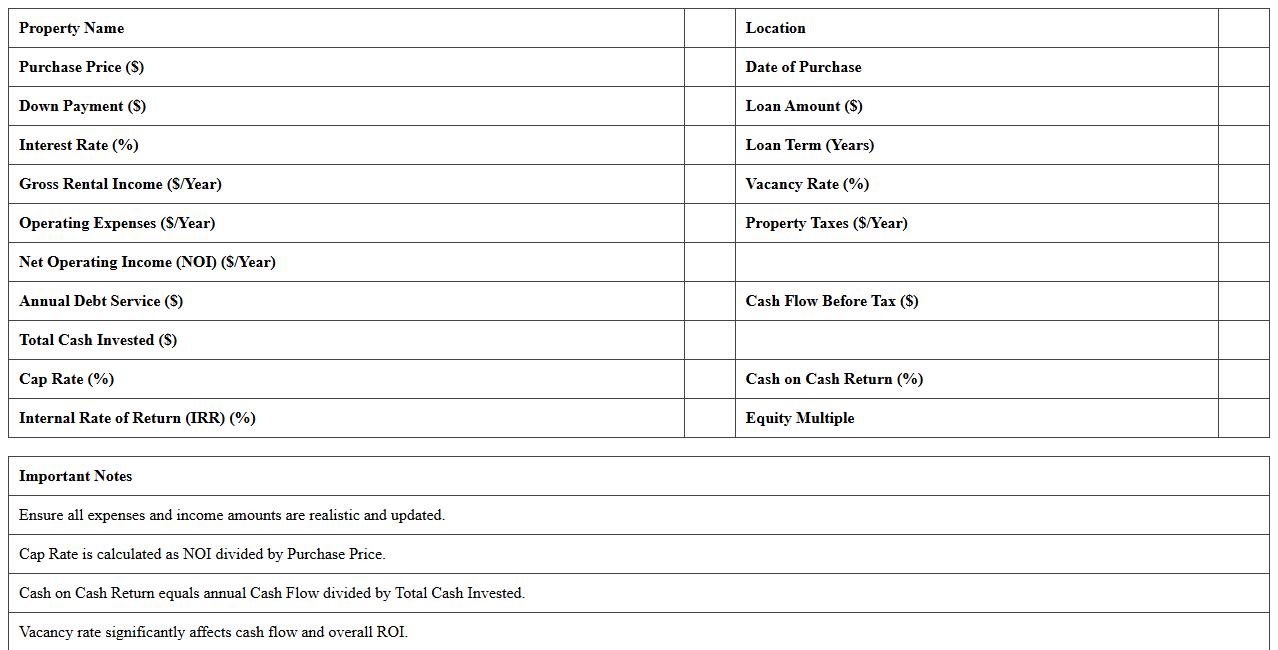

Simple ROI Calculator Spreadsheet for Real Estate

A

Simple ROI Calculator Spreadsheet for Real Estate is a digital tool designed to evaluate the return on investment by analyzing property purchase costs, rental income, expenses, and potential profits. It helps real estate investors make informed decisions by providing clear projections of cash flow, net operating income, and overall investment performance. Using this spreadsheet simplifies complex calculations, saving time and reducing errors, ultimately optimizing investment strategies.

Real Estate Investment Analysis Excel Template

The

Real Estate Investment Analysis Excel Template is a comprehensive spreadsheet designed to evaluate the financial viability of property investments by calculating key metrics such as cash flow, return on investment (ROI), net present value (NPV), and internal rate of return (IRR). This template streamlines the decision-making process by organizing complex data inputs, including purchase price, rental income, expenses, and financing terms, into clear, actionable insights. Investors and analysts use this tool to optimize portfolio performance, compare investment opportunities, and forecast long-term profitability with precision.

Rental Property ROI Calculation Worksheet

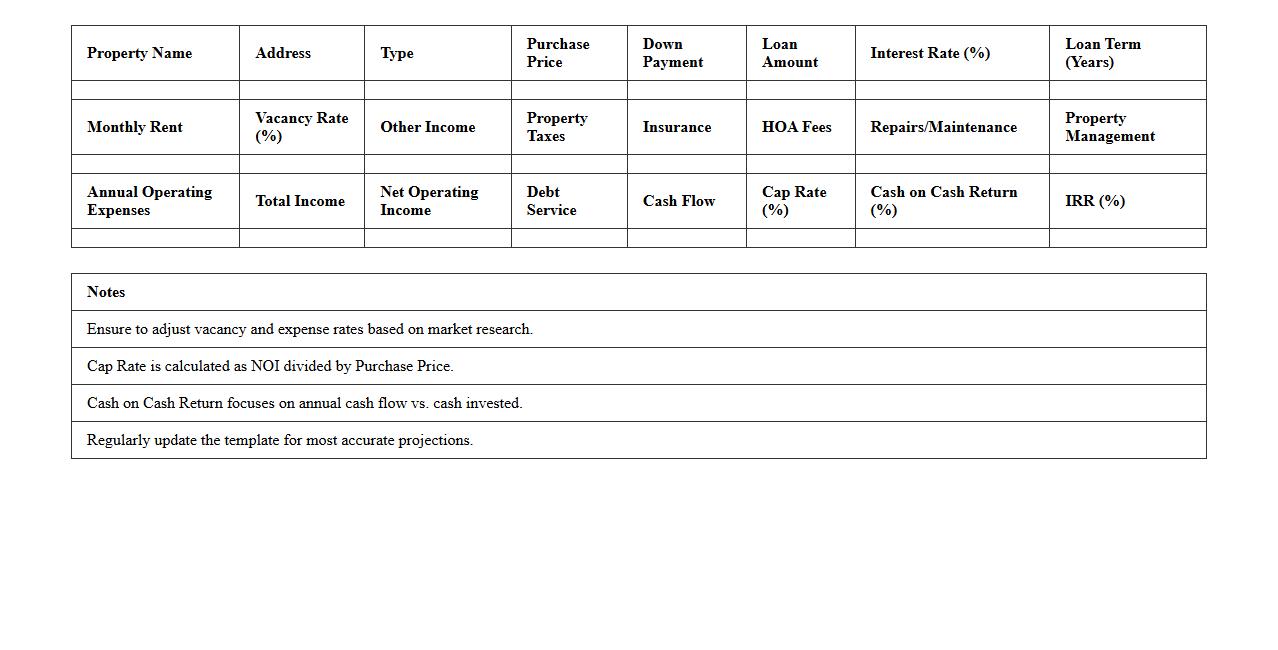

A

Rental Property ROI Calculation Worksheet is a financial tool designed to help investors accurately assess the return on investment for rental properties by calculating net income, expenses, and cash flow. This document streamlines the evaluation process, enabling clear comparison of potential properties and informed decision-making through detailed analysis of costs such as mortgage, maintenance, taxes, and rental income. Utilizing this worksheet improves accuracy in forecasting profitability and optimizing investment strategies for real estate portfolios.

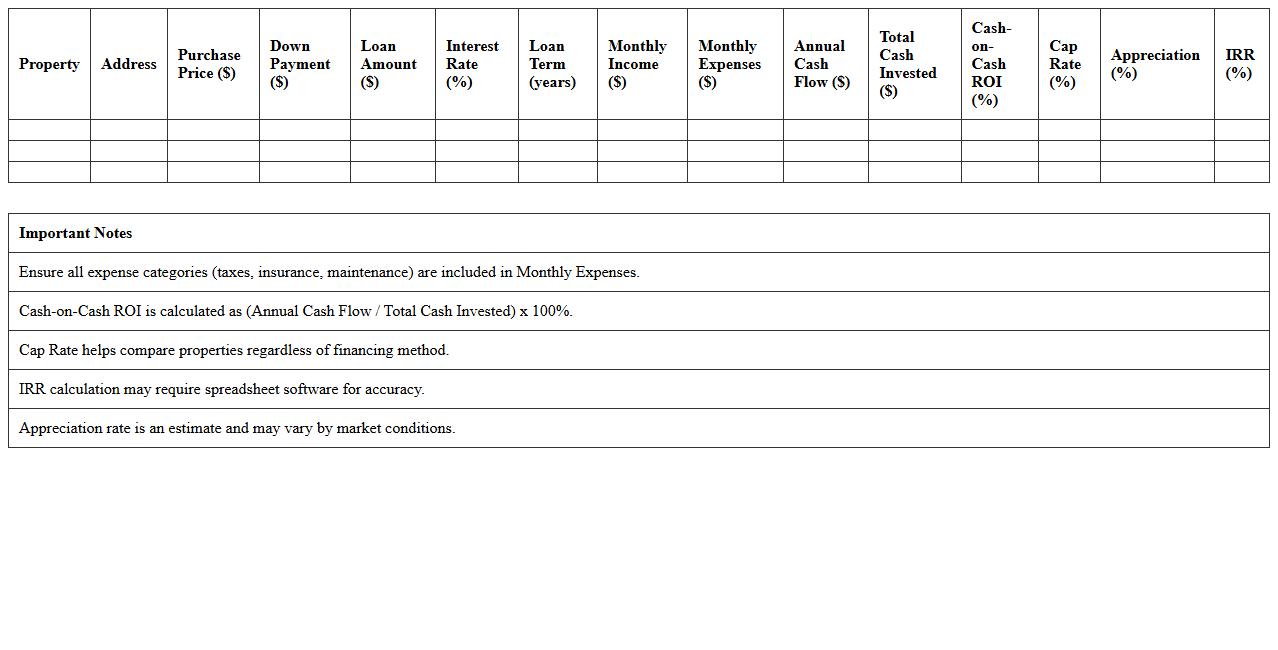

Multifamily Real Estate ROI Excel Tool

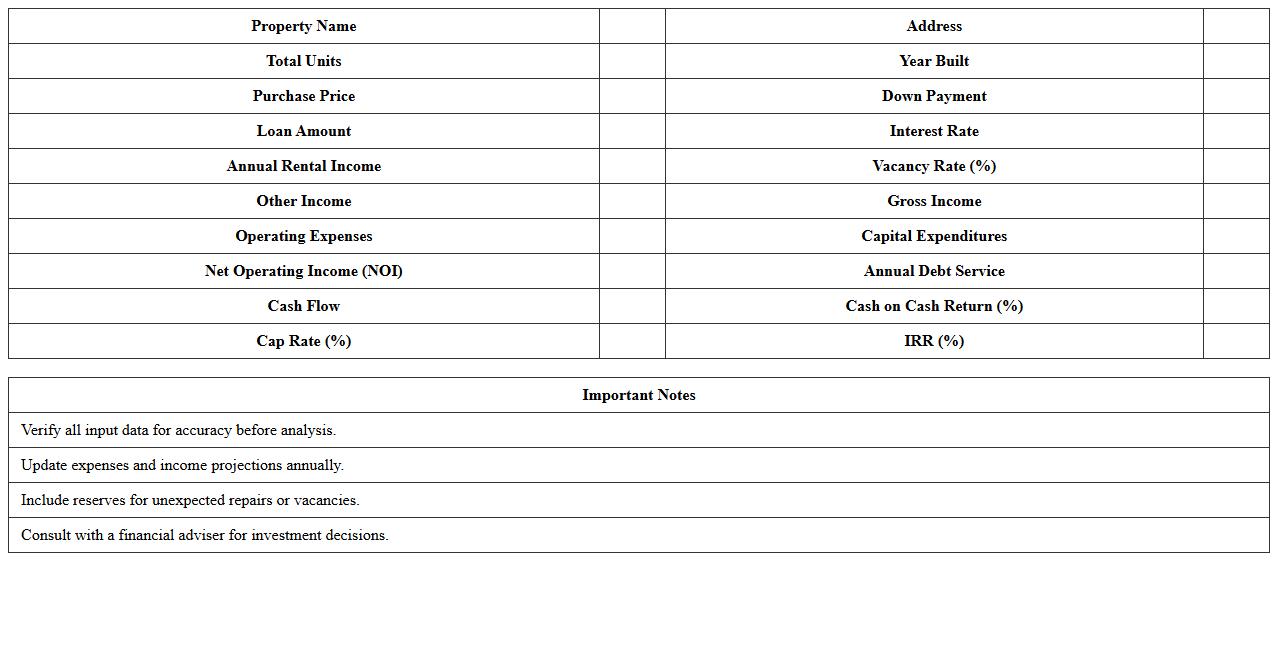

The

Multifamily Real Estate ROI Excel Tool is a comprehensive spreadsheet designed to analyze the return on investment for multifamily property acquisitions and management. It calculates critical metrics such as cash flow, cap rate, internal rate of return (IRR), and equity multiple, enabling investors to make informed financial decisions quickly. This tool streamlines complex data analysis, helping users optimize investment strategies and maximize profitability in multifamily real estate ventures.

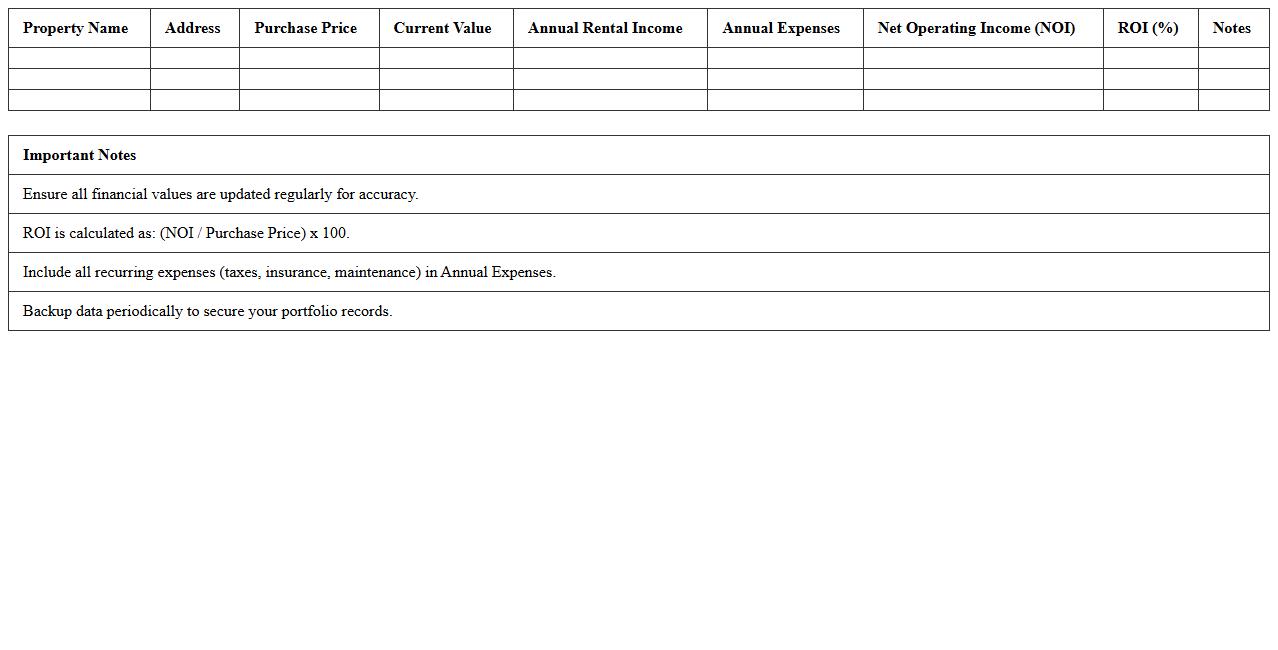

Rental Income and ROI Tracking Spreadsheet

The

Rental Income and ROI Tracking Spreadsheet is a comprehensive tool designed to monitor rental property earnings and calculate the return on investment efficiently. It organizes rental income, expenses, and cash flow, providing clear insights into property performance. This document helps investors make informed decisions by accurately tracking financial metrics and optimizing rental portfolio management.

Fix and Flip ROI Calculator Excel Template

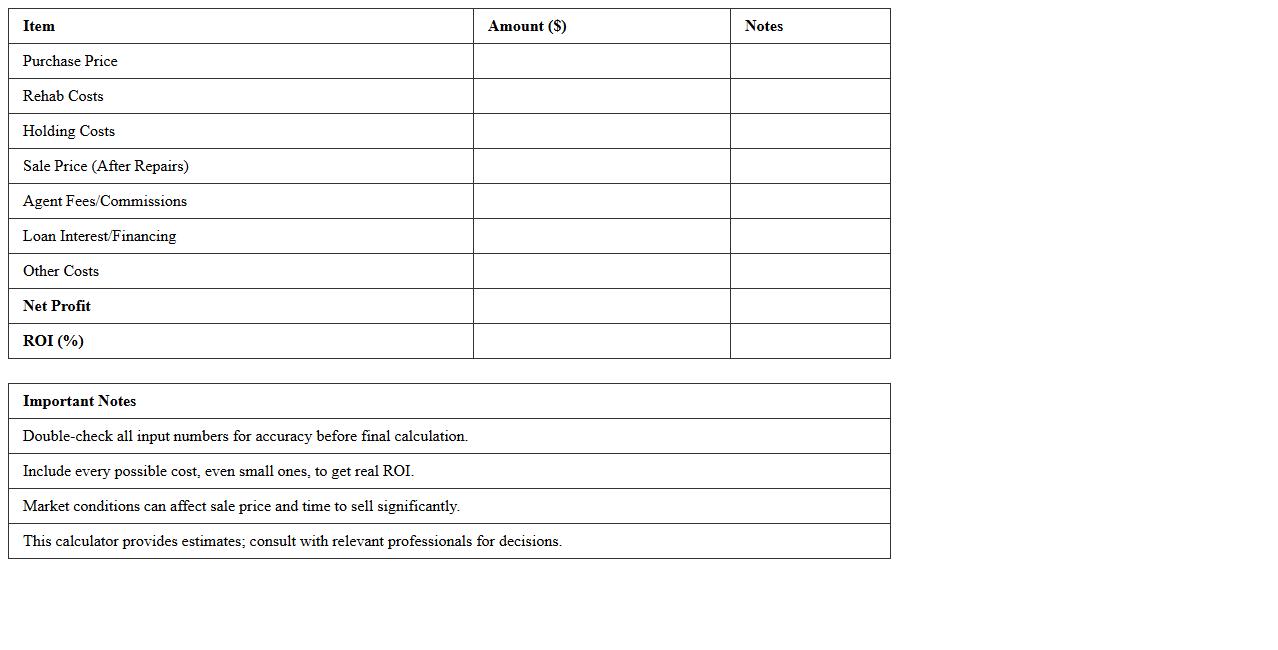

The

Fix and Flip ROI Calculator Excel Template is a financial tool designed to help real estate investors accurately estimate the return on investment for renovation projects. It allows users to input purchase price, repair costs, holding costs, and anticipated sale price to calculate potential profits and ROI percentages. This template aids in making informed decisions by providing clear projections of financial outcomes, minimizing risks, and optimizing investment strategies.

Cash Flow and ROI Projection Excel Sheet

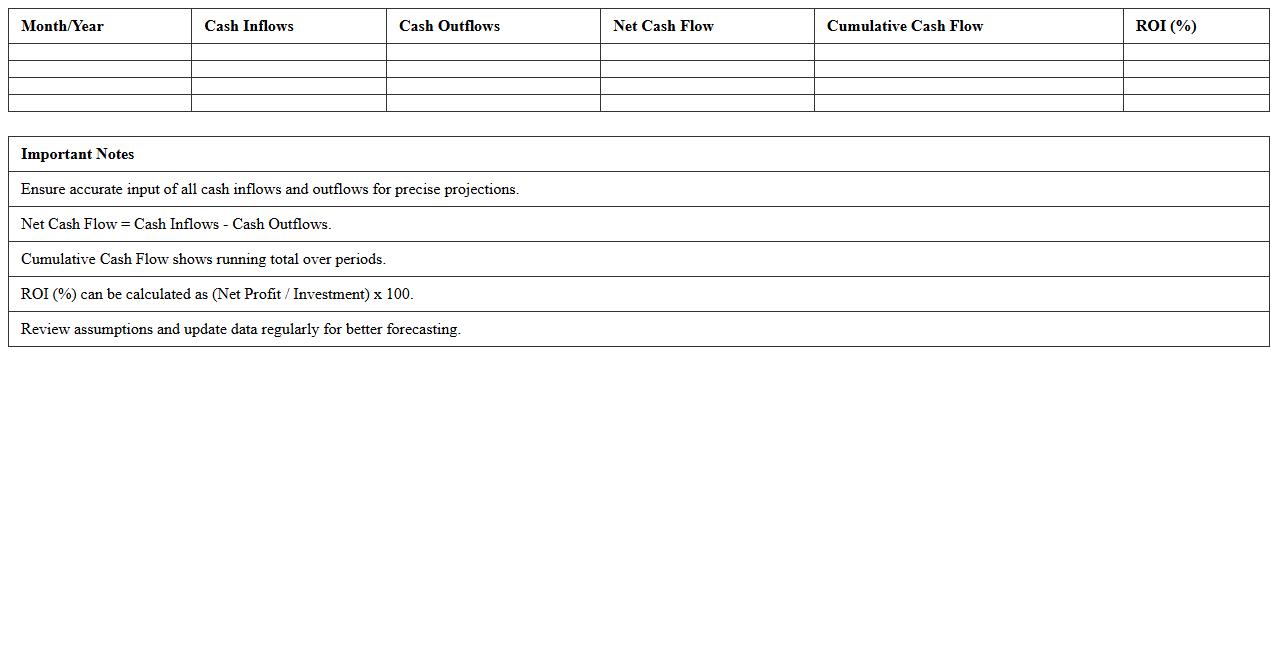

A

Cash Flow and ROI Projection Excel Sheet is a financial tool designed to forecast inflows and outflows of cash alongside the expected return on investment over a specified period. It helps businesses and investors analyze liquidity, plan budgets efficiently, and make data-driven decisions to optimize profitability. By visualizing future financial performance, this document aids in risk assessment and strategic planning for sustainable growth.

Commercial Real Estate ROI Analysis Template

A

Commercial Real Estate ROI Analysis Template is a structured document designed to evaluate the return on investment for commercial property ventures by detailing income, expenses, property appreciation, and financing costs. It enables investors and real estate professionals to make informed decisions by providing a clear projection of potential profitability and risk factors. Using this template streamlines financial analysis, ensures consistency in evaluations, and supports strategic investment planning for maximizing commercial property returns.

Property Portfolio ROI Dashboard Excel

The

Property Portfolio ROI Dashboard Excel document provides a comprehensive visual representation of returns on investment across multiple real estate assets, allowing for quick assessment of performance metrics such as rental yield, cash flow, and appreciation. This tool helps investors efficiently track property income, expenses, and overall portfolio growth by consolidating complex financial data into easy-to-understand charts and summaries. Using this dashboard enhances decision-making by identifying high-performing properties and optimizing investment strategies to maximize return on investment.

Real Estate Deal ROI Comparison Spreadsheet

A

Real Estate Deal ROI Comparison Spreadsheet is a powerful tool designed to analyze and compare the return on investment across multiple property deals by organizing key financial metrics, such as purchase price, rental income, expenses, and projected profits. It enables investors to make data-driven decisions by clearly visualizing and contrasting potential returns, cash flow, and overall profitability for each property option. Using this spreadsheet helps optimize investment strategies, minimize risk, and maximize financial outcomes in real estate ventures.

How do I customize ROI formulas in the ROI Calculation Excel for mixed-use real estate projects?

To customize ROI formulas for mixed-use real estate projects, modify the cash flow inputs by segregating income streams from different property types. Use separate columns for commercial and residential revenues and expenses to ensure accuracy. Update the formula references accordingly to reflect these segmented cash flows in your ROI calculations.

Which Excel functions best handle variable cash flow timing in real estate ROI analysis?

The XIRR function is ideal for handling variable cash flow timing in real estate ROI analysis as it accounts for irregular dates. Additionally, the NPV function helps calculate the net present value of uneven cash flows by discounting future amounts. Combining these functions provides a more accurate measurement of ROI when cash inflows and outflows occur at different times.

Can the template calculate ROI on short-term vs. long-term rental strategies?

Yes, the template can calculate ROI for both short-term and long-term rental strategies by differentiating revenue streams and expense patterns. Customize separate sections for each rental type with corresponding occupancy rates and costs. This allows you to compare profitability and cash flows effectively within the same spreadsheet.

How does the spreadsheet account for property tax fluctuations in annual ROI?

The spreadsheet accounts for property tax fluctuations by enabling inputs for yearly tax variations or percentage changes. You can update annual tax expense fields to reflect anticipated increases or decreases over time. This flexibility ensures the ROI calculations incorporate realistic property tax scenarios affecting overall returns.

What is the best way to integrate renovation costs into the ROI Calculation Excel template?

Renovation costs should be incorporated as one-time capital expenditures within the investment cost section of the ROI template. Allocate the costs to the specific year they occur and adjust the cash flow to reflect these expenses accurately. This method captures the impact of renovations on overall ROI without distorting regular operational cash flows.