The Audit Trail Excel Template for Non-Profit Organizations streamlines financial record-keeping by tracking all transactions with date, description, and user details. This template enhances transparency and accountability, crucial for maintaining donor trust and regulatory compliance. Its easy-to-use format simplifies auditing processes and ensures accurate financial reporting.

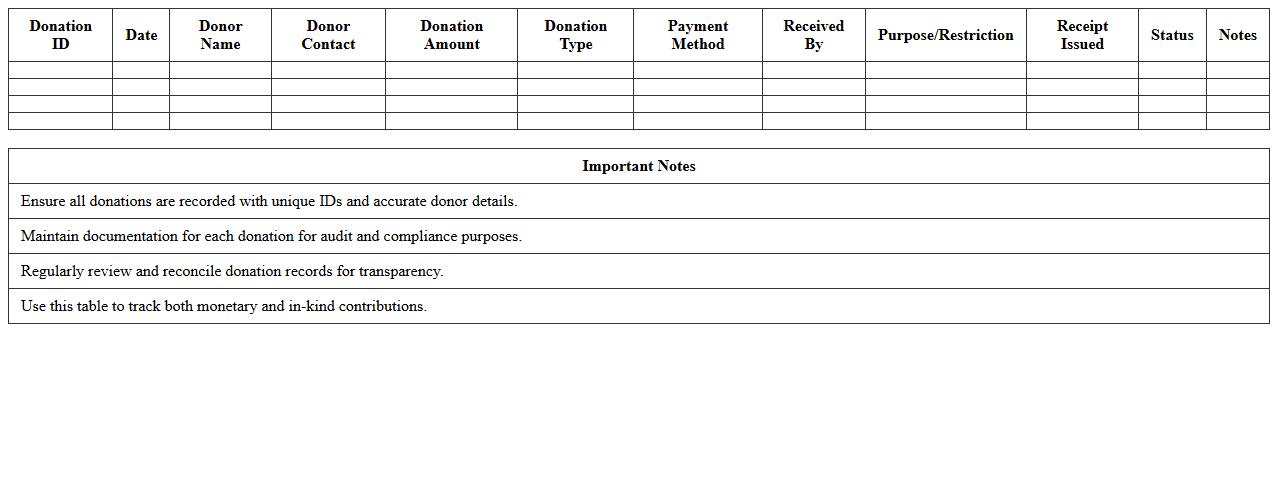

Donation Audit Trail Excel Template for Non-Profit Organizations

The

Donation Audit Trail Excel Template for Non-Profit Organizations is a comprehensive tool designed to track and document every donation transaction with clarity and accuracy. This template helps maintain transparency by recording donor details, donation amounts, dates, and payment methods, facilitating easy reconciliation and reporting for audits. Using this template streamlines financial oversight, ensures regulatory compliance, and enhances donor trust by providing a clear and organized record of all contributions.

Expense Tracking Audit Sheet for Non-Profit Financial Audits

An

Expense Tracking Audit Sheet for Non-Profit Financial Audits is a detailed document used to record and verify all expenses incurred by a non-profit organization during a specific period. It ensures transparency and accuracy by systematically organizing expenditure data, which supports compliance with regulatory standards and facilitates financial accountability. This tool is crucial for identifying discrepancies, optimizing budget allocation, and providing clear evidence during external audits, ultimately enhancing donor trust and organizational integrity.

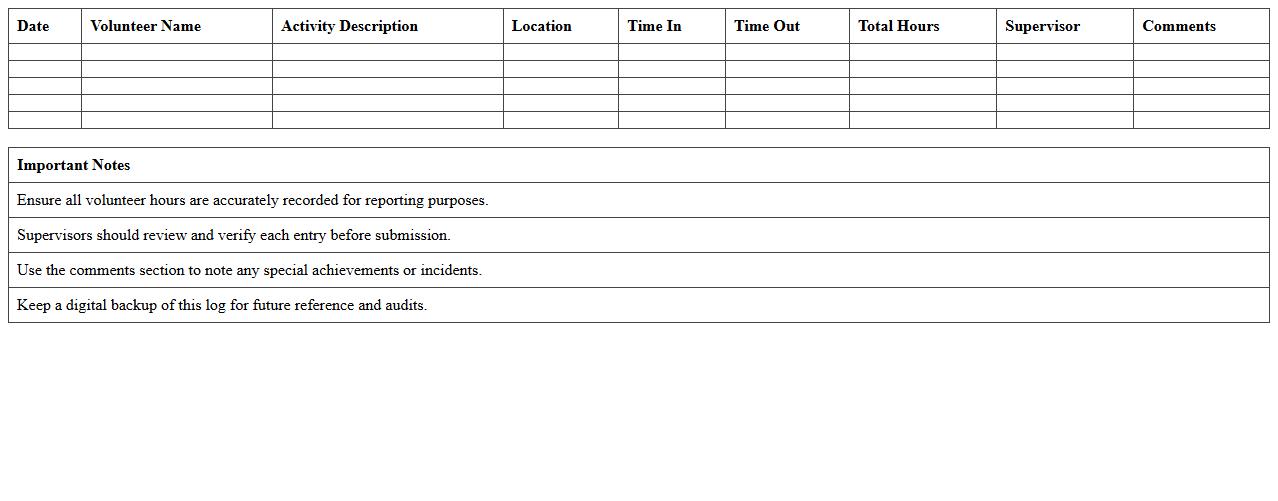

Volunteer Activity Audit Log Excel Template

The

Volunteer Activity Audit Log Excel Template is a structured spreadsheet designed to track and record volunteer activities in a detailed and organized manner. It allows organizations to monitor volunteer hours, tasks performed, and attendance efficiently, ensuring accurate data for reporting and compliance purposes. This template helps streamline audit processes, improve accountability, and optimize volunteer management by providing clear, accessible records of all volunteer engagements.

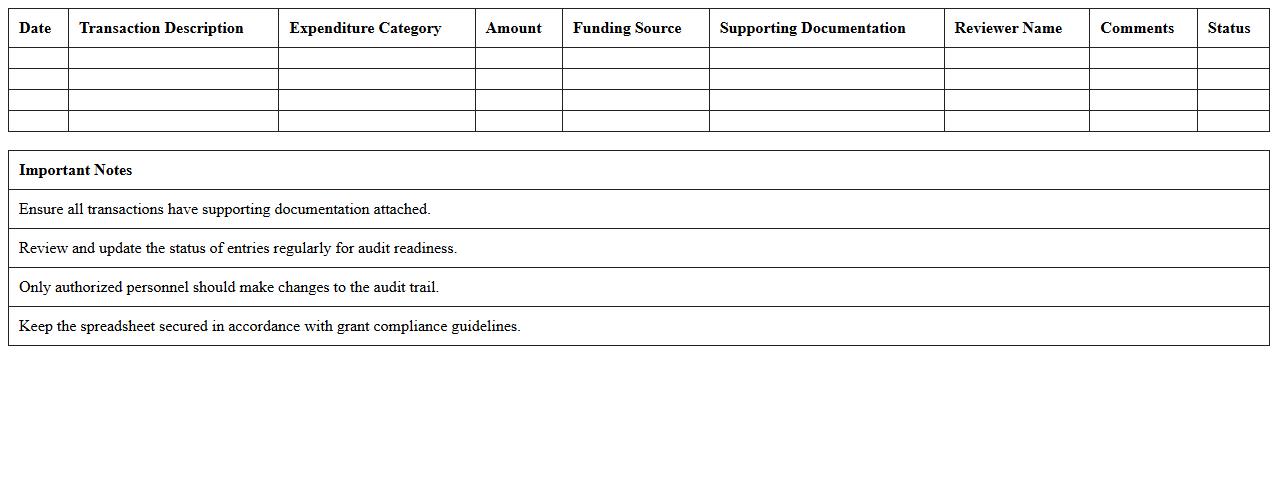

Grant Compliance Audit Trail Excel Spreadsheet

The

Grant Compliance Audit Trail Excel Spreadsheet is a detailed document that tracks all financial transactions, activities, and compliance requirements related to grant funding. It helps organizations systematically monitor adherence to grant terms, ensuring transparency and accountability in fund usage. By maintaining this record, stakeholders can easily prepare for audits, identify discrepancies, and demonstrate compliance with funding regulations.

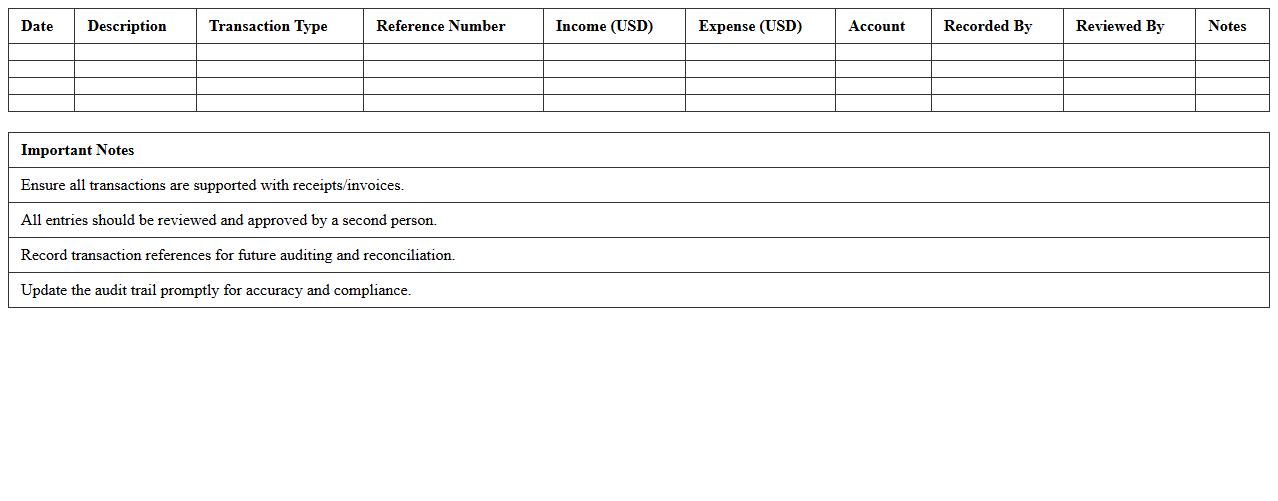

Non-Profit Event Financial Audit Trail Template

A

Non-Profit Event Financial Audit Trail Template document serves as a detailed record-keeping tool that tracks all financial transactions related to a non-profit event, ensuring transparency and accountability. It helps organizations monitor income, expenses, and donations accurately, facilitating compliance with regulatory requirements and simplifying the audit process. Utilizing this template enhances financial oversight, reduces the risk of errors or fraud, and supports effective reporting to stakeholders.

Restricted Funds Audit Trail Excel Tracker

The

Restricted Funds Audit Trail Excel Tracker document is a detailed spreadsheet designed to monitor and document the usage of funds with specific constraints or limitations. It ensures compliance with donor or regulatory requirements by providing a clear, organized record of all transactions related to restricted funds, facilitating transparency and accountability. This tool is essential for financial audits, helping organizations track fund allocation accurately and verify that resources are used solely for their designated purposes.

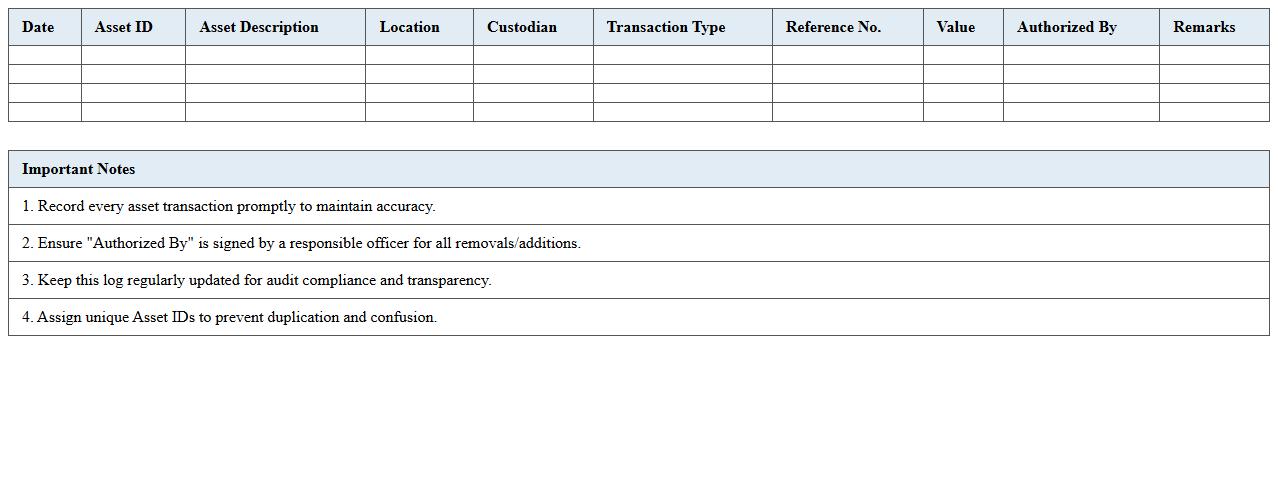

Non-Profit Asset Audit Trail Log Excel Sheet

A

Non-Profit Asset Audit Trail Log Excel Sheet document is a detailed record-keeping tool designed to track the acquisition, movement, and status of assets within a non-profit organization. It ensures transparency and accountability by maintaining chronological entries of asset transactions, which supports compliance with regulatory standards and enhances financial oversight. This log is useful for preventing asset mismanagement, facilitating audits, and providing a clear history for stakeholders reviewing organizational resources.

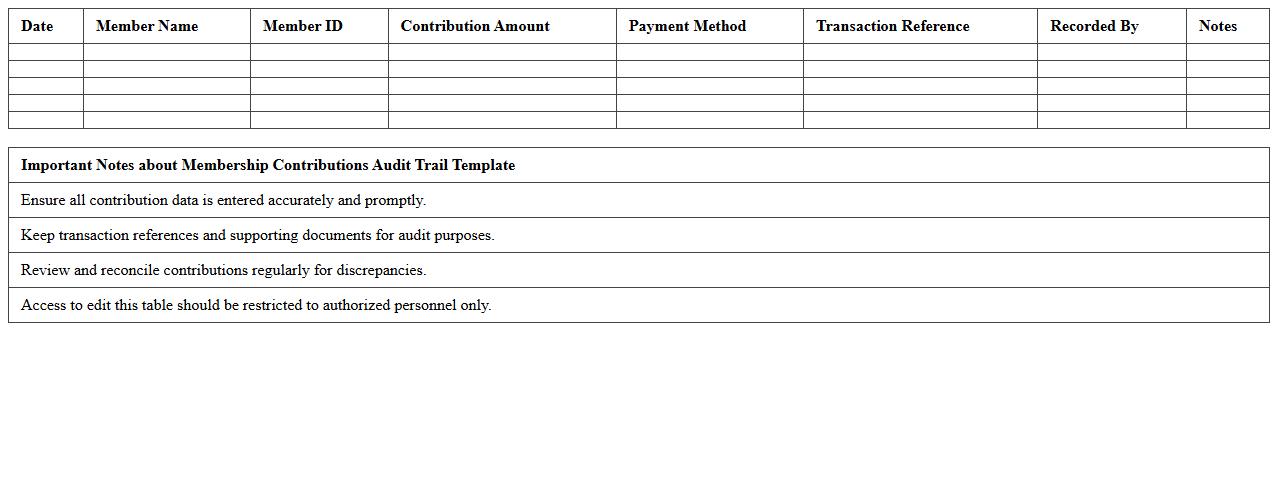

Membership Contributions Audit Trail Template

The

Membership Contributions Audit Trail Template document records detailed transactions of membership fees, ensuring accurate tracking and accountability. It helps organizations maintain transparent financial records by documenting each contribution systematically. This template is essential for auditing purposes, simplifying reconciliation, and supporting compliance with financial regulations.

Program Expenditure Audit Tracking Spreadsheet

The

Program Expenditure Audit Tracking Spreadsheet is a comprehensive tool designed to monitor and document financial audits related to specific programs or projects. It helps organizations systematically track expenditure details, identify discrepancies, and ensure compliance with budgeting and financial regulations. Using this spreadsheet enhances transparency, supports accurate reporting, and aids in effective financial management throughout audit cycles.

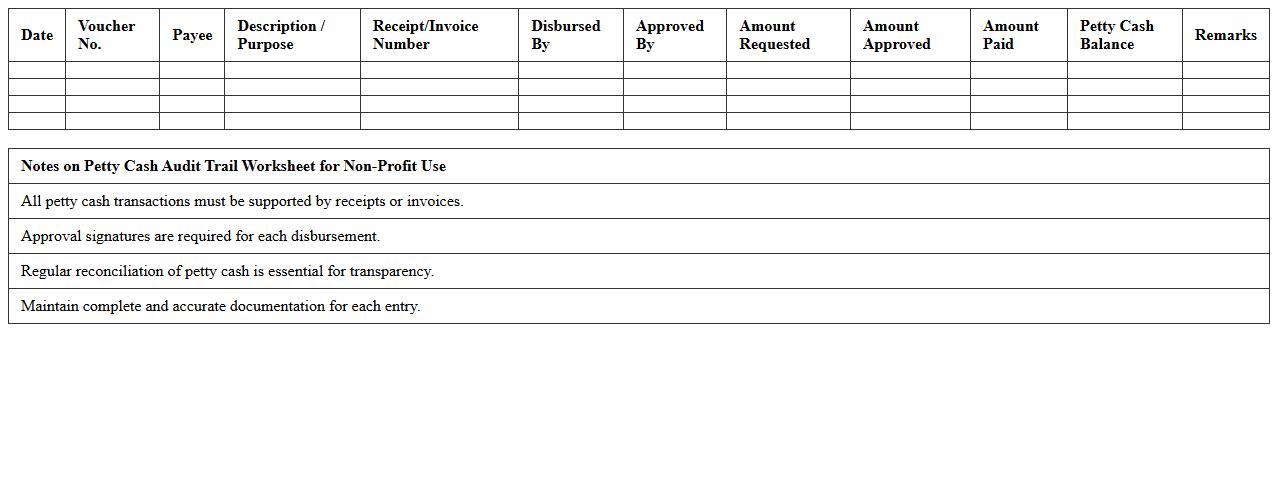

Petty Cash Audit Trail Worksheet for Non-Profit Use

The

Petty Cash Audit Trail Worksheet for Non-Profit Use document tracks all small cash expenditures, ensuring transparency and accuracy in financial reporting. It helps maintain detailed records of petty cash transactions, supporting accountability and compliance with regulatory requirements. This worksheet is essential for preventing misuse of funds and facilitating efficient internal audits within non-profit organizations.

How can an audit trail in Excel track restricted fund allocations for grant compliance?

An audit trail in Excel can track restricted fund allocations by recording every transaction detail, including date, amount, and purpose. Using structured tables ensures transparency and enables easy identification of funds dedicated to specific grants. This system supports compliance by providing a chronological record that auditors can verify.

What Excel formulas best maintain transaction integrity in donation records?

Excel formulas like SUMIF and COUNTIF help maintain transaction integrity by validating donation totals and ensuring consistency across records. Conditional formatting and data validation formulas prevent incorrect entries and alert users to discrepancies. These tools collectively enforce accuracy and reliability in donation tracking.

How to automate version history for donor acknowledgment letters in Excel?

Automating version history in Excel can be achieved by creating macros that save copies of donor acknowledgment letters with timestamped filenames. Using VBA scripts allows logging of every change made to the letters, preserving a detailed version history. This automation ensures all updates are documented without manual intervention.

Which Excel features help prevent unauthorized edits in audit trails for non-profits?

Features like worksheet protection and password encryption restrict unauthorized edits to audit trails. Utilizing Excel's track changes and locked cells further secures sensitive data from accidental or intentional modifications. These protections maintain the integrity of financial records critical to non-profit organizations.

How to link supporting documents to audit trail entries in Excel for expense verification?

Linking supporting documents in Excel can be done by embedding hyperlinks in audit trail entries that direct to scanned receipts or invoices. You can organize these files within a structured folder system and reference them within cells for easy access. This method enhances expense verification by connecting tangible evidence directly to recorded transactions.

More Audit Excel Templates