The Freelance Income Calculation Excel Template for Gig Workers simplifies tracking earnings and expenses, ensuring accurate financial management. It includes customizable categories for various income sources and project types, streamlining budgeting and tax preparation. This template enhances organization and helps gig workers maximize their financial efficiency.

Monthly Freelance Earnings Tracker Excel Template

The

Monthly Freelance Earnings Tracker Excel Template is a comprehensive tool designed to help freelancers systematically record and analyze their monthly income from various projects. It provides clear visual summaries and detailed breakdowns of earnings, enabling users to monitor financial progress, manage taxes effectively, and make informed decisions about their freelance career. By using this template, freelancers can maintain organized financial records, ensure timely invoicing, and optimize their income streams for better financial planning.

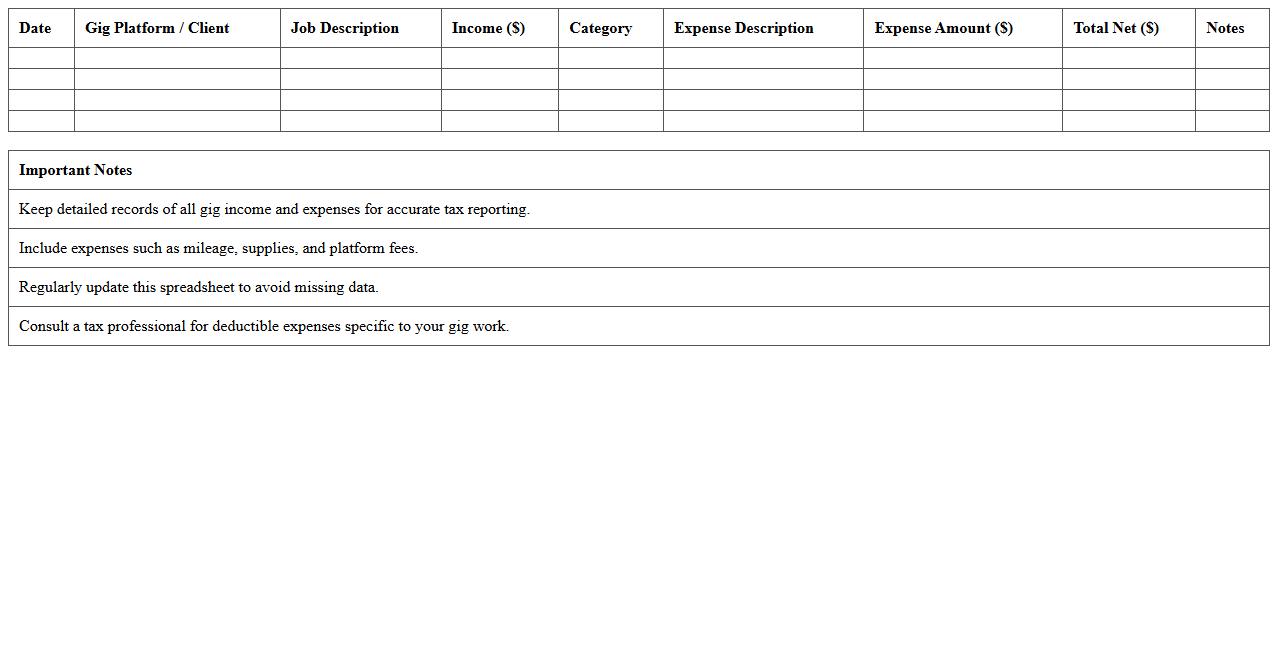

Gig Worker Income and Expenses Spreadsheet

A

Gig Worker Income and Expenses Spreadsheet is a digital tool designed to track earnings and costs associated with freelance or gig economy jobs. This document helps gig workers systematically record payments, deductible expenses, and taxes, ensuring accurate financial management and easier filing during tax season. Maintaining such a spreadsheet enhances budgeting, cash flow monitoring, and overall financial planning for independent contractors.

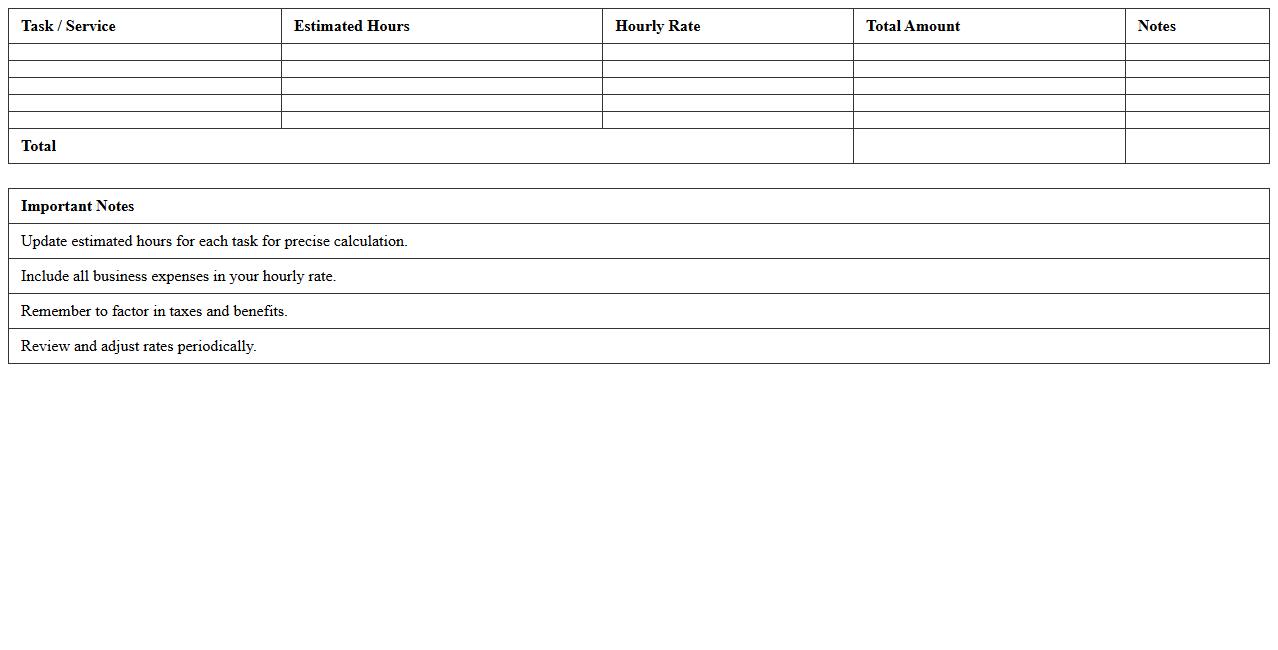

Freelance Hourly Rate Calculator Excel Sheet

The

Freelance Hourly Rate Calculator Excel Sheet is a tool designed to help freelancers accurately determine their hourly rates by factoring in expenses, desired profit, and billable hours. It streamlines financial planning by providing a clear breakdown of costs and income targets, ensuring sustainable and competitive pricing strategies. This document enhances budgeting efficiency and supports informed decision-making for freelance professionals.

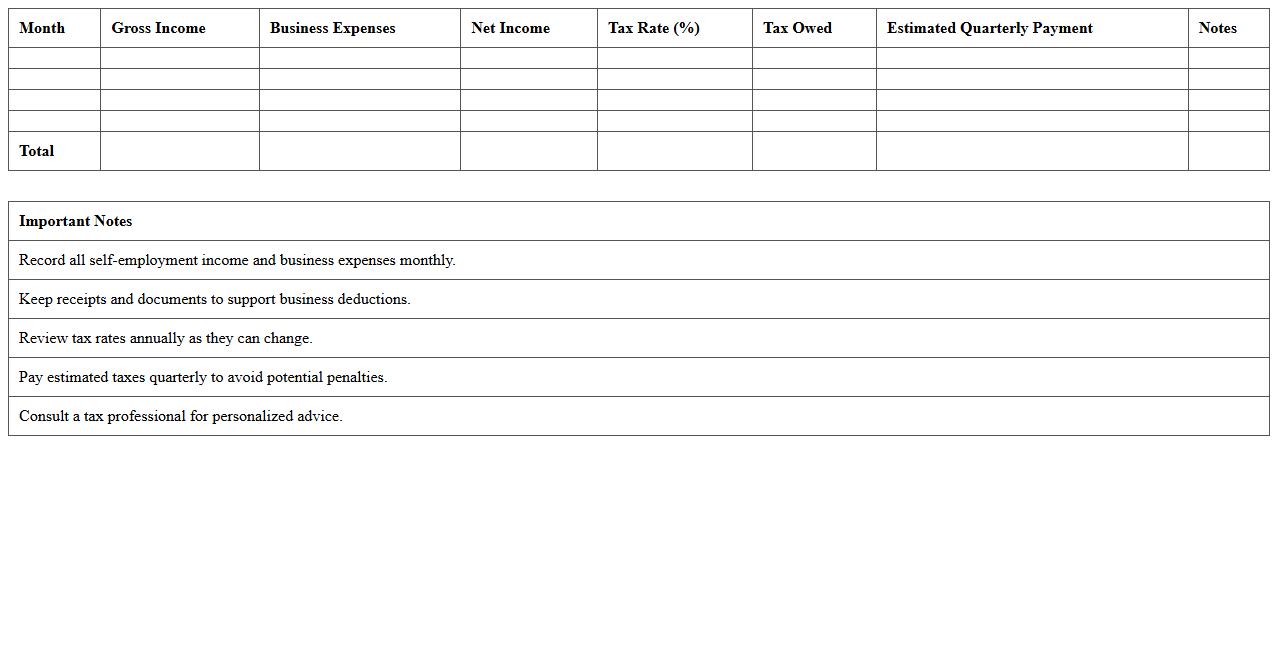

Self-Employed Income & Tax Estimator Template

The

Self-Employed Income & Tax Estimator Template is a practical tool designed to help freelancers, contractors, and entrepreneurs accurately project their income and estimate tax liabilities throughout the fiscal year. By organizing income streams, expenses, and potential deductions, it simplifies complex calculations and provides clearer financial insights. This document aids in effective budgeting, ensures timely tax payments, and helps avoid surprises during tax season.

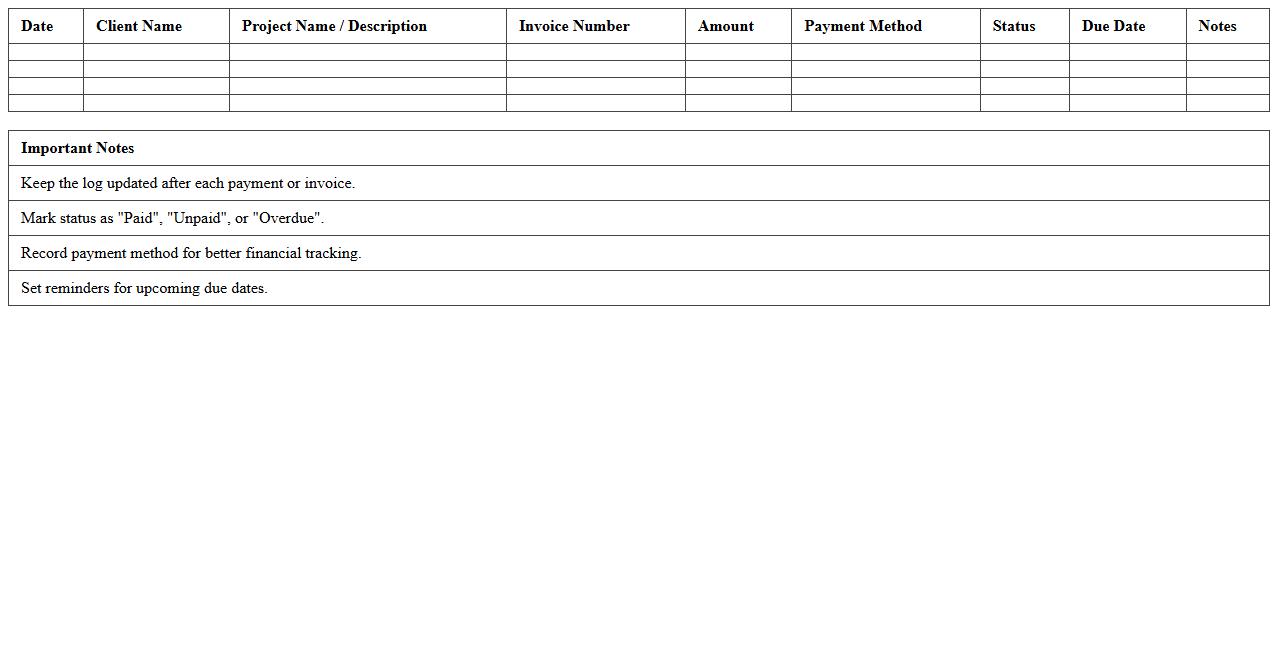

Freelance Projects Payment Log Template

A

Freelance Projects Payment Log Template is a structured document designed to track payments received for freelance work, including details such as project name, client information, payment dates, amounts, and payment methods. It helps freelancers maintain accurate financial records, monitor outstanding invoices, and ensure timely payment collection. Using this template improves financial organization and simplifies tax preparation by providing a clear, consolidated overview of income from various projects.

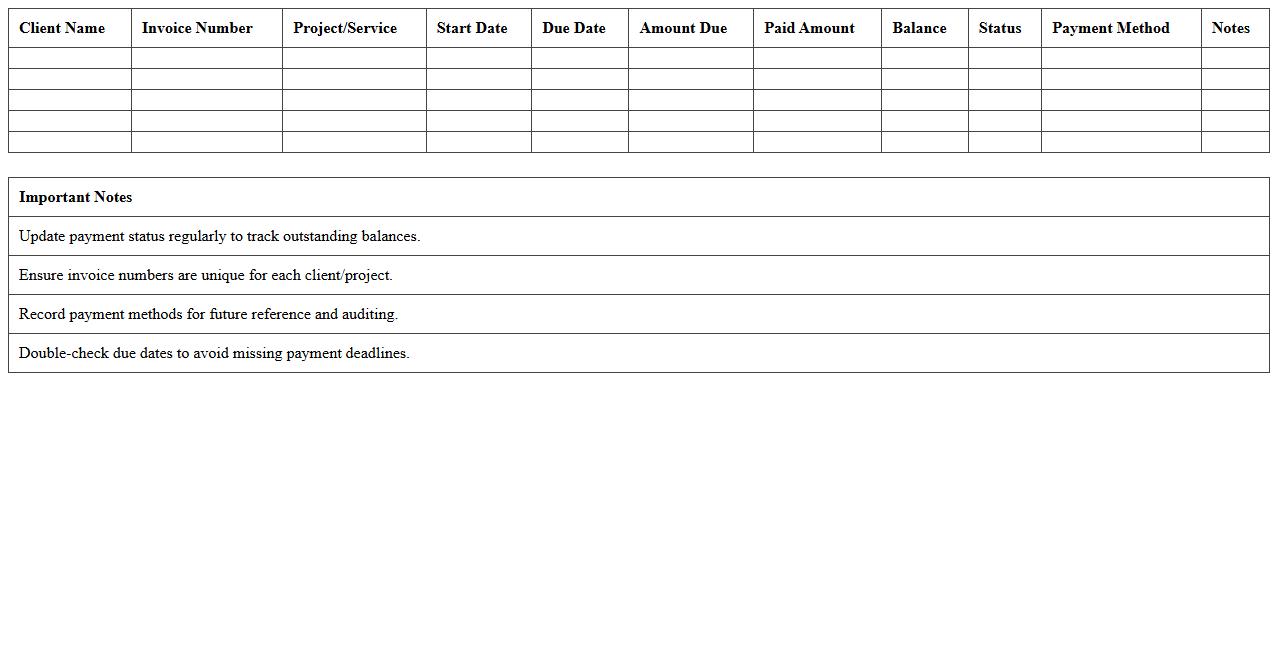

Weekly Invoice Tracker for Gig Workers Excel

The

Weekly Invoice Tracker for Gig Workers Excel document is a powerful tool designed to help freelancers and gig workers organize and monitor their earnings on a weekly basis. It allows users to record invoices, track payment statuses, calculate total income, and manage client details efficiently. This tracker streamlines financial management, ensuring timely payments and accurate income reporting, which is essential for budgeting and tax purposes.

Client Payment Schedule Excel Template

The

Client Payment Schedule Excel Template is a structured document designed to organize and track payment dates, amounts, and statuses for multiple clients efficiently. It helps businesses maintain clear financial records, manage cash flow, and avoid missed or delayed payments by providing a centralized and customizable platform. Using this template enhances accuracy in billing processes and improves client relationship management by ensuring timely and transparent payment tracking.

Freelance Revenue and Profit Tracker Spreadsheet

A

Freelance Revenue and Profit Tracker Spreadsheet is a digital tool designed to help freelancers systematically record and analyze their income and expenses. It enables users to monitor project payments, track business costs, and calculate net profit accurately, promoting better financial management. This spreadsheet enhances decision-making by providing clear insights into cash flow and profitability trends over time.

Project-Based Income Tracker Excel Sheet

The

Project-Based Income Tracker Excel Sheet is a specialized document designed to monitor and organize income generated from various projects accurately. It helps users track payment dates, client details, project costs, and revenue, enabling clear financial oversight. This tool enhances budgeting, forecasting, and ensures timely invoicing, making it invaluable for freelancers, small businesses, and project managers.

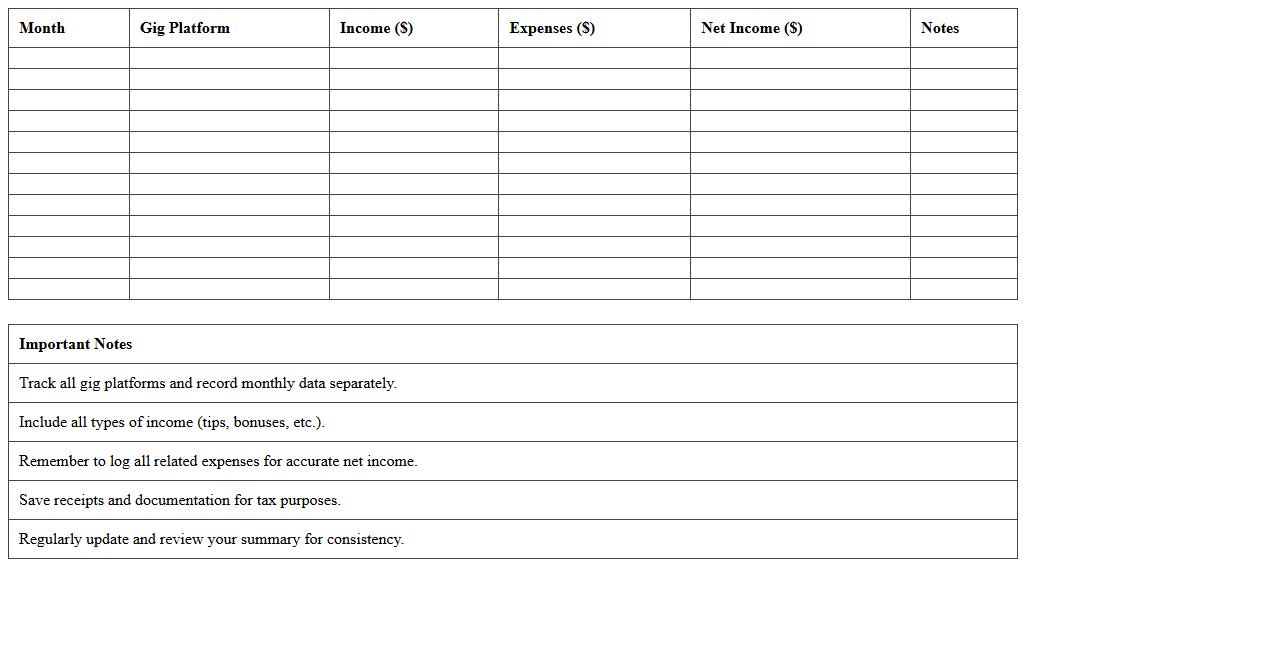

Gig Worker Annual Income Summary Excel Template

The

Gig Worker Annual Income Summary Excel Template is a comprehensive tool designed to track and organize yearly earnings from multiple gig economy jobs in a streamlined format. It simplifies income management by automatically calculating totals, categorizing revenue sources, and providing clear visual summaries to help gig workers monitor financial progress. This template is essential for effective budget planning, tax preparation, and maximizing overall income visibility.

What formulas best automate irregular freelance income tracking in Excel?

To automate irregular freelance income tracking in Excel, use the SUMIF function to total earnings based on date or category. The IFERROR formula helps manage data entry errors ensuring smooth calculations. Combining these with dynamic tables and conditional formatting enhances data accuracy and visibility.

How to categorize multiple gig income streams for efficient tax reporting?

Efficient tax reporting requires clear categorization of gig income by creating distinct columns for each income source. Use data validation dropdowns to standardize categories and avoid inconsistent entries. PivotTables can then summarize income by category, simplifying tax preparation and analysis.

Which Excel templates work for tracking project-based versus hourly earnings?

Project-based earnings templates focus on fixed payments with columns for project name, payment amount, and due date. Hourly earnings templates require fields for hours worked, hourly rate, and total pay calculated by multiplying hours and rate. Both templates benefit from built-in formulas to automate calculations and generate summaries.

How to visualize monthly freelance income fluctuations with Excel charts?

Utilize line charts or bar charts in Excel to effectively visualize monthly income fluctuations over time. Organize your data chronologically and use dynamic ranges to update charts as new data is added. This visual approach helps identify trends, peaks, and dips in freelance earnings easily.

What are effective Excel methods for calculating tax deductions from gig income?

Calculate tax deductions by creating a separate worksheet listing deductible expenses linked to gig income. Use SUMIF formulas to aggregate expenses by category, ensuring accurate totals for tax reporting. Incorporate percentage formulas to estimate deductible amounts based on specific tax rules or limits.

More Calculation Excel Templates