The Audit Checklist Excel Template for Small Businesses provides a structured and easy-to-use format to track compliance and financial accuracy. It helps organizations systematically review key areas such as financial records, internal controls, and operational processes to ensure regulatory adherence. This template enhances efficiency by offering customizable fields tailored to the specific needs of small businesses.

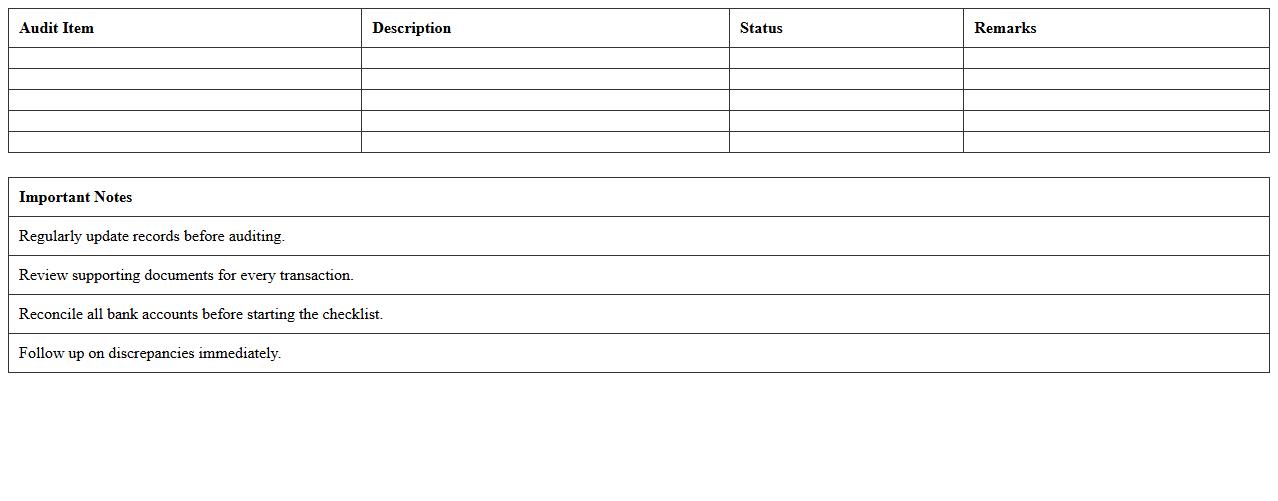

Financial Audit Checklist Excel Template for Small Businesses

The

Financial Audit Checklist Excel Template for small businesses is a structured document designed to streamline the audit process by organizing key financial data, compliance requirements, and audit tasks into an easy-to-use spreadsheet. It helps business owners and accountants systematically verify financial statements, internal controls, and regulatory adherence, ensuring accuracy and transparency. This template enhances efficiency by reducing errors, saving time during audits, and providing a clear overview of financial health for informed decision-making.

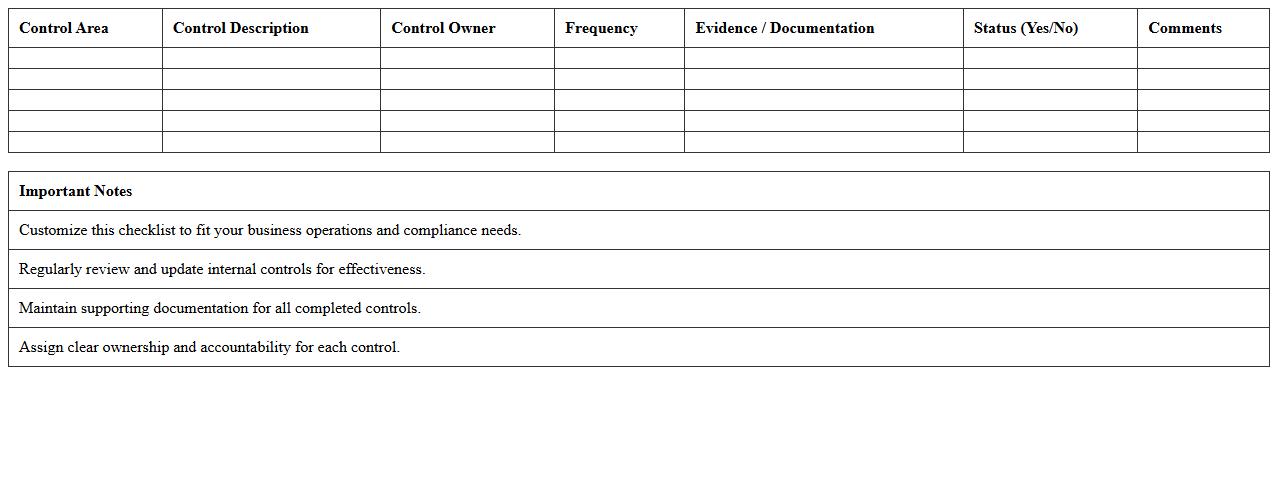

Internal Controls Audit Checklist Excel Template for Small Businesses

The

Internal Controls Audit Checklist Excel Template for small businesses is a structured tool designed to help evaluate and ensure the effectiveness of internal controls within an organization. This template simplifies the process of identifying control weaknesses, monitoring compliance, and managing risks by providing a comprehensive list of control activities categorized by business functions. Small businesses benefit from this resource by improving operational efficiency, preventing fraud, and maintaining accurate financial reporting, all within an accessible and easy-to-use Excel format.

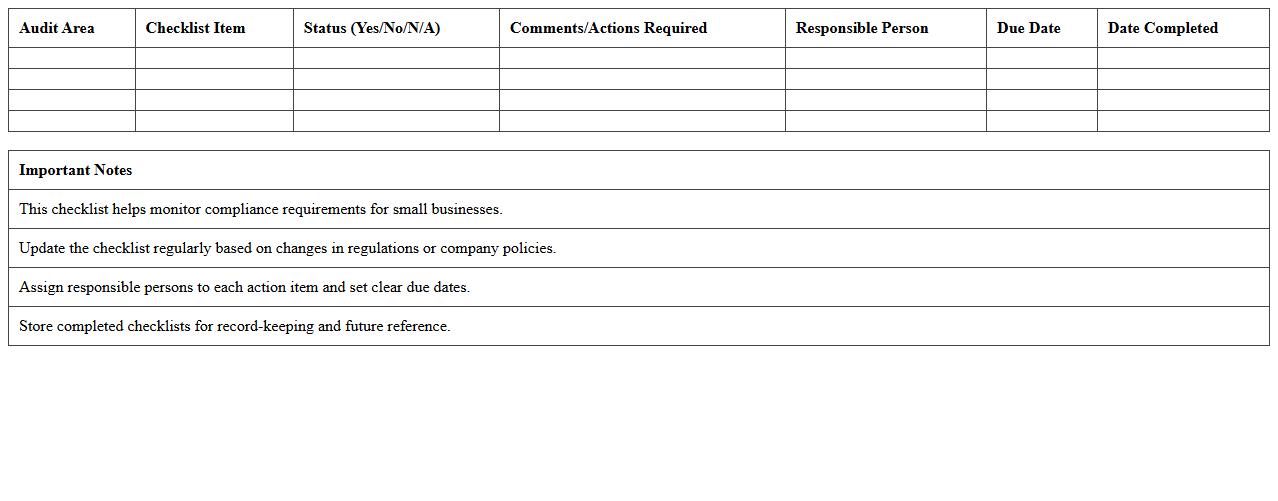

Compliance Audit Checklist Excel Template for Small Businesses

The

Compliance Audit Checklist Excel Template for small businesses is a structured document designed to systematically verify adherence to industry regulations and internal policies. It streamlines the auditing process by organizing requirements, tracking completion status, and highlighting areas that need corrective action. This template helps businesses maintain regulatory compliance, reduce legal risks, and improve operational efficiency through consistent monitoring.

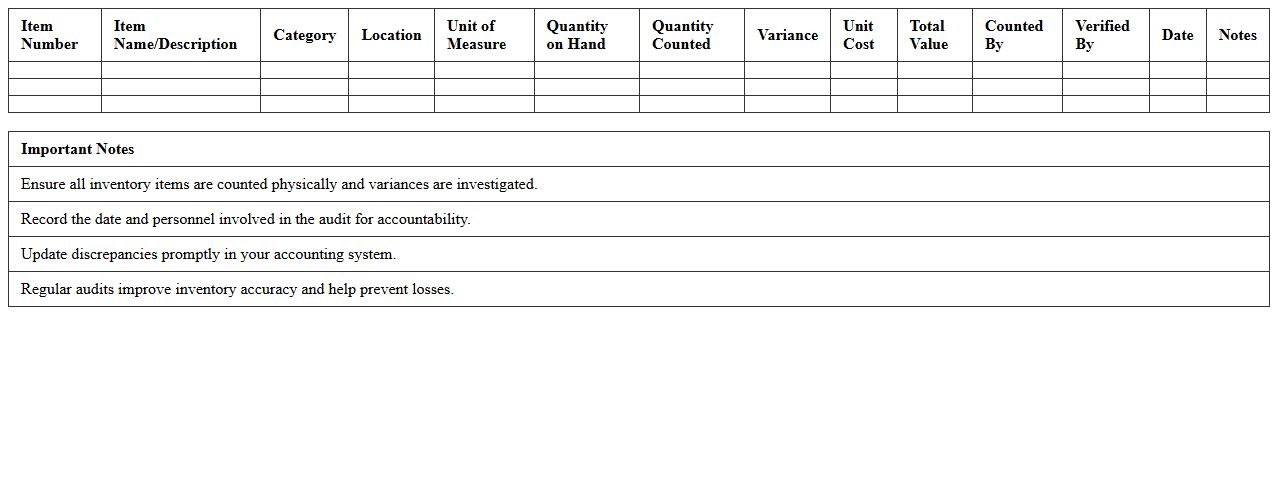

Inventory Audit Checklist Excel Template for Small Businesses

The

Inventory Audit Checklist Excel Template for small businesses is a structured document designed to systematically track and verify stock levels, product conditions, and discrepancies during inventory audits. This template streamlines the auditing process by providing clear sections for item descriptions, quantities, audit dates, and notes, ensuring accuracy and accountability in inventory management. Utilizing this tool helps small business owners prevent stock loss, improve order accuracy, and maintain timely restocking strategies, leading to enhanced operational efficiency.

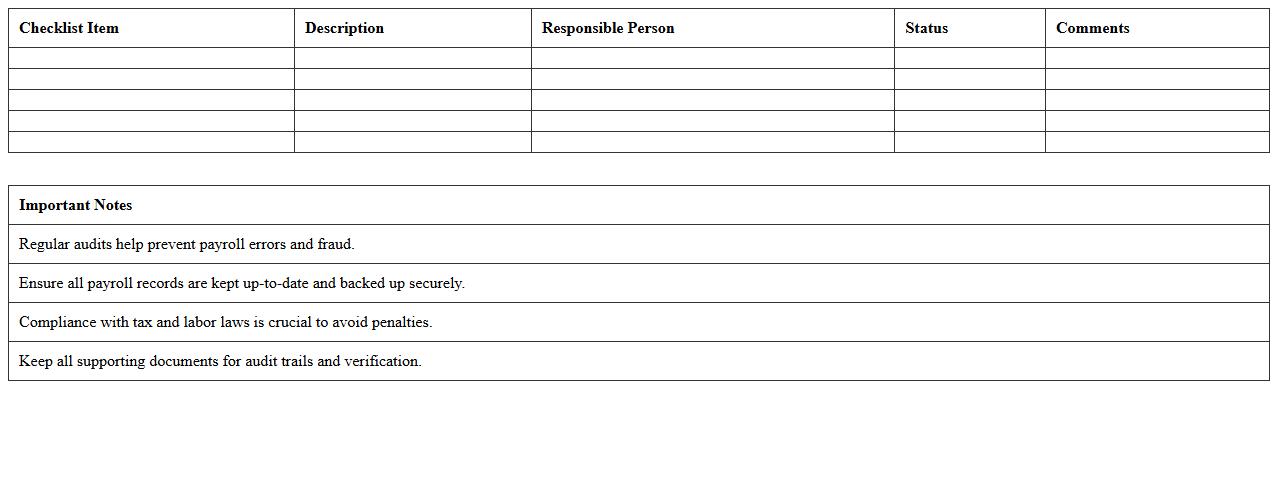

Payroll Audit Checklist Excel Template for Small Businesses

The

Payroll Audit Checklist Excel Template for small businesses is a structured tool designed to systematically verify payroll accuracy and compliance with tax regulations. It helps identify discrepancies in employee wages, tax withholdings, and benefits, ensuring payroll processes adhere to legal standards and reduce financial risks. Utilizing this template streamlines payroll audits, saves time, and enhances accountability within the organization.

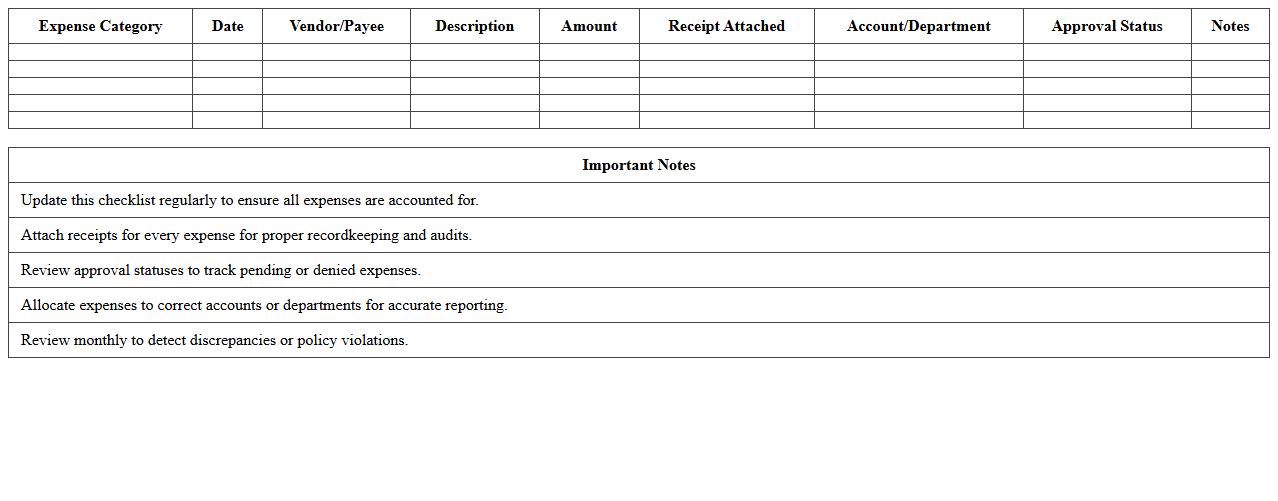

Expense Audit Checklist Excel Template for Small Businesses

The

Expense Audit Checklist Excel Template for small businesses is a structured document designed to systematically review and verify all business-related expenditures. It helps identify discrepancies, prevent fraud, and ensures that all expenses comply with company policies and budget allocations. Utilizing this template increases financial accuracy and supports effective cost management for small business owners.

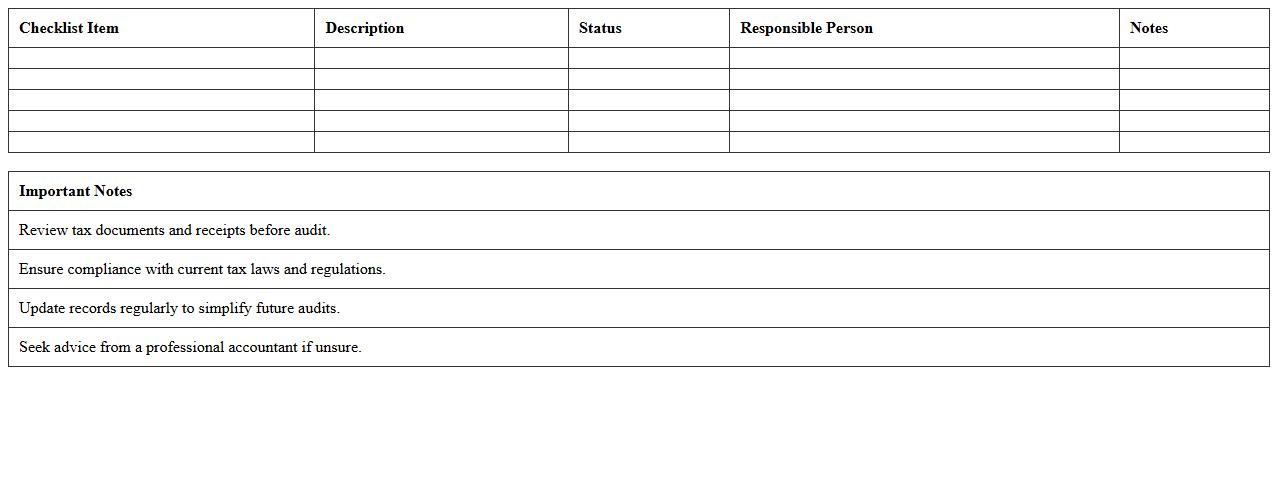

Tax Audit Checklist Excel Template for Small Businesses

The

Tax Audit Checklist Excel Template for Small Businesses is a structured document designed to organize and track essential tax audit requirements and records efficiently. It helps small businesses ensure compliance by systematically listing key audit items such as financial statements, tax returns, and supporting documents, reducing the risk of errors or omissions. This template promotes accuracy and preparedness, making the tax audit process more manageable and less time-consuming for business owners.

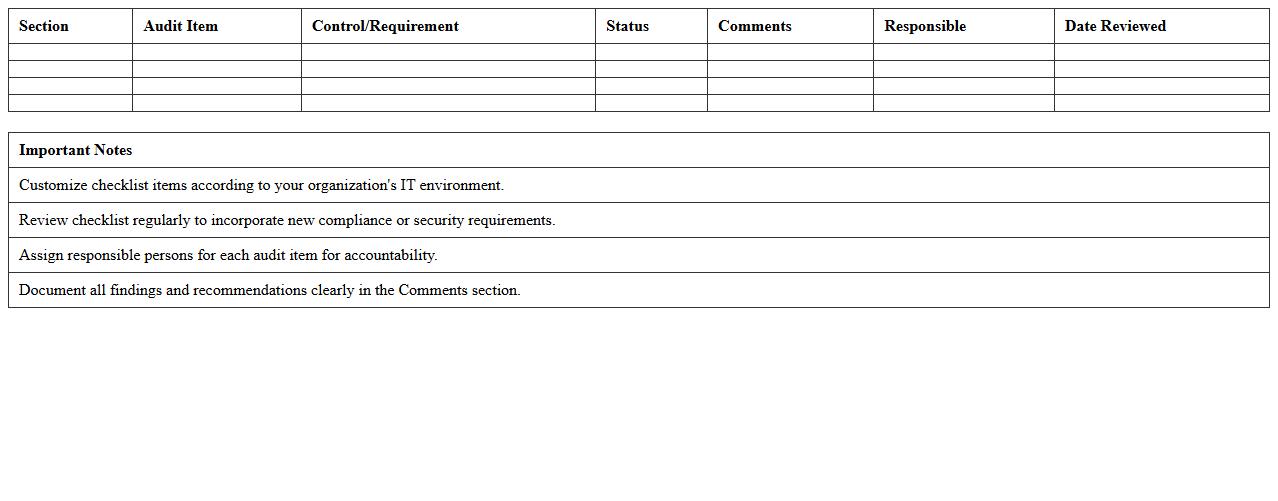

IT Systems Audit Checklist Excel Template for Small Businesses

The

IT Systems Audit Checklist Excel Template for small businesses is a structured tool designed to evaluate the security, compliance, and efficiency of IT infrastructure. It streamlines the audit process by organizing key checkpoints such as software updates, access controls, data backup procedures, and network security into an easy-to-follow format. This template helps small businesses identify vulnerabilities, ensure regulatory compliance, and optimize IT operations without requiring extensive technical expertise.

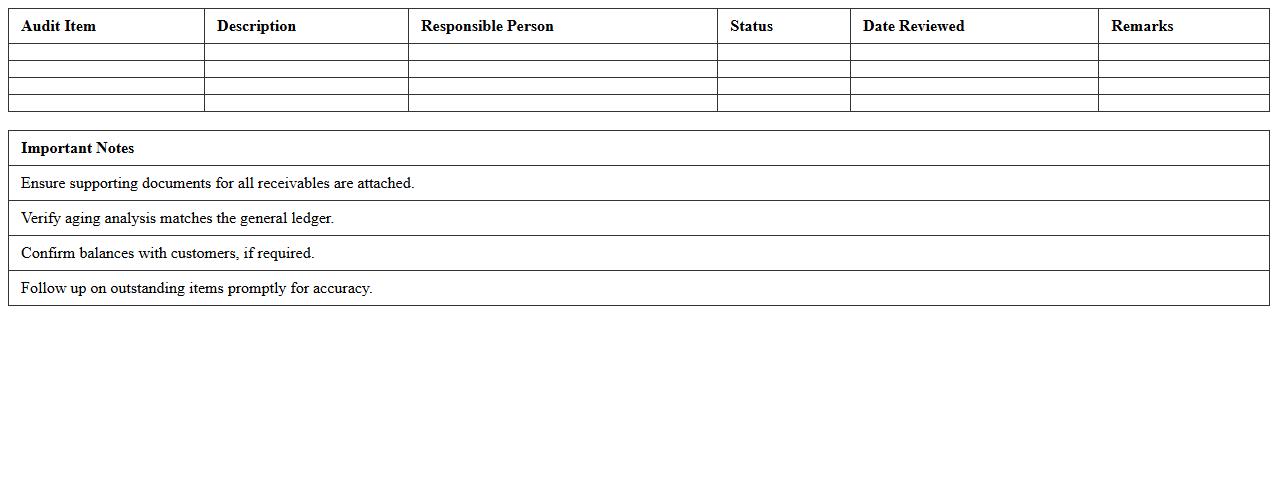

Accounts Receivable Audit Checklist Excel Template for Small Businesses

The

Accounts Receivable Audit Checklist Excel Template for small businesses is a structured tool designed to systematically review and verify outstanding invoices, payment records, and customer balances. It helps ensure accuracy in financial reporting, detect discrepancies, and improve cash flow management by identifying overdue accounts efficiently. Small businesses benefit from this template by streamlining their audit processes and maintaining healthy accounts receivable practices.

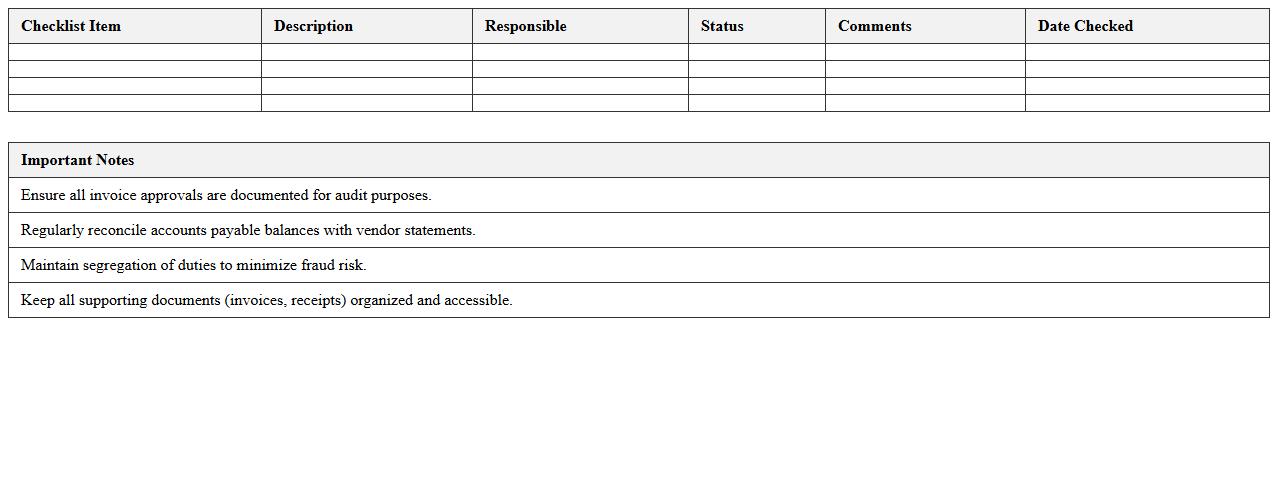

Accounts Payable Audit Checklist Excel Template for Small Businesses

The

Accounts Payable Audit Checklist Excel Template for small businesses is a structured document designed to streamline the process of verifying and managing supplier invoices, payments, and expense records. It helps identify discrepancies, prevent fraud, and ensure compliance with internal financial controls by providing a clear, itemized framework for auditing. This tool enhances accuracy and efficiency in accounts payable management, ultimately saving time and reducing the risk of costly errors.

What key financial controls should an Audit Checklist Excel include for small businesses?

An effective Audit Checklist Excel for small businesses must incorporate key financial controls such as cash management, expense tracking, and revenue recognition. These controls help ensure accurate financial reporting and safeguard assets from fraud or error. Including sections for approval processes, reconciliation procedures, and segregation of duties enhances overall financial integrity.

How can Excel formulas automate risk assessments in a small business audit checklist?

Excel formulas can automate risk assessments by calculating risk scores based on predefined criteria such as transaction volume, variance thresholds, and compliance status. Using functions like IF, VLOOKUP, and conditional logic, the checklist can identify high-risk areas and flag potential issues automatically. This automation speeds up the audit process and improves accuracy by minimizing human error.

Which compliance items are essential for a small business Audit Checklist Excel?

Essential compliance items include tax filings, regulatory licenses, employee payroll deductions, and industry-specific standards. The checklist should verify documentation and deadlines to ensure the business meets legal requirements consistently. Including reminders and audit trails in Excel helps maintain up-to-date compliance records efficiently.

What templates offer segregation of duties tracking in an audit checklist spreadsheet?

Templates designed for segregation of duties tracking typically include roles and permissions matrices that clarify individual responsibilities within financial processes. These templates provide visual dashboards or lists linking tasks with assigned personnel to ensure no single person controls multiple critical functions. Using such templates enhances internal controls and reduces fraud risks.

How can conditional formatting in Excel highlight audit discrepancies for small businesses?

Conditional formatting in Excel can highlight audit discrepancies by automatically changing cell colors based on error thresholds, duplicate entries, or missing information. This visual cue makes it easier to spot anomalies without manually scanning data. By setting rules for outliers and inconsistencies, auditors can quickly focus on areas needing attention.

More Audit Excel Templates