The Consolidated Financial Statement Excel Template for Multi-Subsidiary Businesses streamlines the process of aggregating financial data across multiple entities, providing a clear and accurate overview of overall financial health. This template ensures seamless integration of individual subsidiary reports, enabling efficient consolidation and elimination of intercompany transactions. Designed for ease of use, it supports detailed financial analysis and decision-making for complex corporate structures.

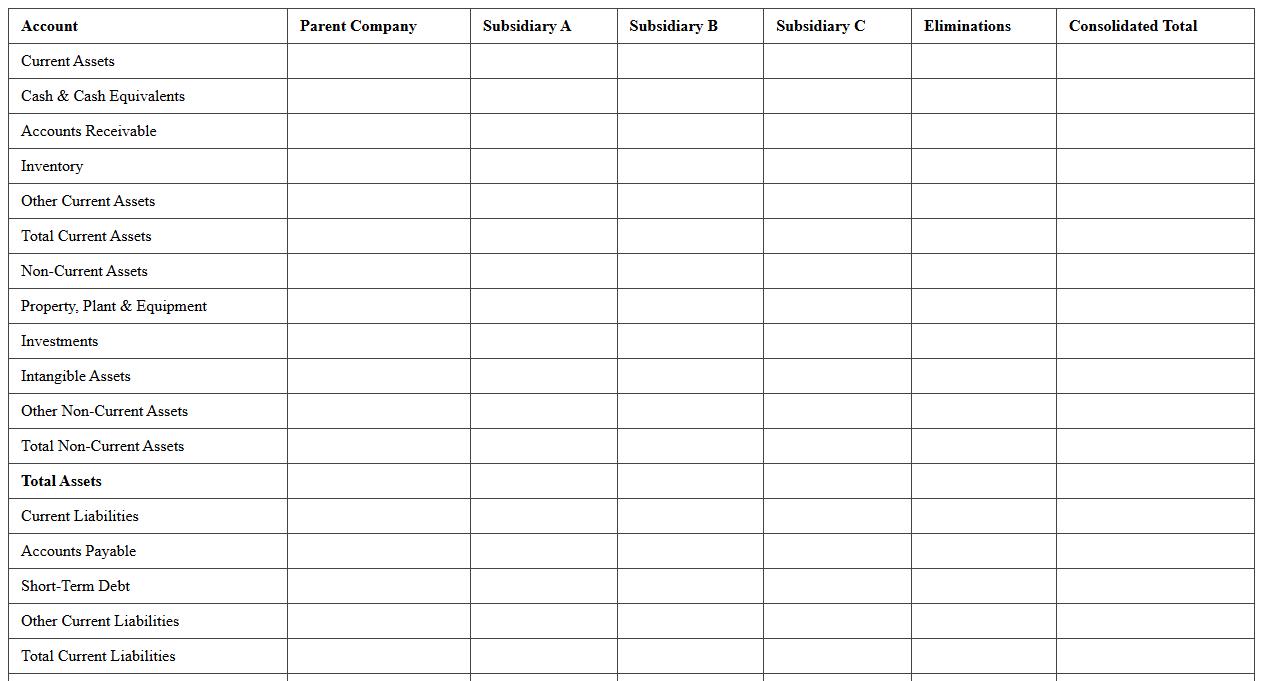

Multi-Subsidiary Consolidated Balance Sheet Excel Template

The

Multi-Subsidiary Consolidated Balance Sheet Excel Template is a financial tool designed to aggregate the balance sheets of multiple subsidiaries into a single, comprehensive report. It enables accurate consolidation of assets, liabilities, and equity across different entities, ensuring compliance with accounting standards and facilitating financial analysis. This template streamlines the consolidation process, saving time and reducing errors, making it invaluable for corporate finance teams managing complex organizational structures.

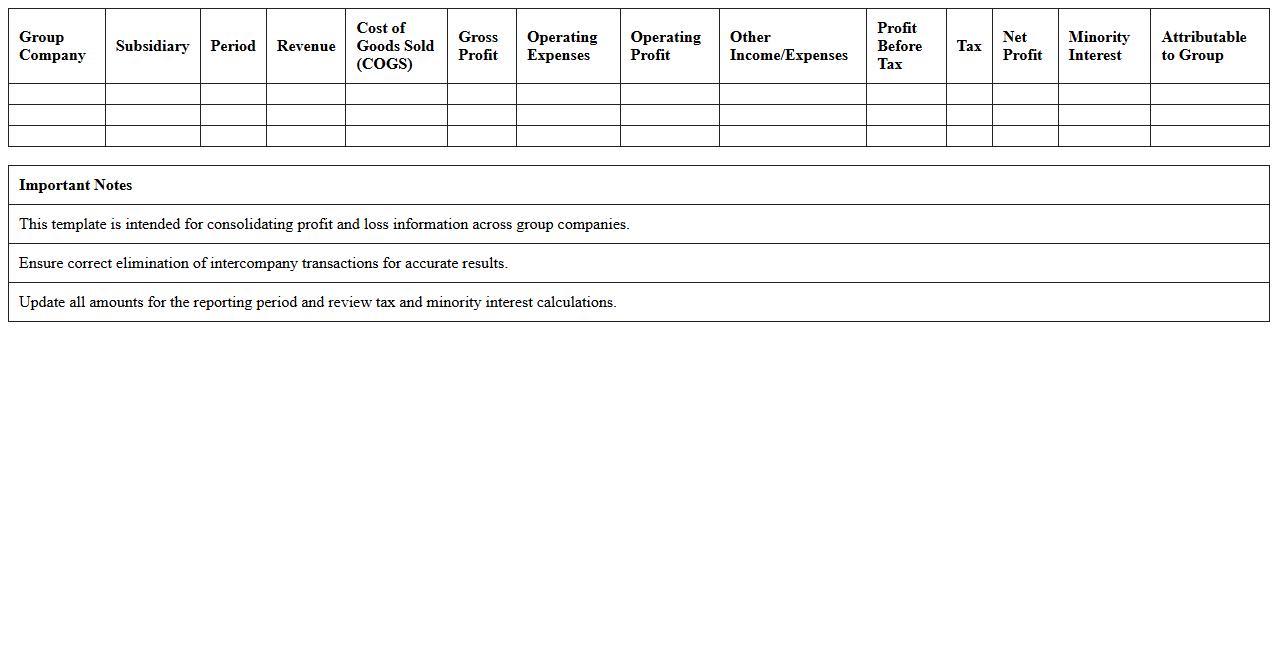

Group-Level Profit and Loss Statement Excel Template

The

Group-Level Profit and Loss Statement Excel Template document is a financial tool designed to consolidate and analyze the revenue, expenses, and net profit of multiple entities within a corporate group. It enables streamlined tracking of group-wide financial performance, allowing businesses to identify profit drivers and cost centers efficiently. This template simplifies complex data aggregation, enhances accuracy in reporting, and supports strategic decision-making by providing clear insights into the overall financial health of the group.

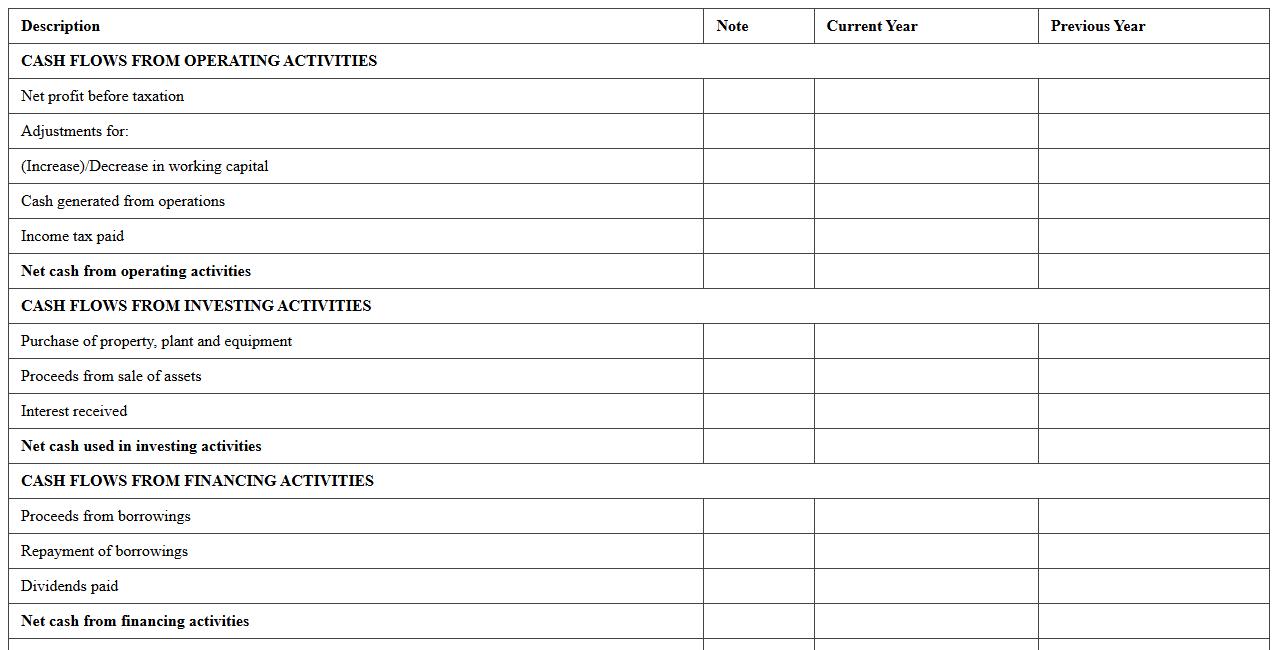

Consolidated Cash Flow Statement Excel Spreadsheet

A

Consolidated Cash Flow Statement Excel Spreadsheet document consolidates cash inflows and outflows from multiple subsidiaries into a single comprehensive report, providing a clear overview of an organization's liquidity status. It enables accurate tracking of operational, investing, and financing cash movements across all entities, facilitating improved financial analysis and decision-making. This tool is essential for financial professionals seeking to streamline cash flow reporting, enhance forecasting accuracy, and maintain regulatory compliance.

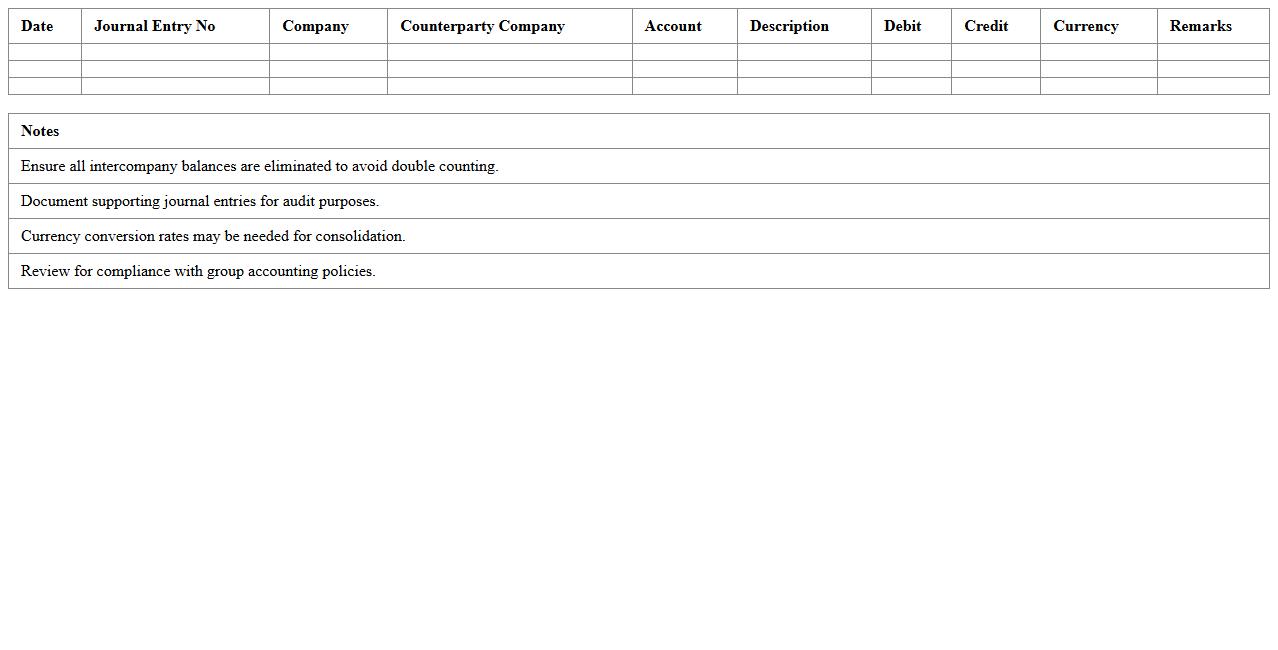

Intercompany Elimination Journal Excel Template

The

Intercompany Elimination Journal Excel Template is a structured spreadsheet designed to facilitate the consolidation process by eliminating intercompany transactions and balances between subsidiaries within a corporate group. This template helps ensure accurate financial reporting by preventing double counting of revenues, expenses, receivables, and payables that occur due to internal trading. By automating eliminations and maintaining transparent records, it streamlines the closing process and enhances compliance with accounting standards such as IFRS and GAAP.

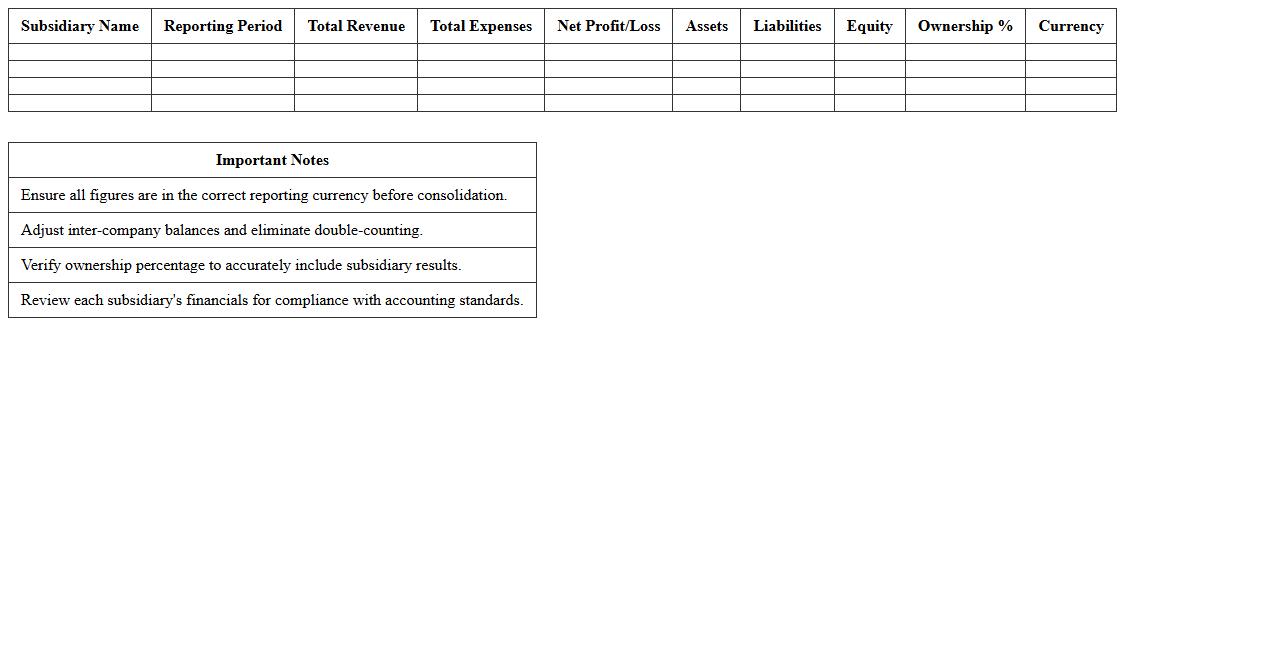

Subsidiary-wise Financial Statement Consolidation Template

The

Subsidiary-wise Financial Statement Consolidation Template is a structured spreadsheet designed to aggregate and consolidate financial data from multiple subsidiary companies into a single comprehensive report. This template facilitates accurate and efficient financial analysis by standardizing data inputs, enabling consistent comparison and integration of balance sheets, income statements, and cash flow statements across subsidiaries. It is useful for corporations to gain clear visibility into overall financial performance, streamline reporting processes, and ensure compliance with regulatory requirements.

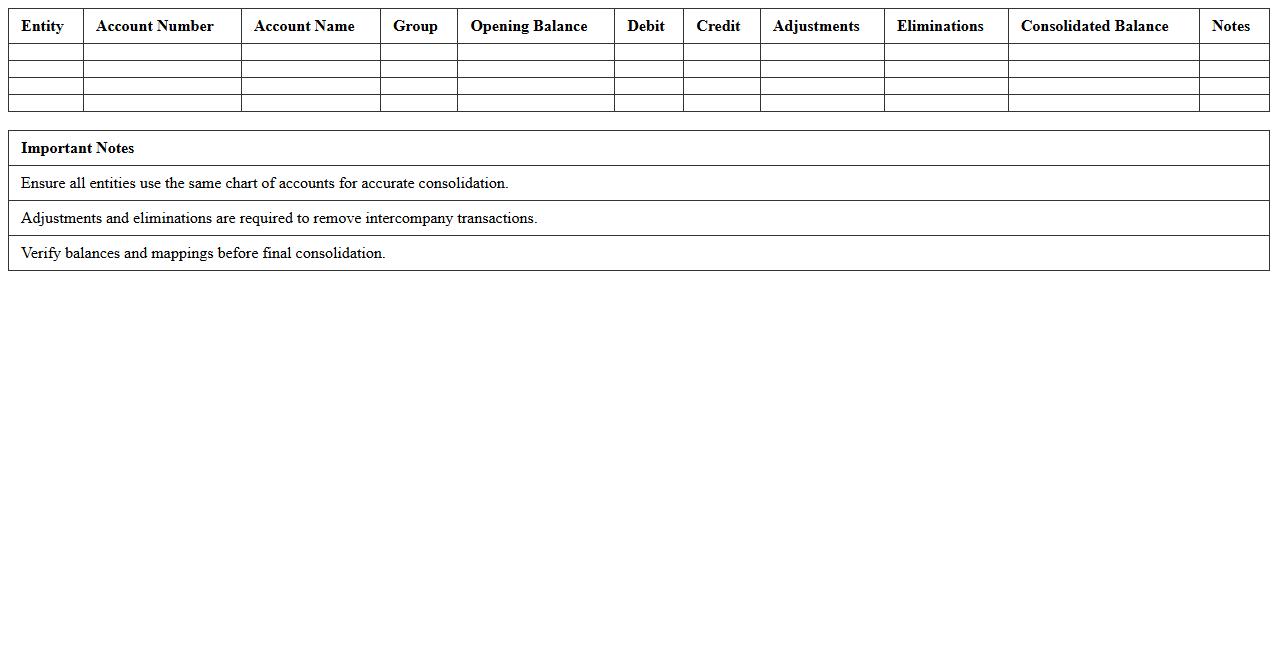

Multi-Entity Trial Balance Consolidation Excel Sheet

A

Multi-Entity Trial Balance Consolidation Excel Sheet is a financial tool designed to aggregate trial balance data from multiple subsidiaries or business units into a single, comprehensive report. It streamlines the consolidation process by automating intercompany eliminations, currency translations, and standardizing account structures across entities. This document enhances accuracy, saves time in financial closing, and provides a clear overview of overall company performance for better decision-making.

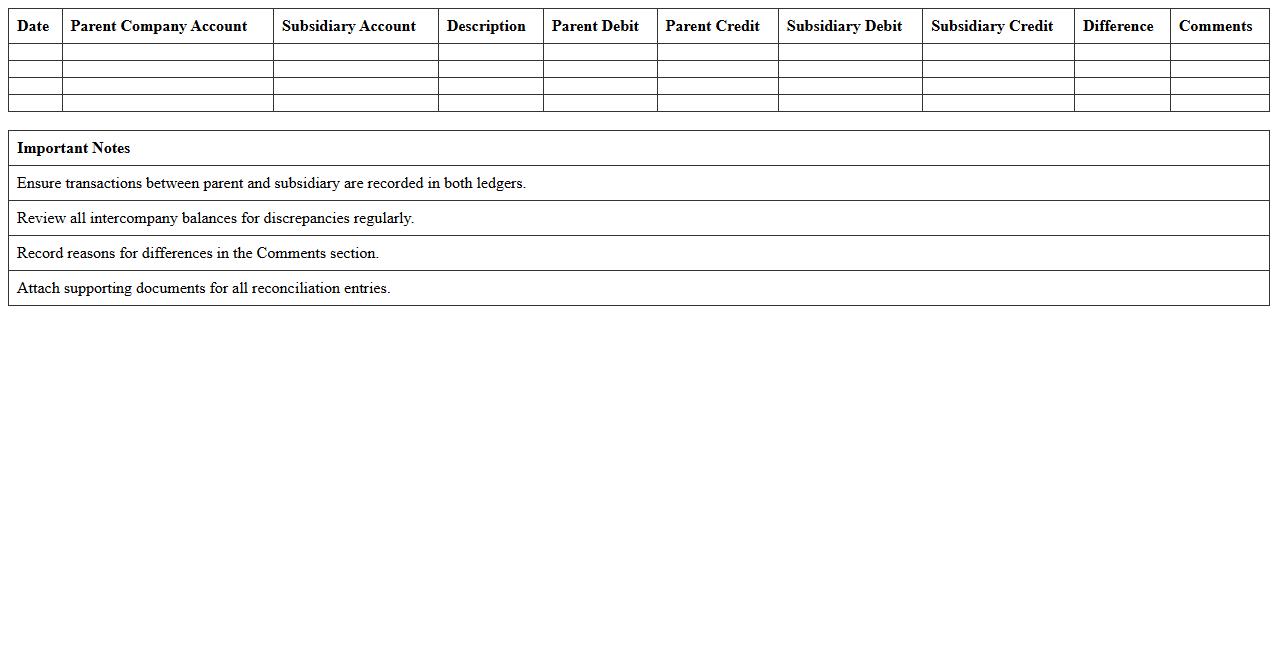

Parent-Subsidiary Reconciliation Excel Template

The

Parent-Subsidiary Reconciliation Excel Template document is designed to streamline the process of matching intercompany transactions between a parent company and its subsidiaries, ensuring accurate consolidation of financial statements. It helps identify and resolve discrepancies such as intercompany balances, eliminations, and intercompany profits or losses, minimizing errors and enhancing reporting accuracy. This template is crucial for maintaining compliance with accounting standards and improving the efficiency of the financial close process in multinational organizations.

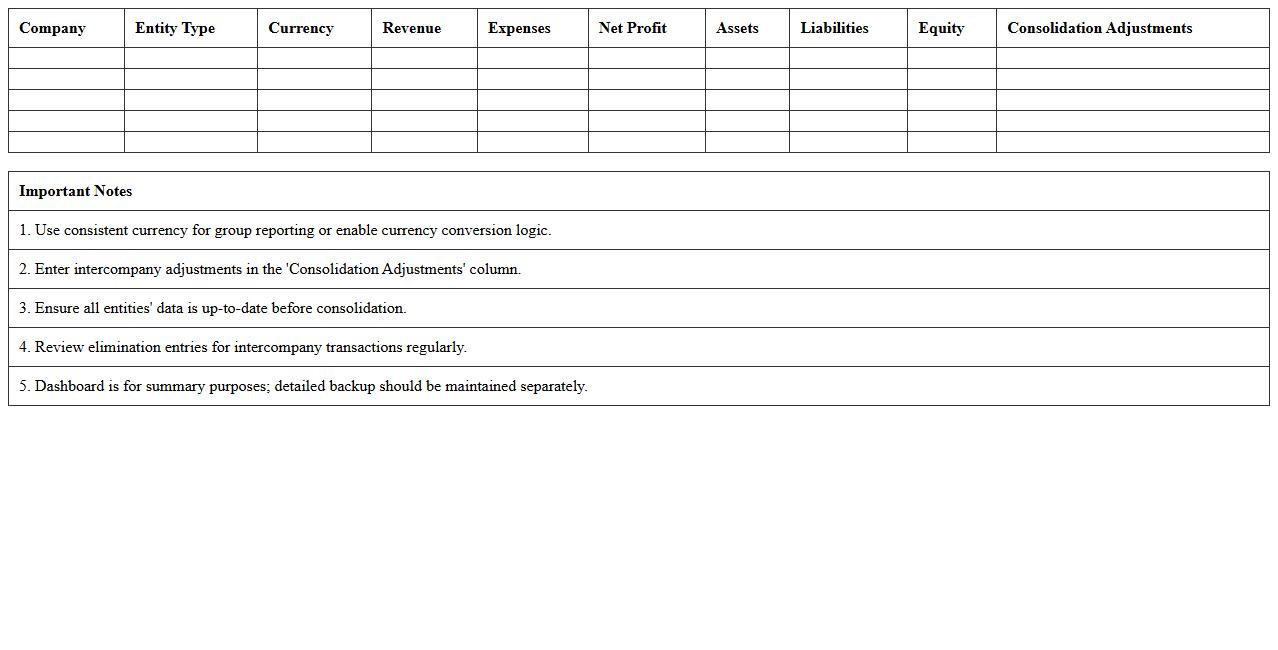

Group Consolidation Financial Dashboard Excel Template

The

Group Consolidation Financial Dashboard Excel Template is a powerful tool designed to aggregate and visualize financial data from multiple entities within a corporate group, enabling seamless tracking of consolidated financial performance. It offers real-time insights into key metrics such as revenue, expenses, profit margins, and cash flows, helping finance teams streamline reporting and ensure accuracy across subsidiaries. This template enhances decision-making by providing a centralized, automated platform for financial analysis, reducing manual errors and saving valuable time during month-end or quarterly close processes.

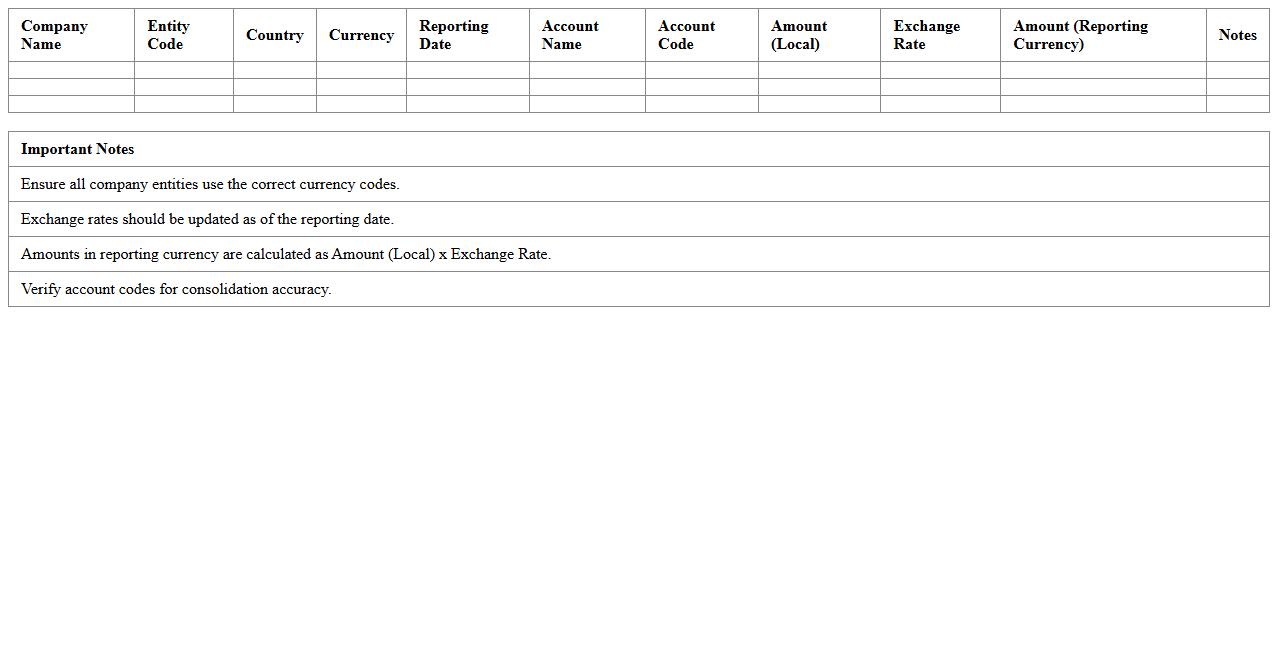

Multi-Company Foreign Currency Reporting Excel Template

The

Multi-Company Foreign Currency Reporting Excel Template is a specialized tool designed to consolidate and analyze financial data from multiple subsidiaries operating in different currencies. It streamlines currency conversion, intercompany eliminations, and reporting by providing automated calculations and standardized formats. This template enhances accuracy in financial consolidation and supports timely decision-making by delivering clear, comprehensive insights into multi-currency financial performance.

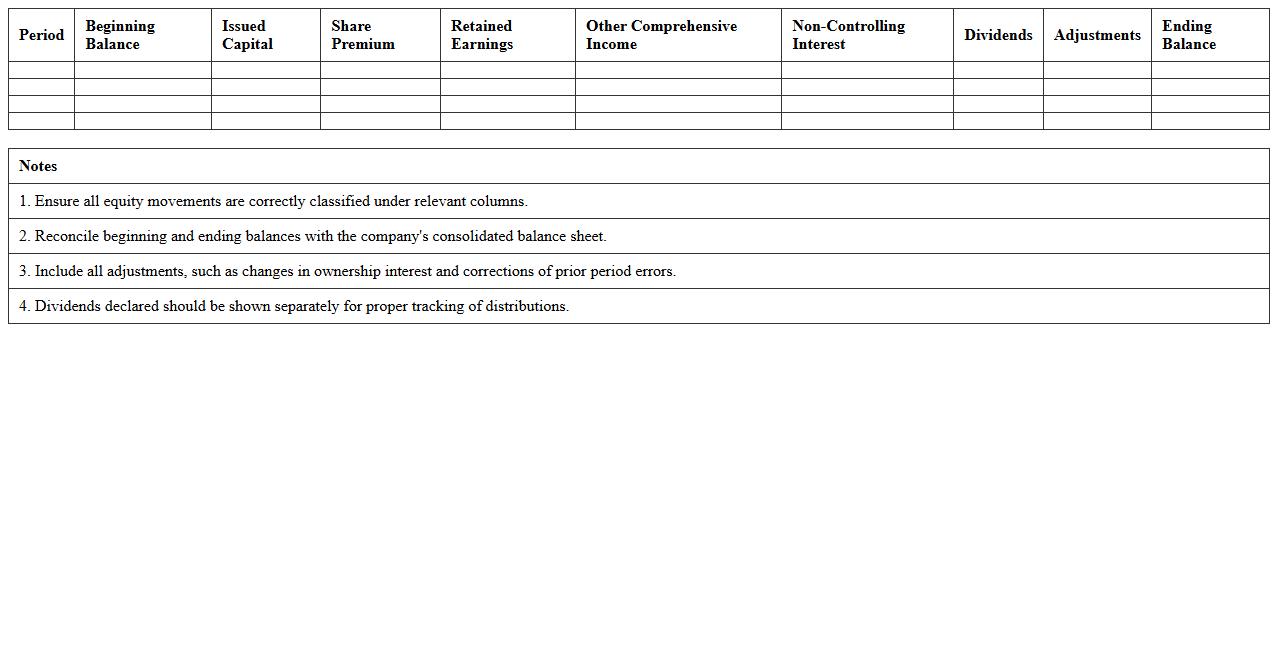

Consolidated Equity Roll-Forward Excel Spreadsheet

The

Consolidated Equity Roll-Forward Excel Spreadsheet document tracks the changes in shareholders' equity over a specific period, detailing components such as retained earnings, common stock, and additional paid-in capital. It provides a clear view of equity movements, enabling accurate financial analysis and reporting for stakeholders and management. This tool is essential for reconciling beginning and ending equity balances, ensuring transparency and compliance with accounting standards.

How does the template handle currency conversion for subsidiaries in different countries?

The template uses automated currency conversion formulas linked to real-time exchange rates to standardize financial data from subsidiaries operating in various currencies. This ensures consistent reporting by converting each subsidiary's financials into the parent company's reporting currency. Additionally, the template includes options to adjust conversion rates manually for period-specific fluctuations.

Can minority interest calculations be automated within the Excel framework?

The Excel framework incorporates built-in functions to automate minority interest calculations based on the percentage ownership and net income attributable to minority shareholders. By linking subsidiary equity accounts and earnings, the model dynamically updates minority interest values in consolidated reports. This automation reduces errors and enhances the accuracy of financial consolidation.

Does the worksheet support intercompany elimination entries across subsidiaries?

The worksheet supports comprehensive intercompany elimination entries by enabling users to input and reconcile transactions between subsidiaries. The model automatically identifies and removes intercompany balances and transactions to prevent double counting in the consolidated financial statements. This feature is crucial for maintaining the integrity of consolidated results.

Is there a process for consolidating differing fiscal year ends in the Excel model?

The Excel model includes a structured approach to consolidate differing fiscal year ends by applying adjustment entries that align subsidiary reporting periods with the parent company's fiscal year. This process involves prorating financial data or using bridging adjustments to ensure temporal consistency. Such alignment facilitates accurate and timely consolidated financial statements.

How are parent and subsidiary adjustments tracked for audit transparency?

Parent and subsidiary adjustments are meticulously tracked within the Excel model using a dedicated audit trail sheet that logs all changes, including user details and timestamps. This system enhances audit transparency by providing a clear record of modifications and rationale behind adjustments. It supports compliance requirements and strengthens internal controls during consolidation.

More Statement Excel Templates