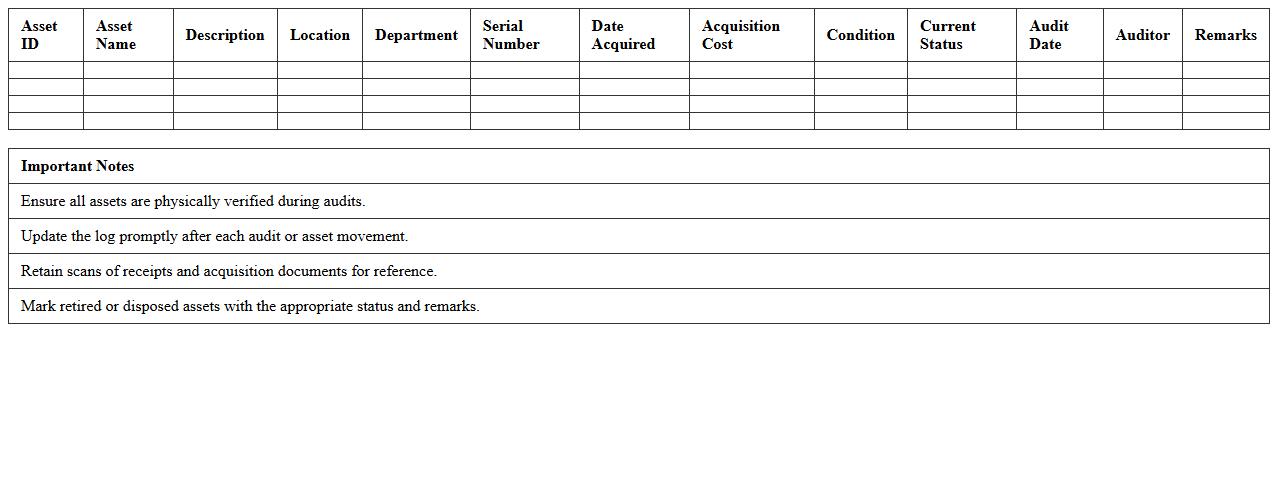

School Fixed Asset Inventory Audit Log

The

School Fixed Asset Inventory Audit Log document systematically records all transactions related to the acquisition, transfer, maintenance, and disposal of fixed assets within a school. This log enhances accountability by providing a transparent trail for auditors and administrators to verify asset existence, condition, and compliance with institutional policies. Maintaining an accurate audit log supports efficient asset management, reduces the risk of loss or misplacement, and aids in financial reporting and budget planning.

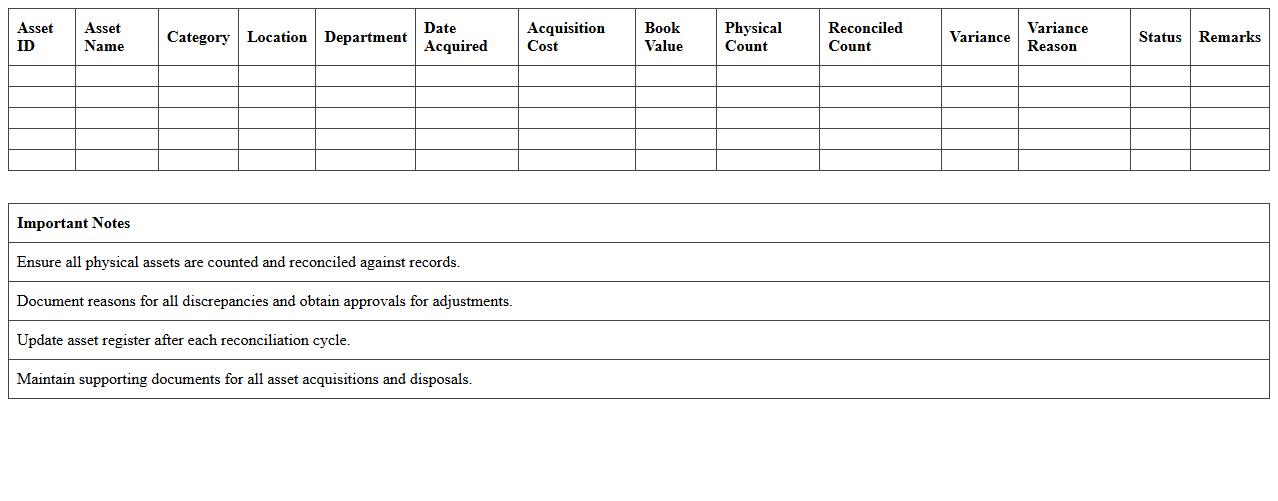

Educational Institution Asset Reconciliation Sheet

An

Educational Institution Asset Reconciliation Sheet is a detailed document used to match the physical assets of a school or university against its recorded inventory, ensuring accuracy in asset management. This sheet helps identify discrepancies, track asset movement, and maintain up-to-date records for financial auditing and operational efficiency. Regular use of this document supports accountability, prevents asset loss, and aids in strategic planning for resource allocation within educational institutions.

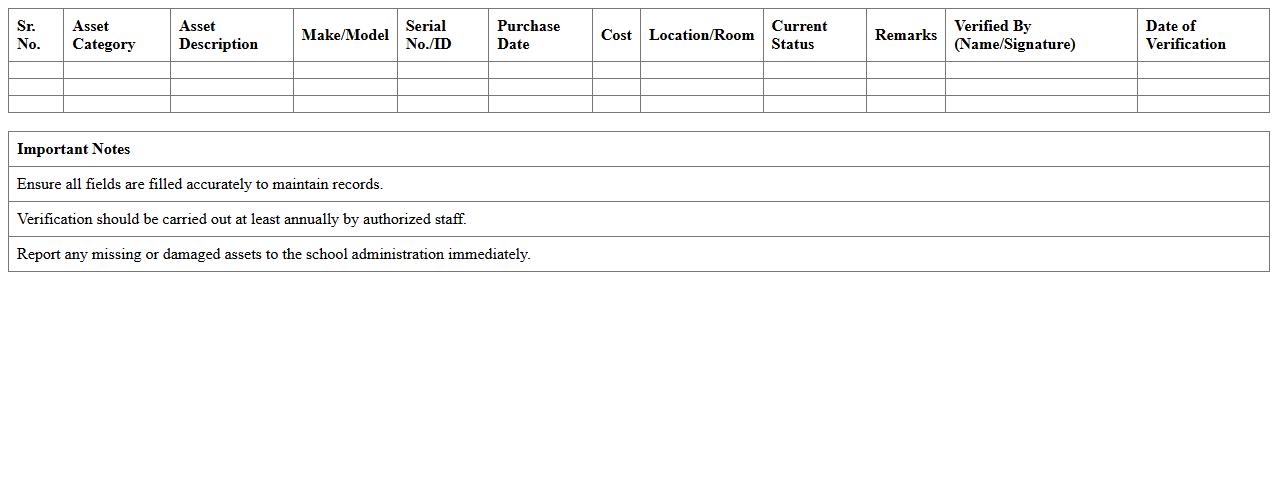

School Property Asset Verification Register

The

School Property Asset Verification Register is a comprehensive document that records and tracks all physical assets owned by a school, including furniture, equipment, and technology. It helps ensure accurate inventory management, accountability, and transparency in the use of school resources. By regularly updating this register, schools can prevent asset loss, plan maintenance, and support financial audits effectively.

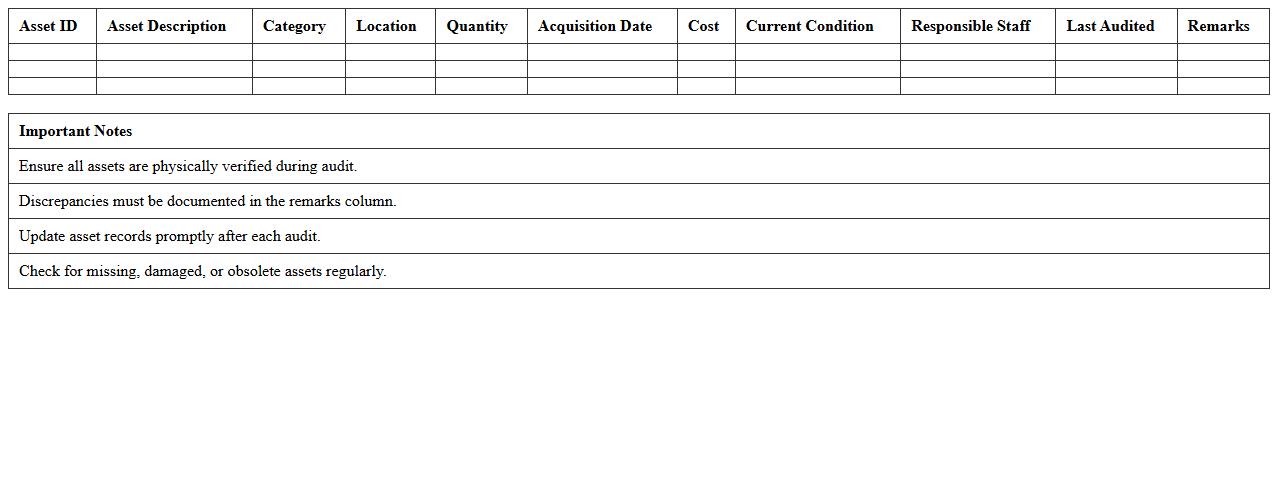

Fixed Asset Checklist for School Audits

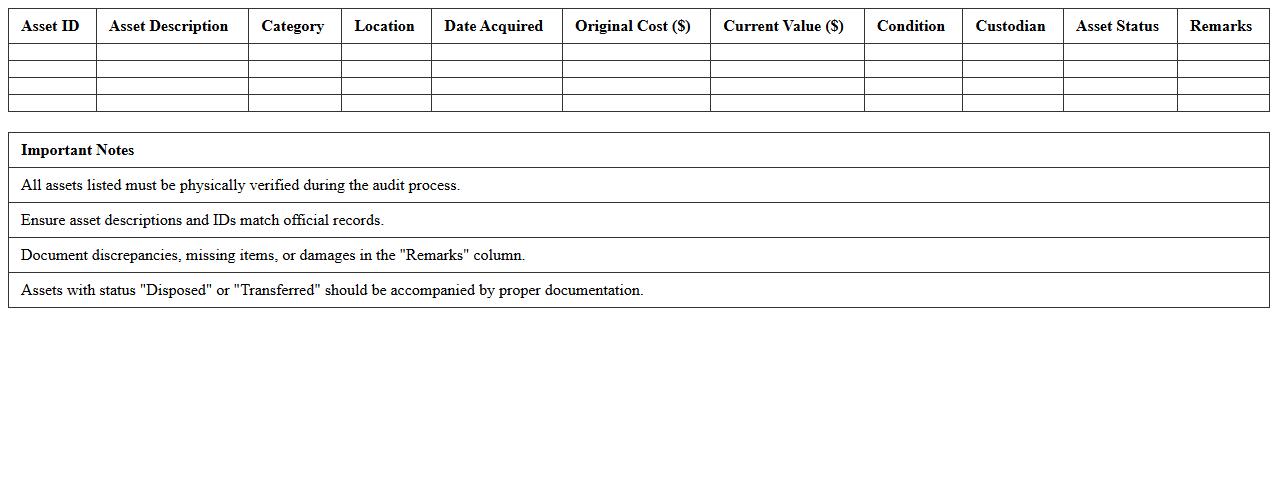

A

Fixed Asset Checklist for School Audits is a comprehensive document used to systematically verify and account for all physical assets owned by a school, such as furniture, computers, and equipment. It ensures accurate tracking, prevents financial discrepancies, and supports compliance with accounting standards and regulatory requirements. This checklist is essential for maintaining transparent asset management and facilitating efficient audit processes within educational institutions.

Classroom Equipment Audit Tracker

A

Classroom Equipment Audit Tracker document systematically records and monitors all educational tools and technology within a classroom setting, ensuring accurate inventory management. It helps identify missing, damaged, or obsolete equipment, enabling timely repairs or replacements to maintain optimal learning environments. This tracker supports budget planning and resource allocation by providing detailed data on equipment usage and condition.

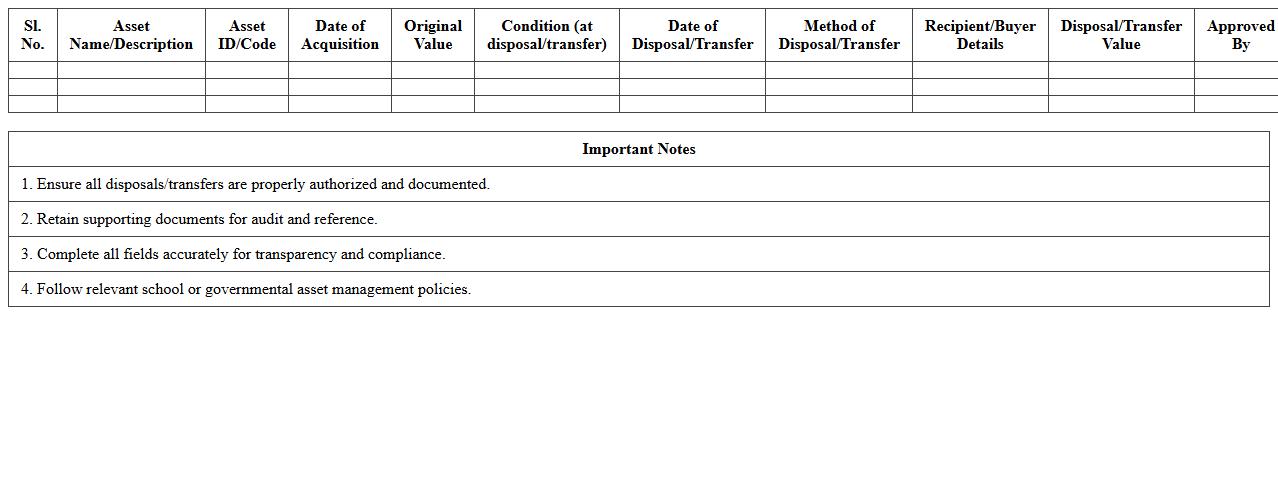

School Asset Disposal and Transfer Record

The

School Asset Disposal and Transfer Record document tracks the movement and removal of school property, ensuring accountability and proper management of resources. It helps prevent asset misplacement, supports financial audits, and maintains an accurate inventory for decision-making. Using this record enhances transparency in handling school assets and facilitates compliance with regulatory requirements.

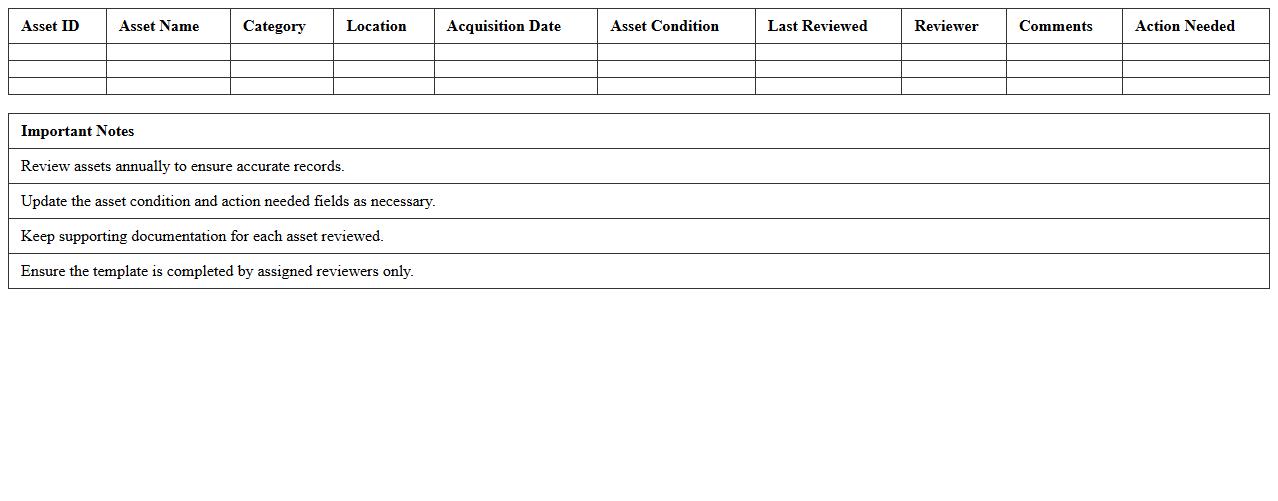

Annual School Fixed Asset Review Template

The

Annual School Fixed Asset Review Template document systematically tracks and evaluates the condition, value, and location of school fixed assets such as computers, furniture, and lab equipment. It ensures accuracy in financial records, supports budgeting decisions, and aids in compliance with auditing standards. Using this template minimizes asset mismanagement and optimizes resource allocation for school administration.

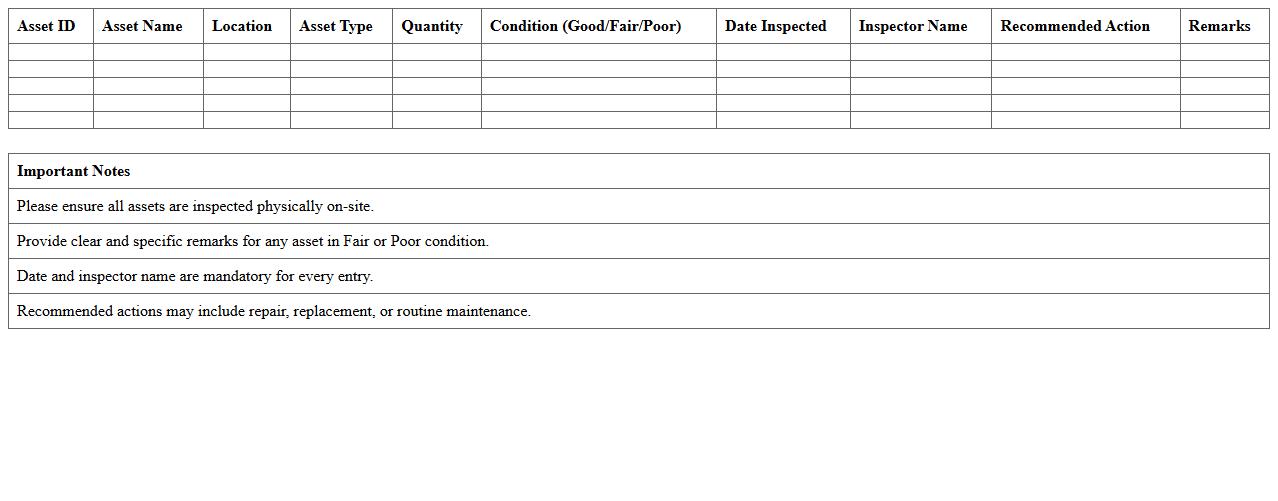

School Asset Condition Assessment Form

The

School Asset Condition Assessment Form is a detailed document used to evaluate the physical state of school infrastructure, equipment, and resources. It helps in identifying maintenance needs, potential safety hazards, and prioritizing repairs or upgrades for optimal functionality. This form is essential for effective asset management, ensuring a safe and conducive learning environment while optimizing budget allocation.

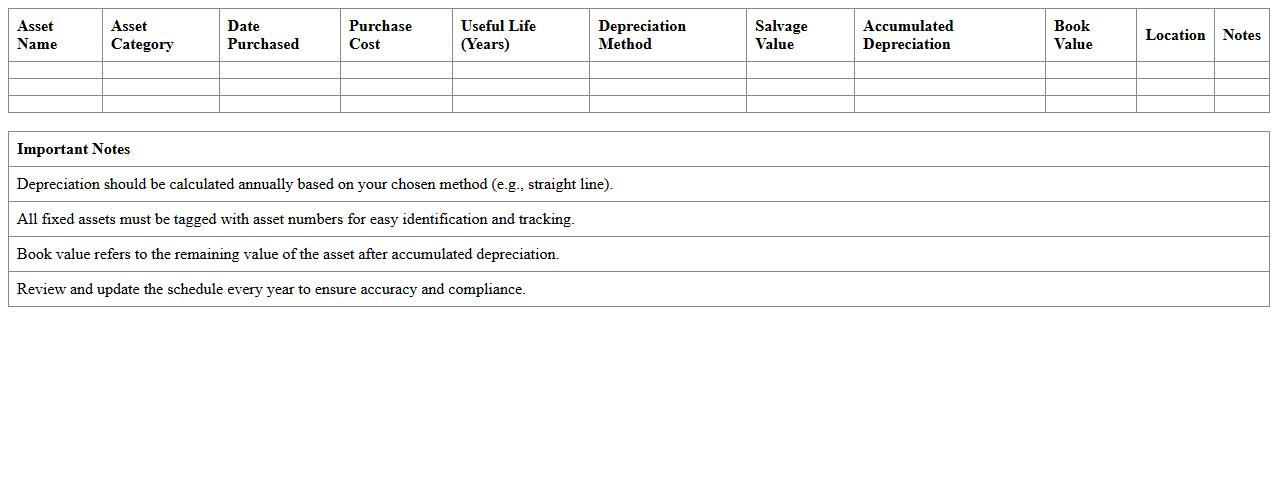

Depreciation Schedule for School Fixed Assets

A

Depreciation Schedule for School Fixed Assets document itemizes the annual reduction in value of school-owned property such as computers, furniture, and vehicles. It provides a systematic way to allocate the asset's cost over its useful life, helping in accurate financial reporting and budgeting. This schedule facilitates informed decision-making for asset replacement and maintenance, ensuring optimal resource management in educational institutions.

School Capital Assets Audit Summary Sheet

The

School Capital Assets Audit Summary Sheet is a detailed document used to record and review the condition, value, and location of a school's fixed assets such as buildings, equipment, and technology. It ensures accurate financial reporting and compliance with auditing standards by providing a clear summary of asset status during audits. This document is essential for effective asset management, helping schools track depreciation, plan maintenance, and allocate resources efficiently.

How do schools customize Fixed Asset Audit Excel templates for unique asset categories?

Schools tailor Fixed Asset Audit Excel templates by adding specific columns for unique asset categories like technology or lab equipment. They adjust dropdown lists and data validation to reflect school-specific assets. This customization ensures accurate tracking and categorization of all assets.

Which formulas track depreciation schedules in school Fixed Asset Audit documents?

Common formulas such as SLN (Straight Line Depreciation) and DB (Declining Balance) are used to calculate asset depreciation schedules. Schools often combine these with date functions like YEARFRAC to track depreciation over time. These formulas help maintain up-to-date asset valuations in audit records.

How can schools automate flagging missing or outdated asset records in Excel audits?

Conditional formatting and IFERROR formulas are frequently used to highlight missing or outdated asset data automatically. Schools implement rules that compare last audit dates with the current date to flag overdue entries. Automation improves the accuracy and efficiency of asset audits.

What security measures protect sensitive school asset data in audit spreadsheets?

Implementing password protection and encryption in Excel ensures sensitive school asset data is secure. Schools also restrict editing permissions and use protected sheets to prevent unauthorized changes. These measures safeguard confidential and critical asset information.

Which columns are essential for compliance in school Fixed Asset Audit Excel sheets?

Essential columns include Asset ID, Description, Purchase Date, Cost, Location, and Depreciation to meet compliance standards. Schools must also track Asset Condition and Disposal Dates for audit completeness. Properly structured columns ensure regulatory and financial compliance.