A Budget Excel Template for Small Business helps streamline financial planning by organizing income, expenses, and cash flow in one easy-to-use spreadsheet. It enables small business owners to track spending, forecast budgets, and make informed decisions for better financial management. Customizable and user-friendly, this template enhances budgeting accuracy and supports growth strategies.

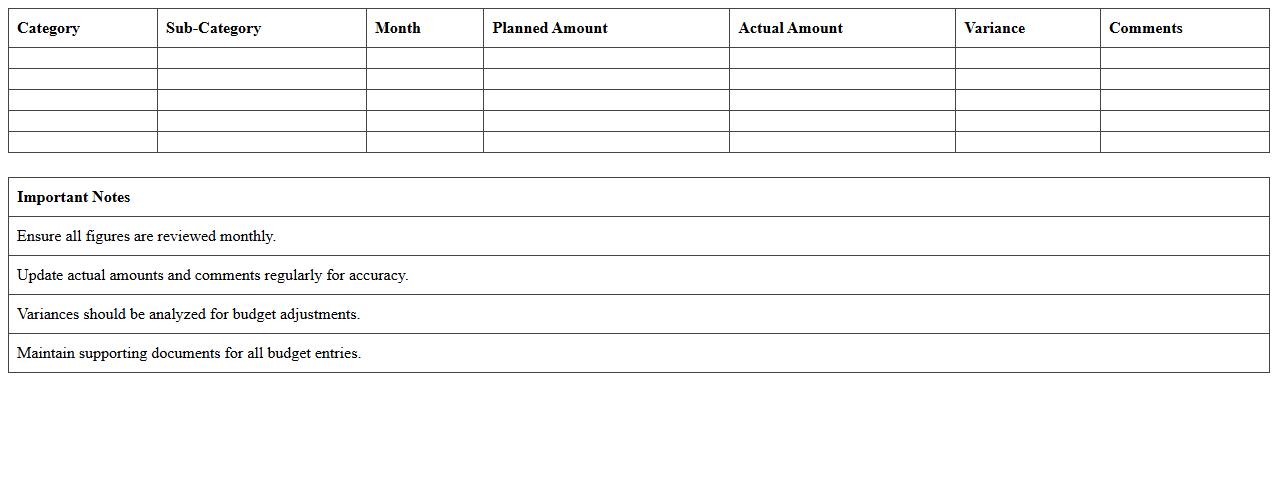

Monthly Expense Tracker Excel Template for Small Businesses

The

Monthly Expense Tracker Excel Template for small businesses is a customizable spreadsheet designed to record, categorize, and monitor all monthly expenditures efficiently. It enables business owners to visualize spending patterns, identify cost-saving opportunities, and maintain accurate financial records for budgeting and tax purposes. Using this template streamlines expense management, aids in cash flow analysis, and supports informed decision-making to enhance overall financial health.

Annual Budget Planning Excel Sheet for Small Enterprises

An

Annual Budget Planning Excel Sheet for Small Enterprises is a structured financial tool designed to help small businesses track income, expenses, and cash flow throughout the year. This document enables precise forecasting, resource allocation, and financial decision-making by organizing data into clear categories and time periods. Using this sheet enhances budget control, supports strategic planning, and improves overall financial management for small enterprises.

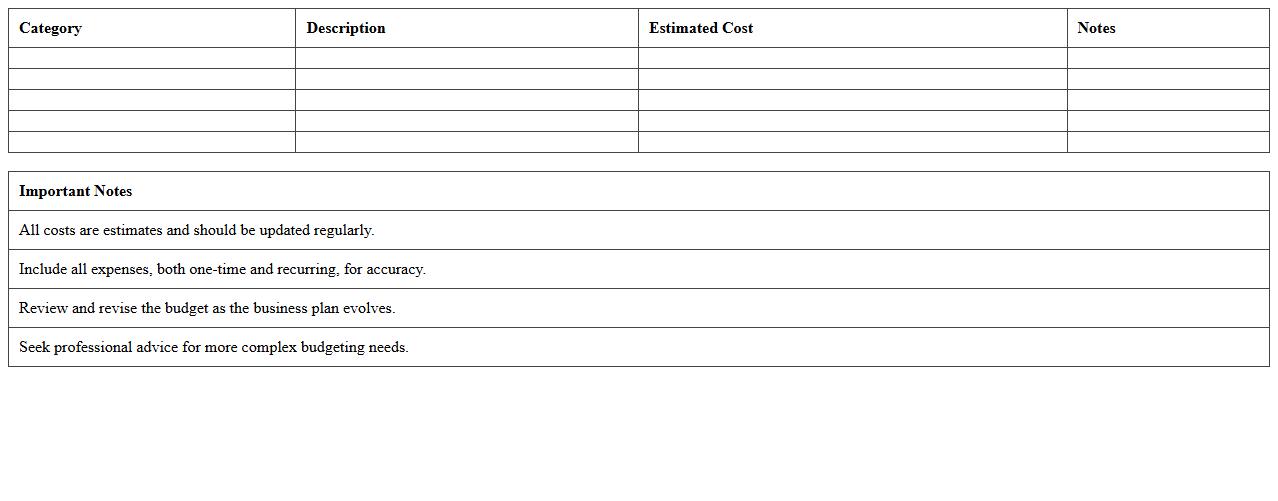

Startup Costs Budget Excel Template for Small Business Owners

A

Startup Costs Budget Excel Template for small business owners is a structured spreadsheet designed to help estimate and organize all initial expenses required to launch a business. This template allows entrepreneurs to input various cost categories such as equipment, marketing, legal fees, and office supplies, providing a clear overview of total startup capital needed. Using this tool improves financial planning accuracy, aids in securing funding, and ensures better cash flow management during the critical early stages of a business.

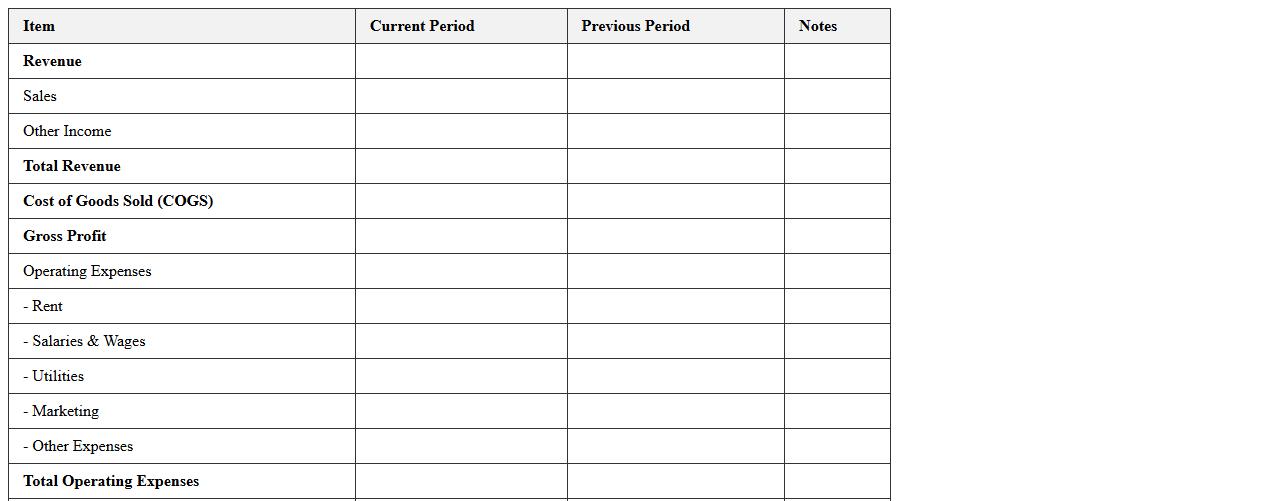

Profit and Loss Statement Excel Template for Small Companies

A

Profit and Loss Statement Excel Template for small companies is a pre-designed spreadsheet that helps track and summarize revenues, costs, and expenses over a specific period. This template simplifies financial analysis by automating calculations, enabling business owners to monitor profitability and identify areas for cost control. Using this document improves accuracy in financial reporting and supports informed decision-making for business growth.

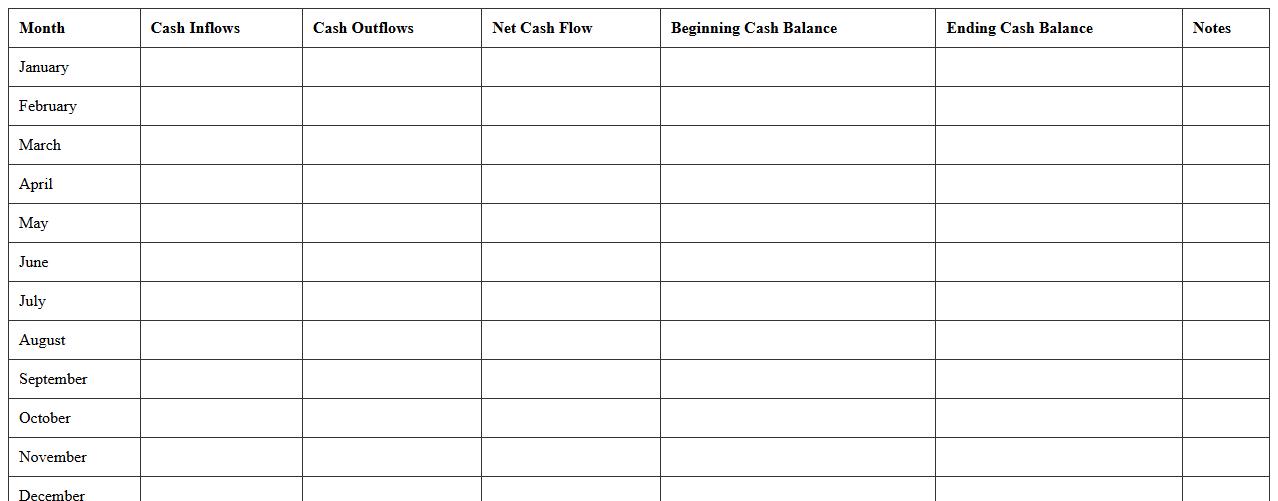

Cash Flow Budget Excel Spreadsheet for Small Businesses

A

Cash Flow Budget Excel Spreadsheet for small businesses is a financial tool designed to track and forecast cash inflows and outflows, helping owners manage liquidity effectively. It allows for detailed monthly or weekly projections of revenues, expenses, and net cash position, enabling better decision-making and avoiding cash shortages. This spreadsheet streamlines budgeting processes and provides clear visibility into the business's financial health.

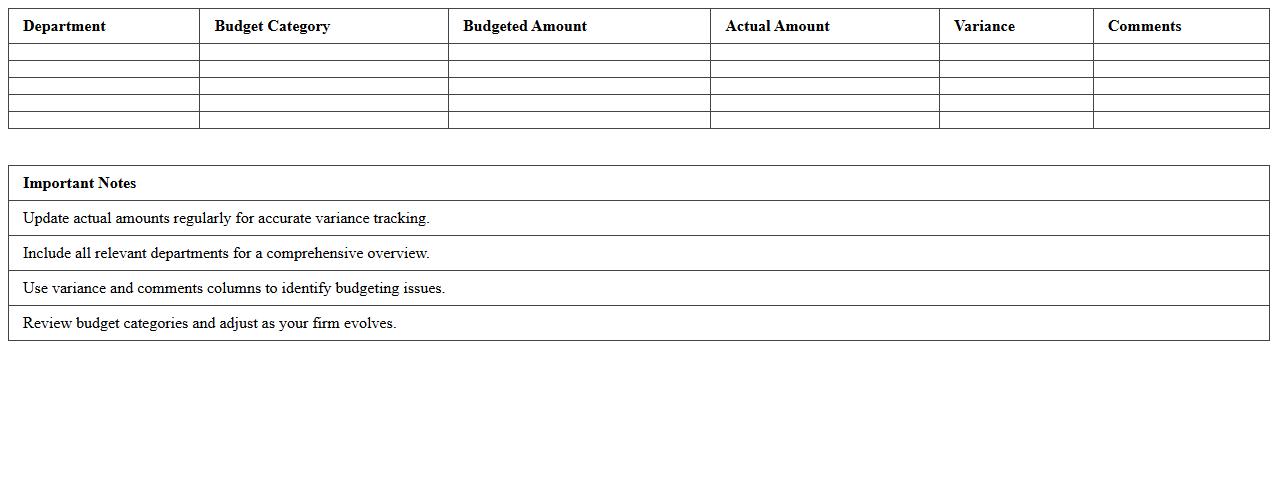

Departmental Budget Allocation Excel Template for Small Firms

The

Departmental Budget Allocation Excel Template for small firms is a structured spreadsheet designed to help businesses efficiently distribute financial resources across various departments. It enables clear tracking of expenses, forecasts budget needs, and supports informed decision-making by providing a comprehensive overview of departmental spending. This tool enhances financial management, ensuring optimal allocation of funds and promoting fiscal responsibility within small enterprises.

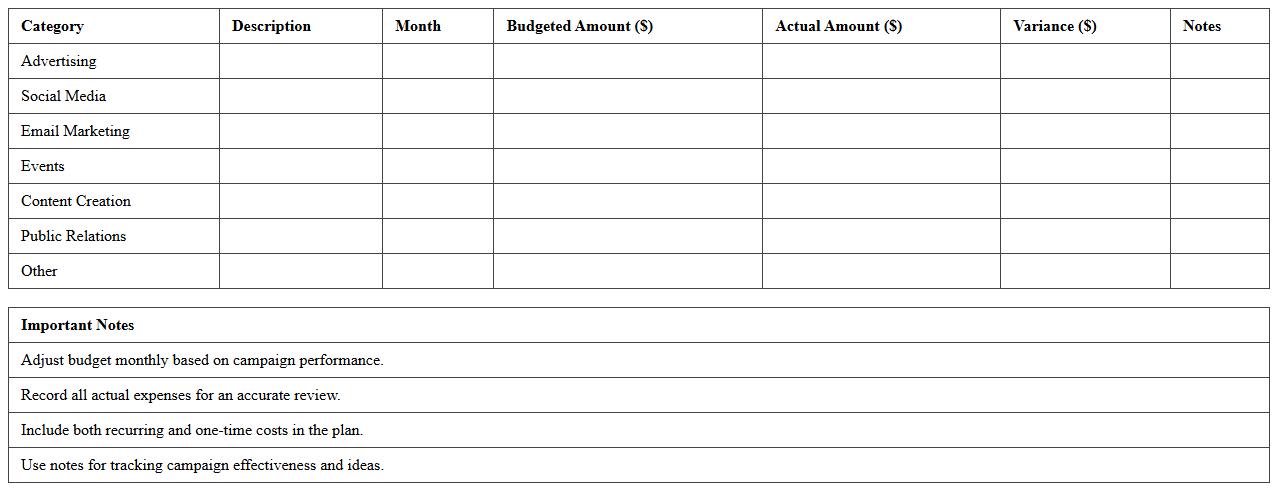

Marketing Budget Planner Excel Template for Small Businesses

A

Marketing Budget Planner Excel Template for small businesses is a structured spreadsheet designed to help allocate, track, and manage marketing expenses effectively. It enables small business owners to forecast costs, monitor spending across various campaigns, and optimize resource allocation for maximum return on investment. Utilizing this template promotes financial discipline and supports data-driven marketing decisions that enhance overall business growth.

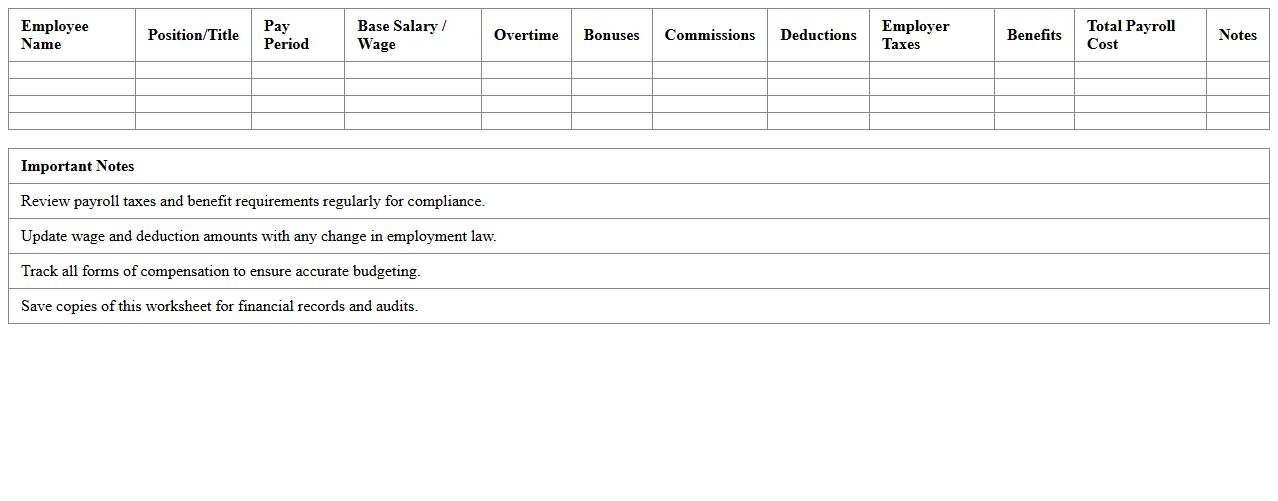

Payroll Budget Excel Worksheet for Small Business Employers

A

Payroll Budget Excel Worksheet for small business employers is a structured spreadsheet tool designed to track, calculate, and manage employee wages, taxes, and benefits efficiently. It helps businesses forecast labor costs, control expenses, and ensure accurate payroll processing, reducing errors and saving time. Using this worksheet enhances financial planning and compliance with tax regulations, supporting informed decision-making and overall business stability.

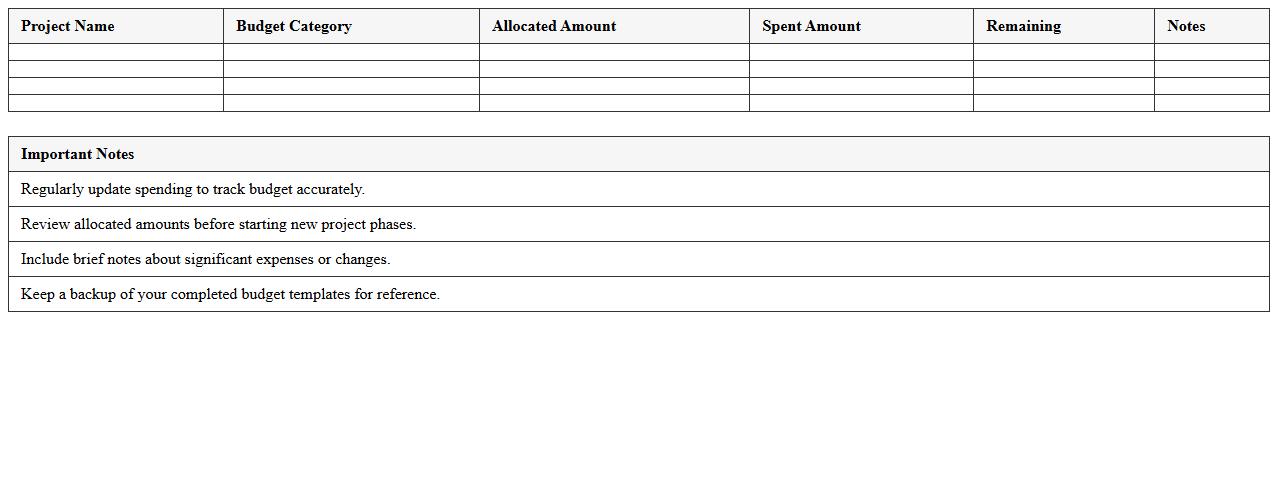

Project Budget Management Excel Template for Small Business Teams

The

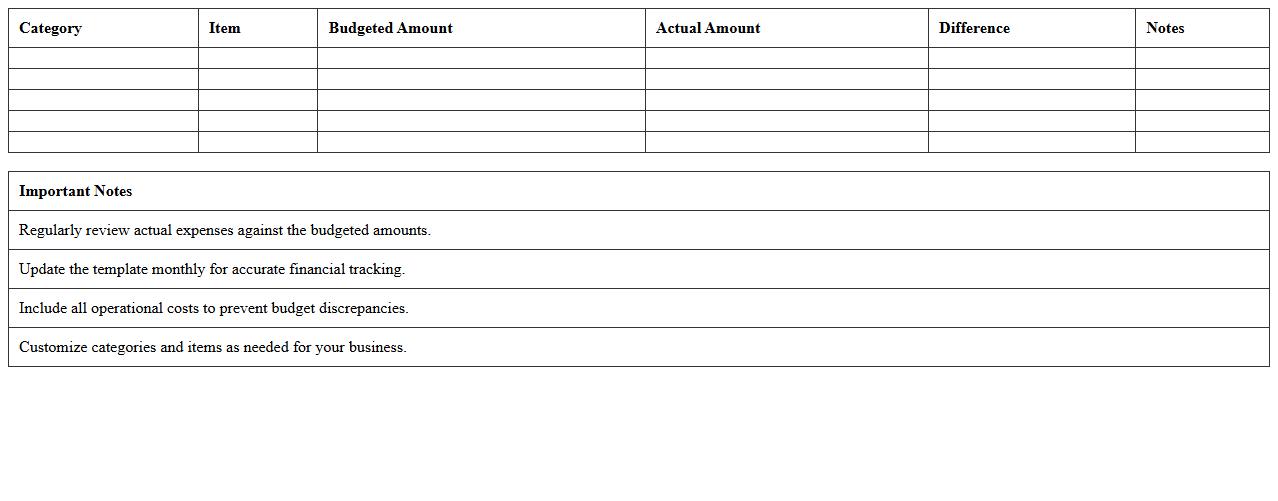

Project Budget Management Excel Template for Small Business Teams is a structured tool designed to track and control project expenses efficiently. It allows teams to allocate resources, monitor costs, and compare planned budgets against actual spending in real-time, helping to prevent overspending and ensure financial accountability. Using this template improves financial planning accuracy and supports effective decision-making throughout the project lifecycle.

Business Operational Budget Excel Template for Small Enterprises

The

Business Operational Budget Excel Template for small enterprises is a structured spreadsheet designed to help businesses accurately forecast and manage their monthly and annual expenses and revenues. It enables users to allocate resources efficiently, track financial performance, and identify cost-saving opportunities, ensuring better cash flow management. This template supports decision-making by providing clear visibility into operational costs, helping small businesses maintain profitability and plan for growth.

How can I automate expense tracking in a budget Excel template for small businesses?

Automate expense tracking by using Excel formulas like SUMIFS to total costs based on categories and dates. Implement data validation to ensure consistent expense entry, enhancing accuracy. Use conditional formatting to highlight overspending or unusual expense entries automatically.

What formulas optimize cash flow forecasting in small business budget sheets?

Key formulas for cash flow forecasting include SUMIF to aggregate cash inflows and outflows over specific periods. Use IF functions to conditionally predict future transactions based on business trends. Incorporate NPV (Net Present Value) to evaluate the profitability of future cash flows accurately.

How do I categorize irregular income in a small business budget Excel document?

To categorize irregular income, create a specific income category for unpredictable revenue streams in your budget. Use lookup functions like VLOOKUP or INDEX MATCH to assign incoming amounts to these categories automatically. Apply date-based filters to analyze irregular income trends over time and improve forecasting.

Which Excel charts best visualize profit and loss for small business budgets?

Line charts effectively display profit and loss trends over time, highlighting fluctuations. Use column charts for comparing income and expenses side-by-side monthly or quarterly. A waterfall chart is ideal to illustrate how individual income and expense items contribute to net profit or loss.

How can I set up scenario analysis for budget planning in Excel for a small business?

Set up scenario analysis by using Excel's Scenario Manager to define multiple budget outcomes based on varying assumptions. Use data tables to test how changes in key variables affect overall budget results. Incorporate goal seek to find target values for specific financial metrics under different scenarios.

More Budget Excel Templates