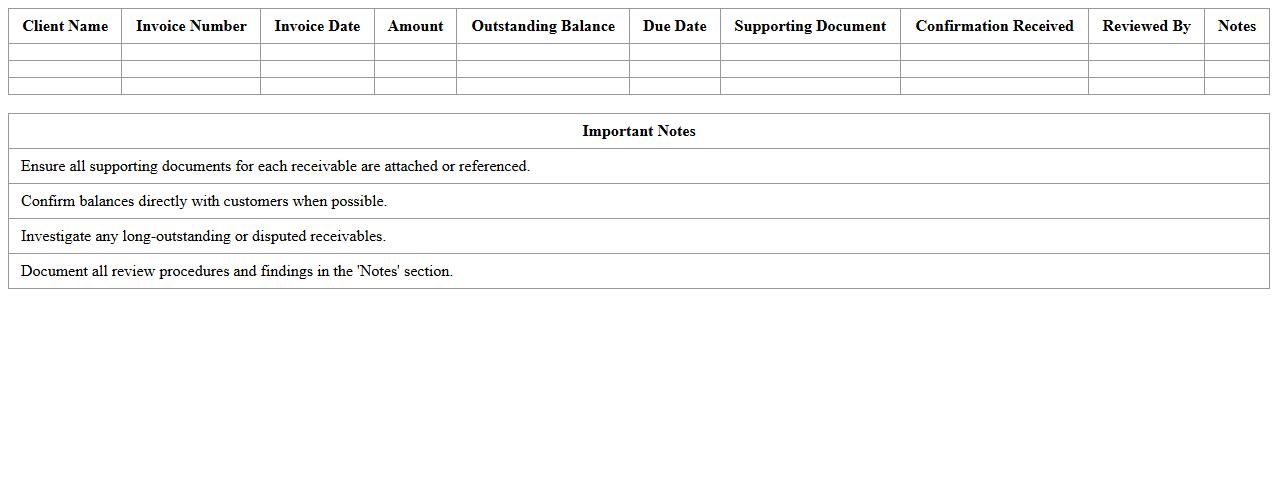

Accounts Receivable Audit Evidence Collection Template

The

Accounts Receivable Audit Evidence Collection Template is a structured document designed to systematically gather and organize audit evidence related to a company's accounts receivable. It helps auditors track key information such as customer balances, confirmation statuses, and supporting documents, ensuring thorough verification of receivables accuracy and existence. This template enhances audit efficiency by providing a consistent framework for evidence collection, reducing errors and facilitating compliance with auditing standards.

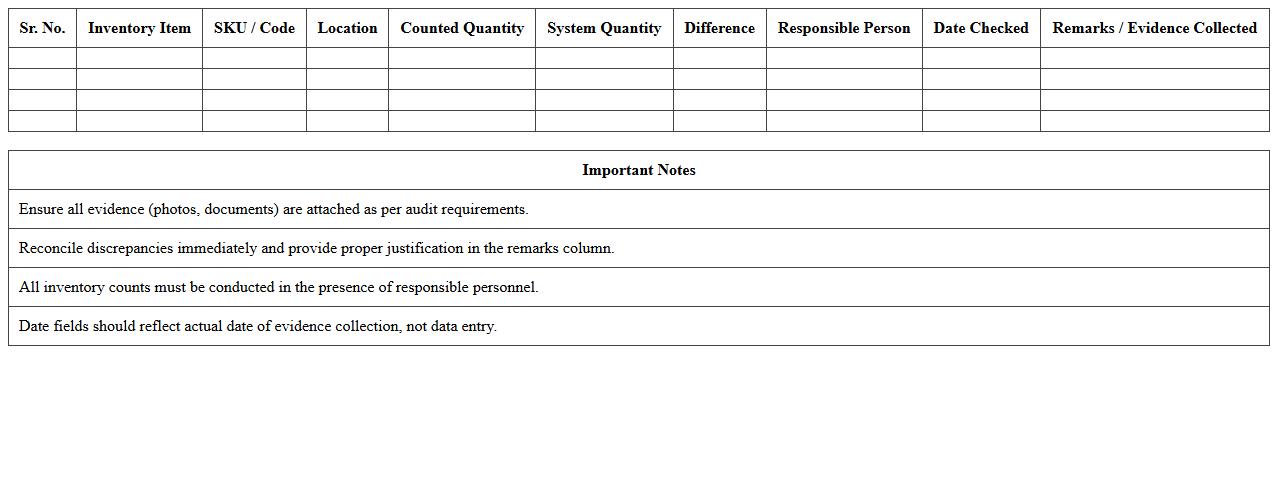

Inventory Audit Evidence Collection Excel Sheet

The

Inventory Audit Evidence Collection Excel Sheet document is a structured tool designed to systematically gather and record audit evidence related to inventory. It helps auditors track inventory counts, discrepancies, and valuation details efficiently, ensuring accuracy and completeness in audit processes. By organizing data clearly, this sheet supports compliance with auditing standards and enhances the reliability of inventory assessments for businesses.

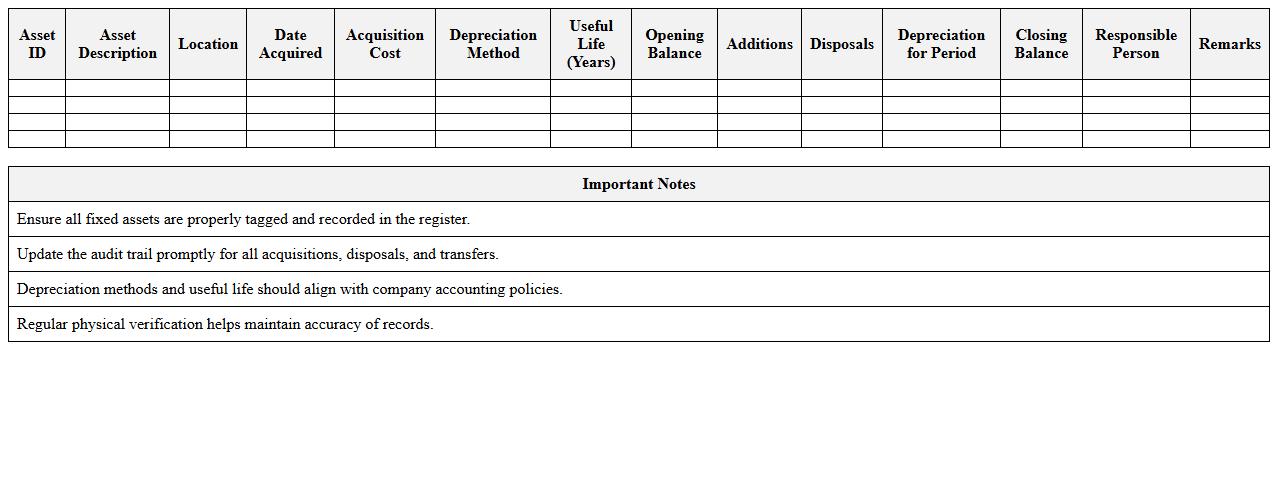

Fixed Assets Audit Trail Documentation Template

The

Fixed Assets Audit Trail Documentation Template is a structured document designed to systematically record the history and changes related to fixed assets within an organization. It captures essential information such as asset acquisitions, transfers, disposals, and depreciation adjustments, ensuring transparency and accuracy in financial reporting. This template proves invaluable by facilitating compliance with auditing standards, simplifying asset tracking, and enhancing the reliability of fixed asset records for internal and external audits.

Revenue Recognition Audit Evidence Tracker

The

Revenue Recognition Audit Evidence Tracker document systematically organizes and records all relevant audit evidence related to revenue recognition processes, ensuring compliance with accounting standards such as IFRS 15 and ASC 606. It enhances audit efficiency by providing a centralized reference that supports the verification of revenue timing, measurement, and classification controls. This tool is essential for auditors and finance teams to maintain transparency, reduce risks of misstatements, and improve the accuracy of financial reporting.

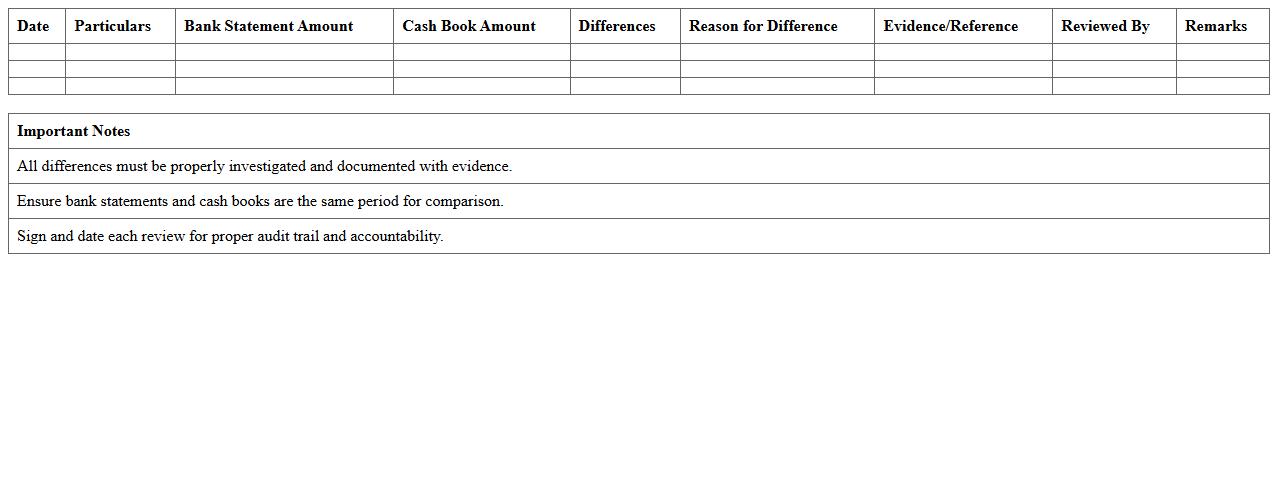

Cash and Bank Reconciliation Audit Evidence Sheet

The

Cash and Bank Reconciliation Audit Evidence Sheet is a crucial document that records and verifies the reconciliation process between a company's cash book and bank statements, ensuring accuracy and consistency in financial records. This sheet serves as concrete audit evidence to detect discrepancies, errors, or fraudulent activities in cash handling and bank transactions. It facilitates auditors in validating the integrity of financial statements and supports effective internal controls and compliance audits.

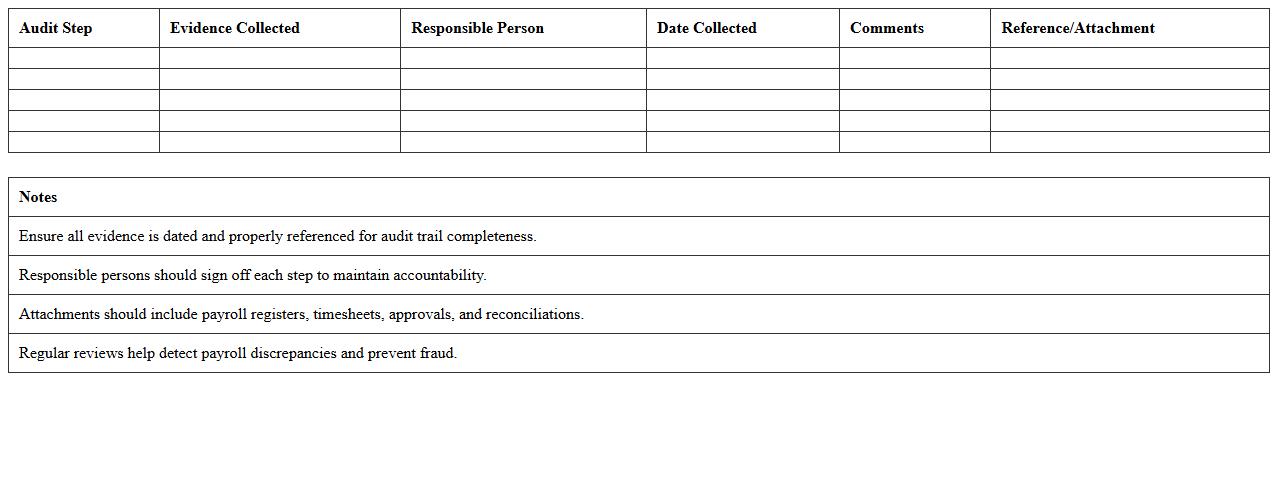

Payroll Audit Evidence Collection Excel Template

The

Payroll Audit Evidence Collection Excel Template is a structured spreadsheet designed to systematically gather and organize payroll audit data, such as employee time records, compensation details, tax withholdings, and compliance checks. This template streamlines the audit process by providing predefined fields and checklists that ensure accuracy and consistency in data capture, facilitating efficient review and verification. It is useful for auditors and HR professionals to identify discrepancies, ensure regulatory compliance, and support financial integrity within an organization's payroll system.

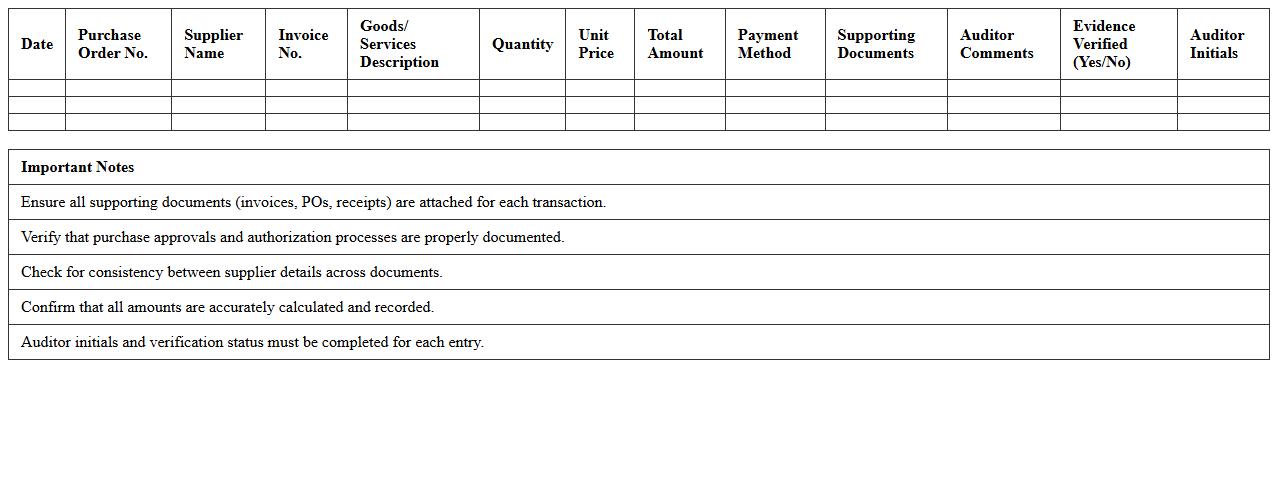

Purchase Transactions Audit Evidence Worksheet

The

Purchase Transactions Audit Evidence Worksheet is a comprehensive document used by auditors to systematically collect and organize evidence related to purchase transactions during an audit. It helps ensure all purchase records are accurate, complete, and compliant with accounting standards, supporting the verification of liabilities and expenses. This worksheet enhances audit efficiency by providing a clear framework for tracing transaction details, validating vendor invoices, and detecting discrepancies.

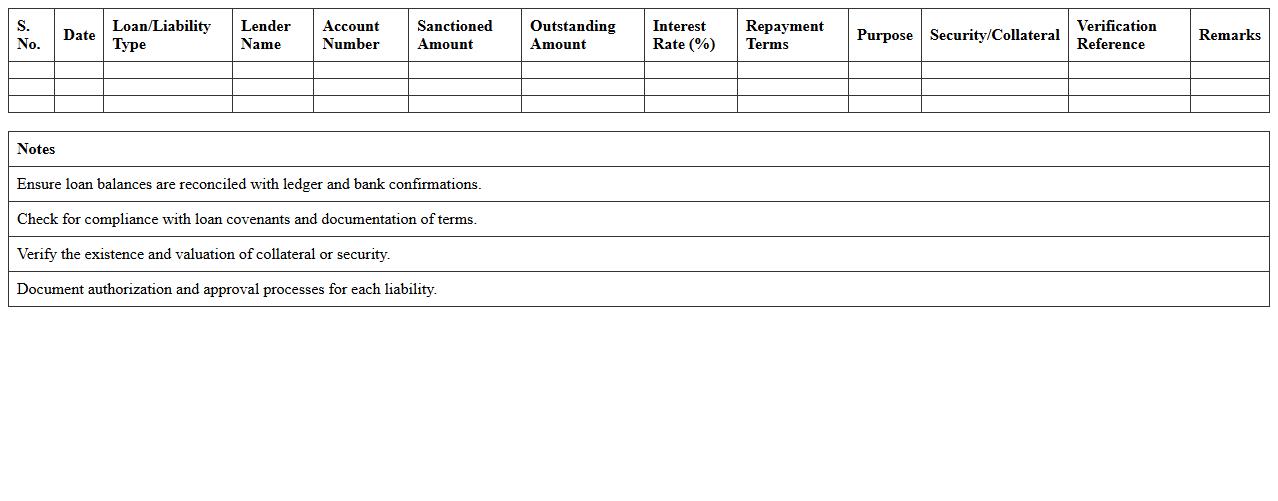

Loans and Liabilities Audit Documentation Template

The

Loans and Liabilities Audit Documentation Template is a structured record designed to systematically capture all relevant information during the audit of loans and liabilities. It ensures comprehensive tracking of financial obligations, interest rates, repayment terms, and compliance with accounting standards, facilitating accuracy and transparency. This template streamlines the auditing process, reduces errors, and enhances accountability by providing a consistent format for documenting essential audit findings.

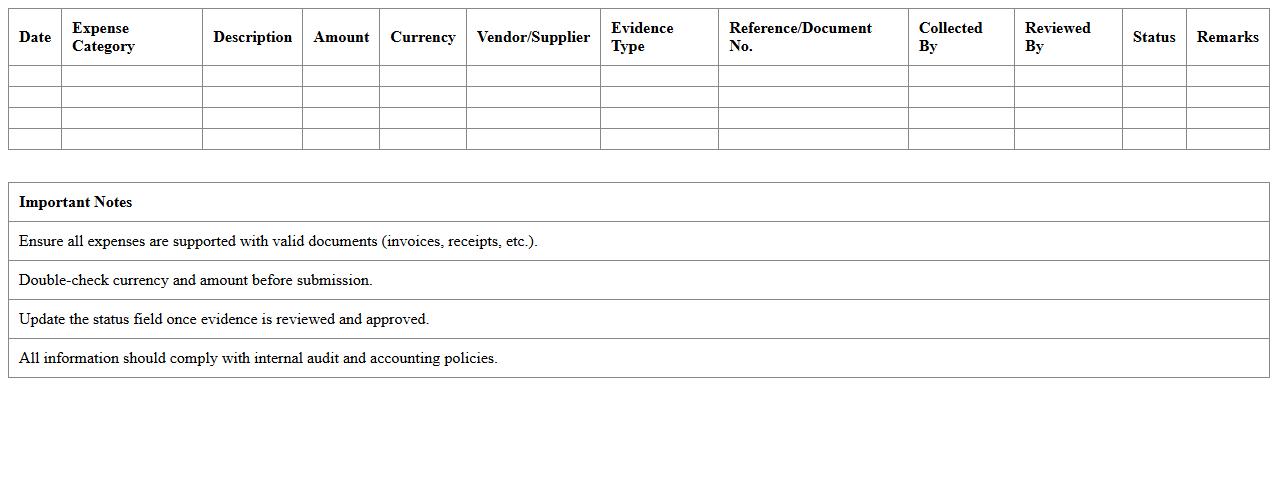

Expenses Audit Evidence Collection Spreadsheet

The

Expenses Audit Evidence Collection Spreadsheet is a structured document designed to systematically gather and organize proof of financial transactions for auditing purposes. It helps ensure accuracy and compliance by tracking receipts, invoices, and related documentation linked to expenses, facilitating transparent financial reviews. This tool streamlines the audit process, reduces errors, and supports effective internal controls by providing clear, accessible evidence of expenditures.

Financial Statement Assertions Audit Evidence Excel Tracker

The

Financial Statement Assertions Audit Evidence Excel Tracker document is a comprehensive tool designed to organize and monitor audit evidence linked to various financial statement assertions such as existence, completeness, valuation, rights and obligations, and presentation. It enhances audit efficiency by systematically tracking evidence collection, identification of gaps, and ensuring alignment with auditing standards. This tracker enables auditors and finance professionals to maintain accuracy, improve documentation, and streamline the overall audit process.

How can Excel macros streamline sampling for audit evidence collection?

Excel macros automate repetitive tasks such as selecting random samples from large datasets, enhancing efficiency in audit evidence collection. By utilizing macros, auditors can standardize sampling procedures, ensuring consistency and accuracy. This automation reduces manual errors and saves significant time during the audit process.

What Excel formulas best validate data integrity in audit evidence sheets?

Formulas like VLOOKUP and IFERROR are essential for cross-referencing and identifying mismatches within audit data. The COUNTIF function helps detect duplicates or missing entries that may compromise data integrity. Utilizing conditional formulas ensures that audit evidence sheets remain accurate and reliable for decision-making.

Which Excel features help track changes in audit document versions?

The Track Changes feature allows auditors to monitor modifications across different versions of audit documents efficiently. Using Comments and Version History enhances collaboration and transparency during evidence review. These tools ensure that every change is documented, facilitating audit traceability and accountability.

How to design an Excel template for audit evidence sufficiency assessment?

Creating an effective template involves structuring clear criteria and scoring mechanisms to evaluate the sufficiency of audit evidence systematically. Incorporating dropdown lists and checkboxes improves data consistency and simplifies input. Visual aids like charts and conditional formatting help highlight evidence status and gaps effectively.

What methods in Excel flag potential inconsistencies within audit documentation?

Excel's Conditional Formatting is a powerful tool to visually identify anomalies such as outliers and data entry errors. Using formulas like IF combined with logical functions can automatically flag unexpected or inconsistent values. PivotTables assist in summarizing data trends, highlighting discrepancies that require further investigation.