The Bank Statement Excel Template for Personal Finance offers an organized way to track income, expenses, and account balances efficiently. This customizable template helps users monitor financial transactions, categorize spending, and maintain a clear overview of their personal budget. Utilizing this tool enhances money management and supports informed decision-making for improved financial health.

Monthly Personal Bank Statement Excel Template

The

Monthly Personal Bank Statement Excel Template is a digital document designed to organize and track monthly income, expenses, and bank transactions efficiently. It helps users maintain accurate financial records, monitor cash flow, and identify spending patterns for better budgeting. Using this template streamlines the reconciliation of bank statements, ensuring easier financial management and faster decision-making.

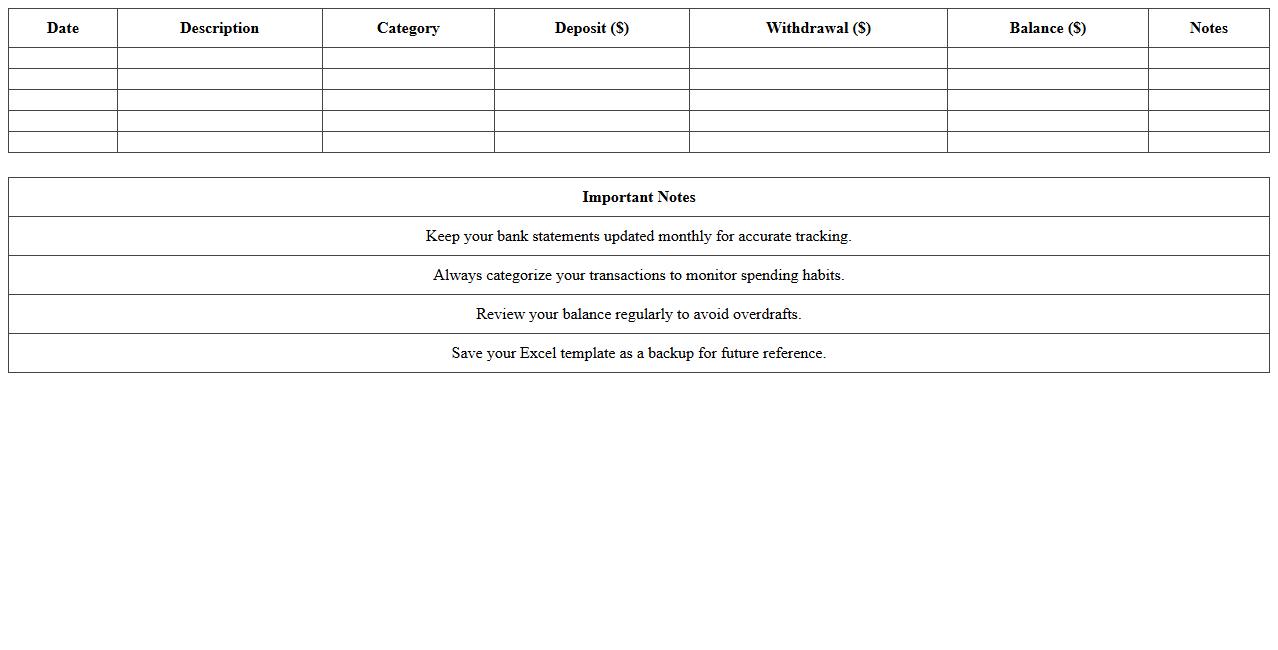

Personal Finance Tracker Bank Statement Template

A

Personal Finance Tracker Bank Statement Template is a structured document designed to record and organize bank transactions systematically. It helps individuals monitor income, expenses, and account balances consistently, enabling better budgeting and financial planning. Using this template promotes clarity in managing personal finances, reducing errors, and improving savings strategies over time.

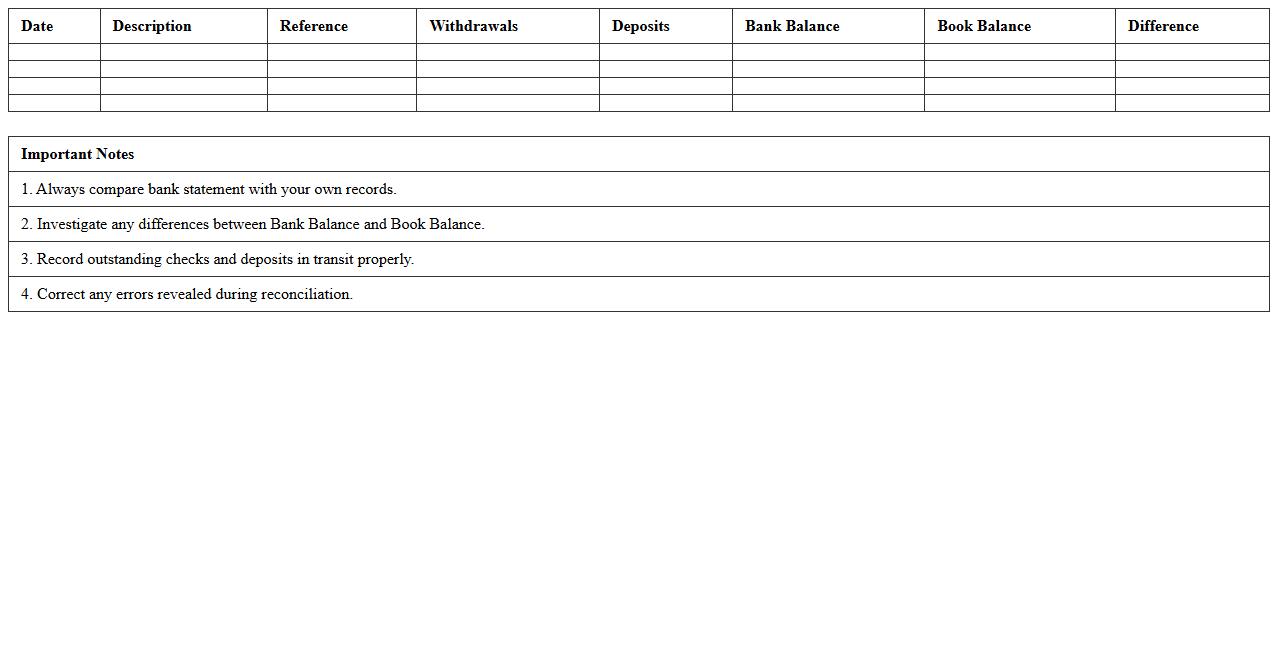

Simple Bank Statement Reconciliation Excel

A

Simple Bank Statement Reconciliation Excel document is a spreadsheet tool designed to match and verify the transactions recorded in a business's accounting records against the bank statement. It helps identify discrepancies such as missed entries, errors, or fraudulent activities by systematically comparing debit and credit transactions, ensuring accurate financial reporting. This tool streamlines the reconciliation process, saves time, and enhances the accuracy of cash flow management for businesses and individuals.

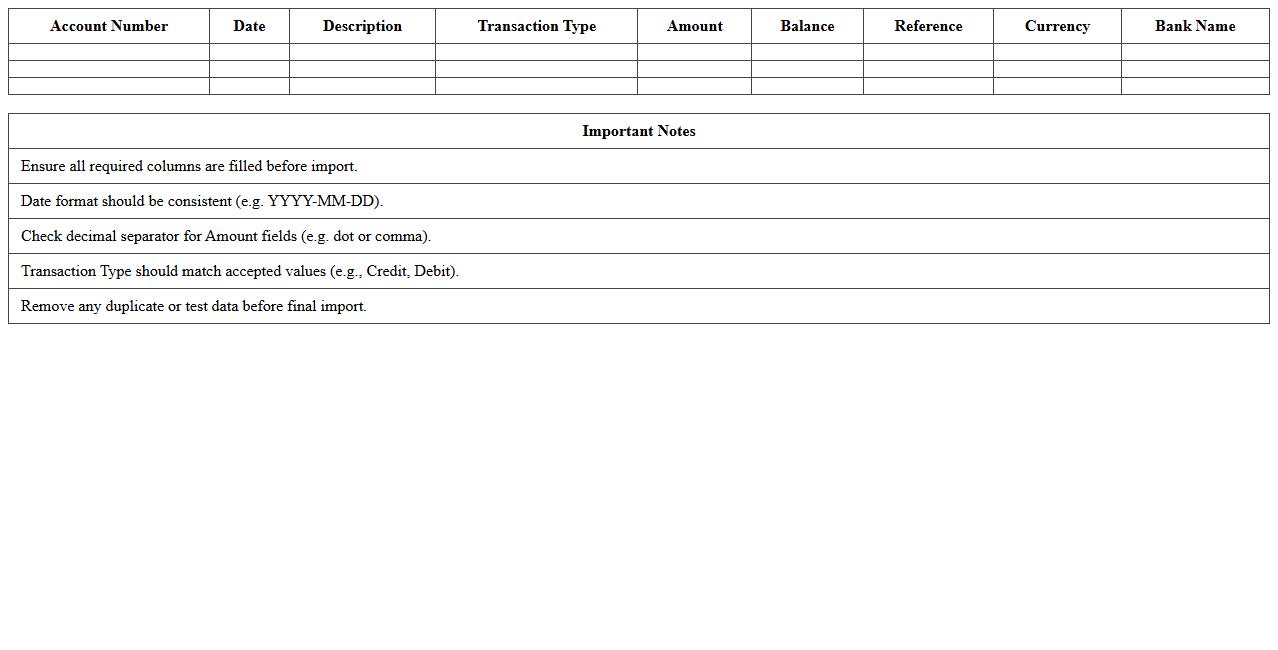

Automated Bank Statement Import Template

The

Automated Bank Statement Import Template document is a structured file format designed to facilitate the seamless uploading of bank transaction data into accounting or financial management software. This template standardizes data such as transaction dates, amounts, and descriptions, ensuring accuracy and reducing manual entry errors. Utilizing this template improves financial reconciliation efficiency, enhances data consistency, and saves valuable time in bookkeeping processes.

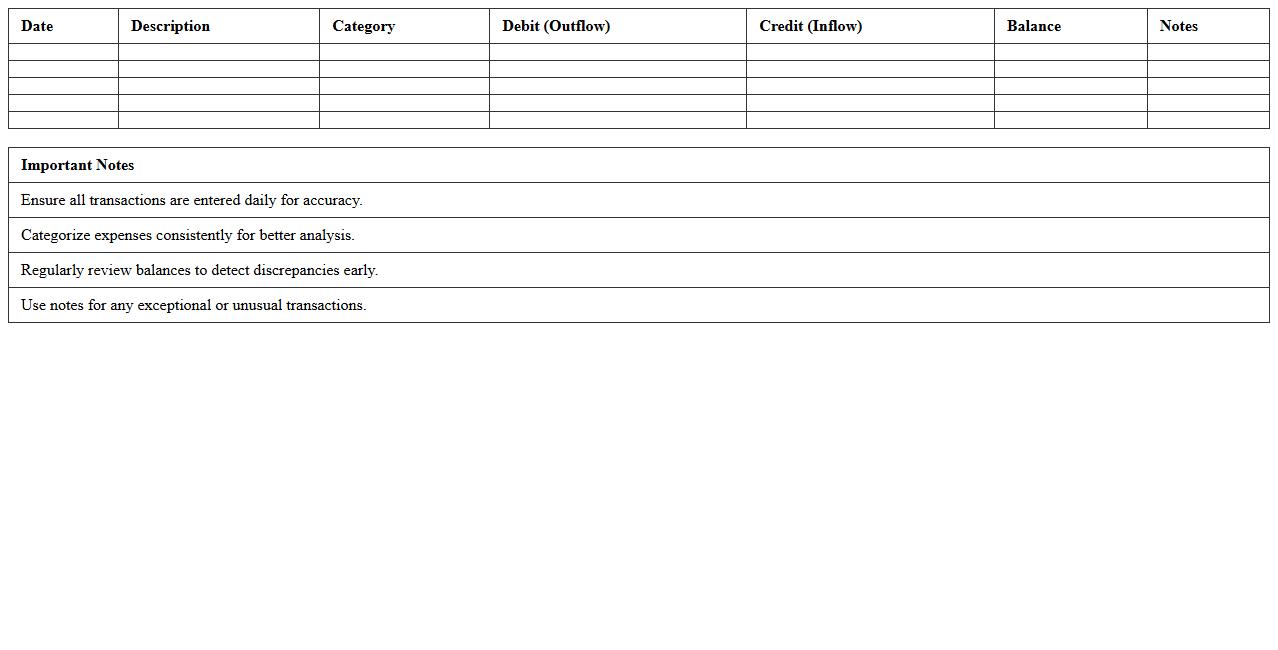

Household Bank Statement Analysis Spreadsheet

A

Household Bank Statement Analysis Spreadsheet is a structured document designed to categorize and track income, expenses, and financial transactions from bank statements for effective budgeting. It helps users identify spending patterns, manage cash flow, and make informed decisions to improve financial health. This tool simplifies complex data, turning raw bank statements into actionable insights for better household financial management.

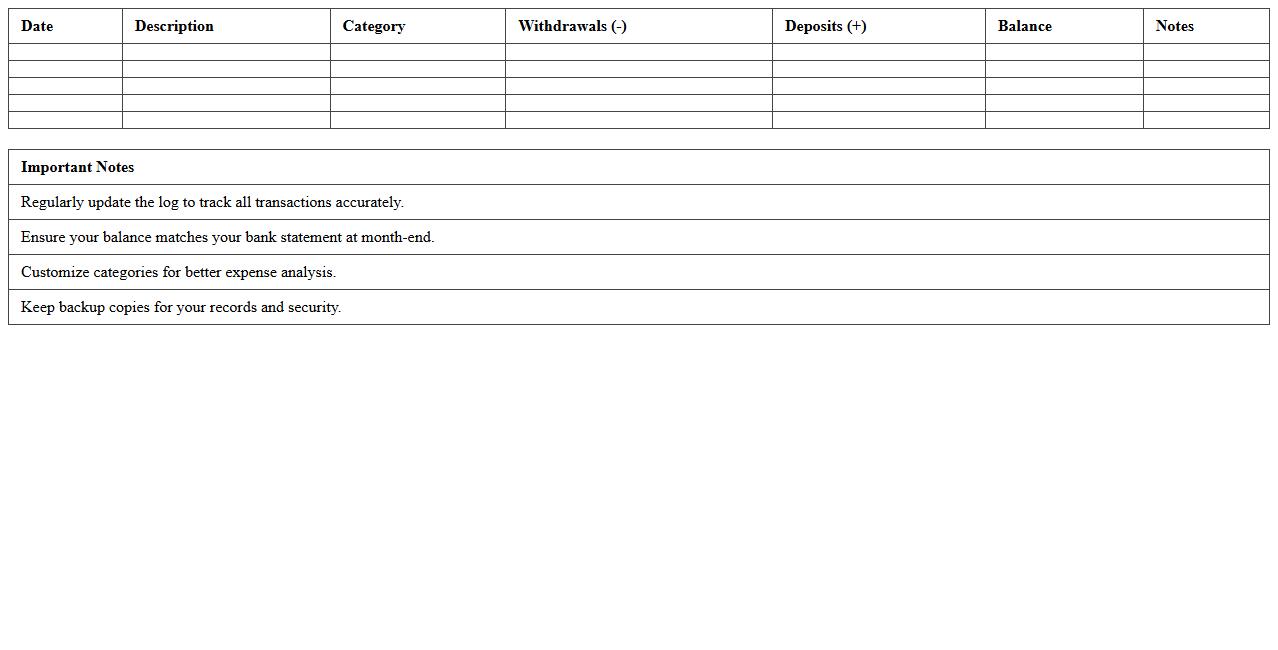

Customizable Personal Bank Statement Log

A

Customizable Personal Bank Statement Log document is a tailored record-keeping tool that allows individuals to systematically track their financial transactions, income, and expenses in a personalized format. It enhances financial management by providing clear visibility into spending habits, aiding in budgeting, tax preparation, and identifying discrepancies in bank statements quickly. This document is especially useful for maintaining accurate financial records, improving financial planning, and ensuring financial accountability.

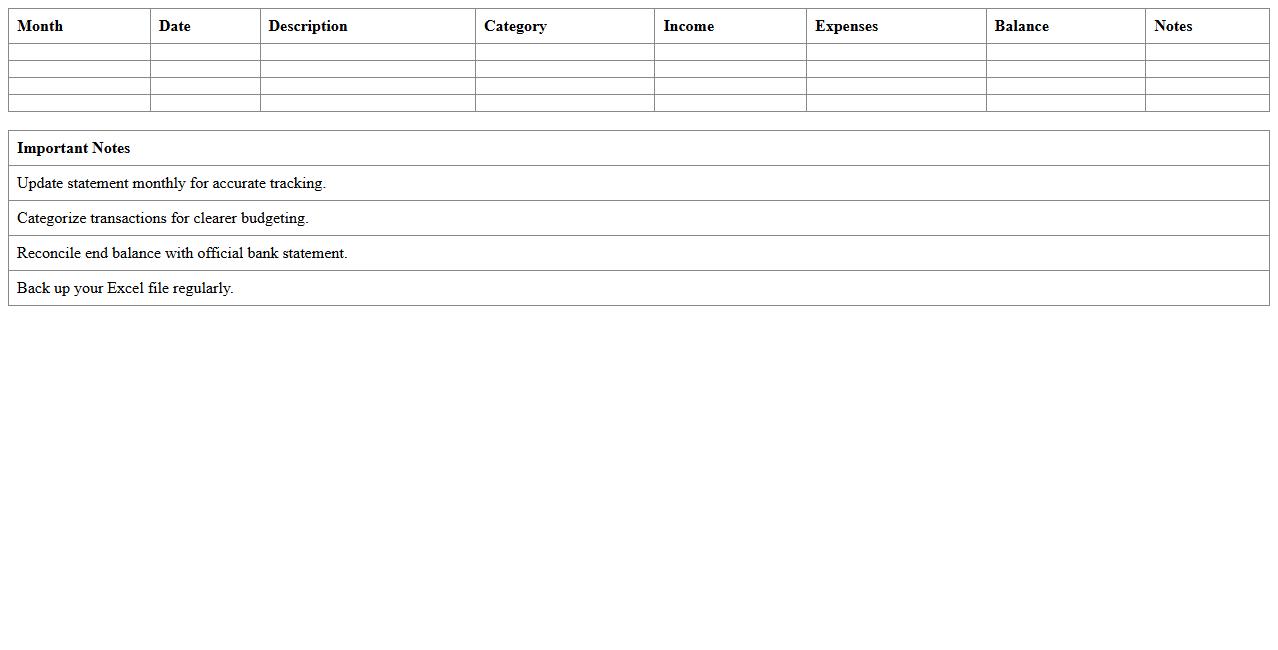

Yearly Bank Statements Personal Finance Excel

A

Yearly Bank Statements Personal Finance Excel document is a comprehensive spreadsheet designed to organize and analyze annual bank transactions efficiently. It helps users track income, expenses, and savings over the year, providing clear insights into spending habits and financial health. By consolidating data into a structured format, it simplifies budgeting, tax preparation, and financial planning for better money management.

Savings Account Bank Statement Tracker Template

A

Savings Account Bank Statement Tracker Template document is a structured tool designed to organize and monitor transactions from savings account statements efficiently. It helps users easily track deposits, withdrawals, interest earnings, and account balances, ensuring accurate financial management and budgeting. This template is useful for maintaining financial transparency, identifying spending patterns, and preparing for tax purposes or financial audits.

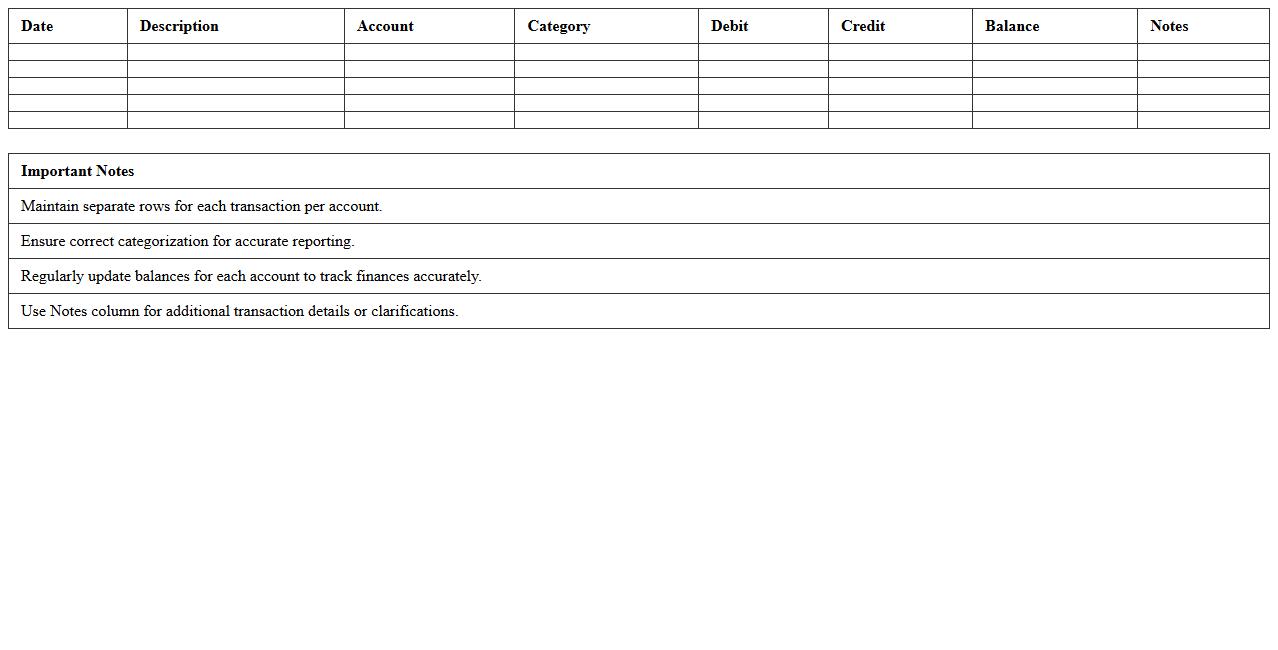

Multi-Account Personal Bank Statement Sheet

A

Multi-Account Personal Bank Statement Sheet is a consolidated financial document that compiles transaction details from multiple bank accounts into a single, organized format. This sheet provides a comprehensive overview of an individual's cash flow, helping to track expenses, monitor income sources, and manage budgets effectively. It is especially useful for financial planning, loan applications, and tax preparation by offering clear and accessible financial data in one place.

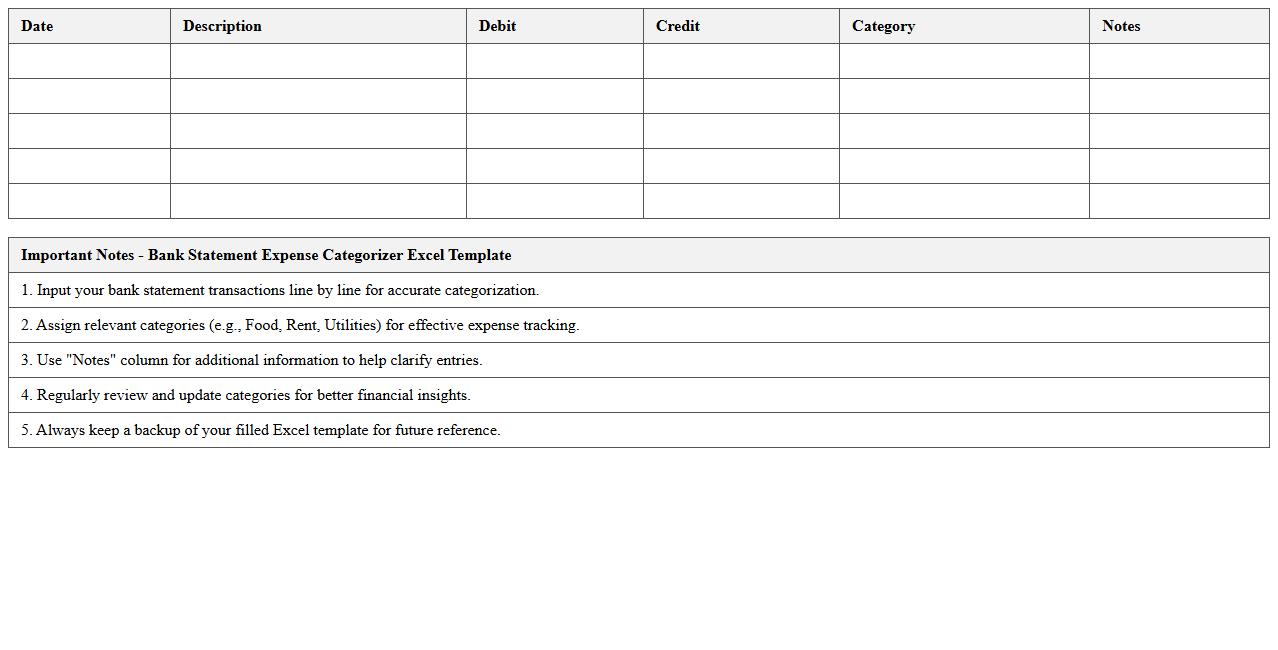

Bank Statement Expense Categorizer Excel Template

The

Bank Statement Expense Categorizer Excel Template is a powerful tool designed to automatically sort and categorize your financial transactions from bank statements into predefined expense groups. This document streamlines budgeting and financial analysis by providing clear insights into spending patterns, enabling users to track expenses, identify saving opportunities, and improve cash flow management. Its customizable categories and automated data processing save time while enhancing accuracy in personal or business financial tracking.

How to automate monthly bank statement imports into Excel for budgeting?

To automate monthly bank statement imports into Excel, use Power Query for seamless data extraction and transformation. Connect your bank statement files, typically CSV or XLSX, and set up recurring queries to refresh data automatically. This process eliminates manual updates and ensures your budgeting data stays current with minimal effort.

What Excel formulas best track recurring expenses from bank statements?

Excel formulas like SUMIF and COUNTIF are ideal for tracking recurring expenses by filtering transactions based on specific vendors or categories. Utilize the IF function to create conditional checks for regular payments, combined with VLOOKUP for matching expense descriptions. These formulas help identify and monitor consistent spending patterns effectively over time.

How to categorize bank statement transactions in Excel for tax reporting?

To categorize bank statement transactions for tax reporting, create a structured table with columns for description, date, amount, and tax category. Use Excel's Data Validation feature to enforce consistent category entries and pivot tables to summarize expenses by tax-relevant groups. This clear categorization simplifies tax preparation and audit readiness.

Which Excel templates visualize cash flow from bank statement data?

Excel templates

How to reconcile bank statement entries with personal finance records in Excel?

Reconciliation involves comparing bank statement entries against personal finance logs using formulas like MATCH and conditional formatting to highlight discrepancies. Setting up side-by-side records for date, amount, and description allows for a detailed transaction review. This method ensures accurate financial tracking and timely correction of errors.

More Statement Excel Templates