The Monthly Budget Excel Template for Small Businesses helps entrepreneurs track income and expenses with ease, ensuring financial control. Designed for simplicity, it offers customizable categories to fit various business needs and aids in forecasting future cash flows. This tool enhances budget accuracy and supports strategic decision-making for small business growth.

Monthly Expense Tracker for Small Businesses

A

Monthly Expense Tracker for Small Businesses document systematically records all financial outflows each month, allowing business owners to monitor spending patterns accurately. This tool helps in budgeting effectively, identifying cost-saving opportunities, and maintaining financial health by preventing overspending. By providing clear visibility into expenses, it supports informed decision-making and enhances overall financial management.

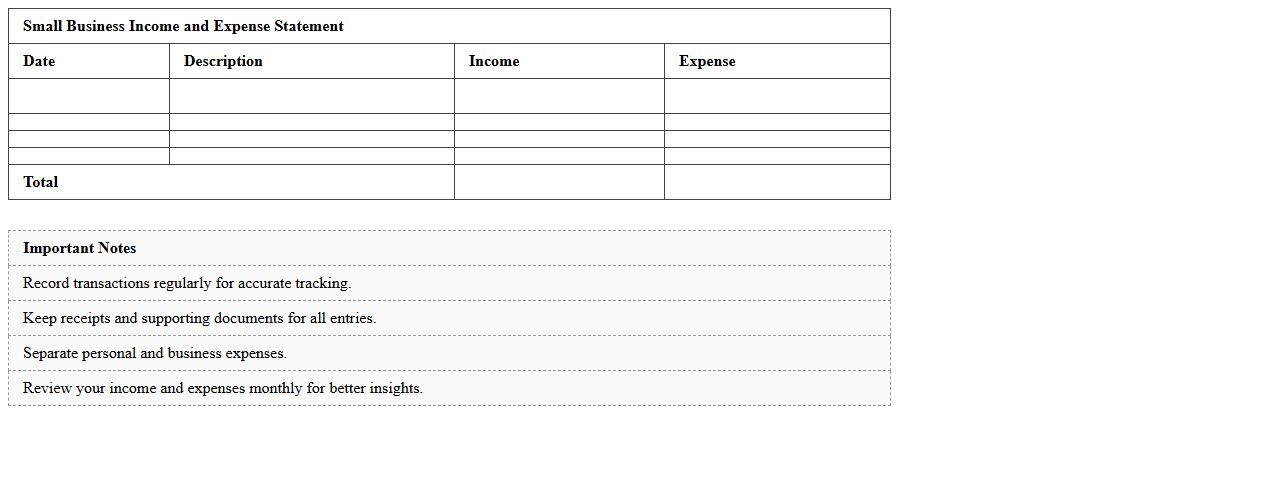

Small Business Income and Expense Statement

A

Small Business Income and Expense Statement is a financial document that records all revenues and expenses over a specific period, providing a clear overview of a business's profitability. This statement helps business owners track cash flow, manage budgets, and prepare accurate tax filings by categorizing income and deductible costs. By analyzing this document, entrepreneurs can make informed decisions to optimize operations and enhance financial performance.

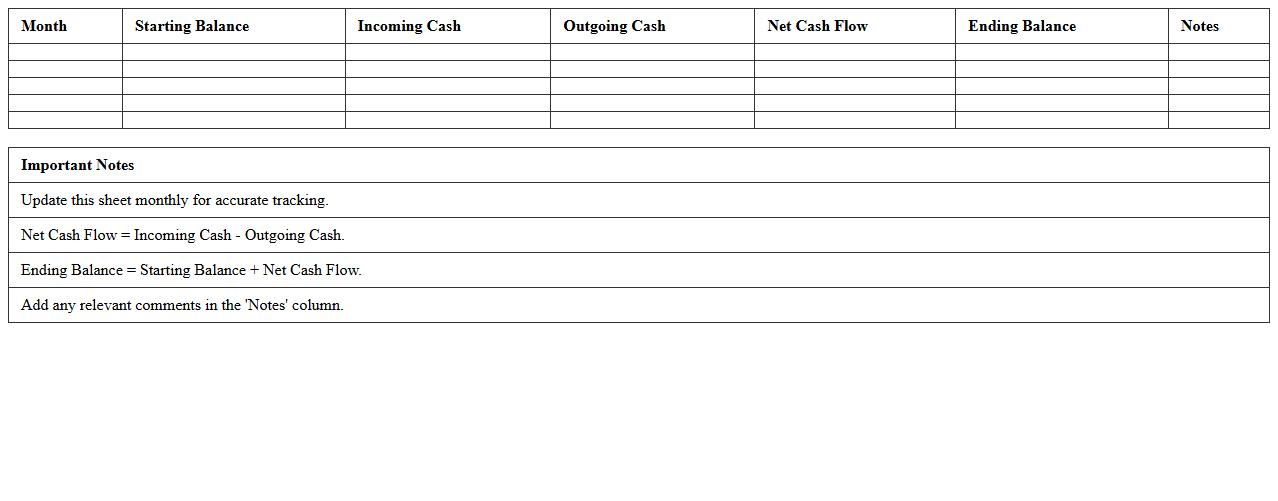

Monthly Cash Flow Management Sheet

A

Monthly Cash Flow Management Sheet is a financial document designed to track and organize incoming and outgoing cash flows over a 30-day period, helping individuals or businesses maintain budgetary control. This sheet highlights income sources such as salary, investments, and sales, alongside expenses like rent, utilities, and loans, enabling clear visibility of net cash position. By using this tool, users can identify spending patterns, prevent overspending, and make informed decisions to optimize savings and investments.

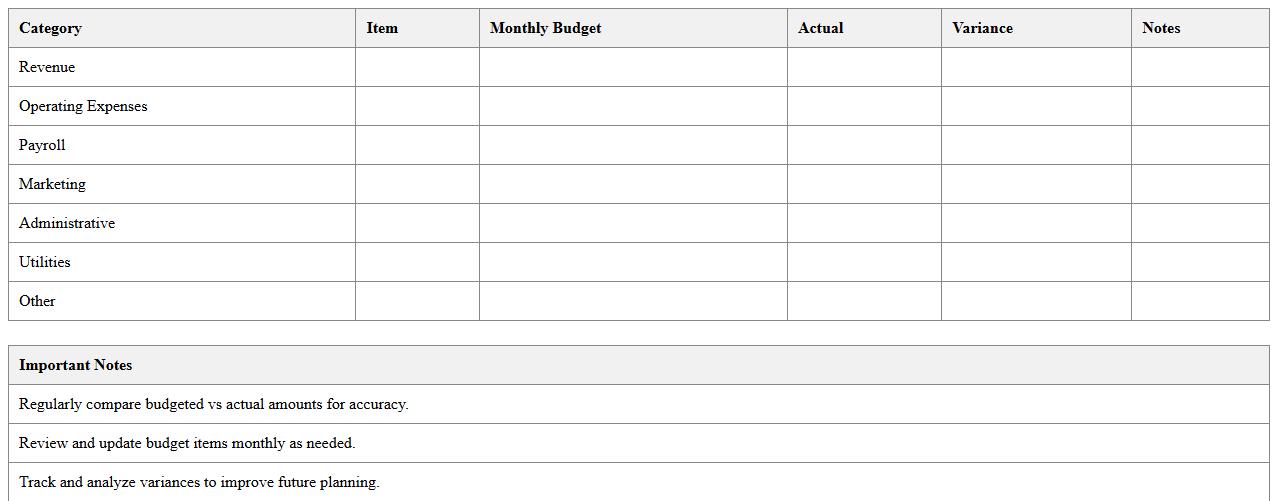

Business Operating Budget Planner

A

Business Operating Budget Planner document is a detailed financial tool that outlines expected revenues and expenses over a specific period, helping businesses allocate resources effectively. It enables precise tracking of operating costs, forecasting cash flow, and ensuring financial goals align with strategic plans. By providing clarity and control over fiscal performance, this planner supports informed decision-making and sustainable growth.

Sales and Revenue Monthly Tracker

The

Sales and Revenue Monthly Tracker document is a tool designed to monitor and analyze monthly sales figures and revenue streams systematically. It helps businesses identify trends, measure performance against targets, and make informed decisions for future growth strategies. By providing a clear overview of financial progress, this tracker enhances budgeting accuracy and supports effective resource allocation.

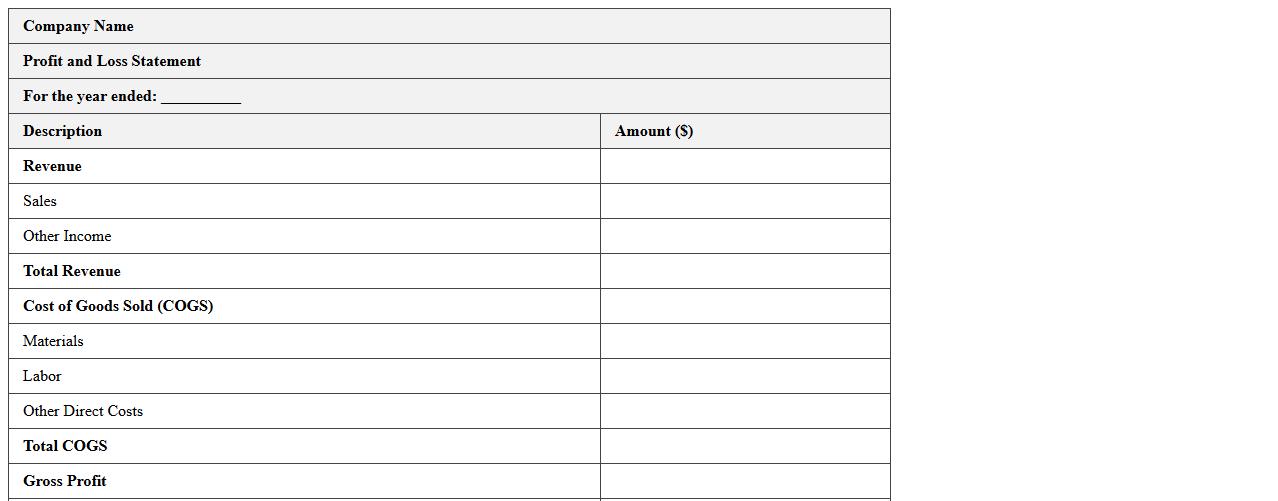

Profit and Loss Statement Excel Template

A

Profit and Loss Statement Excel Template is a pre-designed spreadsheet that helps businesses track and analyze their revenues, expenses, and net profit over a specific period. It simplifies financial reporting by organizing data into clear categories, enabling quick insight into profitability and operational efficiency. This template is useful for making informed decisions, budgeting accurately, and communicating financial performance to stakeholders.

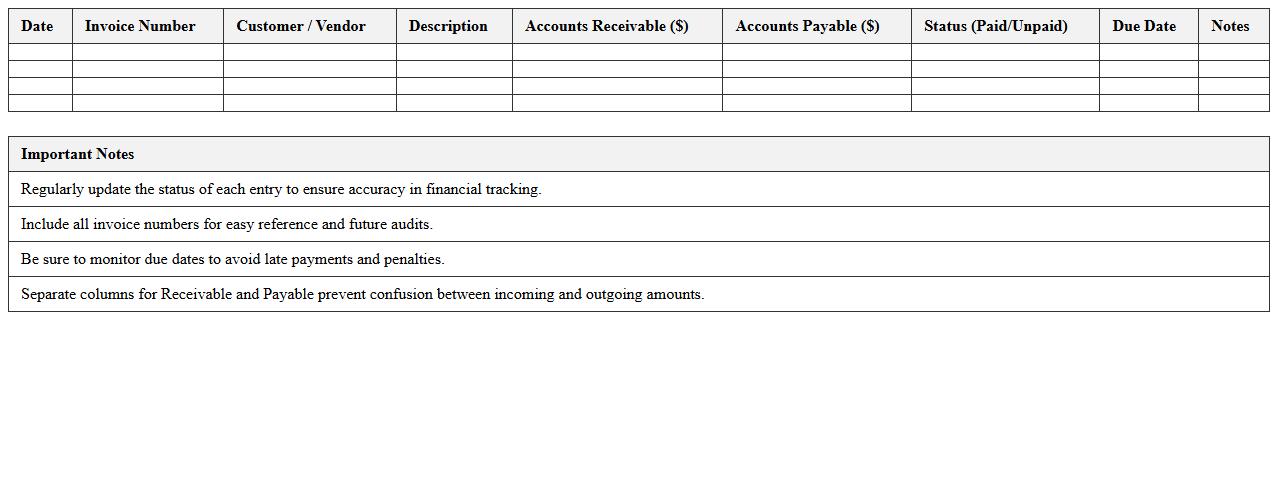

Monthly Accounts Payable and Receivable Log

The

Monthly Accounts Payable and Receivable Log document tracks all outgoing payments and incoming revenues within a specific period, enabling accurate financial management. It helps businesses maintain a clear record of debts owed to suppliers and cash expected from customers, ensuring timely payments and receipts. This log supports cash flow optimization, budget forecasting, and identification of outstanding balances for effective decision-making.

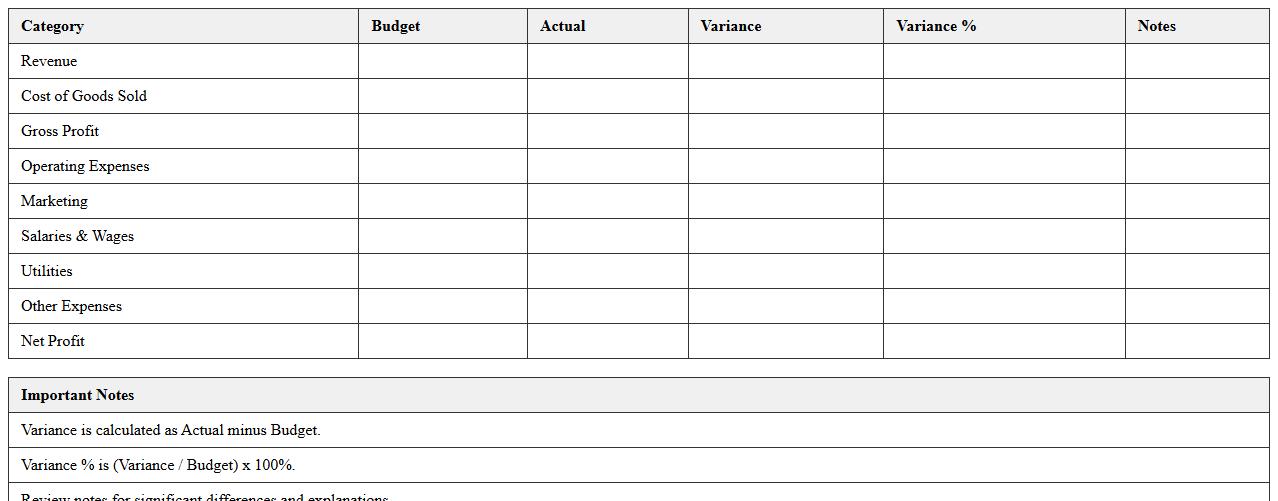

Business Budget vs Actual Analysis Sheet

A

Business Budget vs Actual Analysis Sheet is a financial document that compares projected budget figures against actual expenditures and revenues within a specific period. It helps organizations identify variances, optimize resource allocation, and enhance financial control by highlighting budget overruns or underspending. This analysis is essential for strategic decision-making, improving forecasting accuracy, and ensuring fiscal discipline in business operations.

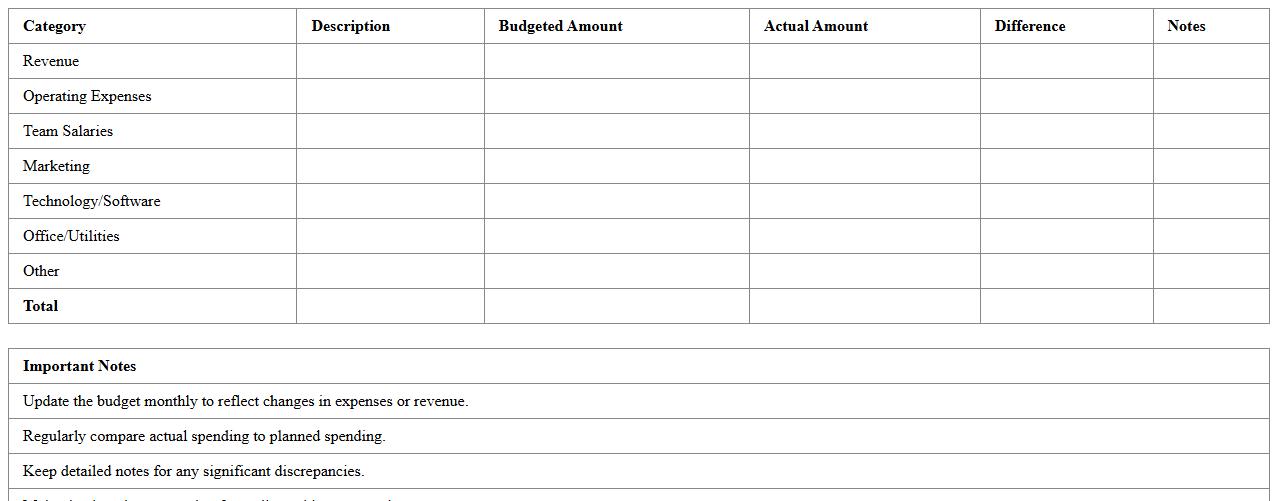

Startup Monthly Budget Planner

A

Startup Monthly Budget Planner document is a financial tool designed to help entrepreneurs systematically track income, expenses, and cash flow on a monthly basis. It enables startups to allocate resources efficiently, monitor financial performance, and identify areas for cost-saving or strategic investment. Using this planner enhances budgeting accuracy and supports informed decision-making for sustainable business growth.

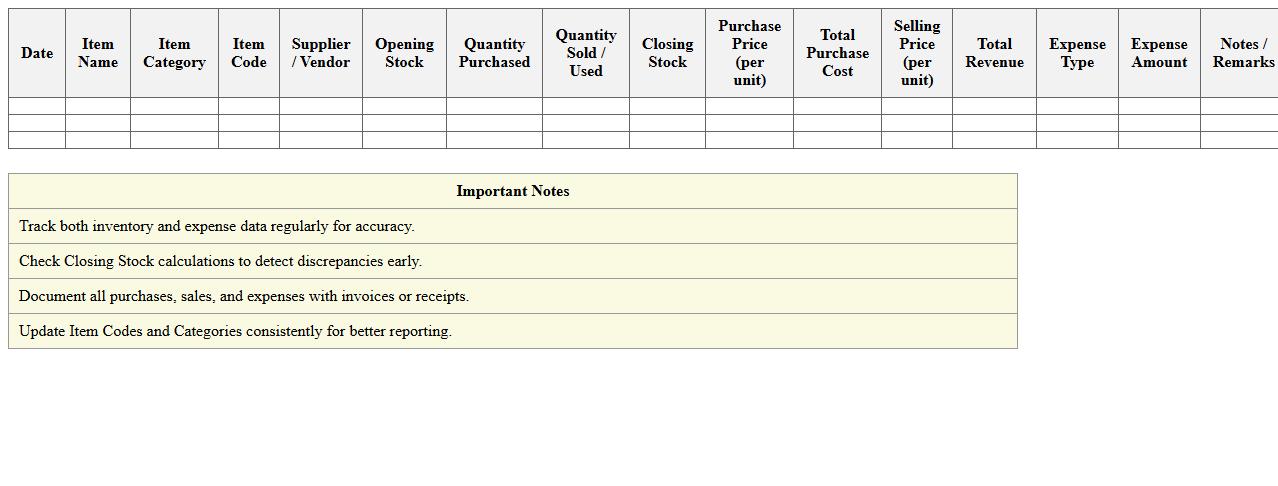

Inventory and Expense Management Template

An

Inventory and Expense Management Template document is a structured tool designed to track and organize stock levels, purchases, and costs effectively. It helps businesses monitor inventory quantities, forecast needs, and control spending by providing clear visibility into resource allocation. This template streamlines financial management, reduces errors, and supports informed decision-making for operational efficiency.

How can monthly budget Excel templates be customized for seasonal small business expenses?

To customize monthly budget Excel templates for seasonal small business expenses, first, identify the specific months with higher or lower activity. Use separate columns or rows to track these seasonal variations distinctly. Incorporate formulas like SUMIFS to dynamically calculate expenses incurred during peak seasons.

What formula optimizes cash flow tracking in a small business monthly budget sheet?

The SUMPRODUCT formula effectively optimizes cash flow tracking by multiplying and summing income and expense values across different categories. It enables businesses to calculate net cash flow for each month by subtracting total expenses from total income automatically. This approach streamlines cash flow monitoring and highlights potential periods of cash shortage.

Which Excel charts best visualize monthly budget variances for small businesses?

Column and line charts are ideal for visualizing monthly budget variances, as they clearly display actual versus budgeted amounts. A combination chart can overlay actual spending and budgeted values for easier comparison. Heat maps can also be used to highlight months with the most significant variances, enhancing quick data interpretation.

How to set up automated alerts for budget overruns in Excel for small businesses?

Automated alerts in Excel can be created using Conditional Formatting rules that change cell colors when expenses exceed budgets. Additionally, use Excel formulas like IF combined with data validation to flag overruns instantly. Integrating VBA macros can also trigger email notifications for immediate alerts on budget breaches.

What permissions should be set for team collaboration on a small business budget Excel document?

Set view and edit permissions appropriately to protect sensitive budget data while enabling collaboration. Grant editing rights only to authorized team members responsible for budget input and updates. Use password protection and track changes features to maintain data integrity and transparency within the collaborative environment.

More Budget Excel Templates