The Income and Expense Register Excel Template for Freelancers is designed to help self-employed professionals track their earnings and expenditures efficiently. This customizable spreadsheet allows freelancers to monitor cash flow, categorize expenses, and generate financial summaries for better budgeting. It simplifies tax preparation and ensures accurate financial management throughout the fiscal year.

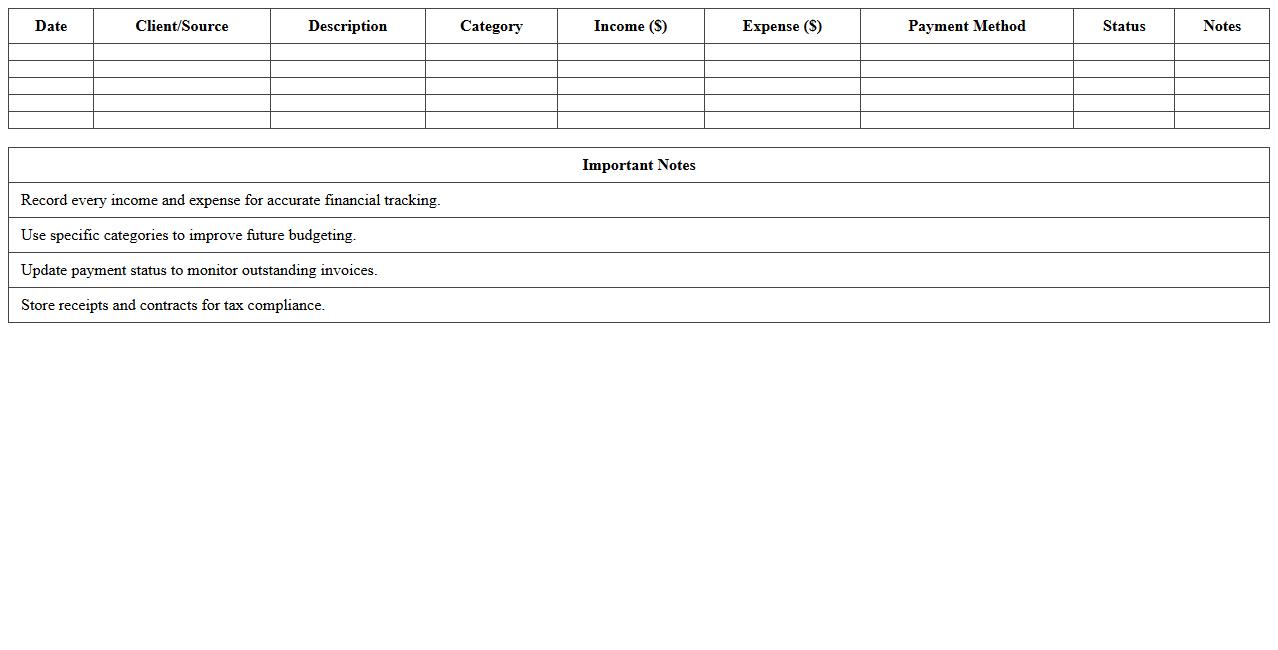

Freelancer Monthly Income Tracker Spreadsheet

The

Freelancer Monthly Income Tracker Spreadsheet is a comprehensive tool designed to monitor and organize freelance earnings on a monthly basis. It provides a clear overview of income sources, project payments, and outstanding invoices, enabling freelancers to manage cash flow efficiently. This spreadsheet helps in budgeting, forecasting future earnings, and ensuring timely tax calculations for financial stability and growth.

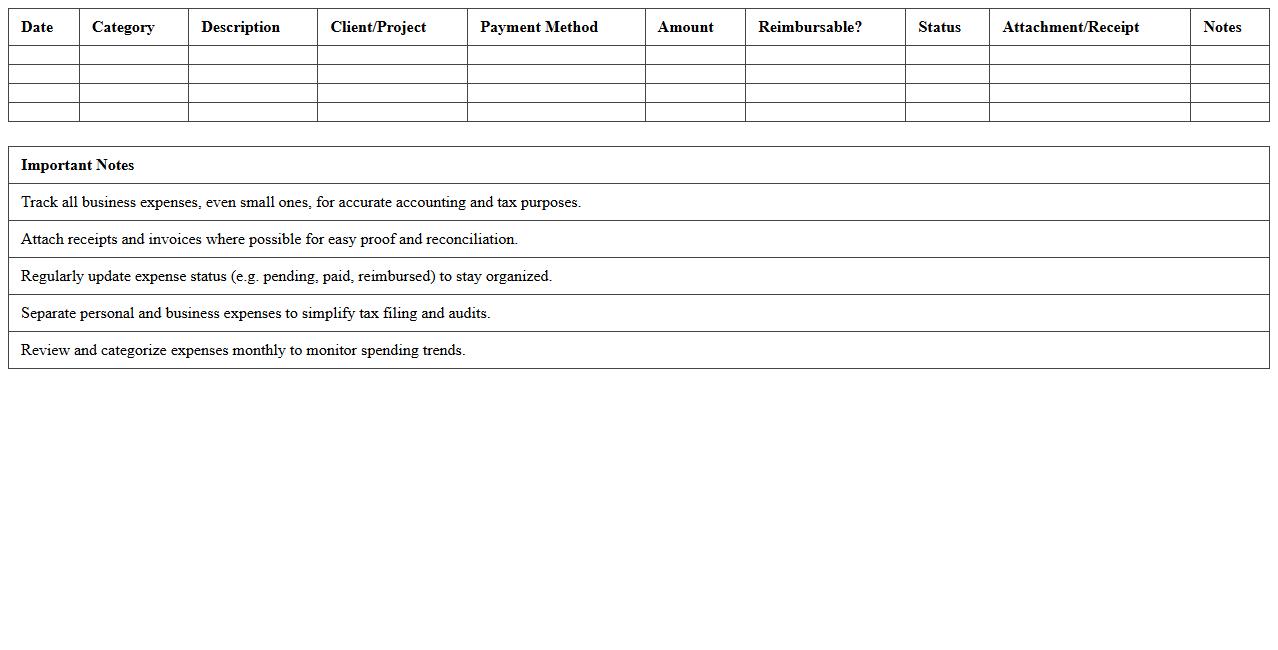

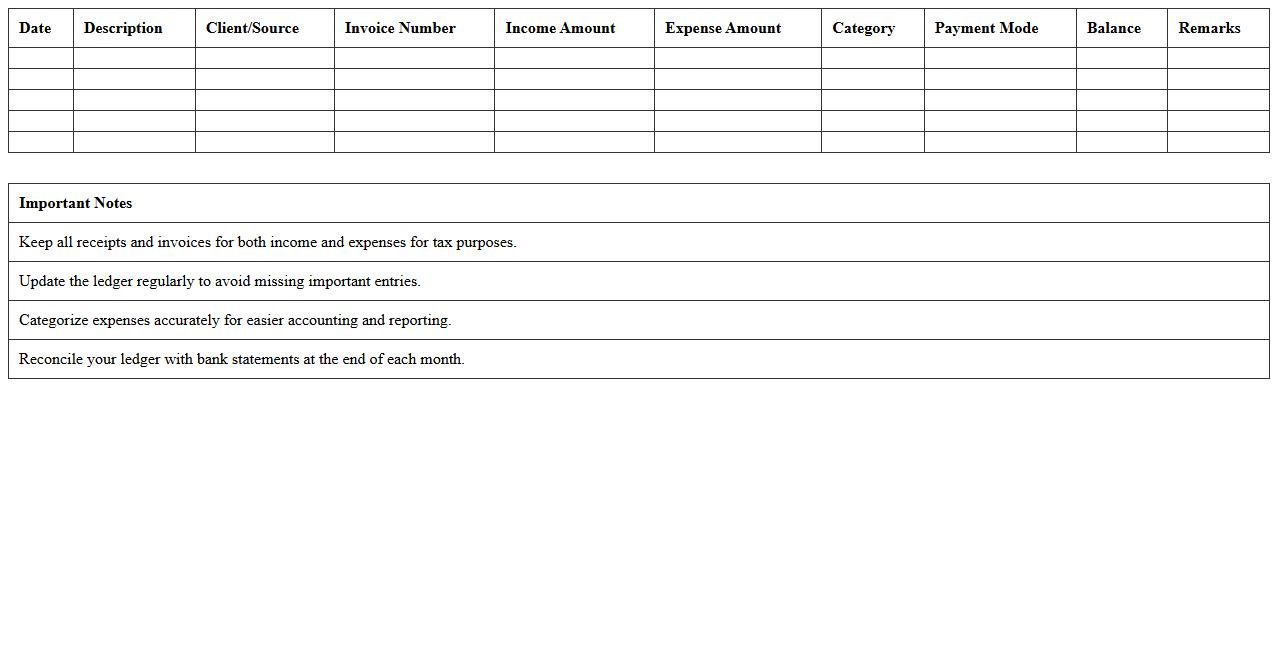

Freelance Expense Log & Management Worksheet

A

Freelance Expense Log & Management Worksheet is a structured document designed to track and organize all business-related expenses incurred by freelancers. It helps maintain accurate financial records, simplifies tax preparation, and provides clear insights into budgeting and cash flow management. Using this worksheet ensures freelancers can optimize their expense tracking, leading to better financial control and increased profitability.

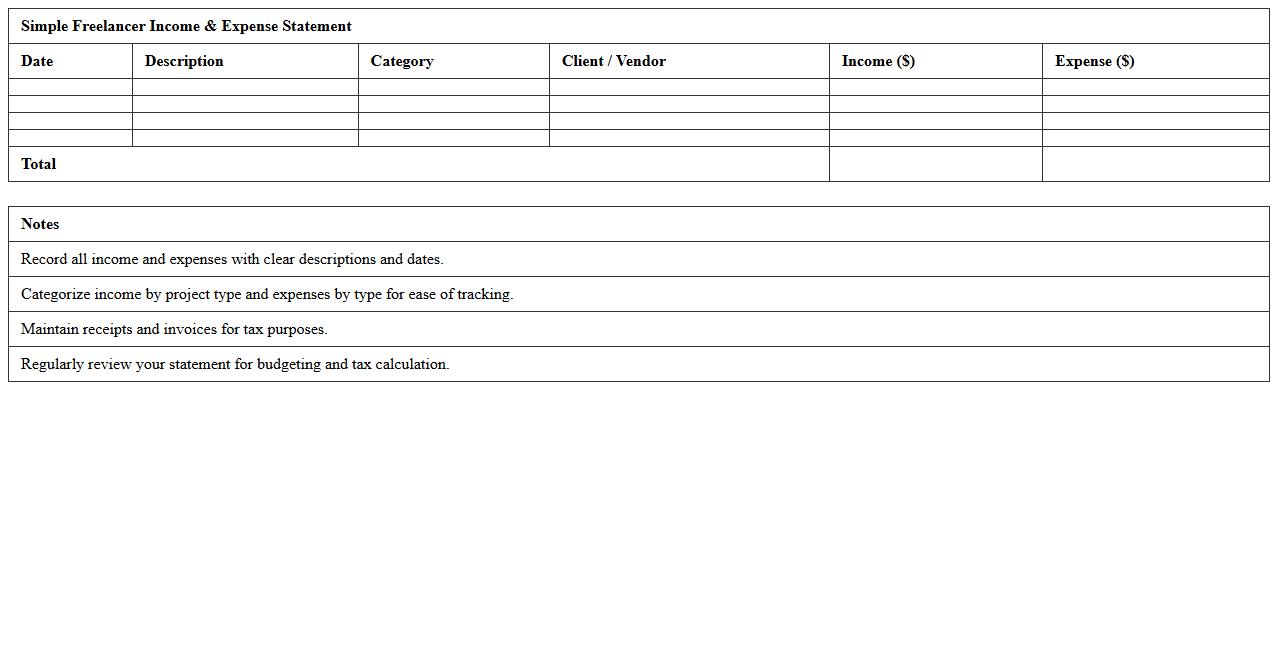

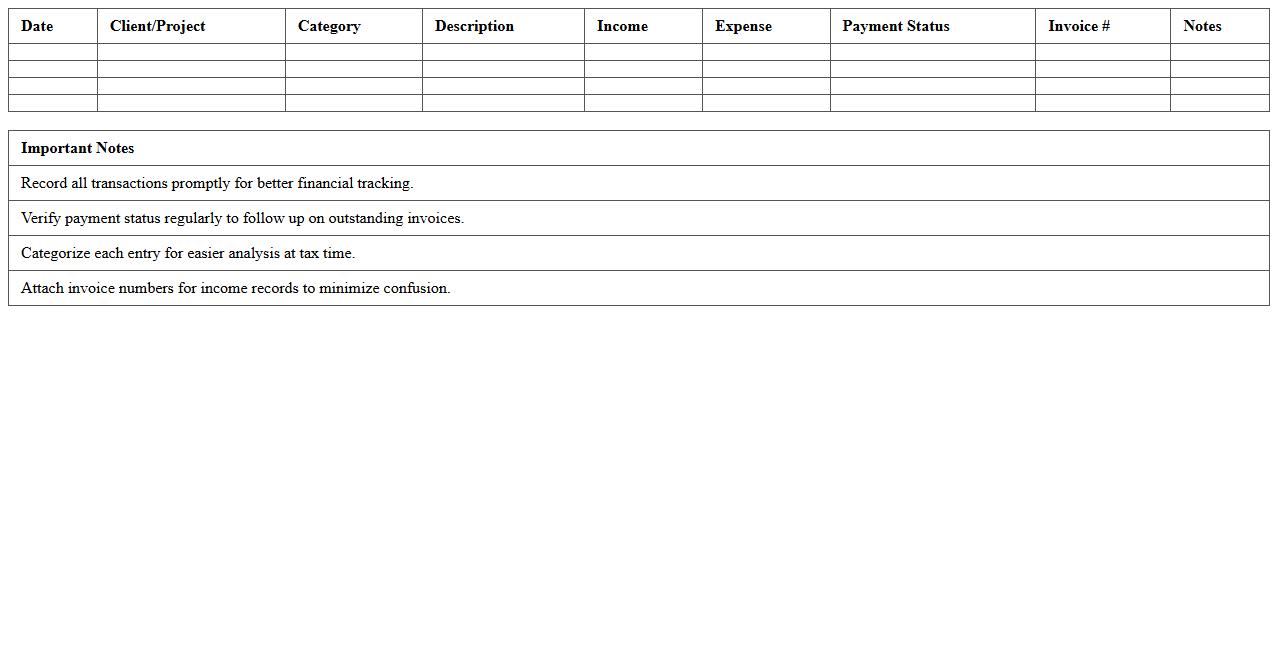

Simple Freelancer Income & Expense Statement Excel

The

Simple Freelancer Income & Expense Statement Excel document is a streamlined financial tracking tool designed specifically for freelancers to record and manage their income and expenses efficiently. It helps users maintain organized financial records, making it easier to monitor cash flow, prepare for tax filings, and identify potential deductions. By using this Excel sheet, freelancers can gain clear insights into their profitability and ensure accurate financial reporting throughout the year.

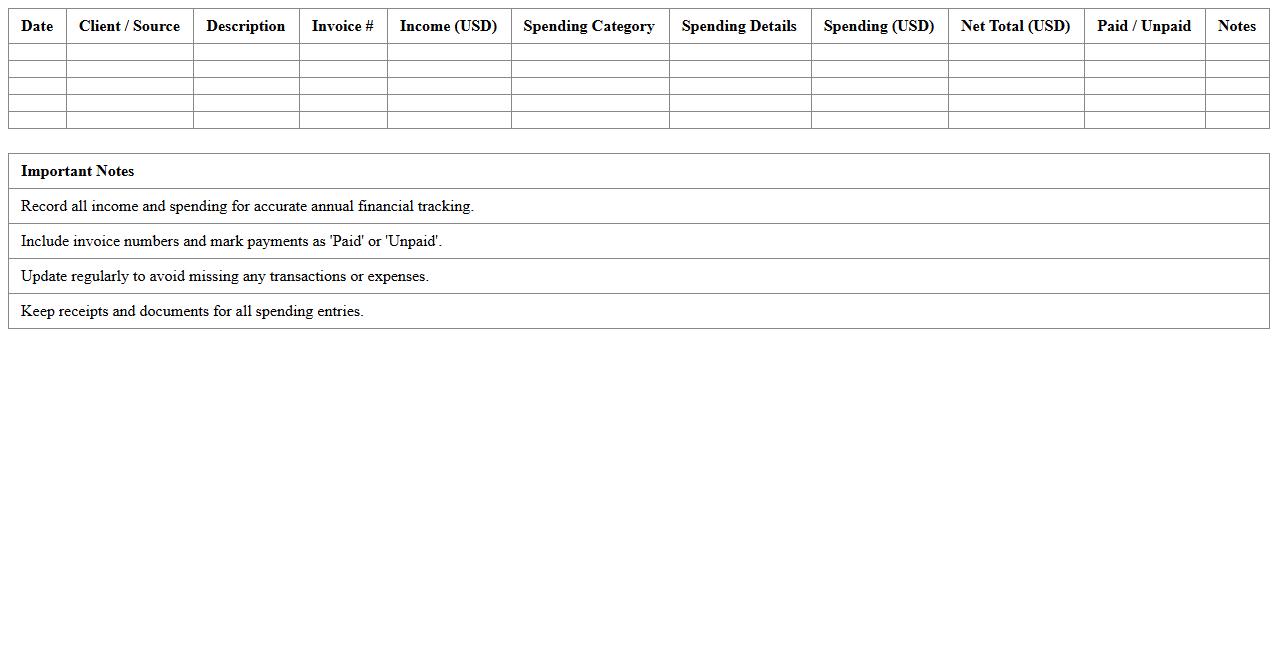

Annual Freelance Income and Spending Register

The

Annual Freelance Income and Spending Register is a comprehensive document used to track all earnings and expenses related to freelance work within a fiscal year. This register helps freelancers maintain accurate financial records, ensuring proper tax filing and improved budget management. By systematically recording income and expenditures, it provides valuable insights for optimizing cash flow and identifying deductible expenses.

Detailed Income/Expense Sheet for Freelancers

A

Detailed Income/Expense Sheet for Freelancers is a comprehensive financial record that tracks all sources of income and business-related expenses. It helps freelancers monitor cash flow, manage budgets, and prepare accurate tax filings by organizing transactions clearly. Using this document enhances financial transparency and ensures compliance with tax regulations, ultimately supporting better financial decision-making.

Freelancer Earnings and Costs Tracker Template

The

Freelancer Earnings and Costs Tracker Template document is a structured tool designed to help independent contractors monitor their income and expenses efficiently. By organizing financial data in one place, it enables freelancers to assess profitability, manage budgets, and prepare for tax obligations with greater accuracy. This template enhances financial clarity, supporting informed decision-making and improved cash flow management.

Professional Income-Expense Ledger for Freelancers

A

Professional Income-Expense Ledger for Freelancers is a detailed financial record that tracks all income earned and expenses incurred during freelance work. This document is crucial for accurate tax filing, budgeting, and financial analysis, enabling freelancers to monitor profitability and make informed business decisions. Maintaining this ledger helps ensure compliance with tax regulations by providing clear documentation needed for deductions and audits.

Freelancer Project Income & Expense Organizer

The

Freelancer Project Income & Expense Organizer document is a tool designed to track and categorize all earnings and expenditures related to freelance projects. It helps freelancers maintain clear financial records, ensuring accurate invoicing, budgeting, and tax preparation. Using this organizer enhances financial management by providing insight into project profitability and cash flow.

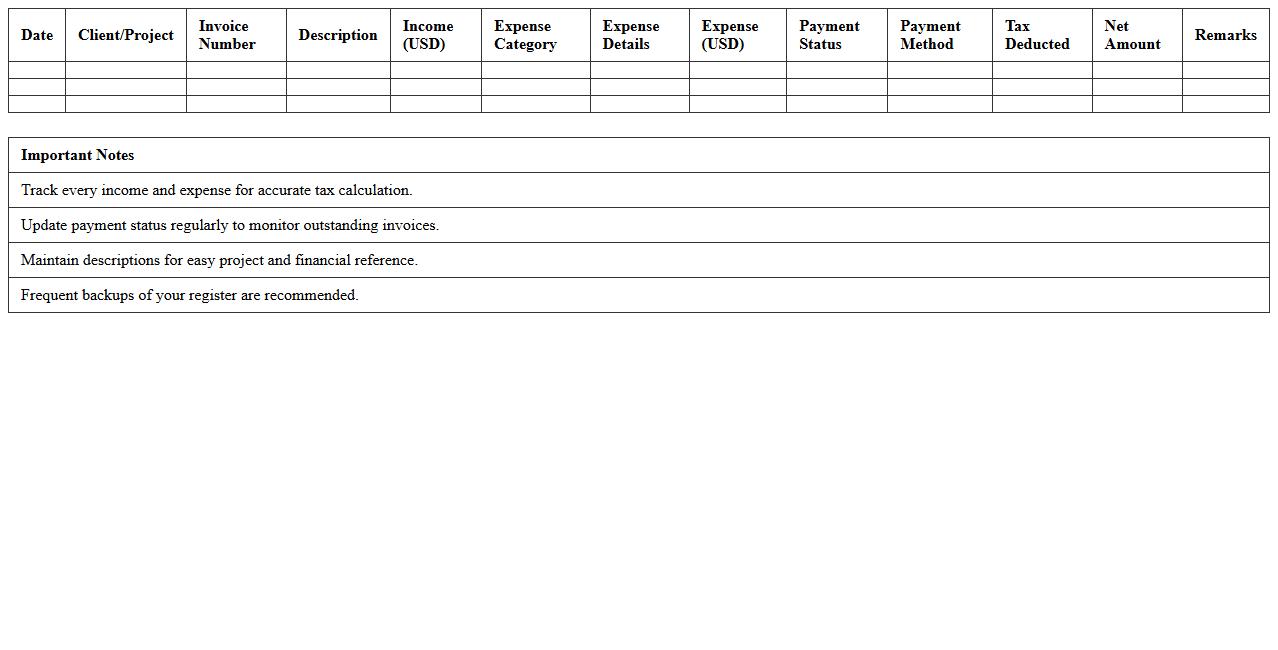

Comprehensive Freelancer Financial Register Excel

The

Comprehensive Freelancer Financial Register Excel document serves as a detailed tool to track income, expenses, taxes, and project-based earnings for independent contractors. This register enhances financial organization by consolidating all monetary transactions into one accessible spreadsheet, facilitating better budgeting and tax preparation. Users can analyze cash flow trends, prepare accurate invoices, and ensure timely payments, improving overall financial management efficiency.

Freelance Budget Planner & Invoice Tracker Template

The

Freelance Budget Planner & Invoice Tracker Template document is a specialized tool designed to help freelancers manage their finances efficiently by organizing budgets and tracking invoices in one place. It allows users to monitor income, expenses, and payment statuses, ensuring timely billing and accurate financial planning. This template enhances cash flow management, reduces the risk of missed payments, and supports better financial decision-making for independent professionals.

How can I automate monthly income and expense categorization in my Excel register?

To automate monthly income and expense categorization, use Excel's IF and VLOOKUP formulas to assign categories based on transaction descriptions. Implement data validation drop-downs for consistent entry, improving accuracy in categorization. Additionally, leverage PivotTables to summarize categorized data monthly for a clear financial overview.

What advanced Excel formulas track project-specific earnings for freelancers?

Freelancers can use the SUMIFS formula to track project-specific earnings by summing income based on multiple criteria like project name and date. Combining INDEX and MATCH functions enables dynamic searching of earnings linked to specific projects. Using these formulas together helps maintain detailed and organized project income records efficiently.

How do I customize tax-deductible expense fields for freelance work in my spreadsheet?

Customize tax-deductible expense fields by creating specific categories for deductible and non-deductible expenses using drop-down lists. Use conditional formatting to highlight expenses eligible for tax deductions, making review and reporting simpler. Integrate SUMIF formulas to calculate total tax-deductible amounts accurately for tax filing purposes.

Which Excel templates best visualize freelance cash flow over multiple clients?

Templates featuring dynamic dashboards with PivotCharts and Slicers are ideal for visualizing freelance cash flow across clients. Templates like income-expense trackers or budget planners customizable per client offer useful cash flow insights. They enable freelancers to analyze trends, manage income streams, and optimize client financial performance effectively.

What security measures protect sensitive financial data in an Excel income-expense sheet?

To protect sensitive financial data, use Excel's password protection and encryption features to secure the entire workbook or individual sheets. Implement restricted editing by allowing only trusted users to modify key data, enhancing data integrity. Additionally, regularly back up files and consider using OneDrive or SharePoint for secure cloud storage with access controls.

More Register Excel Templates