The Bank Statement Excel Template for Account Reconciliation simplifies tracking and matching bank transactions with accounting records. It features automated formulas and clear formatting to quickly identify discrepancies and ensure accurate financial statements. This template enhances efficiency in managing cash flow and maintaining precise account balances.

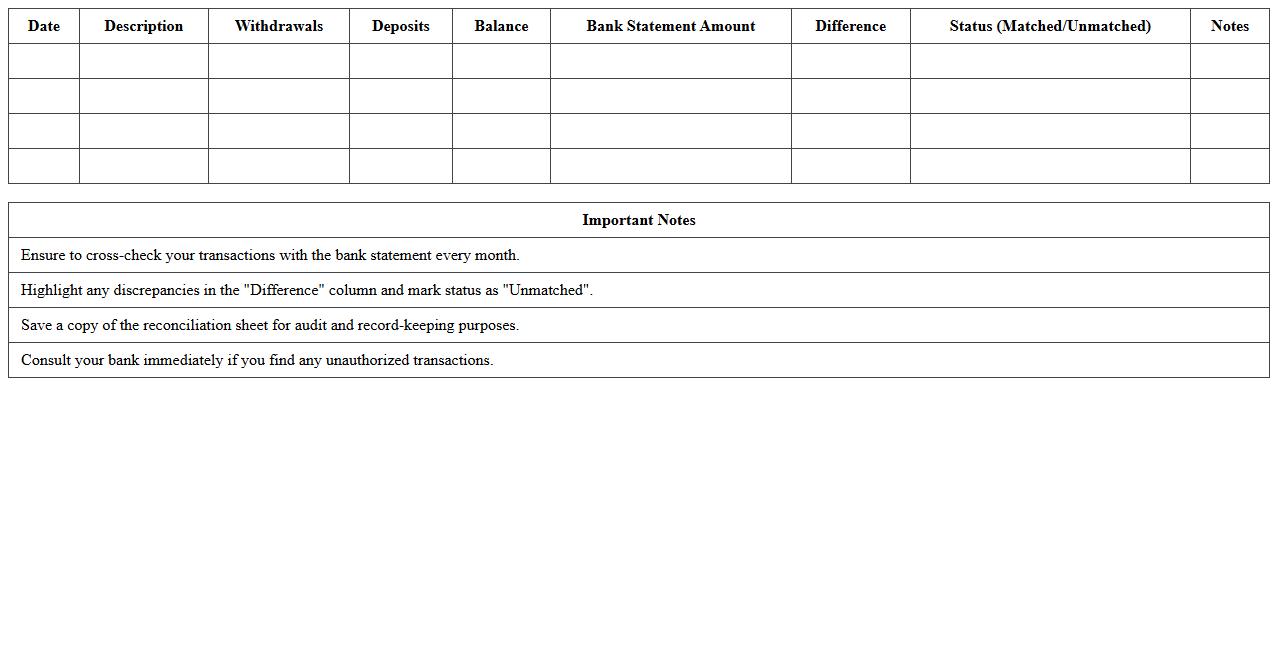

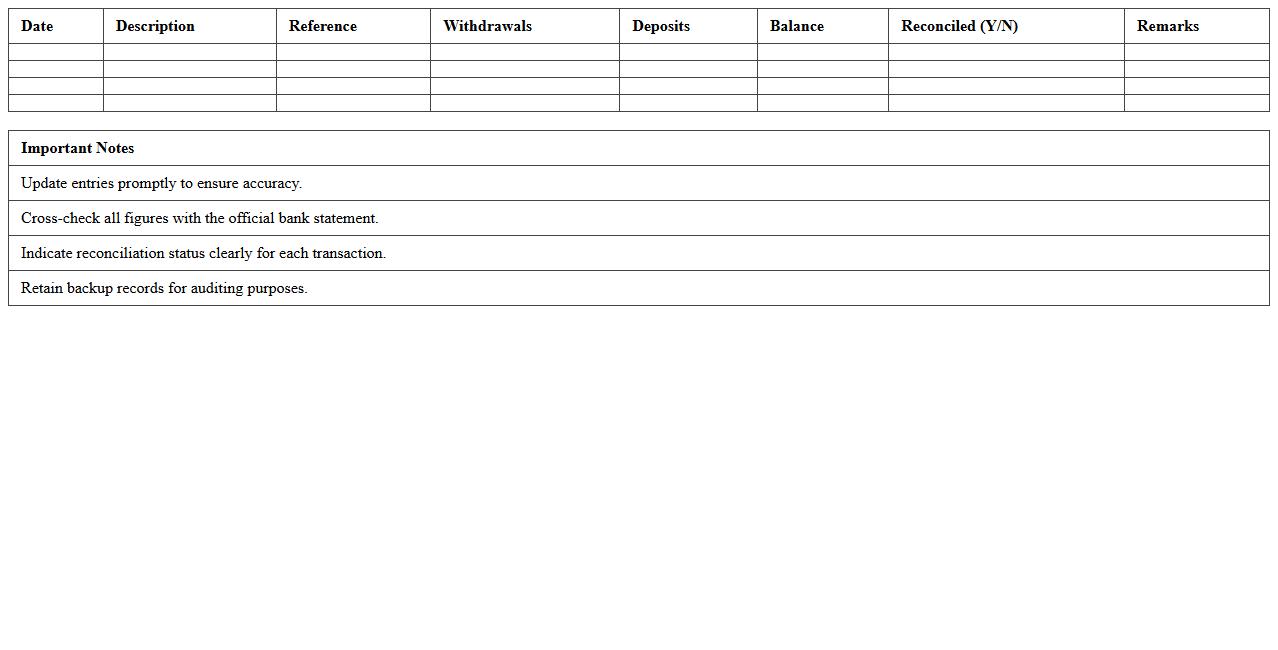

Personal Bank Statement Reconciliation Excel Template

The

Personal Bank Statement Reconciliation Excel Template is a structured spreadsheet designed to help individuals systematically compare their bank statements against personal financial records. It enables users to identify discrepancies, verify transactions, and ensure accuracy in account balances, which is crucial for effective budget management and fraud detection. This template streamlines the reconciliation process, saving time and reducing errors associated with manual tracking.

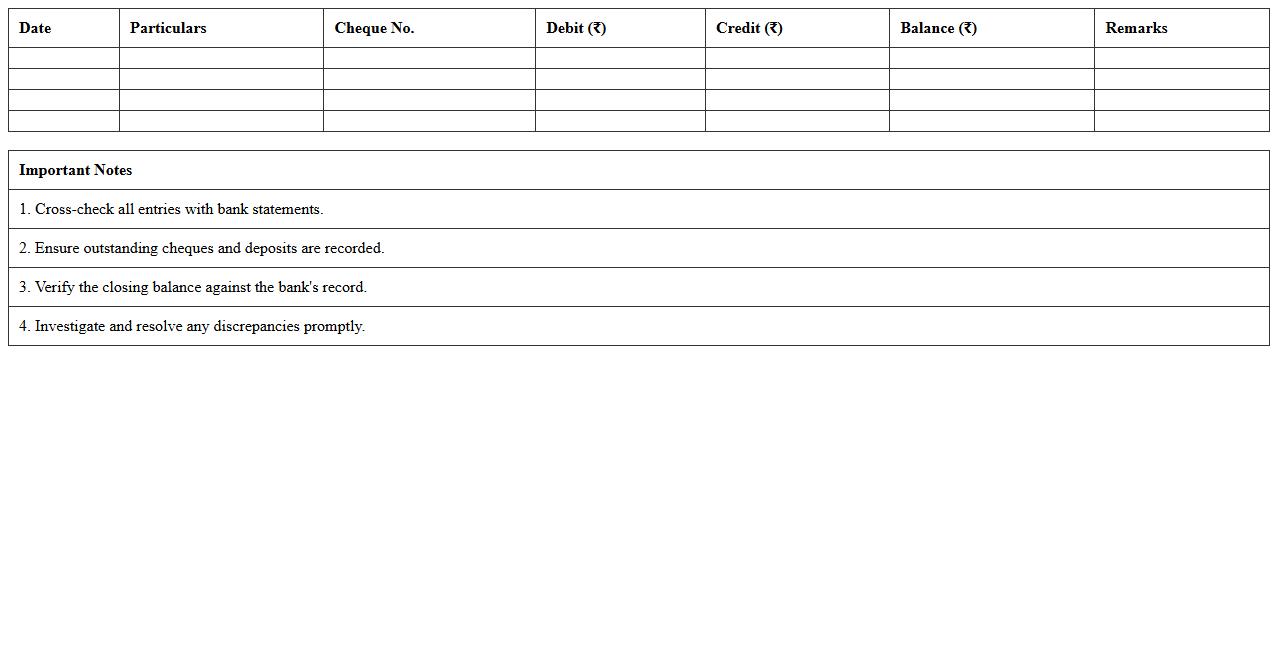

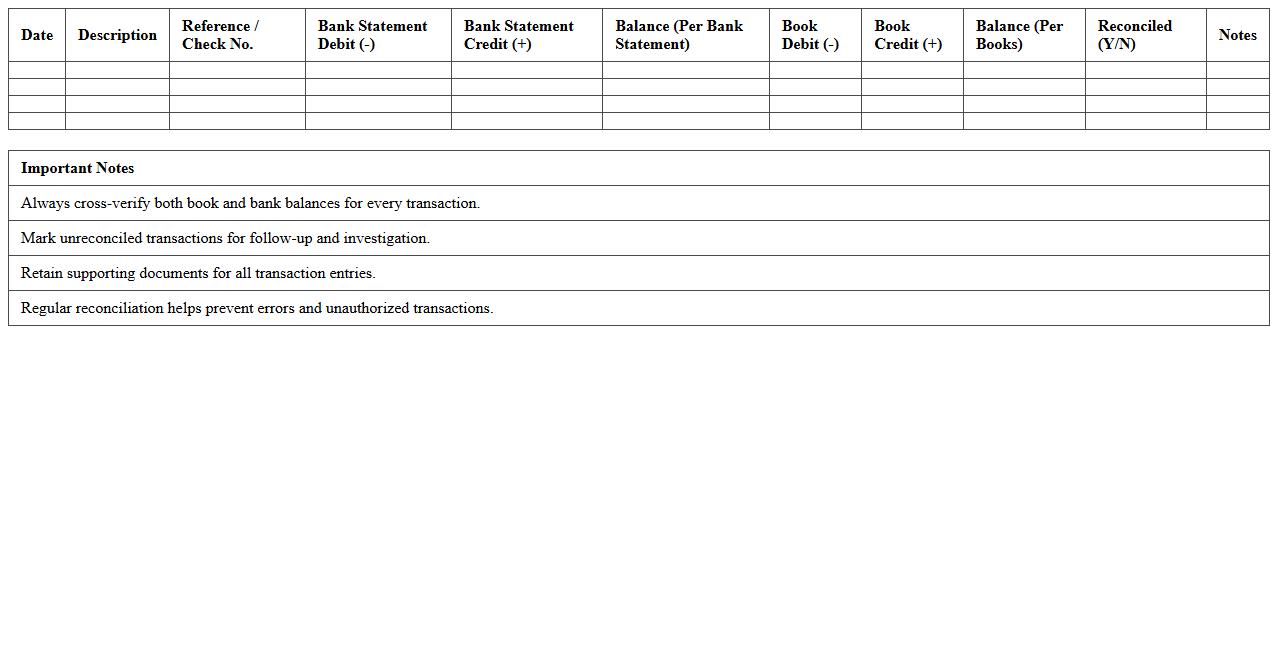

Business Account Reconciliation Statement Excel Sheet

A

Business Account Reconciliation Statement Excel Sheet document is a financial tool used to compare and validate the balances in a company's accounting records against bank statements or other financial records. This ensures accuracy by identifying discrepancies, such as errors or unauthorized transactions, thereby maintaining the integrity of financial data. Utilizing this Excel sheet enhances efficient record-keeping, simplifies audit processes, and supports informed decision-making based on reliable financial information.

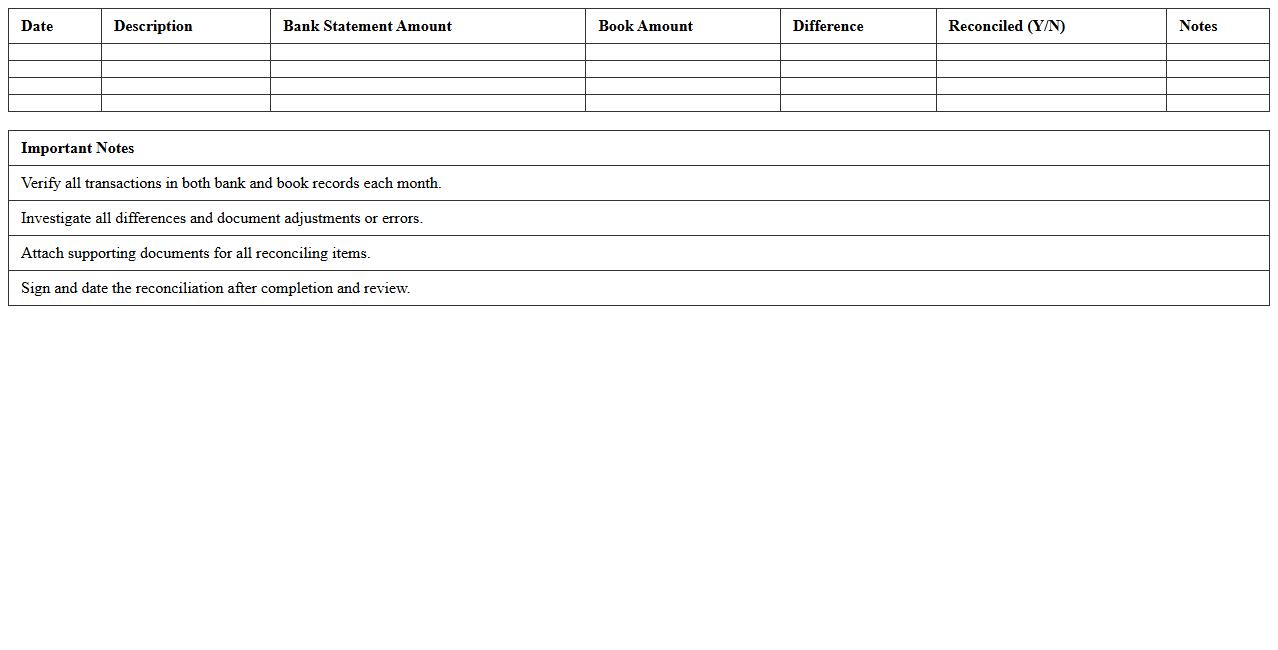

Monthly Bank Statement Reconciliation Spreadsheet

A

Monthly Bank Statement Reconciliation Spreadsheet document systematically compares the bank statement with internal financial records to identify discrepancies and ensure accuracy. It helps detect errors, unauthorized transactions, and timing differences, thus improving financial control and preventing fraud. Using this spreadsheet streamlines the reconciliation process, saves time, and supports accurate financial reporting for businesses and individuals.

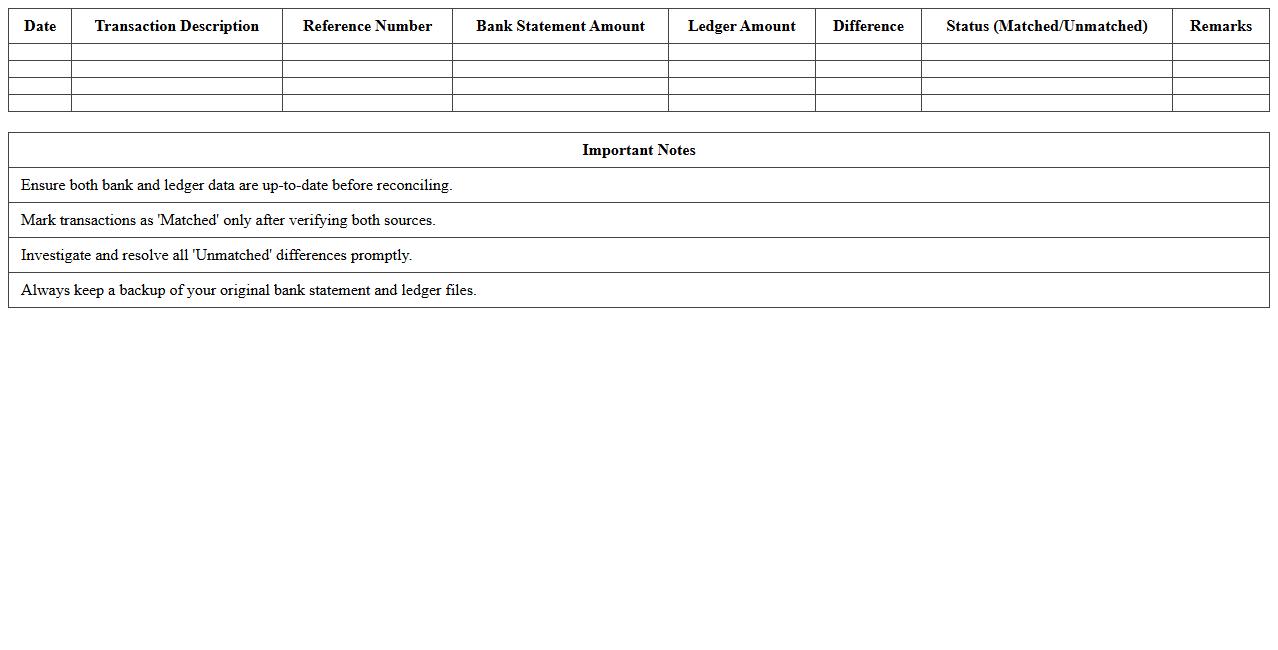

Automated Bank Statement Reconciliation Excel Template

The

Automated Bank Statement Reconciliation Excel Template is a powerful financial tool designed to streamline the reconciliation process by automatically matching transactions between bank statements and accounting records. It significantly reduces manual errors and saves time by quickly identifying discrepancies and unmatched entries, enhancing accuracy in financial reporting. This template is invaluable for businesses aiming to maintain precise cash flow management and ensure compliance with auditing standards.

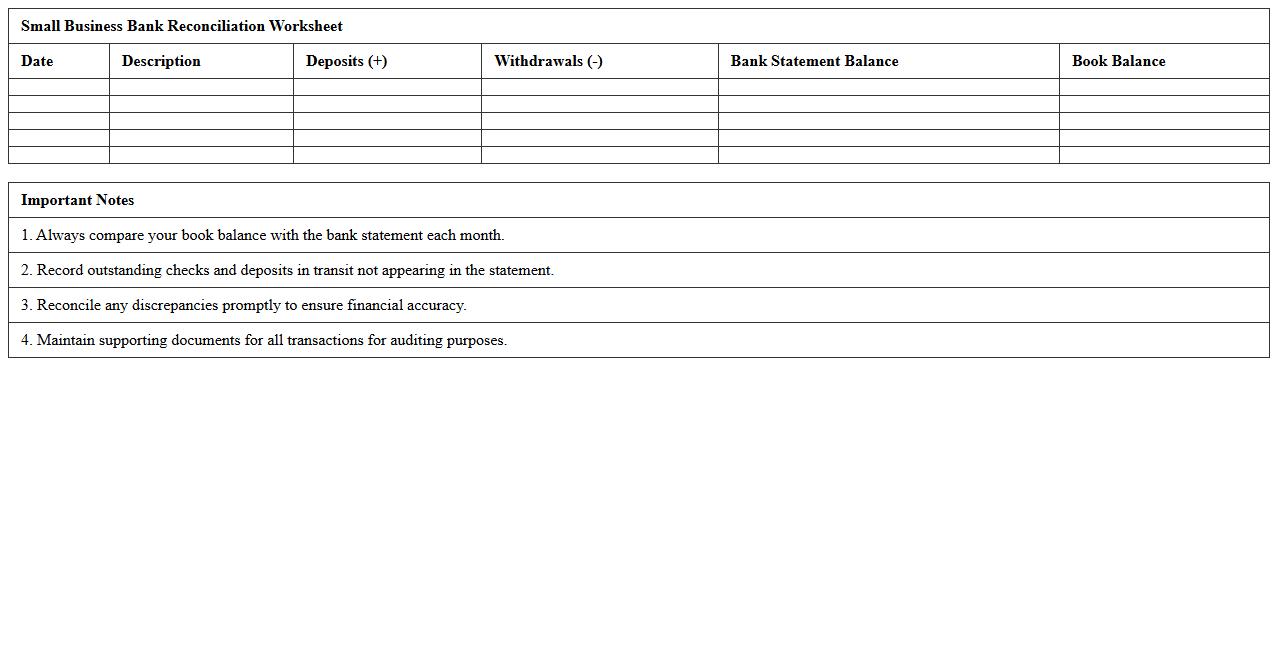

Small Business Bank Reconciliation Worksheet

A

Small Business Bank Reconciliation Worksheet is a financial document used to compare and match the cash balance on a company's books to the corresponding bank statement. It helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring accurate cash flow management. This worksheet is crucial for maintaining precise financial records and supporting effective decision-making in small business operations.

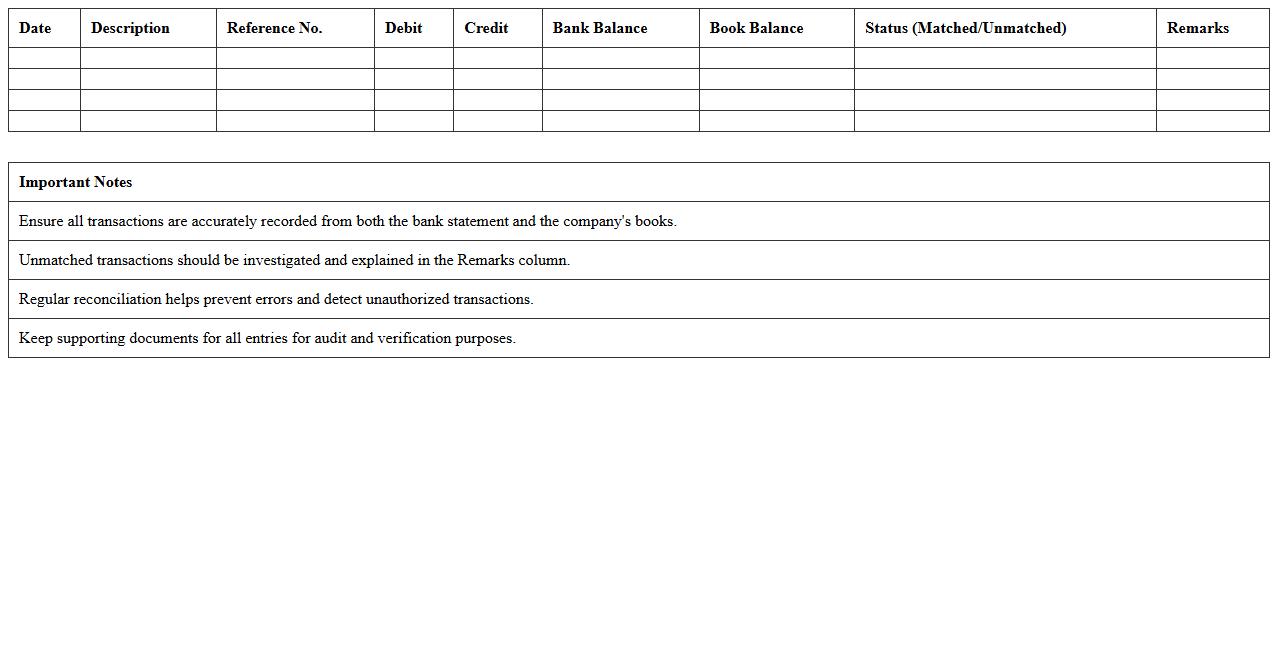

Corporate Bank Account Statement Matching Excel

A

Corporate Bank Account Statement Matching Excel document helps businesses reconcile their bank statements with internal financial records efficiently. It automates the comparison of transactions, identifying discrepancies such as missing entries or duplicate payments to ensure accuracy in accounting. This tool enhances financial control, reduces manual errors, and speeds up the reconciliation process for improved cash flow management.

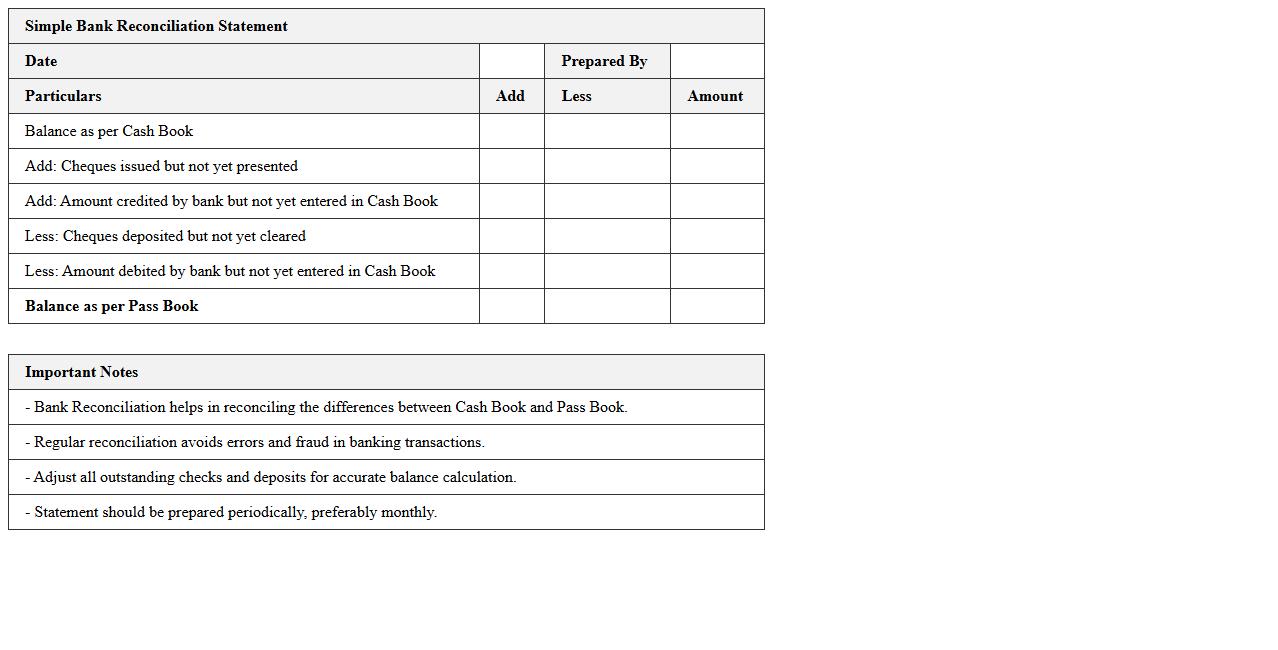

Simple Bank Reconciliation Statement Excel Format

A

Simple Bank Reconciliation Statement Excel Format is a structured spreadsheet designed to compare and reconcile the balance shown in a company's bank statement with its own accounting records. This document helps identify discrepancies such as outstanding checks, deposits in transit, or bank errors, ensuring accurate financial records. Using this format improves financial accuracy, streamlines accounting processes, and aids in effective cash flow management.

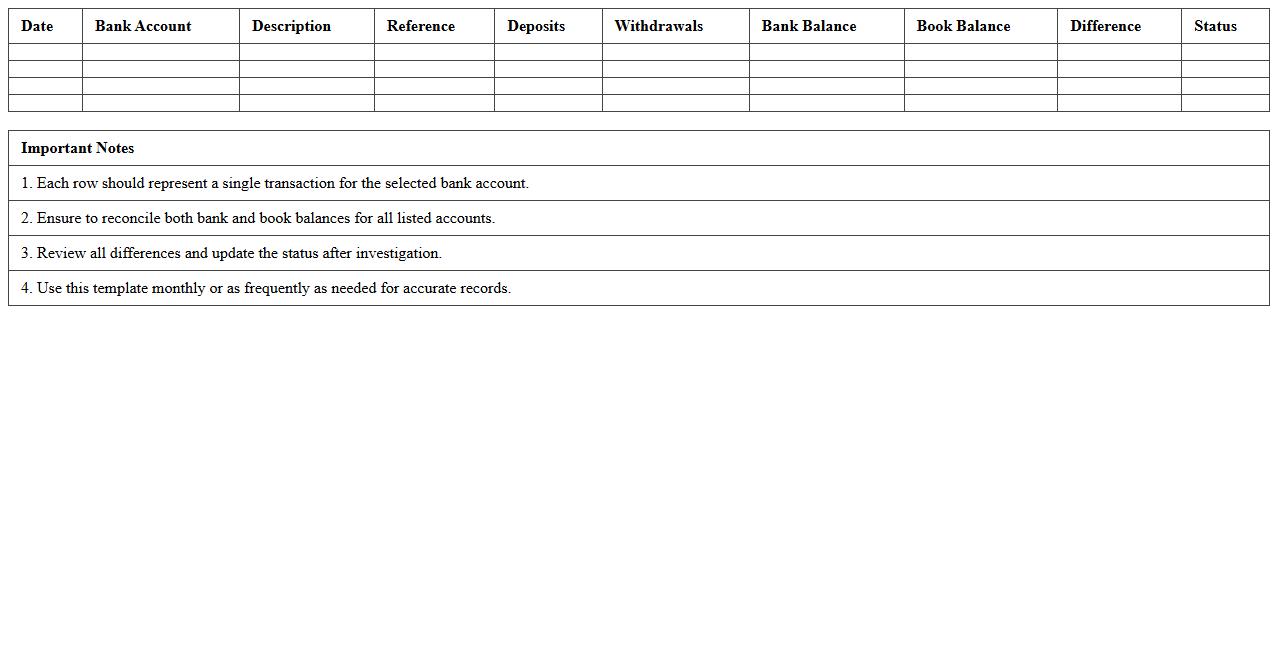

Multiple Account Bank Reconciliation Excel Template

The

Multiple Account Bank Reconciliation Excel Template is a versatile tool designed to streamline the process of matching and verifying transactions across various bank accounts within a single spreadsheet. It enables users to efficiently track discrepancies, manage financial records, and ensure accuracy in cash flow monitoring, reducing manual errors and saving time. This template is particularly useful for businesses or individuals handling multiple accounts, providing a consolidated view that simplifies financial reconciliation and enhances overall accounting accuracy.

Comprehensive Bank Statement Reconciliation Workbook

The

Comprehensive Bank Statement Reconciliation Workbook is a detailed financial tool designed to systematically compare and verify bank statements against internal accounting records to identify discrepancies or errors. It enhances accuracy in financial reporting by providing clear, organized tracking of transactions, outstanding checks, and deposits in transit. This workbook is essential for maintaining up-to-date reconciled accounts, ensuring compliance, and improving cash flow management.

Editable Bank Statement Excel Reconciliation Template

The

Editable Bank Statement Excel Reconciliation Template is a customizable spreadsheet designed to help users systematically compare their bank statements against internal financial records, ensuring accuracy and identifying discrepancies. It streamlines the reconciliation process by automating calculations, categorizing transactions, and highlighting unmatched entries, which reduces errors and saves time. This template is especially useful for accountants, business owners, and financial managers aiming to maintain precise financial control and improve transparency in cash flow management.

How can I automate bank statement import into Excel for monthly account reconciliation?

To automate bank statement import, use Excel's Power Query feature to connect directly to your bank's CSV or Excel files. This allows for seamless data refreshes without manual copying each month. Scheduling automatic refreshes ensures your data stays current and supports efficient reconciliation.

Which Excel formulas best identify discrepancies between bank statements and ledger entries?

Excel formulas like VLOOKUP, IFERROR, and SUMIFS are essential for pinpointing mismatched transactions. These formulas help compare bank statement amounts against ledger entries to flag missing or incorrect amounts. Using conditional formatting alongside these functions enhances visibility of discrepancies.

What data validation rules should I use for flagging duplicate transactions in bank statement imports?

Apply custom data validation rules using the COUNTIF function to detect duplicates based on transaction IDs or amounts. Setting criteria to alert users when a transaction appears more than once maintains data integrity. Integrating these rules during import prevents processing errors caused by repeated entries.

How do I design a pivot table to quickly spot uncleared items from bank statement uploads?

Create a pivot table with transaction status as a filter and bank statement dates as rows to quickly isolate uncleared items. Summarizing amounts by clearance status allows easy identification of outstanding transactions. Adding slicers enhances interactivity and speeds up monthly reconciliation efforts.

What are effective filtering methods in Excel to reconcile multi-currency bank statements?

Use Excel's Data Filter coupled with custom formulas to separate transactions by currency codes effectively. Implementing filters on currency columns streamlines the review process across different currencies. Additionally, using helper columns with conversion rates aids in unified reconciliation of values.

More Statement Excel Templates