The Budget Excel Template for Small Business Owners simplifies financial planning by organizing income, expenses, and cash flow in a clear, customizable format. This template helps track spending patterns, forecast profits, and maintain control over budgets to make informed business decisions. Small business owners can easily monitor financial health and identify areas for cost-saving opportunities.

Monthly Expense Tracker Excel Template for Small Business Owners

The

Monthly Expense Tracker Excel Template for small business owners is a structured spreadsheet designed to record, categorize, and analyze monthly expenditures efficiently. It simplifies financial management by providing clear visibility into cash flow, helping businesses identify spending patterns, control costs, and improve budgeting accuracy. This tool supports informed decision-making by generating detailed reports that highlight key expense areas critical for sustaining profitability.

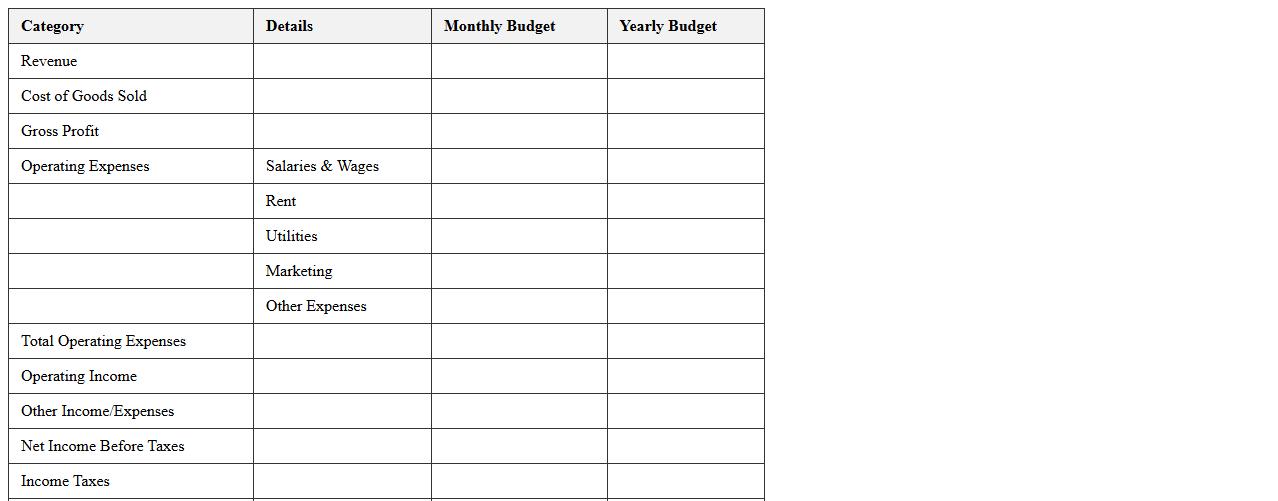

Income Statement Budget Excel Template for Small Business

An

Income Statement Budget Excel Template for small business is a structured financial tool designed to forecast revenues, expenses, and net profit over a specific period. This template helps business owners monitor cash flow, plan operational costs, and make informed decisions to achieve financial goals. By organizing budget projections and actual results, it improves financial accuracy and supports strategic growth initiatives.

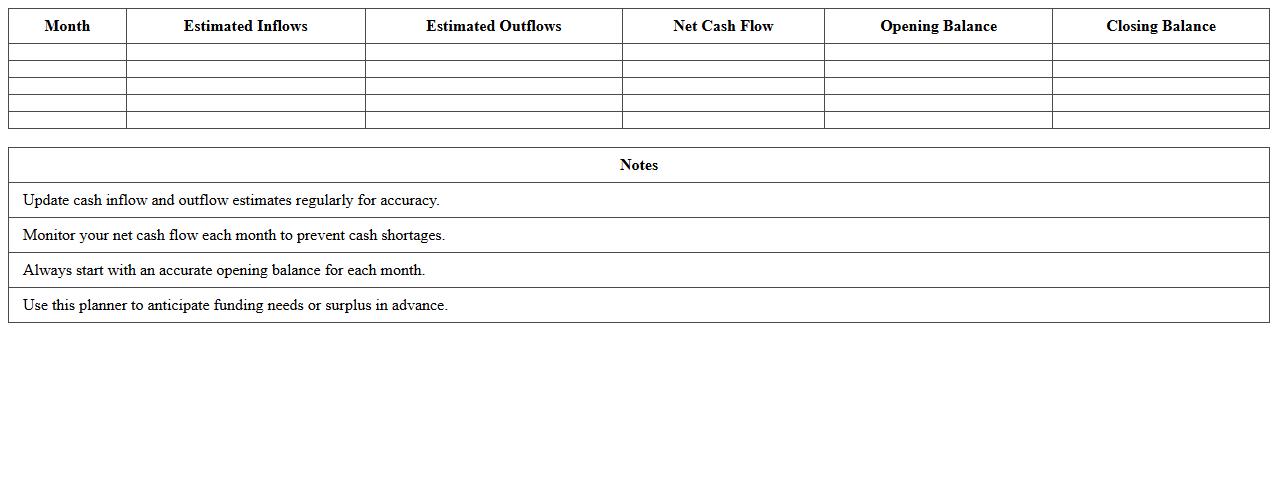

Cash Flow Budget Planner Excel Template for Entrepreneurs

The

Cash Flow Budget Planner Excel Template for entrepreneurs is a financial tool designed to track and manage the inflows and outflows of cash within a business. It helps entrepreneurs forecast future cash positions, identify potential shortages, and plan expenditures effectively to maintain liquidity. By providing a clear overview of revenue streams and expenses, this template supports informed decision-making and ensures sustainable business growth.

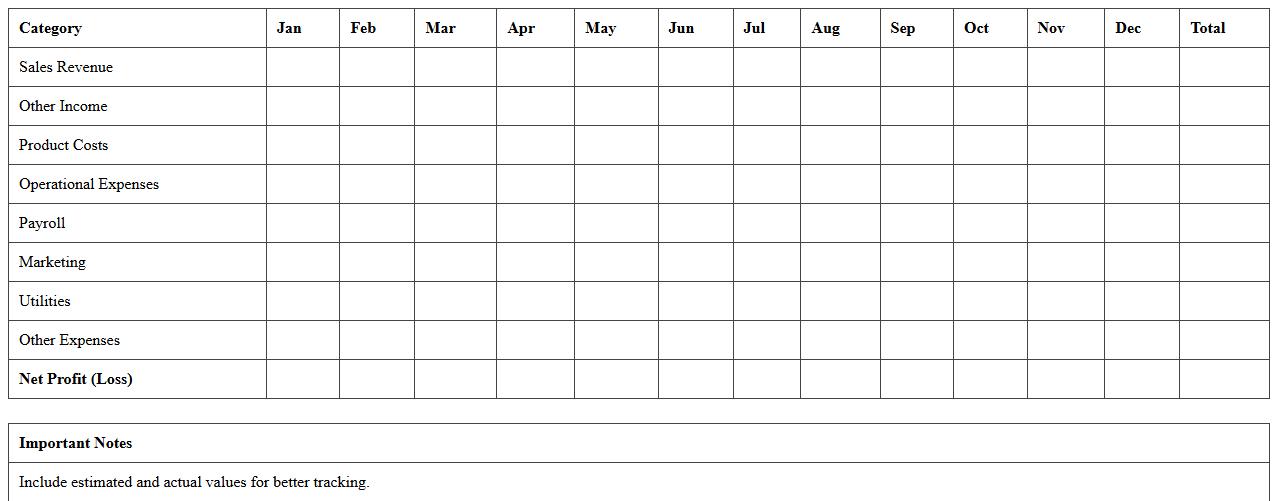

Annual Business Budget Excel Spreadsheet for Small Enterprises

The

Annual Business Budget Excel Spreadsheet for Small Enterprises is a comprehensive financial tool designed to track income, expenses, and cash flow over a 12-month period. This document helps small business owners plan and allocate resources effectively, enabling better decision-making and cost control. By providing clear visualizations and organized data, it enhances financial forecasting and supports strategic growth initiatives.

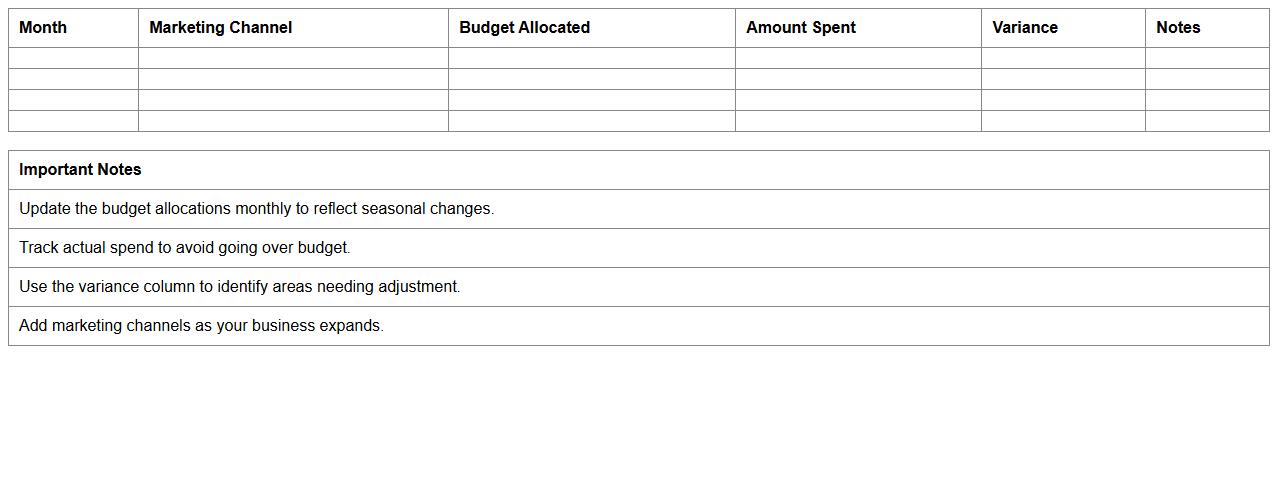

Marketing Budget Excel Template for Small Business Owners

A

Marketing Budget Excel Template for small business owners is a structured spreadsheet designed to help plan, track, and manage marketing expenses effectively. It allows users to allocate funds across various campaigns, monitor spending in real time, and analyze return on investment to optimize future marketing strategies. This tool enhances financial control, ensuring marketing efforts stay within budget while maximizing impact.

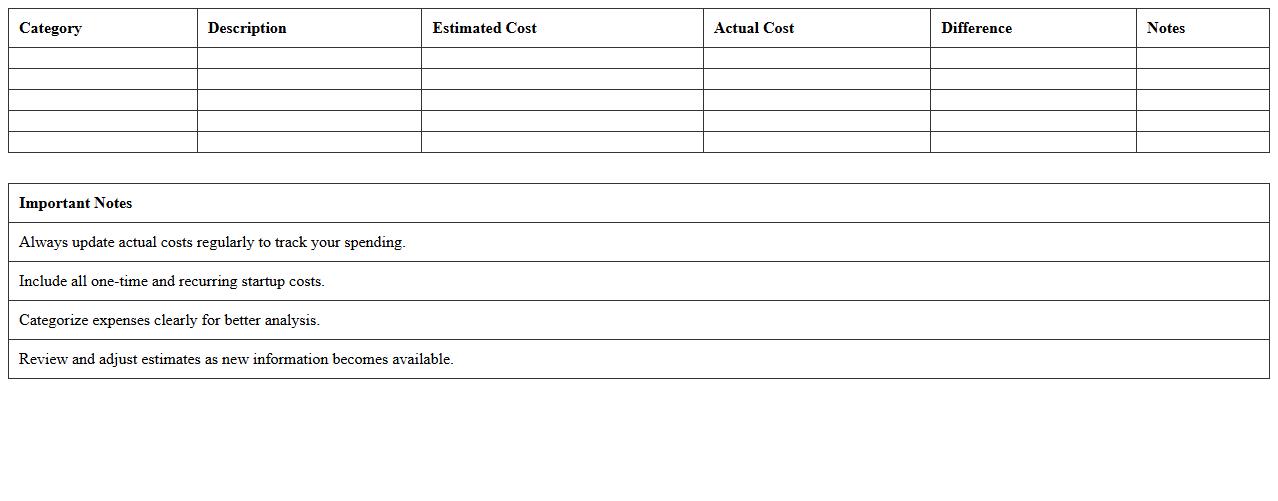

Startup Cost Budget Excel Template for Small Business

A

Startup Cost Budget Excel Template for Small Business is a structured spreadsheet designed to help entrepreneurs estimate and organize all initial expenses required to launch their business. This document enables precise tracking of costs such as equipment, licenses, marketing, and operational expenses, ensuring financial clarity from the outset. Using this template promotes effective financial planning, prevents budget overruns, and supports informed decision-making throughout the startup phase.

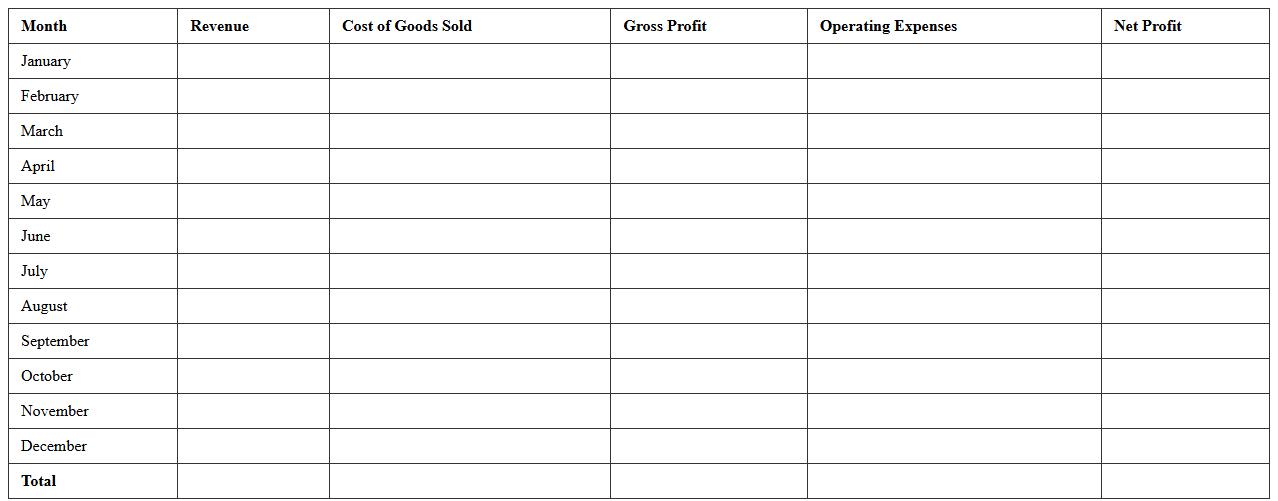

Projected Profit and Loss Budget Excel Template for Small Businesses

A

Projected Profit and Loss Budget Excel Template for small businesses is a structured financial tool designed to estimate future revenues, expenses, and net profit over a specific period. This template helps entrepreneurs accurately forecast cash flow, manage operational costs, and set realistic financial goals. Utilizing this document enhances strategic planning and supports informed decision-making by providing clear visibility into expected business performance.

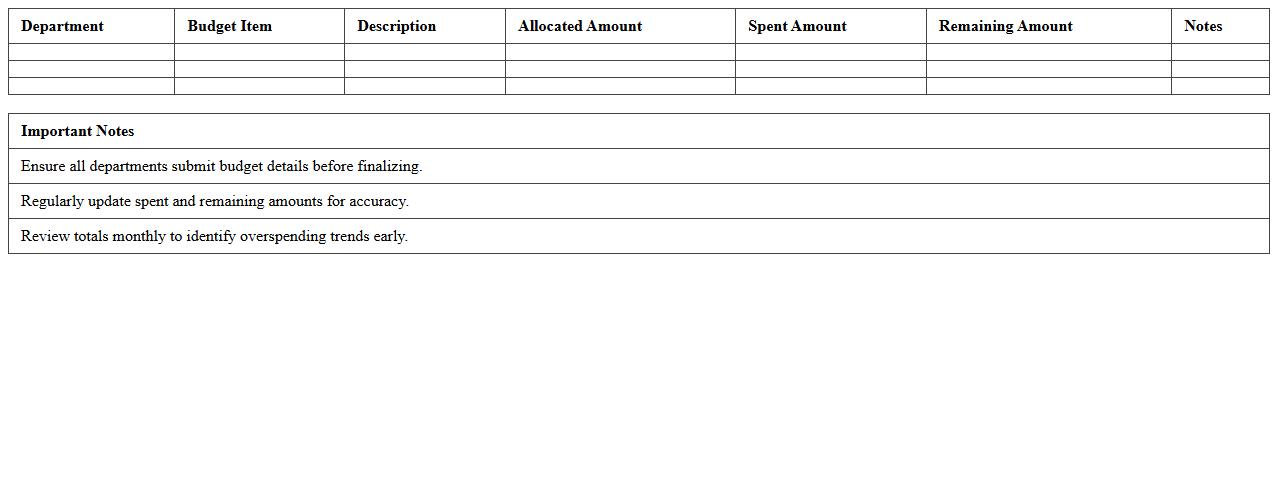

Departmental Budget Breakdown Excel Template for Small Business

The

Departmental Budget Breakdown Excel Template for small businesses is a comprehensive financial tool designed to allocate and monitor expenses across various departments efficiently. It enables businesses to track budgeted versus actual expenditures, ensuring better control over spending and facilitating informed decision-making. By providing clear visualizations and detailed summaries, the template helps optimize resource allocation and supports financial planning accuracy.

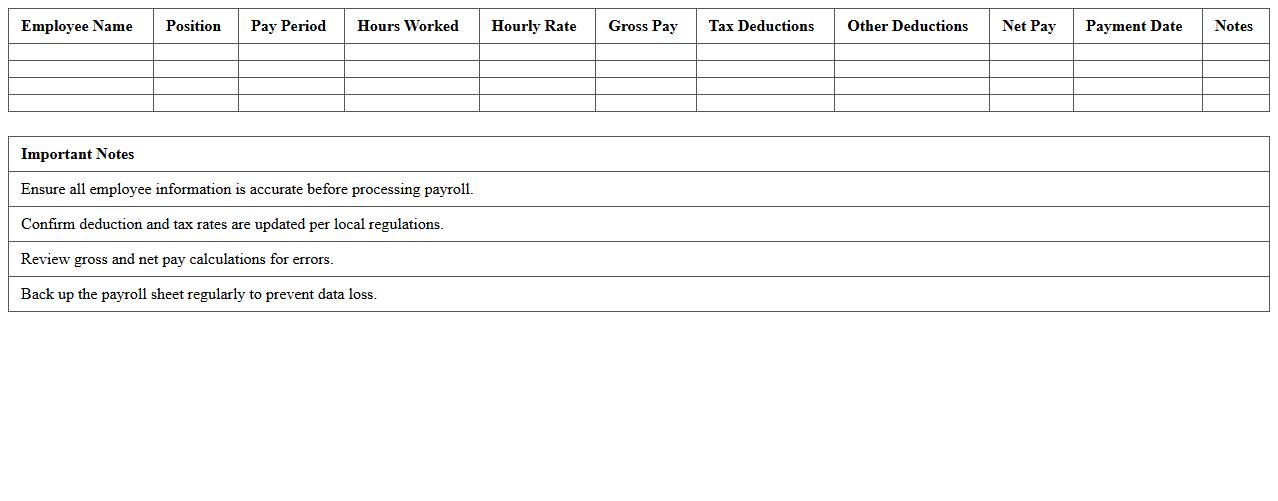

Small Business Payroll Budget Excel Template Sheet

The

Small Business Payroll Budget Excel Template Sheet document is a structured tool designed to simplify payroll management by organizing employee salary data, tax deductions, and benefit contributions in one place. It helps small business owners accurately forecast payroll expenses, ensure compliance with tax regulations, and maintain financial control. Using this template reduces errors, saves time, and supports strategic budgeting decisions for sustainable business growth.

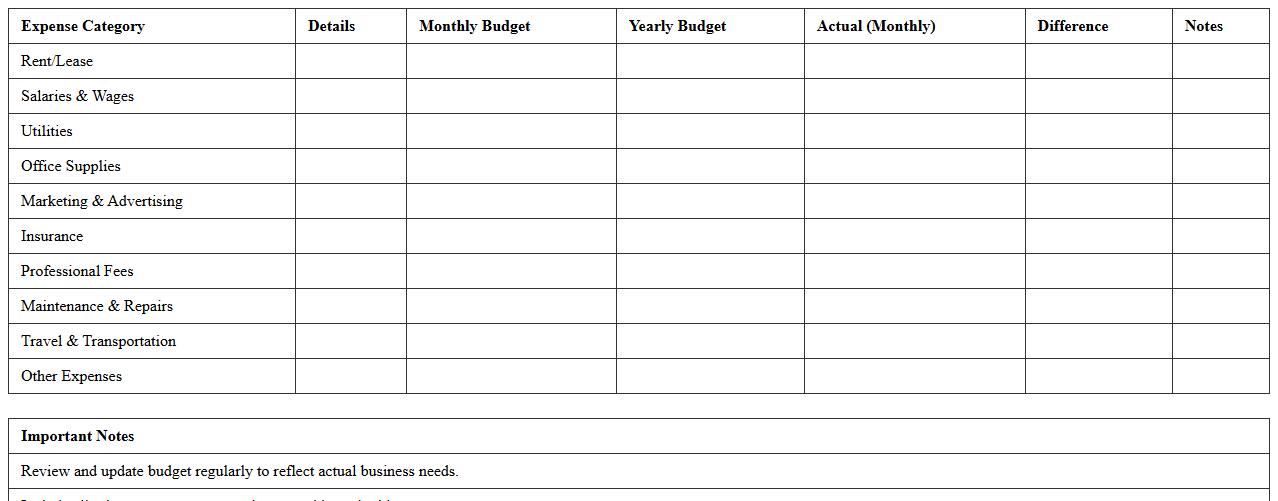

Business Operating Expense Budget Excel Template for SMEs

A

Business Operating Expense Budget Excel Template for SMEs is a structured financial planning tool designed to help small and medium-sized enterprises accurately forecast and manage their operating costs. This template allows businesses to categorize expenses, track spending trends, and maintain control over budget allocations, which supports informed decision-making and efficient resource management. Utilizing this document promotes financial discipline, minimizes overspending, and enhances operational efficiency by providing clear visibility into cash flow and expense patterns.

How can I automate monthly expense tracking in a budget excel for micro-businesses?

To automate monthly expense tracking in Excel, use Excel tables combined with data validation to organize and restrict input. Implement SUMIF or SUMIFS formulas to automatically total expenses by category and month. Additionally, use pivot tables to create dynamic reports that update as new data is entered.

What advanced formulas help forecast cash flow in small business budget spreadsheets?

The FORECAST.LINEAR function is pivotal for predicting future cash flows based on historical trends. Combine this with IF and AND formulas to create dynamic scenarios adjusting for varying income or expenses. Using OFFSET in conjunction with these can build rolling forecast models that adapt as new data arrives.

Which Excel templates best suit inventory-heavy small business budgets?

Templates with integrated inventory management and expense tracking features are ideal for inventory-heavy budgets. Look for templates that include sections for stock levels, reorder points, and cost calculations to maintain accurate budgeting. Microsoft's inventory tracker templates or customizable budget templates with inventory add-ons work best for small businesses.

How do I set up department-specific budget sheets for a small company in Excel?

Create individual worksheets for each department named accordingly and link them to a summary dashboard for consolidation. Use consistent budget categories across sheets to enable meaningful comparisons and total calculations. Employ cell references and 3D formulas to pull data from different department sheets into one overview.

What conditional formatting highlights overspending in a small business budget excel?

Use conditional formatting rules that compare actual expenses against budgeted amounts to highlight overspending. Apply color scales or bold red fills when expenses exceed budget thresholds to draw immediate attention. Incorporate formulas like =Actual>Budget to automate these warnings effectively across the spreadsheet.

More Budget Excel Templates