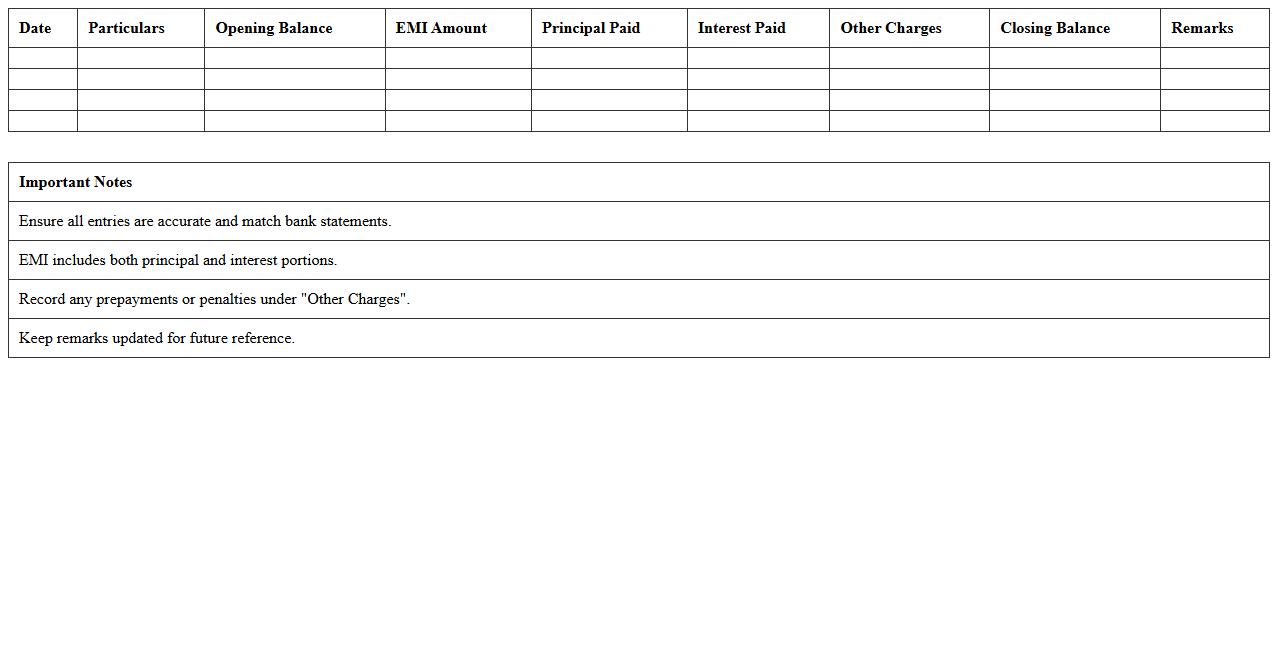

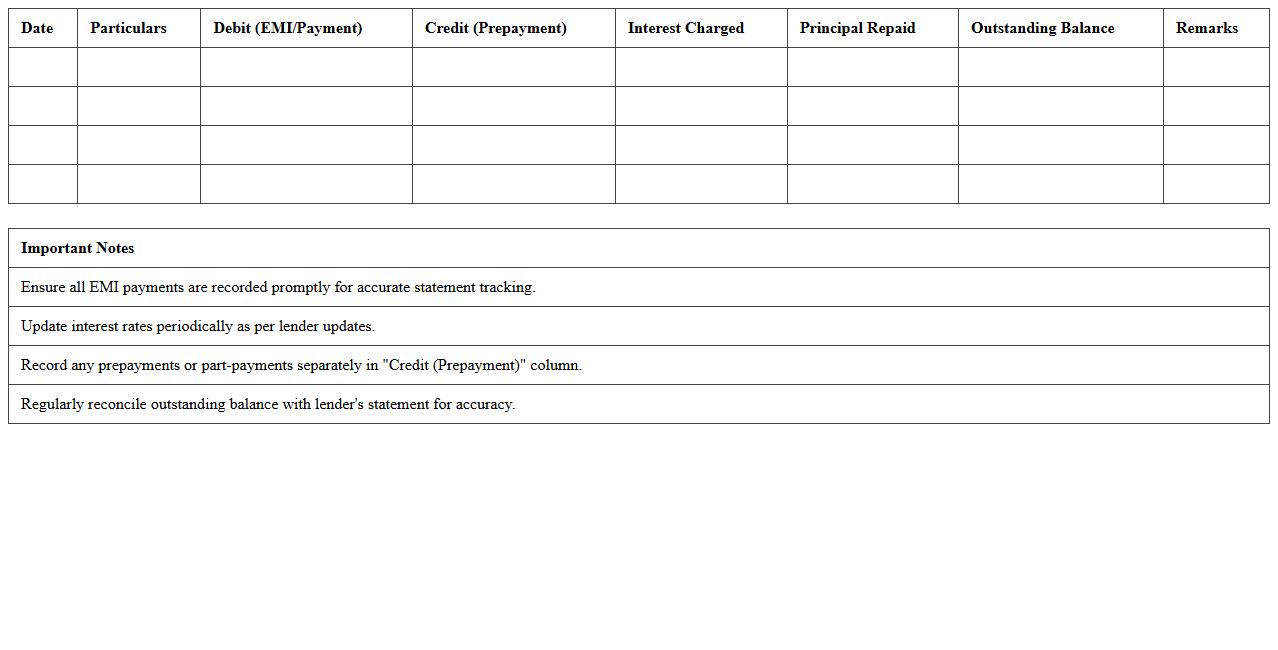

Personal Loan Account Statement Excel Template

A

Personal Loan Account Statement Excel Template is a spreadsheet designed to track and manage loan transactions, including principal amounts, interest, payments, and outstanding balances. It helps users maintain clear, organized financial records, facilitating easy monitoring of loan repayment progress and accurate calculation of dues. This template enhances financial planning and decision-making by providing a comprehensive overview of the loan status in a user-friendly, customizable format.

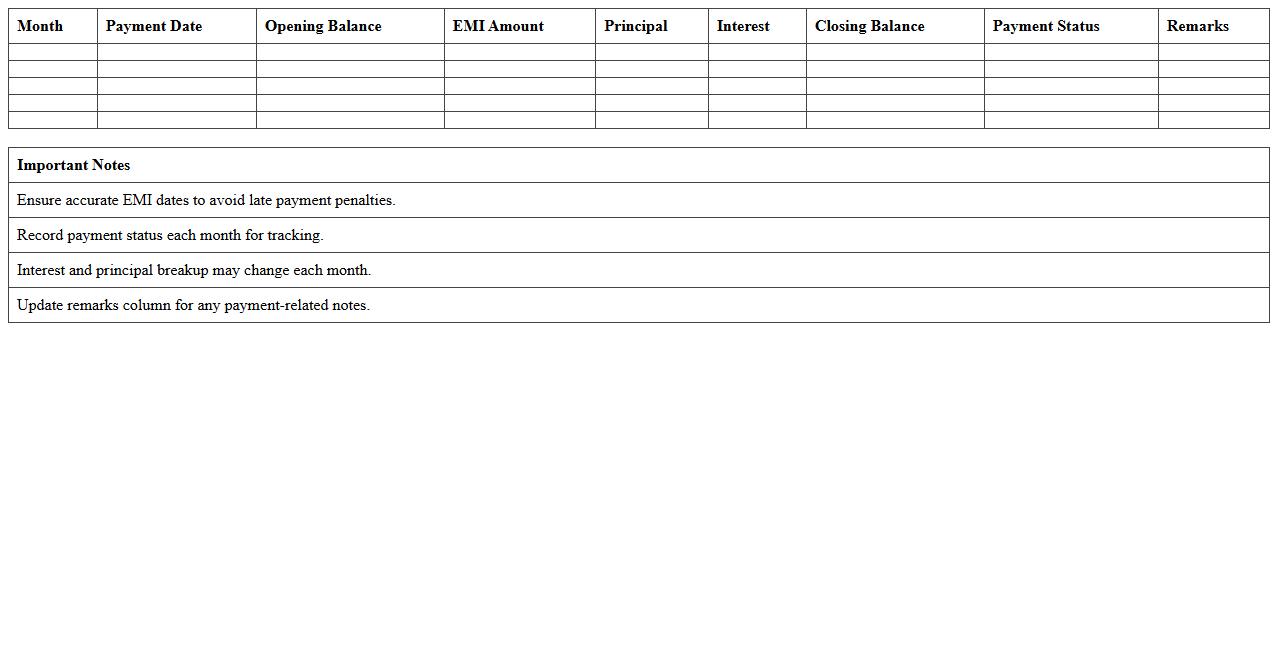

Monthly Loan Payment Statement Excel Sheet

A

Monthly Loan Payment Statement Excel Sheet document is a structured financial tool that tracks loan repayments, interest accruals, and outstanding balances on a monthly basis. This sheet provides clear visibility into payment schedules, helping users manage their finances by ensuring timely payments and avoiding penalties. It simplifies budgeting and financial planning by consolidating all loan-related information into an easy-to-read format.

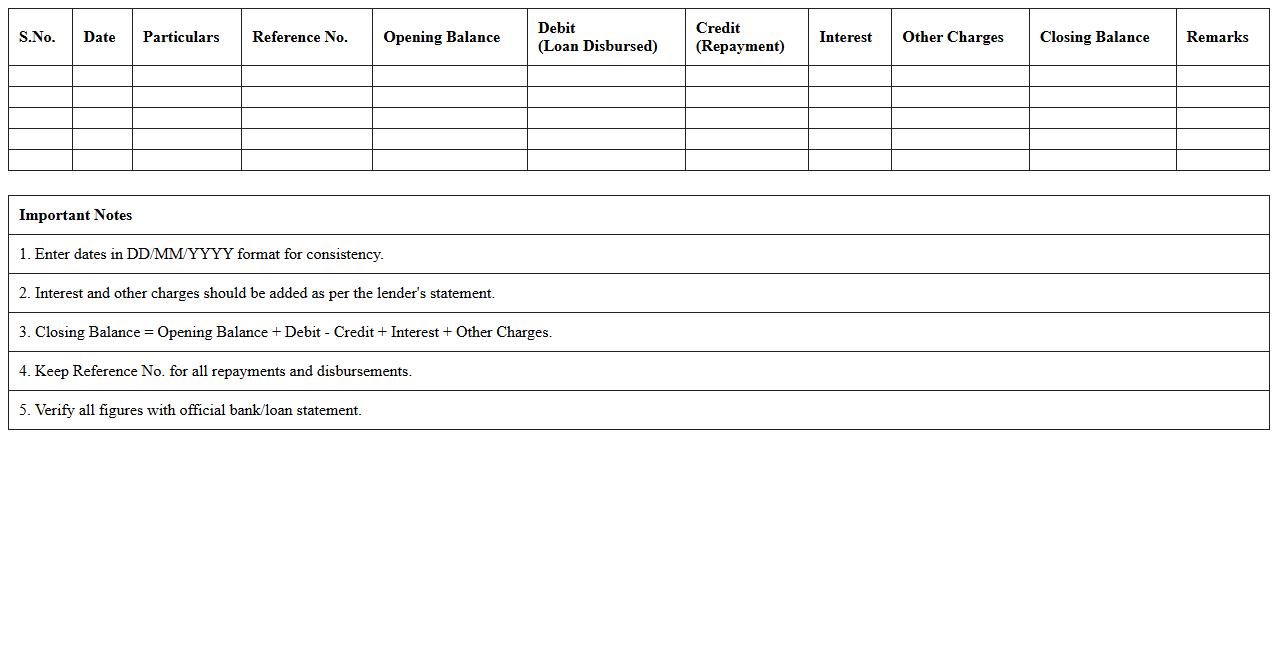

Loan Repayment Account Statement Excel Format

A

Loan Repayment Account Statement Excel Format document is a structured spreadsheet that tracks loan repayments, including principal, interest, balance, and payment dates. It provides a clear and organized way to monitor loan status, ensuring timely payments and accurate financial records. This format is useful for borrowers and lenders to analyze payment history, manage schedules, and plan future financial obligations effectively.

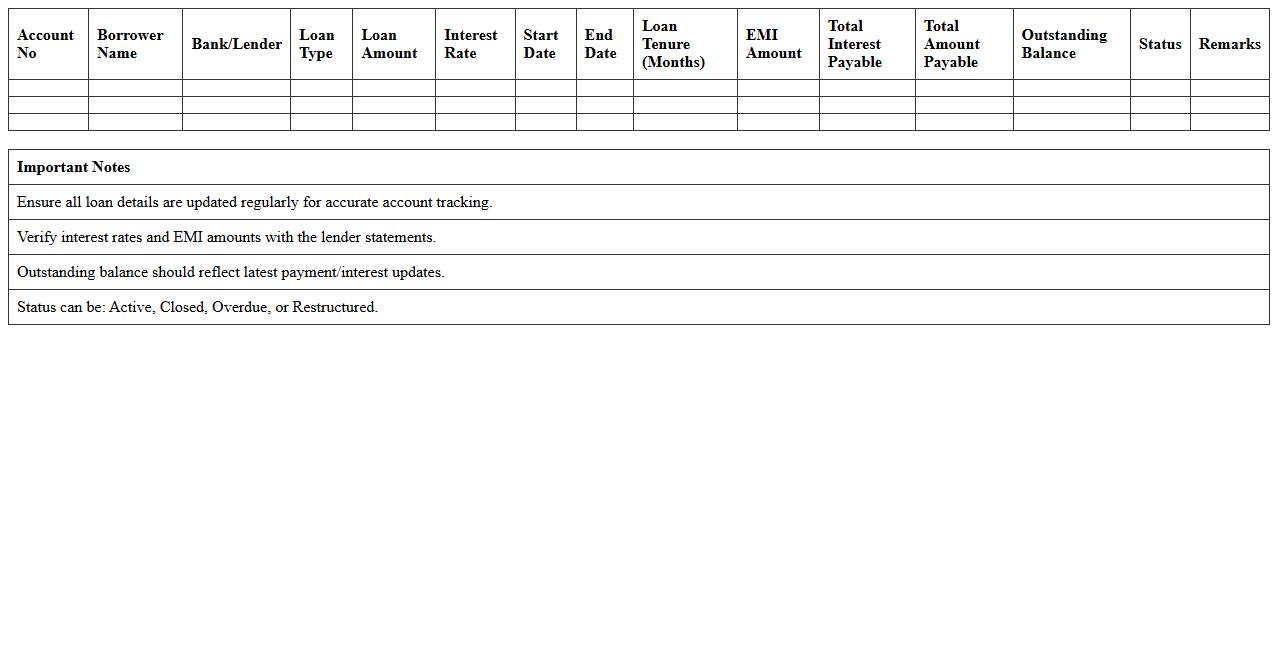

Business Loan Account Summary Excel Template

A

Business Loan Account Summary Excel Template is a structured spreadsheet designed to track and manage loan details such as principal amounts, interest rates, repayment schedules, and outstanding balances. This template helps businesses maintain clear records of their loan obligations, enabling efficient financial monitoring and planning. Using it ensures accurate tracking of payments and loan status, which supports informed decision-making and improves financial transparency.

Bank Loan Statement and EMI Tracker Excel

A

Bank Loan Statement details the amount borrowed, interest rate, repayment schedule, and outstanding balance, providing a clear overview of the loan status. An EMI Tracker Excel document helps monitor Equated Monthly Installments, ensuring timely payments and preventing defaults by organizing due dates, amounts, and payment history. These tools are essential for effective financial management, enabling borrowers to stay informed and maintain healthy credit scores.

Home Loan Account Statement Excel Spreadsheet

A

Home Loan Account Statement Excel Spreadsheet is a digital document that organizes detailed loan information including principal, interest, repayment schedule, and outstanding balance in a structured format. It helps borrowers track their payment history, calculate remaining dues, and plan financial strategies effectively. This spreadsheet enhances financial transparency and aids in easy verification of loan details, improving loan management efficiency.

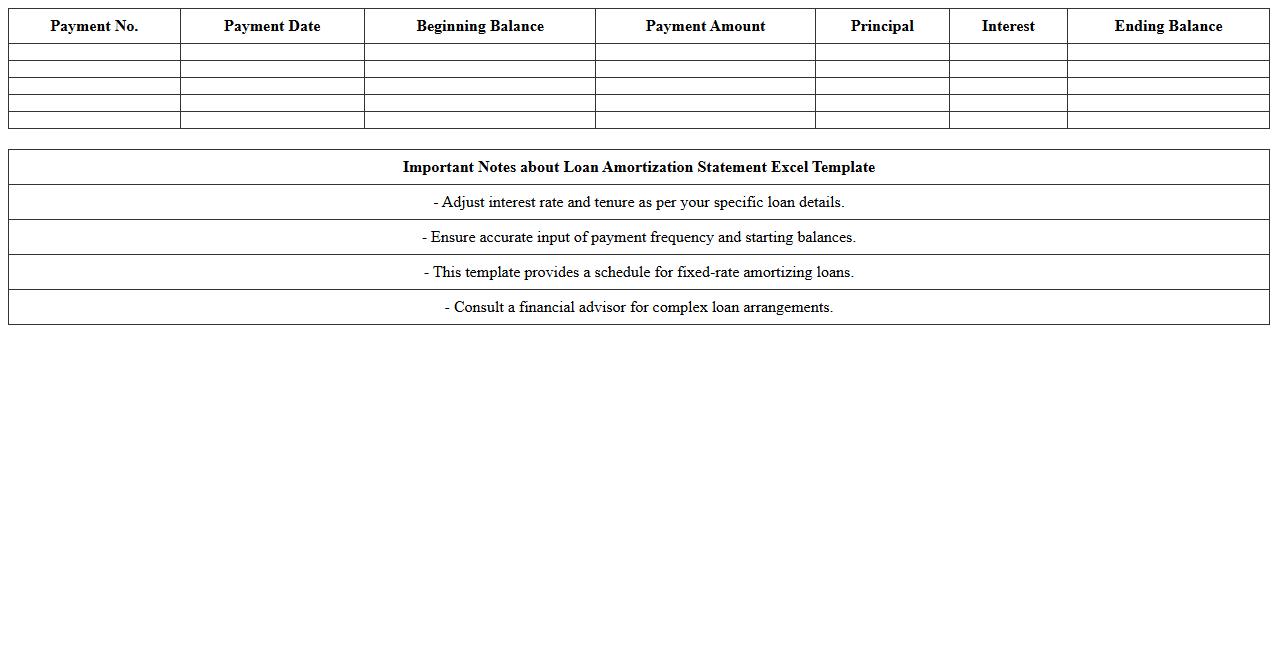

Loan Amortization Statement Excel Template

A

Loan Amortization Statement Excel Template is a structured spreadsheet tool designed to calculate and display a detailed repayment schedule for loans, breaking down principal and interest payments over time. This template is useful for borrowers and lenders to track outstanding balances, understand payment distribution, and plan finances effectively. By providing clear visualization of each installment, it aids in managing loan terms and forecasting future financial obligations with precision.

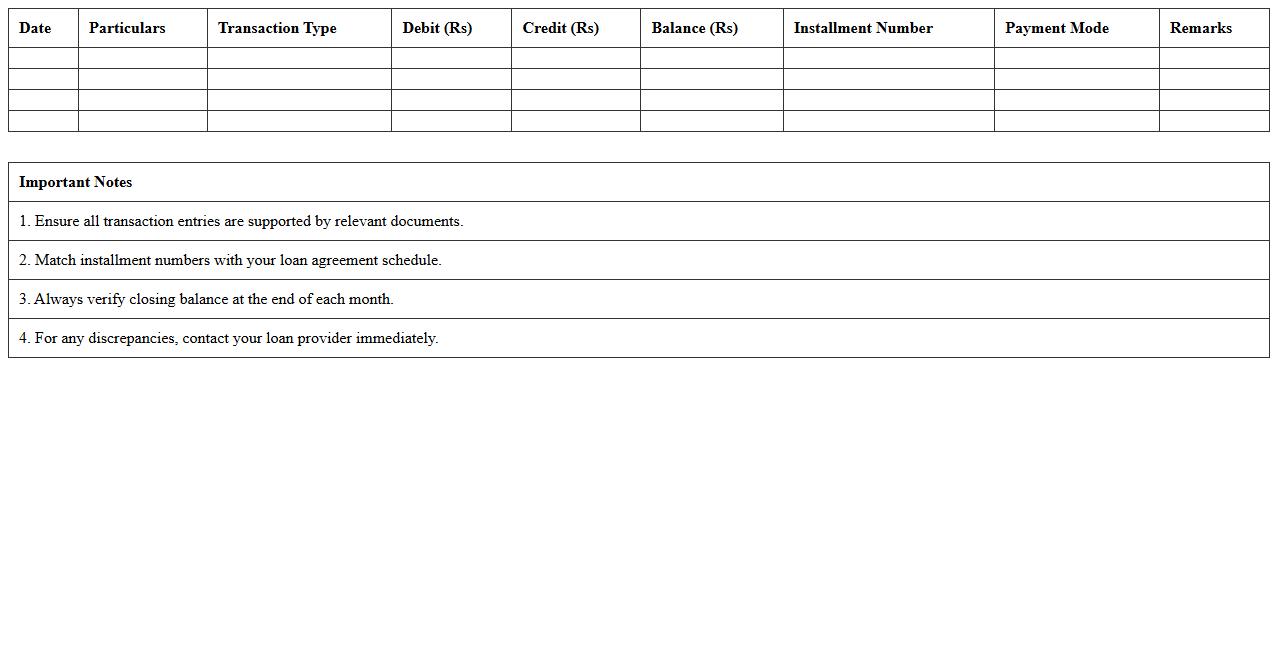

Auto Loan Account Statement Excel Format

An

Auto Loan Account Statement Excel Format document is a structured spreadsheet designed to track loan details, payment schedules, interest calculations, and outstanding balances. It helps borrowers and lenders maintain clear records of monthly installments, remaining principal amounts, and due dates, enabling efficient financial management. Using this format enhances transparency, simplifies loan tracking, and aids in accurate financial planning.

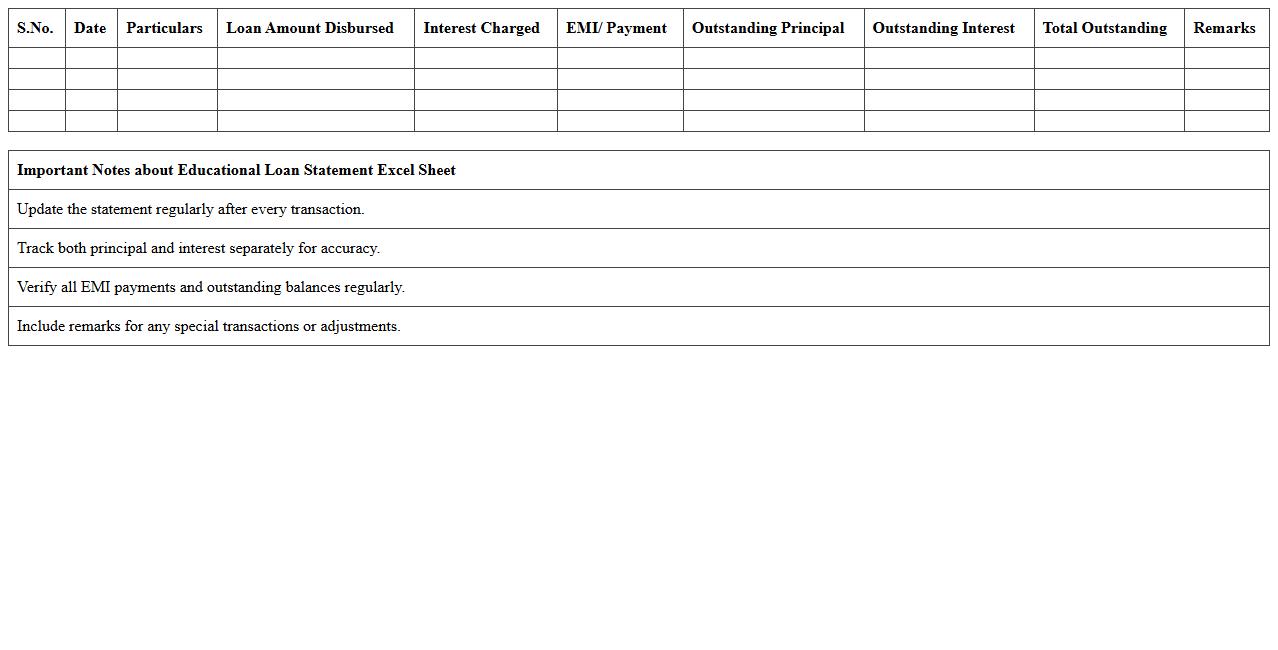

Educational Loan Statement Excel Sheet

An

Educational Loan Statement Excel Sheet is a detailed document that tracks the principal, interest, payment dates, and outstanding balance of an education loan over time. It helps borrowers organize repayment schedules, monitor loan progress, and calculate total interest paid, enabling efficient financial planning. This tool is essential for managing loan obligations accurately and avoiding missed payments.

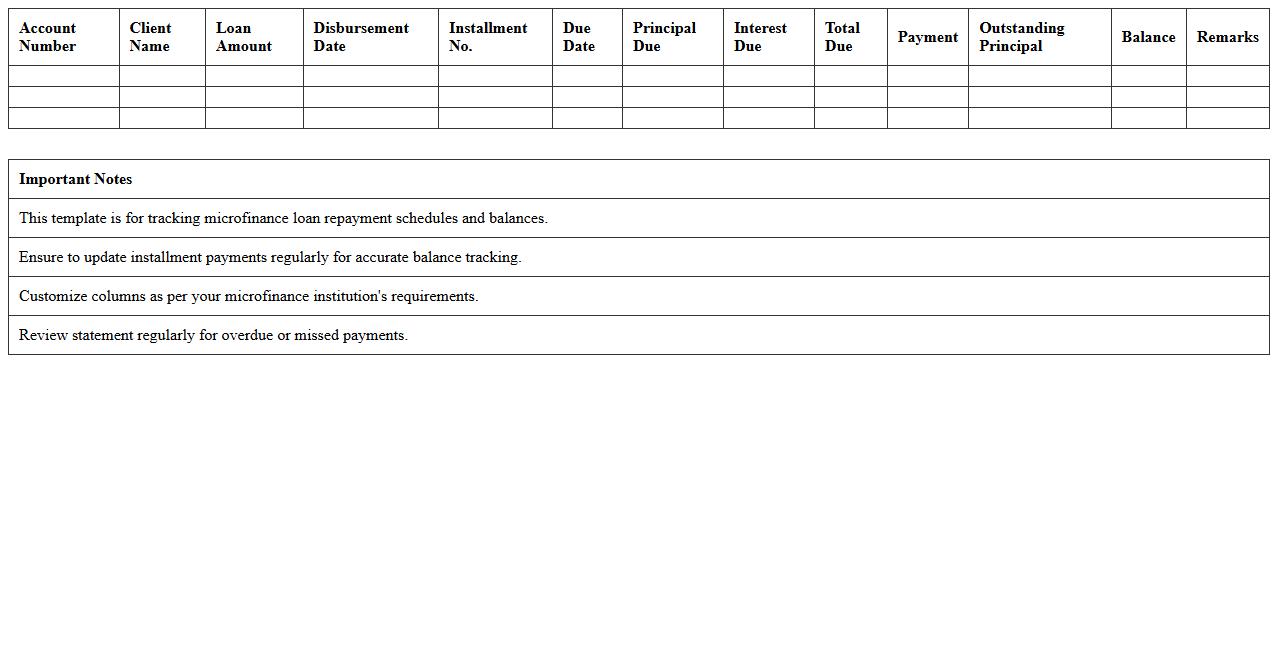

Microfinance Loan Account Statement Excel Template

A

Microfinance Loan Account Statement Excel Template document is a structured spreadsheet designed to track and manage loan details, repayments, and balances for microfinance clients. It enables accurate financial record-keeping, simplifies loan monitoring, and improves transparency for both lenders and borrowers. Using this template helps streamline accounting processes, ensuring efficient loan portfolio management and timely decision-making.

How to automate loan repayment schedules in an Account Statement Excel sheet?

To automate loan repayment schedules in Excel, use the PMT function to calculate consistent payment amounts. Incorporate conditional formatting to highlight due dates accurately, enhancing visual tracking. Link payment dates and amounts with formulas to update balances automatically in your account statement.

What formula tracks overdue loan payments within an Excel account statement?

The formula =IF(TODAY()>DueDate, "Overdue", "On Time") can effectively track overdue loan payments. Combine this with COUNTIF to summarize overdue entries for quick analysis. Conditional formatting further emphasizes late payments for timely follow-up within the Excel sheet.

Which Excel template features best support multi-loan tracking by account?

Templates with dynamic tables and multi-sheet organizing capabilities are ideal for tracking multiple loans by account. Features like dropdown lists for loan types and payment status enable efficient data entry and sorting. Pivot tables provide insightful summaries, making them crucial for detailed multi-loan tracking.

How do you reconcile loan disbursements and repayments in Excel account statements?

Use SUMIF formulas to total disbursements and repayments by loan account, ensuring accurate balance tracking. Cross-check transactions with the original loan agreement dates to align entries correctly. Reconciling in Excel requires consistent referencing of loan IDs to match every disbursement against repayments.

What data validation ensures accurate loan entry in Excel account statements?

Implement dropdown lists and date constraints through data validation to avoid incorrect loan entries. Use custom formulas to prevent negative numbers and ensure amounts fall within expected ranges. Proper data validation reduces errors and maintains the integrity of your loan tracking system in Excel.

![]()