The Loan Statement Excel Template for Private Money Lenders is designed to streamline loan tracking and management. It provides a comprehensive overview of loan disbursements, repayments, and outstanding balances in an easy-to-use spreadsheet format. This template enhances accuracy and saves time by automating calculations and organizing financial data clearly.

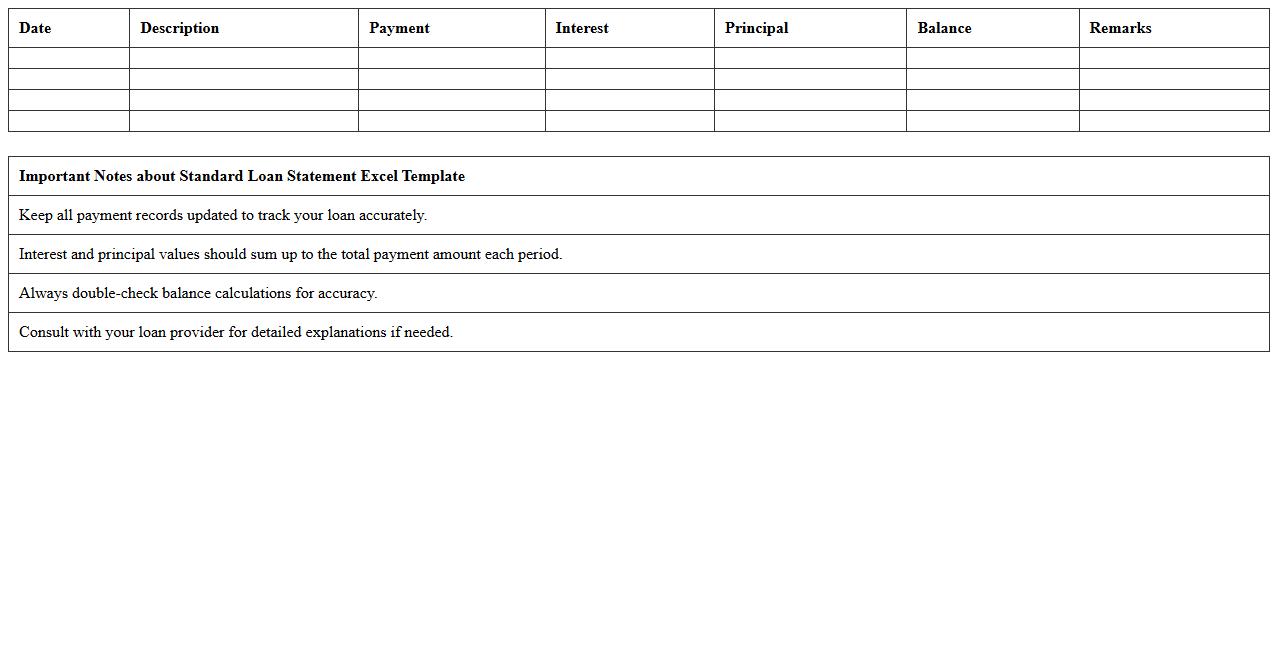

Standard Loan Statement Excel Template

A

Standard Loan Statement Excel Template document is a pre-designed spreadsheet that tracks loan details such as principal, interest, payment dates, and outstanding balances. It enables users to efficiently monitor loan repayments, calculate interest accruals, and generate clear financial statements for personal or business use. Utilizing this template enhances accuracy, organization, and financial analysis by automating complex calculations and maintaining comprehensive loan records.

Private Loan Balance Sheet Tracker

A

Private Loan Balance Sheet Tracker document is a financial tool designed to monitor and manage outstanding private loan amounts, interest rates, payment schedules, and lender details in one organized spreadsheet. It helps individuals and businesses maintain accurate records, reduce the risk of missed payments, and analyze loan impact on overall financial health. By providing clear visibility into loan obligations, this tracker supports informed decision-making and improved cash flow management.

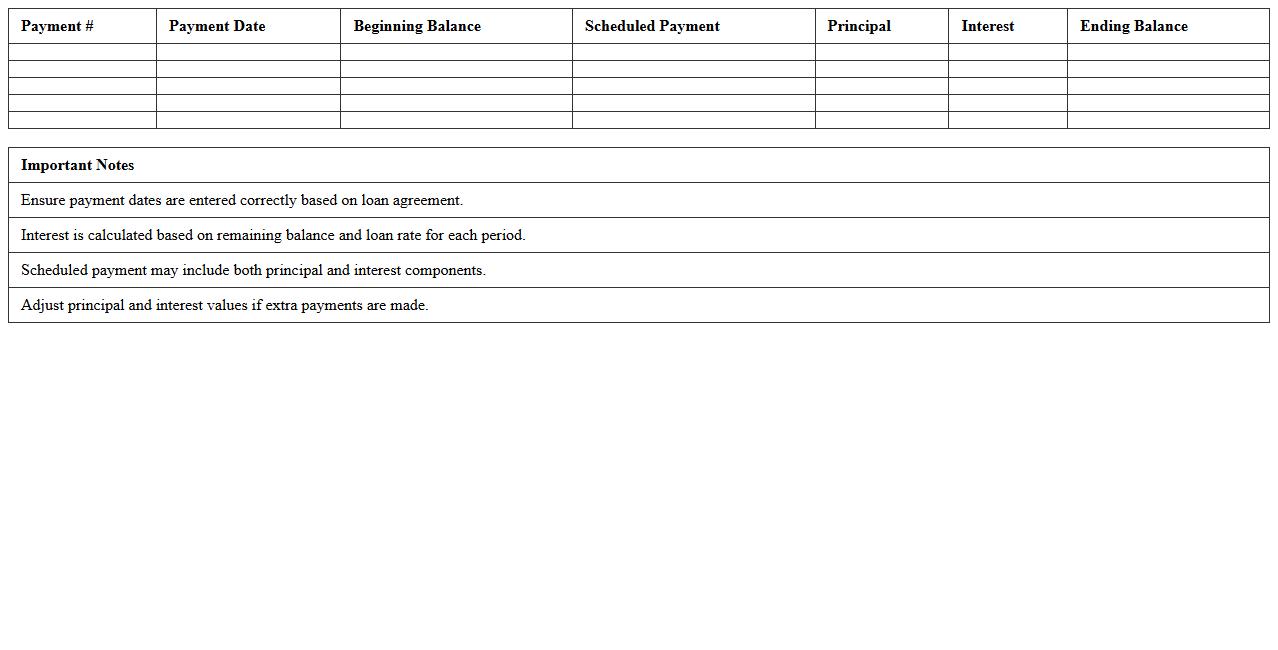

Loan Repayment Schedule Spreadsheet

A

Loan Repayment Schedule Spreadsheet is a detailed document that outlines the timeline and amounts for repaying a loan, including principal and interest payments. It helps borrowers track their payment due dates, remaining balances, and total interest paid over the life of the loan, enabling better financial planning. Using this spreadsheet promotes timely payments and prevents default by providing clear visibility into loan obligations.

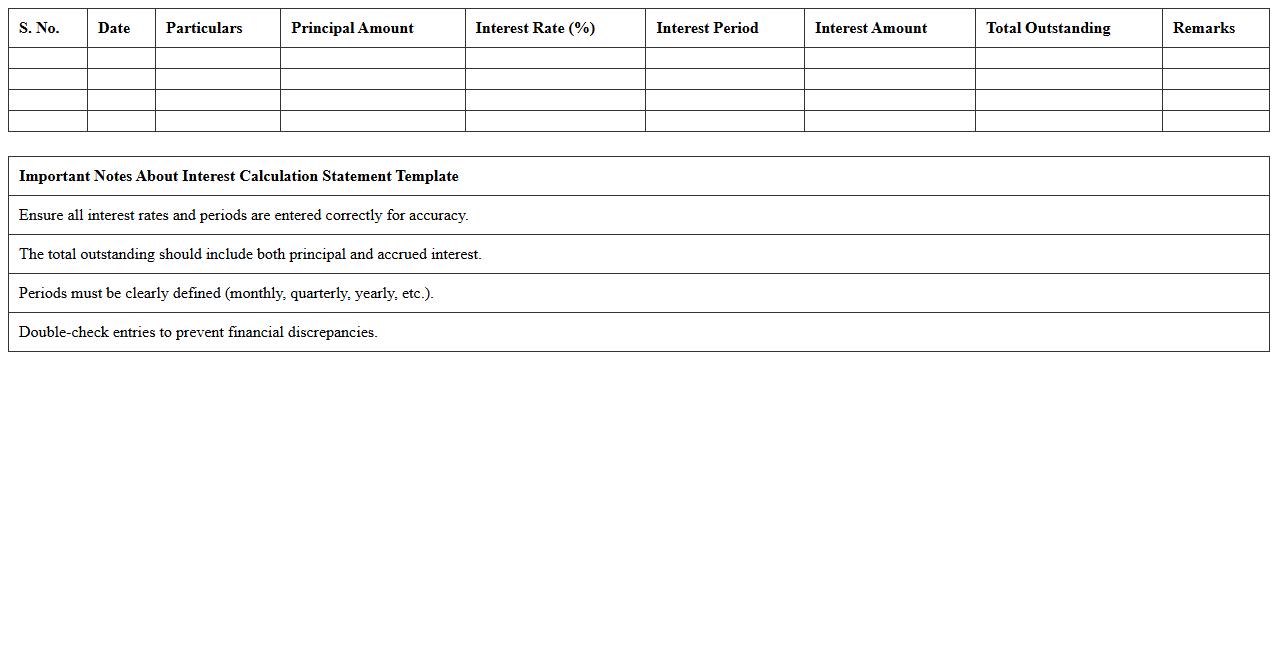

Interest Calculation Statement Template

An

Interest Calculation Statement Template document systematically outlines the calculation of interest on loans, deposits, or other financial instruments, ensuring accuracy and transparency. It helps businesses and individuals track interest accrued or payable over specific periods, simplifying financial analysis and record-keeping. Using this template reduces errors, saves time, and provides a clear summary essential for financial reporting and decision-making.

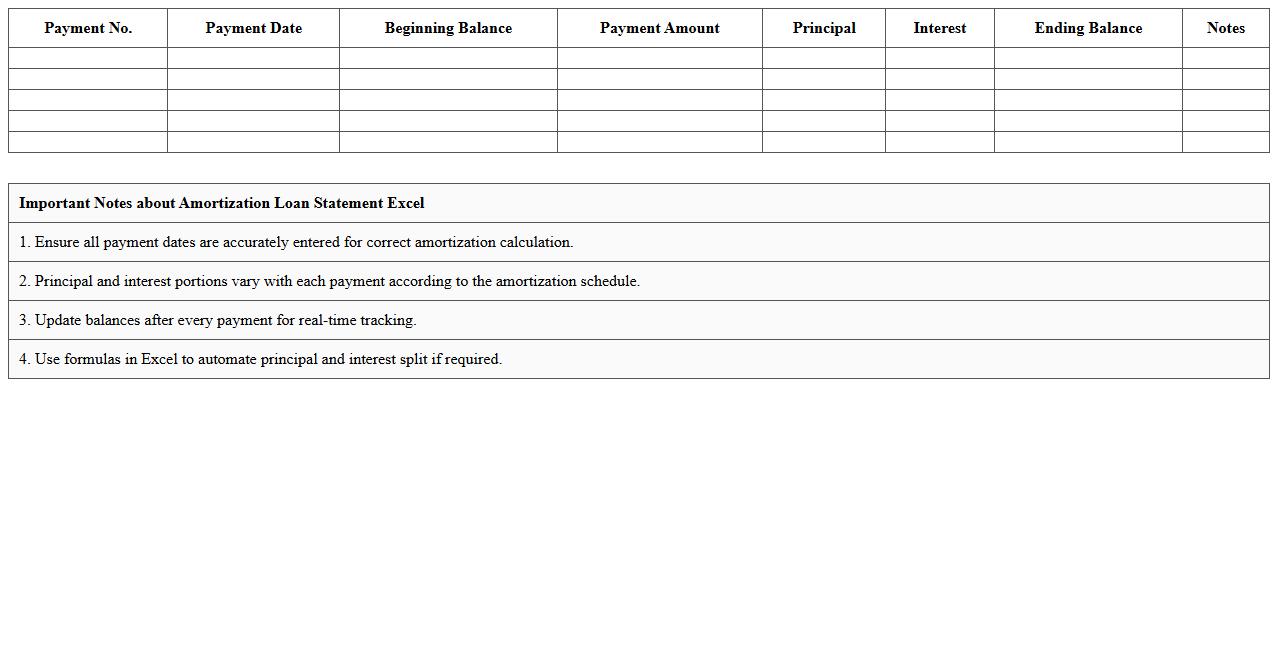

Amortization Loan Statement Excel

An

Amortization Loan Statement Excel document is a detailed spreadsheet that tracks loan payments over time, breaking down each installment into principal and interest components. It helps users visualize the repayment schedule, understand the impact of each payment on the loan balance, and accurately forecast remaining debt. This tool is essential for financial planning, budgeting, and managing loan obligations effectively.

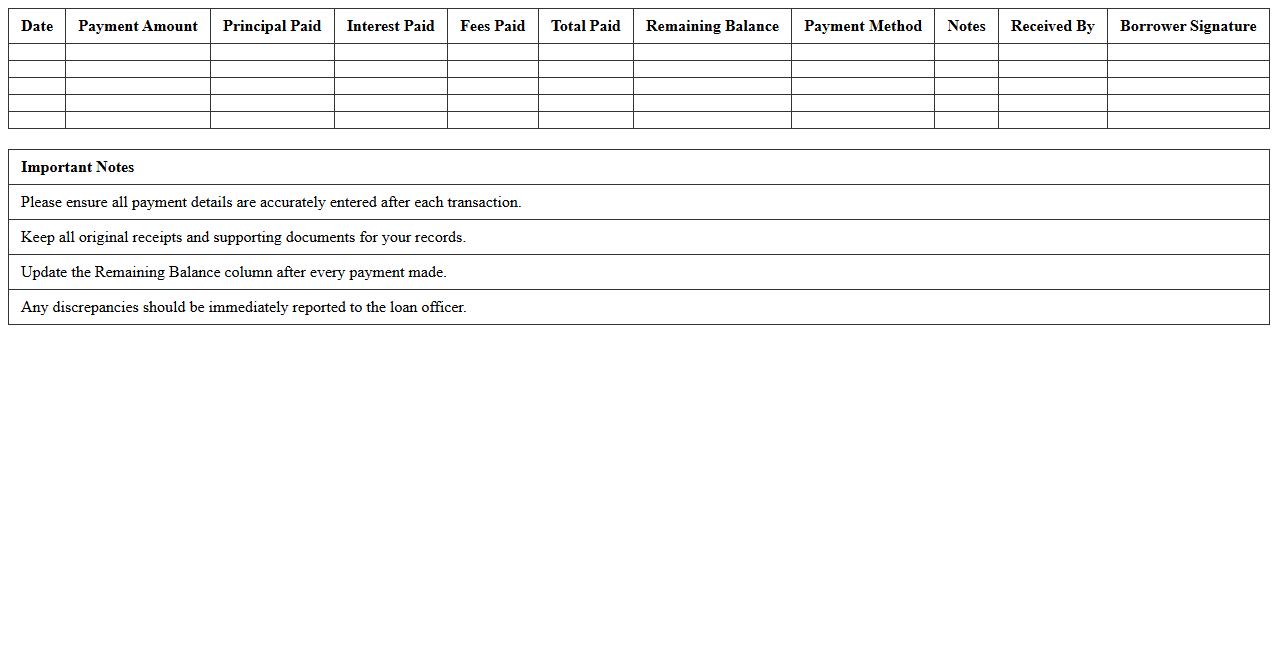

Borrower Payment History Log Sheet

A

Borrower Payment History Log Sheet is a detailed record tracking all payments made by a borrower towards a loan or credit account. This document helps monitor payment consistency, identify late or missed payments, and assess creditworthiness. Financial institutions and lenders use this log sheet to make informed decisions on loan approvals, restructures, or collections.

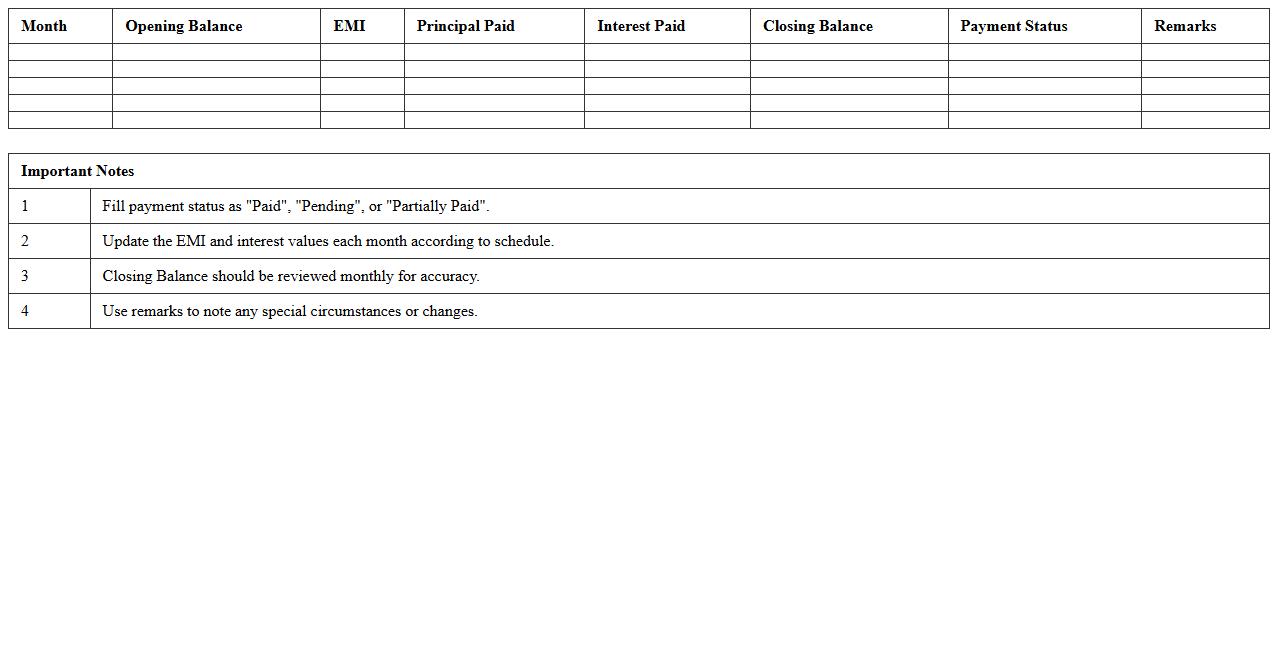

Monthly Loan Summary Template

A

Monthly Loan Summary Template document consolidates essential information about loan accounts, including payment history, outstanding balance, interest accrued, and due dates. It provides a clear and organized overview that aids in tracking financial obligations, ensuring timely repayments, and managing budget efficiently. Using this template helps individuals and businesses maintain accurate records, facilitate loan reconciliation, and improve financial planning.

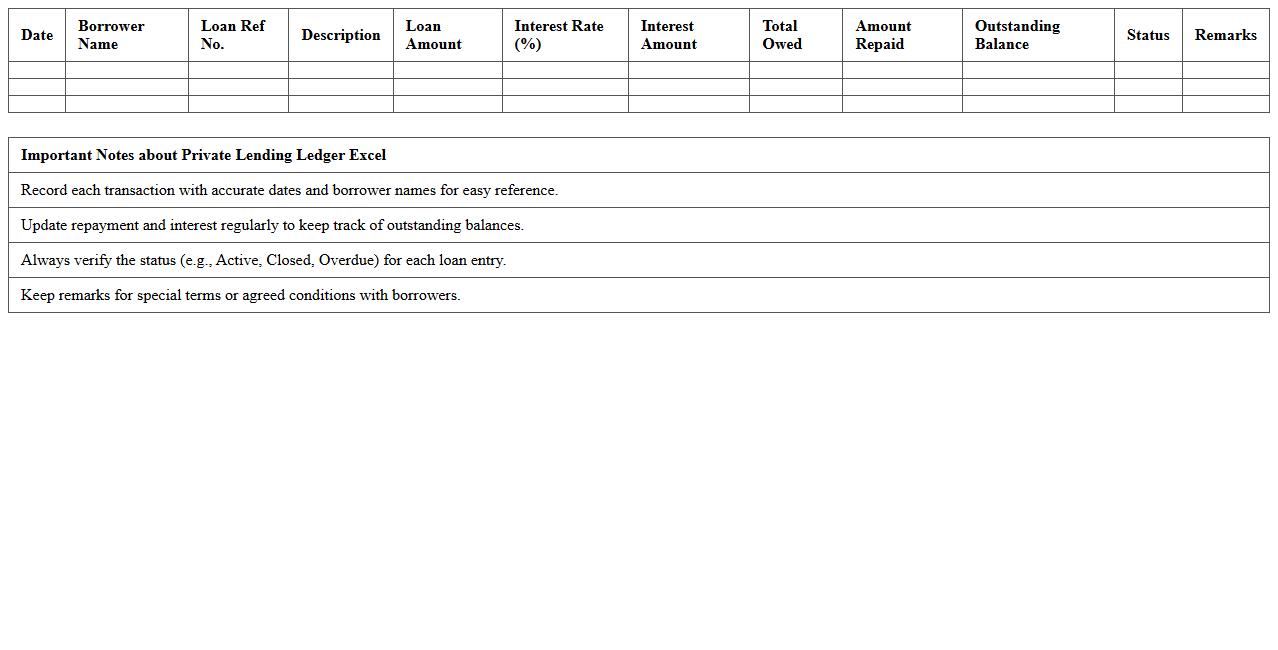

Private Lending Ledger Excel

A

Private Lending Ledger Excel document is a specialized spreadsheet designed to track loans between private parties, detailing principal amounts, interest rates, payment schedules, and outstanding balances. It enables lenders to monitor repayment progress accurately, calculate interest accrued, and maintain clear records for financial management and tax purposes. Using this tool helps ensure transparency, minimizes errors, and supports informed decision-making in private lending activities.

Multi-Borrower Loan Statement Tracker

The

Multi-Borrower Loan Statement Tracker document consolidates loan statements from multiple borrowers into a single organized record, enabling easy monitoring of repayment status and loan balances. It enhances financial management by providing clear visibility into each borrower's contribution and outstanding amounts, reducing errors and missed payments. This tool is essential for lenders and financial institutions managing joint or syndicated loans, streamlining reporting and improving decision-making efficiency.

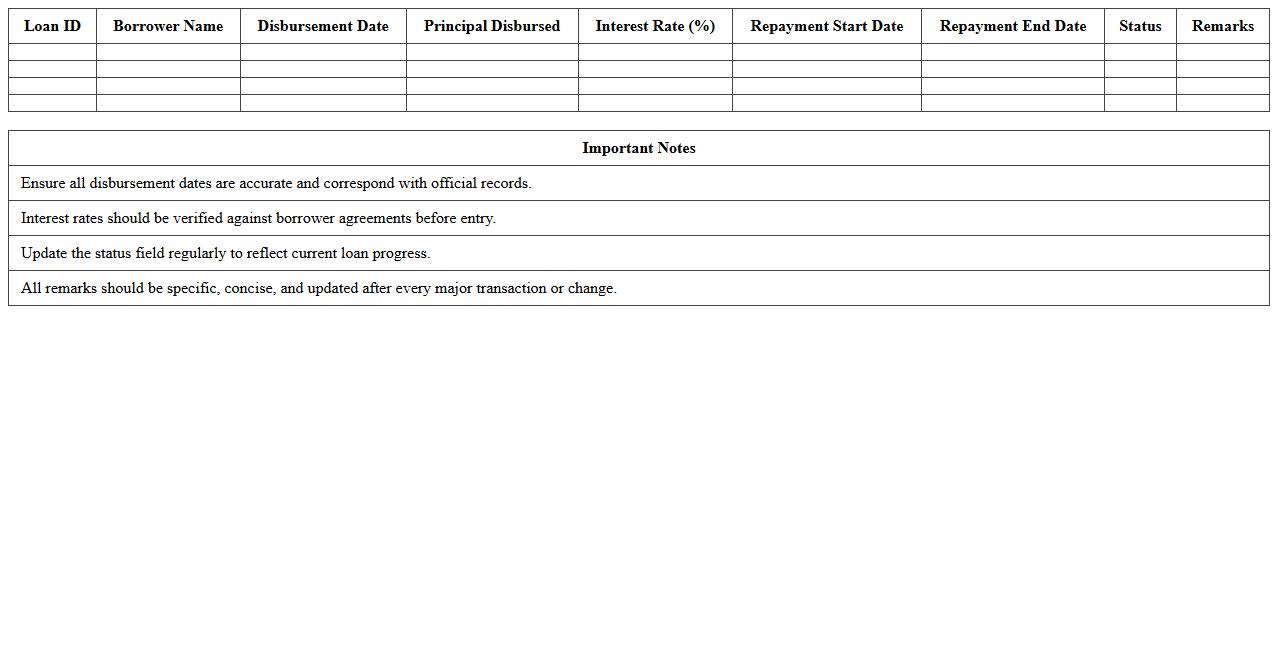

Detailed Loan Disbursement Record

A

Detailed Loan Disbursement Record document provides a comprehensive breakdown of loan amounts disbursed, including dates, installment numbers, and corresponding borrower details. This record is essential for tracking repayment schedules, verifying fund utilization, and ensuring transparency in loan management. Financial institutions and borrowers rely on this document to maintain accurate financial records and facilitate audit processes.

How to automate interest calculation formulas in a loan statement Excel sheet for private lenders?

To automate interest calculation, use Excel formulas like PMT, IPMT, or custom formulas with principal, rate, and time. Input dynamic cell references to adjust interest based on the loan balance and payment dates. Automating these formulas reduces manual errors and improves accuracy.

What data fields are essential for tracking borrower payments in a private money loan statement?

Critical data fields include borrower name, loan amount, payment date, payment amount, interest rate, and outstanding balance. Including payment status and remarks can help monitor borrower compliance. These fields enable comprehensive tracking of loan performance and repayment schedules.

How to generate amortization schedules within a multi-loan Excel statement template?

Use Excel's PMT, IPMT, and PPMT functions combined with tables for each loan to create detailed amortization schedules. Incorporate dynamic inputs such as loan term, interest rate, and payment frequency. Linking schedules by borrower or loan ID ensures clear multi-loan management.

What Excel features help flag missed or late payments for private money lenders?

Conditional formatting and formulas like IF and TODAY() can automatically flag missed or late payments by comparing due dates with actual payment dates. Creating visual alerts with color changes improves loan monitoring efficiency. Data validation further prevents input errors affecting payment tracking.

How to secure sensitive borrower information in a shared loan statement Excel document?

Secure sensitive data using password protection and Excel's sheet and workbook encryption features. Restrict editing permissions and utilize hidden sheets to safeguard critical borrower information. Additionally, consider cloud storage with access controls for secure document sharing.

More Statement Excel Templates