The Statement of Retained Earnings Excel Template for SaaS Companies streamlines financial tracking by clearly outlining profits retained for business growth and reinvestment. Designed specifically for SaaS models, it accommodates subscription revenue nuances and recurring expenses, enabling accurate equity analysis. This template helps SaaS companies maintain transparent financial records while facilitating strategic planning and investor reporting.

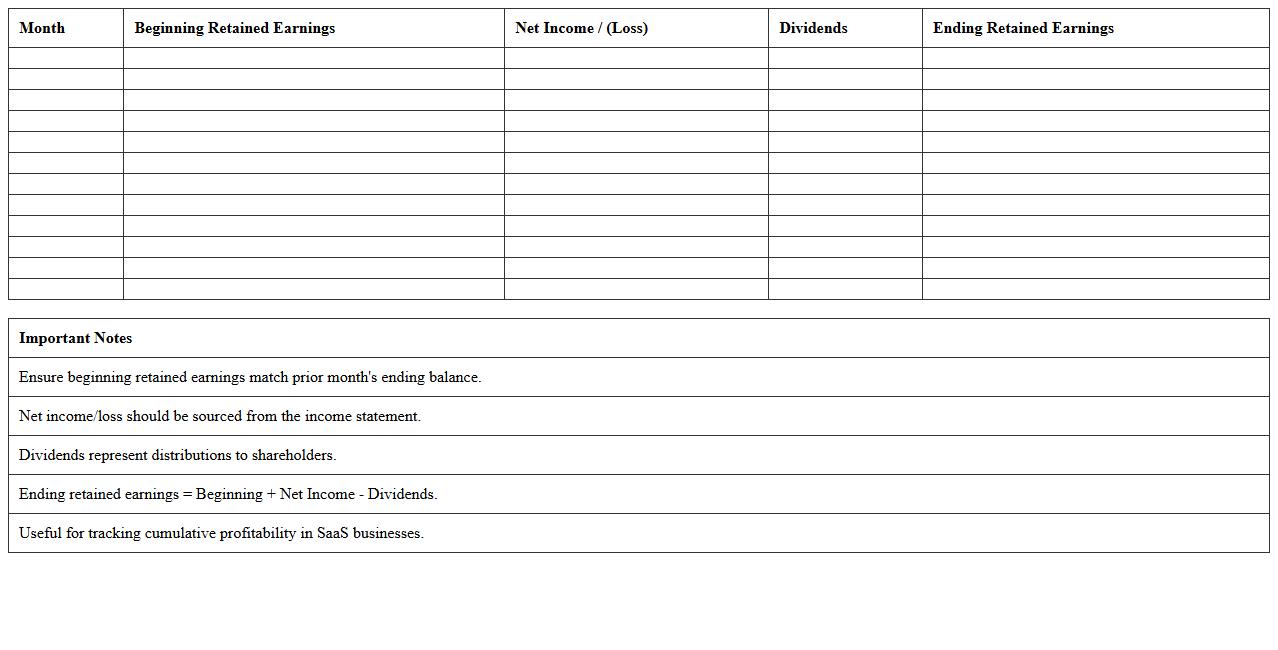

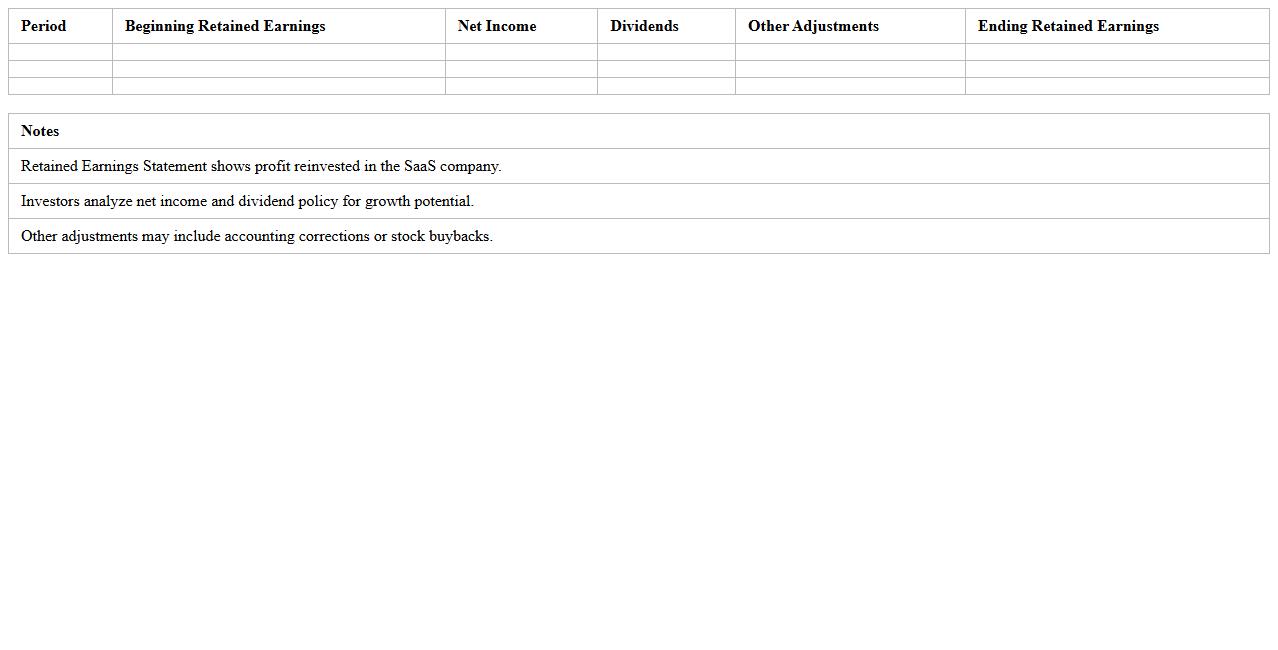

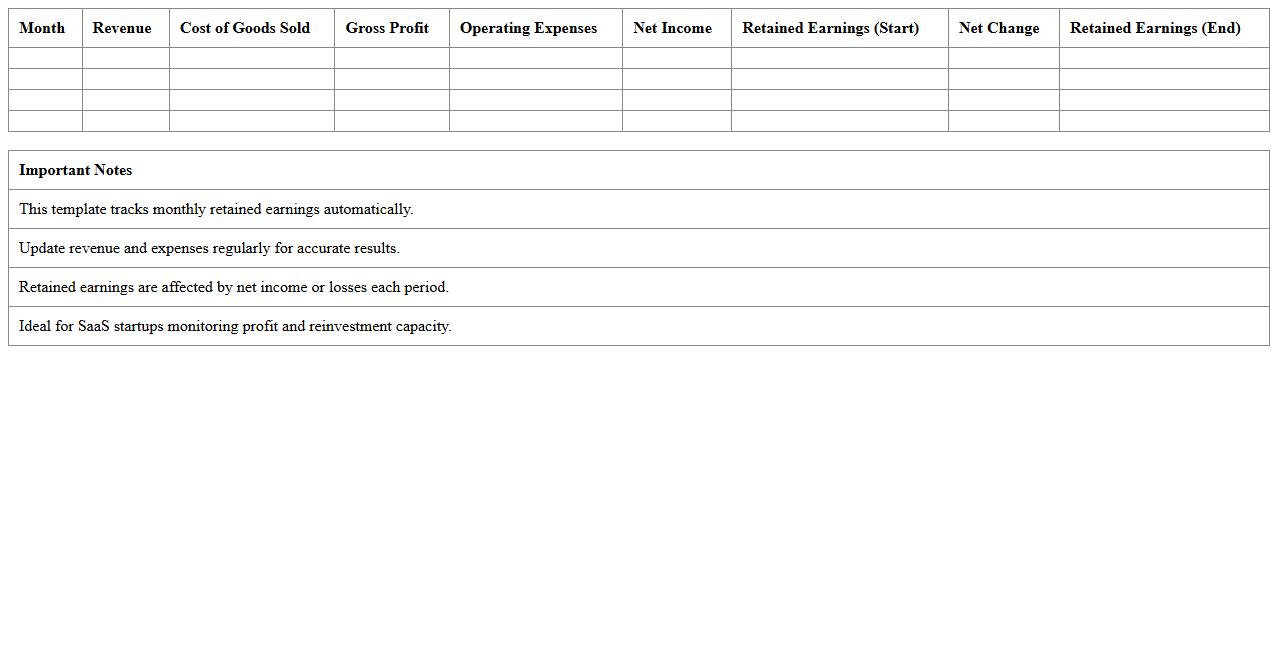

Monthly Statement of Retained Earnings Excel Template for SaaS

The

Monthly Statement of Retained Earnings Excel Template for SaaS documents tracks a company's accumulated profits and losses over time, reflecting changes in equity due to net income and dividends. This template automates calculations and organizes financial data, enabling SaaS businesses to monitor retained earnings accurately each month. It supports informed decision-making by providing clear insights into company profitability and reinvestment capacity.

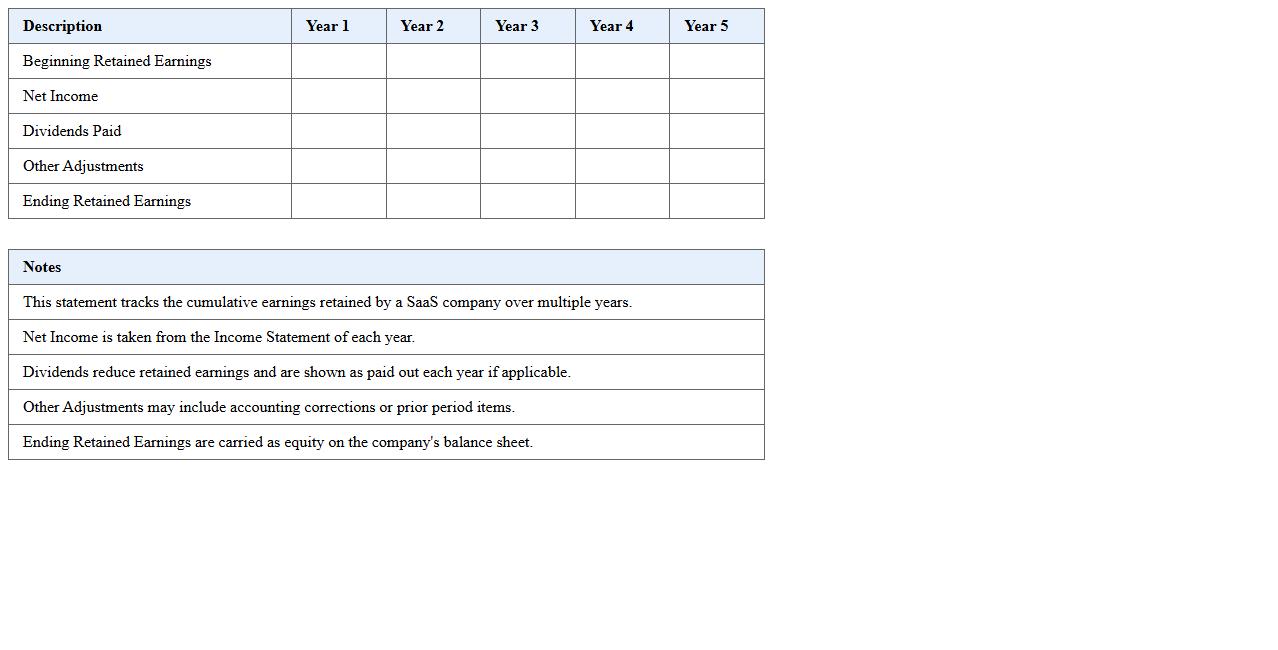

Annual Retained Earnings Tracker for SaaS Businesses

The

Annual Retained Earnings Tracker for SaaS businesses is a vital financial document that monitors the cumulative net income retained within the company after dividends are paid out each year. It provides clear insights into the company's profitability and reinvestment capability over multiple fiscal periods, facilitating strategic decisions for growth and resource allocation. This tracker helps SaaS businesses maintain financial health by accurately reflecting earnings that fuel innovation, scalability, and operational stability.

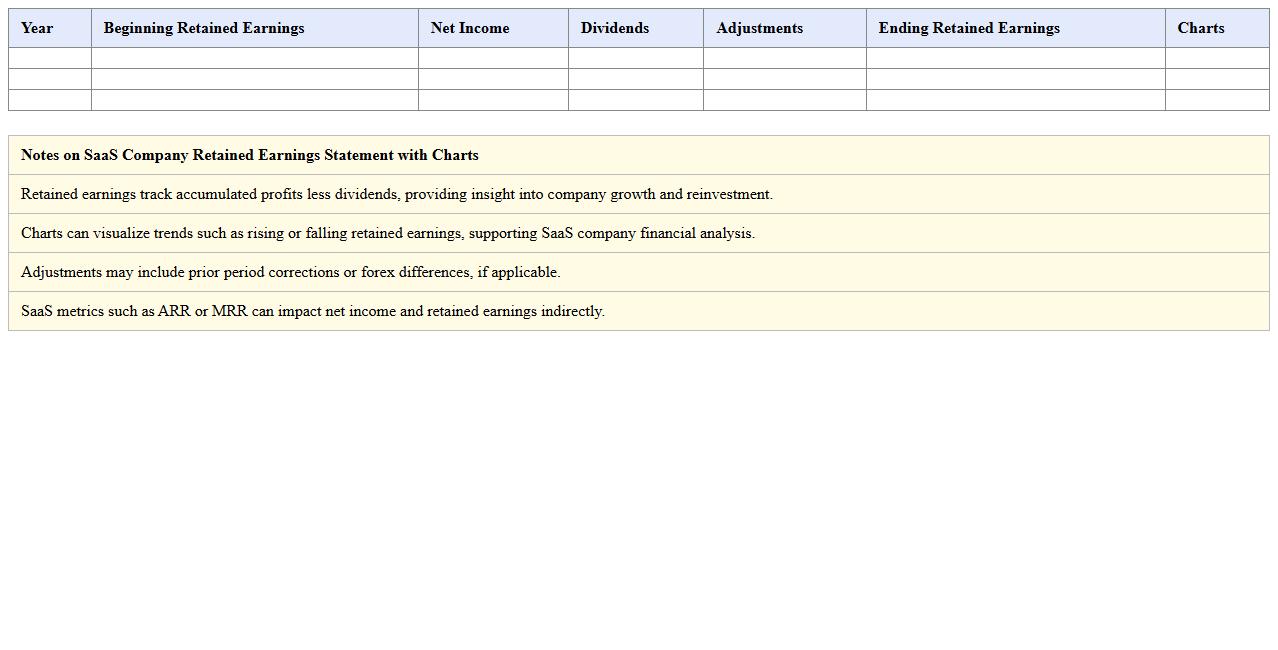

SaaS Company Retained Earnings Statement with Charts

The

SaaS Company Retained Earnings Statement with Charts document provides a detailed financial overview showing how retained earnings have changed over time, reflecting net income minus dividends paid. This statement helps investors, management, and stakeholders understand the company's profitability and reinvestment strategy by visualizing trends through insightful charts. Analyzing this document allows for informed decision-making regarding growth opportunities, dividend policies, and overall financial health in a subscription-based business model.

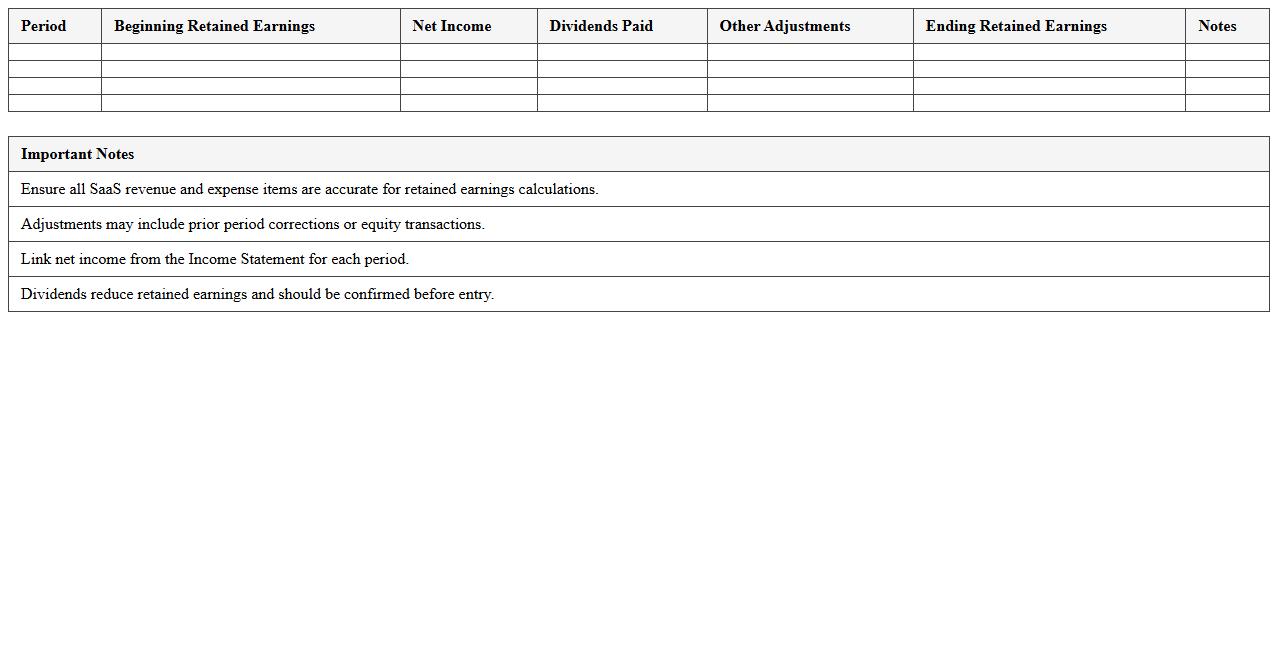

Retained Earnings Reconciliation Excel Sheet for SaaS

A

Retained Earnings Reconciliation Excel Sheet for SaaS documents the changes in retained earnings over a specific period, capturing net income, dividends, and adjustments. This tool ensures accuracy in financial reporting by reconciling beginning and ending retained earnings balances, critical for tracking profitability and reinvestment in SaaS businesses. It helps CFOs and accountants maintain transparency, support audit processes, and make informed strategic decisions based on detailed equity movements.

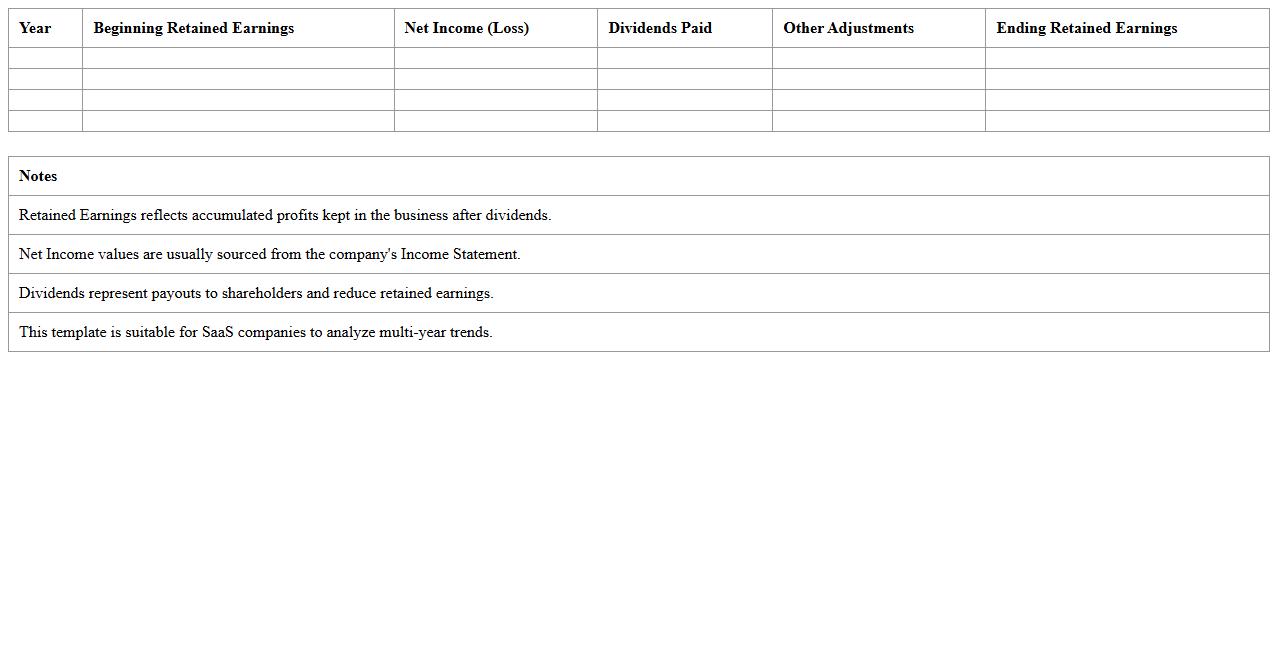

Multi-Year Retained Earnings Analysis Template – SaaS

The

Multi-Year Retained Earnings Analysis Template - SaaS document systematically tracks and evaluates retained earnings over multiple fiscal years, providing clear visibility into profit reinvestment and shareholder equity changes. It enables SaaS businesses to identify trends, assess financial health, and make informed strategic decisions regarding dividend policies and growth investments. By offering a consolidated view of retained earnings data, this template supports accurate forecasting and effective long-term financial planning.

SaaS Retained Earnings Statement Template for Investors

The

SaaS Retained Earnings Statement Template for Investors is a financial document designed to track and report the accumulated profits retained in a Software as a Service (SaaS) company over time. It helps investors understand how the company reinvests its earnings to support growth, cover expenses, and enhance shareholder value. This template provides clarity on profit allocation, aiding decision-making and fostering investor confidence in the company's financial health.

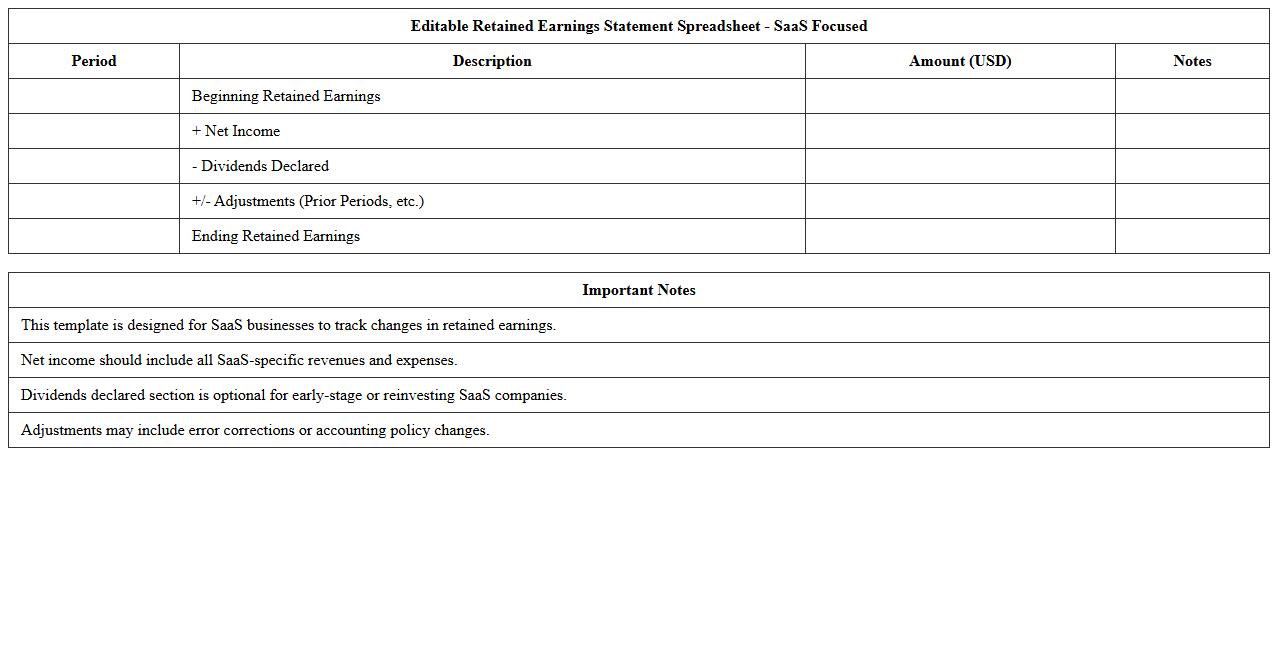

Editable Retained Earnings Statement Spreadsheet – SaaS Focused

The

Editable Retained Earnings Statement Spreadsheet tailored for SaaS businesses provides a dynamic tool to accurately track and manage retained earnings over time. This spreadsheet allows users to input and adjust financial data related to profits, dividends, and equity changes, ensuring precise reflection of a company's financial health. Its flexibility and clarity facilitate better decision-making and financial planning in subscription-based models.

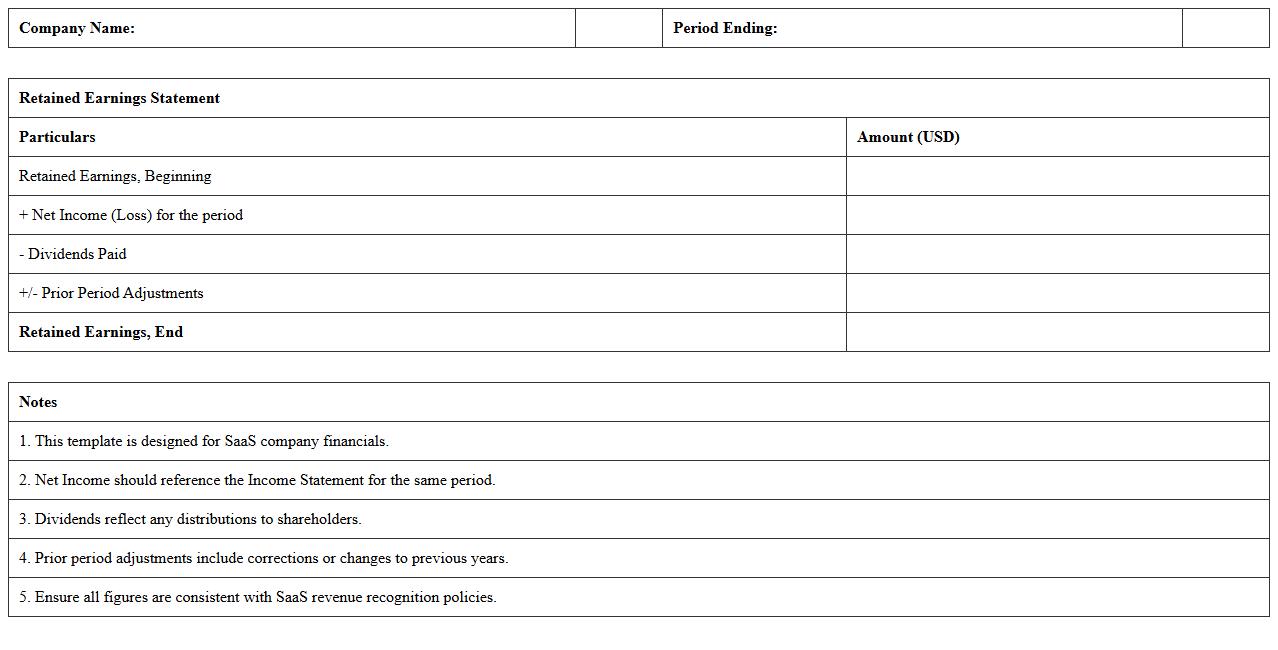

SaaS Financial Statement: Retained Earnings Excel Format

A

SaaS Financial Statement: Retained Earnings Excel Format document tracks the accumulated profits or losses of a software-as-a-service company over time, reflecting changes due to net income and dividend distributions. This format allows finance teams to easily update, analyze, and present retained earnings data with accuracy and clarity, essential for investor reporting and decision-making. Utilizing an Excel template streamlines financial record-keeping, improves transparency, and supports strategic planning for sustainable growth.

Statement of Retained Earnings with Historical Data – SaaS

The

Statement of Retained Earnings with Historical Data - SaaS document outlines the accumulated profits reinvested in a company over time, highlighting changes in retained earnings across multiple periods. It provides critical insights into financial health by tracking profit retention versus dividend distribution, enabling stakeholders to assess growth sustainability and reinvestment strategies. SaaS companies benefit from this analysis to optimize cash flow management, validate operational success, and make data-driven decisions for long-term value creation.

Automated Retained Earnings Excel Template for SaaS Startups

The

Automated Retained Earnings Excel Template for SaaS startups is a financial tool designed to efficiently track and project retained earnings over multiple periods. It automates calculations by integrating revenue, expenses, dividends, and net income data, enabling SaaS founders to maintain accurate and up-to-date financial records. This template helps optimize cash flow management, supports strategic decision-making, and ensures compliance with accounting standards specific to subscription-based business models.

How do you automate deferred revenue recognition in the Statement of Retained Earnings Excel for SaaS businesses?

To automate deferred revenue recognition, use Excel formulas that systematically allocate revenue across service periods. Implement lookup tables tied to subscription start and end dates to calculate monthly revenue recognition. Pivot these calculations to update the Statement of Retained Earnings dynamically as new transactions enter the system.

Which custom formulas track churn impact on retained earnings for SaaS models?

Custom formulas combining customer churn rates and revenue loss metrics can directly adjust retained earnings for churn impact. Use IF and SUMPRODUCT functions to isolate churned customer revenue within your dataset. Linking these insights to the Statement of Retained Earnings helps quantify churn's financial effect accurately.

How should you categorize annual vs. monthly billing adjustments in retained earnings statements?

Categorize annual and monthly billing adjustments distinctly to ensure clarity in cash flow reporting. Annual billing should be amortized across the relevant months, while monthly billing is recognized as revenue immediately or deferred within that period. Classifying these correctly avoids misstating retained earnings and improves transparency.

What's the best Excel template structure for revenue expansion (upsells) in SaaS retained earnings?

The ideal Excel template includes separate tabs for base revenue and upsell expansions, with pivot tables summarizing net impacts on retained earnings. Use dynamic ranges and data validation for consistent input of upsell transactions. This structure allows clear visibility into how upsells contribute incrementally to retained earnings growth.

How do you reconcile non-cash adjustments from customer credits in retained earnings for SaaS?

Non-cash customer credit adjustments require ledger entries reflecting their deferred impact on retained earnings. Apply Excel formulas to track credits issuance, redemption, and expiration across reporting periods. Balancing these entries ensures your Statement of Retained Earnings accurately reflects adjustments without cash flow distortions.

More Statement Excel Templates