The Payroll Audit Excel Template for HR Departments streamlines the process of verifying employee payments and tax deductions, ensuring accuracy and compliance with labor laws. This template allows HR professionals to easily track discrepancies and generate detailed reports, reducing errors and saving time. Customizable features help adapt the template to specific organizational payroll policies and audit requirements.

Employee Payroll Audit Tracker Template

The

Employee Payroll Audit Tracker Template is a structured document designed to monitor and verify payroll activities, ensuring accuracy and compliance with company policies and legal requirements. It helps identify discrepancies, track payroll transactions, and maintain detailed records for audits, reducing the risk of errors and fraud. This template streamlines payroll management by providing clear visibility into employee payments and deductions, enhancing financial control and reporting efficiency.

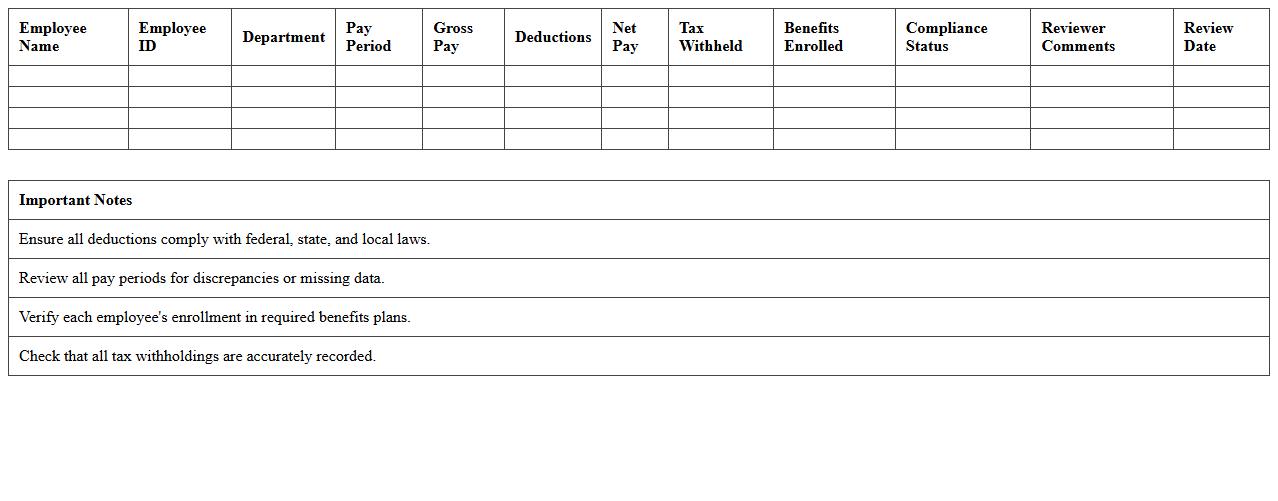

HR Payroll Compliance Review Sheet

The

HR Payroll Compliance Review Sheet document is a detailed checklist used to ensure all payroll processes align with federal, state, and local labor laws and tax regulations. It helps organizations identify discrepancies, reduce compliance risks, and maintain accurate employee compensation records. Utilizing this sheet streamlines payroll audits, enhances transparency, and safeguards the company from costly penalties and legal issues.

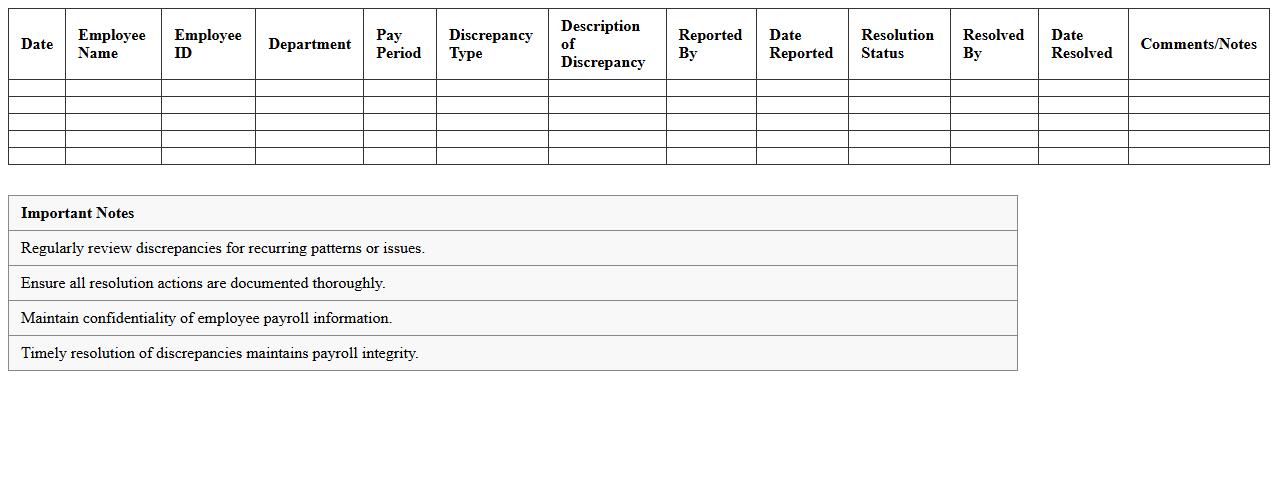

Payroll Discrepancy Audit Log Spreadsheet

The

Payroll Discrepancy Audit Log Spreadsheet document is a detailed record that tracks and identifies inconsistencies or errors in payroll processing, such as miscalculations, missing payments, or incorrect deductions. This document is essential for ensuring accuracy in employee compensation, allowing organizations to quickly resolve payroll issues and maintain compliance with labor laws. By systematically documenting discrepancies, it enhances transparency and supports internal audits for financial accountability.

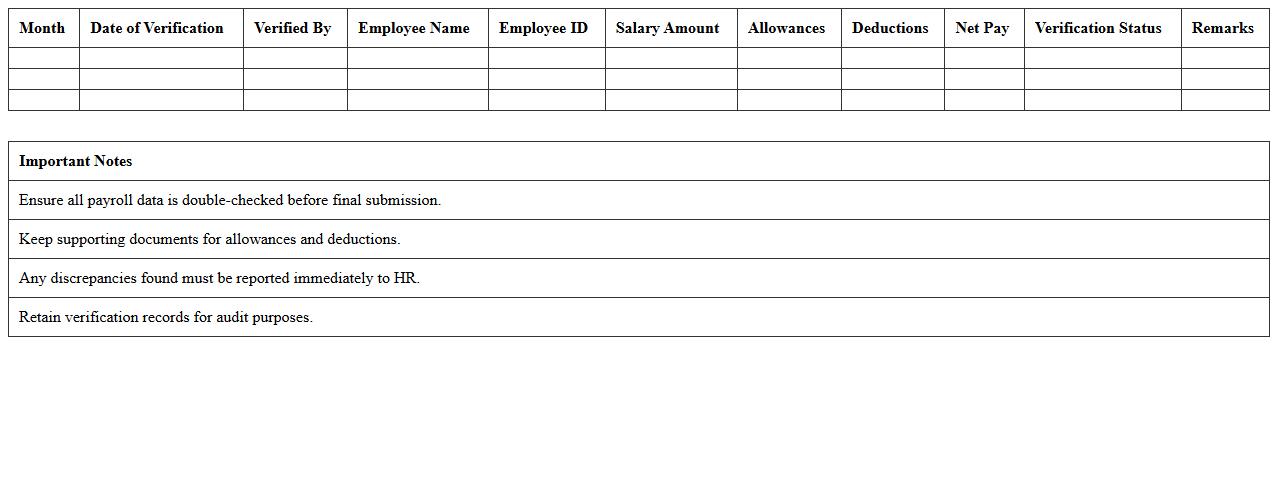

Monthly Payroll Verification Checklist Excel

A

Monthly Payroll Verification Checklist Excel document streamlines the process of reviewing employee payroll data, ensuring accuracy and compliance with legal standards. It helps identify discrepancies such as incorrect salary calculations, missing attendance records, and tax deductions before the final payroll run. This tool enhances efficiency by providing a structured format for payroll managers to verify all necessary components monthly, reducing payroll errors and potential financial risks.

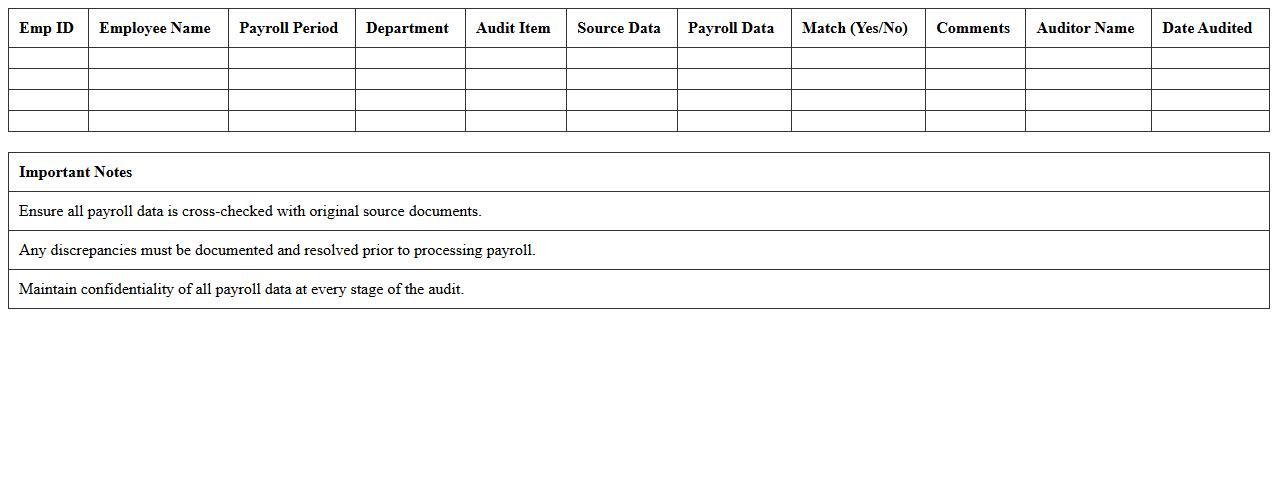

Payroll Data Accuracy Audit Template

A

Payroll Data Accuracy Audit Template is a structured document designed to systematically review and verify payroll records for errors or discrepancies. It helps organizations ensure compliance with tax regulations, labor laws, and internal policies by identifying inaccuracies in employee compensation, deductions, and benefits. Utilizing this template enhances financial integrity, reduces the risk of payroll fraud, and streamlines the audit process for payroll management teams.

Salary and Wage Audit Tracker for HR

A

Salary and Wage Audit Tracker is an essential HR document designed to monitor and analyze employee compensation, ensuring compliance with company policies and legal standards. It helps identify pay disparities, maintain payroll accuracy, and supports internal audits to promote fairness and transparency in salary management. Utilizing this tracker enhances decision-making processes related to salary adjustments and budgeting within the organization.

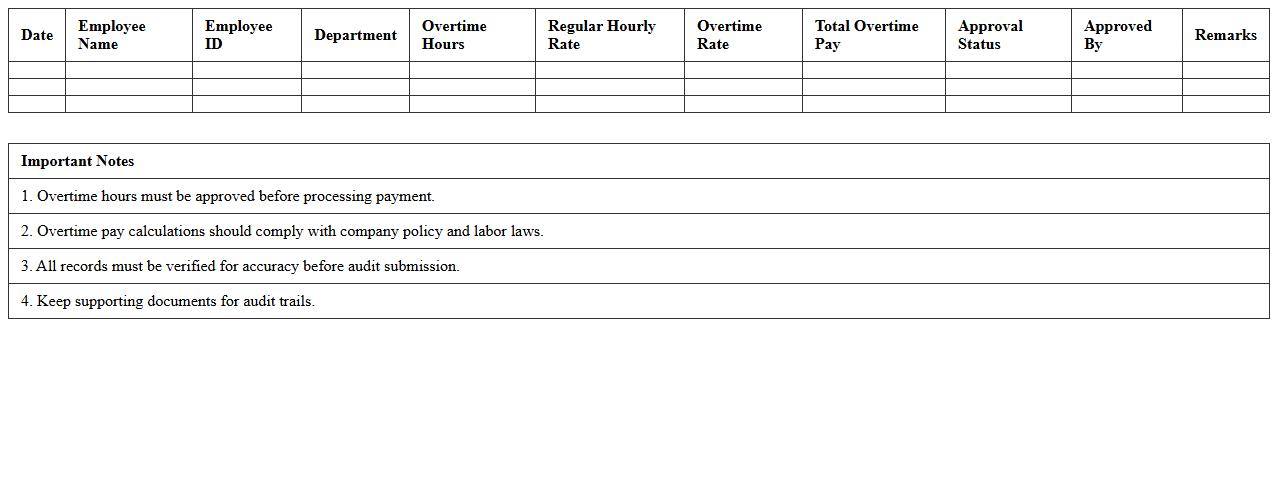

Overtime Payment Audit Excel Sheet

An

Overtime Payment Audit Excel Sheet is a structured document designed to systematically review and verify employee overtime payments against recorded work hours and company policies. This tool helps organizations ensure accuracy in payroll, identify discrepancies, and maintain compliance with labor regulations. By providing detailed analysis and clear documentation, it supports efficient financial management and reduces the risk of costly errors or fraud.

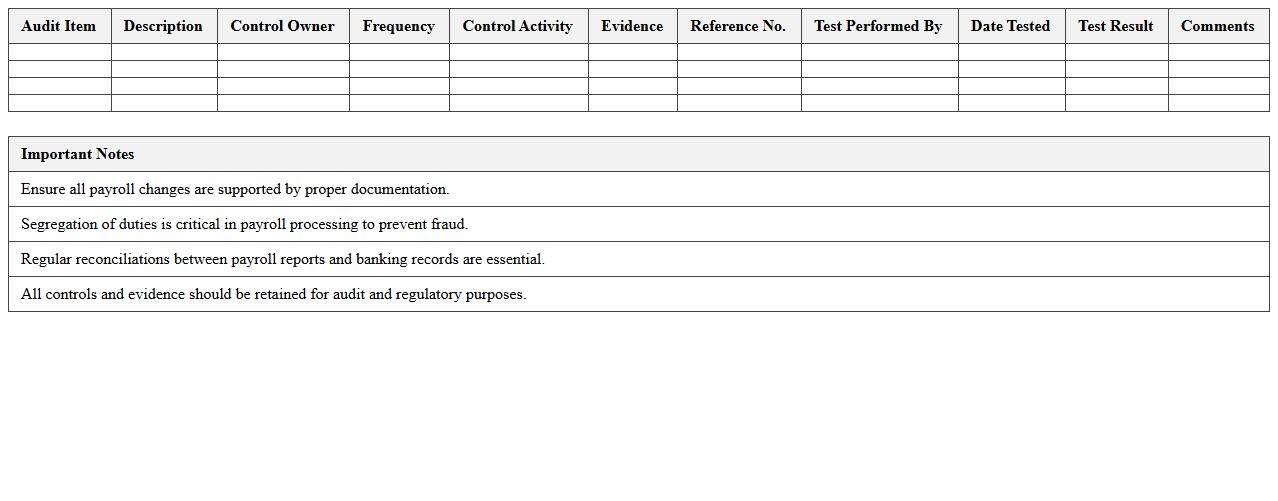

Payroll Process Control Audit Worksheet

The

Payroll Process Control Audit Worksheet is a comprehensive document designed to evaluate and monitor the accuracy and compliance of payroll procedures within an organization. It helps identify discrepancies, ensures adherence to regulatory requirements, and enhances internal controls to prevent errors or fraud in payroll processing. Utilizing this worksheet streamlines payroll audits, improves financial accountability, and supports effective workforce management.

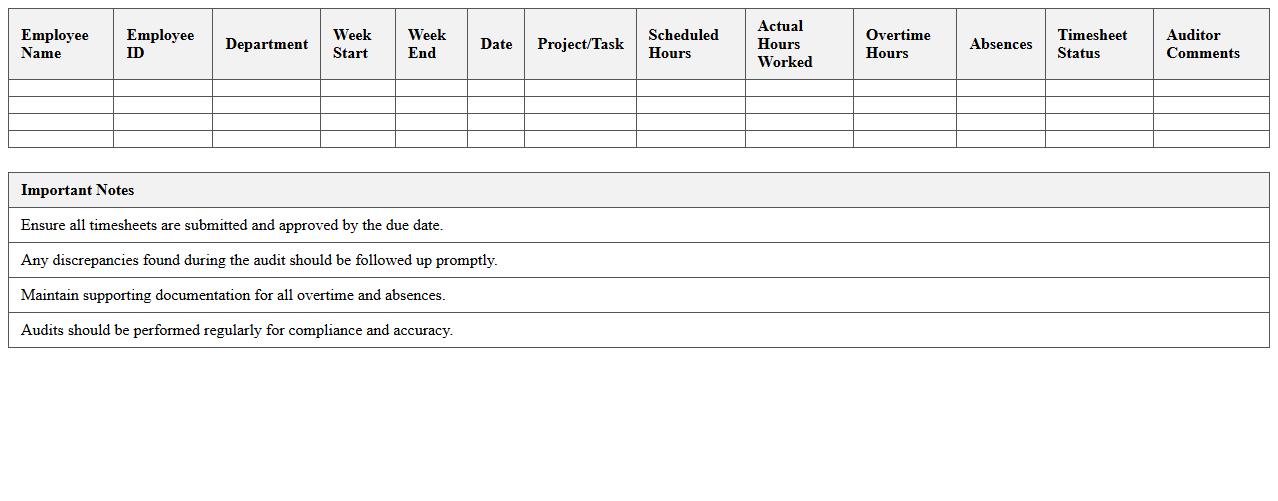

Employee Timesheet Audit Analysis Template

The

Employee Timesheet Audit Analysis Template document is a structured tool designed to systematically review and verify employee time entries for accuracy and compliance with company policies. It helps identify discrepancies, ensure correct payroll processing, and improve workforce productivity by highlighting irregularities or patterns of time mismanagement. Utilizing this template enhances operational efficiency and supports transparent record-keeping for both management and HR departments.

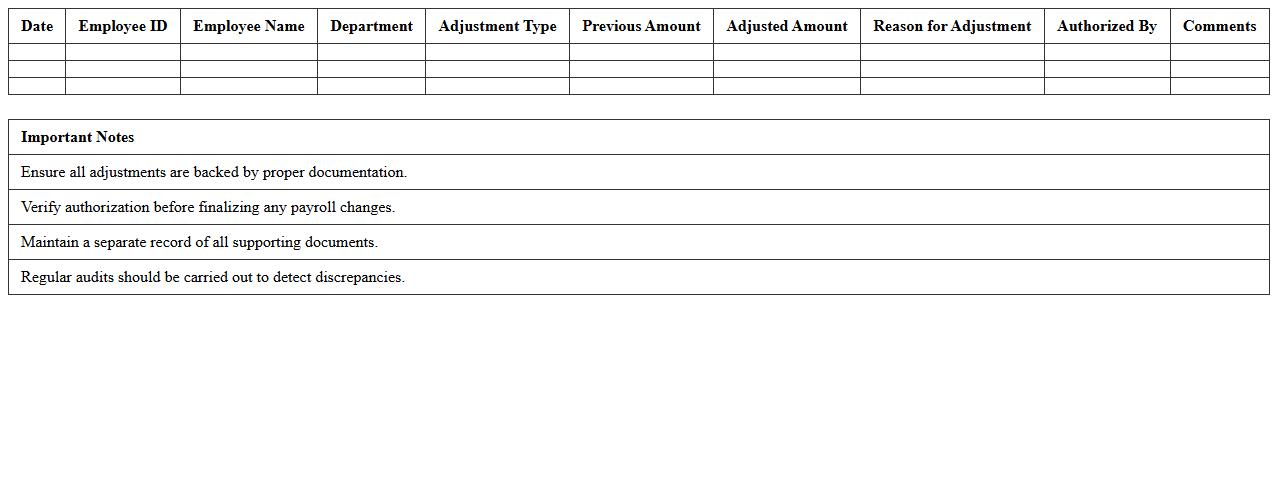

Payroll Adjustment Audit Report Excel

The

Payroll Adjustment Audit Report Excel document is a detailed spreadsheet that tracks and verifies all corrections made to employee payroll records, ensuring accuracy and compliance. This report helps organizations identify discrepancies, detect unauthorized changes, and maintain transparent financial records. Using this audit report enhances payroll integrity, streamlines internal audits, and supports regulatory compliance efforts.

How do I automate overtime calculations in a Payroll Audit Excel template for HR?

To automate overtime calculations in a Payroll Audit Excel template, use the IF function combined with time thresholds. You can set conditions such as hours worked beyond 40 hours to calculate overtime pay automatically. Incorporate formulas like =IF(Hours>40,(Hours-40)*Overtime_Rate,0) for precise tracking.

What formulas best flag duplicate payments in payroll audit spreadsheets?

The COUNTIF function is effective for identifying duplicate payments in payroll spreadsheets. By applying =COUNTIF(range, payment_ID)>1, you can easily highlight repeated entries. Conditional formatting can then be used to visually flag these duplicates for further review.

Which Excel features help track employee benefit deductions accuracy?

Data validation and VLOOKUP are key Excel features for ensuring employee benefit deduction accuracy. Data validation enforces correct input values, while VLOOKUP checks deduction rates against the official benefit tables. Together, they maintain consistent and error-free payroll deductions.

How can I link payroll audit Excel data with employee attendance records?

You can link payroll data and attendance records using Excel's Power Query or by creating lookup formulas like INDEX-MATCH. These methods allow smooth synchronization between hours worked and payroll calculations. This link ensures payroll reflects actual attendance for accuracy in payments.

What pivot table setup highlights payroll discrepancies across departments?

Creating a pivot table with department as rows and payroll amounts as values helps highlight discrepancies. Adding conditional formatting to the pivot table can flag departments with unusual payment totals. Incorporate filters for pay period and employee status to refine discrepancy analysis further.

More Audit Excel Templates