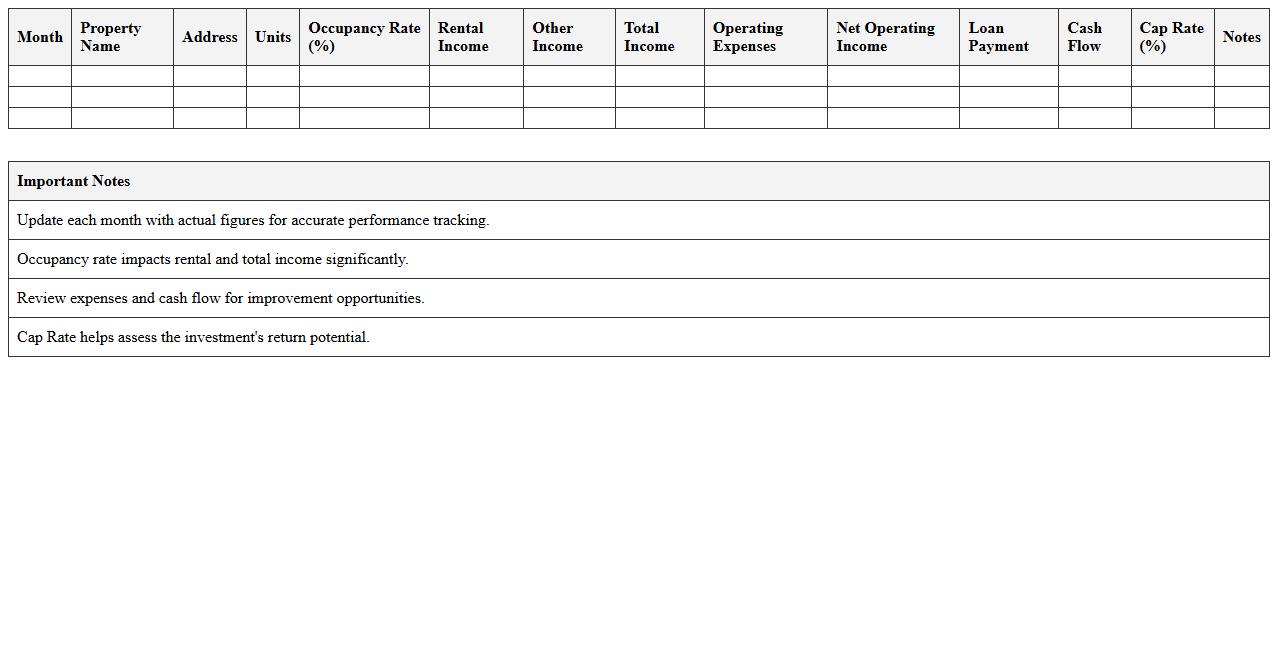

Monthly Investment Performance Statement Template for Real Estate

A

Monthly Investment Performance Statement Template for Real Estate is a structured document that tracks and summarizes the financial performance of real estate investments on a monthly basis. It helps investors and property managers monitor cash flow, rental income, expenses, and return on investment, enabling informed decision-making and portfolio optimization. This template simplifies complex data into clear, actionable insights, improving transparency and accountability in real estate asset management.

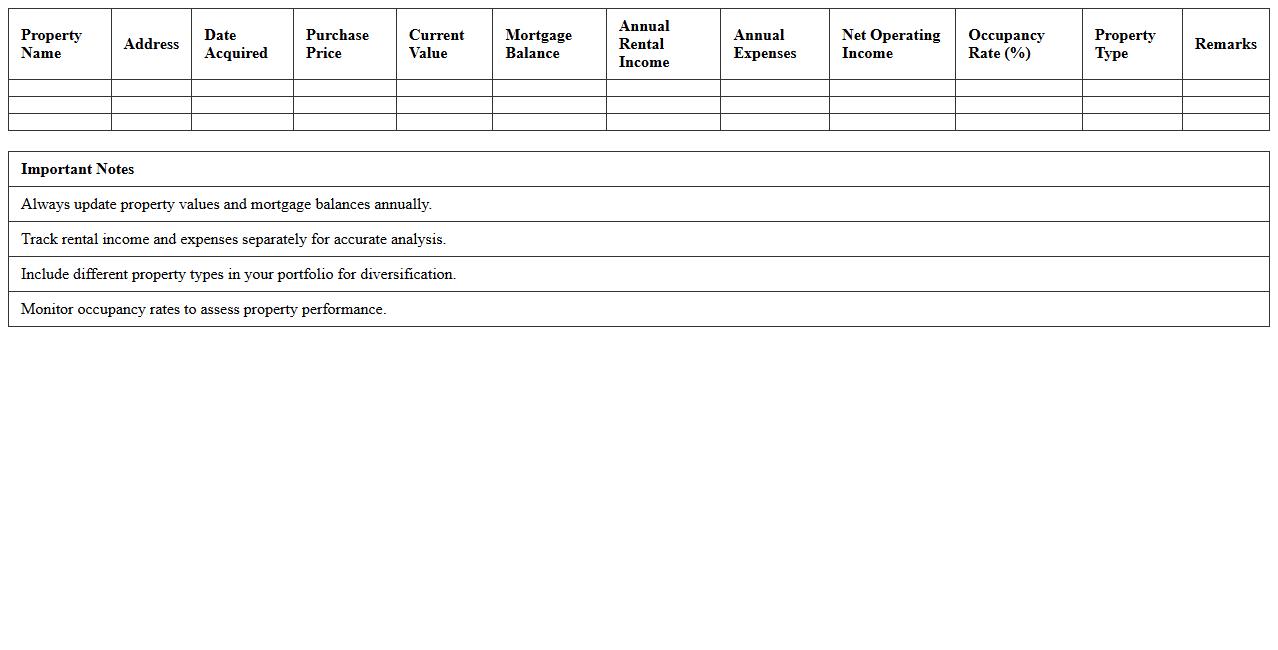

Real Estate Portfolio Investment Statement Excel Sheet

A

Real Estate Portfolio Investment Statement Excel Sheet document is a detailed financial tool designed to track, analyze, and manage multiple real estate assets within an investment portfolio. It consolidates essential data such as property values, rental income, expenses, and returns, allowing investors to monitor performance and make informed decisions. This document enhances investment strategies by providing clear insights into cash flow, asset appreciation, and portfolio diversification, ultimately supporting effective wealth management.

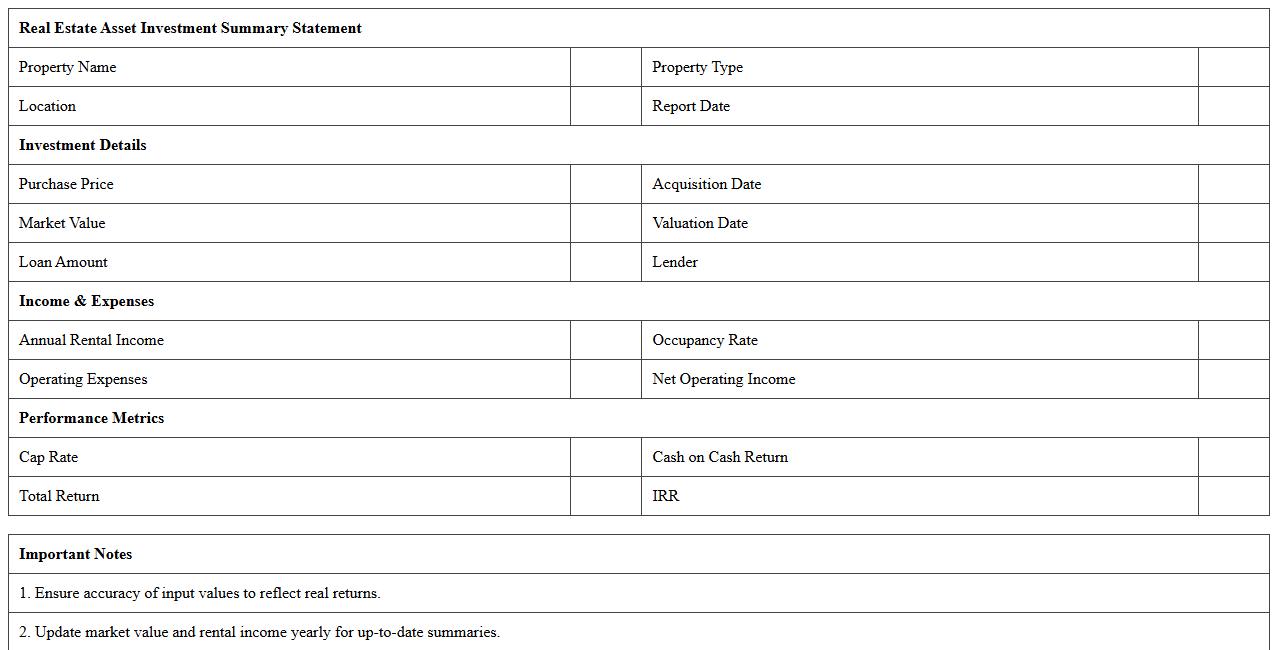

Real Estate Asset Investment Summary Statement Template

A

Real Estate Asset Investment Summary Statement Template is a structured document that consolidates key financial and performance data of real estate investments into a clear, concise format. It helps investors and stakeholders quickly assess the profitability, risks, and overall status of real estate assets, facilitating informed decision-making. By standardizing information, this template improves transparency and supports efficient portfolio management.

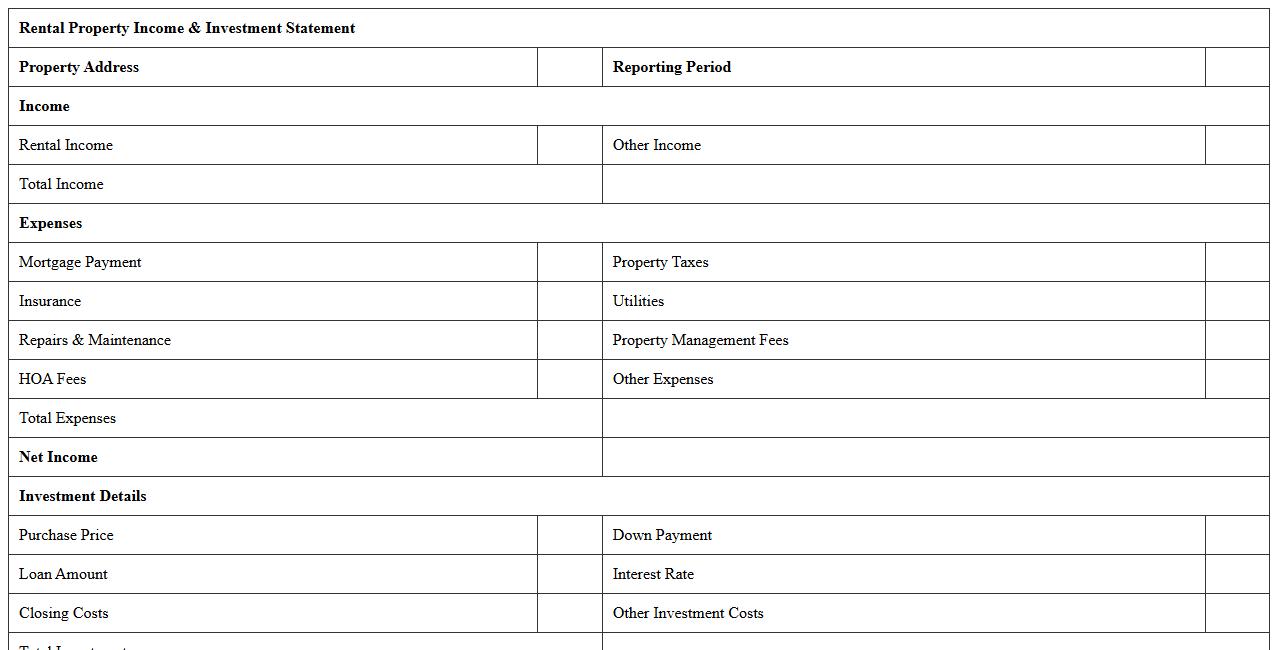

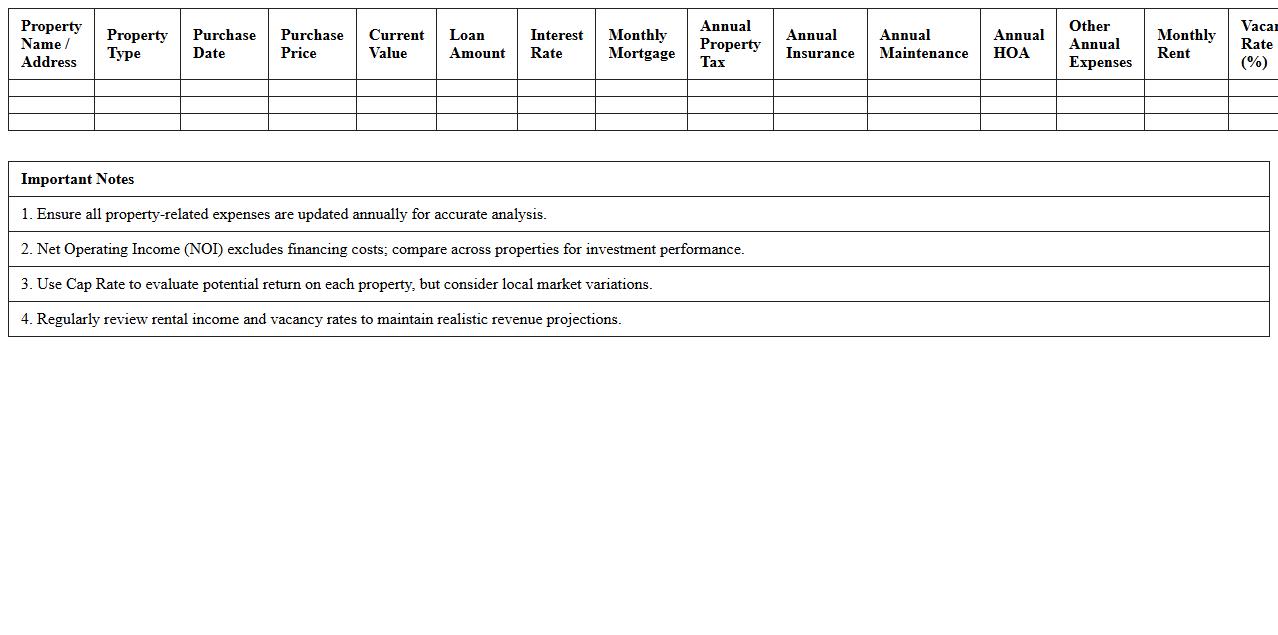

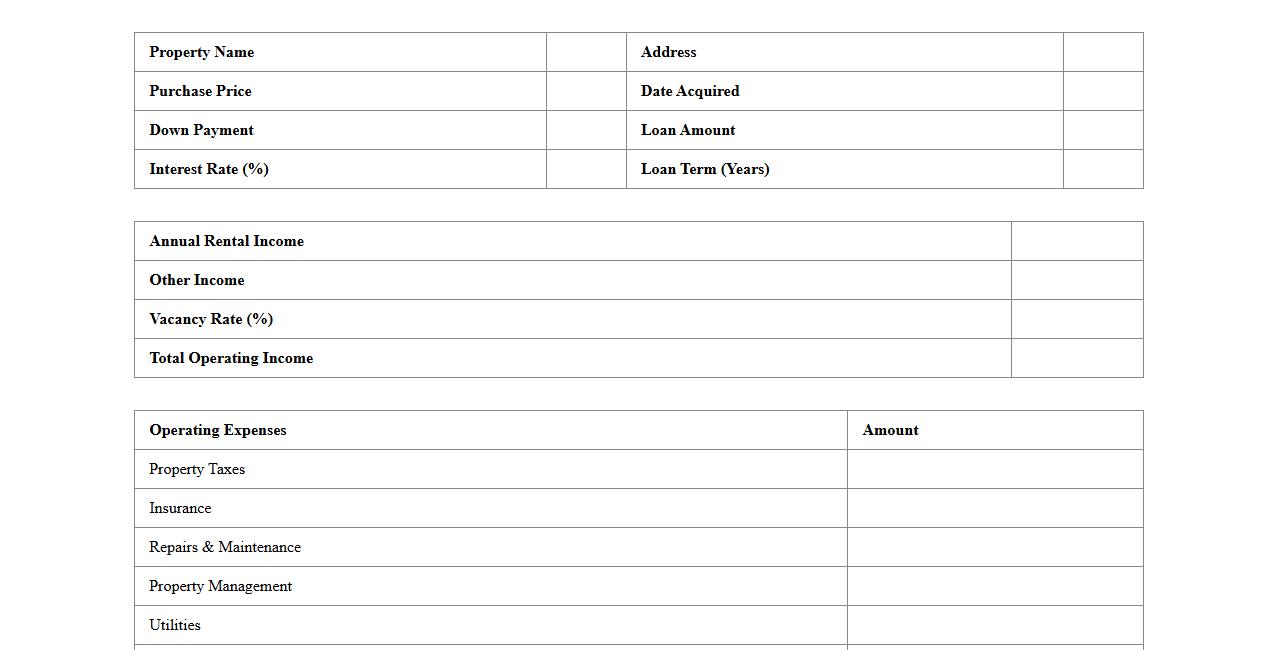

Rental Property Income & Investment Statement Excel

The

Rental Property Income & Investment Statement Excel document is a comprehensive financial tool designed to track rental income, expenses, and investment performance for property owners. It helps users analyze cash flow, calculate net profit, and monitor return on investment over time, enabling informed decision-making. This document streamlines record-keeping and provides clear insights into the financial health of rental properties, supporting better property management and investment strategies.

Real Estate Investor Yearly Investment Statement Template

The

Real Estate Investor Yearly Investment Statement Template is a structured document that summarizes all financial activities, including income, expenses, and property values, related to real estate investments over a fiscal year. It helps investors track performance, monitor cash flow, and prepare accurate tax filings by organizing essential data in one comprehensive report. Using this template enhances financial transparency and supports informed decision-making for future real estate ventures.

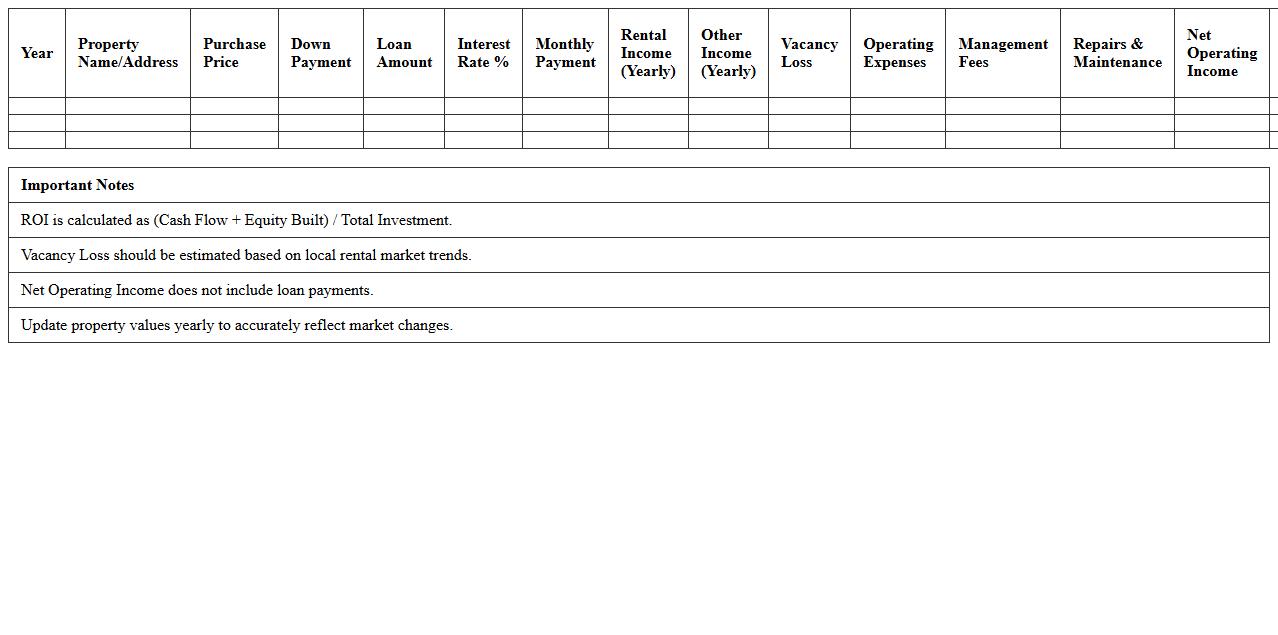

Real Estate Investment Statement for Multiple Properties

A

Real Estate Investment Statement for Multiple Properties is a comprehensive financial report that consolidates income, expenses, and performance metrics across all owned real estate assets. This document helps investors evaluate profitability, manage cash flow, and make informed decisions about property portfolio adjustments or acquisitions. It provides a clear snapshot of investment health, facilitating strategic planning and risk management in real estate ventures.

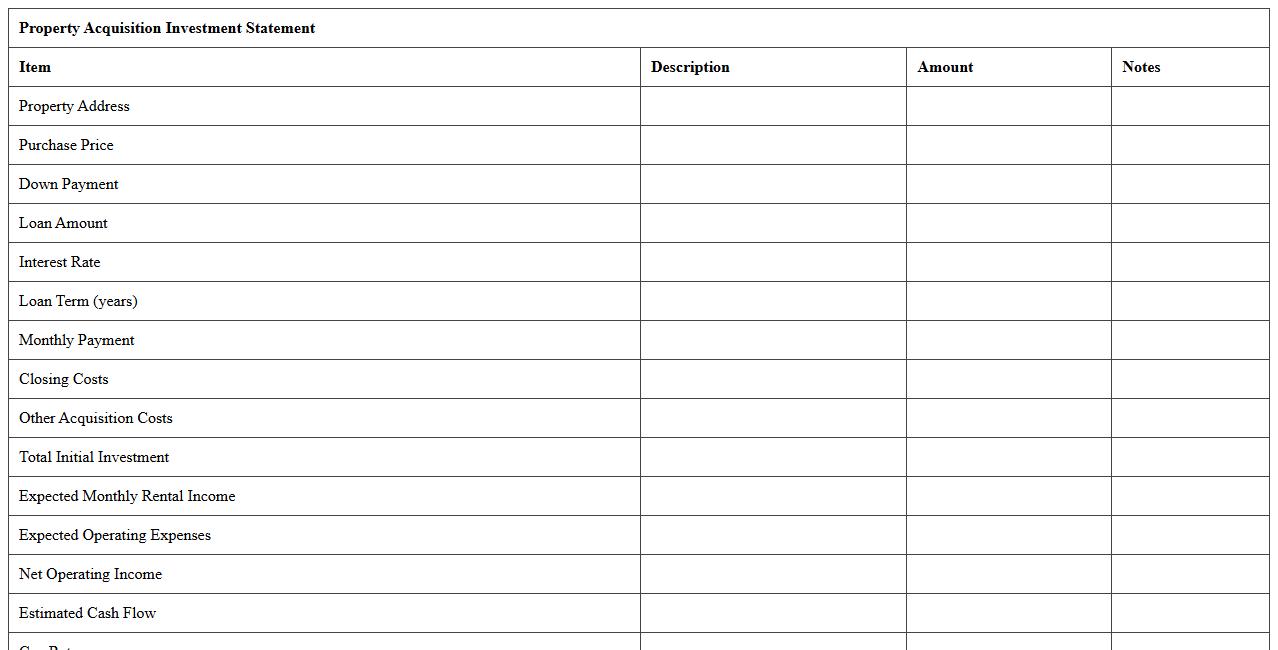

Property Acquisition Investment Statement Excel Template

The

Property Acquisition Investment Statement Excel Template is a structured financial document designed to organize and analyze all costs, revenues, and returns associated with purchasing real estate. It helps investors clearly track expenses such as purchase price, closing costs, and renovation fees while projecting rental income or resale value to evaluate investment profitability. Using this template enhances decision-making by providing a comprehensive, easy-to-understand overview of property acquisition financials in a customizable spreadsheet format.

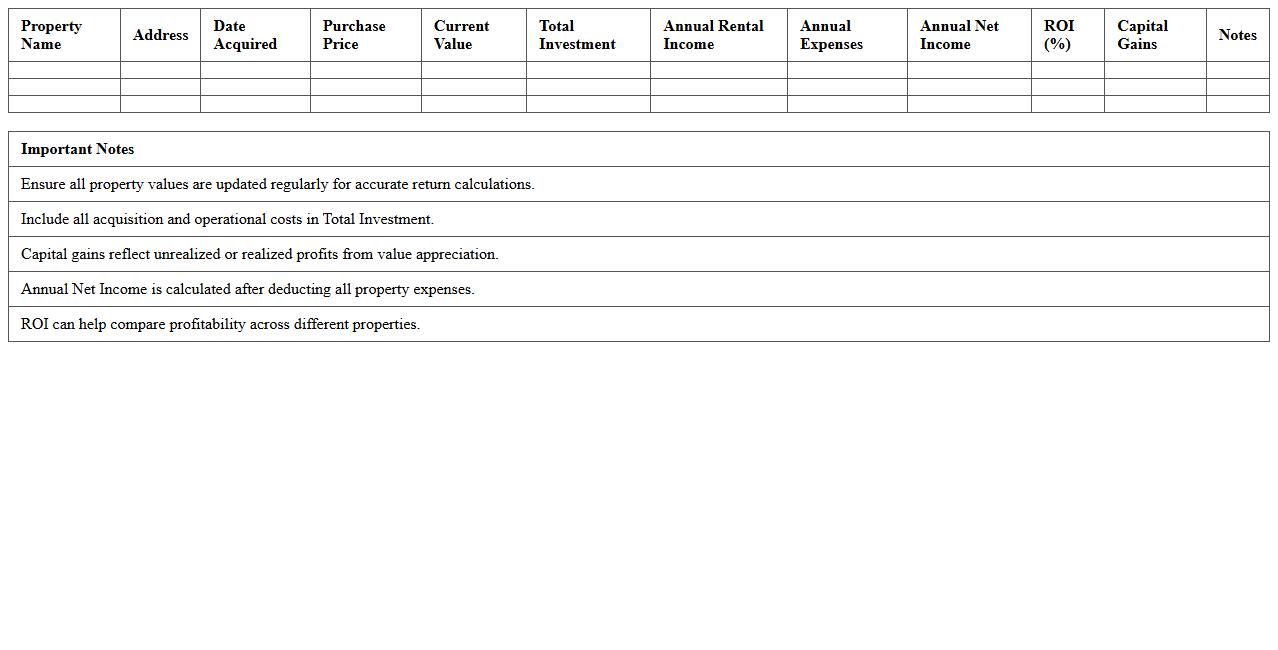

Real Estate Returns and Investment Statement Spreadsheet

A

Real Estate Returns and Investment Statement Spreadsheet is a detailed document that tracks income, expenses, and overall profitability of real estate investments, providing clear visibility into cash flow, return on investment (ROI), and equity growth. It helps investors analyze performance metrics such as net operating income (NOI), capitalization rate, and internal rate of return (IRR), enabling informed decision-making. By organizing financial data in a structured format, this spreadsheet facilitates strategic planning, tax reporting, and portfolio optimization.

Excel Statement Template for Real Estate Investment Analysis

An

Excel Statement Template for Real Estate Investment Analysis is a structured spreadsheet designed to organize and evaluate the financial performance of property investments. It allows investors to input key data such as purchase price, rental income, expenses, and financing terms to calculate metrics like cash flow, return on investment, and net present value. This tool streamlines decision-making by providing a clear financial overview, making it easier to compare investment opportunities and forecast potential returns accurately.

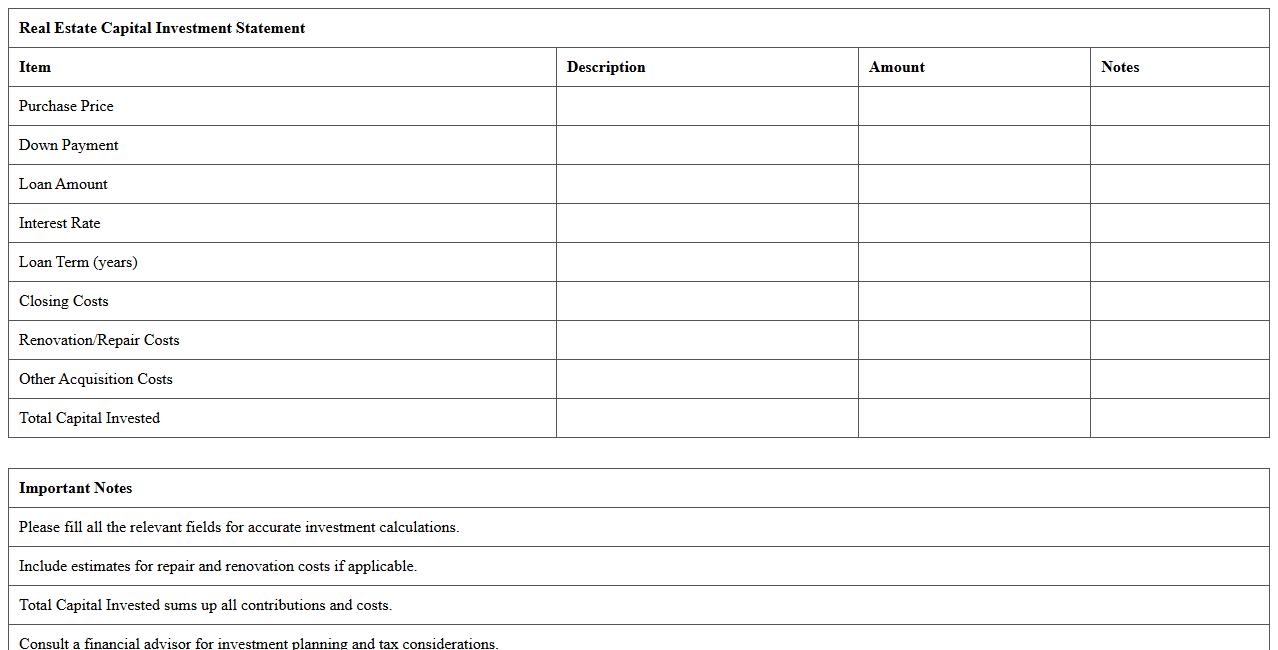

Real Estate Capital Investment Statement Excel Sheet

A

Real Estate Capital Investment Statement Excel Sheet is a comprehensive financial document used to track and analyze investments in real estate assets. It consolidates data on capital inflows, outflows, ownership structures, and returns, enabling investors to monitor performance and make informed decisions. This tool enhances transparency, facilitates budgeting, and supports effective portfolio management by providing clear insights into the financial health of real estate projects.

Which Excel formulas best automate ROI calculations for real estate investments?

The ROI formula in Excel typically involves dividing the net profit by the initial investment using simple arithmetic formulas like =(Net_Profit/Initial_Investment). To automate computations, functions such as SUM and IF can be integrated for detailed cash flow analysis. Leveraging the NPV and IRR functions provides deeper insight into the investment's profitability over time.

How do you structure a cash flow forecast in an Investment Statement for multifamily properties?

A structured cash flow forecast in Excel begins with listing all income streams such as rent and ancillary services in rows and projecting these monthly or annually in columns. Next, deduct operating expenses and reserve allocations to reflect net cash flow accurately. Using formatted tables with dynamic formulas allows for easy updates and scenario planning within the Investment Statement.

What key metrics should be highlighted in a real estate investor's Excel summary sheet?

The summary sheet should prominently display metrics like Cash on Cash Return, Cap Rate, and Debt Service Coverage Ratio (DSCR) for quick evaluation. Including total rental income, operating expenses, and net operating income (NOI) ensures comprehensive performance tracking. Visual indicators such as conditional formatting help emphasize critical trends and variances in these key figures.

How can you track capital expenditures (CapEx) over time within an Investment Statement Excel file?

Track CapEx by creating a dedicated sheet or section where costs are logged by date, category, and project description. Incorporating Excel features like tables and PIVOT TABLES enables dynamic summary and trend analysis over multiple periods. Integrating these with the main cash flow forecast ensures CapEx impact is reflected accurately in overall financial modeling.

What dynamic charts are most useful for visualizing rental income trends in Excel?

Line charts are ideal for showing rental income trends over time due to their clear depiction of continuous data changes. Stacked column charts can illustrate income sources breakdown to visualize diversified revenue streams effectively. Adding slicers and pivot chart capabilities enhances interactivity and allows users to explore data by property or time period effortlessly.