Personal Investment Portfolio Tracker Spreadsheet

A

Personal Investment Portfolio Tracker Spreadsheet is a digital tool designed to record, monitor, and analyze individual investment assets such as stocks, bonds, and mutual funds. It provides real-time updates on portfolio performance, asset allocation, and investment gains or losses, helping investors make informed decisions. By consolidating all financial data in one place, it enhances financial planning, risk management, and goal tracking efficiently.

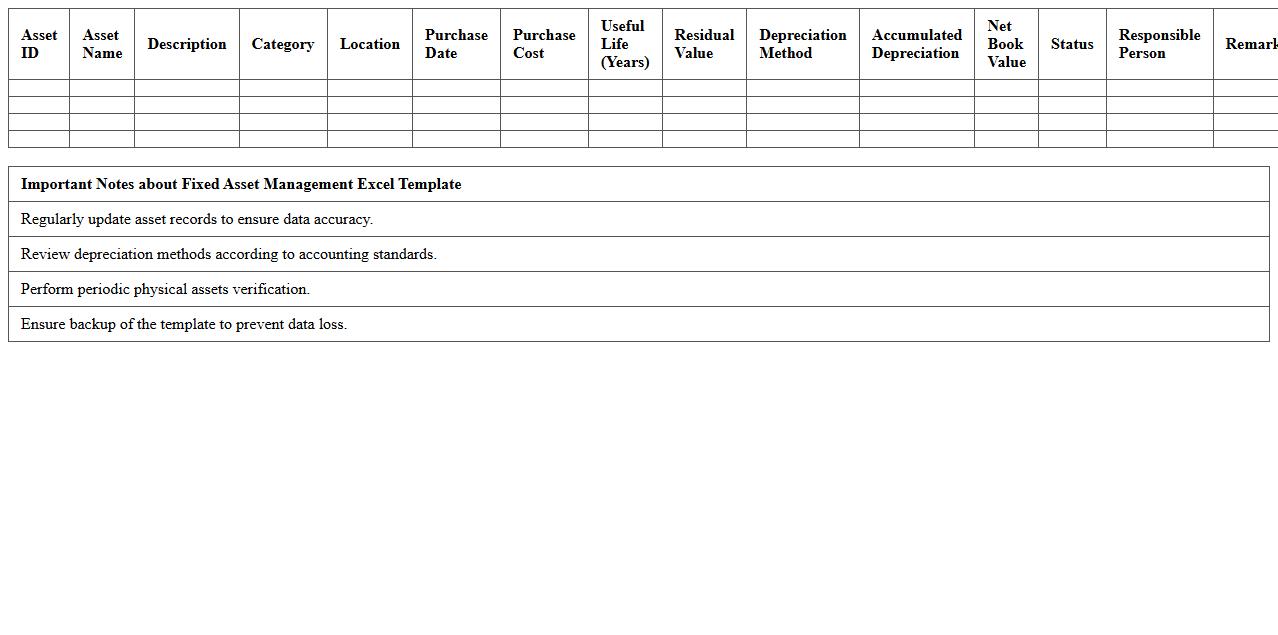

Fixed Asset Management Excel Template

A

Fixed Asset Management Excel Template is a comprehensive spreadsheet designed to track and manage an organization's fixed assets, such as equipment, machinery, and property. It helps in monitoring asset details, depreciation schedules, maintenance records, and asset life cycles efficiently. This tool enhances accuracy in financial reporting, ensures compliance with accounting standards, and aids in optimizing asset utilization and budgeting decisions.

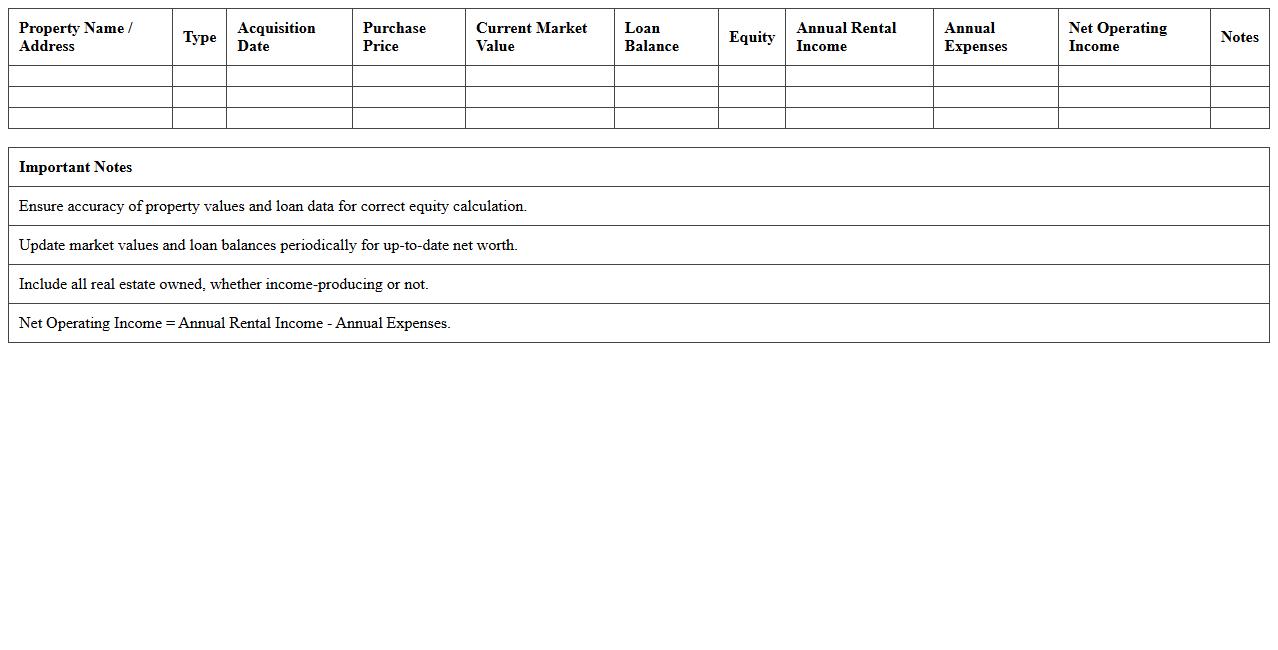

Real Estate Holdings Statement Sheet

A

Real Estate Holdings Statement Sheet is a detailed document that outlines an individual's or organization's property assets, including ownership details, market values, and financial encumbrances. This statement provides a clear overview of real estate investments, aiding in portfolio management and financial planning. It is useful for assessing asset distribution, tracking property performance, and facilitating informed decision-making in real estate transactions.

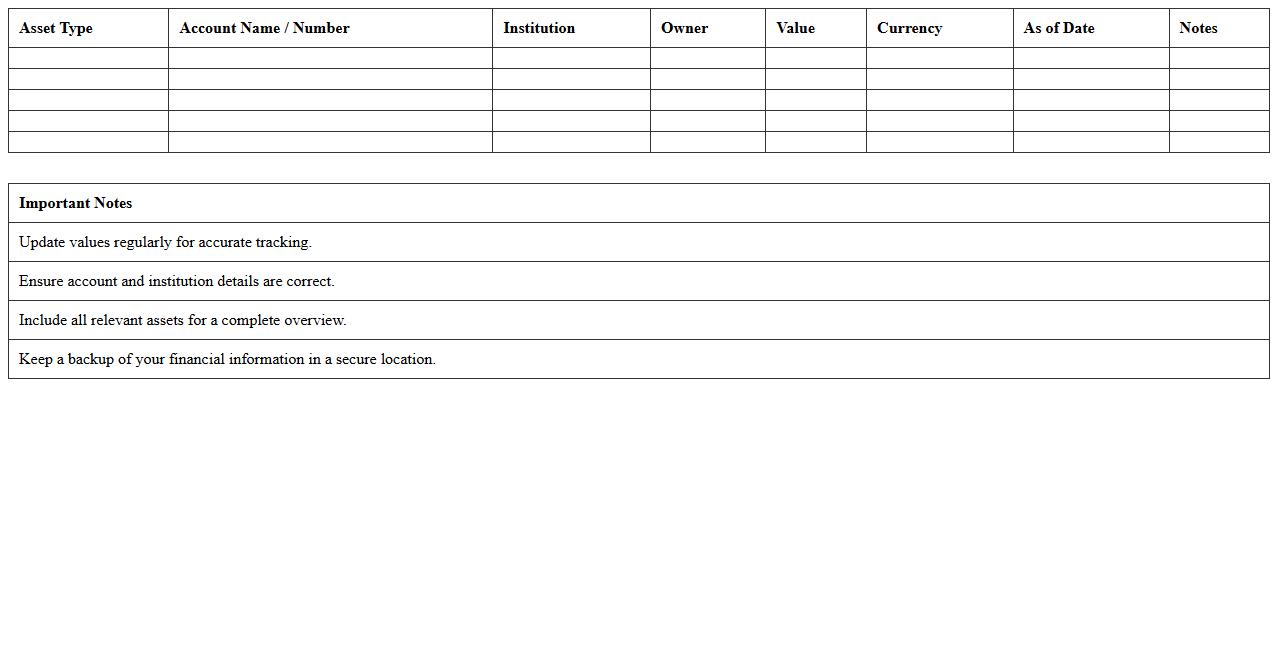

Financial Assets Overview Excel Planner

The

Financial Assets Overview Excel Planner is a comprehensive spreadsheet designed to organize, track, and analyze various financial assets including stocks, bonds, real estate, and savings. It provides a clear summary of asset allocation, investment performance, and portfolio diversification, helping users make informed financial decisions. This planner enhances financial management by offering a centralized tool for monitoring net worth, optimizing asset distribution, and planning future investments effectively.

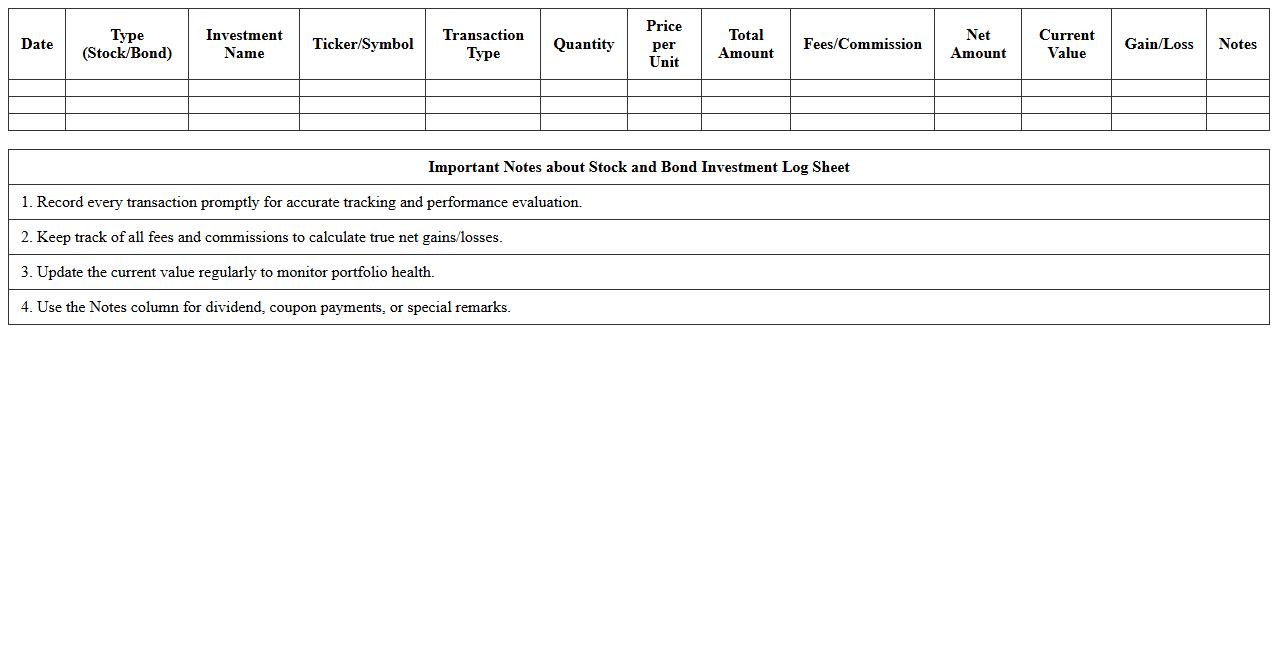

Stock and Bond Investment Log Sheet

A

Stock and Bond Investment Log Sheet document is a detailed record used to track purchases, sales, dividends, interest payments, and other key transactions related to stock and bond investments. This log sheet helps investors monitor their portfolio performance, analyze historical data for better decision-making, and maintain accurate records for tax reporting purposes. Keeping a systematic investment log enhances financial planning and supports risk management by providing clear insights into investment patterns and returns.

Cryptocurrency Asset Tracking Worksheet

A

Cryptocurrency Asset Tracking Worksheet is a detailed spreadsheet designed to monitor and manage digital currency holdings, including transaction history, wallet addresses, purchase prices, and current market values. This document helps investors maintain accurate records for tax reporting, portfolio analysis, and risk management by consolidating all relevant data in one place. Using a structured tracking worksheet enhances financial transparency and supports informed decision-making in the rapidly changing cryptocurrency market.

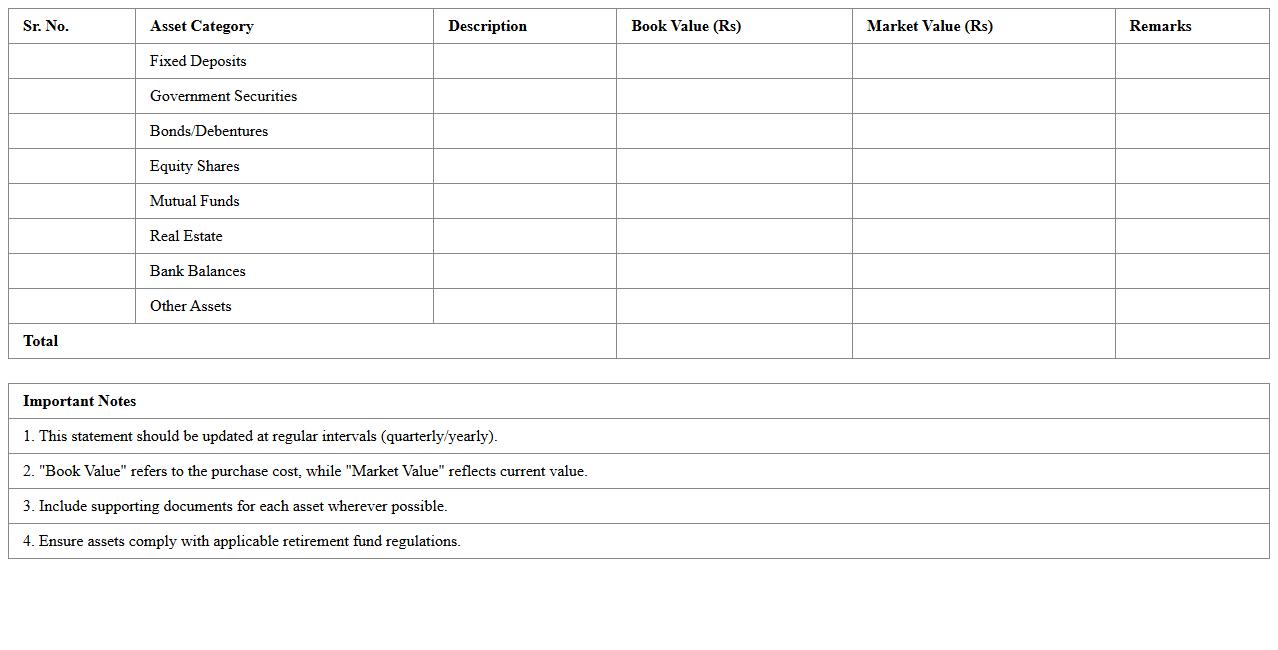

Retirement Fund Asset Statement Template

A

Retirement Fund Asset Statement Template is a structured document designed to track and summarize the value and composition of retirement assets over time. It helps individuals and financial advisors monitor investment performance, contribution history, and asset allocation, enabling better planning for future financial security. Using this template enhances clarity in managing retirement funds and supports informed decision-making for achieving long-term retirement goals.

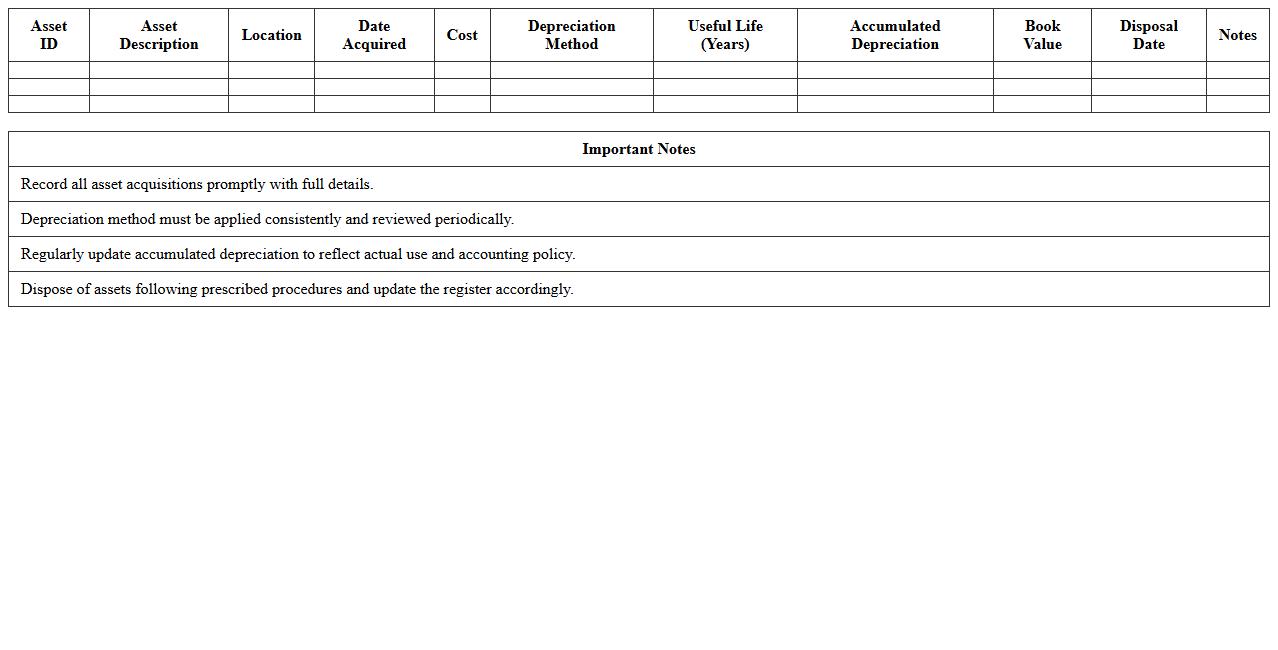

Depreciable Assets Register Excel

A

Depreciable Assets Register Excel document is a detailed spreadsheet used to track assets subject to depreciation, including purchase dates, cost, accumulated depreciation, and current book value. It enables precise calculation of depreciation expenses based on methods such as straight-line or reducing balance, ensuring accurate financial reporting and compliance with accounting standards. This register supports asset management by providing a clear overview of asset lifecycles, aiding in budgeting, tax filings, and informed decision-making regarding asset replacement or disposal.

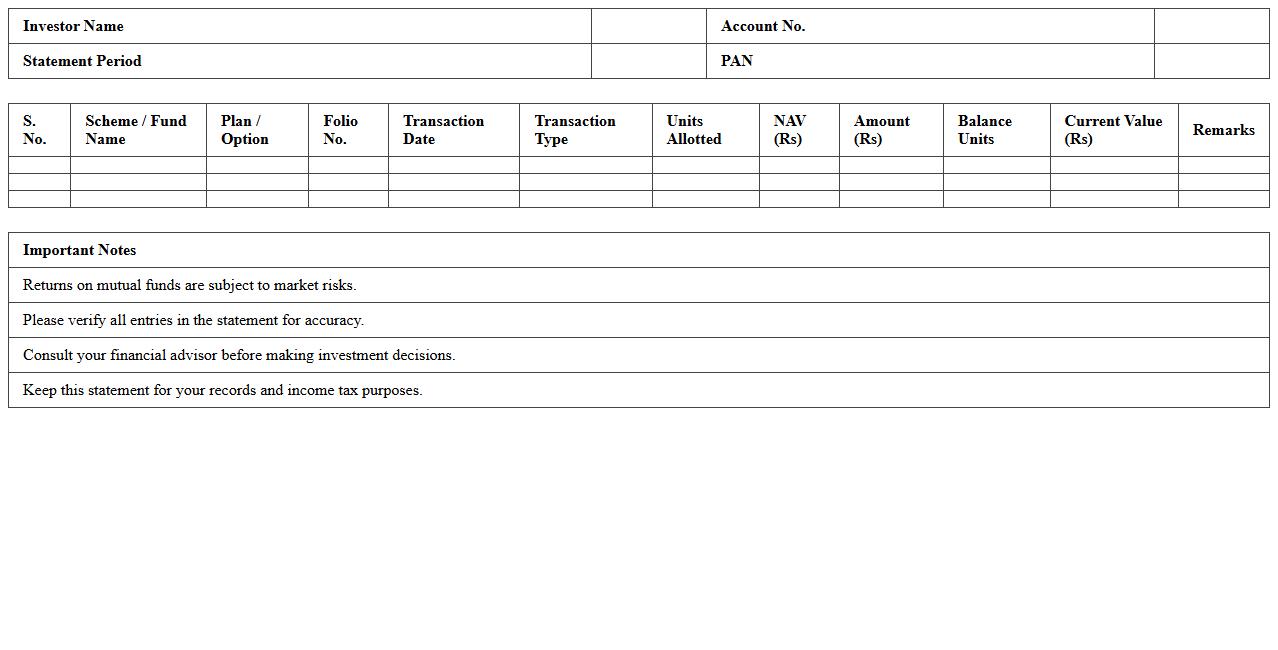

Mutual Fund Investment Statement Sheet

A

Mutual Fund Investment Statement Sheet is a detailed financial document that provides a comprehensive record of all transactions, holdings, and performance related to an individual's mutual fund investments. It helps investors track the value of their investments, monitor dividends, capital gains, and redemption details, ensuring transparency and facilitating informed decision-making. This statement is essential for portfolio analysis, tax reporting, and assessing the effectiveness of investment strategies over time.

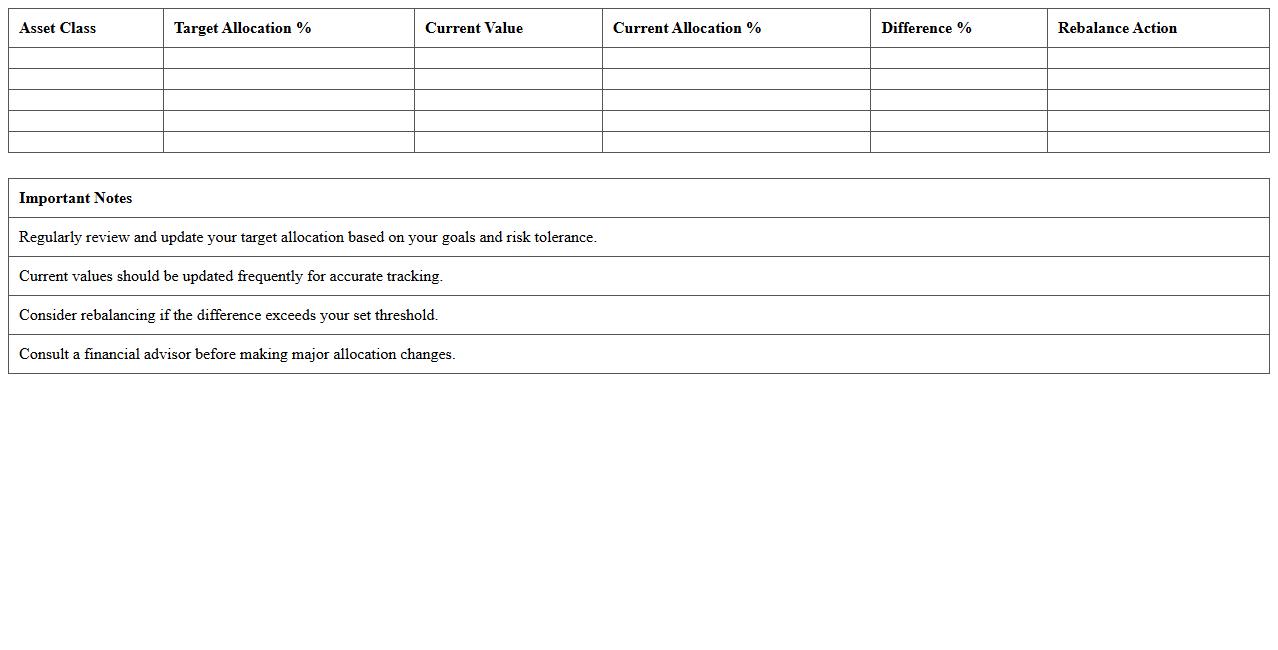

Asset Allocation Dashboard Excel

The

Asset Allocation Dashboard Excel document provides a comprehensive visualization of investment portfolios by categorizing assets into classes such as stocks, bonds, and cash, helping investors monitor their diversification. It enables users to track performance, adjust allocations according to risk tolerance, and make data-driven decisions to optimize portfolio returns. This tool is essential for maintaining balance in investments and ensuring alignment with financial goals.

How can I automate asset value updates in my Assets Statement Excel for real-time investment tracking?

To automate asset value updates, use Excel's Web Queries or the integration with Power Query to pull live data from financial websites. Another effective method is utilizing Excel's dynamic arrays with STOCKHISTORY or custom VBA scripts that connect to APIs providing real-time investment prices. Regularly refreshing your data connections ensures your asset values stay current for accurate investment tracking.

What advanced Excel formulas help categorize and summarize diverse investment types in an asset statement?

Advanced formulas such as SUMIFS, COUNTIFS, and ARRAY formulas can categorize investments by type and aggregate values efficiently. Using FILTER and XLOOKUP allows dynamic extraction and summarization based on multiple criteria. Combining these with PivotTables provides a powerful way to organize and analyze diverse portfolio data.

Which Excel templates are best for visualizing portfolio diversification in an Assets Statement?

Excel templates with built-in pie charts and bar graphs are ideal for illustrating portfolio diversification metrics clearly. Templates like the Investment Portfolio Tracker offer customizable dashboards tailored for visualizing asset allocation by category. These visually intuitive templates help investors quickly identify concentration risks and balance in their portfolios.

How do I set up conditional formatting to flag underperforming assets in my investment tracking sheet?

Use Excel's Conditional Formatting rules to highlight assets that fall below a specific return threshold or benchmark values. Creating formulas that compare the asset's current value against a set benchmark can automatically flag underperforming investments with color coding. This method ensures instant visual cues for investment review and decision-making.

What methods can I use in Excel to compare historical vs current asset allocations for a portfolio review?

Comparing historical and current asset allocations can be achieved using Excel's PivotTables combined with timeline slicers for date-based filtering. Additionally, using line charts or stacked bar charts with historical data snapshots helps visualize allocation shifts over time. Incorporating these techniques supports effective portfolio reviews and trend analysis.

![]()