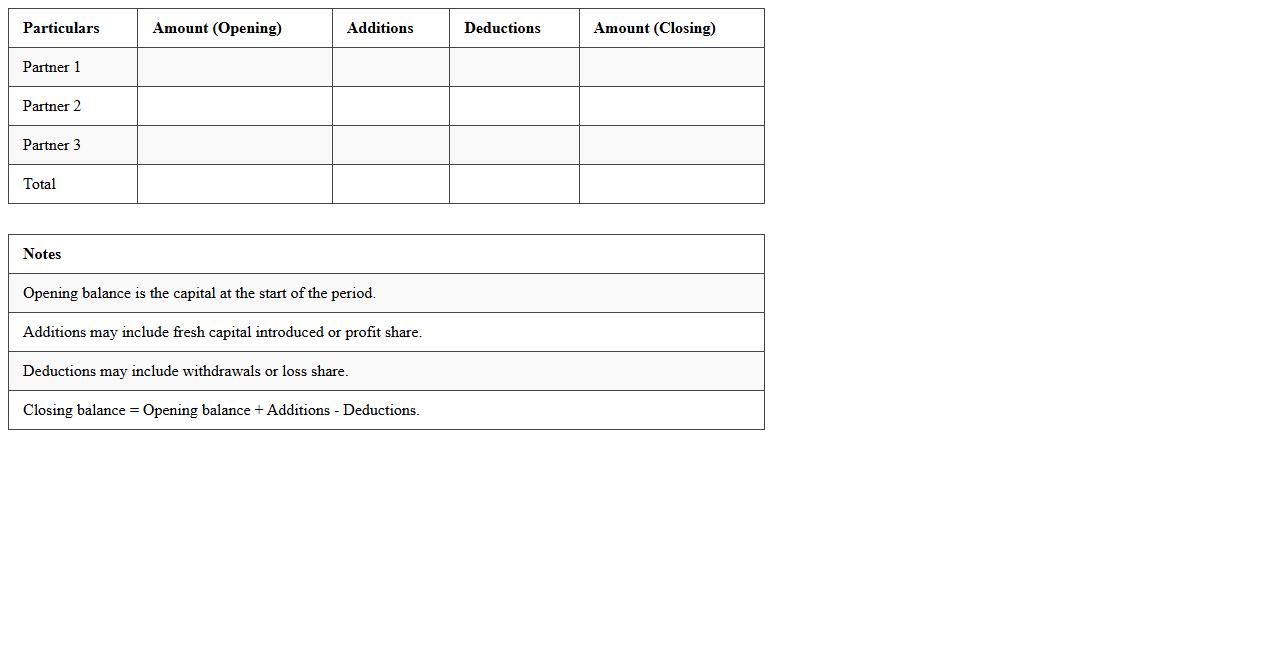

Opening and Closing Capital Balances Excel Sheet

An

Opening and Closing Capital Balances Excel Sheet document tracks the initial and final capital amounts within a specific accounting period, enabling accurate financial management and reporting. It helps businesses monitor changes in equity by summarizing contributions, withdrawals, and net profits or losses, ensuring transparent financial health assessment. This tool is essential for maintaining consistent records and simplifying year-end reconciliation processes.

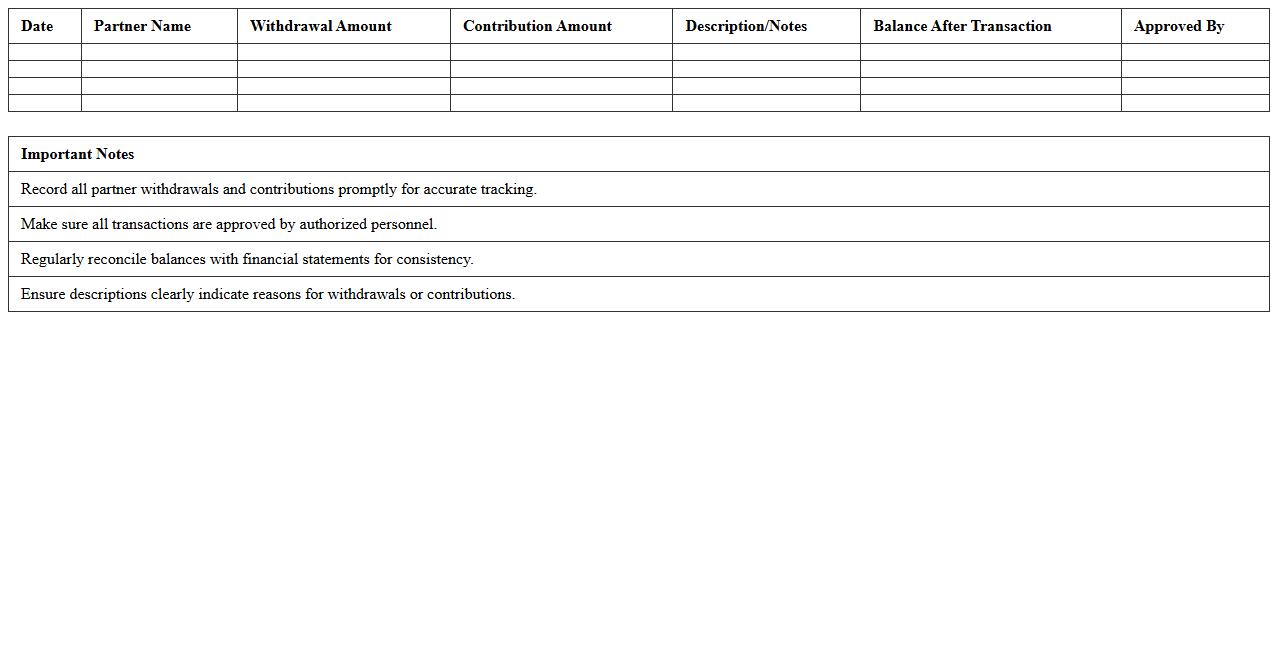

Partner Withdrawals and Contributions Log Template

The

Partner Withdrawals and Contributions Log Template document is a structured tool used to systematically record all financial transactions between business partners, including capital contributions and withdrawals. It helps maintain clear and accurate financial records, ensuring transparency and accountability in managing partnership funds. This template streamlines tracking of each partner's equity changes, facilitating effective financial management and decision-making within the business.

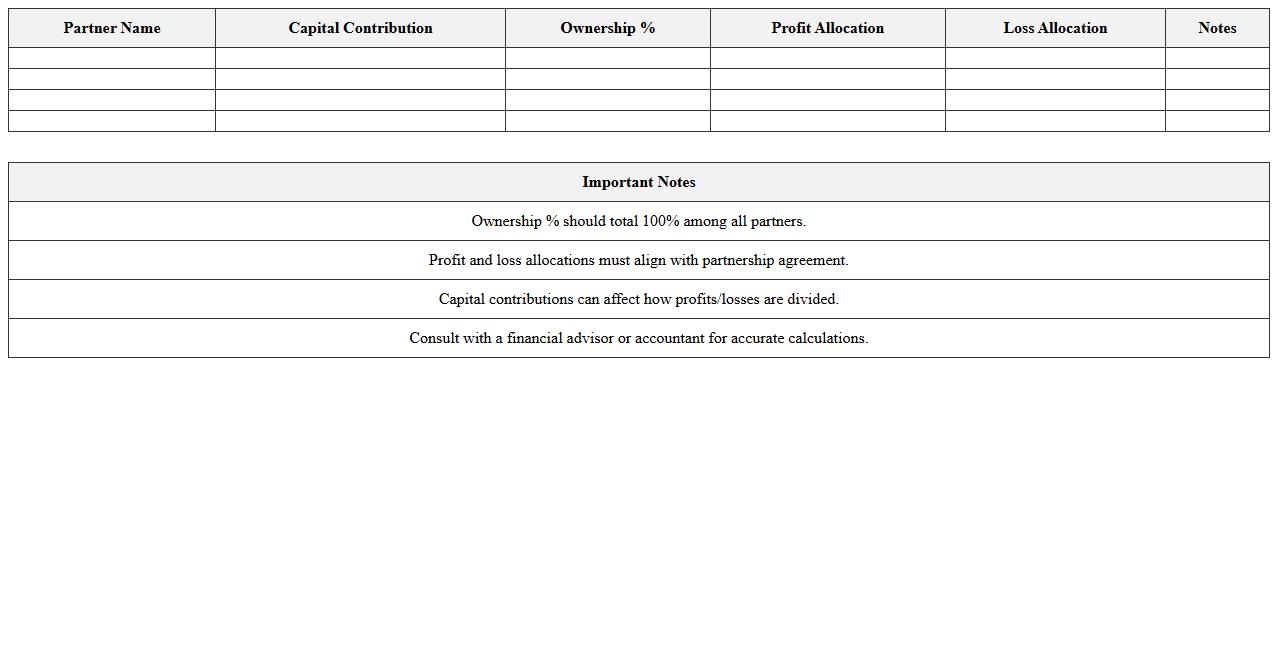

Partnership Profit & Loss Allocation Excel Template

The

Partnership Profit & Loss Allocation Excel Template is a structured financial tool designed to distribute profits and losses among partners based on agreed-upon ratios. It streamlines complex calculations, ensures accuracy, and provides clear visibility into each partner's share, facilitating transparent financial reporting. Businesses use this template to simplify partnership accounting, improve decision-making, and maintain compliance with financial agreements.

Yearly Partner Capital Movement Report Template

The

Yearly Partner Capital Movement Report Template is a structured document designed to track and summarize changes in partner capital accounts over the fiscal year. It helps businesses monitor investments, withdrawals, and revaluations, ensuring accurate financial reporting and compliance with accounting standards. Utilizing this template facilitates transparency among partners and supports strategic decision-making by providing clear insights into capital fluctuations.

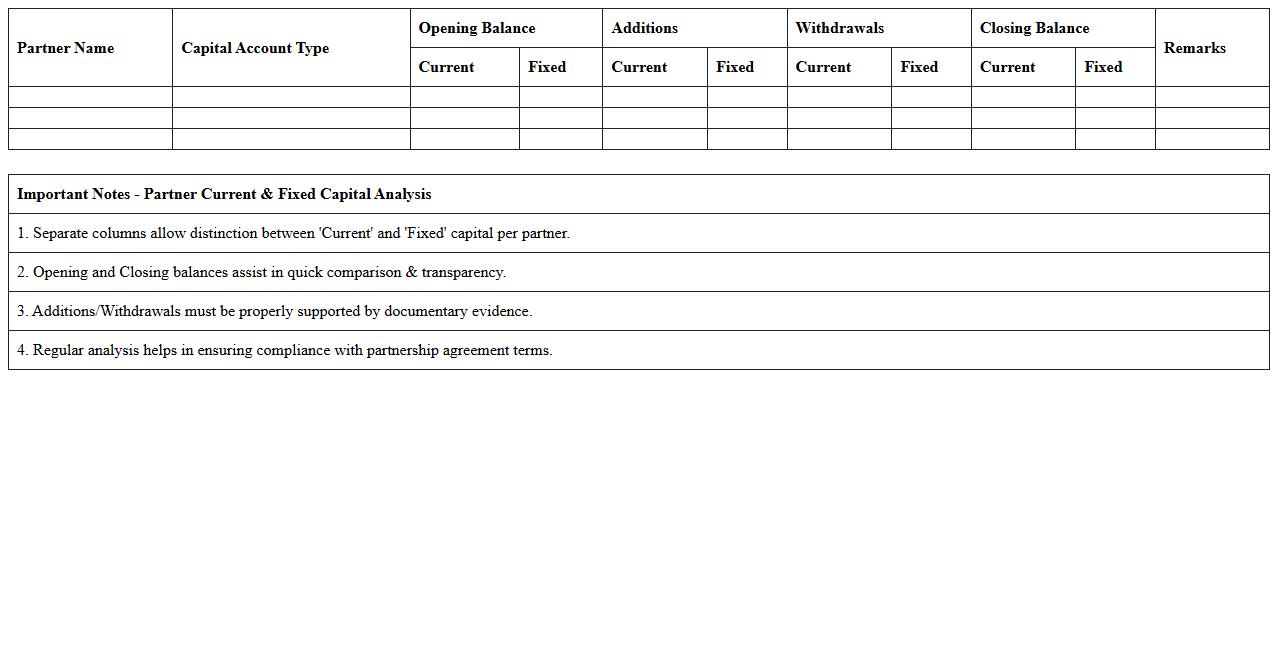

Partner Current & Fixed Capital Analysis Excel

The

Partner Current & Fixed Capital Analysis Excel document systematically tracks and analyzes both current and fixed capital contributions of business partners, providing clear financial insights. By organizing capital data efficiently, it enables users to monitor equity changes, evaluate investment returns, and make informed decisions regarding profit sharing or additional funding. This tool is essential for maintaining transparent partner accounts and supporting accurate financial planning.

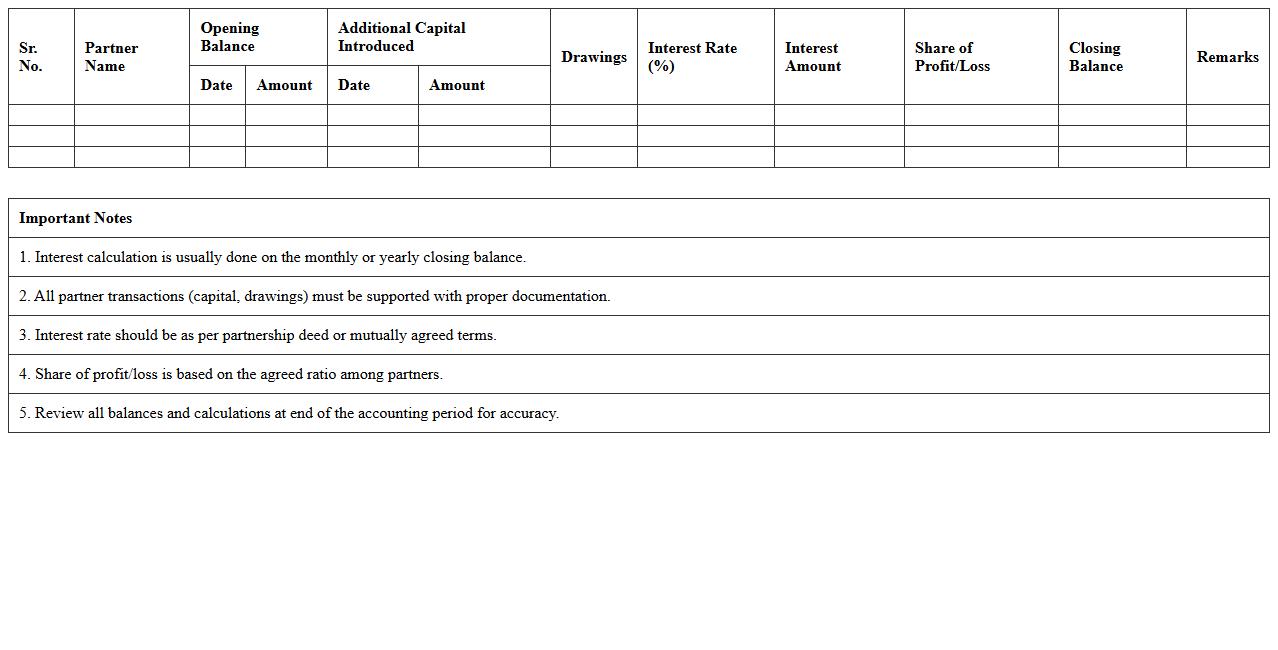

Partner Settlement and Interest Calculation Sheet

The

Partner Settlement and Interest Calculation Sheet is a detailed financial document used to calculate the payable or receivable interest among business partners based on their respective investments and profit-sharing ratios. It ensures accurate distribution of profits and settlement of capital balances by tracking contributions, withdrawals, and interest accruals over time. This document is essential for maintaining transparency, preventing disputes, and facilitating smooth financial reconciliation within partnerships.

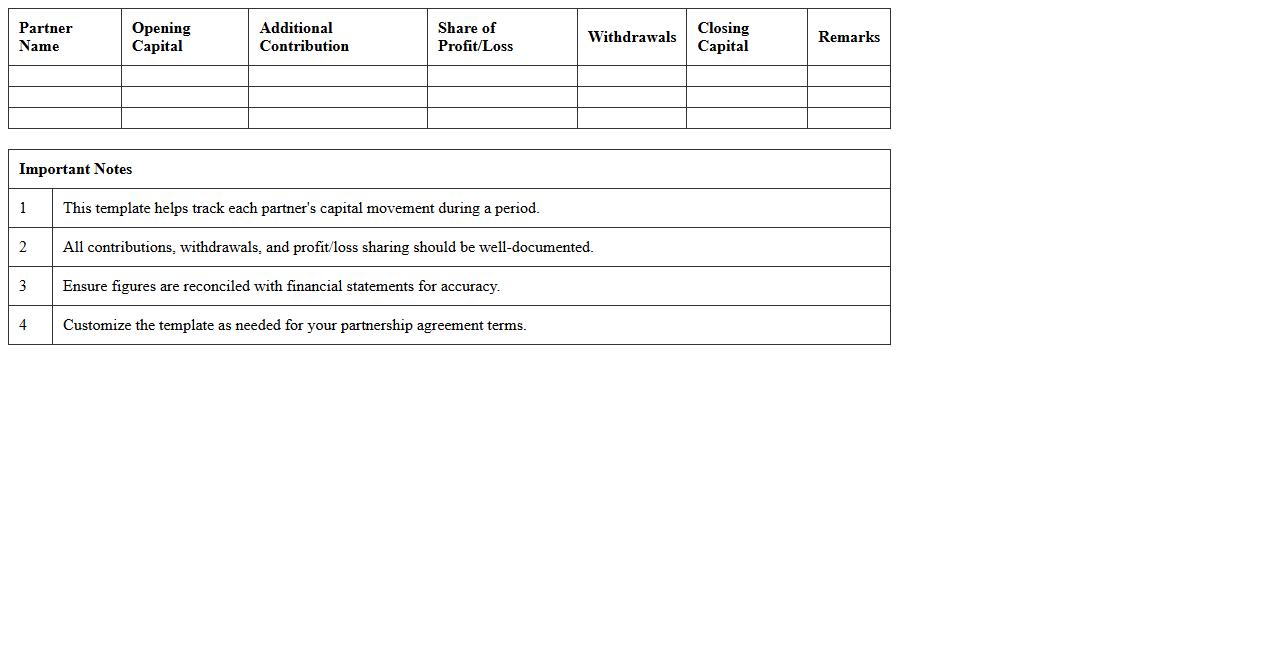

Partner Capital Statement Summary Excel Template

The

Partner Capital Statement Summary Excel Template is a structured financial document designed to track and summarize capital contributions, withdrawals, and partner equity balances in a partnership. It streamlines the management of partner accounts by providing clear visibility into individual capital changes over time, ensuring accurate financial reporting and compliance. This template enhances decision-making by offering a concise overview of each partner's financial standing within the business.

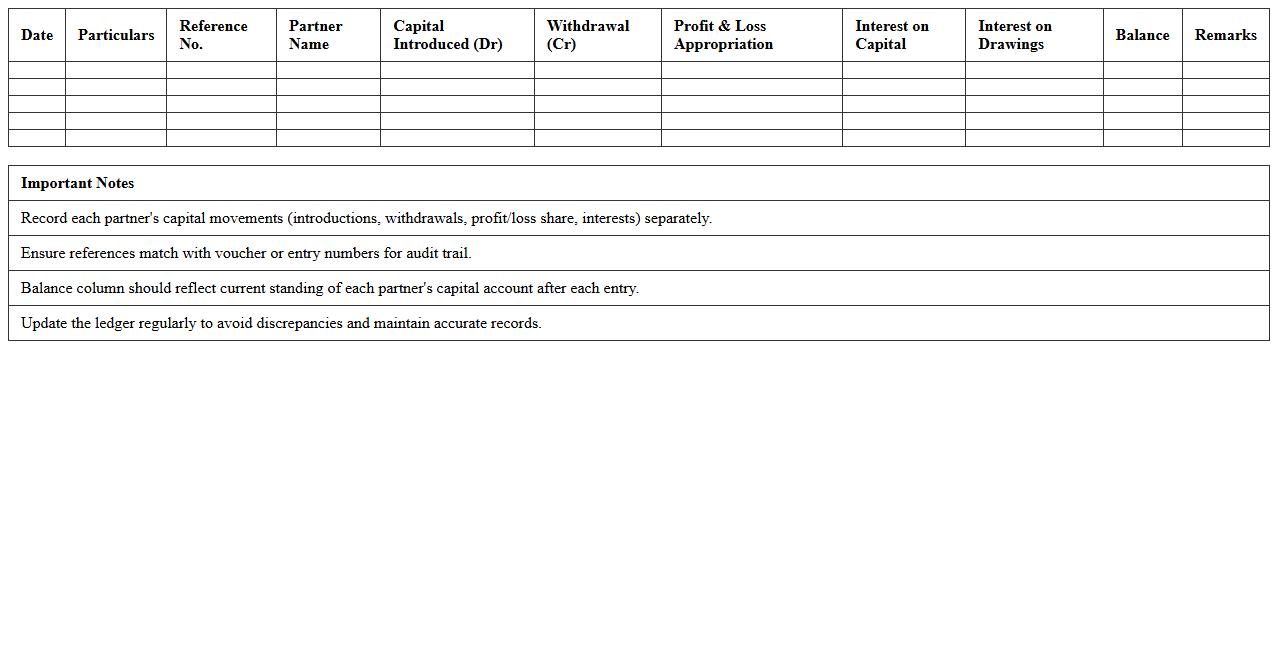

Partnership Capital Account Ledger Spreadsheet

A

Partnership Capital Account Ledger Spreadsheet is a detailed financial document used to record each partner's capital contributions, withdrawals, and share of profits or losses in a partnership. This ledger helps maintain accurate and transparent tracking of individual partner equity, ensuring clarity in financial standings and facilitating dispute resolution. It is essential for proper accounting and legal compliance in partnerships, enabling efficient management of partner investments and distributions.

How to automate annual Partner Capital Statement updates in Excel for partnerships?

To automate annual Partner Capital Statement updates, use Excel tables to dynamically capture data changes. Incorporate PivotTables to summarize partner contributions, withdrawals, and earnings efficiently. Automating with Power Query allows seamless data refreshes from various sources, ensuring accurate and up-to-date statements.

What Excel formulas best track individual partner contributions and withdrawals?

Utilize the SUMIFS formula to aggregate contributions and withdrawals by partner and date. Employ IF statements combined with logical conditions to differentiate between transaction types. The INDEX-MATCH function enhances tracking by retrieving specific transactions related to each partner's account.

How to structure macros for calculating profit allocation in a Partner Capital Statement?

Create macros that first gather input data such as capital balances and partnership agreements. The macro should implement the profit allocation logic based on predefined allocation percentages entered for each partner. Finally, program the macro to update individual capital accounts and generate a summary report automatically.

Which Excel template features simplify audit trails for partnership capital accounts?

Templates with transaction-level logging provide a clear audit trail by recording every capital movement with timestamps. Including data validation rules ensures entries are consistent and error-free, strengthening audit reliability. Built-in filtering options make reviewing historical transactions straightforward and transparent.

Tips for visualizing changes in partner capital balances using Excel charts?

Use stacked column charts to display individual partner balances and their fluctuations over time. Implement line graphs to highlight trend movements in capital contributions and withdrawals. Incorporate dynamic chart ranges linked to tables for automatic updates when data changes.

More Statement Excel Templates