A Bank Reconciliation Statement Excel Template for Small Businesses simplifies the process of matching your business's financial records with bank statements, ensuring accuracy and timely detection of discrepancies. Designed for ease of use, this template helps small business owners track transactions, identify errors, and maintain organized financial records. Utilizing this tool enhances cash flow management and supports informed decision-making.

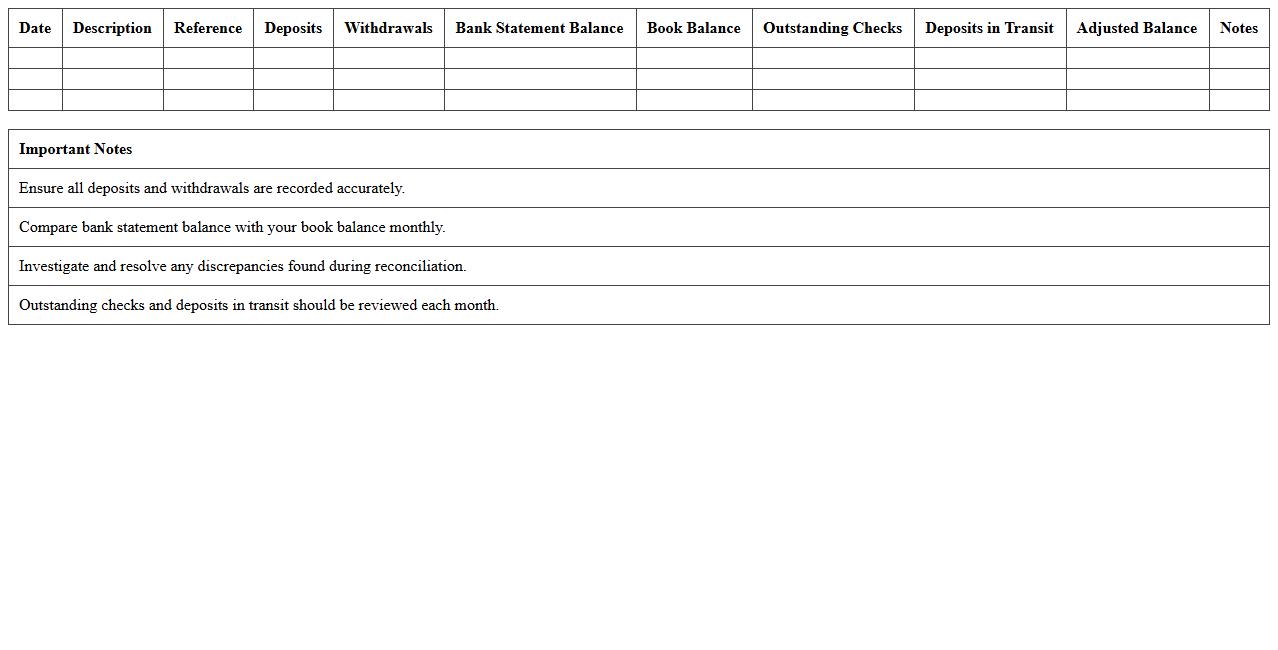

Monthly Bank Reconciliation Excel Template

The

Monthly Bank Reconciliation Excel Template is a structured spreadsheet designed to compare a company's cash records with its bank statements, identifying discrepancies such as outstanding checks or deposits in transit. This tool helps businesses maintain accurate financial records, detect errors, and prevent fraud by ensuring that all transactions are accounted for and properly recorded. Using this template streamlines the reconciliation process, improves cash flow management, and supports compliance with accounting standards.

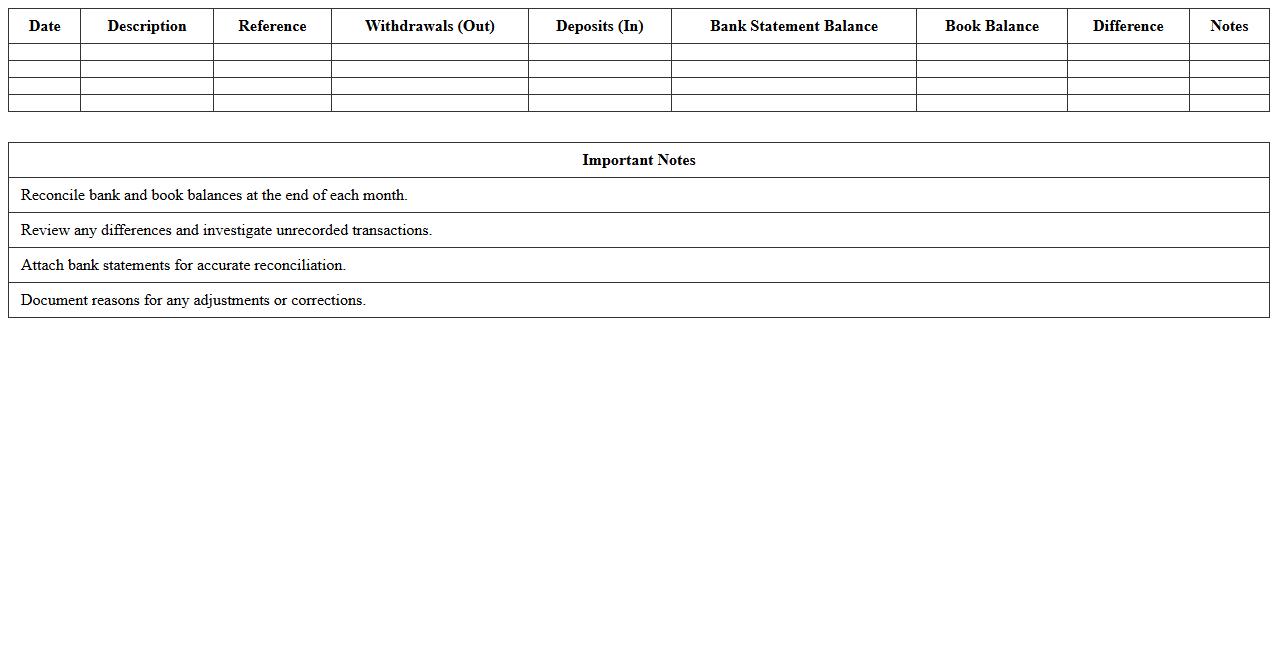

Simple Business Bank Reconciliation Spreadsheet

A

Simple Business Bank Reconciliation Spreadsheet is a structured document designed to compare a company's financial records with its bank statements, ensuring accuracy and identifying discrepancies. This tool helps businesses track deposits, withdrawals, and fees systematically, making it easier to detect errors or fraudulent activities. By maintaining precise reconciliation, businesses can improve cash flow management, enhance financial reporting, and support audit processes effectively.

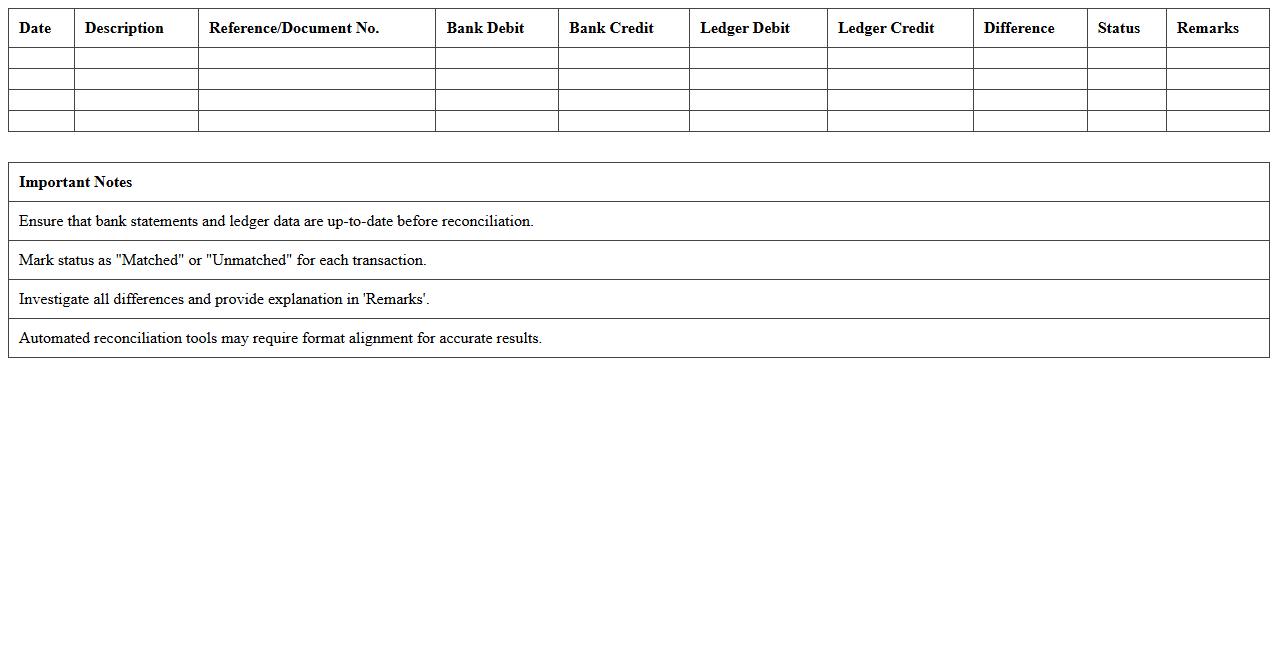

Automated Bank Statement Reconciliation Template

An

Automated Bank Statement Reconciliation Template document streamlines the process of matching bank transactions with internal financial records, reducing manual errors and saving time. It enhances accuracy by automatically flagging discrepancies and inconsistencies, facilitating faster resolution and improved financial control. This tool is essential for maintaining up-to-date, reliable account records, aiding in audits and ensuring compliance with financial regulations.

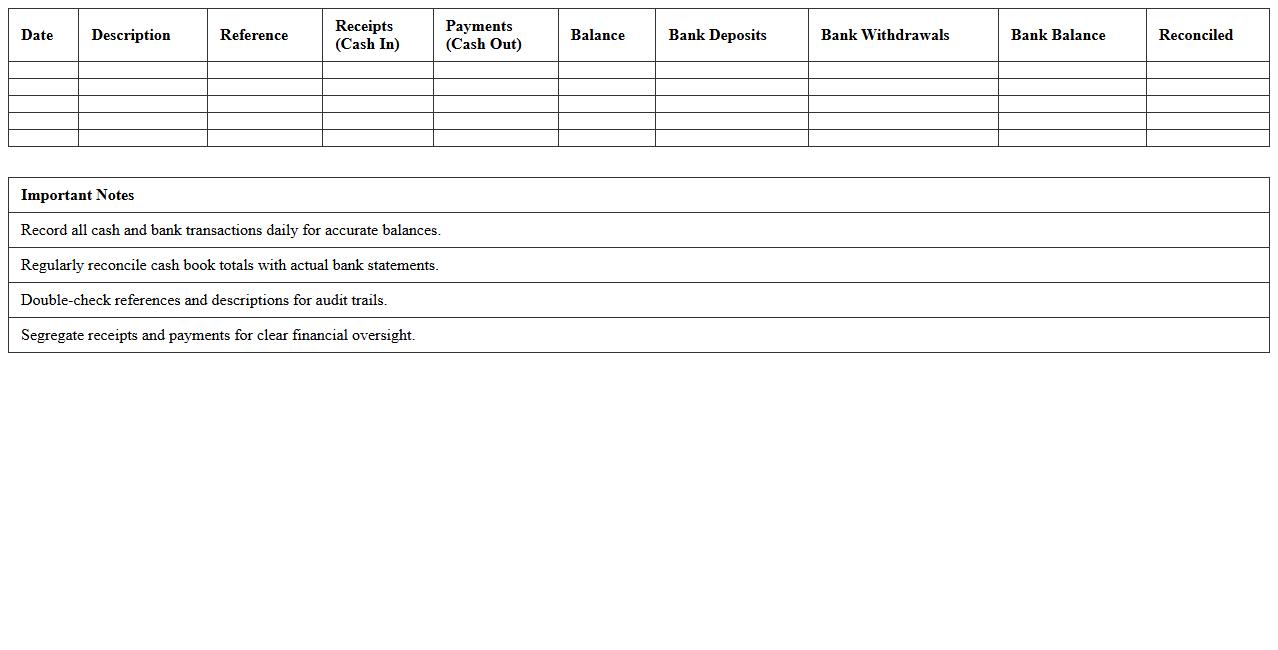

Small Business Cash Book & Bank Reconciliation Excel

A

Small Business Cash Book & Bank Reconciliation Excel document is a financial management tool designed to track cash transactions and reconcile bank statements accurately. It helps small businesses monitor daily cash flow, identify discrepancies between records and bank statements, and maintain accurate financial data. Using this Excel document improves financial control, aids in budgeting, and simplifies the preparation of reports for audits or tax purposes.

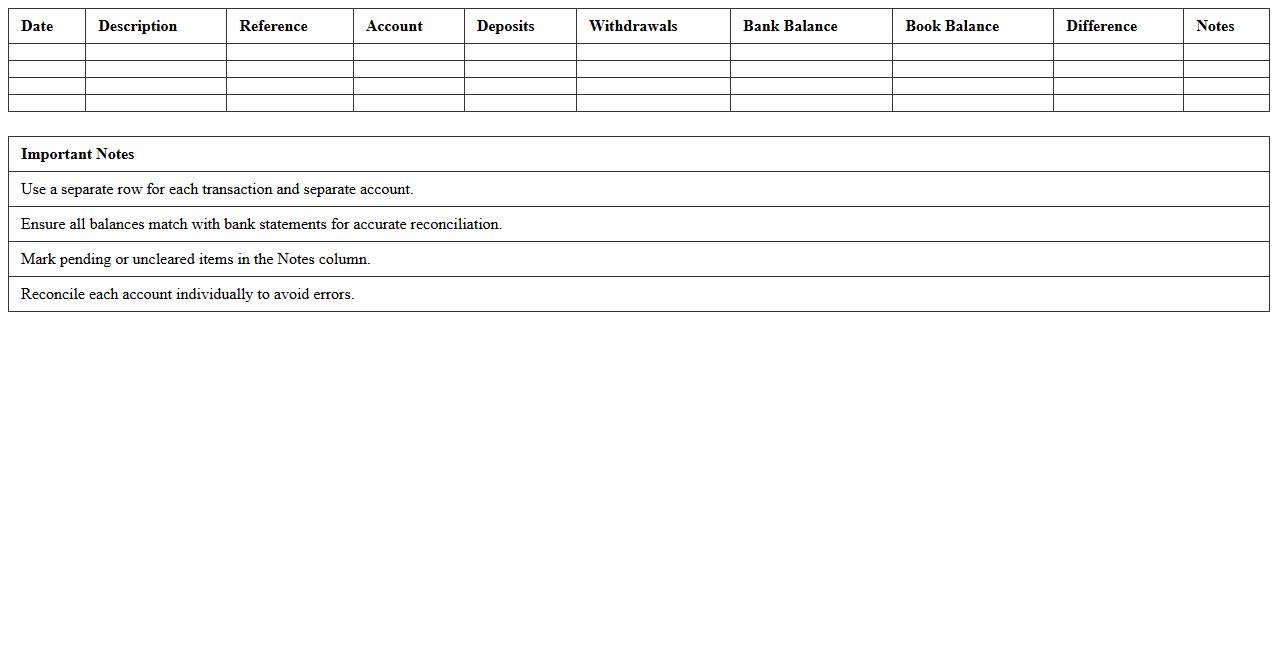

Multiple Account Bank Reconciliation Spreadsheet

A

Multiple Account Bank Reconciliation Spreadsheet is a comprehensive tool designed to track and reconcile transactions across various bank accounts simultaneously. It streamlines the process of matching bank statements with internal records, helping to identify discrepancies, prevent errors, and maintain accurate financial data. This spreadsheet enhances financial control by providing a clear overview of cash flow and simplifying audit preparations.

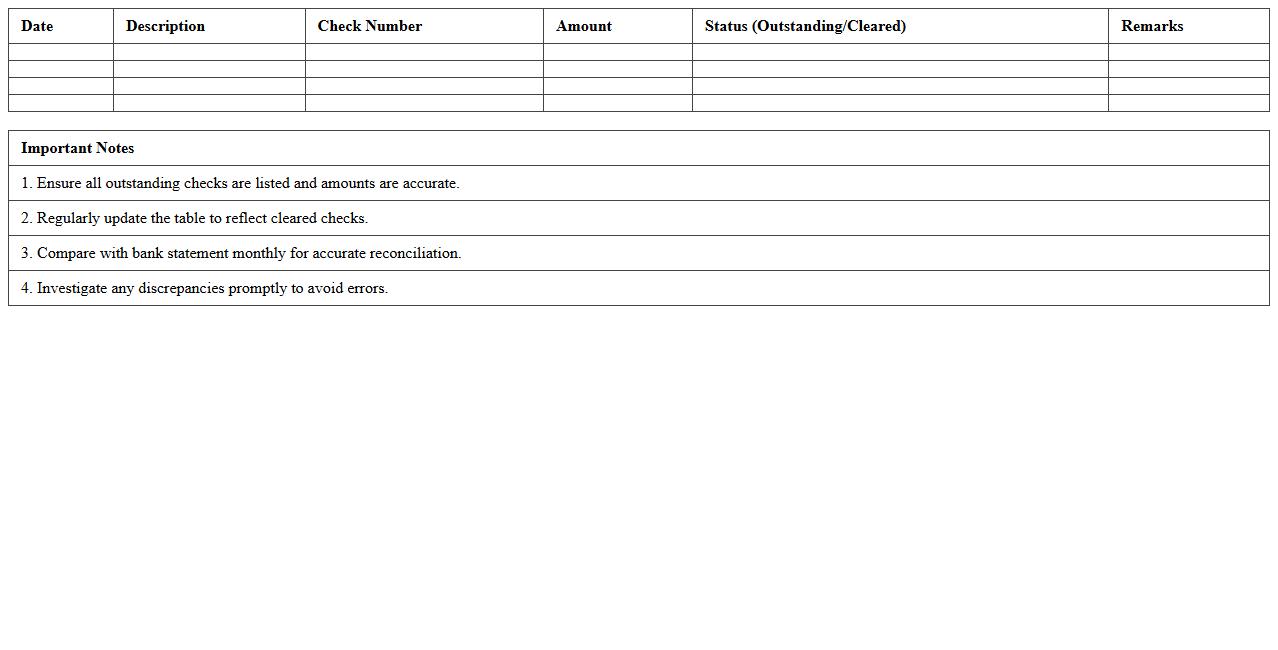

Bank Reconciliation with Outstanding Checks Template

A

Bank Reconciliation with Outstanding Checks Template document helps match the organization's accounting records with the bank statement by identifying discrepancies related to uncashed or pending checks. It ensures accurate financial tracking by highlighting outstanding checks that have not yet cleared the bank, facilitating timely adjustments and fraud detection. This template streamlines the reconciliation process, improving cash flow management and maintaining accurate ledger balances.

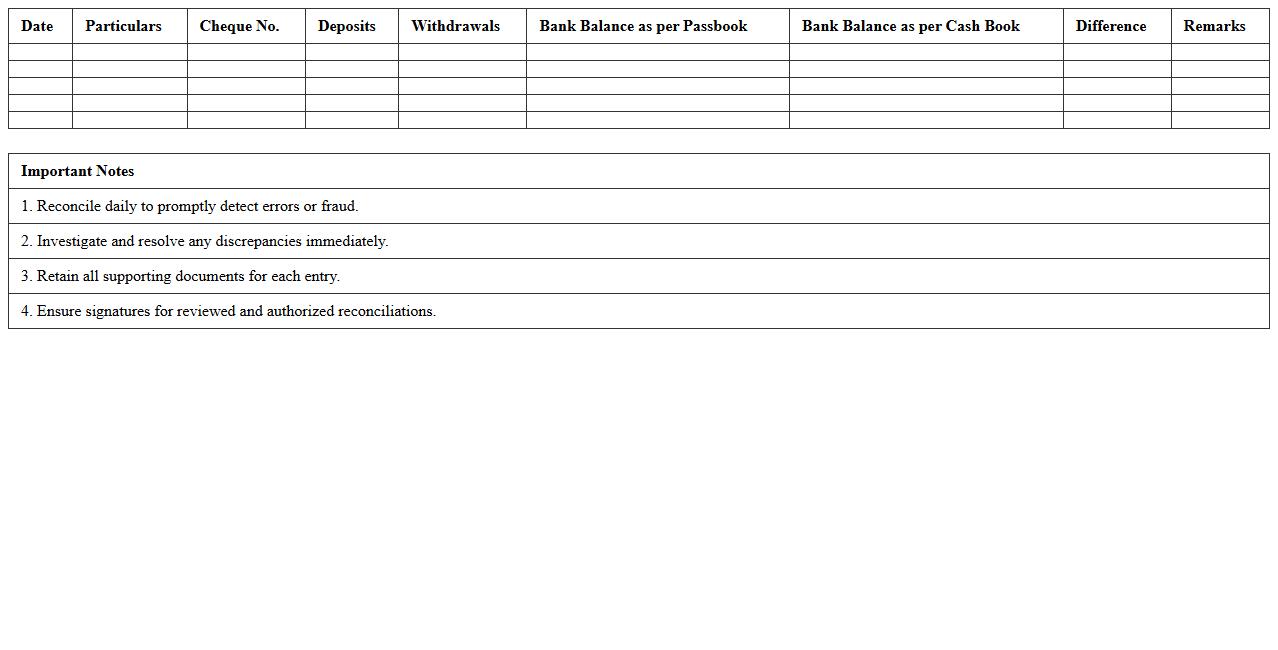

Daily Bank Reconciliation Sheet for Small Companies

A

Daily Bank Reconciliation Sheet for small companies is a financial document used to compare the company's daily bank statements with its internal cash records. It helps identify discrepancies, errors, or unauthorized transactions promptly, ensuring accurate cash flow management and preventing potential fraud. This daily reconciliation enhances financial control, supports timely decision-making, and maintains the integrity of the company's accounting data.

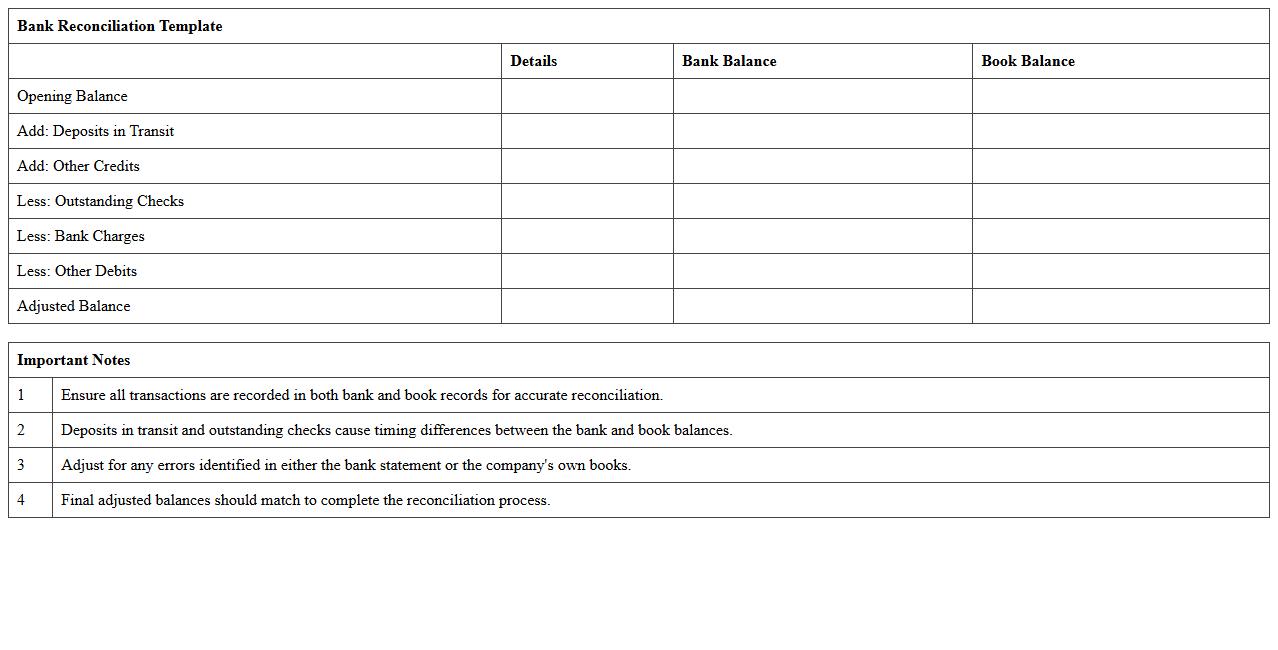

Bank Reconciliation Template with Bank and Book Balance

A

Bank Reconciliation Template with Bank and Book Balance document is a financial tool that helps businesses match their internal accounting records with bank statements. It identifies discrepancies between the bank balance and the book balance, ensuring accuracy in cash management and detecting errors or fraudulent transactions. This template streamlines the reconciliation process, improves financial accuracy, and supports better decision-making by providing a clear overview of a company's cash position.

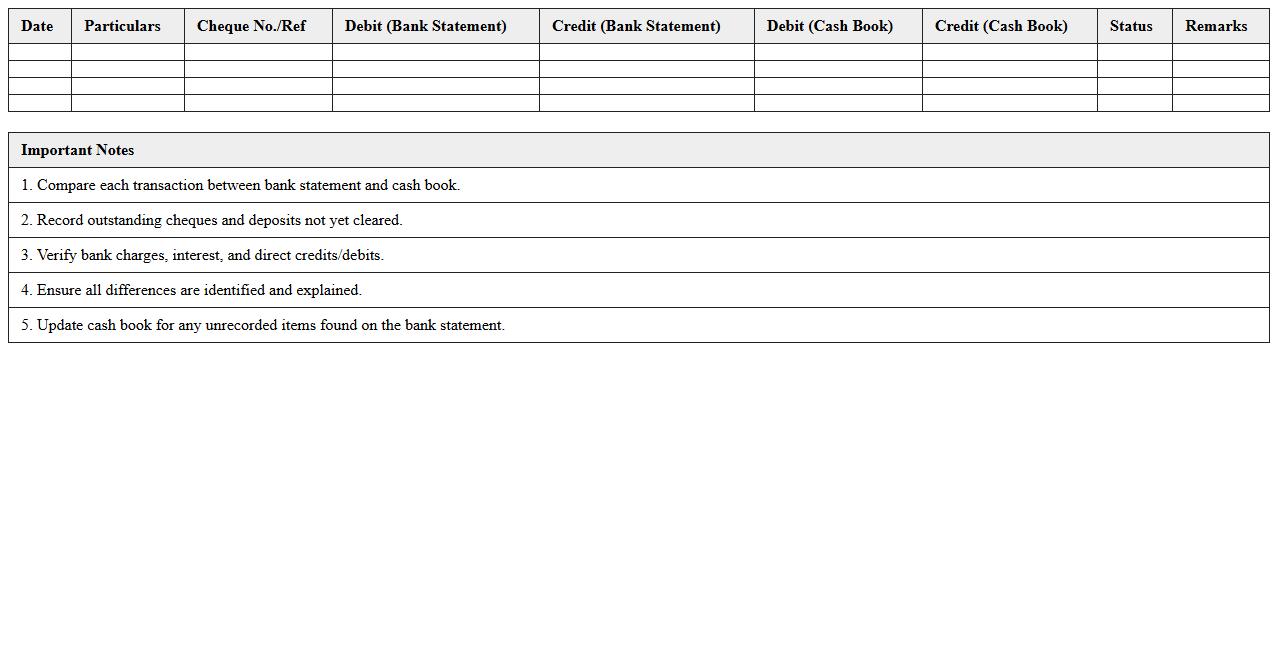

Transaction-Based Bank Reconciliation Excel Format

A

Transaction-Based Bank Reconciliation Excel Format document organizes financial transactions to match bank statements with internal records, ensuring accuracy and identifying discrepancies. It streamlines the accounting process by automatically comparing deposits, withdrawals, and balances, reducing manual errors and saving time. This document is essential for maintaining financial integrity, detecting fraud, and providing a clear audit trail for businesses.

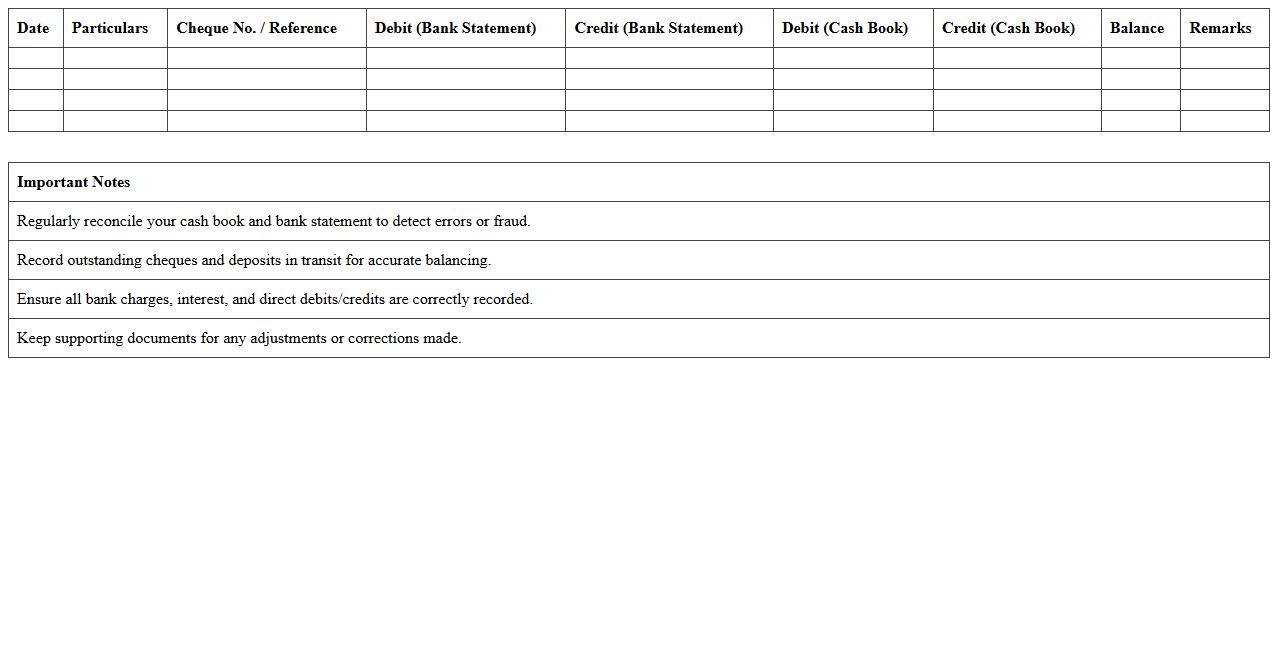

Excel Bank Reconciliation Statement for Small Businesses

An

Excel Bank Reconciliation Statement for small businesses is a financial document that compares the company's book balance with the bank statement to identify discrepancies and ensure accuracy. It helps detect errors, missing transactions, or potential fraud by systematically matching deposits, withdrawals, and bank fees. Utilizing this tool improves cash flow management, enhances financial transparency, and supports accurate bookkeeping.

How to automate bank reconciliation statement templates in Excel for small business transactions?

To automate bank reconciliation statements in Excel, start by setting up dynamic tables that update as new transactions are added. Use Excel functions like VLOOKUP or INDEX-MATCH to automatically compare bank and accounting records. Integrating macros can further streamline the process by performing repetitive reconciliation tasks at the click of a button.

What are common Excel formulas for matching deposits and withdrawals in a bank reconciliation statement?

Common Excel formulas for matching deposits and withdrawals include SUMIF to total amounts based on criteria, and MATCH to locate matching entries between two data ranges. The IF function helps to create logical tests that highlight discrepancies. Combining these formulas ensures accurate pairing of transactions during reconciliation.

How to flag unreconciled items in an Excel bank reconciliation for small business accounts?

Use conditional formatting rules to flag unreconciled items by highlighting unmatched deposits or withdrawals automatically. Employ the ISERROR function around lookup formulas to identify missing or unmatched data. This visual indication speeds up error detection and correction in small business reconciliation processes.

Which Excel features help track recurring bank errors in monthly reconciliations?

Excel features like PivotTables provide a powerful way to summarize and analyze recurring bank errors over multiple months. Conditional formatting can be used to spot repeated discrepancies and trends easily. Additionally, data validation rules help prevent entry errors during reconciliation, improving accuracy over time.

How to secure sensitive bank data in Excel-based reconciliation statements for small enterprises?

Securing sensitive bank data involves applying password protection to Excel files and individual sheets to restrict unauthorized access. Use Excel's cell locking feature combined with encryption to safeguard critical financial information. Regularly backing up files and controlling user permissions further enhances data security for small businesses.

More Statement Excel Templates