The Budget Excel Template for Personal Finance Tracking helps individuals easily monitor income and expenses, enabling better financial management. It offers customizable categories and automatic calculations to provide clear insights into spending habits and savings goals. Users can track monthly budgets and adjust their financial plans to achieve greater control over their personal finances.

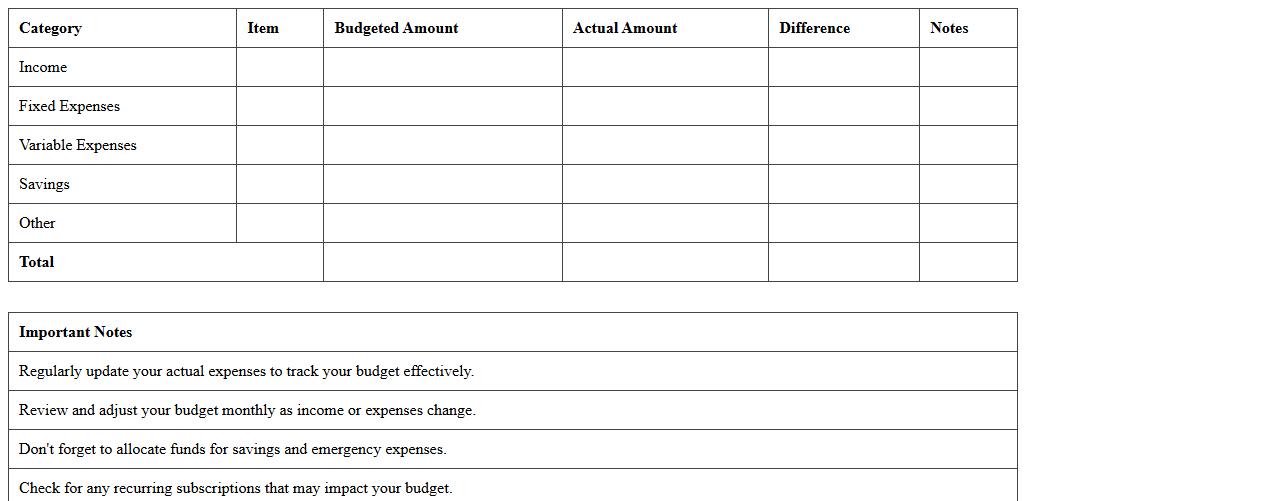

Monthly Household Budget Planner Excel Template

A

Monthly Household Budget Planner Excel Template is a digital spreadsheet designed to help individuals and families track income, expenses, and savings systematically. This tool allows users to categorize spending, monitor cash flow, and identify areas to reduce costs for better financial management. Utilizing this template enhances budgeting accuracy, promotes disciplined saving habits, and supports achieving financial goals efficiently.

Personal Expense Tracker Spreadsheet Template

A

Personal Expense Tracker Spreadsheet Template is a digital document designed to help individuals systematically record and categorize their daily, weekly, or monthly expenses. This tool enhances financial awareness by providing clear visibility into spending patterns, enabling better budgeting and improved money management. Utilizing this template allows users to identify unnecessary expenses and optimize savings, fostering healthier financial habits.

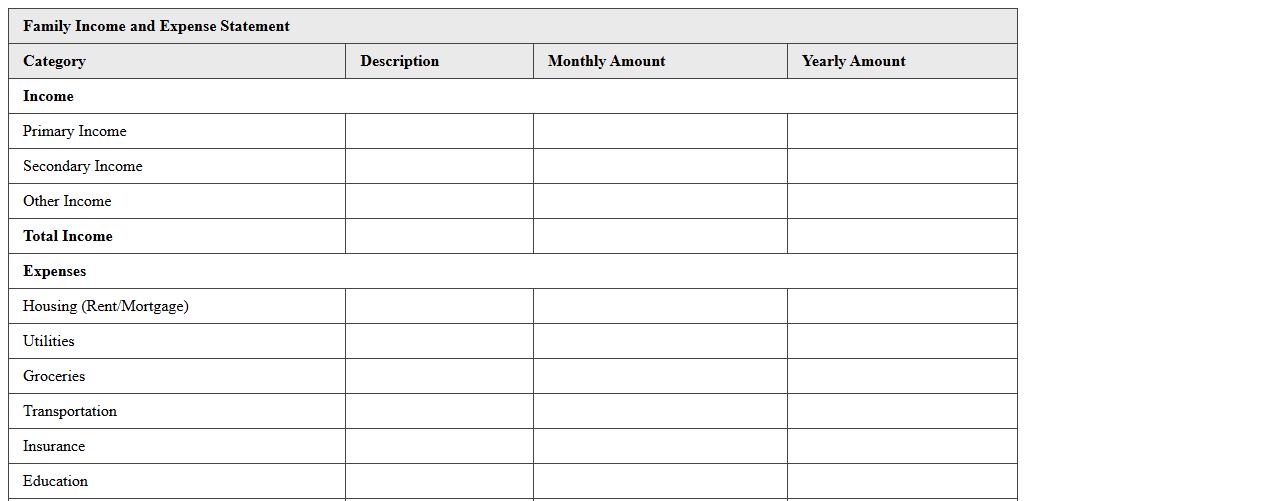

Family Income and Expense Statement Excel

A

Family Income and Expense Statement Excel document is a structured spreadsheet designed to track and organize household earnings and expenditures over a specific period. This tool helps users monitor cash flow, identify spending patterns, and make informed financial decisions to manage budgets effectively. Utilizing Excel's features like formulas and charts enhances accuracy and provides visual insights into financial health.

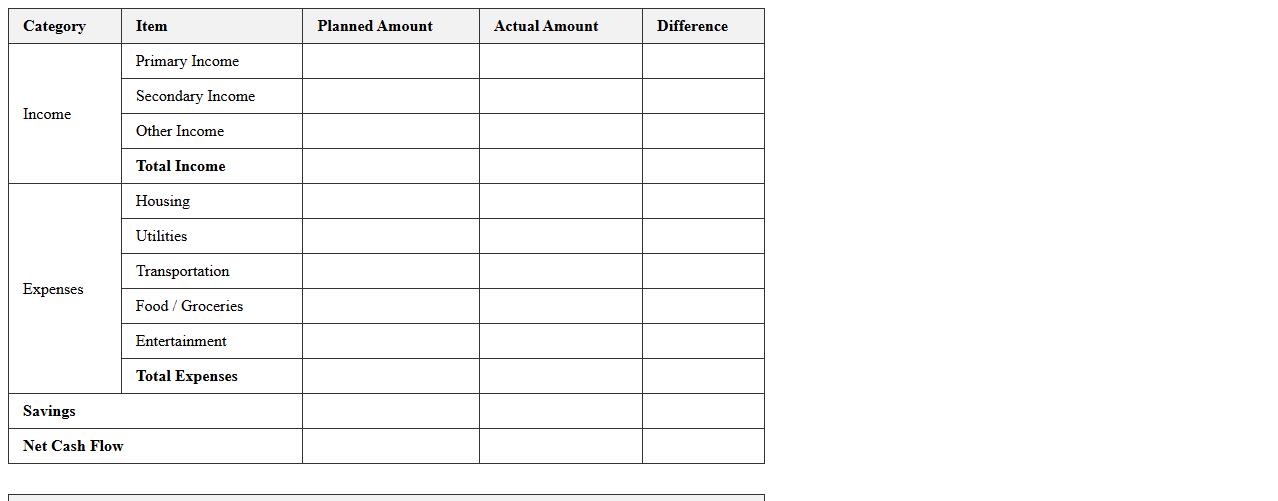

Simple Personal Finance Budget Worksheet

A

Simple Personal Finance Budget Worksheet is a structured document designed to track income, expenses, and savings in an organized manner. It helps individuals monitor their financial habits, identify spending patterns, and allocate funds efficiently to meet financial goals. Using this worksheet promotes better money management, reduces debt risk, and supports long-term financial stability.

Household Savings Tracker Excel Template

The

Household Savings Tracker Excel Template document is a structured spreadsheet designed to help individuals monitor and manage their savings effectively. It provides a clear overview of income, expenses, and savings goals, enabling users to analyze spending patterns and increase financial discipline. By using this template, households can make informed decisions to optimize their budget and achieve long-term financial stability.

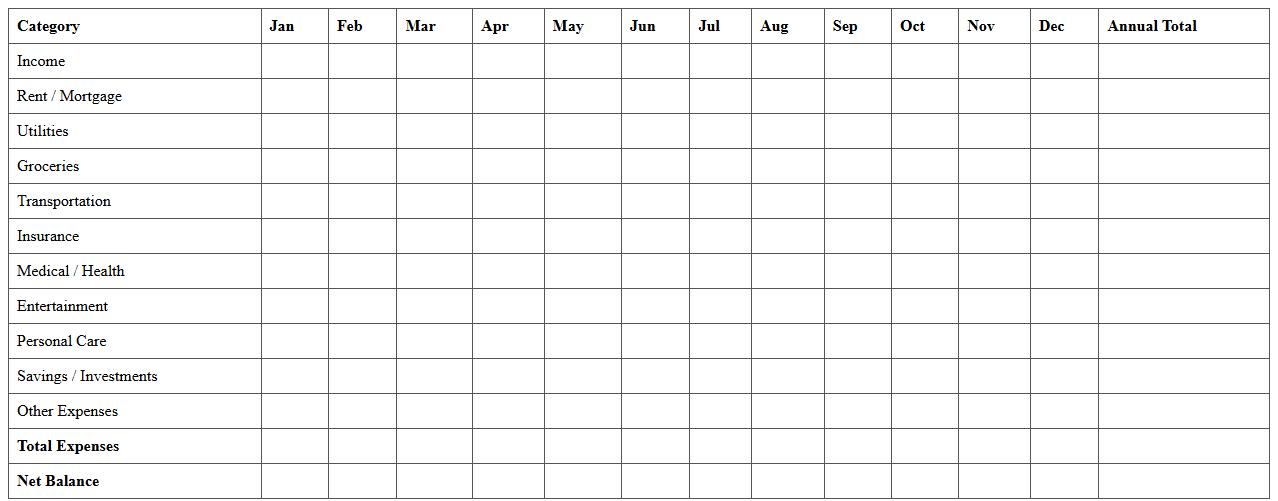

Annual Personal Budget Planning Spreadsheet

An

Annual Personal Budget Planning Spreadsheet is a detailed financial tool designed to track income, expenses, savings, and investments over a 12-month period. It helps individuals organize their finances by categorizing spending, setting financial goals, and forecasting cash flow to prevent overspending. Utilizing this spreadsheet improves financial discipline, enhances decision-making, and promotes long-term wealth management.

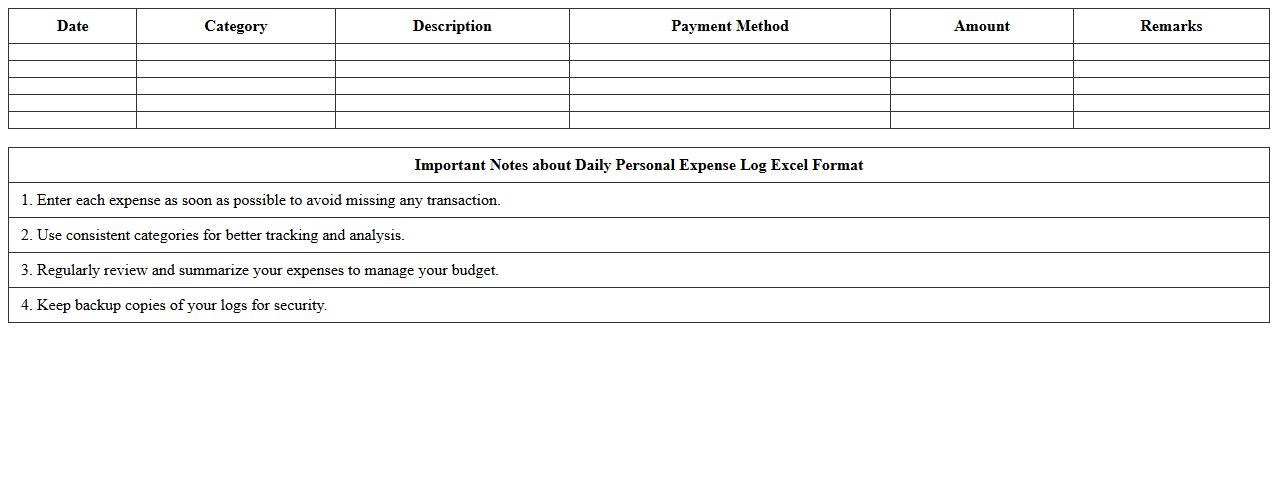

Daily Personal Expense Log Excel Format

A

Daily Personal Expense Log Excel Format document is a structured spreadsheet designed to track and categorize daily spending, helping individuals monitor their financial habits efficiently. It enables users to input expenses, analyze spending patterns, and maintain a clear record for budgeting and saving purposes. This tool proves invaluable for improving financial discipline and making informed decisions to manage personal finances more effectively.

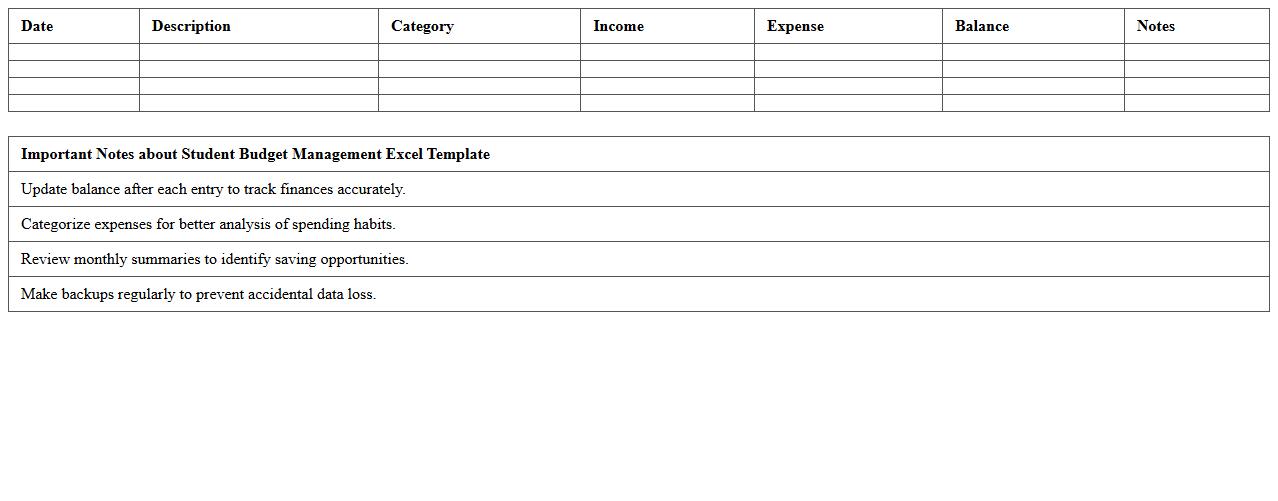

Student Budget Management Excel Template

The

Student Budget Management Excel Template is a pre-designed spreadsheet that helps students track income, expenses, and savings efficiently. It allows users to categorize spending, set financial goals, and monitor monthly cash flows, ensuring better control over personal finances. This tool is essential for maintaining financial discipline and avoiding overspending during academic years.

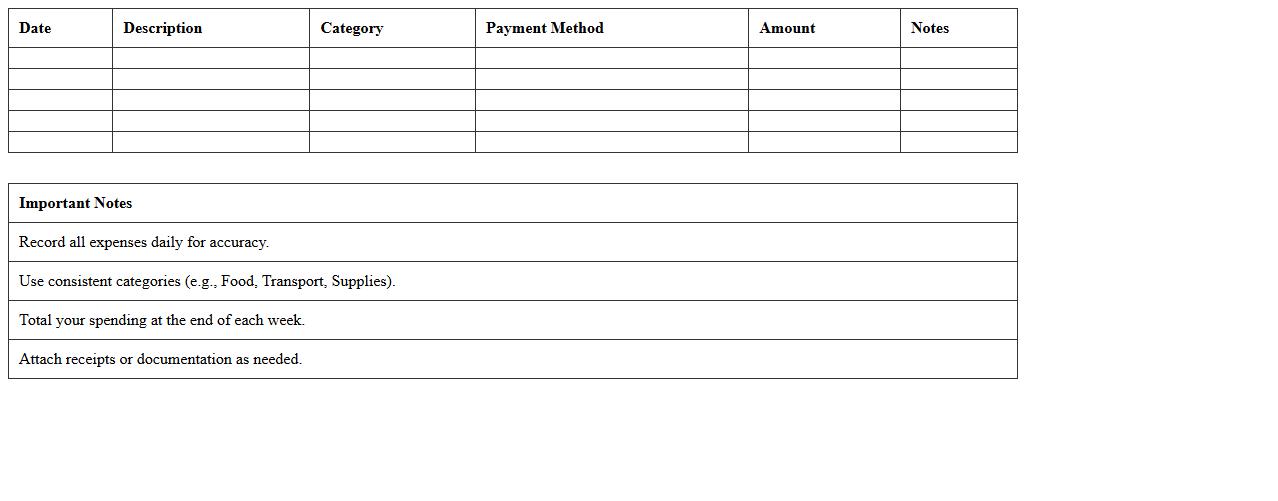

Weekly Spending Report Excel Form

The

Weekly Spending Report Excel Form document is a structured spreadsheet designed to track and analyze weekly expenditures efficiently. It helps users monitor their spending patterns, identify cost-saving opportunities, and maintain a balanced budget by providing clear, organized financial data. This tool enhances financial discipline and supports informed decision-making through detailed expense categorization and automatic total calculations.

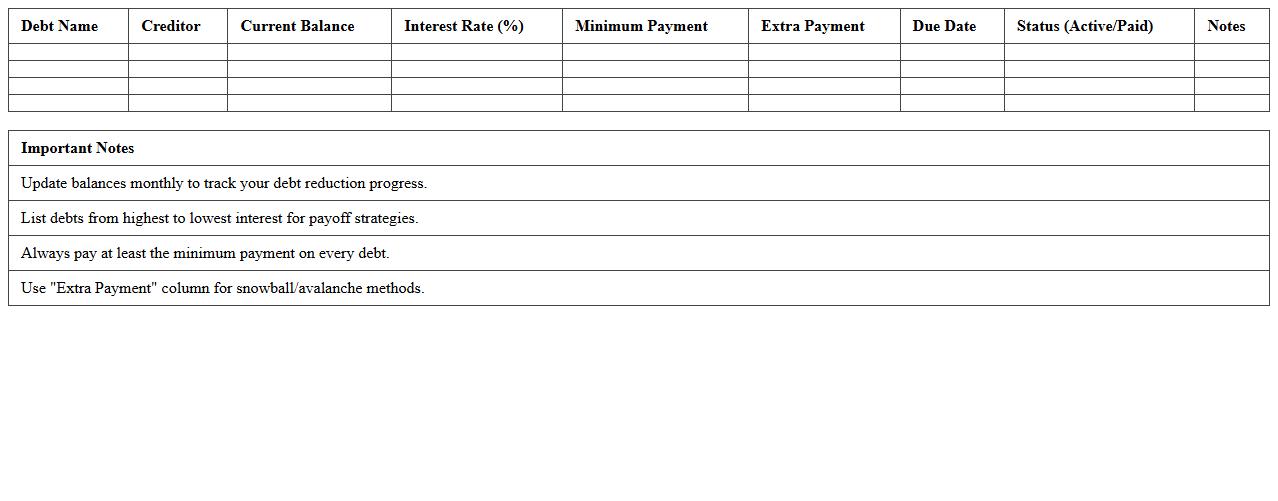

Personal Debt Reduction Budget Spreadsheet

A

Personal Debt Reduction Budget Spreadsheet is a detailed financial tool designed to track, manage, and reduce individual debt efficiently by organizing income, expenses, and debt payments in a structured format. It helps users visualize monthly payments towards various debts, calculate interest savings, and prioritize high-interest obligations to accelerate debt payoff. This spreadsheet improves financial discipline, enhances cash flow management, and supports strategic planning for achieving long-term debt freedom.

How can I automate expense categorization in my Budget Excel template?

To automate expense categorization, use Excel's IF and VLOOKUP functions with a predefined category table. This approach matches descriptions with categories automatically based on keywords. Additionally, leveraging Excel's Power Query can streamline data import and transformation for dynamic categorization.

What are the best custom formulas for monthly savings tracking?

Effective formulas include =SUM to total savings deposits and =SUMIFS to filter savings by month. Use =B2-C2 where B2 is income and C2 is expenses to calculate monthly savings directly. Combining these formulas helps maintain an accurate and up-to-date view of your monthly savings performance.

How do I link multiple income sources within one Excel budget sheet?

Integrate multiple income sources by creating separate income tables and use =SUM or =SUMIF formulas to aggregate them in a summary cell. Employ named ranges to organize income data clearly and improve formula readability. Linking sources dynamically provides a comprehensive view of your total income flow.

Which pivot table setup reveals hidden spending patterns effectively?

Create a pivot table with rows as expense categories and columns as time periods like months or weeks. Add filters for payment methods or vendors to identify unusual spending. Using conditional formatting inside the pivot table highlights trends, making it easier to spot hidden spending behaviors.

Can conditional formatting be used to flag overspending in real time?

Yes, apply conditional formatting rules to compare actual expenses against budget limits, changing cell colors when spending exceeds thresholds. Use formulas like =B2>C2 where B2 is expense and C2 is budget limit to trigger alerts. This dynamic approach provides instant visual warnings to help control overspending efficiently.

More Budget Excel Templates

![]()