The Financial Audit Excel Template for Startup Firms is a comprehensive tool designed to streamline the auditing process by organizing financial data efficiently. It helps startups track expenses, revenues, and compliance requirements with customizable sheets tailored to specific audit needs. This template enhances accuracy and saves time, making financial audits more manageable for emerging businesses.

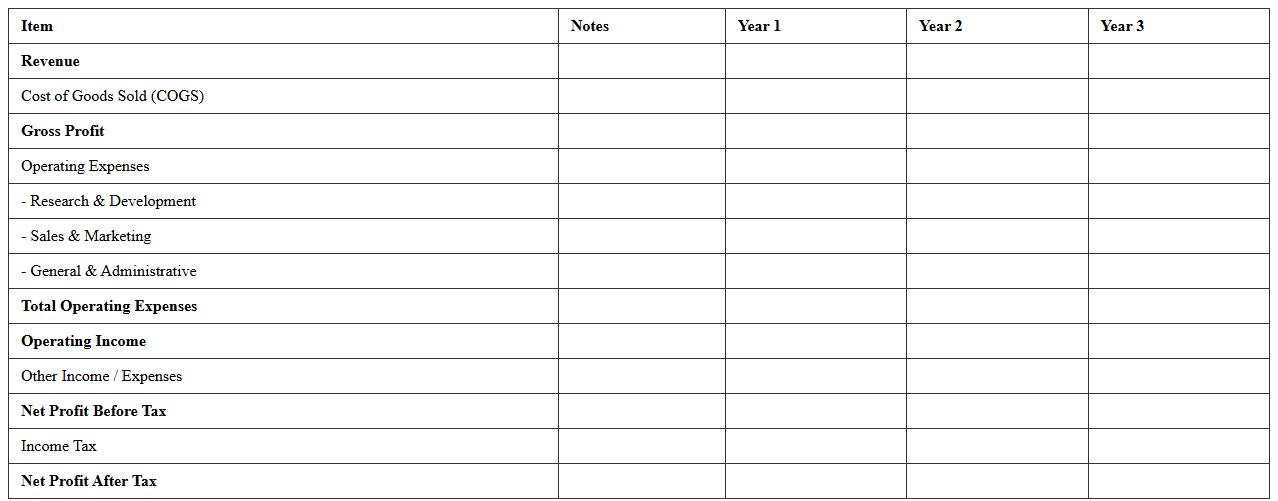

Income Statement Template for Startup Financial Audit

An

Income Statement Template for a Startup Financial Audit document provides a standardized format to accurately record and analyze revenues, expenses, and profits over a specific period. It is useful for startups as it ensures compliance with auditing standards, facilitates transparent financial reporting, and helps identify areas for cost optimization and profitability improvement. This template streamlines the audit process by organizing financial data clearly, aiding investors and stakeholders in decision-making.

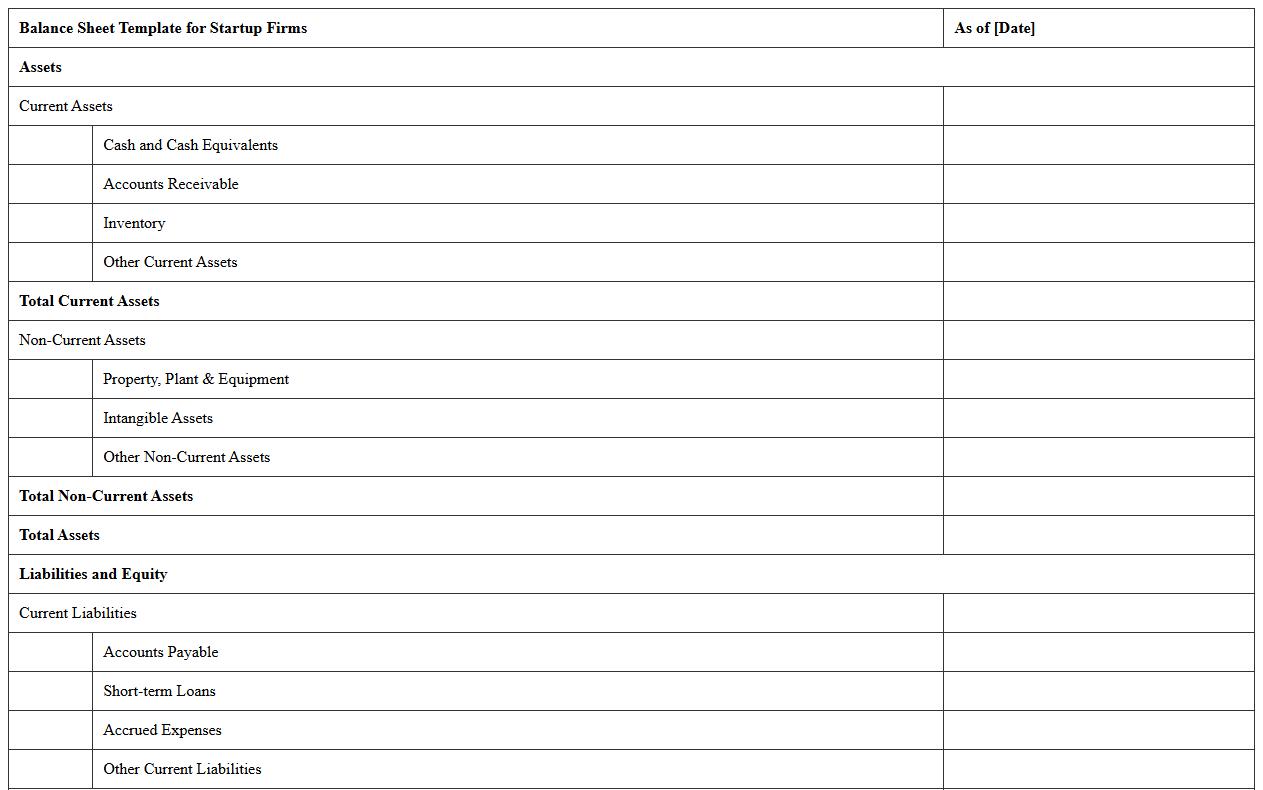

Balance Sheet Template for Startup Firms

A

Balance Sheet Template for Startup Firms is a structured financial document that outlines a company's assets, liabilities, and equity at a specific point in time, tailored for new businesses. It helps startup founders and investors evaluate the firm's financial health, manage resources effectively, and make informed decisions about funding and growth strategies. Using this template ensures accuracy and consistency in financial reporting, aiding compliance with accounting standards and attracting potential investors.

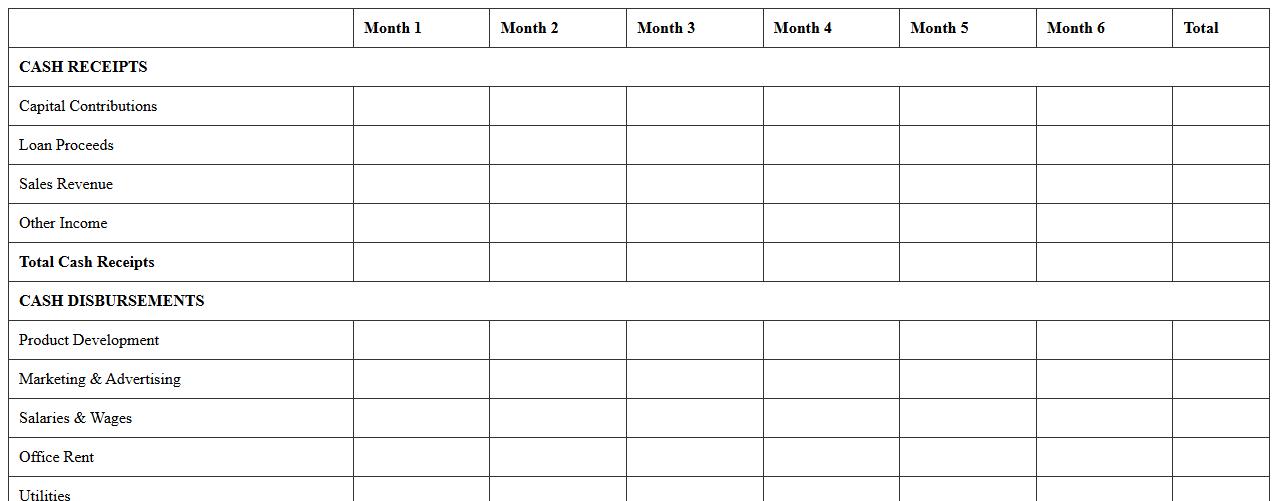

Startup Cash Flow Statement Excel Template

A

Startup Cash Flow Statement Excel Template is a pre-designed spreadsheet that helps new businesses track incoming and outgoing cash over specific periods, ensuring accurate financial management. It allows entrepreneurs to forecast cash surpluses or shortages, making it easier to plan for expenses, investments, and funding requirements. This tool is crucial for maintaining liquidity and supporting informed decision-making during the early stages of a startup.

Expense Tracking Audit Sheet for Startups

An

Expense Tracking Audit Sheet for startups is a detailed financial document designed to monitor and verify all business expenses systematically. It enables startups to maintain accurate records, identify discrepancies, and manage cash flow efficiently, ensuring compliance with accounting standards. This tool is essential for budgeting, financial planning, and preparing for audits, ultimately supporting better decision-making and financial transparency.

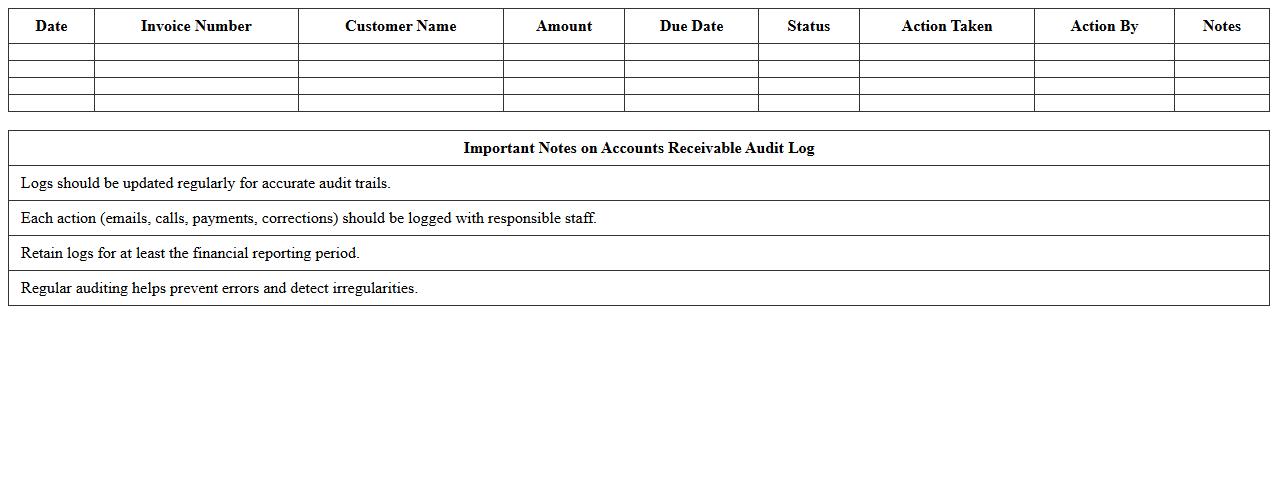

Accounts Receivable Audit Log for Startup Companies

The

Accounts Receivable Audit Log for startup companies is a detailed record tracking all transactions related to customer payments and outstanding invoices. It provides transparency by documenting changes, adjustments, and payment histories, which helps in identifying discrepancies and improving cash flow management. This log is essential for startups to ensure accurate financial reporting, support internal controls, and prepare for audits.

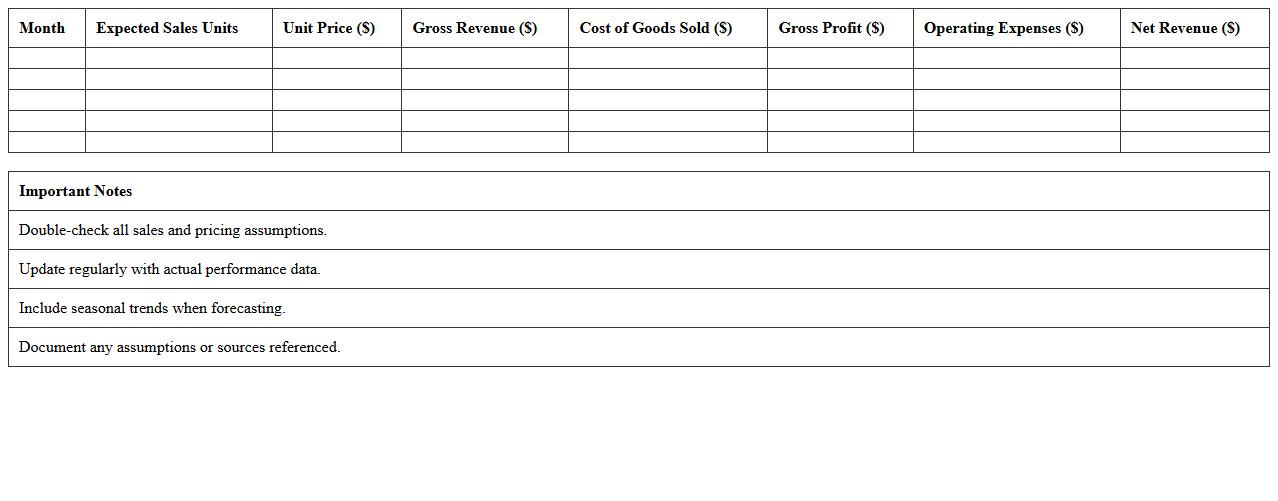

Revenue Forecast Audit Template for New Businesses

The

Revenue Forecast Audit Template for new businesses is a structured document designed to systematically review and validate projected income streams. It helps identify discrepancies, assess assumptions, and ensure realistic financial planning by providing clear criteria and checkpoints for revenue predictions. This tool maximizes accuracy in budgeting and investment decisions, enhancing overall financial strategy and investor confidence.

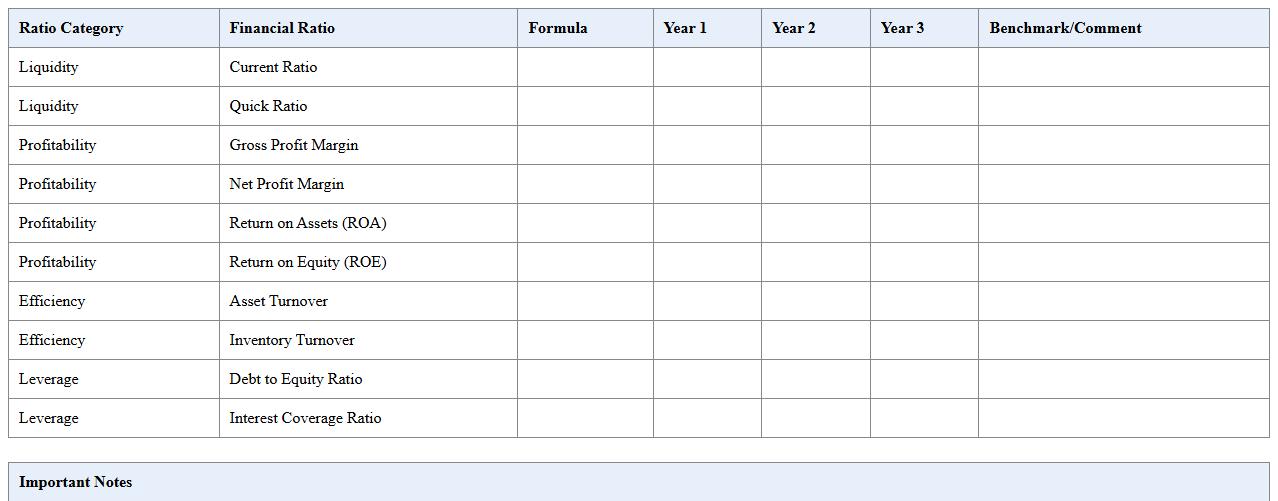

Financial Ratio Analysis Excel for Startup Audit

Financial Ratio Analysis Excel for Startup Audit document is a comprehensive tool designed to evaluate key financial metrics such as liquidity, profitability, and solvency through automated calculations within Excel. This document streamlines the auditing process by providing clear visualizations and comparative data that help identify financial strengths and weaknesses. Using

financial ratio analysis enables startups to make informed decisions, optimize resource allocation, and improve investor confidence by showcasing financial health transparently.

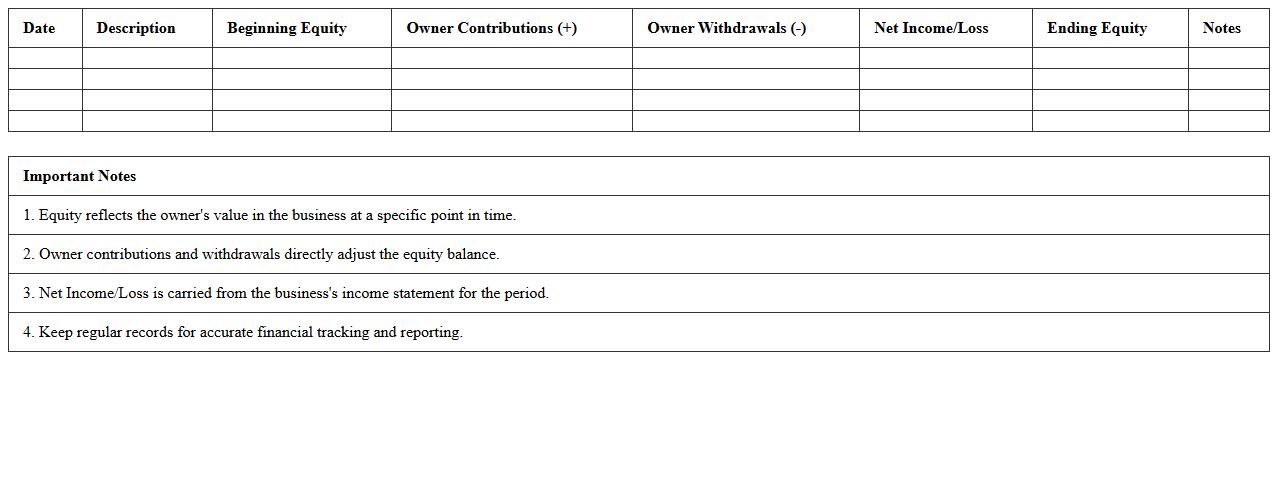

Startup Owner’s Equity Reconciliation Sheet

The

Startup Owner's Equity Reconciliation Sheet is a financial document that tracks changes in the owner's equity over a specific period, detailing contributions, withdrawals, and retained earnings. It helps entrepreneurs and investors monitor the accurate ownership stakes and assess the financial health of the startup. By providing clarity on equity movements, this sheet supports informed decision-making and ensures transparent financial reporting.

Audit Checklist Tracker for Startup Financials

An

Audit Checklist Tracker for Startup Financials is a detailed document that organizes and monitors the essential financial audit tasks for early-stage companies. It helps ensure compliance with accounting standards, tracks progress on audit requirements, and identifies areas needing attention. This tool streamlines the audit process, reduces errors, and provides clear visibility into the financial health and readiness of the startup.

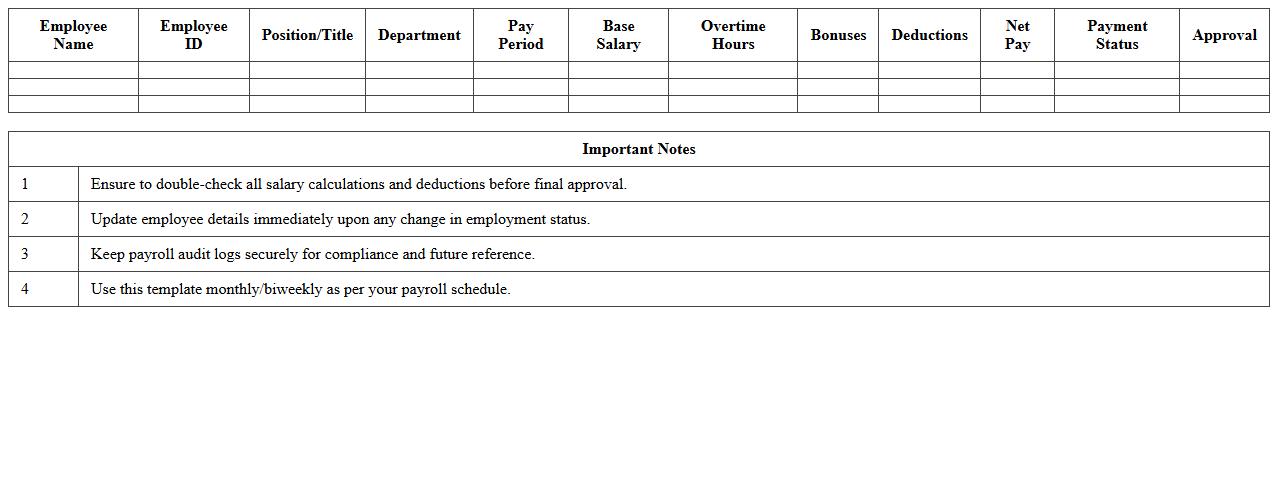

Startup Payroll Audit Excel Template

The

Startup Payroll Audit Excel Template document is a specialized tool designed to help businesses systematically review and verify payroll data for accuracy and compliance. It enables startups to track employee payments, tax deductions, and benefits efficiently, reducing errors and ensuring adherence to regulatory standards. This template enhances financial transparency and streamlines audit processes, saving time and preventing costly payroll discrepancies.

What Excel templates best track startup-specific financial audit trails?

The best Excel templates for tracking startup financial audit trails include customizable ledger and journal templates that capture every transaction with timestamps. These templates often feature columns for transaction details, categories, and amounts, ensuring transparency and accountability. Utilizing audit trail templates helps startups comply with regulatory requirements and maintain precise records.

How to automate anomaly detection in startup expense reports using Excel?

Automating anomaly detection in Excel involves using conditional formatting coupled with formulas such as IF, AVERAGE, and STDEV to highlight unusual expense entries. Adding data validation rules and creating dynamic pivot tables can further identify deviations from typical spending patterns. This approach enables startups to quickly flag suspicious transactions for review.

Which Excel formulas streamline audit reconciliations for startup cash flows?

Key Excel formulas such as SUMIFS, VLOOKUP, and MATCH help streamline audit reconciliations by cross-verifying cash inflows and outflows against bank statements and ledgers. Combining these functions with logical operators like IFERROR ensures accuracy in identifying discrepancies. These techniques optimize the reconciliation process for startup cash flow audits.

How to structure Excel workbooks for multi-round startup funding audits?

Structuring Excel workbooks for multi-round funding audits requires separate sheets for each funding round to maintain clarity and detailed tracking. Linking sheets with dynamic references and using named ranges enhances data integrity and access. Incorporating summary dashboards consolidates key metrics, making audits more efficient and transparent.

What Excel dashboards visualize audit findings for startup executive summaries?

Effective Excel dashboards for visualizing audit findings use charts and pivot tables to present key financial KPIs such as expense trends, cash flow variances, and funding milestones. Incorporating slicers and interactive elements allows executives to filter data for targeted insights. These dashboards transform complex audit data into concise, actionable summaries.

More Audit Excel Templates