The Tax Statement Excel Template for Independent Contractors simplifies organizing and tracking income, expenses, and tax deductions. This customizable template helps freelancers accurately report earnings and calculate taxes owed, ensuring compliance with tax regulations. Easy to use and update, it supports financial management throughout the fiscal year.

Income and Expense Tax Statement Excel for Contractors

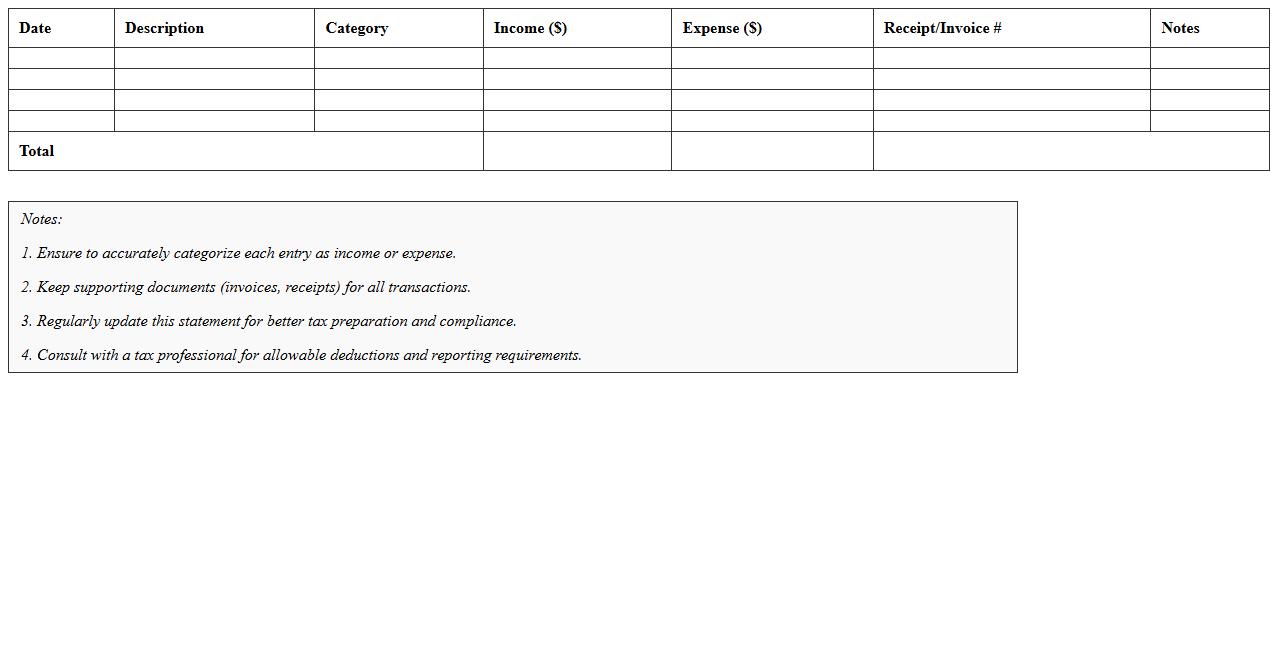

An Income and Expense Tax Statement Excel for Contractors document is a tailored financial spreadsheet designed to track income and deductible expenses throughout the fiscal year. This tool helps contractors organize their financial data systematically, ensuring accurate tax reporting and simplifying the preparation of tax returns. By using this

Income and Expense Tax Statement, contractors can maximize tax deductions, improve financial planning, and ensure compliance with tax regulations.

1099 Tax Reporting Excel Template for Freelancers

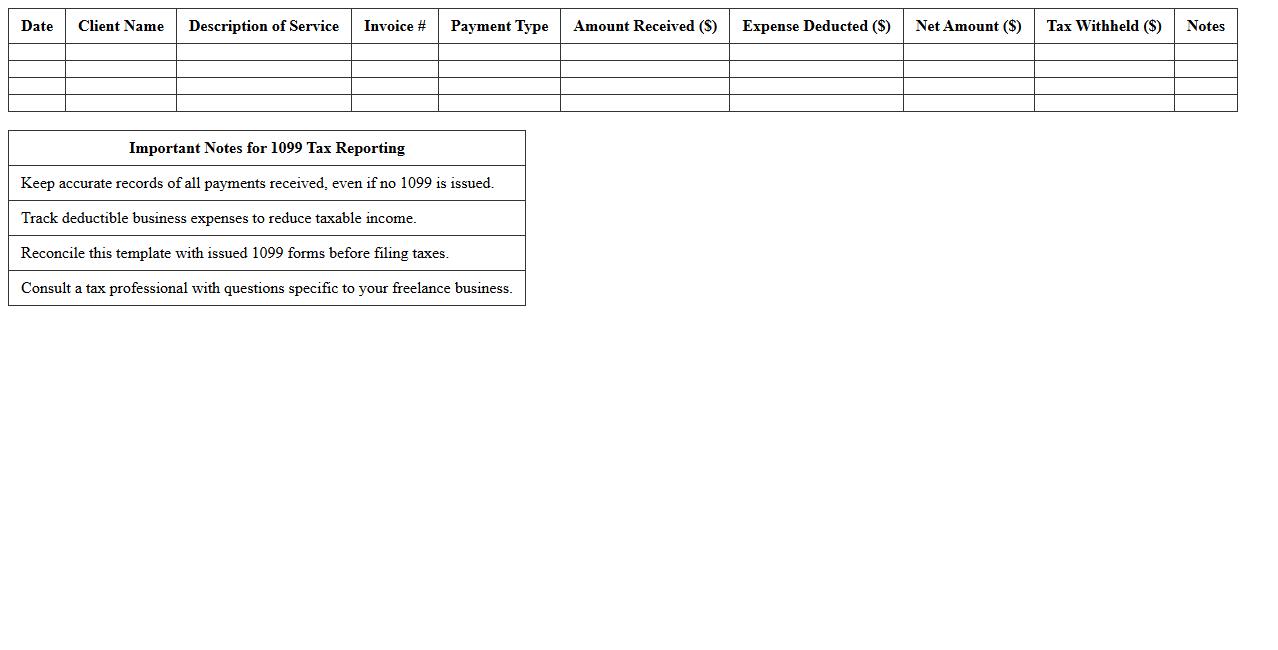

The

1099 Tax Reporting Excel Template for freelancers is a structured spreadsheet designed to track income and expenses for tax purposes, ensuring accurate and efficient preparation of 1099 forms. This template simplifies the process of organizing payments received from multiple clients, reducing errors and saving time during tax season. By using this tool, freelancers can maintain clear financial records that facilitate compliance with IRS requirements and streamline tax reporting.

Self-Employed Tax Summary Excel Worksheet

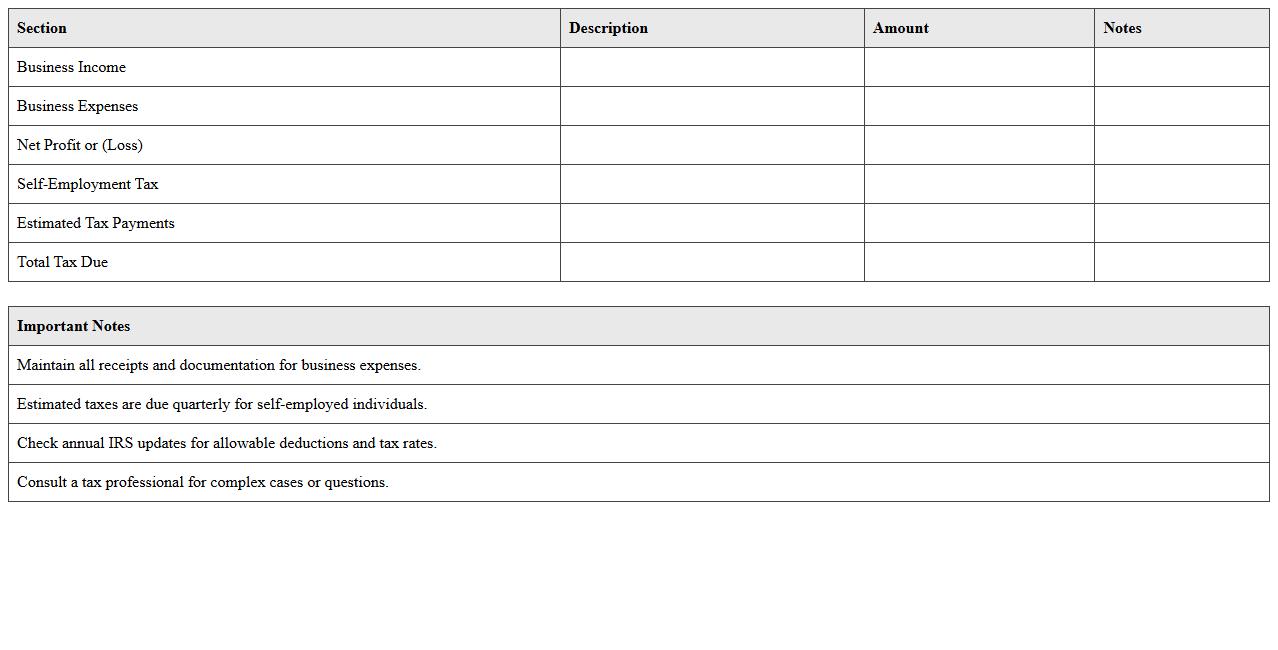

The

Self-Employed Tax Summary Excel Worksheet is a specialized document designed to organize and calculate income, expenses, and tax liabilities for self-employed individuals. It streamlines tax preparation by automatically summarizing financial data, ensuring accuracy and compliance with tax regulations. This tool is essential for managing deductions, estimating quarterly taxes, and simplifying year-end tax filing processes.

Annual Income Tax Statement Sheet for Contractors

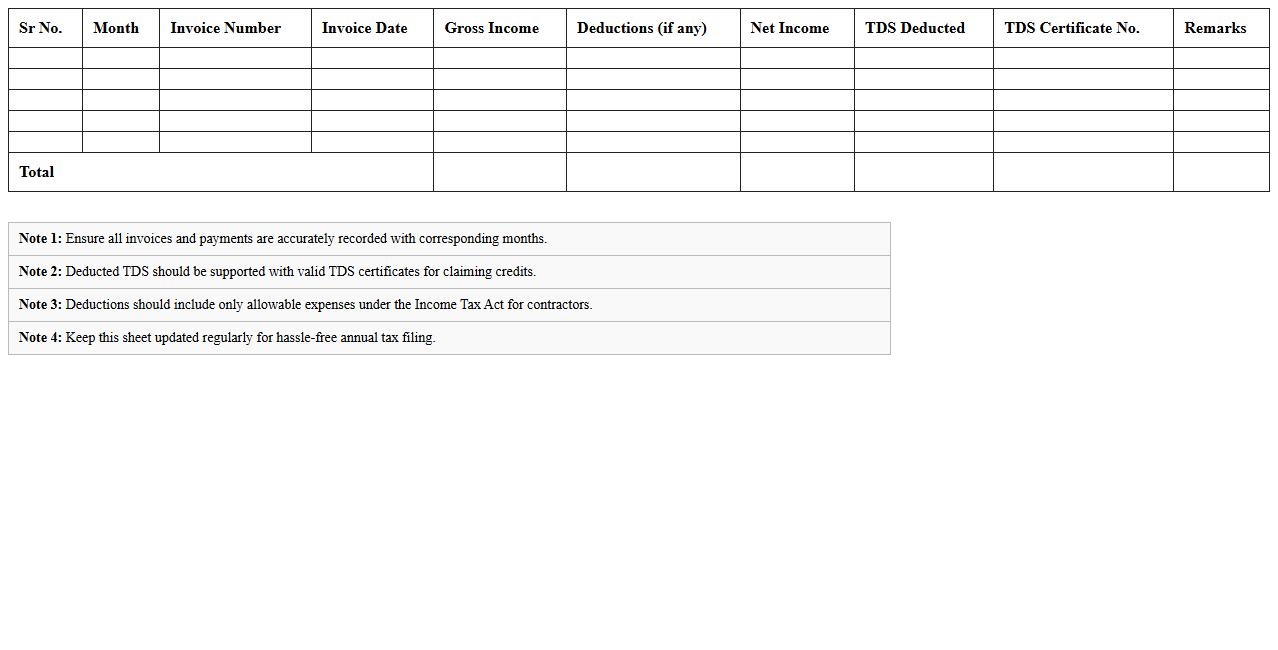

The

Annual Income Tax Statement Sheet for Contractors is a detailed financial document that reports the total income earned and taxes withheld during the fiscal year. This statement is essential for accurate tax filing, ensuring compliance with government regulations and avoiding penalties. It provides contractors with a clear summary of their taxable income, aiding in effective personal financial management and tax planning.

Quarterly Tax Statement Excel Tracker for Independent Workers

The

Quarterly Tax Statement Excel Tracker for independent workers is a specialized spreadsheet designed to organize and monitor income, expenses, and tax payments on a quarterly basis. It helps freelancers, contractors, and self-employed individuals accurately calculate estimated taxes and avoid underpayment penalties by providing clear summaries and automated calculations. Using this tracker enhances financial management and ensures timely compliance with tax filing deadlines.

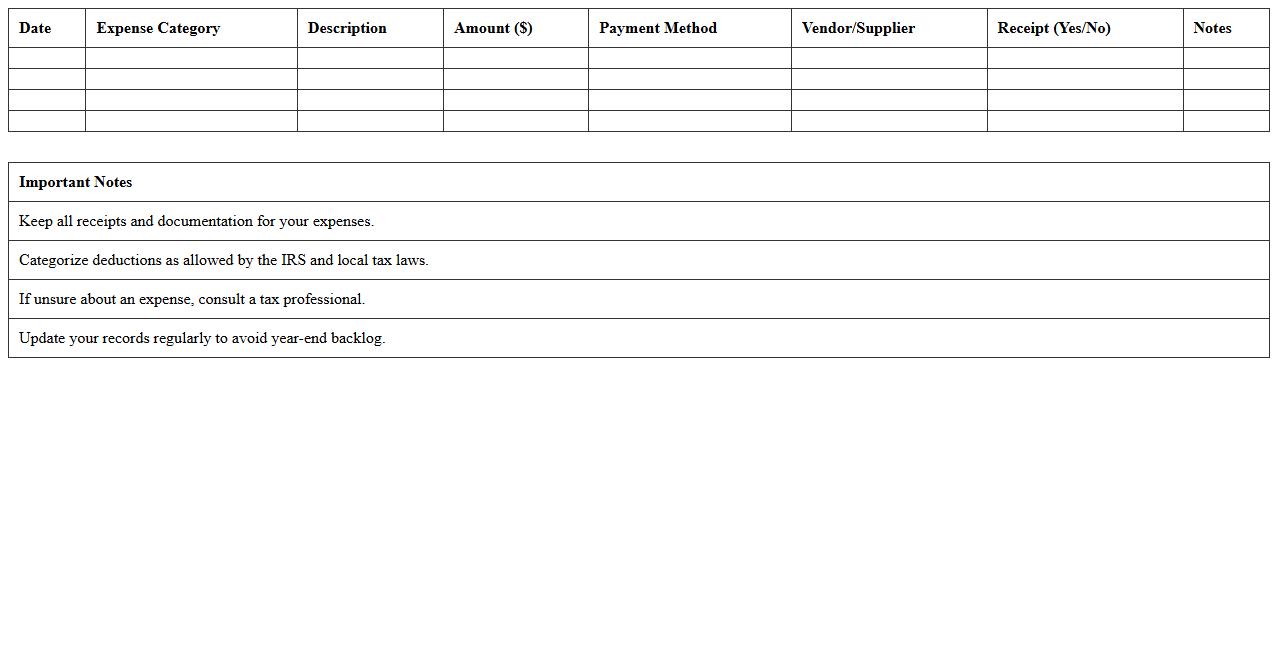

Independent Contractor Tax Deductions Excel Template

The

Independent Contractor Tax Deductions Excel Template is a highly organized spreadsheet designed to track and categorize business expenses for tax purposes. It helps independent contractors systematically record deductible costs such as office supplies, travel, and equipment, ensuring accurate tax reporting and maximizing potential refunds. Utilizing this template streamlines financial management, reduces errors, and simplifies the process of preparing tax returns.

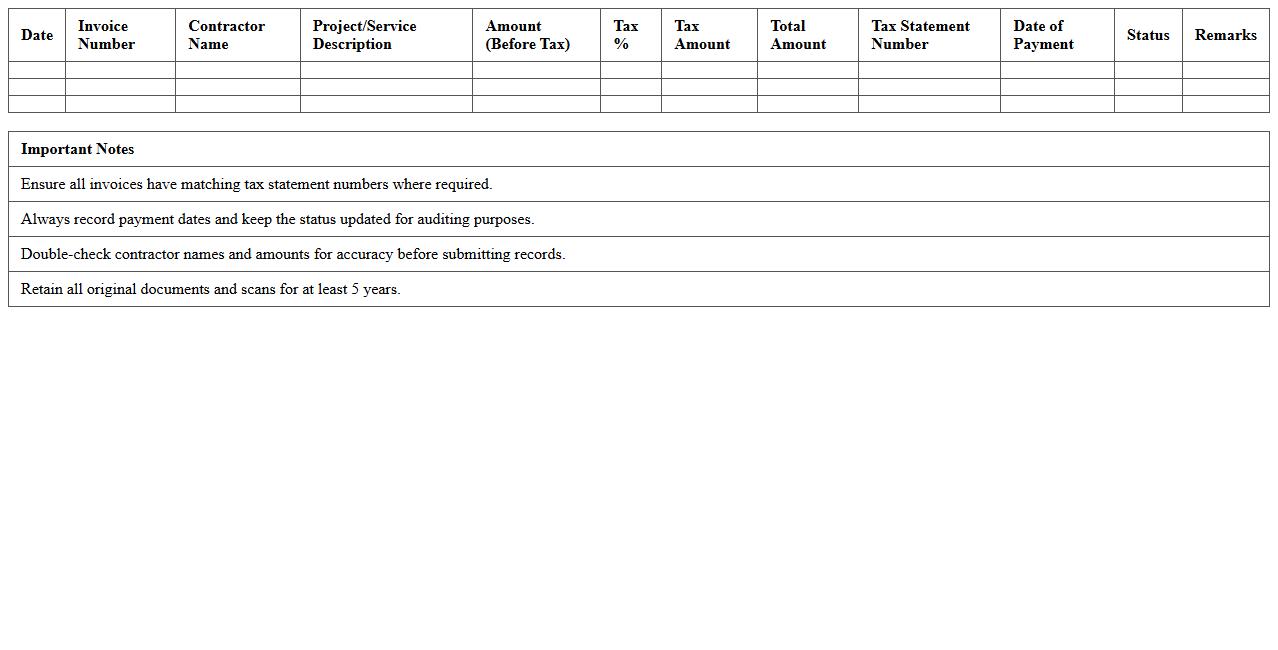

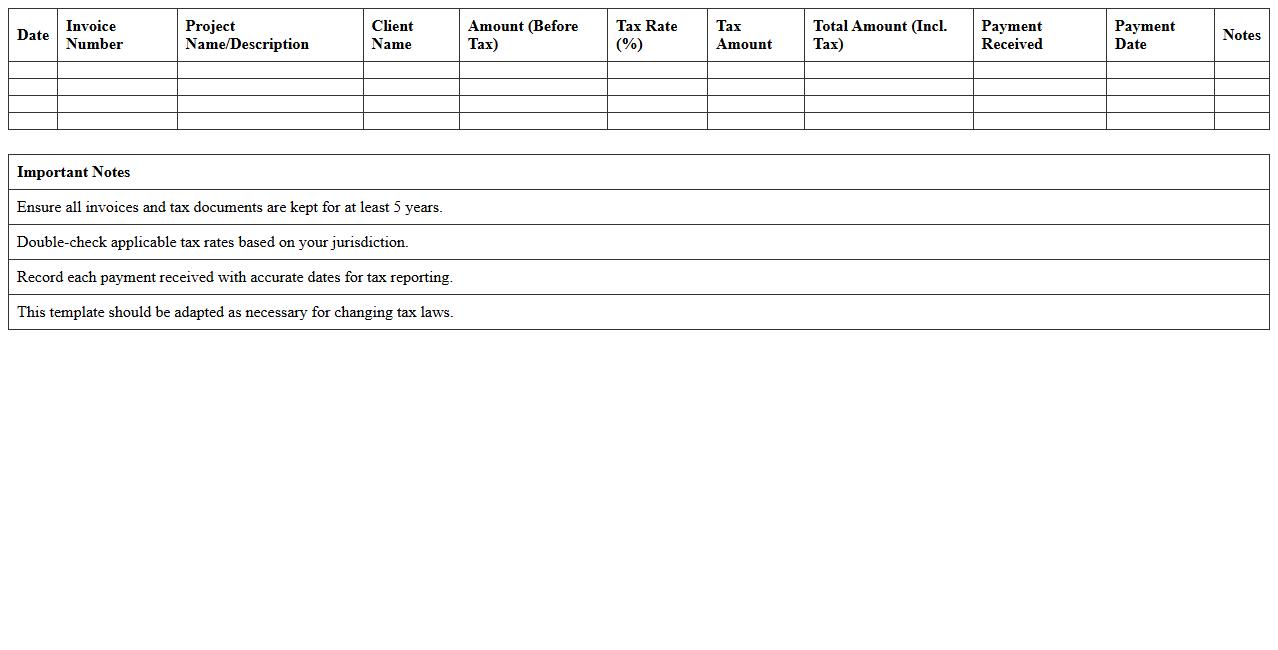

Invoice and Tax Statement Record Sheet for Contractors

The

Invoice and Tax Statement Record Sheet for Contractors is a crucial document that consolidates all billing invoices and tax-related information for contractor services, providing a clear overview of payments made and taxes withheld. This record sheet streamlines financial tracking, ensuring compliance with tax regulations and simplifying the preparation of tax returns. It enhances accuracy in accounting, reduces errors, and serves as essential proof of financial transactions for audits and legal purposes.

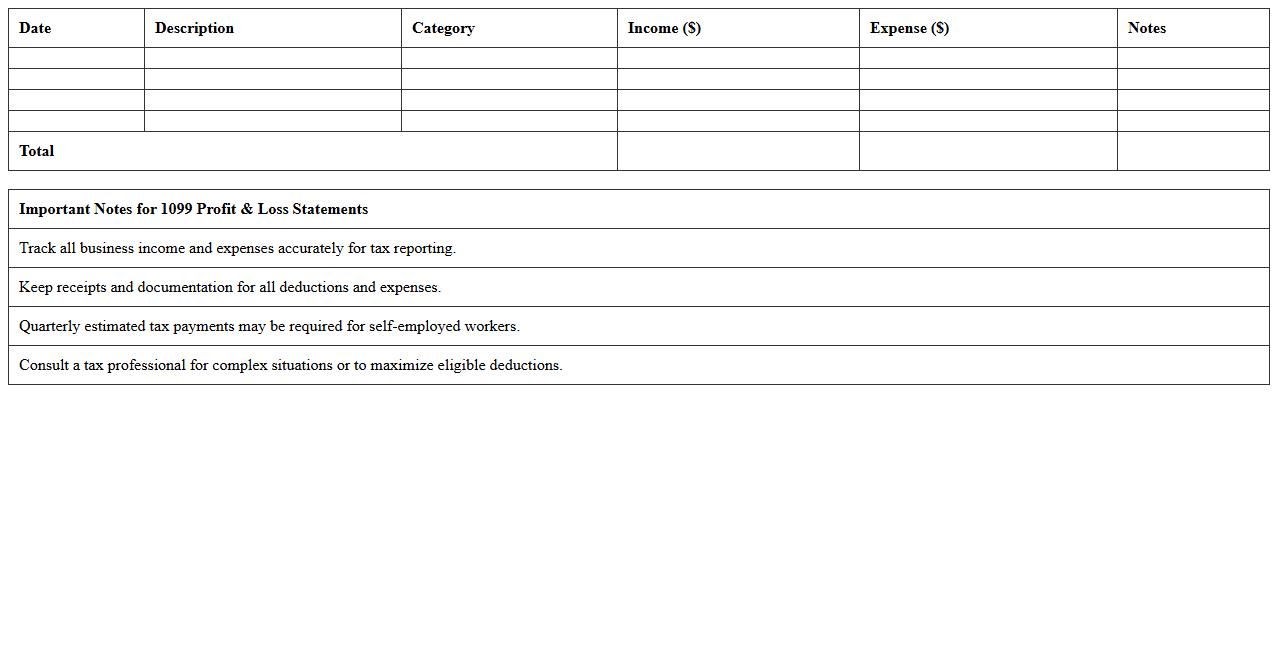

Profit and Loss Tax Statement Excel for 1099 Workers

The

Profit and Loss Tax Statement Excel for 1099 Workers document organizes income and business expenses into a clear, digital format, helping independent contractors accurately report earnings to the IRS. It simplifies tracking deductible expenses and calculating net profit, which directly impacts tax liability and potential refund amounts. This tool enhances financial clarity and ensures compliance with tax regulations, reducing the risk of errors during tax filing.

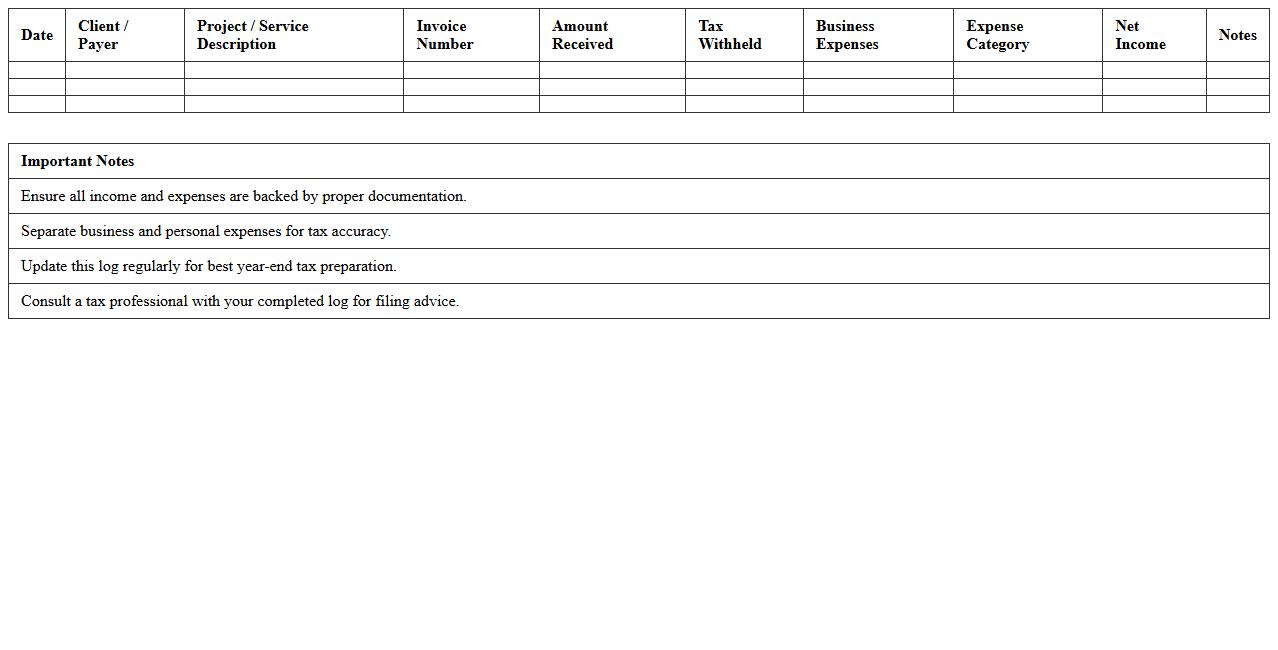

Year-End Tax Statement Excel Log for Freelancers

The

Year-End Tax Statement Excel Log for Freelancers is a comprehensive spreadsheet designed to track income, expenses, and tax deductions throughout the fiscal year. It helps freelancers organize financial data systematically, making it easier to prepare accurate tax returns and identify potential tax savings. Using this log enhances financial transparency and simplifies the end-of-year tax filing process, ensuring compliance with tax regulations.

Contractor Income Tax Documentation Excel Template

The

Contractor Income Tax Documentation Excel Template is a structured spreadsheet designed to help contractors systematically record and organize income, expenses, and tax-related information throughout the fiscal year. This template streamlines the process of tracking deductible expenses, generating accurate tax reports, and preparing for tax filing, reducing errors and saving valuable time. Using this tool ensures compliance with tax regulations while maximizing allowable deductions, ultimately supporting better financial management for independent contractors.

How can I automate 1099-NEC calculations in a Tax Statement Excel for contractors?

To automate 1099-NEC calculations in Excel, start by using SUMIFS formulas to total payments exceeding the $600 threshold. Incorporate conditional formatting to highlight contractors nearing the 1099-NEC reporting limit. This approach ensures accurate and streamlined contractor payment tracking for tax reporting.

What formulas track deductible expenses in a contractor's tax statement spreadsheet?

Utilize SUMIF and SUMPRODUCT formulas to precisely track deductible expenses by category within the spreadsheet. Apply data validation techniques to restrict expense entries to allowable deductible types. These formulas help maintain organized and compliant expense records for contractor tax deductions.

Which columns are essential for quarterly tax estimates in an Excel tax statement?

Essential columns for quarterly tax estimates include Income, Expenses, Estimated Tax Liability, and Payment Dates. Including columns for Tax Rate and Tax Withheld improves accuracy in estimating quarterly payments. Structuring these columns enables effective tax planning and cash flow management for contractors.

How do I link multiple income sources for contractors in one tax Excel sheet?

Link multiple income sources by using Excel's VLOOKUP or INDEX-MATCH functions to consolidate data from different sheets. Ensure each income stream is assigned a unique identifier for accurate cross-referencing. This method provides a comprehensive view of total income for precise tax calculations.

What template features help flag missing contractor W-9 details in the tax statement?

Incorporate data validation rules and conditional formatting to flag missing W-9 details such as TIN or address. Use IFERROR and ISBLANK formulas to automatically identify incomplete fields. These features facilitate compliance and prevent reporting delays by ensuring complete contractor information.

More Statement Excel Templates