The Budget Excel Template for Family Monthly Finances offers a comprehensive and user-friendly tool to track income, expenses, and savings effectively. It allows families to categorize spending, monitor budget goals, and analyze financial health on a monthly basis. This template simplifies money management, making it easier to plan for future expenses and improve financial stability.

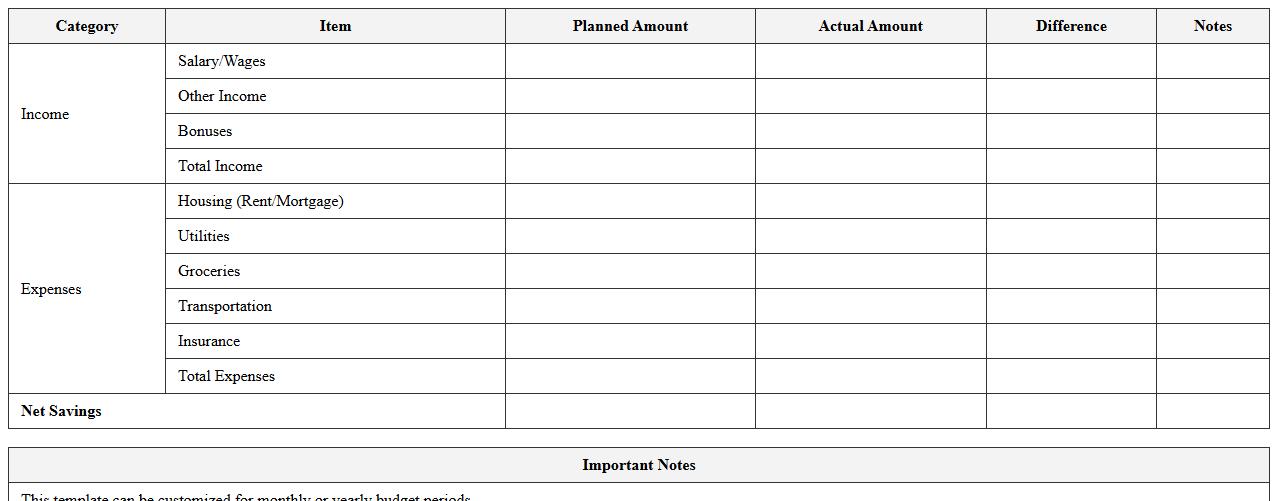

Family Monthly Income and Expense Tracker Spreadsheet

The

Family Monthly Income and Expense Tracker Spreadsheet is a practical tool designed to organize and monitor household finances by recording all sources of income and categorizing monthly expenses. It helps individuals and families gain clear insights into their spending patterns, enabling better budgeting and financial planning. By using this spreadsheet, users can identify areas to save money, avoid overspending, and work toward financial goals with improved control over their cash flow.

Household Budget Planner Excel Sheet

A

Household Budget Planner Excel Sheet is a digital tool designed to help individuals or families track income, expenses, and savings in an organized manner. By categorizing spending and forecasting future costs, it enables efficient financial management and helps avoid overspending. Utilizing this sheet can lead to better financial decisions, improved savings, and a clearer understanding of monthly cash flow.

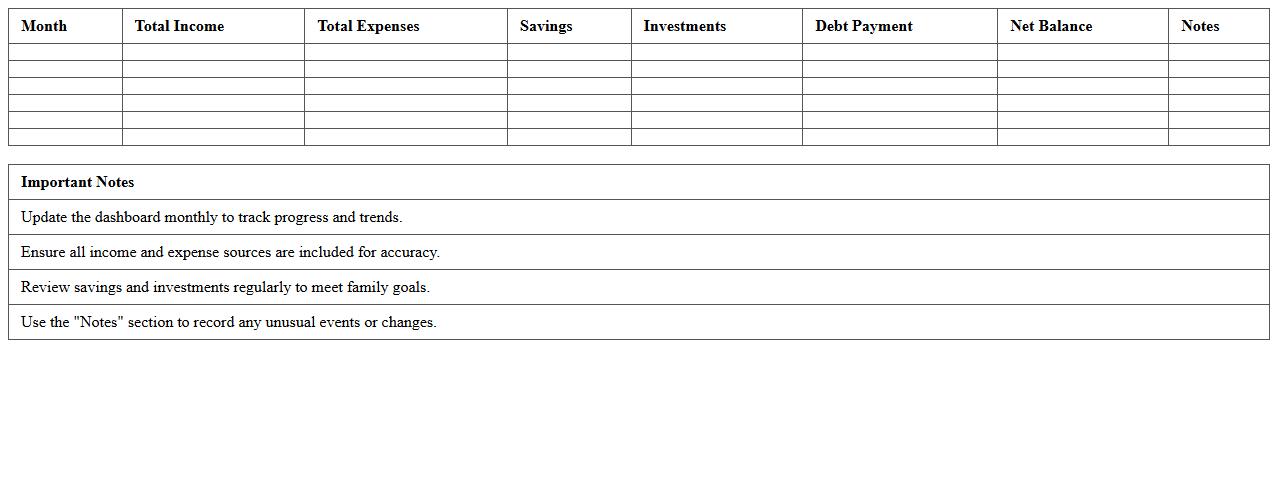

Family Expense Breakdown Excel Template

The

Family Expense Breakdown Excel Template is a structured spreadsheet designed to categorize and track household expenditures efficiently. It helps users monitor spending patterns, budget effectively, and identify areas for cost-saving by organizing expenses into specific categories. Using this template enhances financial planning and supports informed decision-making to maintain a balanced family budget.

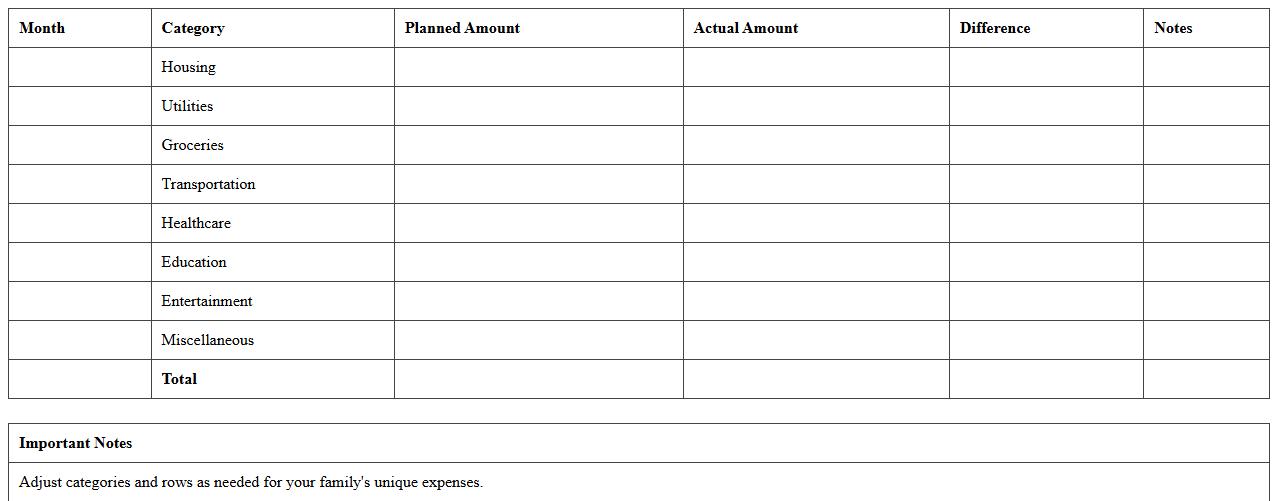

Monthly Family Financial Dashboard Spreadsheet

The

Monthly Family Financial Dashboard Spreadsheet is a comprehensive tool designed to track and analyze household income, expenses, savings, and debts on a monthly basis. It organizes financial data into clear categories, enabling families to monitor spending patterns, set budgets, and identify opportunities for cost savings. By providing a visual overview of financial health, this spreadsheet aids in making informed decisions to achieve long-term financial stability and goals.

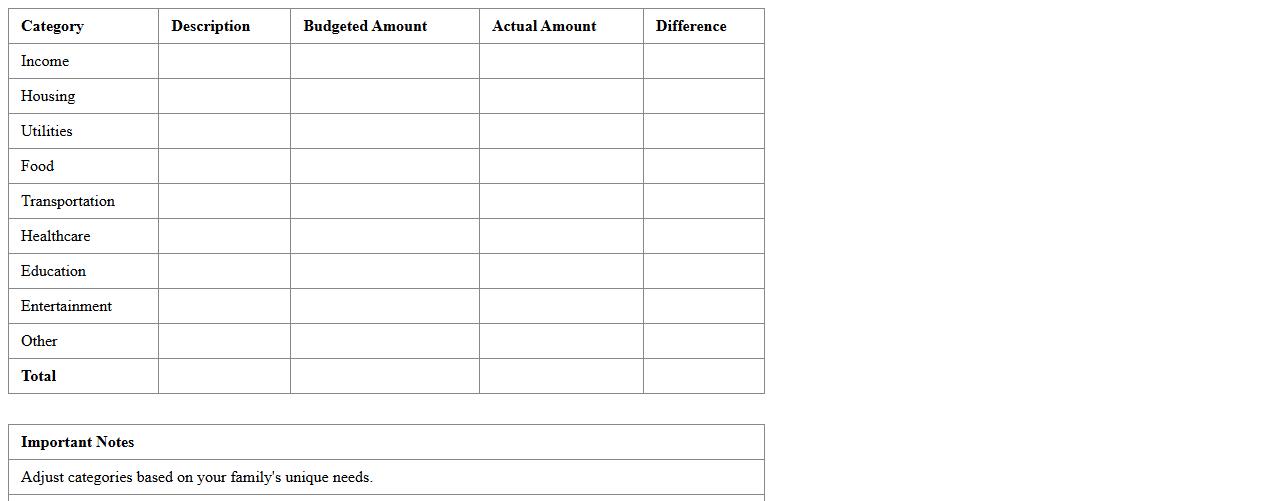

Simple Family Budget Sheet in Excel

A

Simple Family Budget Sheet in an Excel document is a structured financial tool designed to track household income, expenses, and savings efficiently. It helps families allocate funds wisely by categorizing expenses such as groceries, utilities, and entertainment, ensuring better financial control and planning. This organized approach enables users to identify spending patterns, reduce unnecessary costs, and achieve financial goals reliably.

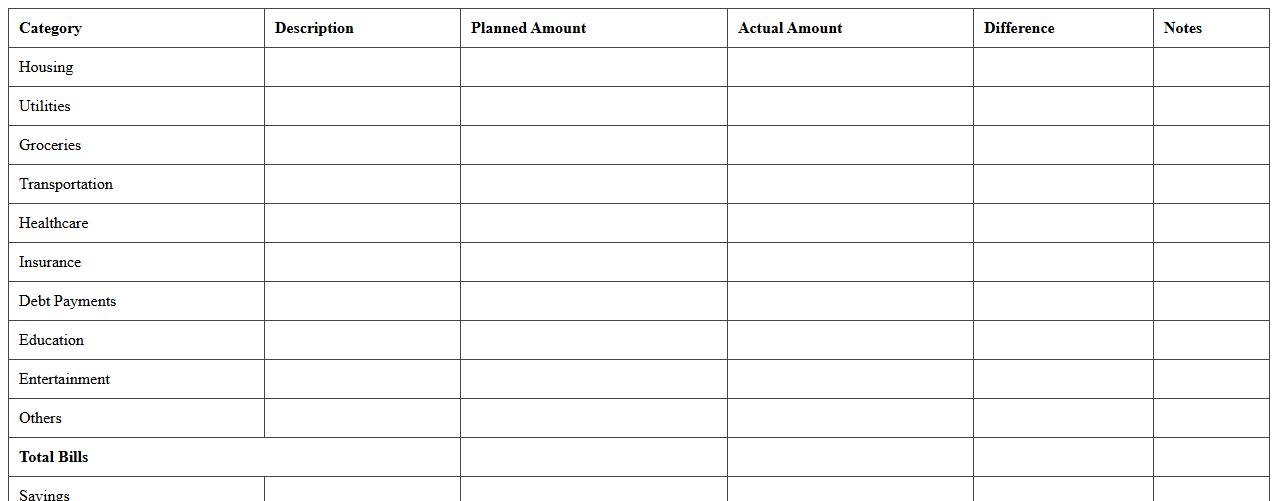

Family Monthly Bills and Savings Planner

The

Family Monthly Bills and Savings Planner document is a structured tool designed to track income, expenses, and savings goals within a household. It helps individuals organize monthly bills such as utilities, rent, groceries, and medical costs, ensuring timely payments and preventing financial shortfalls. By providing a clear overview of spending patterns, it enables better budgeting decisions and fosters disciplined savings habits for financial stability.

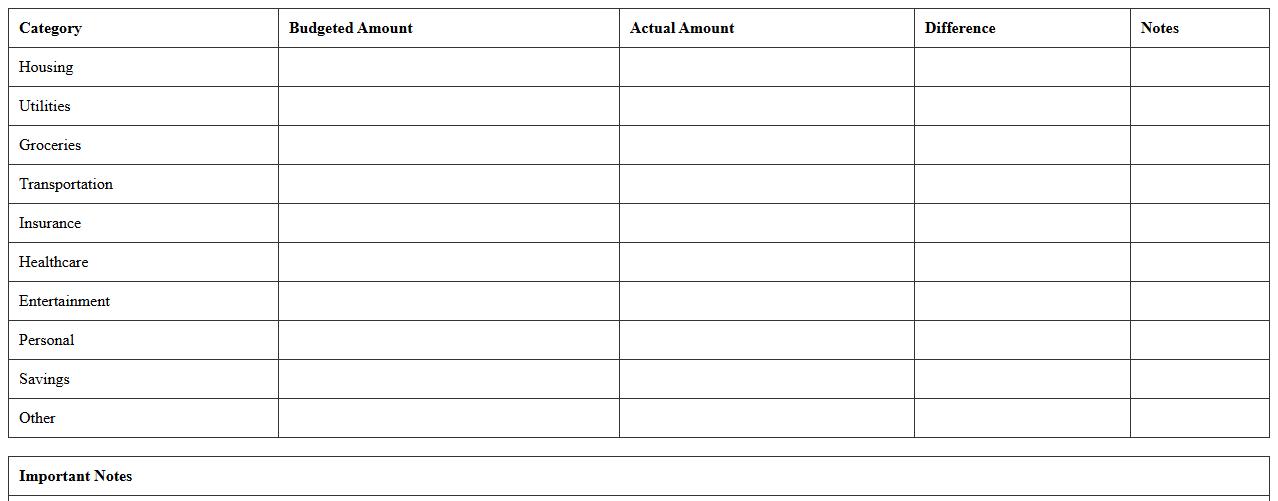

Home Budget Allocation Excel Template

The

Home Budget Allocation Excel Template is a customizable spreadsheet designed to help individuals track and manage household income and expenses efficiently. It enables users to categorize spending, set budget limits, and monitor financial goals, leading to improved financial awareness and control. By providing a clear overview of monthly allocations, this tool assists in optimizing resource distribution and avoiding overspending.

Family Financial Goals Tracking Spreadsheet

A

Family Financial Goals Tracking Spreadsheet is a structured document designed to organize and monitor household income, expenses, savings, and investment objectives. It helps users visualize progress towards budgeting targets, debt reduction, emergency fund growth, and long-term financial aspirations. Utilizing this tool promotes disciplined money management, enhances financial decision-making, and supports achieving economic stability for families.

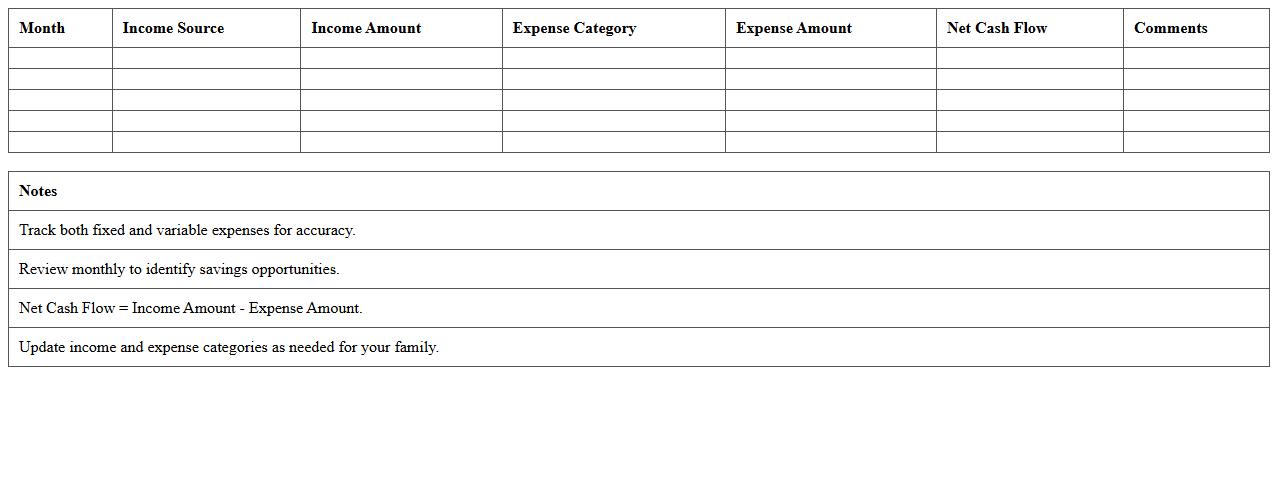

Family Cash Flow Analysis Excel Sheet

A

Family Cash Flow Analysis Excel Sheet document is a financial tool designed to track and manage the inflows and outflows of money within a household. It helps users visualize their income sources, monthly expenses, savings, and debt repayments, providing a clear picture of their financial health. By using this document, families can make informed budgeting decisions, identify spending patterns, and plan for future financial goals effectively.

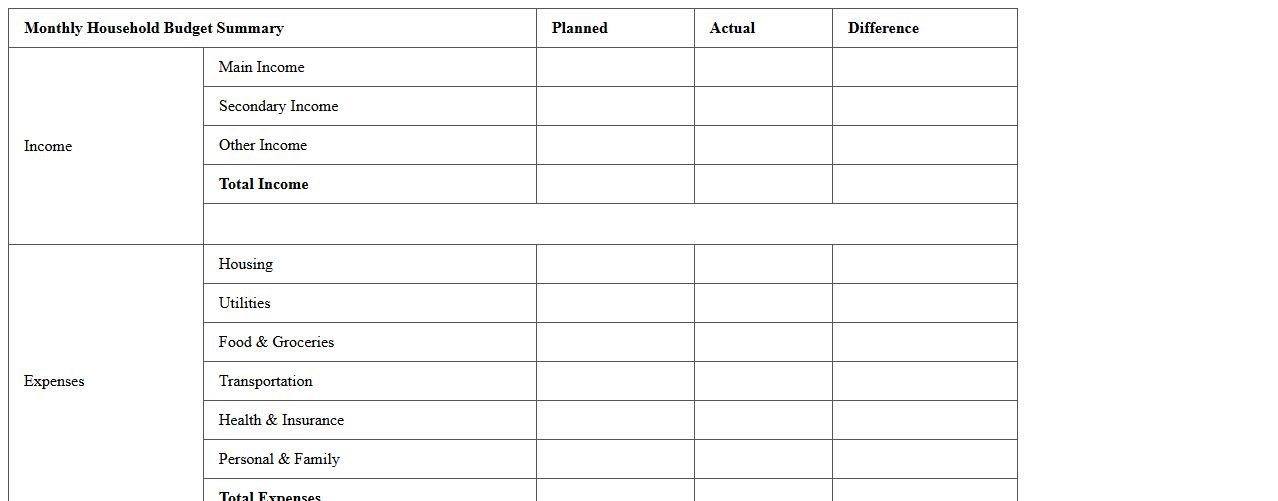

Monthly Household Budget Summary Excel Template

The

Monthly Household Budget Summary Excel Template is a structured document designed to track and organize monthly income, expenses, and savings for a household. It helps users visualize spending patterns, manage bills efficiently, and identify areas for cost reduction to improve financial health. By providing a clear overview of financial activities, this template supports informed decision-making and effective budgeting.

How can I automate recurring family expenses in a Budget Excel template?

To automate recurring family expenses in Excel, use the "Fill Handle" or "AutoFill" feature to replicate expense patterns over months. Setting up formulas with fixed intervals, such as monthly or yearly, helps maintain consistent entries without manual input. Incorporate Excel's IF and DATE functions to trigger payments on specific dates, ensuring timely tracking.

What are effective ways to categorize irregular family income in Excel?

Effective categorization of irregular family income involves creating distinct income categories, such as freelance, gifts, or bonuses, within your Excel sheet. Utilize dropdown lists via Data Validation to standardize income entries and reduce errors. Summarize income sources using PivotTables to gain clearer insights and analyze trends efficiently.

How do I create visual trends for kids' expenses across months in Excel?

Creating visual trends for kids' expenses involves setting up a structured data table with monthly expenses per child. Use Excel's Chart tools, such as Line Charts or Column Charts, to illustrate spending patterns over time. Enhance clarity by applying slicers or filters to compare expenses between different months or categories easily.

Which Excel formulas help track savings goals for multiple family members?

To track savings goals for multiple family members, use SUMIF and SUMIFS formulas to aggregate savings contributions by individual. Incorporate goal thresholds with conditional formulas like IF and AND to monitor progress against set targets. Dynamic formulas combined with data validation enable real-time updates and accurate tracking across members.

How can I set conditional alerts for overspending in any budget category?

Setting conditional alerts for overspending requires applying Conditional Formatting rules targeting budget category cells. Configure rules to change colors or icons when expenses exceed predefined limits, providing instant visual warnings. Combine these alerts with data validation and summary sheets for comprehensive budget oversight.

More Budget Excel Templates