The Family Budget Excel Template for Household Expense Management offers a user-friendly tool to track income and expenses efficiently. It helps organize monthly bills, savings goals, and discretionary spending in one clear, customizable spreadsheet. This template ensures better financial planning and control, reducing the stress of managing household finances.

Family Monthly Expense Tracker Excel Template

The

Family Monthly Expense Tracker Excel Template is a powerful tool designed to organize and monitor household spending efficiently. It helps users categorize expenses, set budgets, and analyze spending patterns to maintain financial discipline. By providing clear insights into monthly cash flow, this template aids in reducing unnecessary costs and improving saving habits.

Household Budget Planner Spreadsheet

A

Household Budget Planner Spreadsheet document is a digital tool designed to organize and track income, expenses, and savings in a structured format. It enables users to monitor spending habits, plan monthly budgets, and identify areas for cost reduction efficiently. By providing clear visibility into financial flows, this spreadsheet supports better money management and helps achieve financial goals.

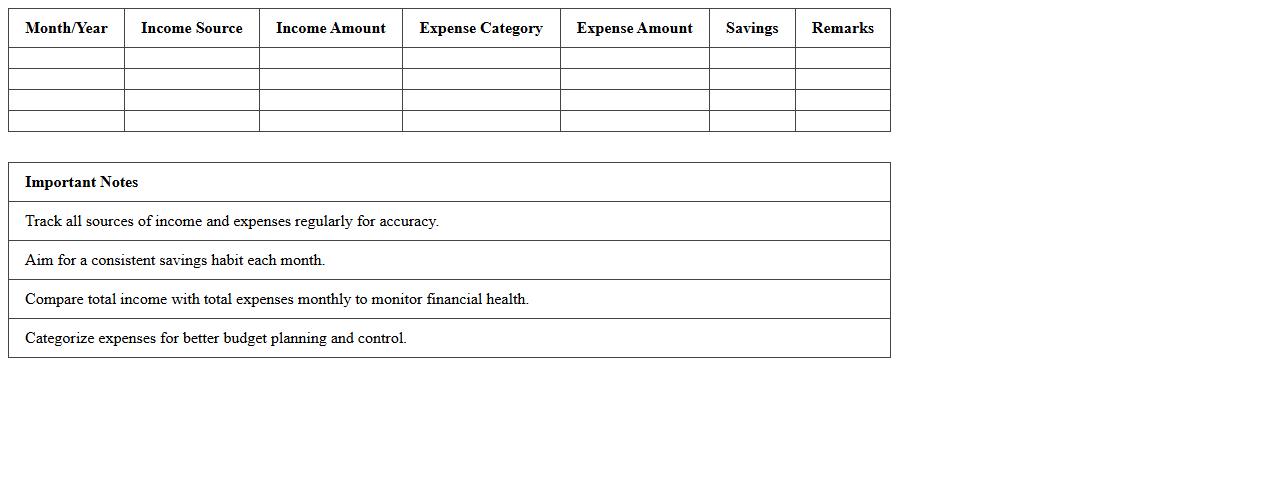

Family Income vs Expenses Analysis Excel

The

Family Income vs Expenses Analysis Excel document is a financial tool designed to track and compare household income against expenses systematically. It helps users identify spending patterns, manage budgets effectively, and make informed decisions to improve savings. By providing clear visual summaries and detailed breakdowns, this Excel sheet enhances financial awareness and fosters better money management habits.

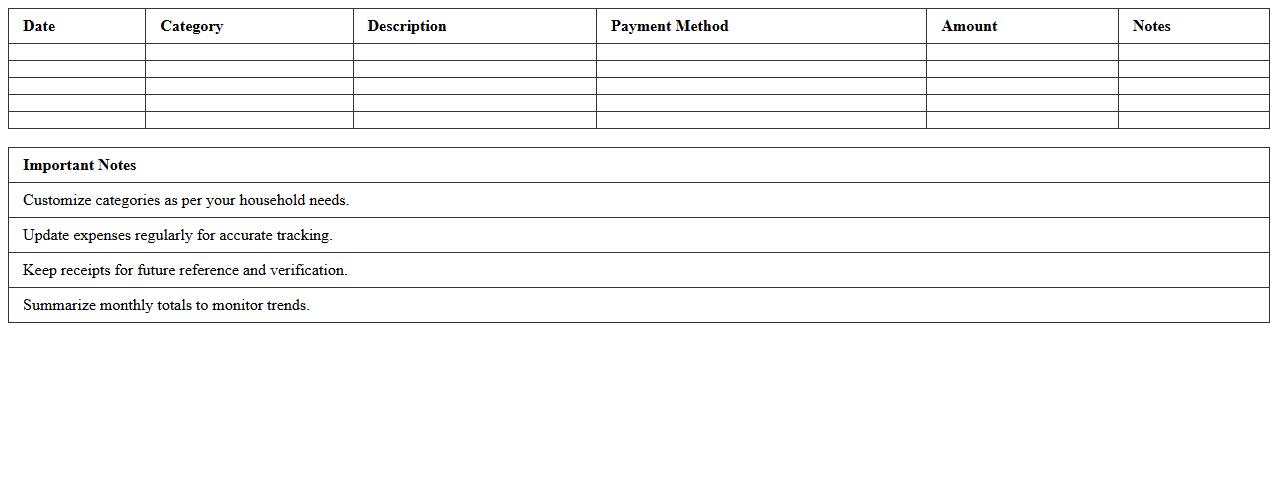

Home Expense Categorization Excel Sheet

A

Home Expense Categorization Excel Sheet is a structured spreadsheet designed to track and classify household expenses by categories such as utilities, groceries, rent, and entertainment. This document helps users monitor spending patterns, identify areas to cut costs, and create effective budgeting plans. By providing clear insights into financial habits, it supports better money management and long-term financial stability.

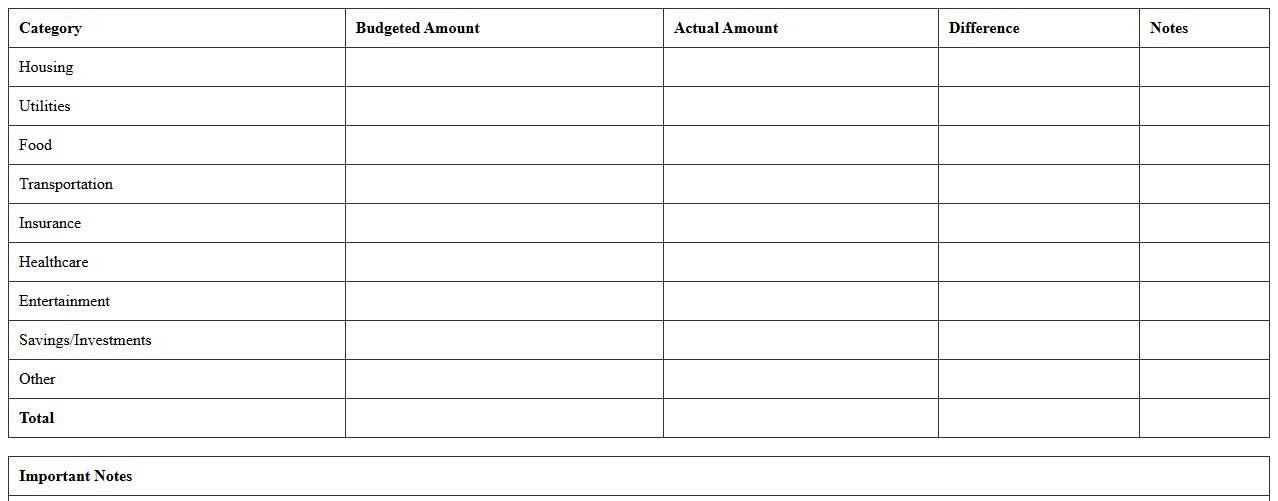

Monthly Family Budget Allocation Worksheet

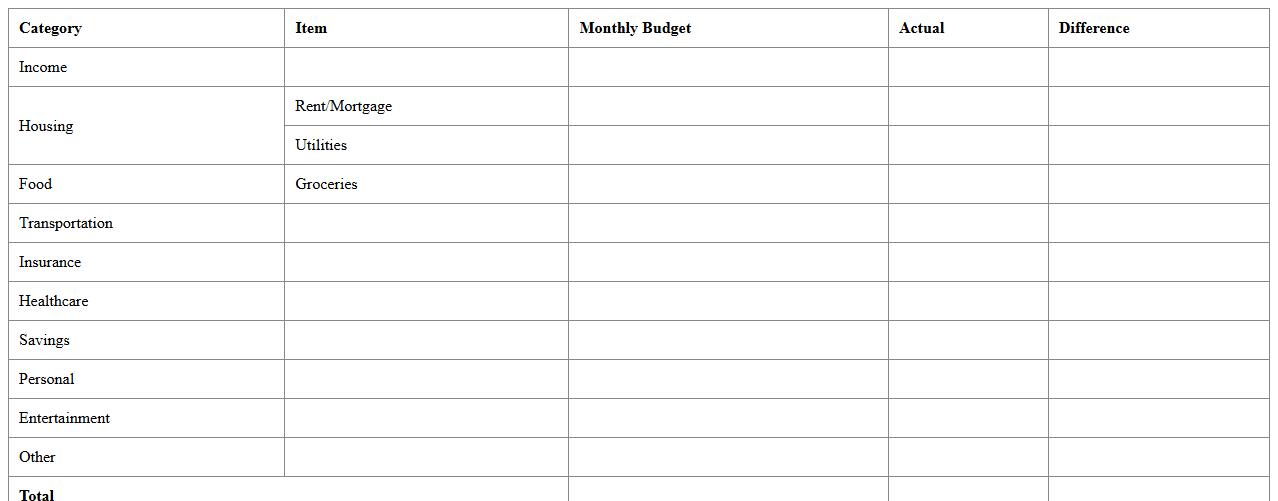

A

Monthly Family Budget Allocation Worksheet is a structured financial tool designed to help families plan and track their monthly income and expenses effectively. It categorizes spending into essential areas such as housing, utilities, groceries, transportation, and savings, enabling clearer visibility of financial habits and priorities. Using this worksheet promotes better money management, supports debt reduction, and helps ensure that families allocate resources toward both necessities and future goals responsibly.

Family Savings and Expense Dashboard Excel

The

Family Savings and Expense Dashboard Excel document is a comprehensive financial tool designed to track income, expenses, and savings over time, providing clear visual summaries through charts and tables. It helps families monitor monthly spending patterns, set budget goals, and identify areas to reduce costs, enhancing financial awareness and control. Using this dashboard enables efficient money management, promoting informed decisions that support long-term financial stability and growth.

Household Bill Payment Tracker Template

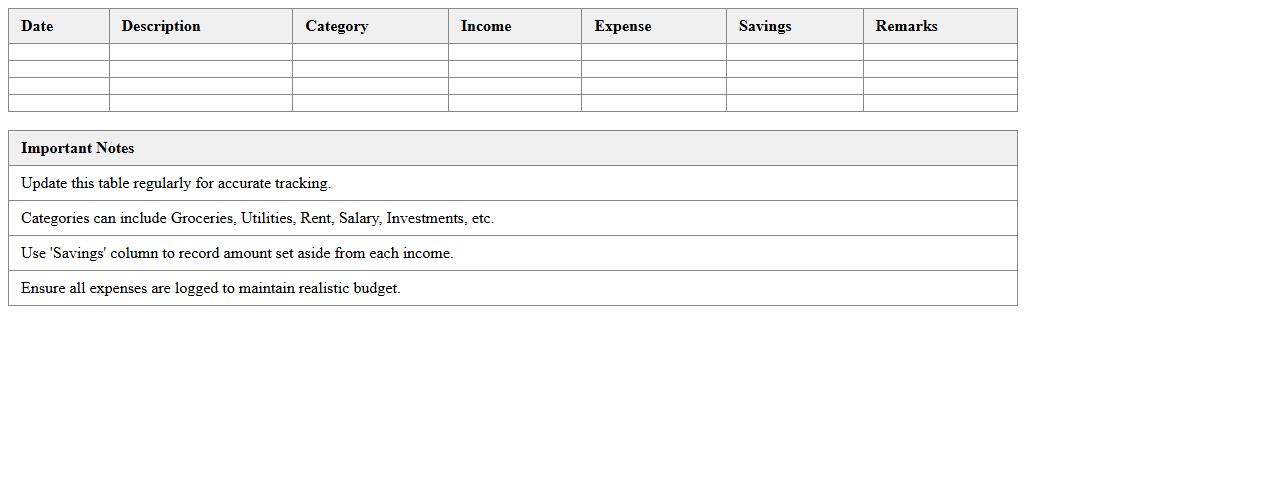

A

Household Bill Payment Tracker Template is a structured document designed to organize and monitor monthly expenses such as utilities, rent, and subscriptions. It helps users avoid missed payments and late fees by providing clear visibility of due dates and amounts owed. By maintaining accurate records, this template enhances budgeting efficiency and promotes financial discipline within households.

Annual Family Financial Planner Spreadsheet

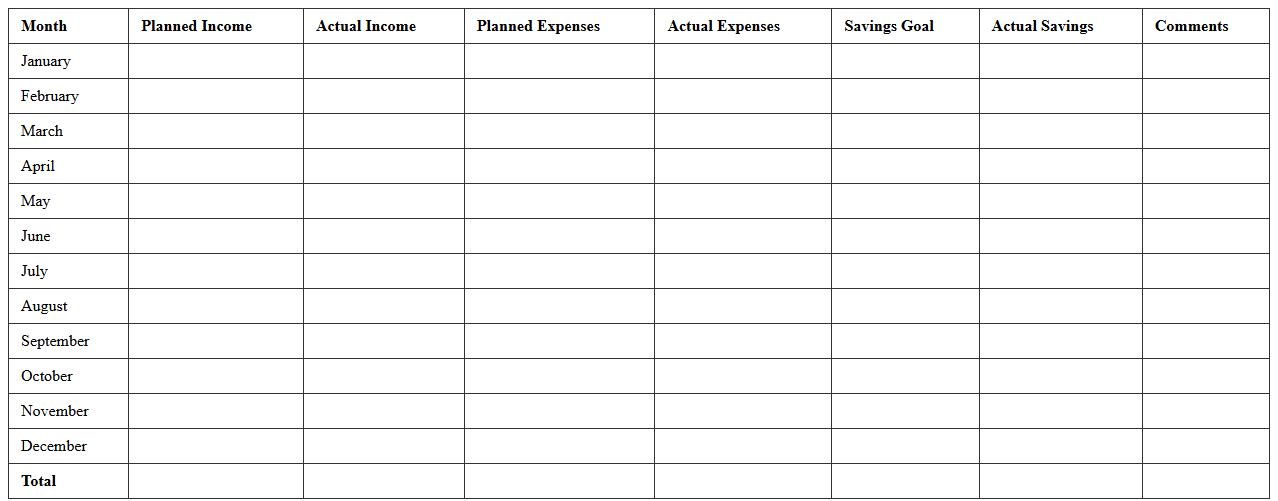

An

Annual Family Financial Planner Spreadsheet is a comprehensive document designed to track and organize all family income, expenses, savings, and investments throughout the year. It helps users visualize financial patterns, set realistic budgets, and plan for future expenses, enabling better money management and informed decision-making. By consolidating financial data in one place, it promotes accountability and ensures financial goals are consistently monitored and achieved.

Family Grocery Expense Management Excel

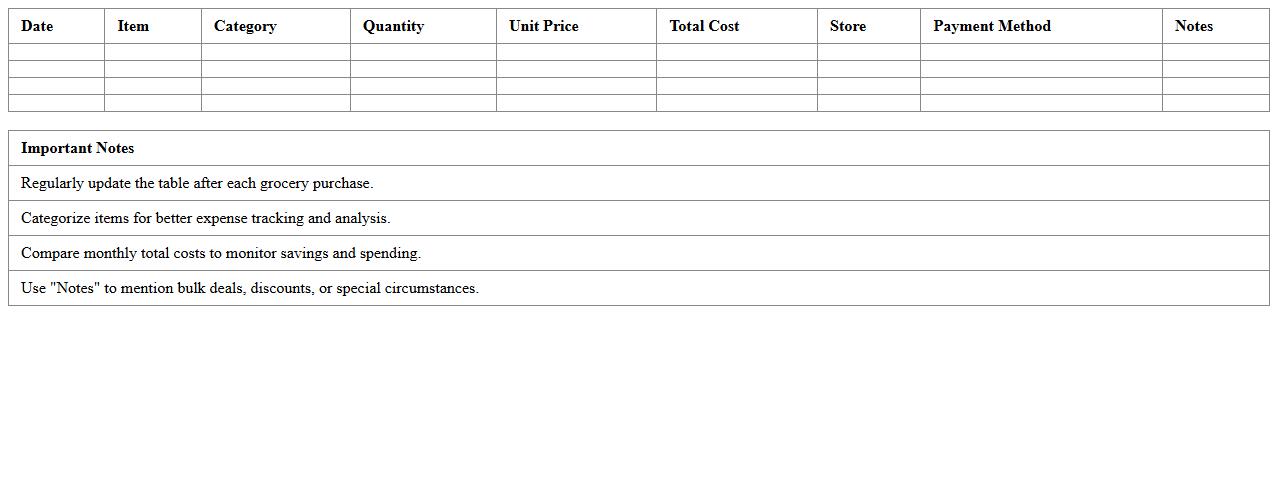

The Family Grocery Expense Management Excel document is a

comprehensive tool for tracking and organizing household grocery spending, enabling users to input purchase details, categorize items, and calculate monthly expenses effortlessly. By providing clear insights into spending patterns, it helps families budget more effectively, reduce unnecessary costs, and plan future shopping trips with precision. This resource supports informed financial decisions and promotes better management of household finances through easy-to-use spreadsheets.

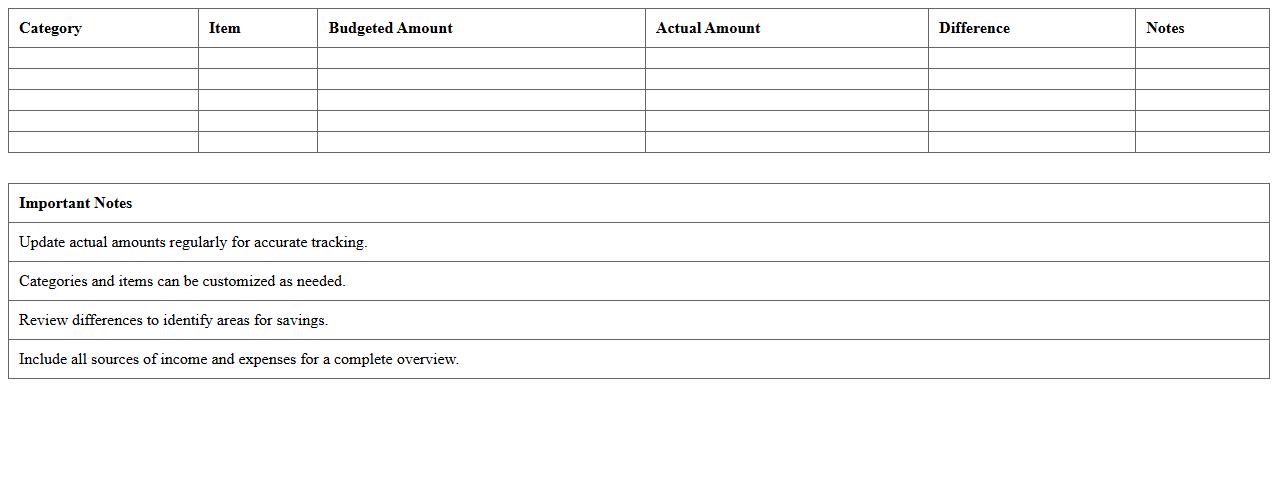

Personal & Family Budget Comparison Worksheet

The

Personal & Family Budget Comparison Worksheet document serves as a detailed tool to track and compare income and expenses over specific periods, helping users identify spending patterns and areas for financial improvement. By organizing financial data systematically, the worksheet aids in setting realistic budgets, managing debts, and prioritizing savings goals for both individuals and families. This practical resource enhances financial awareness and supports better decision-making to achieve long-term financial stability.

How can I automate monthly expense tracking in the Family Budget Excel template?

To automate monthly expense tracking, use Excel's built-in features such as tables and dynamic named ranges to organize data efficiently. Incorporate formulas like SUMIFS and MONTH to automatically sum expenses by category and month. Additionally, leveraging Excel's Power Query can streamline data importing and updating, saving time on manual entry.

What Excel formulas best forecast irregular household costs in the Family Budget spreadsheet?

Excel formulas like AVERAGEIFS and TREND help forecast irregular household costs by analyzing past expense patterns. The combination of IFERROR with FORECAST.LINEAR enables better predictions by handling missing or inconsistent data. Using moving averages or exponential smoothing techniques embedded in formulas can also improve forecasting accuracy.

Which data visualization features help identify overspending in Family Budget Excel sheets?

Conditional formatting highlights cells where spending exceeds budget limits, making overspending easy to spot. Creating charts like bar graphs or pie charts visually represents categories, revealing trends and potential problem areas. Sparklines embedded within cells provide quick visual indicators of spending fluctuations over time.

How do I categorize shared family expenses effectively in a Family Budget template?

To categorize shared family expenses effectively, create separate columns or categories for individual and shared costs. Use data validation dropdown lists to maintain consistency in expense classification. Additionally, leveraging Excel's pivot tables can summarize and analyze shared expenses by family member or category effortlessly.

What security measures can protect sensitive financial data in a Family Budget Excel file?

Protect sensitive data by utilizing Excel's password encryption to restrict unauthorized access. Implement worksheet protection and limit editing permissions to safeguard formulas and critical cells. Additionally, consider storing the file in encrypted cloud storage or sharing it via secure channels for enhanced security.

More Budget Excel Templates