The Profit Margin Calculation Excel Template for Small Businesses simplifies financial analysis by providing an easy-to-use tool for tracking revenue and expenses. This template helps entrepreneurs quickly determine their profit margins, enabling better decision-making and improved cash flow management. Its customizable design suits various industries, making it an essential resource for small business owners.

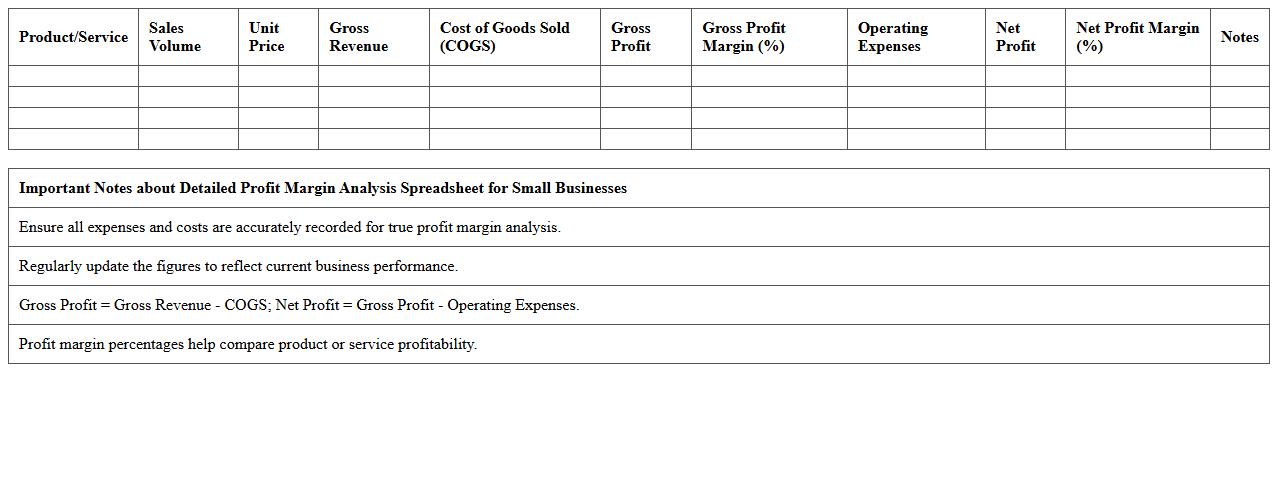

Detailed Profit Margin Analysis Spreadsheet for Small Businesses

A

Detailed Profit Margin Analysis Spreadsheet for small businesses is a comprehensive financial tool designed to track revenues, costs, and expenses with precision to calculate gross, operating, and net profit margins. It enables businesses to identify profitable product lines, control costs, and improve pricing strategies based on accurate margin data. This spreadsheet supports informed decision-making, helping small businesses enhance profitability and achieve sustainable growth.

Small Business Gross Profit Margin Tracker Excel

The

Small Business Gross Profit Margin Tracker Excel document is a financial tool designed to calculate and monitor the gross profit margin of a business, highlighting the difference between revenue and the cost of goods sold. This tracker helps businesses identify profitability trends, manage production costs, and make informed decisions to improve overall financial health. By providing clear insights into profit margins, it supports strategic planning and enhances budget control for small business owners.

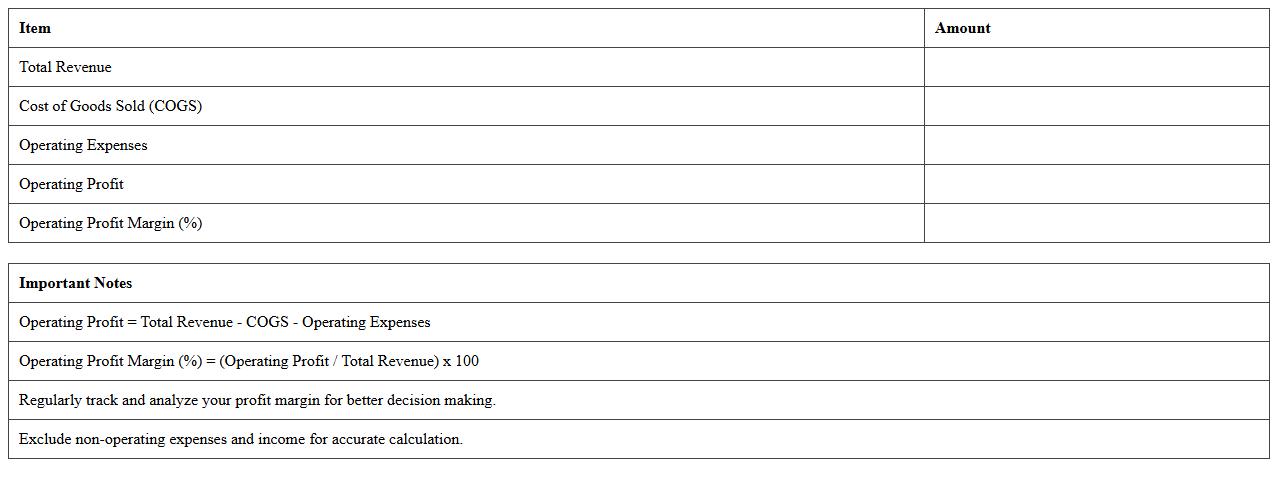

Operating Profit Margin Calculator for Small Companies

An

Operating Profit Margin Calculator for small companies is a financial tool used to measure the efficiency and profitability of a business by calculating the ratio of operating profit to net sales. This document helps small business owners and managers analyze operational performance, identify cost management opportunities, and make informed decisions to improve profit margins. It is essential for maintaining financial health, optimizing expenses, and planning sustainable growth strategies.

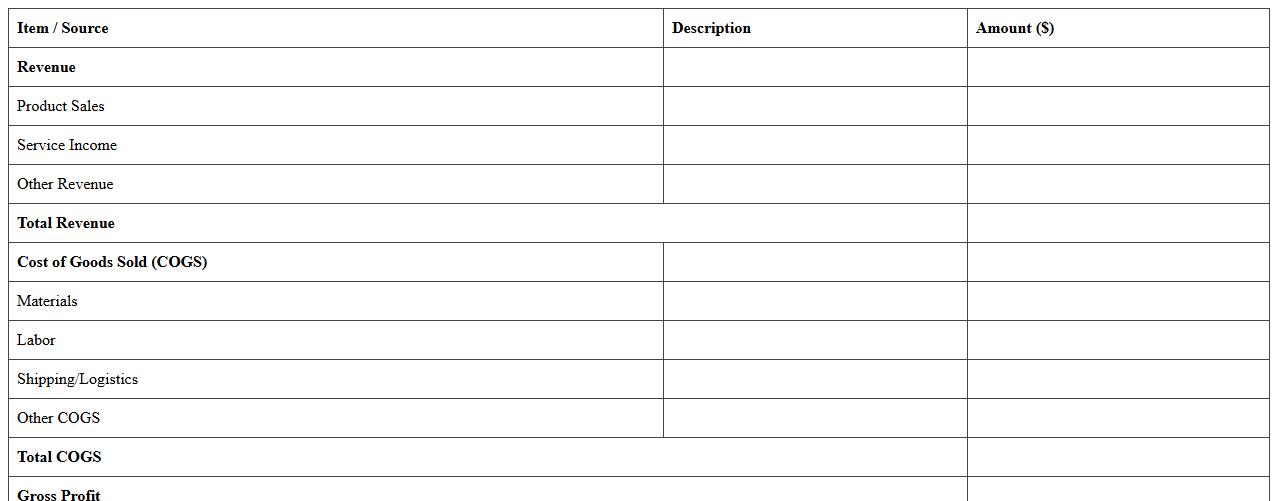

Simple Profit Margin Breakdown Template for Startups

The

Simple Profit Margin Breakdown Template for startups is a structured financial tool that helps new businesses analyze their profitability by itemizing revenue, costs, and gross profit margins clearly. This document enables startups to identify key expense areas and optimize pricing strategies, facilitating better financial decision-making and sustainable growth. By using this template, entrepreneurs can streamline financial planning, track performance metrics efficiently, and communicate profitability insights to stakeholders with clarity.

Revenue and Profit Margin Monitoring Excel Sheet

A

Revenue and Profit Margin Monitoring Excel Sheet document is a financial tracking tool designed to systematically record, calculate, and analyze income and profitability metrics. It helps businesses visualize trends, identify cost-saving opportunities, and ensure sustainable growth by providing clear insights into revenue streams and profit margins. Using this document enables informed decision-making and supports effective budgeting and financial planning.

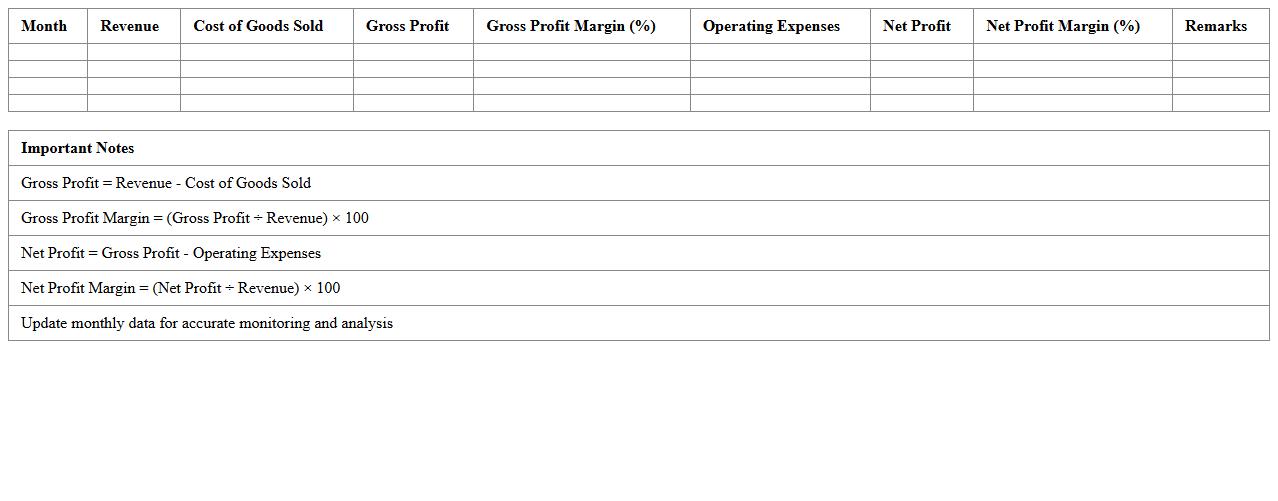

Small Business Monthly Profit Margin Tracker

The

Small Business Monthly Profit Margin Tracker document is a financial tool designed to monitor and analyze the profitability of a business on a monthly basis. It helps entrepreneurs identify trends in revenue, costs, and expenses, enabling informed decisions to maximize profits. By regularly tracking profit margins, businesses can improve budgeting, manage cash flow effectively, and enhance overall financial performance.

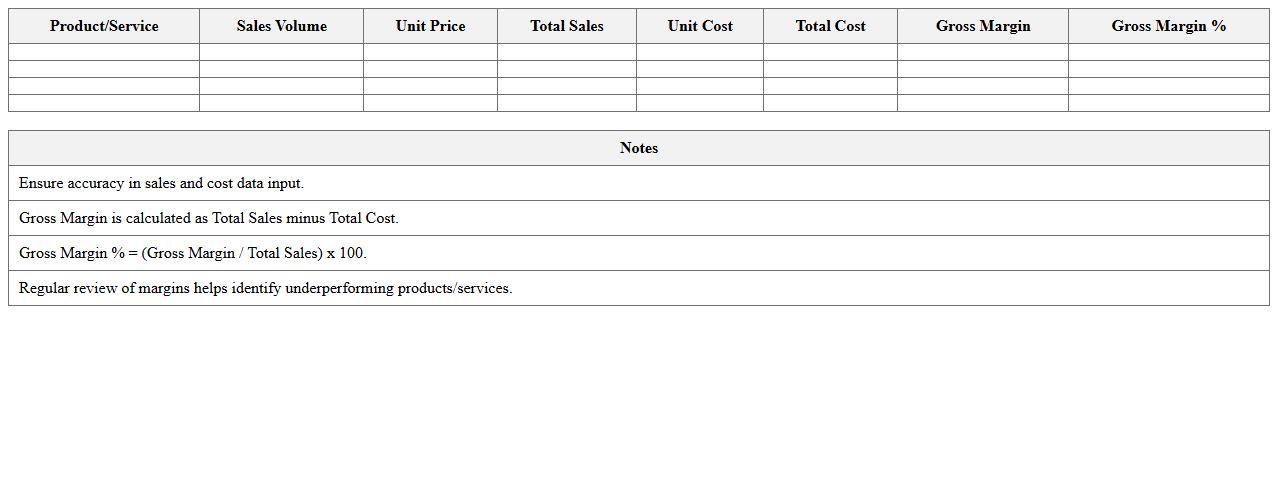

Sales and Cost Margin Analysis Excel Template

The

Sales and Cost Margin Analysis Excel Template is a powerful tool designed to track and evaluate sales performance alongside associated costs, enabling businesses to calculate profit margins effectively. It provides detailed insights into revenue streams, cost structures, and profitability ratios, assisting decision-makers in identifying areas for improvement and optimizing resource allocation. By organizing data systematically, this template enhances financial analysis accuracy, supports strategic planning, and drives informed business growth.

Easy Profit Margin Statement for Entrepreneurs

The

Easy Profit Margin Statement for Entrepreneurs is a financial document that simplifies the calculation of profit margins by clearly outlining revenues, costs, and expenses. This statement helps entrepreneurs quickly assess business profitability, allowing for informed decision-making and efficient resource allocation. By providing a straightforward view of profit margins, it aids in identifying areas to improve cost management and maximize earnings.

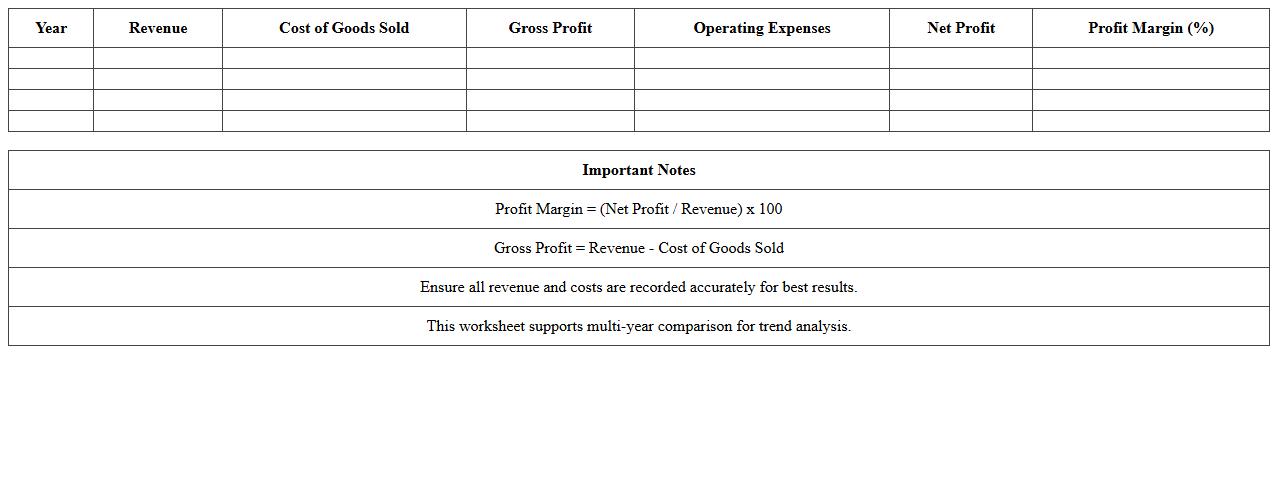

Yearly Profit Margin Comparison Excel Worksheet

The

Yearly Profit Margin Comparison Excel Worksheet document is a comprehensive tool designed to track and analyze profit margins across different fiscal years, providing clear visualizations and comparative metrics. It enables businesses to identify trends, assess financial health, and make data-driven decisions by comparing profitability over time. This worksheet is essential for budgeting, forecasting, and strategic planning to enhance overall financial performance.

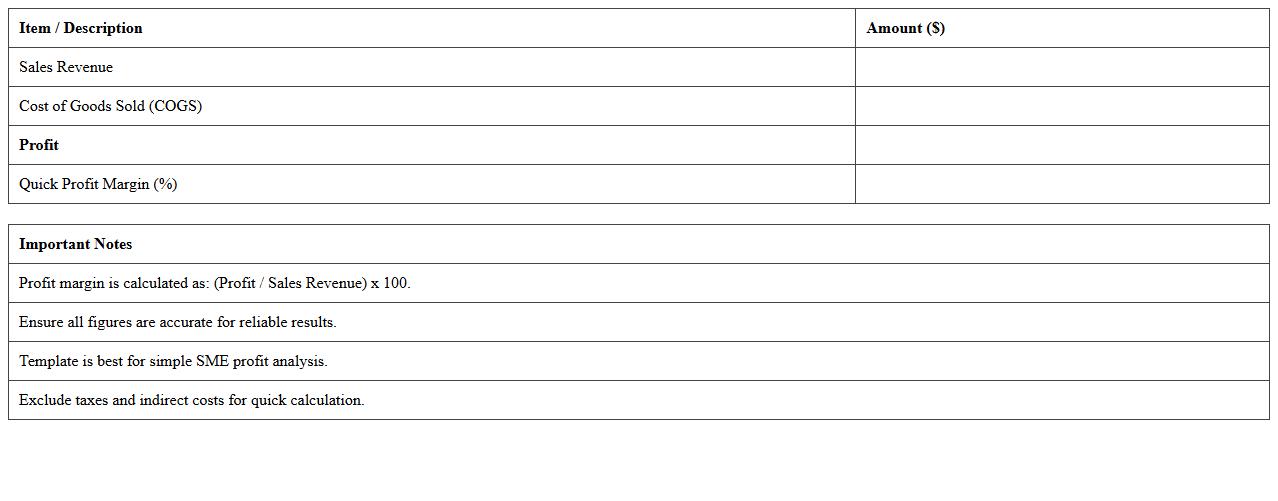

Quick Profit Margin Percentage Calculator for SMEs

The

Quick Profit Margin Percentage Calculator for SMEs is a practical tool designed to rapidly determine the profitability of a business by calculating the profit margin percentage from revenue and cost data. It helps small and medium-sized enterprises evaluate financial performance, optimize pricing strategies, and make informed decisions to enhance profitability. This calculator streamlines financial analysis, saving time and improving accuracy in profit margin assessments critical for business growth.

How can I automate profit margin calculations in Excel for recurring transactions?

To automate profit margin calculations in Excel for recurring transactions, use formulas like SUMPRODUCT or structured tables for dynamic data entry. Set up recurring rows with predefined cost and revenue inputs, then calculate margins using =(Revenue-Cost)/Revenue. Linking these calculations to a master sheet ensures automatic updates and efficient tracking.

What advanced Excel formulas help track cost fluctuations impacting profit margins?

Advanced formulas such as OFFSET, INDEX-MATCH, and dynamic array functions enable real-time tracking of cost fluctuations and their impact on profit margins. By referencing historical and current cost data dynamically, these formulas highlight deviations that affect margins. Incorporating conditional formatting alongside formulas improves visibility of critical changes.

Which Excel templates best visualize small business profit margin trends quarterly?

Templates featuring pivot tables and charts, including column and line graphs, excel at visualizing quarterly profit margin trends for small businesses. Look for templates that incorporate slicers for date filtering and comparative analysis between quarters. These visual tools enable easier decision-making by clearly illustrating margin variances over time.

How do I integrate tax adjustments into profit margin spreadsheets for accuracy?

Integrate tax adjustments by adding separate columns for tax rates and tax amounts that automatically calculate tax impacts on profit margins. Use formulas such as =(Revenue-Cost)*(1-TaxRate) to reflect after-tax profitability accurately. Maintaining tax variables in one section ensures quick updates and consistent accuracy across the spreadsheet.

What custom data validation rules prevent profit margin errors in shared Excel files?

Implement custom data validation rules like setting value ranges for costs and revenues, restricting entries to positive numbers to prevent margin calculation errors. Use formulas in validation settings to check logical conditions, for example, ensuring that revenue always exceeds cost. This approach safeguards data integrity in collaborative Excel environments.

More Calculation Excel Templates