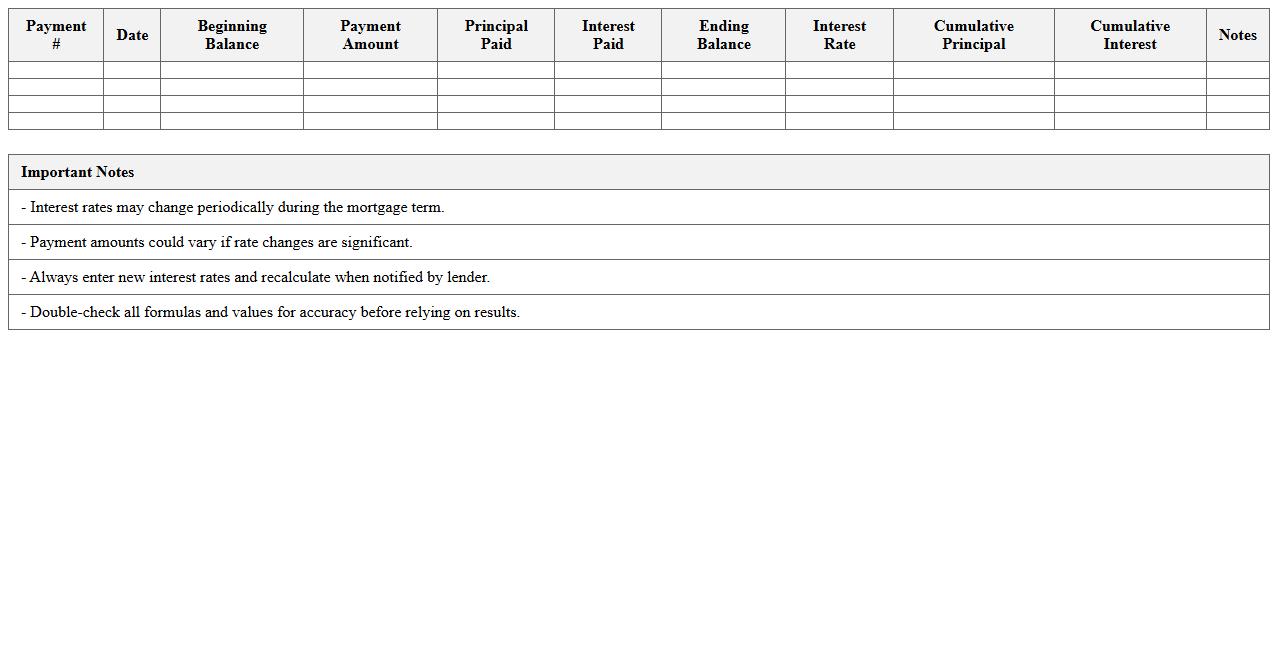

The Loan Amortization Statement Excel Template for Mortgage Brokers provides a detailed breakdown of loan payments, including principal and interest schedules. It enables mortgage brokers to easily track and manage client mortgage repayment timelines and outstanding balances. This customizable template enhances accuracy and efficiency in presenting amortization details for various loan terms.

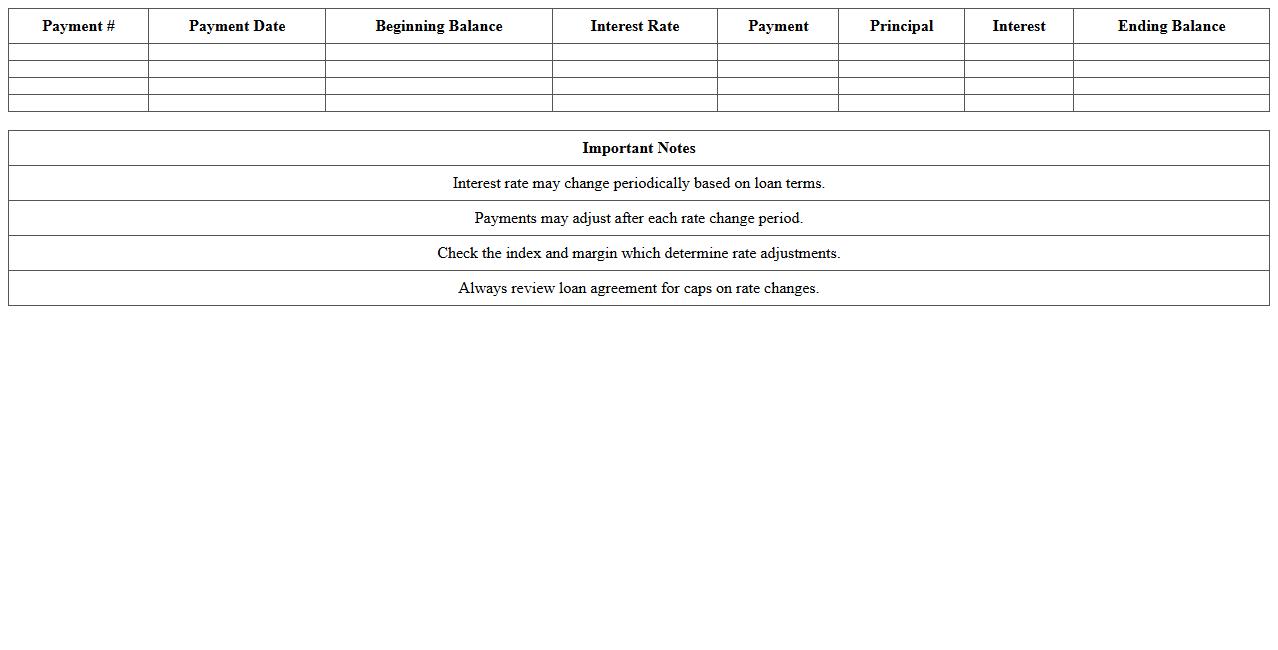

Adjustable Rate Mortgage Amortization Excel Template

An

Adjustable Rate Mortgage Amortization Excel Template is a financial tool designed to calculate and display the changing payment schedule of a mortgage with a variable interest rate. This document helps users project future payments by factoring in interest rate adjustments over the loan term, enabling accurate budgeting and financial planning. It is useful for homeowners, real estate investors, and lenders seeking to understand the impact of fluctuating rates on mortgage costs.

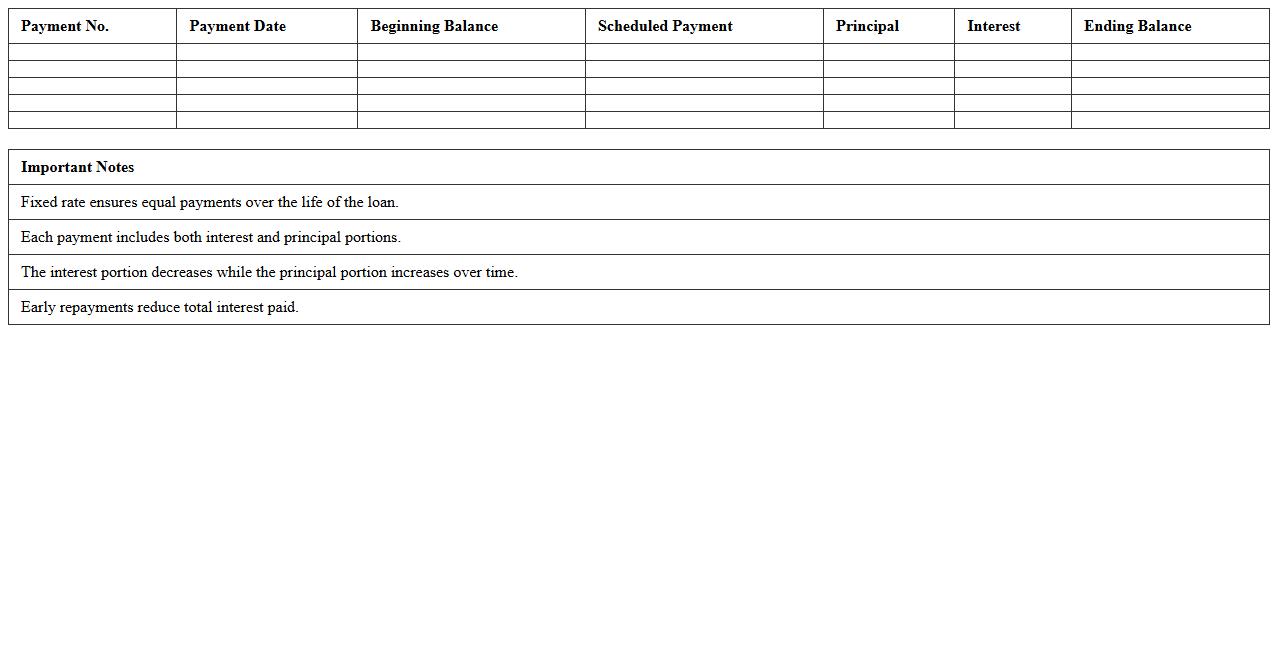

Fixed Rate Loan Amortization Schedule Spreadsheet

A

Fixed Rate Loan Amortization Schedule Spreadsheet is a detailed document that outlines each loan payment over time, showing the split between principal and interest amounts, and tracking the remaining loan balance. It helps borrowers visualize their repayment plan, ensuring clear understanding of payment dates, amounts, and interest costs throughout the loan term. This tool is essential for budgeting, financial planning, and making informed decisions about loan management or early repayment strategies.

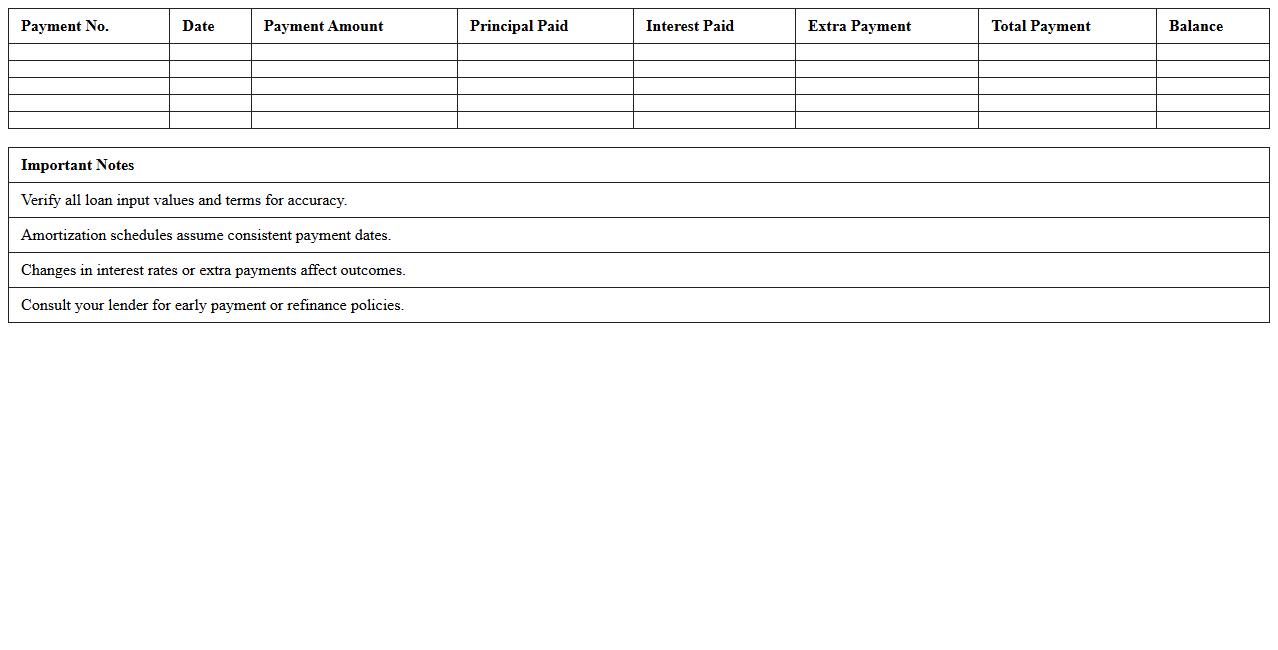

Commercial Loan Amortization Statement Excel

A

Commercial Loan Amortization Statement Excel document provides a detailed schedule of loan payments, including principal and interest breakdowns over the loan term. This Excel tool helps businesses accurately track payment progress, forecast cash flows, and manage debt efficiently. Utilizing this statement enhances financial planning by clearly illustrating how each payment impacts the loan balance over time.

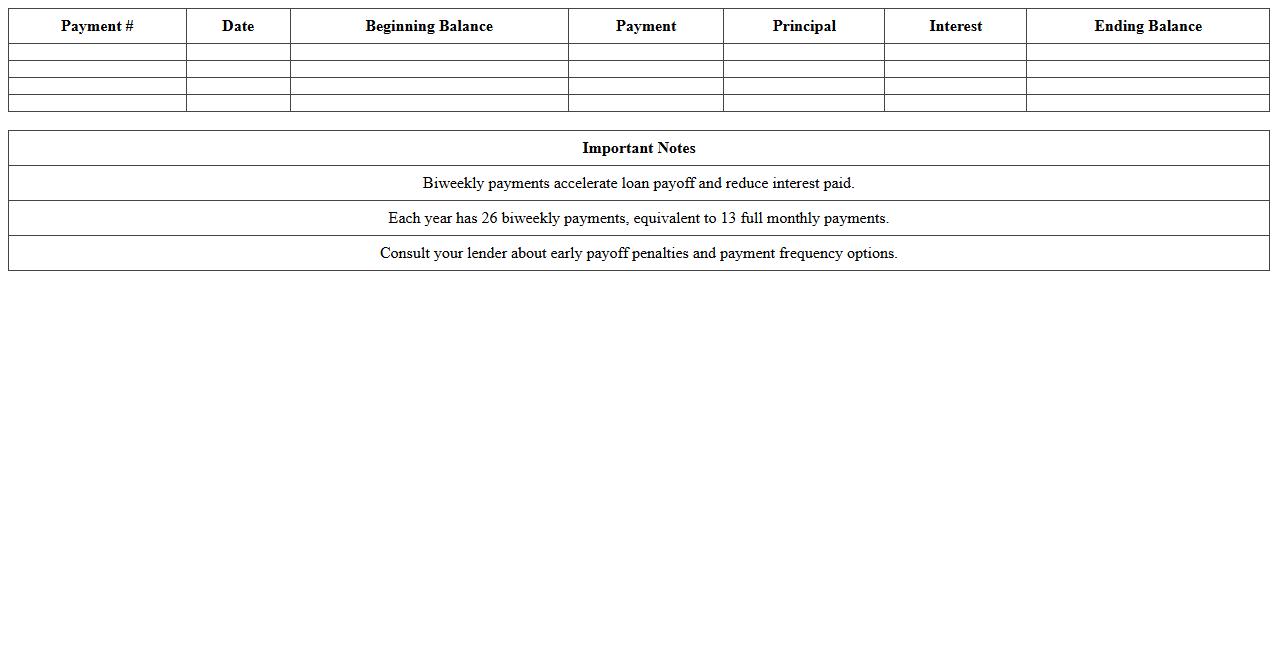

Biweekly Mortgage Payment Amortization Template

A

Biweekly Mortgage Payment Amortization Template is a financial tool that breaks down your mortgage payments into biweekly intervals instead of monthly, allowing you to track how each payment reduces the loan principal over time. This template helps homeowners visualize the impact of making payments every two weeks, which can significantly shorten the loan term and reduce interest costs. By using this document, borrowers can budget more effectively and accelerate mortgage payoff, resulting in substantial long-term savings.

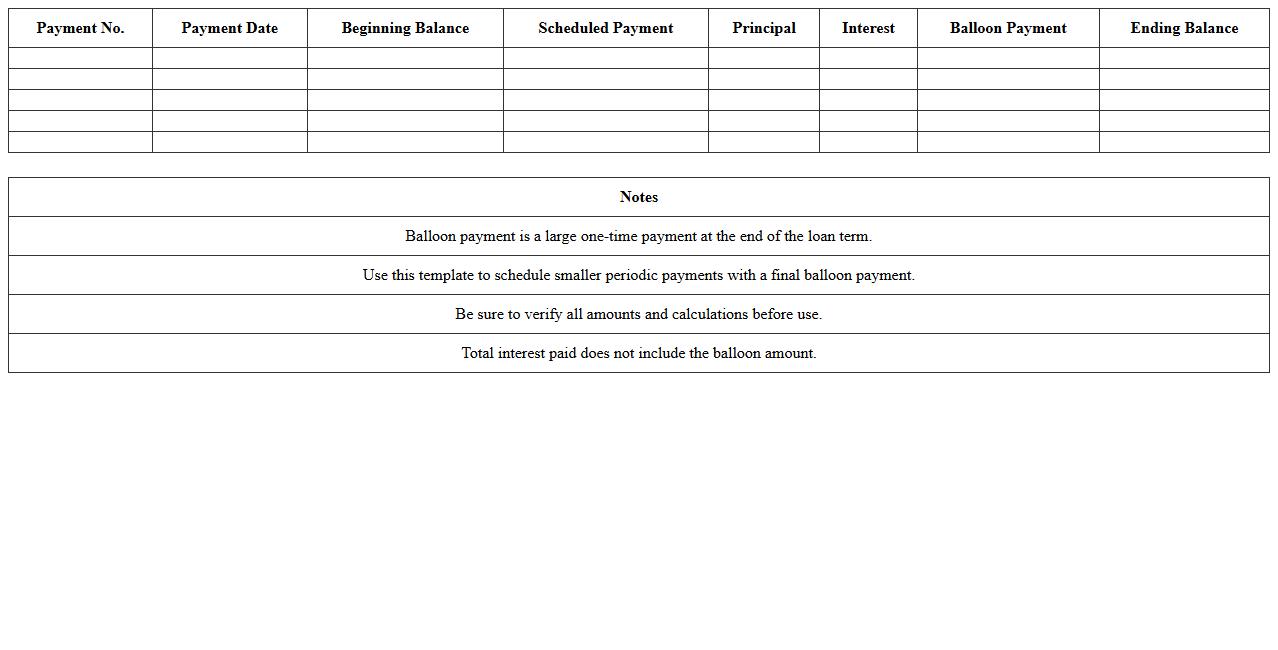

Balloon Payment Loan Amortization Excel Sheet

The

Balloon Payment Loan Amortization Excel Sheet is a financial tool designed to calculate and visualize loan repayment schedules featuring a large final payment. It helps users understand the impact of the balloon payment on monthly installments and interest over the loan term, making it easier to plan cash flow and manage debt. This Excel sheet is particularly valuable for borrowers and financial planners seeking accurate, customizable amortization schedules for loans with non-standard repayment structures.

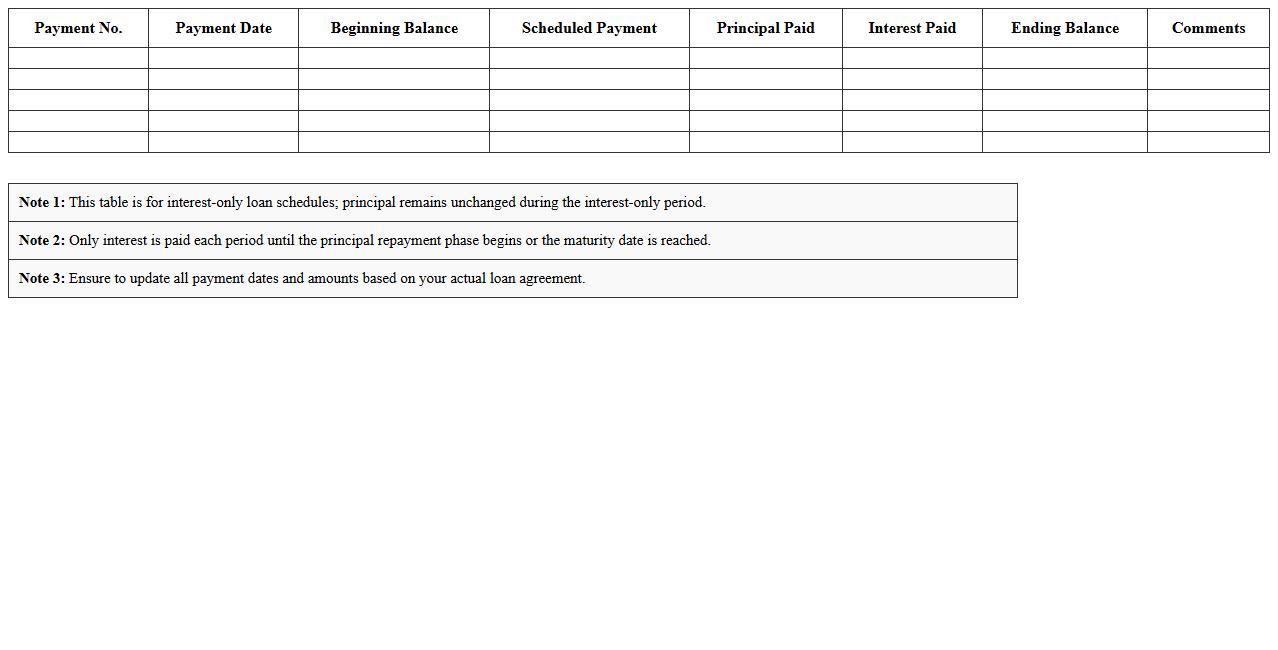

Interest-Only Loan Amortization Statement Template

An

Interest-Only Loan Amortization Statement Template is a detailed financial document designed to track the payment schedule of loans where only interest is paid during the initial term. This template helps borrowers clearly understand the timing and amount of interest payments, as well as the remaining principal balance over time, improving financial planning and budgeting. It is especially useful for managing cash flow, ensuring timely payments, and preparing for eventual principal repayments.

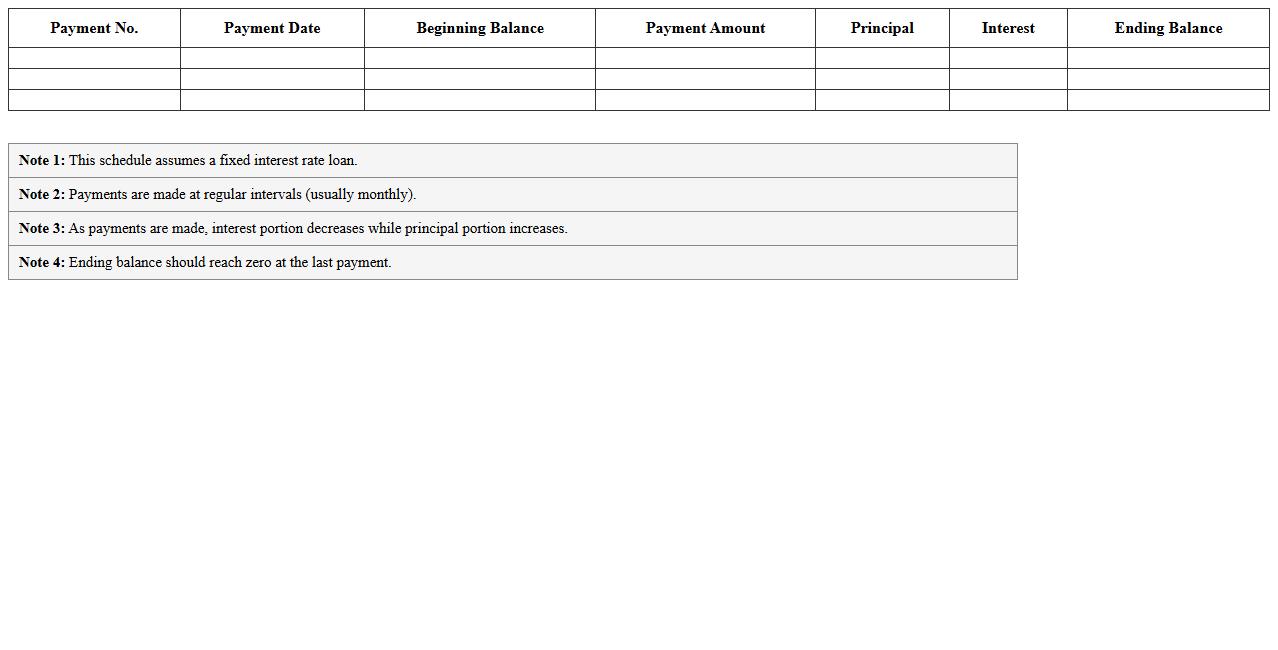

Principal and Interest Amortization Schedule Excel

A

Principal and Interest Amortization Schedule Excel document is a detailed spreadsheet that outlines each loan payment's breakdown into principal and interest over the loan term. It helps users track how much of each payment reduces the loan balance and how much goes toward interest, enabling better financial planning and budgeting. This tool is essential for understanding loan repayment progress, forecasting future payments, and making informed decisions about early repayments or refinancing.

Multi-Loan Amortization Tracker Excel Template

The

Multi-Loan Amortization Tracker Excel Template document is a powerful tool designed to manage and track multiple loan schedules simultaneously, allowing users to input principal amounts, interest rates, and payment terms for each loan. It automatically calculates monthly payments, interest accrued, and remaining balances, facilitating clear visualization of repayment progress. This template is useful for individuals and businesses aiming to organize diverse loan obligations efficiently, optimize cash flow management, and make informed financial decisions.

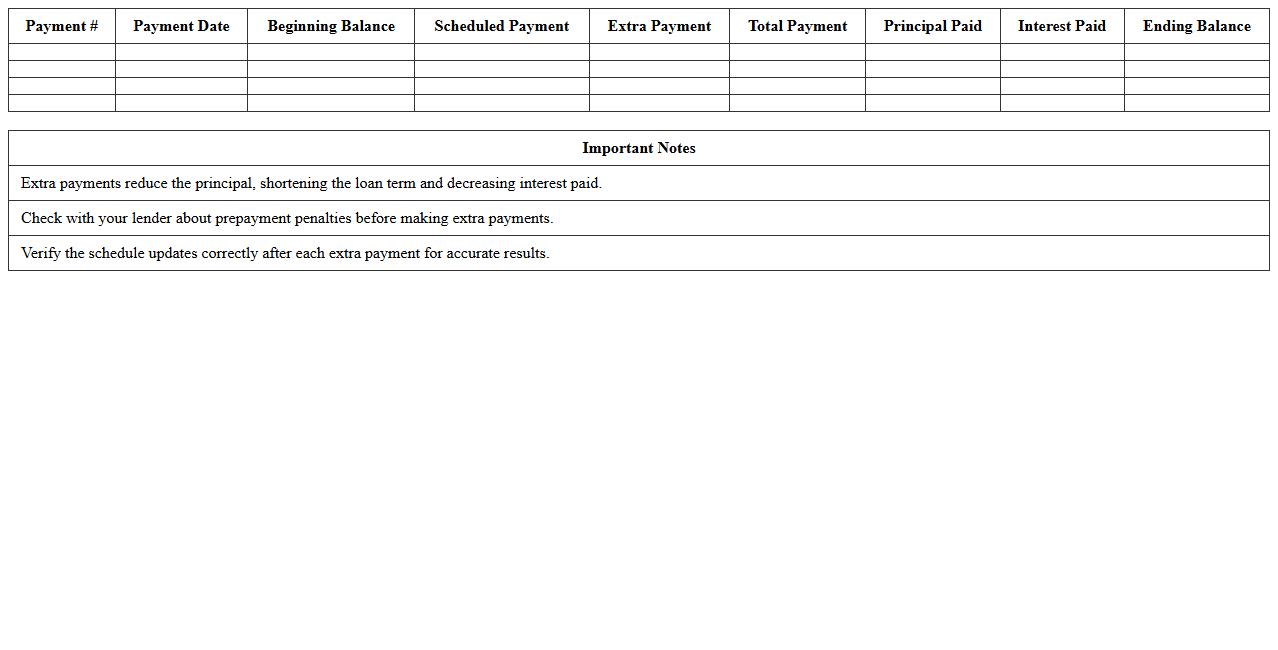

Early Payoff Loan Amortization Calculator Excel

The

Early Payoff Loan Amortization Calculator Excel document is a powerful tool that helps users calculate the impact of making extra payments on their loan schedule, allowing for a detailed breakdown of principal and interest over time. It enables precise tracking of how additional payments reduce the loan term and total interest paid, offering clear financial insights and aiding in effective debt management. This calculator is essential for homeowners, borrowers, and financial planners to optimize loan repayment strategies and save money by avoiding unnecessary interest costs.

Variable Term Mortgage Amortization Excel Form

The

Variable Term Mortgage Amortization Excel Form document is a dynamic spreadsheet designed to calculate and track mortgage payments with fluctuating interest rates over a specified loan term. It enables users to visualize the impact of varying rates on principal and interest payments, helping homeowners and financial planners manage and forecast mortgage obligations accurately. This tool is essential for optimizing repayment strategies and understanding loan amortization schedules under changing financial conditions.

How can I customize the loan amortization statement in Excel for various loan products?

To customize the loan amortization statement in Excel, start by adjusting the input variables such as loan amount, interest rate, and term to match the specific loan product. Use dynamic formulas like PMT, IPMT, and PPMT to calculate payments, interest, and principal dynamically. Incorporate drop-down lists or slicers to allow selection of different loan types for easy comparison.

What Excel formulas best automate escrow calculations for mortgage brokers?

Mortgage brokers can automate escrow calculations using formulas such as SUMIFS to accumulate property taxes and insurance amounts based on payment periods. Use IF statements to conditionally include fees or adjust escrow balances based on payment schedules. Additionally, VLOOKUP or INDEX-MATCH functions help pull relevant escrow rates from a lookup table efficiently.

How do I integrate PMI calculations into an Excel amortization statement?

Integration of PMI (Private Mortgage Insurance) into an amortization schedule involves adding a conditional column that checks the loan-to-value ratio. Use IF formulas to apply PMI costs only if the loan balance exceeds a given percentage of the property value. Calculate PMI payments proportionally and add them to the monthly payment for a complete view.

Which Excel data validation methods ensure accurate borrower payment schedules?

To ensure accurate borrower payment schedules, implement data validation rules like restricting dates to logical ranges using the DATE function. Use list validation to limit input options to predefined payment frequencies or status categories. Additionally, apply error alerts to prevent incorrect data entry, enhancing overall spreadsheet reliability.

How can mortgage brokers generate yearly summaries from a loan amortization Excel template?

Mortgage brokers can create yearly summaries by using the SUMIFS function to aggregate principal, interest, and escrow amounts by year. PivotTables offer another powerful method to dynamically summarize and analyze loan payment data by year. Incorporate charts or dashboards for clear visualization of yearly performance and trends.

More Statement Excel Templates