The Profit and Loss Statement Excel Template for Consultants offers a streamlined way to track revenue, expenses, and net profit specifically tailored for consulting businesses. This template enables consultants to analyze financial performance with customizable categories and clear visual summaries. It simplifies budgeting and forecasting, helping consultants make informed decisions to increase profitability.

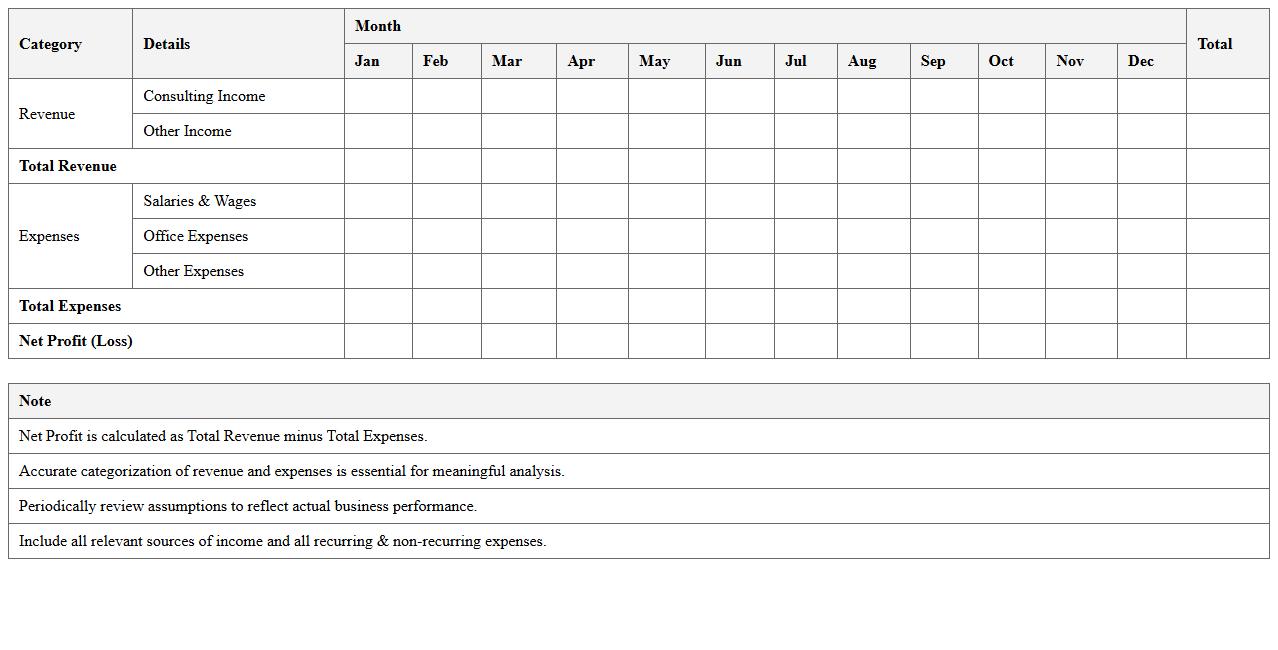

Monthly Profit and Loss Statement for Consulting Firms

The

Monthly Profit and Loss Statement for consulting firms is a financial document that summarizes revenues, expenses, and net profit over a specific month, providing a clear snapshot of business performance. It helps identify cost-saving opportunities, track project profitability, and manage cash flow effectively. By regularly reviewing this statement, consulting firms can make informed decisions to enhance profitability and sustain long-term growth.

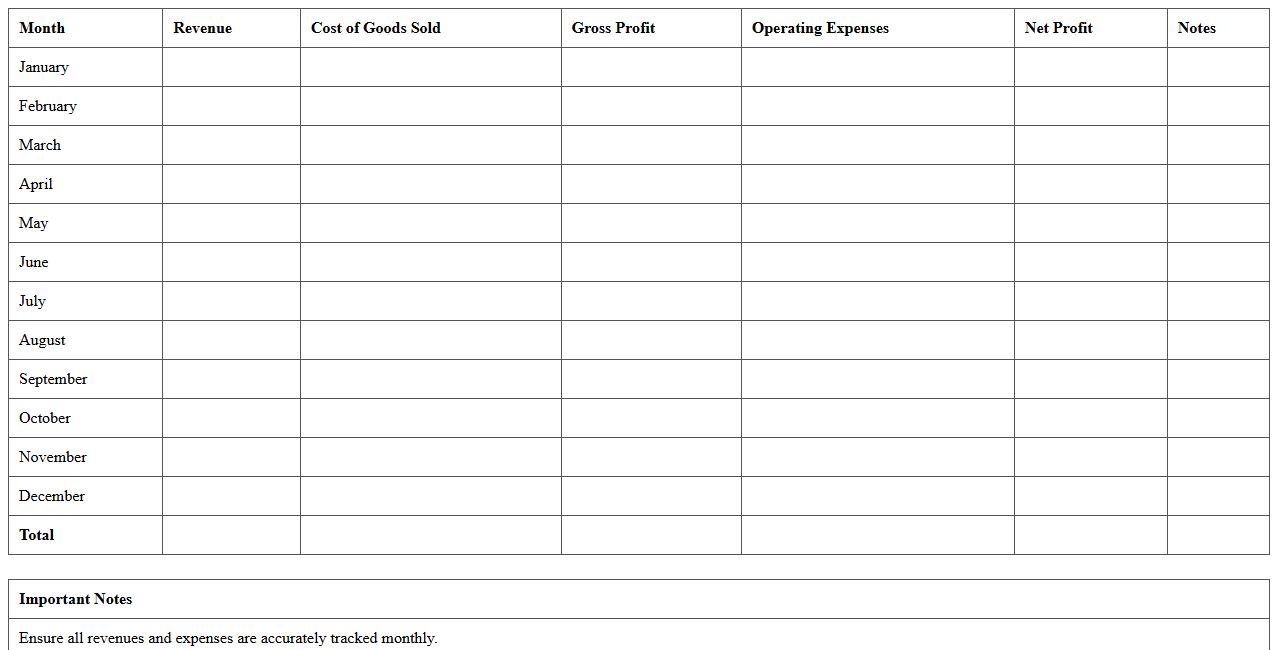

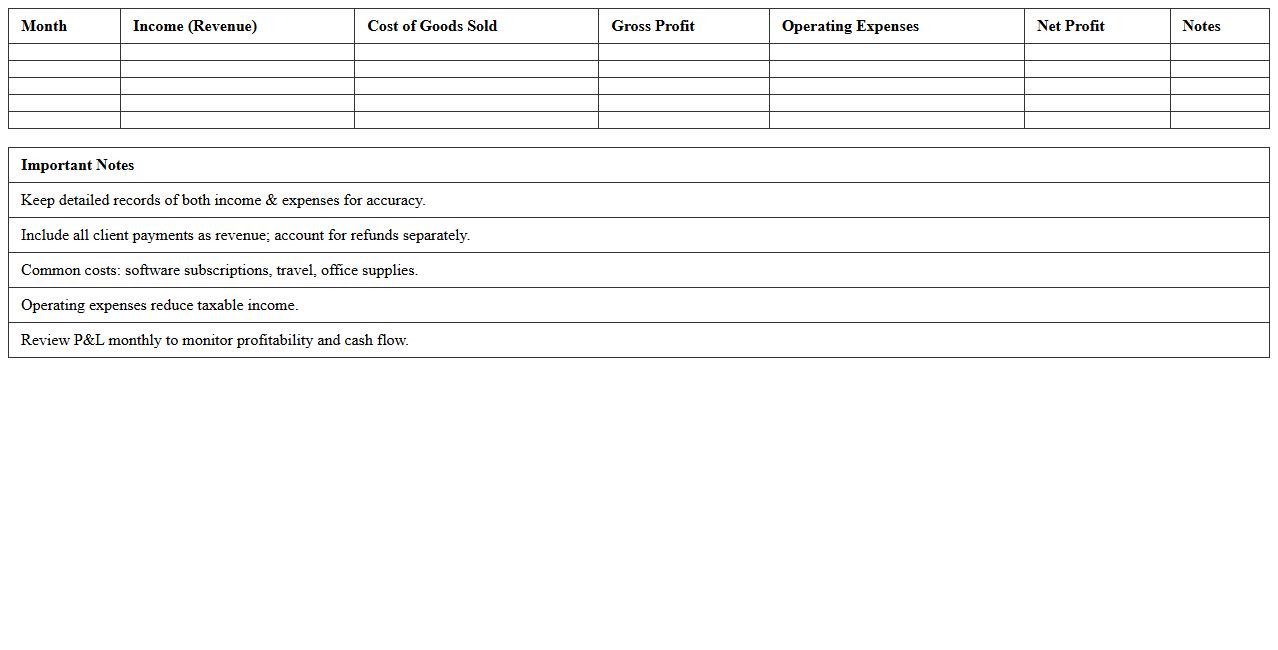

Annual Profit and Loss Worksheet for Consultants

The

Annual Profit and Loss Worksheet for Consultants is a detailed financial document that tracks income, expenses, and net profit over a fiscal year, tailored specifically for consulting professionals. It helps consultants analyze their business performance by providing clear insights into revenue streams and cost structures, enabling informed decision-making for budgeting and tax preparation. Utilizing this worksheet allows consultants to identify trends, optimize profitability, and ensure accurate financial reporting.

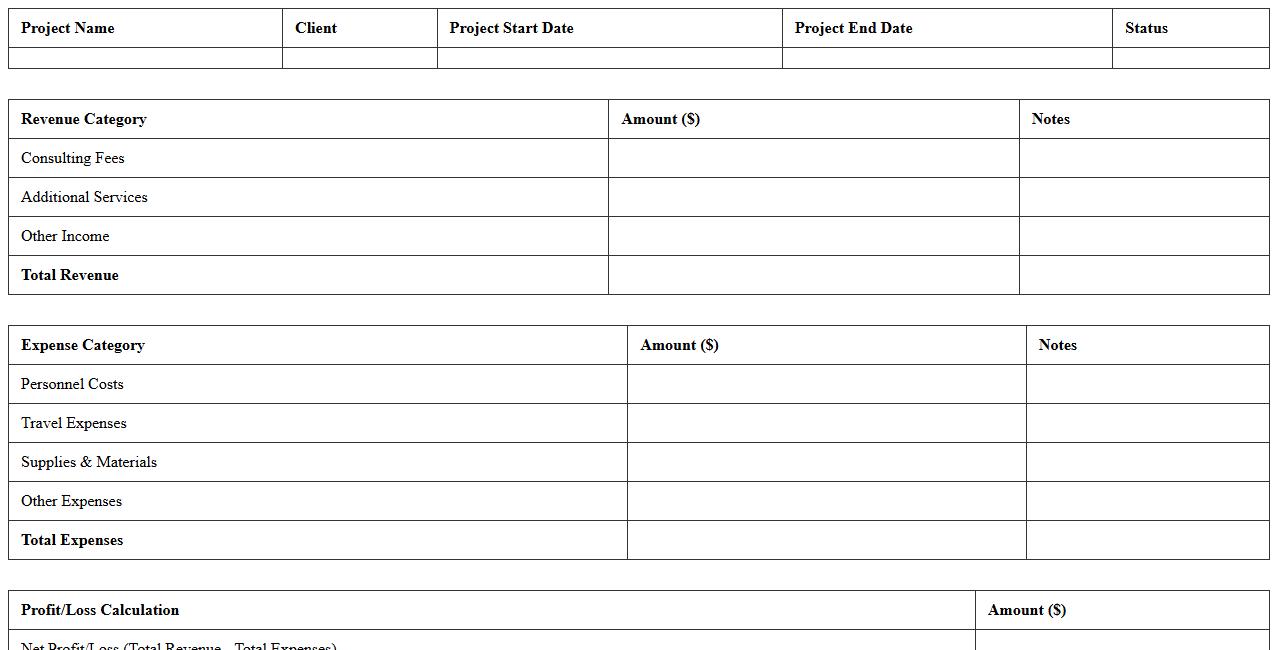

Project-Based P&L Statement Template for Consultants

A

Project-Based P&L Statement Template for consultants is a financial tool designed to track revenues, costs, and profitability specific to individual consulting projects. It allows consultants to accurately allocate expenses and income, providing clear insights into the financial performance of each engagement. This template helps optimize budgeting, improves financial decision-making, and enhances project management by highlighting profit margins on a per-project basis.

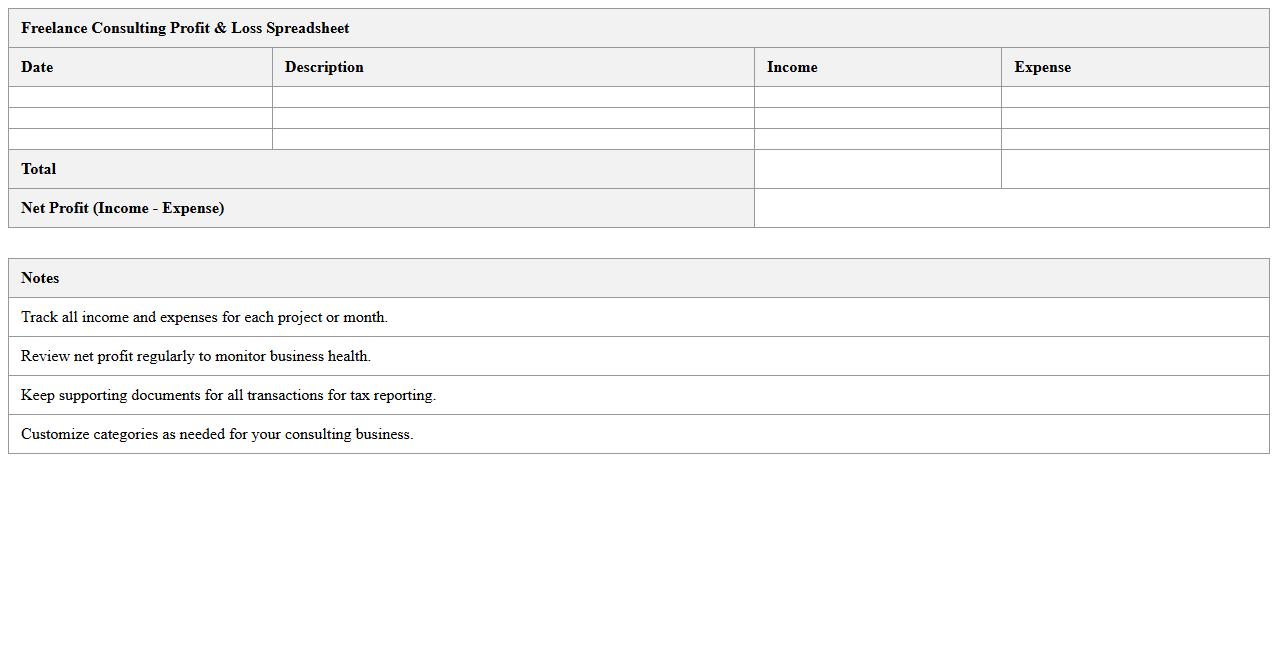

Freelance Consulting Profit & Loss Spreadsheet

The

Freelance Consulting Profit & Loss Spreadsheet document is a financial tool designed to track income, expenses, and net profit for independent consultants. It helps freelancers monitor their cash flow, identify profitable projects, and manage budgets effectively to ensure sustainable business growth. By providing clear insights into financial performance, this spreadsheet supports informed decision-making and tax preparation.

Simple Profit and Loss Tracker for Consultants

A

Simple Profit and Loss Tracker for Consultants is a streamlined financial document designed to help consultants monitor their income and expenses effectively. It provides clear insights into profitability by categorizing revenue streams and tracking business costs, enabling better financial decision-making. Using this tracker enhances budget management, improves cash flow visibility, and supports strategic planning for sustainable business growth.

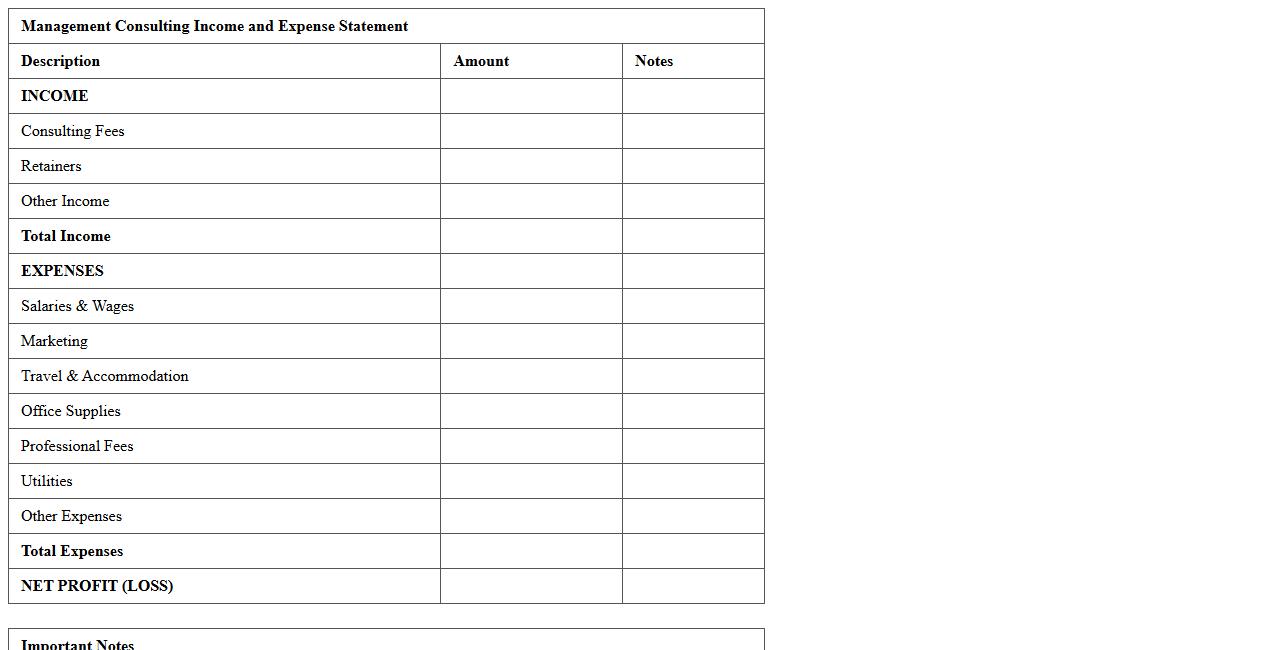

Management Consulting Income and Expense Statement

The

Management Consulting Income and Expense Statement is a financial document that summarizes revenues earned and costs incurred by a consulting firm during a specific period. This statement provides crucial insights into profitability, helping managers analyze performance, control expenses, and make informed strategic decisions. Utilizing this report ensures efficient resource allocation and enhances financial transparency within consulting operations.

Self-Employed Consultant P&L Excel Template

The

Self-Employed Consultant P&L Excel Template document is designed to track income, expenses, and profit margins specifically for independent consultants. This template helps organize financial data efficiently, ensuring accurate profit and loss analysis critical for tax filing and business decision-making. Utilizing this tool enhances financial clarity, enabling consultants to monitor cash flow and improve budget management.

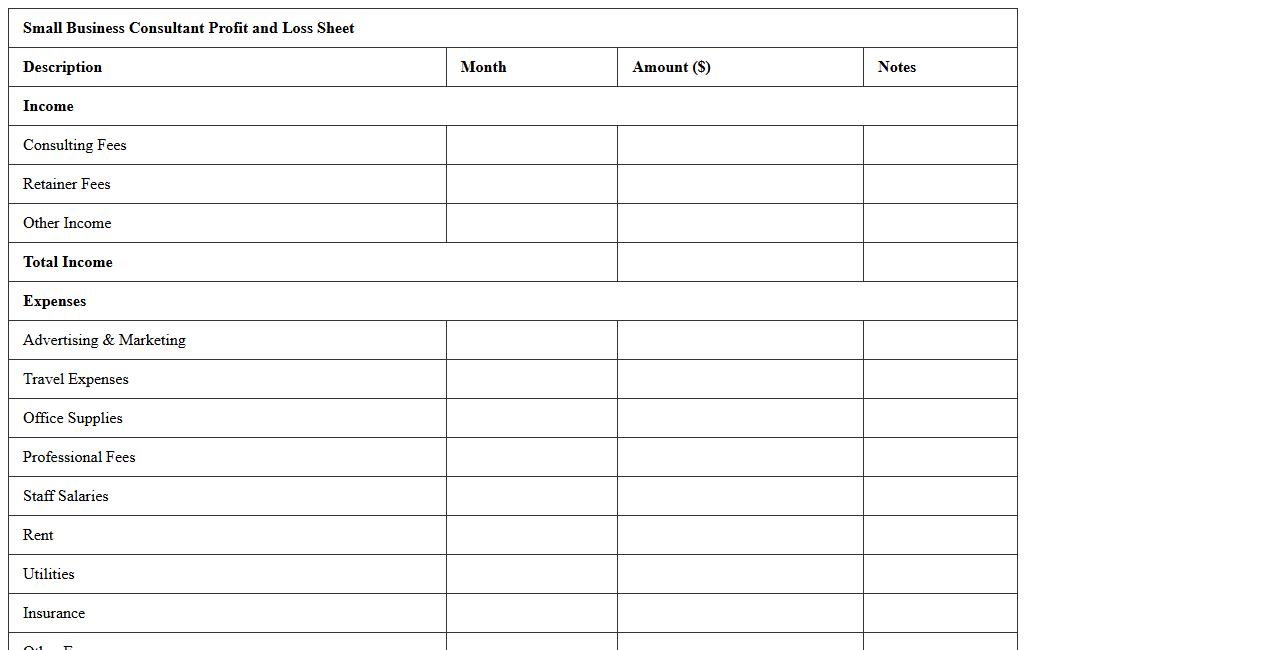

Small Business Consultant Profit and Loss Sheet

A

Small Business Consultant Profit and Loss Sheet is a financial document that summarizes revenues, costs, and expenses incurred during a specific period, providing a clear overview of business profitability. This sheet helps consultants and business owners analyze financial performance, identify areas for cost reduction, and make informed decisions to enhance profitability. By regularly reviewing the profit and loss sheet, small businesses can track growth trends and adjust strategies to ensure long-term financial stability.

Service-Based Profit and Loss Statement for Consultants

A

Service-Based Profit and Loss Statement for consultants is a financial document that tracks revenues and expenses directly linked to individual consulting services or projects. It provides detailed insights into the profitability of each service offering, enabling consultants to identify which services generate the most profit and where costs can be optimized. Using this statement helps improve strategic decision-making, budgeting accuracy, and resource allocation for consulting businesses.

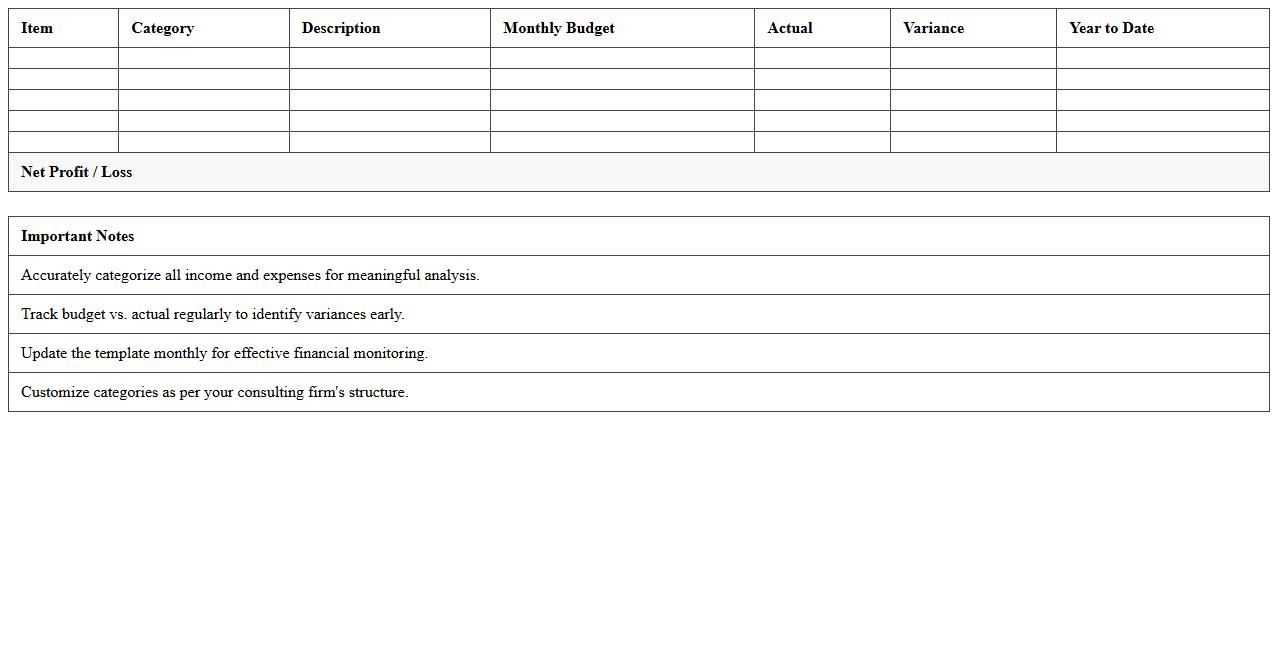

Consulting Firm Budget and Profit & Loss Report Excel Template

The

Consulting Firm Budget and Profit & Loss Report Excel Template document serves as a comprehensive financial management tool designed to track income, expenses, and profitability for consulting businesses. This template allows detailed budgeting and real-time profit and loss analysis, enabling firms to monitor financial health and make informed decisions based on accurate data. Utilizing this document helps improve financial planning accuracy, optimize resource allocation, and enhance overall business performance.

How to customize Excel formulas for consultant-specific revenue streams in a Profit and Loss Statement?

To tailor Excel formulas for consultant-specific revenue streams, start by categorizing income sources clearly in your data set. Use conditional formulas like SUMIF or SUMIFS to aggregate revenues from different consulting projects or service categories. This targeted approach ensures your Profit and Loss statement reflects the unique nature of consulting income accurately.

What best practices ensure accurate expense categorization for consulting services in P&L templates?

Accurate expense categorization begins with clearly defined expense categories aligned to consulting activities, such as travel, software, and subcontractors. Utilize data validation with dropdown lists to maintain consistency in expense entries across your P&L template. Regular reviews and reconciliation help avoid misclassification and improve financial clarity for consulting services.

How can consultants automate client invoice tracking within a Profit and Loss Excel sheet?

Automate client invoice tracking by creating a dedicated sheet for invoices linked to the P&L data via lookup functions like VLOOKUP or XLOOKUP. Incorporate checkboxes or status columns to update payment stages, enabling dynamic summaries on the P&L dashboard. This not only saves time but also provides real-time visibility into outstanding client balances.

Which Excel charts best visualize profitability trends for consultancy reports?

Line charts and column charts are effective for visualizing profitability trends over time in consultancy reports. Use combination charts to compare revenue against expenses side-by-side, highlighting profit margins clearly. Adding trendlines can further help stakeholders interpret long-term financial performance with ease.

What are common P&L reporting errors consultants face and how to flag them in Excel?

Common P&L reporting errors include incorrect formula ranges, miscategorized transactions, and duplicated entries in Excel. Use conditional formatting rules to highlight unusual values or discrepancies automatically for quick identification. Employ error-checking functions and protect your data integrity by locking formula cells to prevent accidental changes.

More Statement Excel Templates