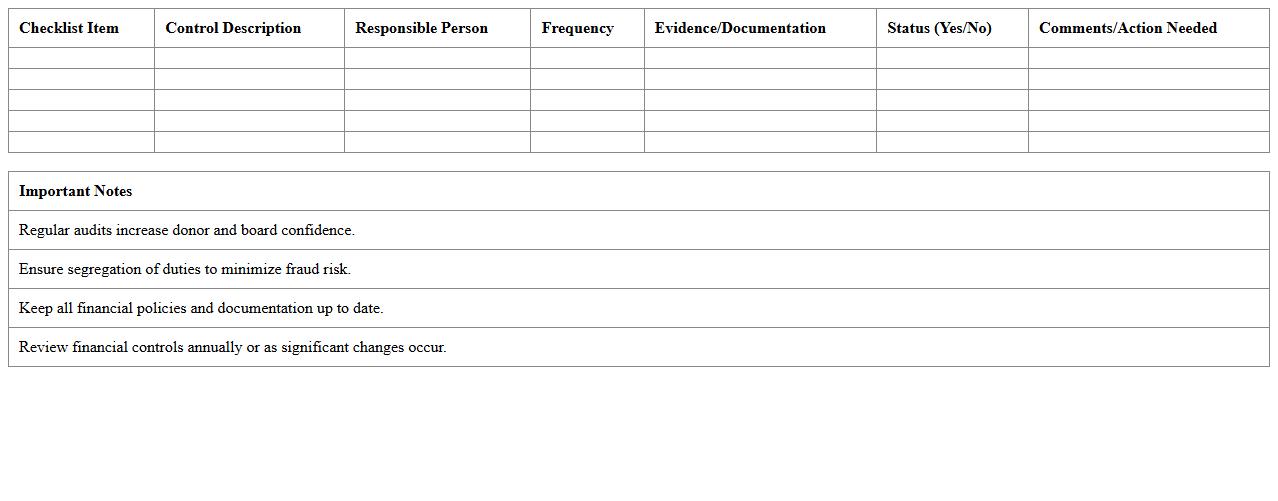

Financial Controls Internal Audit Checklist for Nonprofits (Excel Template)

The

Financial Controls Internal Audit Checklist for Nonprofits (Excel Template) is a structured tool designed to help organizations systematically review and verify their financial processes, ensuring compliance and minimizing risks. This checklist enables nonprofits to identify gaps in financial controls, monitor internal procedures, and maintain transparency and accountability to donors and stakeholders. By using this template, organizations can streamline audit preparation, enhance risk management, and improve overall financial governance.

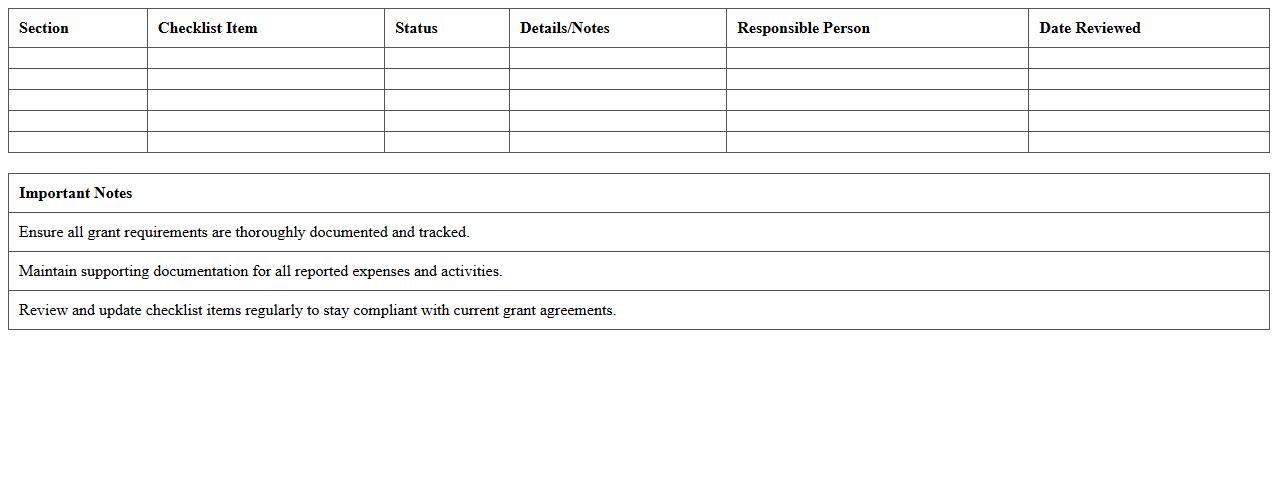

Grant Compliance Audit Checklist for Nonprofit Organizations (Excel Sheet)

The

Grant Compliance Audit Checklist for Nonprofit Organizations is an Excel sheet designed to help nonprofits systematically track and verify adherence to grant requirements, ensuring all financial and programmatic obligations are met. This tool streamlines the audit process by organizing documentation, deadlines, and compliance criteria in one accessible format, reducing the risk of errors or missed reporting. Using this checklist enhances accountability, improves grant management efficiency, and strengthens funder relationships by demonstrating thorough compliance.

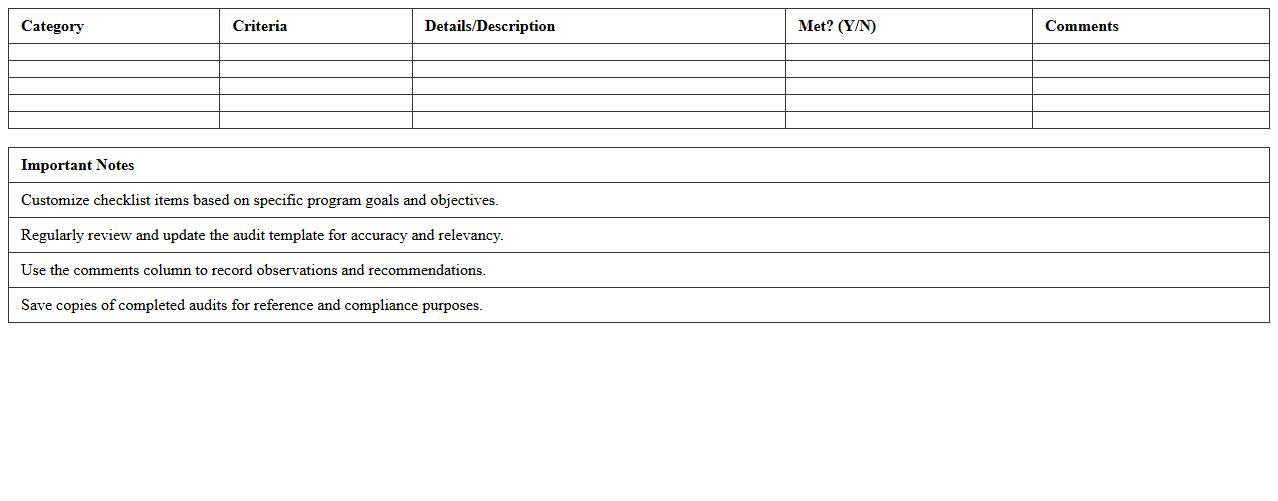

Nonprofit Program Effectiveness Audit Checklist (Excel Format)

The

Nonprofit Program Effectiveness Audit Checklist (Excel Format) is a comprehensive tool designed to evaluate the efficiency and impact of nonprofit programs through systematic criteria and performance indicators. It helps organizations identify strengths, pinpoint areas for improvement, and ensure alignment with their mission and goals by providing a structured framework for data collection and analysis. Utilizing this checklist enhances accountability, supports strategic decision-making, and maximizes the positive outcomes of nonprofit initiatives.

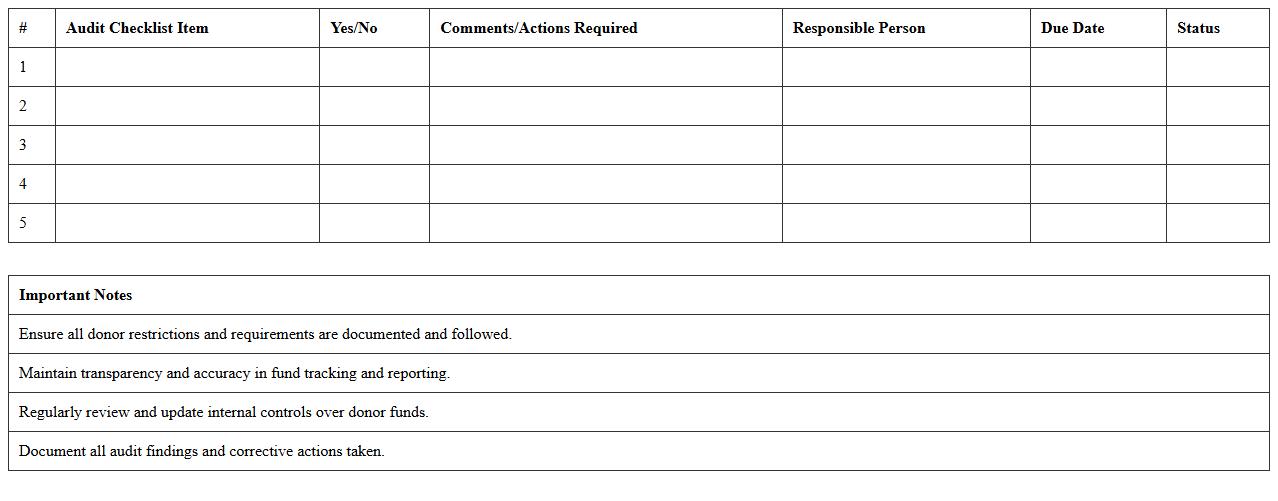

Donor Funds Management Audit Checklist for Nonprofits (Excel Template)

The

Donor Funds Management Audit Checklist for Nonprofits (Excel Template) is a comprehensive tool designed to ensure accurate tracking and accountability of donated funds within nonprofit organizations. It helps streamline the audit process by providing a structured framework to verify compliance with donor restrictions, regulatory requirements, and internal financial controls. Utilizing this checklist enhances transparency, improves financial management, and strengthens trust with donors and stakeholders.

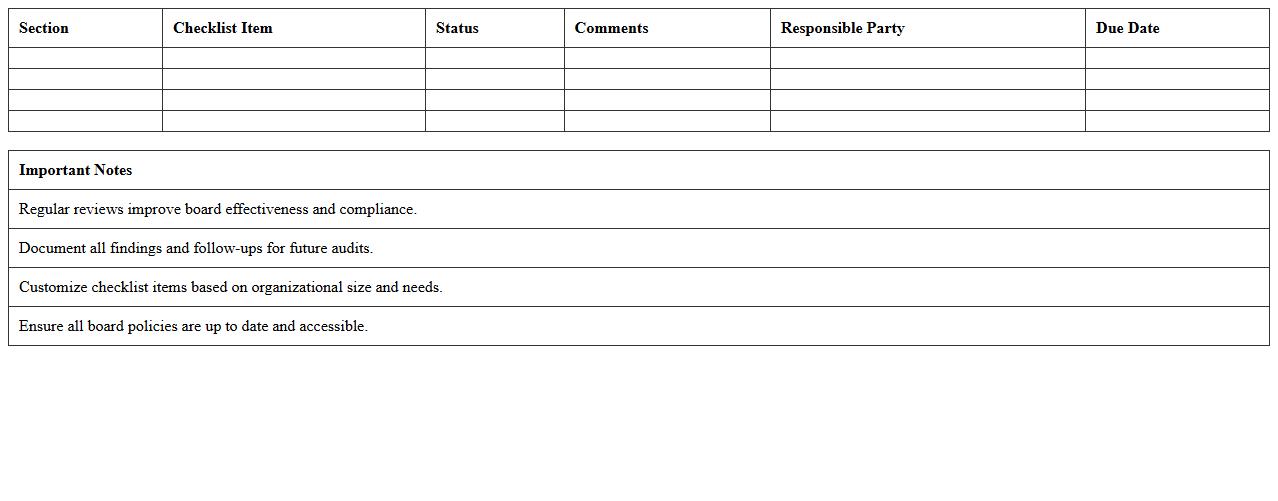

Board Governance Internal Audit Checklist for Nonprofits (Excel File)

The

Board Governance Internal Audit Checklist for Nonprofits (Excel File) is a comprehensive tool designed to evaluate and enhance the effectiveness of nonprofit board governance. It systematically tracks compliance with key governance practices, including policy adherence, board member roles, and meeting documentation, ensuring accountability and transparency. Using this checklist helps organizations identify gaps, improve decision-making processes, and maintain regulatory standards critical for sustaining trust and operational integrity.

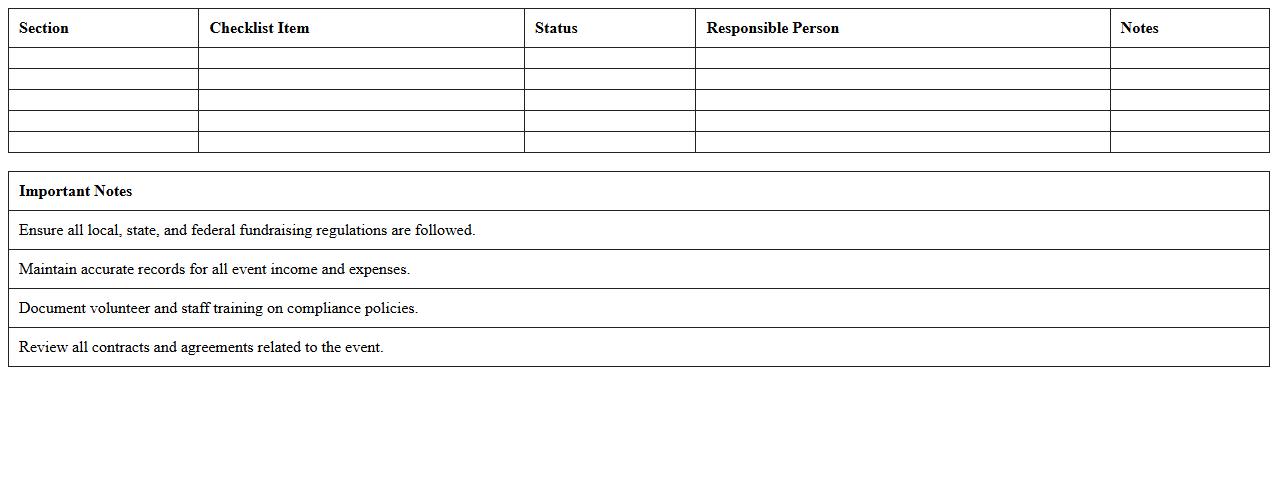

Fundraising Event Compliance Audit Checklist for Nonprofits (Excel Template)

The

Fundraising Event Compliance Audit Checklist for Nonprofits (Excel Template) is a comprehensive tool designed to help nonprofit organizations ensure adherence to legal, financial, and ethical standards during fundraising events. It systematically tracks compliance with IRS regulations, state fundraising laws, and organizational policies, reducing the risk of penalties and reputational damage. Utilizing this checklist enhances transparency, accountability, and operational efficiency, enabling nonprofits to confidently manage and execute successful fundraising initiatives.

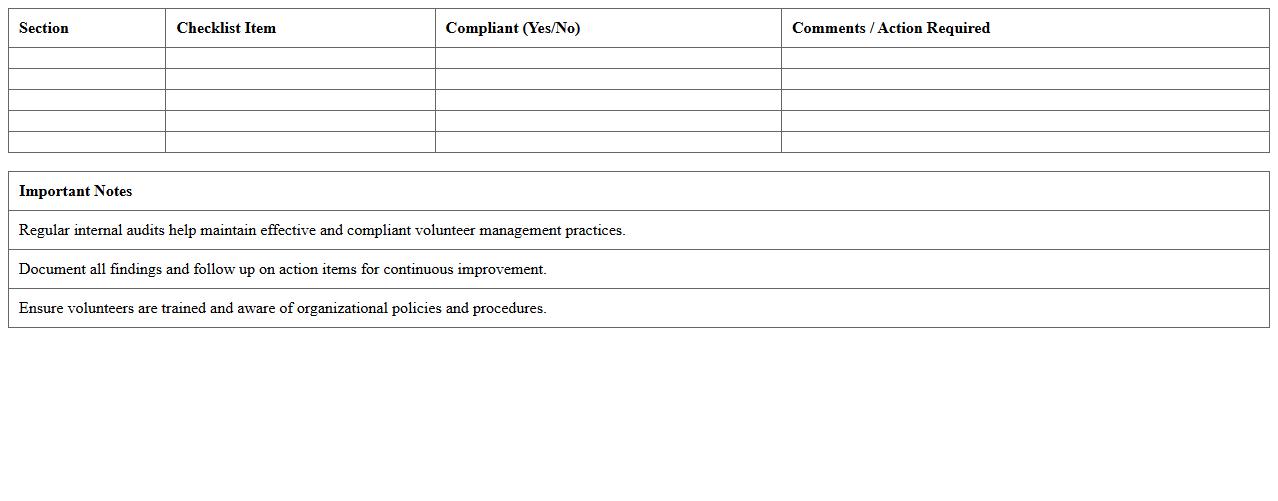

Volunteer Management Internal Audit Checklist for Nonprofits (Excel Workbook)

The

Volunteer Management Internal Audit Checklist for Nonprofits (Excel Workbook) is a comprehensive tool designed to evaluate and improve the efficiency and compliance of volunteer programs. It helps nonprofit organizations systematically assess key areas such as recruitment, training, engagement, and record-keeping, ensuring best practices and regulatory adherence. Utilizing this checklist allows nonprofits to identify gaps, mitigate risks, and enhance the overall impact of their volunteer management processes.

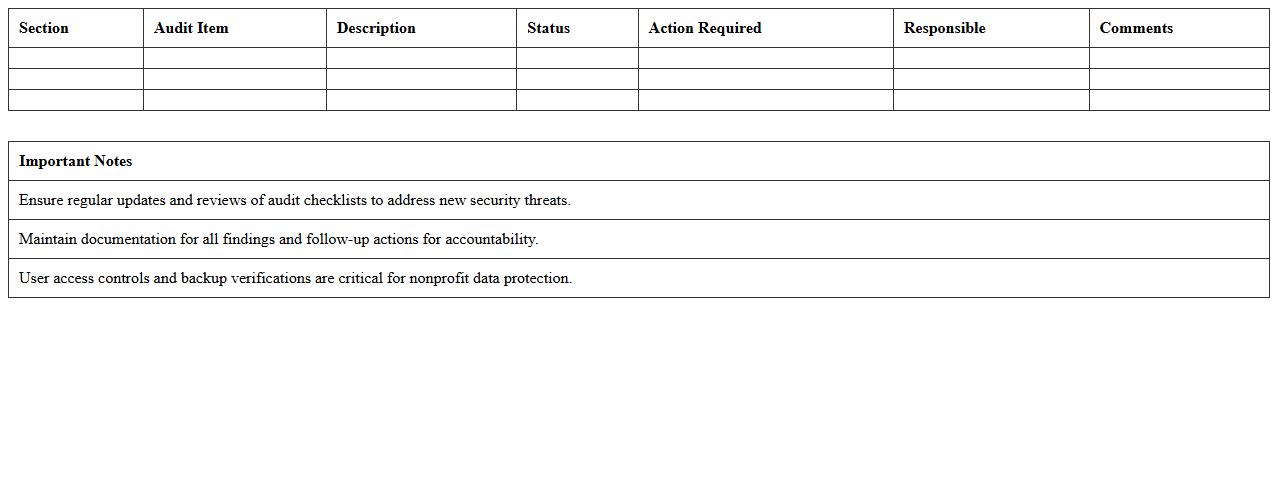

IT Systems Security Audit Checklist for Nonprofit Organizations (Excel Sheet)

The

IT Systems Security Audit Checklist for Nonprofit Organizations (Excel Sheet) is a comprehensive tool designed to systematically evaluate the security posture of IT infrastructures within nonprofit entities. This document assists in identifying vulnerabilities, ensuring compliance with data protection regulations, and prioritizing corrective actions to safeguard sensitive information. By using this checklist, nonprofit organizations can enhance their cybersecurity measures, reduce risk exposure, and maintain the trust of donors and stakeholders.

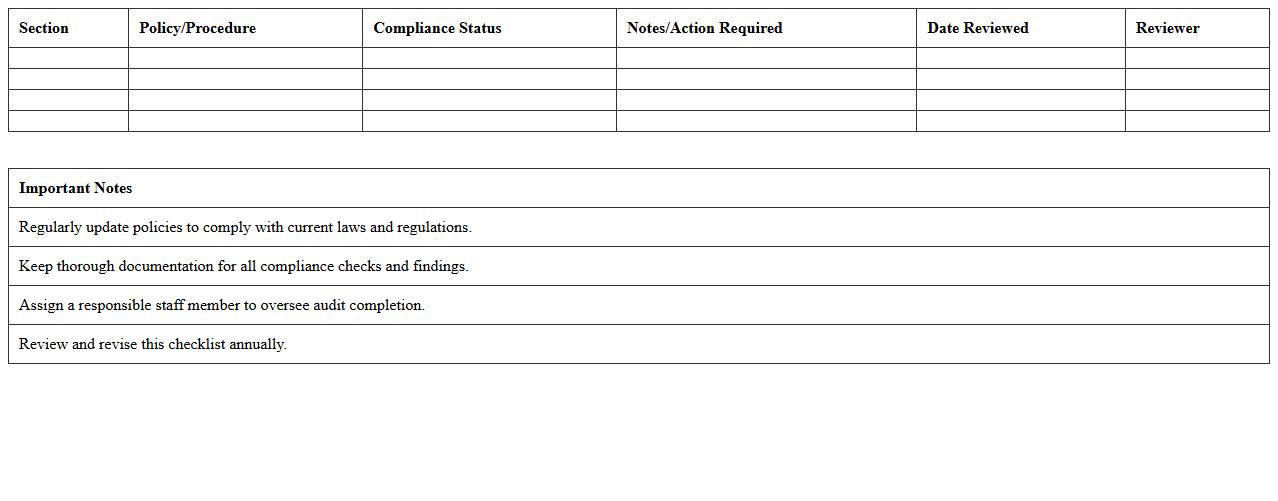

Nonprofit Policy and Procedure Compliance Audit Checklist (Excel Template)

The

Nonprofit Policy and Procedure Compliance Audit Checklist (Excel Template) is a structured tool designed to help organizations systematically review and ensure adherence to regulatory and internal policies. This template facilitates tracking compliance across various operational domains, promoting transparency and accountability within the nonprofit sector. Utilizing this checklist streamlines the audit process, identifies compliance gaps, and supports the maintenance of best practices essential for regulatory compliance and organizational integrity.

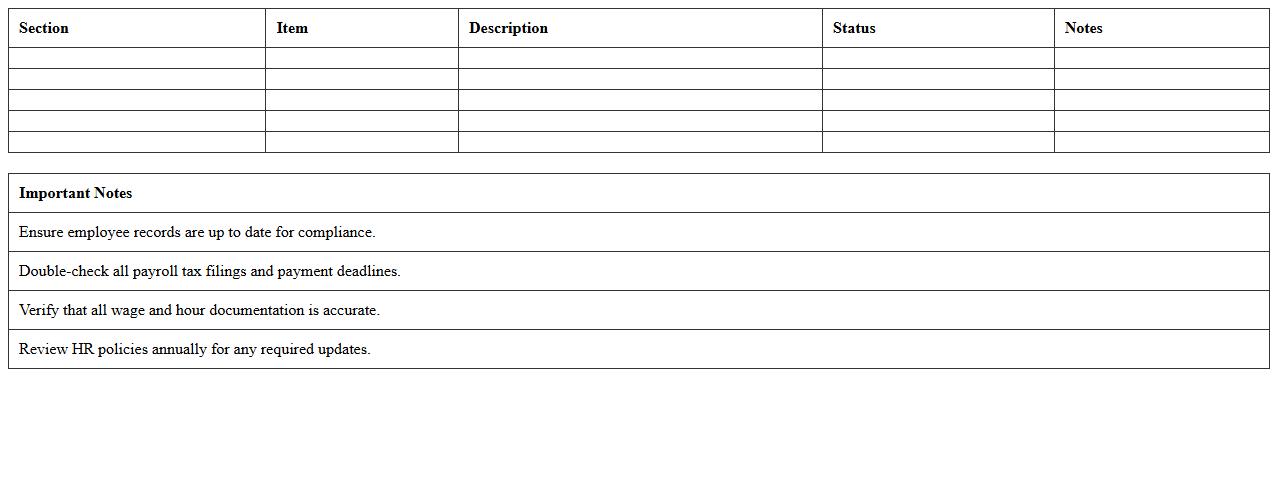

Nonprofit Payroll and HR Audit Checklist (Excel Spreadsheet)

The

Nonprofit Payroll and HR Audit Checklist (Excel Spreadsheet) is a comprehensive tool designed to help nonprofit organizations systematically review payroll and human resources processes for compliance and accuracy. It includes key sections such as employee classification, tax withholdings, benefits administration, and documentation requirements, ensuring all regulatory obligations are met. This checklist streamlines internal audits, reduces risk of errors or penalties, and supports effective record-keeping for nonprofit HR and payroll functions.

How does your Internal Audit Checklist Excel ensure compliance with nonprofit grant requirements?

Our Internal Audit Checklist Excel is designed to align with nonprofit grant requirements by including specific audit points that verify adherence to both federal and state grant regulations. It provides a structured review process to confirm that grant expenditures are properly documented and allowable under grant terms. This systematic approach helps nonprofits maintain compliance and accountability in their grant management.

What key controls are included for donation tracking in your audit checklist?

The checklist incorporates key controls such as verifying the recording of donations in a timely and accurate manner. It mandates reconciliation of donation records with bank statements to detect discrepancies. Additionally, controls ensure that donor restrictions are respected and funds are allocated accordingly.

Does your checklist address segregation of duties specific to nonprofit finance?

Yes, the checklist emphasizes the importance of segregation of duties to reduce the risk of errors and fraud within nonprofit finance functions. It recommends separating responsibilities among authorization, record-keeping, and asset custody to maintain strong internal controls. This approach protects the organization by ensuring no single individual can control all aspects of critical financial transactions.

How frequently does your template recommend reviewing restricted fund balances?

The template suggests monthly reviews of restricted fund balances to ensure accurate tracking and compliance with donor-imposed restrictions. Regular monitoring helps identify any misallocation of funds early and supports transparent financial reporting. This frequency promotes timely corrective actions if discrepancies arise.

Which documentation procedures does your checklist include for program expense verification?

The checklist requires maintaining comprehensive supporting documentation such as invoices, receipts, and timesheets to verify program expenses. It also includes steps for matching expenses to approved budgets and grant scopes. This thorough documentation process validates that funds are spent appropriately and in alignment with program objectives.