The Depreciation Calculation Excel Template for Accountants is a powerful tool designed to simplify asset depreciation tracking and reporting. It offers customizable formulas and structured layouts to accurately compute various depreciation methods such as straight-line and declining balance. Accountants can efficiently manage fixed asset values, ensure compliance with accounting standards, and generate detailed depreciation schedules.

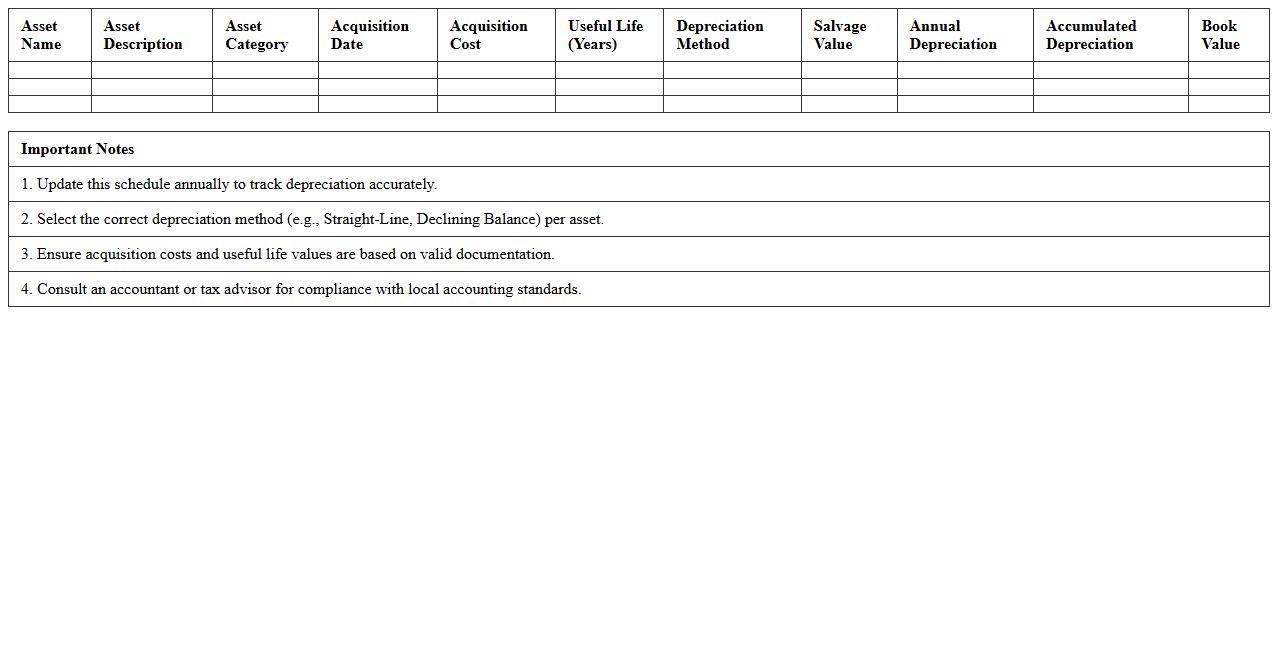

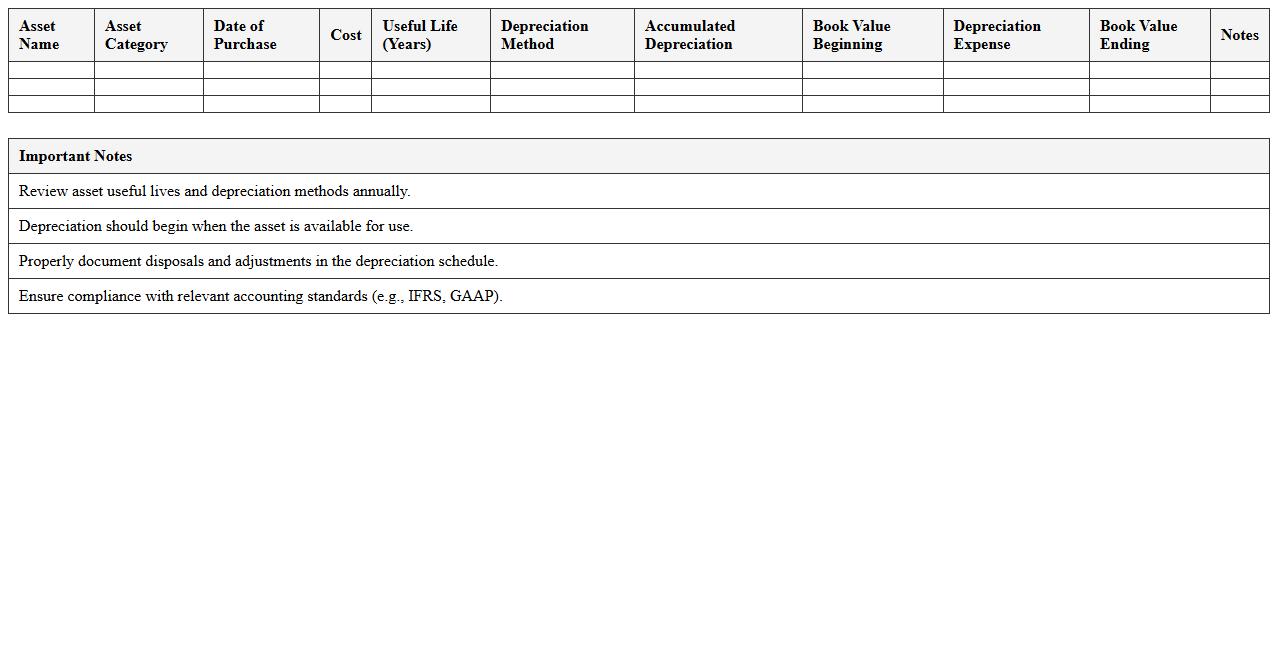

Fixed Asset Depreciation Schedule Excel Template

The

Fixed Asset Depreciation Schedule Excel Template is a structured document designed to track and calculate the depreciation of company assets over time using various accounting methods. It helps businesses accurately allocate asset costs, comply with tax regulations, and forecast asset values for financial reporting. Using this template enhances asset management efficiency and supports precise budgeting by maintaining organized and clear depreciation records.

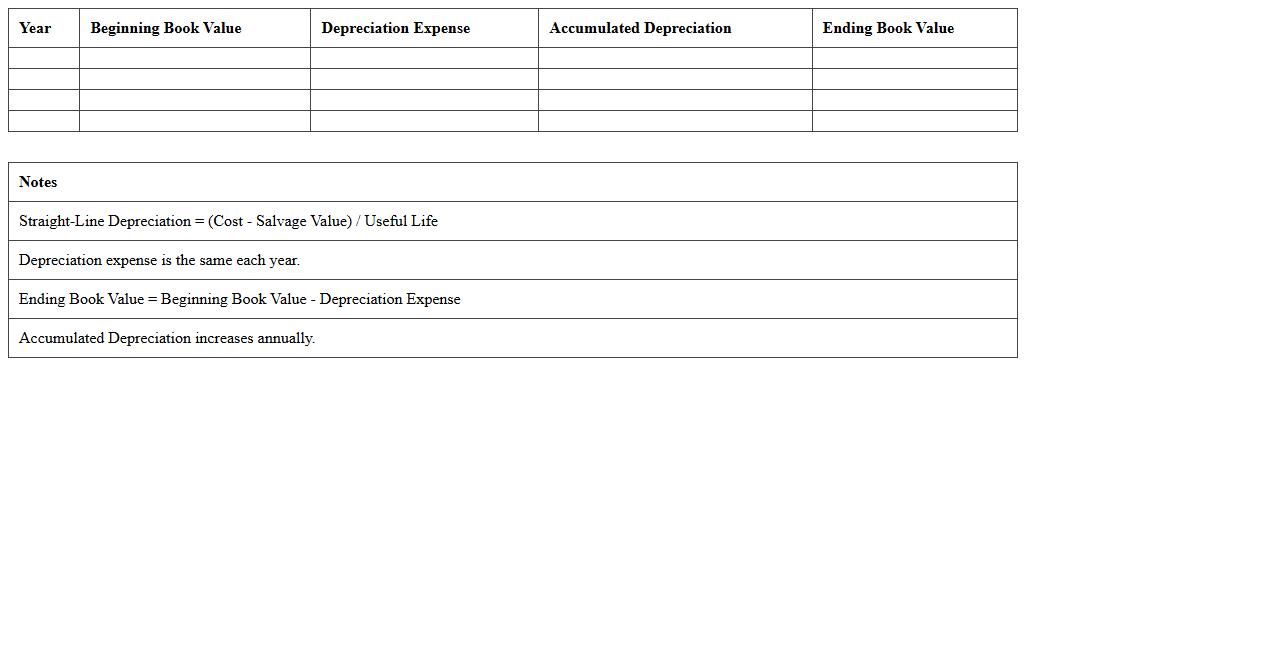

Straight-Line Depreciation Calculator Spreadsheet

A

Straight-Line Depreciation Calculator Spreadsheet document is a tool that automates the calculation of asset depreciation over time by allocating an equal expense amount for each accounting period. This spreadsheet helps businesses accurately track the declining value of fixed assets, ensuring precise financial reporting and tax compliance. By simplifying complex depreciation schedules, it enhances efficiency and reduces errors in asset management and budgeting processes.

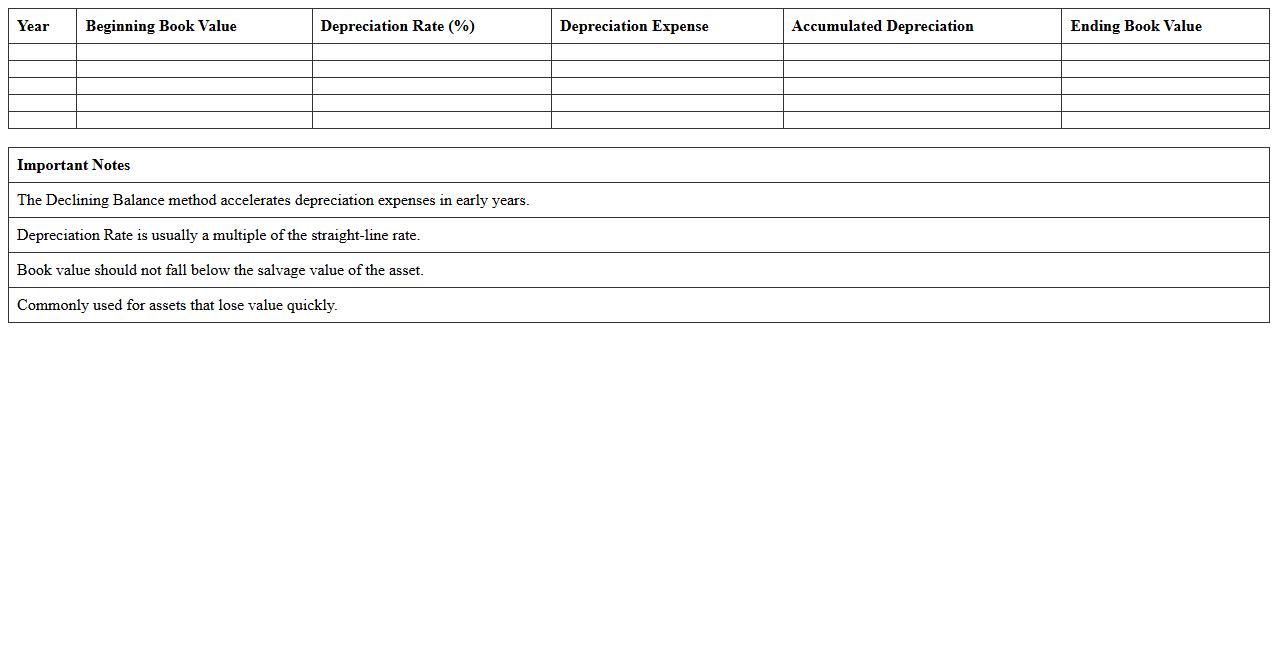

Declining Balance Depreciation Excel Worksheet

A

Declining Balance Depreciation Excel Worksheet is a spreadsheet tool designed to calculate asset depreciation using the declining balance method, which applies a constant depreciation rate to the reducing book value each year. It is useful for accurately tracking the decreasing value of fixed assets over time, aiding in precise financial reporting and tax calculations. This worksheet enhances efficiency by automating complex depreciation schedules and providing clear, organized data for asset management.

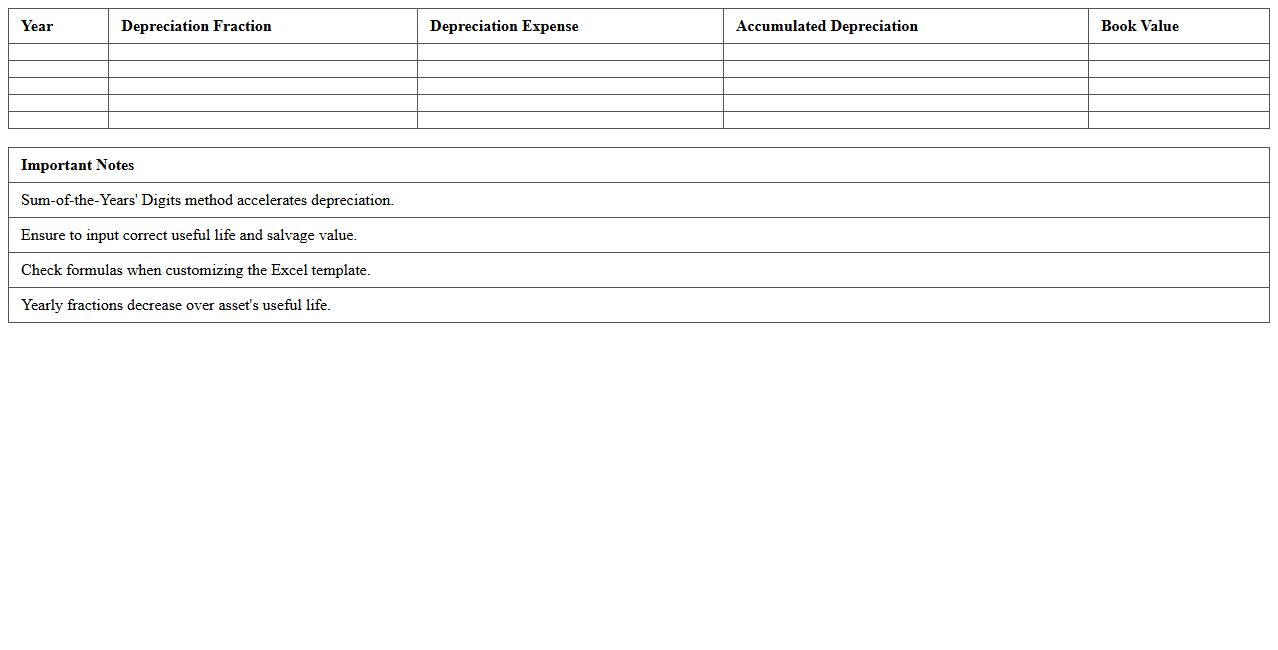

Sum-of-the-Years' Digits Depreciation Excel Tool

The

Sum-of-the-Years' Digits Depreciation Excel Tool document provides a streamlined way to calculate accelerated depreciation for fixed assets, allowing users to allocate higher depreciation expenses in the early years of an asset's useful life. It simplifies complex depreciation computations by automating the formula-based process, improving accuracy and saving time. This tool is especially useful for financial analysts and accountants aiming to optimize tax benefits and financial reporting through precise asset value management.

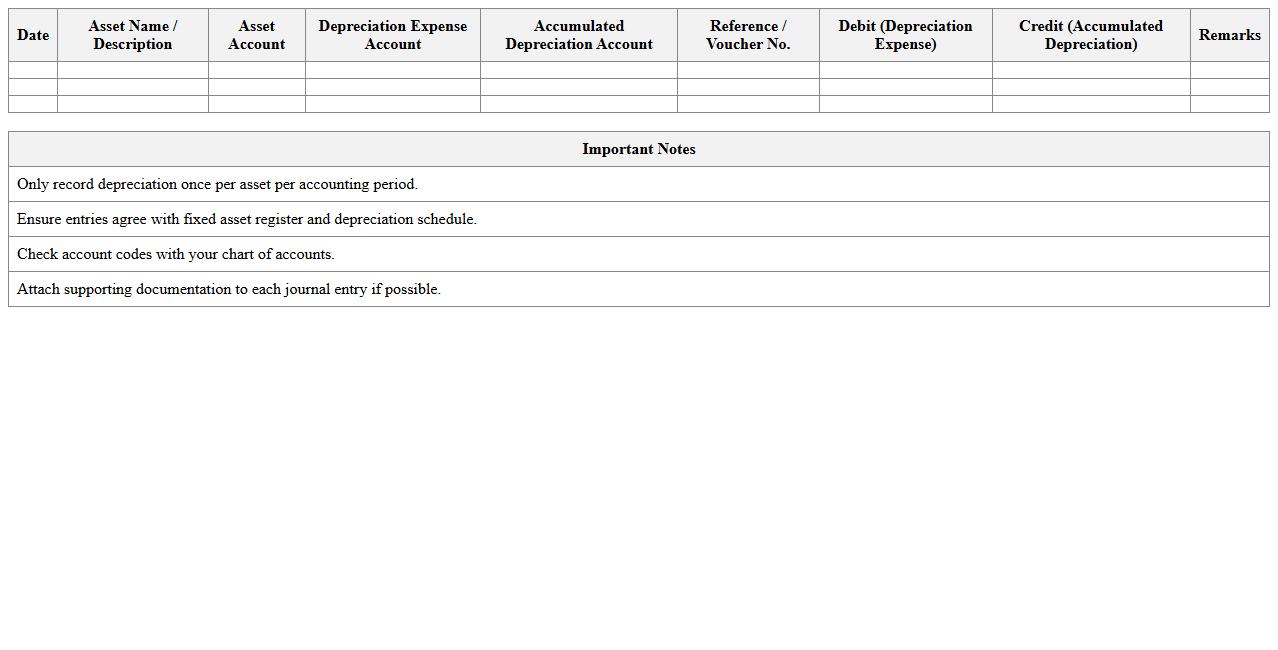

Asset Depreciation Journal Entry Log Spreadsheet

An

Asset Depreciation Journal Entry Log Spreadsheet is a detailed record-keeping tool that tracks the depreciation expenses of fixed assets over time by systematically logging journal entries. This document helps businesses maintain accurate financial statements, ensures compliance with accounting standards, and facilitates efficient asset management by calculating and recording periodic depreciation. Using this spreadsheet enhances transparency, supports audit processes, and aids in budgeting and tax reporting by providing a comprehensive overview of asset value reduction.

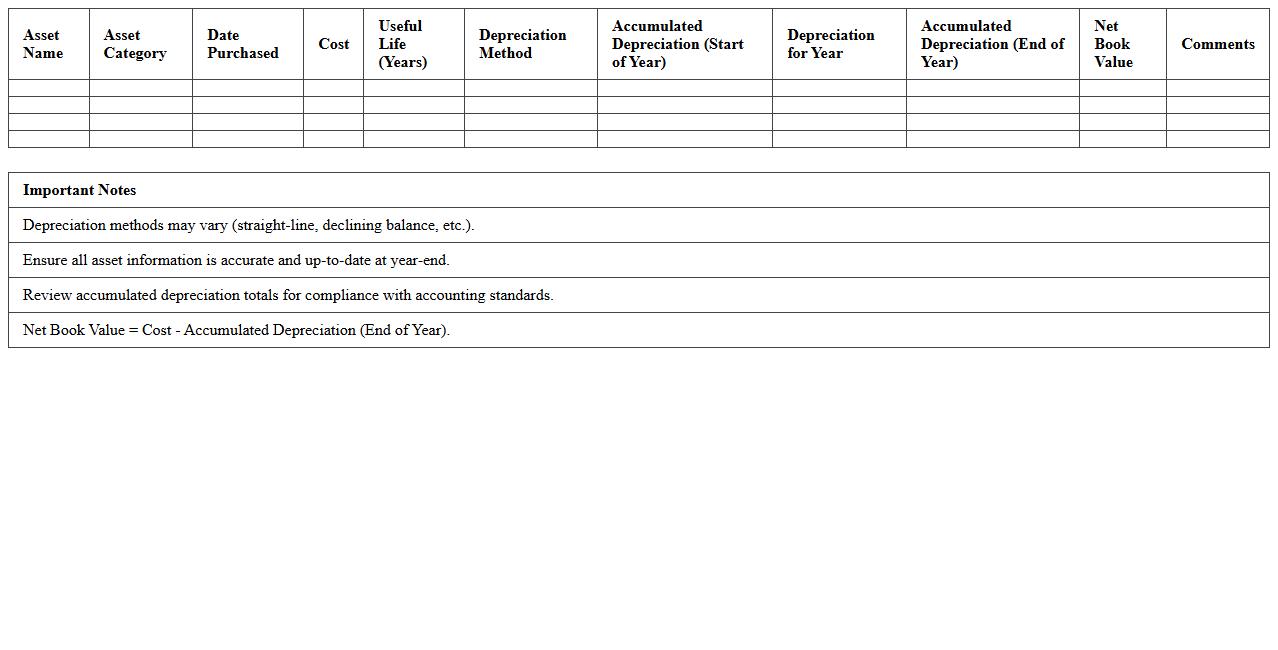

Annual Depreciation Summary Report Template

The

Annual Depreciation Summary Report Template is a structured document that consolidates yearly depreciation data for assets, enabling accurate financial tracking and tax compliance. It helps businesses monitor asset value reductions systematically, ensuring clear visibility of depreciation expenses on financial statements. This template streamlines accounting processes, aids in budgeting, and supports decision-making related to asset management and replacement planning.

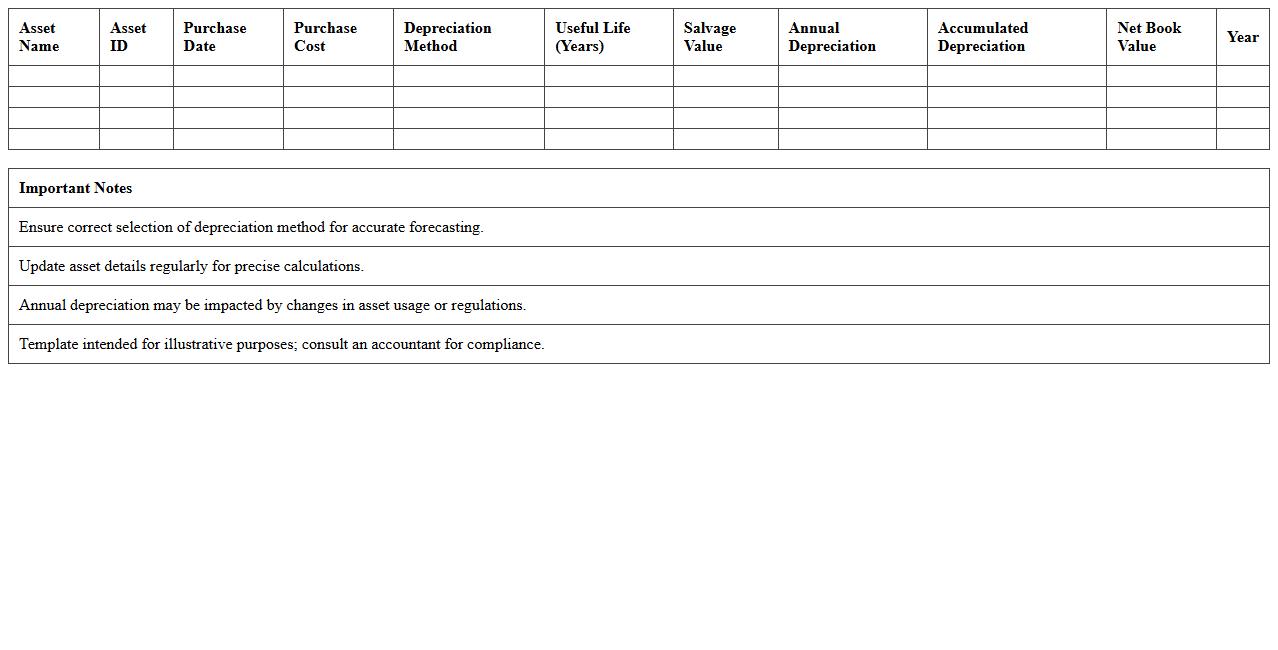

Multiple Asset Depreciation Tracking Sheet

A

Multiple Asset Depreciation Tracking Sheet is a comprehensive document designed to monitor and calculate the depreciation of various assets over time, ensuring accurate financial reporting and asset management. It helps businesses keep track of asset values, depreciation methods, useful life, and accumulated depreciation in one organized format. This tool improves budgeting, tax compliance, and decision-making regarding asset replacement or disposal by providing clear visibility into the current value and status of all tangible assets.

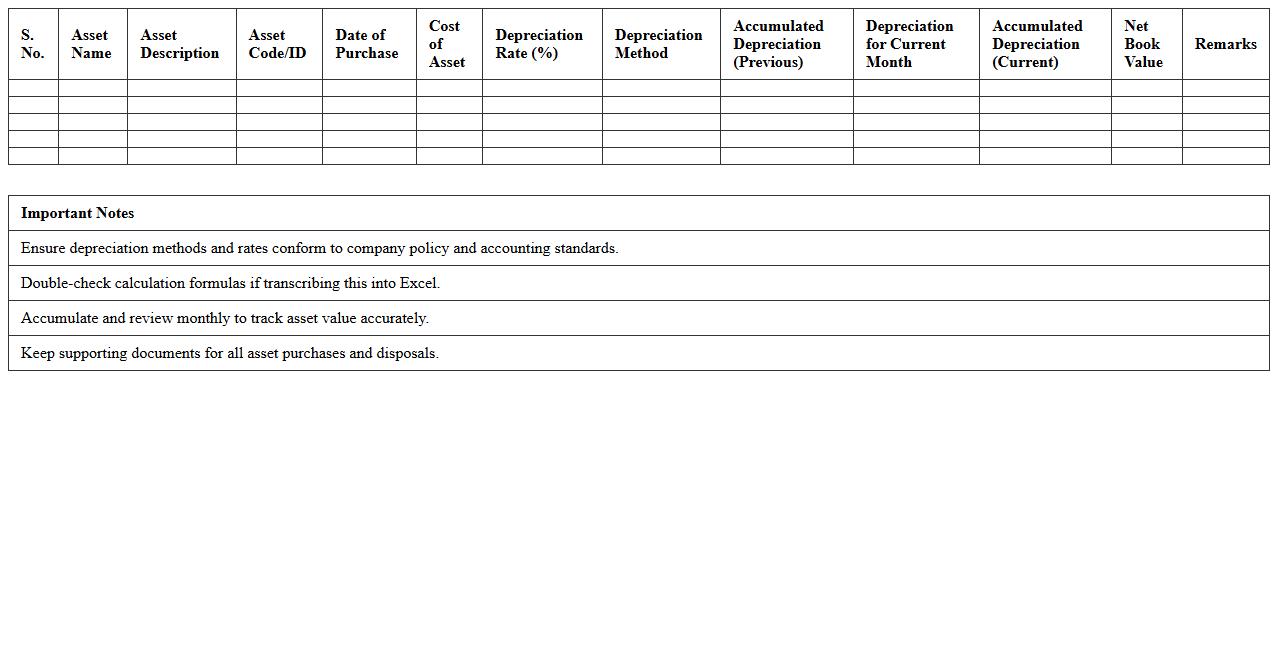

Monthly Depreciation Calculation Register Excel

The

Monthly Depreciation Calculation Register Excel document systematically records and calculates the depreciation of assets on a monthly basis, ensuring accurate tracking of asset value reductions over time. This tool automates complex depreciation schedules, facilitating compliance with accounting standards and aiding in precise financial reporting. It enhances asset management by providing clear insights into asset lifecycles and supports budgeting by forecasting future depreciation expenses.

Property Plant and Equipment Depreciation Sheet

The

Property Plant and Equipment Depreciation Sheet document is a detailed financial record that tracks the depreciation of a company's tangible fixed assets over time. It helps businesses allocate the cost of assets like machinery, buildings, and vehicles systematically, reflecting their reduced value due to wear and tear or obsolescence. This document is essential for accurate financial reporting, tax calculations, and asset management, ensuring compliance with accounting standards and informed decision-making.

Automated Depreciation Forecast Excel Template

The

Automated Depreciation Forecast Excel Template is a powerful financial tool designed to streamline the calculation and projection of asset depreciation over time. It enables accurate tracking of asset value reductions, helping businesses plan budgets, tax liabilities, and asset replacements with precision. Utilizing this template optimizes financial reporting efficiency and supports informed decision-making by providing clear, data-driven insights into asset depreciation trends.

How to automate fixed asset depreciation schedules using Excel formulas?

Automating fixed asset depreciation schedules in Excel requires setting up formulas that calculate depreciation based on asset cost, useful life, and salvage value. Use functions like SLN for straight-line depreciation or DB for declining balance methods to automate calculations. Integrating dynamic named ranges ensures your schedule updates automatically as new assets are added.

Which Excel functions best track accumulated depreciation for multiple assets?

The SUMIF function is essential for aggregating accumulated depreciation across various assets efficiently. Pair it with VLOOKUP or INDEX-MATCH to retrieve asset-specific data within complex schedules. Utilizing the DSUM function can also aid in database-like calculations to streamline depreciation tracking for multiple entries.

What template optimizes straight-line depreciation in Excel for bulk entries?

A robust template for straight-line depreciation should include columns for asset cost, useful life, salvage value, and annual depreciation automatically calculated by the SLN formula. Incorporate drop-down menus to select asset categories and conditional formatting to highlight anomalies or upcoming asset retirement. Bulk data entry is optimized when formulas are pre-applied, minimizing manual updates.

How to visualize depreciation expense trends with Excel pivot charts?

Excel pivot charts provide quick visualization of depreciation trends by summarizing monthly or yearly expense data across assets. Group data by asset type or department to identify patterns and highlight major depreciation contributors. Applying slicers enhances interactivity, allowing users to filter data dynamically for clearer insights.

How can accountants link depreciation data with GL accounts in Excel?

Accountants can link depreciation data to general ledger (GL) accounts by maintaining a mapping table that associates each asset with its respective GL codes. Using Excel functions like INDEX and MATCH, this connection can be dynamically maintained for automated reporting. Regular reconciliation and validation through pivot tables ensure accuracy between depreciation schedules and GL postings.

More Calculation Excel Templates