The Budget Planner Excel Template for Personal Finance Tracking offers an easy-to-use spreadsheet designed to help individuals monitor income, expenses, and savings. It includes customizable categories and automatic calculations to provide clear insights into spending habits. This tool enables effective financial management by organizing data in a visually accessible format.

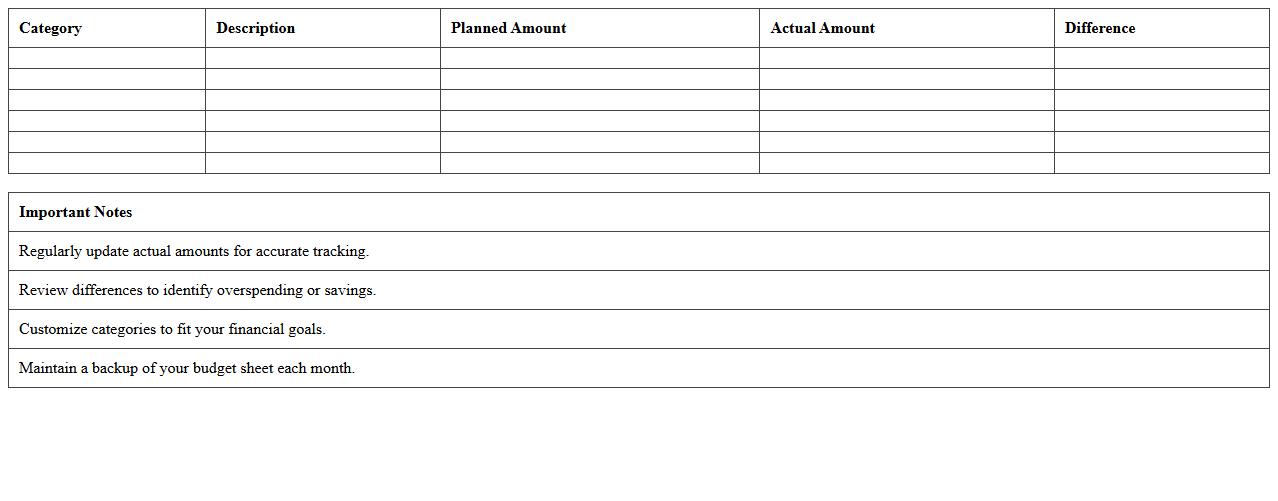

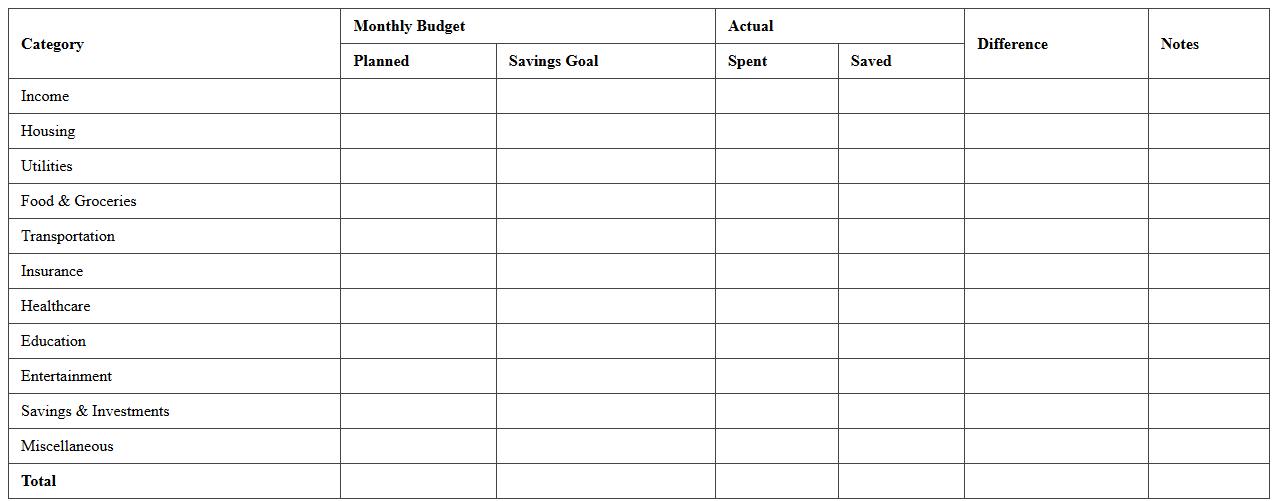

Monthly Budget Planner Excel Template

The

Monthly Budget Planner Excel Template is a digital spreadsheet designed to help individuals and businesses organize and track their monthly income and expenses efficiently. It allows users to categorize spending, set financial goals, and monitor cash flow, promoting better money management and informed decision-making. Utilizing this template can lead to improved budgeting accuracy and greater control over personal or organizational finances.

Personal Expense Tracker Excel Sheet

A

Personal Expense Tracker Excel Sheet is a digital tool designed to record and categorize daily spending, providing a clear overview of financial habits. It helps users monitor income, expenses, and savings goals efficiently by using customizable formulas and charts to visualize data. This organized approach enables better budgeting decisions and promotes financial discipline.

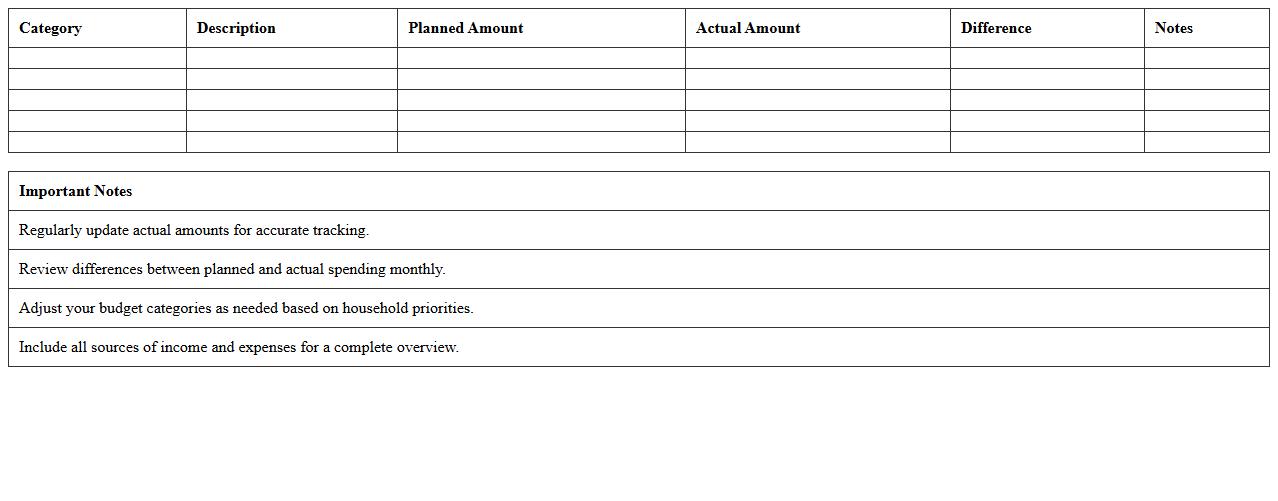

Household Budget Management Excel Template

The

Household Budget Management Excel Template document is a structured tool designed to track and organize personal income, expenses, and savings efficiently. It helps users create detailed monthly budgets, monitor spending patterns, and identify areas to reduce costs, ultimately promoting better financial discipline. By providing visual charts and automated calculations, it simplifies financial planning and supports informed decision-making for improved money management.

Simple Income and Expense Tracker Excel

A

Simple Income and Expense Tracker Excel document is a practical spreadsheet designed to record and categorize financial transactions, enabling users to monitor their cash flow efficiently. By organizing income sources and expenses in a clear format, it helps identify spending patterns, budget effectively, and improve financial decision-making. This tool is especially valuable for individuals and small businesses aiming to maintain financial discipline and enhance savings.

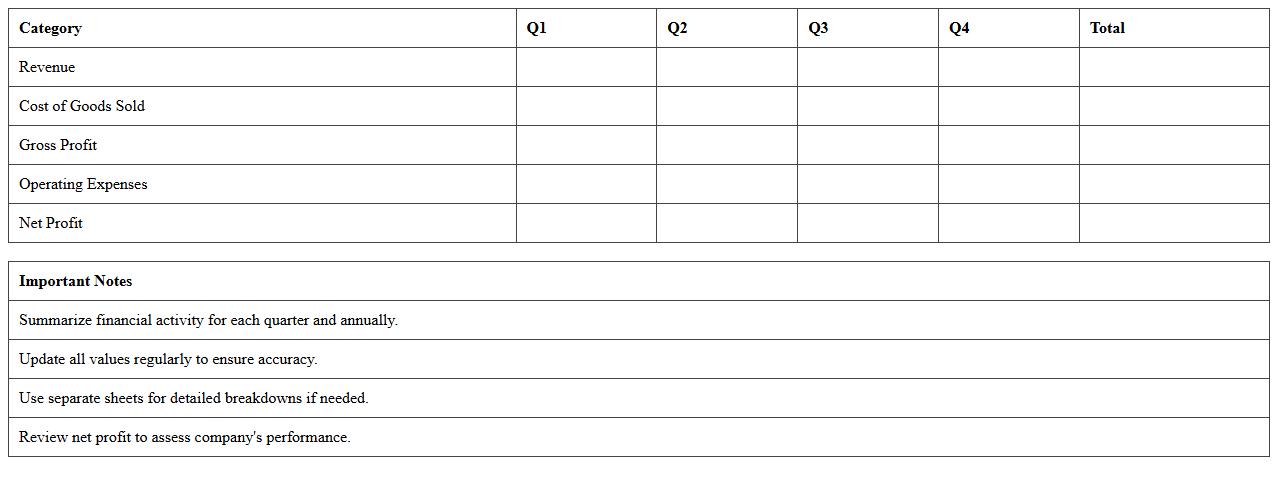

Annual Financial Overview Excel Template

The

Annual Financial Overview Excel Template document is a structured spreadsheet designed to compile and analyze a company's yearly financial data, including revenues, expenses, profits, and key financial ratios. It helps businesses monitor financial performance, identify trends, and make informed budgeting and investment decisions. Utilizing this template streamlines financial reporting, enabling quick access to comprehensive insights and improving strategic planning accuracy.

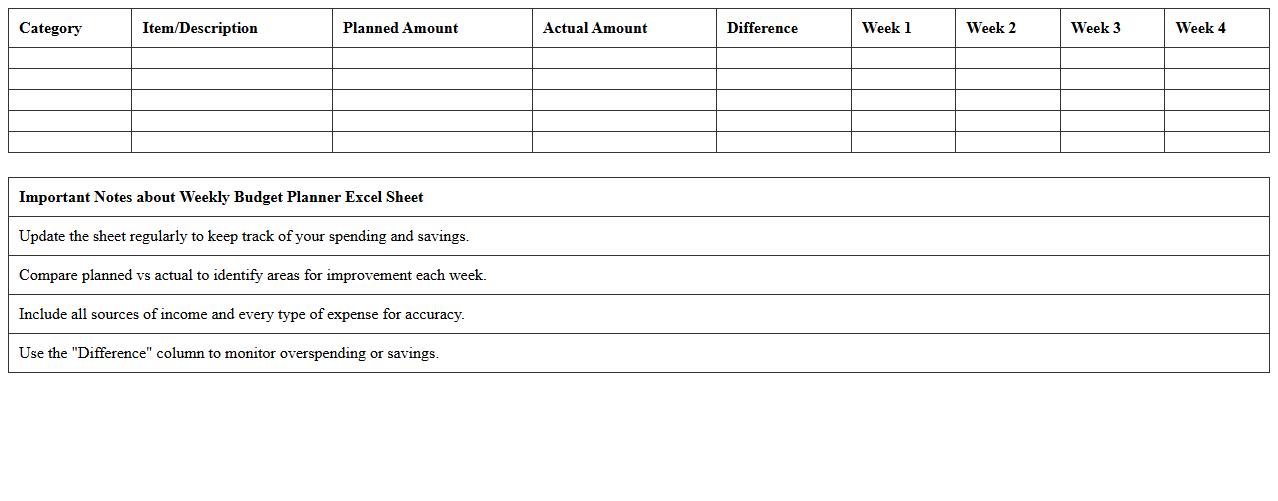

Weekly Budget Planner Excel Sheet

A

Weekly Budget Planner Excel Sheet document is a customizable tool designed to track income, expenses, and savings on a weekly basis, helping users manage their finances effectively. It offers detailed categories for expenses and income sources, enabling clear visualization of cash flow and assisting in identifying spending patterns. This planner enhances financial discipline, supports goal setting, and improves decision-making for better money management.

Family Budget and Savings Plan Excel

The

Family Budget and Savings Plan Excel document is a comprehensive financial tool designed to track household income, expenses, and savings goals efficiently. It helps users monitor spending patterns, allocate funds for essential categories, and plan for future financial needs, improving overall money management. Utilizing this Excel template promotes disciplined budgeting, reduces financial stress, and supports achieving long-term savings objectives.

Debt Payoff Tracker Excel Template

A

Debt Payoff Tracker Excel Template is a customizable spreadsheet designed to help individuals organize and monitor their debt repayment progress. This tool allows users to input various debts, track payment amounts and due dates, and visualize payoff timelines using charts and formulas. By providing clear insights into debt status and helping prioritize payments, it empowers users to manage finances efficiently and achieve debt-free goals faster.

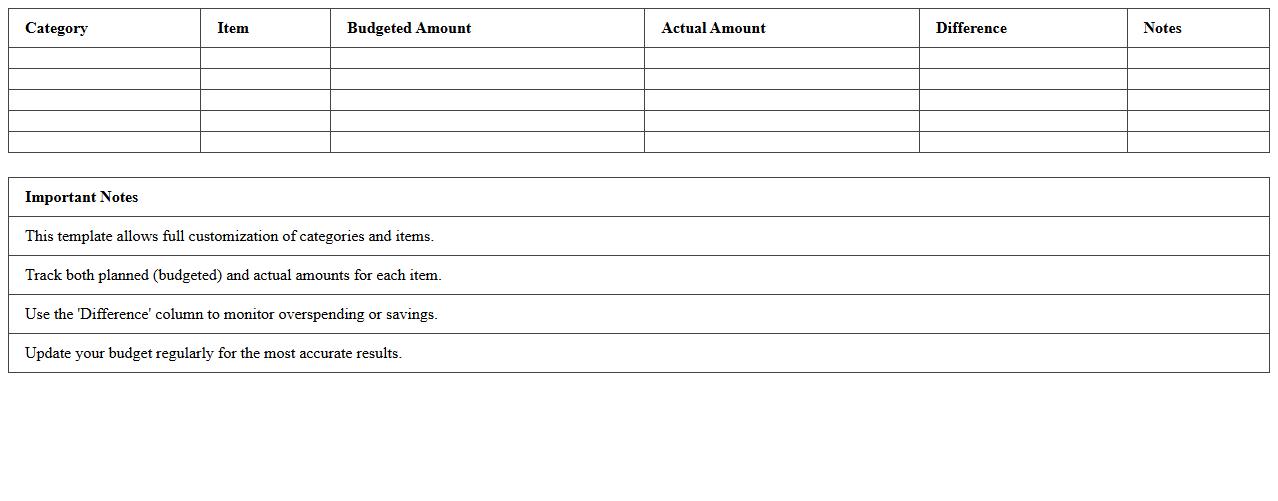

Customizable Personal Budget Spreadsheet

A

Customizable Personal Budget Spreadsheet is a dynamic financial tool designed to track income, expenses, and savings tailored to individual financial goals. It enables users to input personalized categories and adjust parameters, providing a clear overview of cash flow and helping identify spending patterns. This spreadsheet enhances financial management by promoting disciplined budgeting, facilitating goal setting, and supporting informed decision-making for improved financial health.

Emergency Fund Tracker Excel Template

The

Emergency Fund Tracker Excel Template is a practical spreadsheet designed to help individuals monitor and manage their emergency savings efficiently. It enables users to set target goals, track monthly contributions, and visualize progress through charts, ensuring financial preparedness during unexpected situations. Using this template promotes disciplined saving habits and provides a clear overview of financial security status at any time.

How can I automate monthly expense categorization in my Budget Planner Excel sheet?

To automate monthly expense categorization, use the IF and VLOOKUP functions to assign categories based on transaction descriptions. Creating a reference table for common expenses improves accuracy and speeds up data entry. Using dynamic ranges and Excel Tables allows for seamless updates as new transactions are added.

What formulas optimize cash flow forecasts in personal finance tracking Excel templates?

Excel formulas like SUMIFS and FORECAST.LINEAR are essential to pull and project financial data accurately. Integrating these with date functions such as EOMONTH helps organize cash flow by specific periods for better forecasting. Dynamic array formulas like FILTER enable customizable cash flow analysis by user-defined criteria.

How do I integrate debt repayment schedules into Budget Planner Excel documents?

Incorporate debt repayment schedules using formulas that calculate principal and interest payments over time, like the PMT function. Creating amortization tables linked to your debt accounts ensures up-to-date tracking of balances and payment dates. Conditional formatting can highlight upcoming payments and help maintain clear deadlines.

Which Excel charts best visualize savings progress in a personal budget planner?

Line charts effectively show savings growth over time, making trends easy to analyze visually. Progress bar charts and pie charts summarize allocation and how close you are to savings goals. Combining multiple chart types on a dashboard provides an insightful overview of financial health.

How can I securely share my Budget Planner Excel file for collaborative household budgeting?

Use OneDrive or SharePoint with Excel's built-in sharing features to enable real-time collaboration securely. Employ password protection and set edit permissions to control access and prevent unauthorized changes. Regularly back up files and use version history to avoid data loss or overwrite issues.

More Budget Excel Templates

![]()