The Fixed Asset Audit Excel Template for Nonprofit Organizations streamlines the process of tracking and verifying physical assets, ensuring accuracy in financial reporting. It offers customizable fields to record asset details, depreciation schedules, and audit status, enhancing transparency and accountability. This template is essential for nonprofits aiming to maintain precise fixed asset records and comply with regulatory requirements.

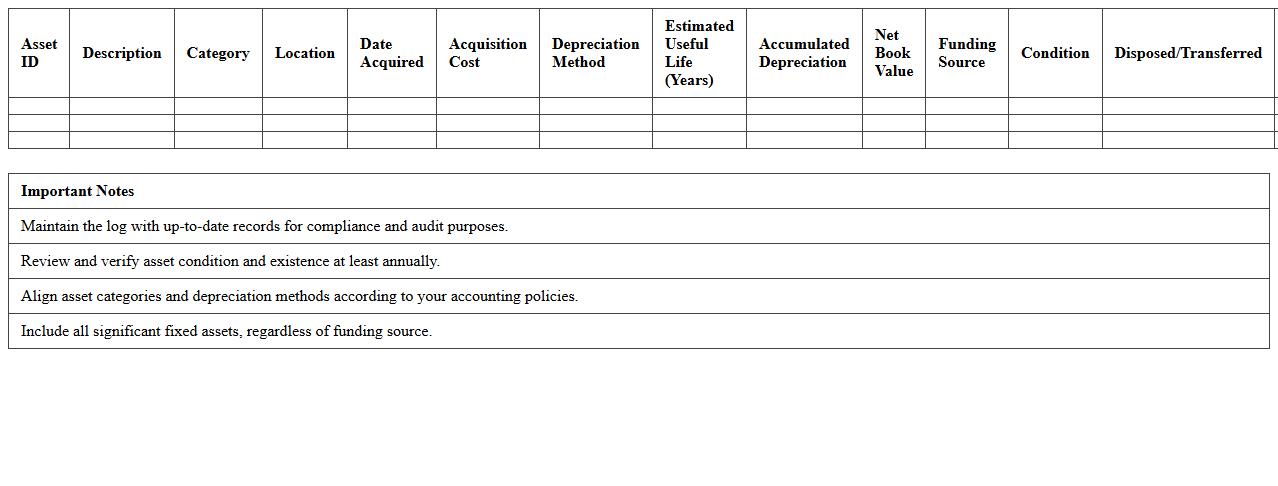

Fixed Asset Inventory Log for Nonprofits

A

Fixed Asset Inventory Log for nonprofits is a detailed record of all physical assets owned by the organization, including purchase dates, costs, locations, and depreciation status. This document helps ensure accurate tracking, accountability, and management of assets, supporting financial audits and compliance with reporting standards. Maintaining such a log enhances transparency and aids in making informed decisions about asset maintenance, replacement, and budgeting.

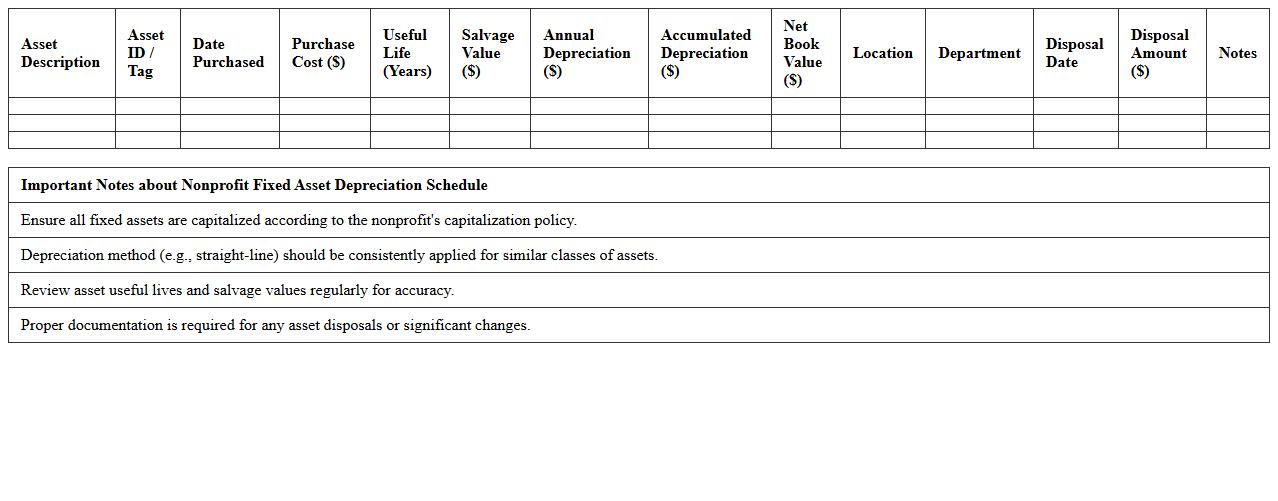

Nonprofit Fixed Asset Depreciation Schedule

A

Nonprofit Fixed Asset Depreciation Schedule document tracks the allocation of an asset's cost over its useful life, essential for accurate financial reporting and compliance with accounting standards. It helps nonprofits manage asset value, budget for replacements, and provides transparency to donors and regulatory agencies. This schedule supports informed decision-making by detailing depreciation expenses, ensuring proper asset management and fiscal responsibility.

Asset Acquisition Tracker for Charity Organizations

The

Asset Acquisition Tracker for Charity Organizations document is a detailed record-keeping tool that monitors all asset purchases and donations, ensuring transparency and accountability. It helps track the source, value, and condition of assets, aiding in accurate financial reporting and compliance with regulatory standards. This document streamlines asset management, supports audit processes, and enables better resource allocation for the charity's mission.

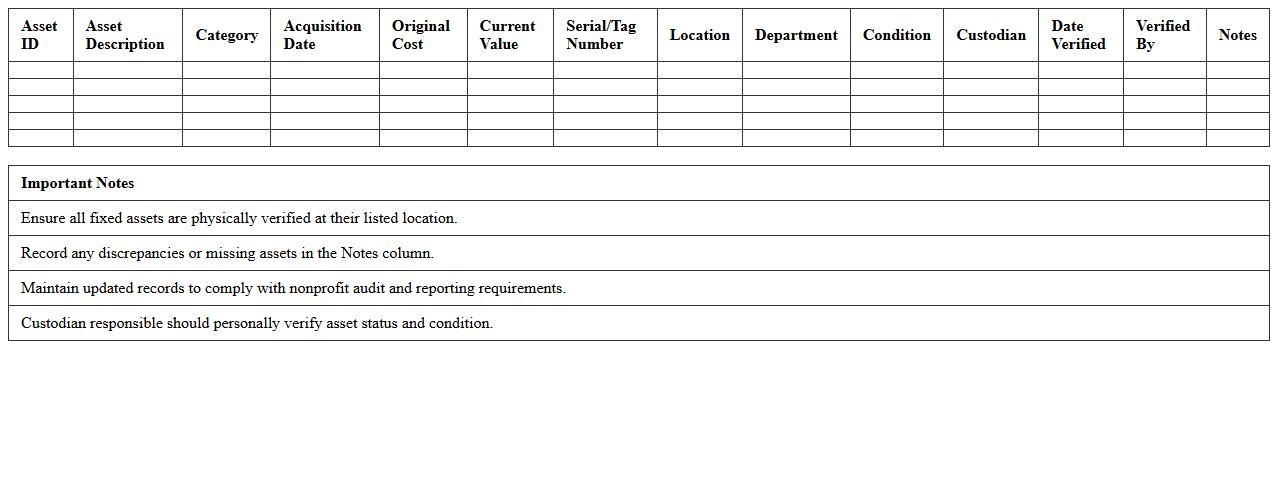

Nonprofit Fixed Asset Location Audit Sheet

A

Nonprofit Fixed Asset Location Audit Sheet is a detailed record used to track the physical locations and statuses of fixed assets owned by a nonprofit organization. This document helps ensure accurate asset management, preventing loss, theft, or misplacement by providing a clear, up-to-date log of asset whereabouts. It supports financial auditing and compliance by verifying asset existence and condition, enhancing accountability and transparency within the nonprofit's operations.

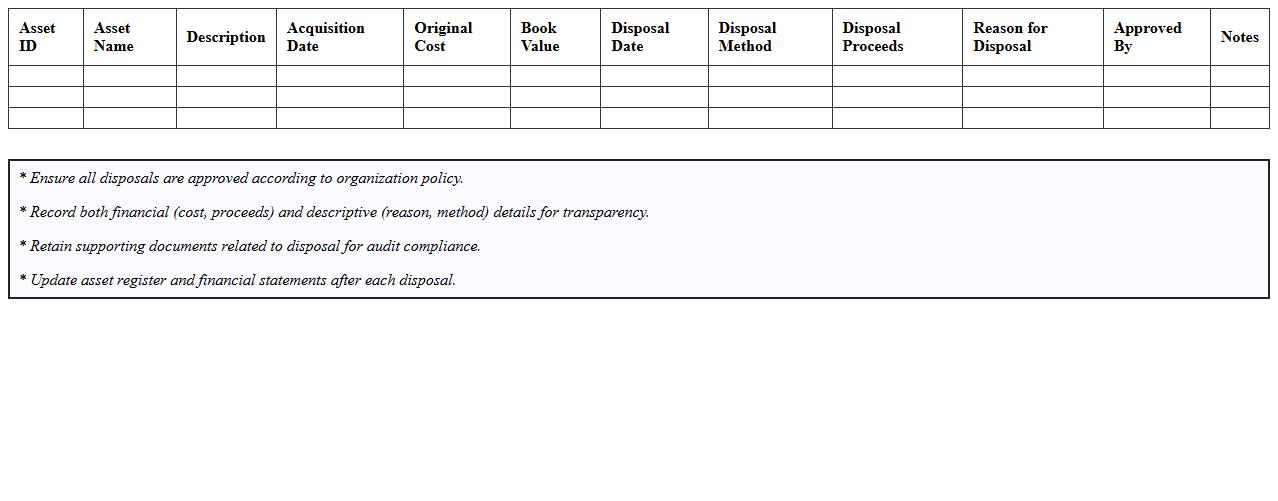

Asset Disposal Record Template for Nonprofits

An

Asset Disposal Record Template for Nonprofits is a structured document designed to track and document the disposal of organizational assets in a transparent and compliant manner. It ensures accurate recording of asset details, disposal methods, and authorization, helping nonprofits maintain accountability and meet audit requirements. Using this template streamlines the process, reduces errors, and supports proper financial reporting and regulatory adherence.

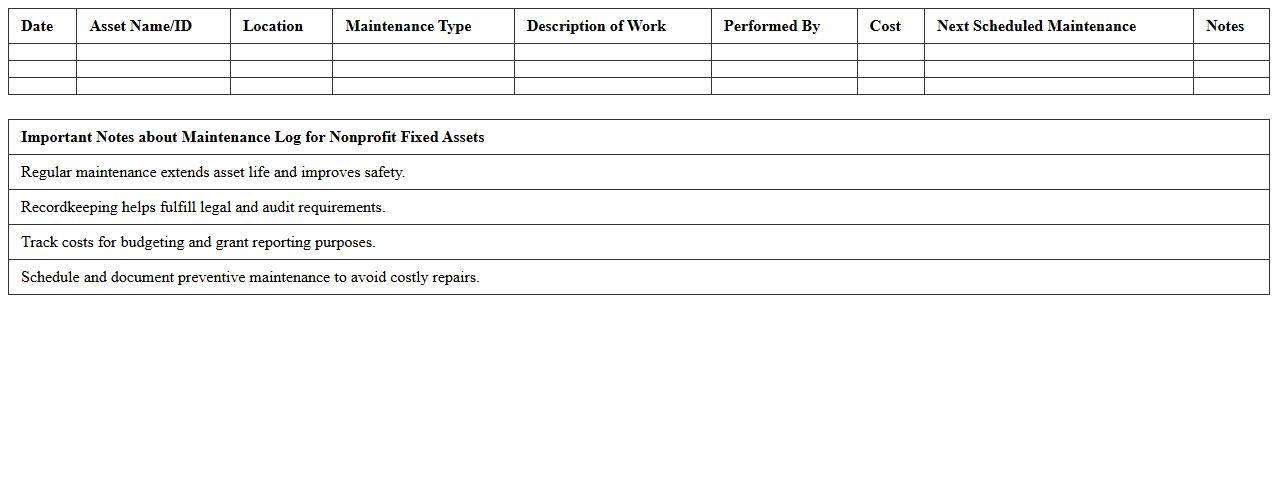

Maintenance Log for Nonprofit Fixed Assets

A

Maintenance Log for Nonprofit Fixed Assets document records detailed information on the upkeep and repairs of assets like equipment, buildings, and vehicles. It is useful for tracking maintenance schedules, ensuring compliance with regulations, and optimizing the lifespan and performance of valuable nonprofit resources. This log also supports transparent financial reporting and helps in budgeting for future maintenance needs.

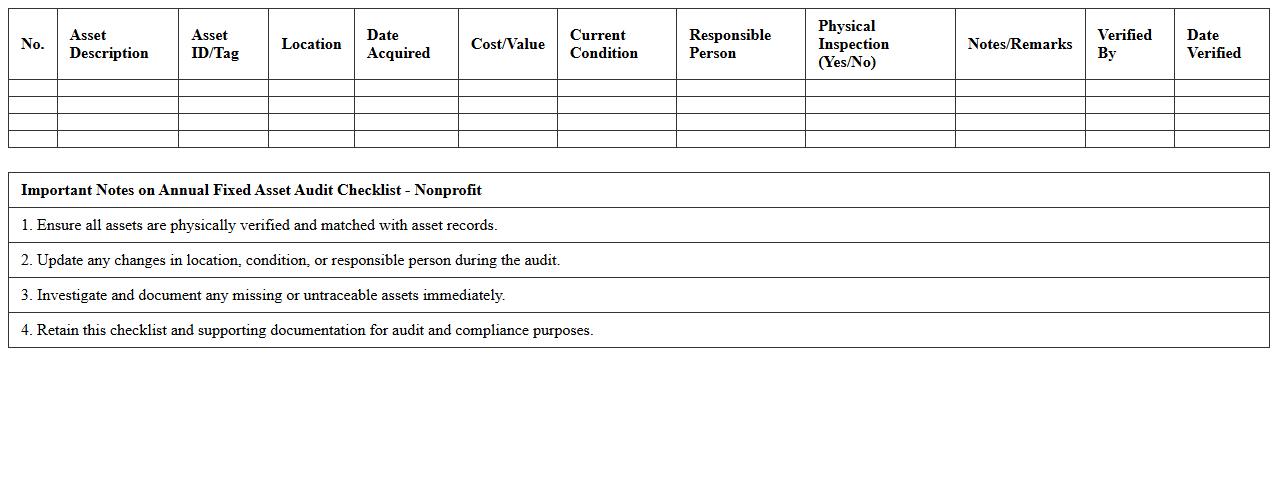

Annual Fixed Asset Audit Checklist - Nonprofit

An

Annual Fixed Asset Audit Checklist - Nonprofit document systematically tracks and verifies the physical existence, condition, and documentation accuracy of fixed assets owned by a nonprofit organization. It helps ensure compliance with accounting standards, improves asset management, and prevents misappropriation or loss of valuable resources. Using this checklist supports transparent financial reporting and strengthens internal controls in nonprofit operations.

Nonprofit Asset Tag Tracking Spreadsheet

A

Nonprofit Asset Tag Tracking Spreadsheet document is a tool designed to systematically record and monitor the physical assets owned by a nonprofit organization. It helps maintain accurate inventory data, track asset locations, and schedule maintenance or audits, ensuring accountability and efficient resource management. By using this spreadsheet, nonprofits can prevent loss, streamline reporting for grants or audits, and optimize the utilization of their valuable assets.

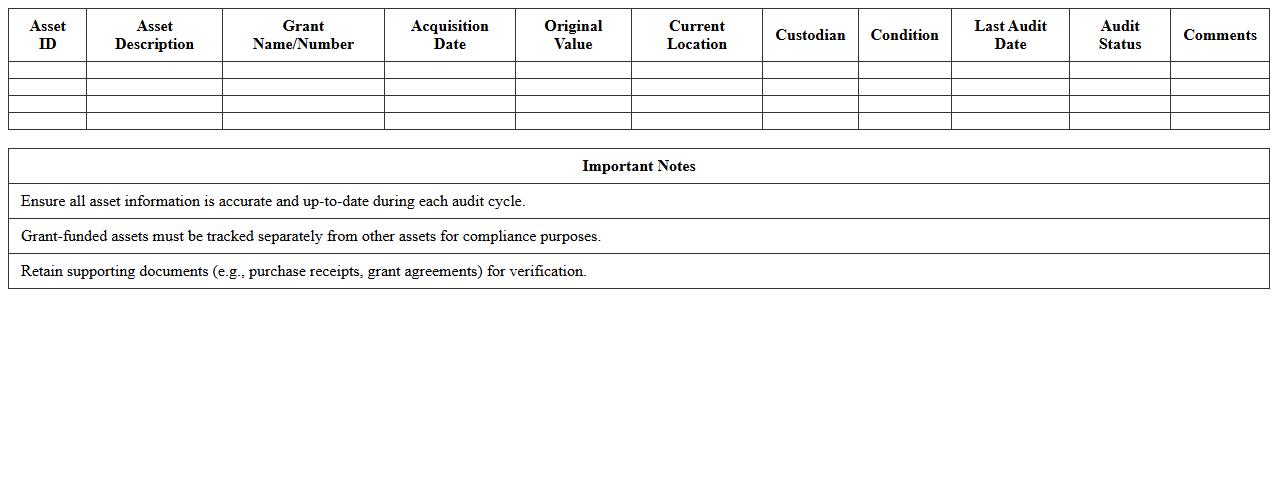

Grant-Funded Asset Audit Register

A

Grant-Funded Asset Audit Register document systematically records and tracks assets acquired through grant funding, ensuring accurate accountability and compliance with grant conditions. This register helps organizations monitor the location, condition, and usage of grant-funded assets, facilitating efficient management and financial reporting. Maintaining this document supports transparency during audits and enhances the ability to meet funding agency requirements.

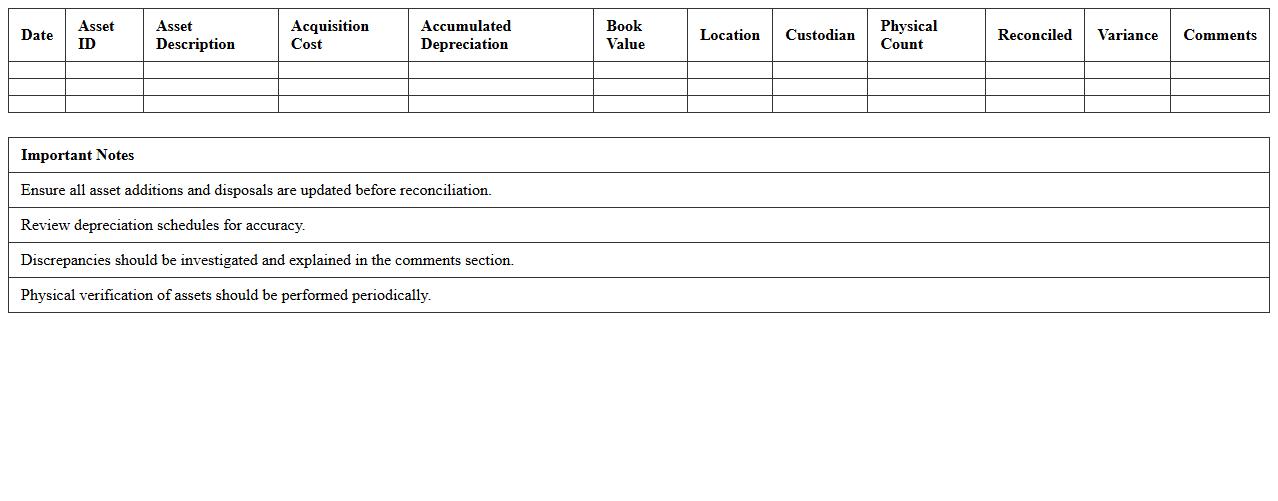

Fixed Asset Reconciliation Report for Nonprofit Organizations

The

Fixed Asset Reconciliation Report for nonprofit organizations is a detailed document that tracks the acquisition, depreciation, and disposal of fixed assets, ensuring accuracy between accounting records and physical inventory. This report helps maintain financial transparency and compliance with regulatory standards by identifying discrepancies and supporting audit processes. It is essential for effective asset management, enabling organizations to make informed decisions about maintenance, budgeting, and resource allocation.

How do you track restricted asset depreciation in a Fixed Asset Audit Excel for nonprofits?

Tracking restricted asset depreciation in a Fixed Asset Audit Excel involves segregating assets funded by specific grants or donors to ensure accurate financial reporting. Use separate columns or tabs to record the depreciation schedule specific to restricted assets, aligning with donor-imposed restrictions. This approach ensures transparency and compliance with nonprofit accounting standards.

What formula identifies grant-funded assets in the audit spreadsheet?

To identify grant-funded assets, use formulas like =IF(ISNUMBER(SEARCH("grant", [asset_funding_cell])), "Grant Funded", "Other") in Excel. This conditional check highlights assets associated with grant sources, enabling proper tracking and reporting. Consistent labeling aids in audit preparation and financial accountability.

How is asset impairment documented in nonprofit Fixed Asset Excel audits?

Asset impairment in nonprofit audits is documented by adjusting the asset's carrying value within the Excel sheet to reflect the reduced recoverable amount. Include columns for impairment triggers, dates, and updated values to maintain a clear record. Proper documentation supports transparency and adherence to accounting guidelines.

Which Excel template fields ensure compliance with nonprofit audit standards?

Key Excel template fields to ensure compliance include asset description, acquisition cost, funding source, depreciation method, accumulated depreciation, and restriction status. These fields enable comprehensive tracking and reporting that align with nonprofit audit requirements. Consistent data entry in these areas supports audit readiness.

How do you reconcile end-of-year asset disposals in a nonprofit audit workbook?

Reconcile end-of-year asset disposals by recording disposal dates, sale proceeds, accumulated depreciation, and removal from the asset list in your audit workbook. Use formulas to calculate gain or loss on disposal, ensuring accurate financial reflection. Regular reconciliation prevents discrepancies and enhances audit accuracy.

More Audit Excel Templates