The VAT Calculation Excel Template for Retail Stores simplifies the process of calculating value-added tax on sales and purchases, ensuring accurate financial records. Designed specifically for retail businesses, it automatically computes VAT amounts based on entered transaction data, reducing errors and saving time. This efficient template supports compliance with tax regulations and enhances overall financial management.

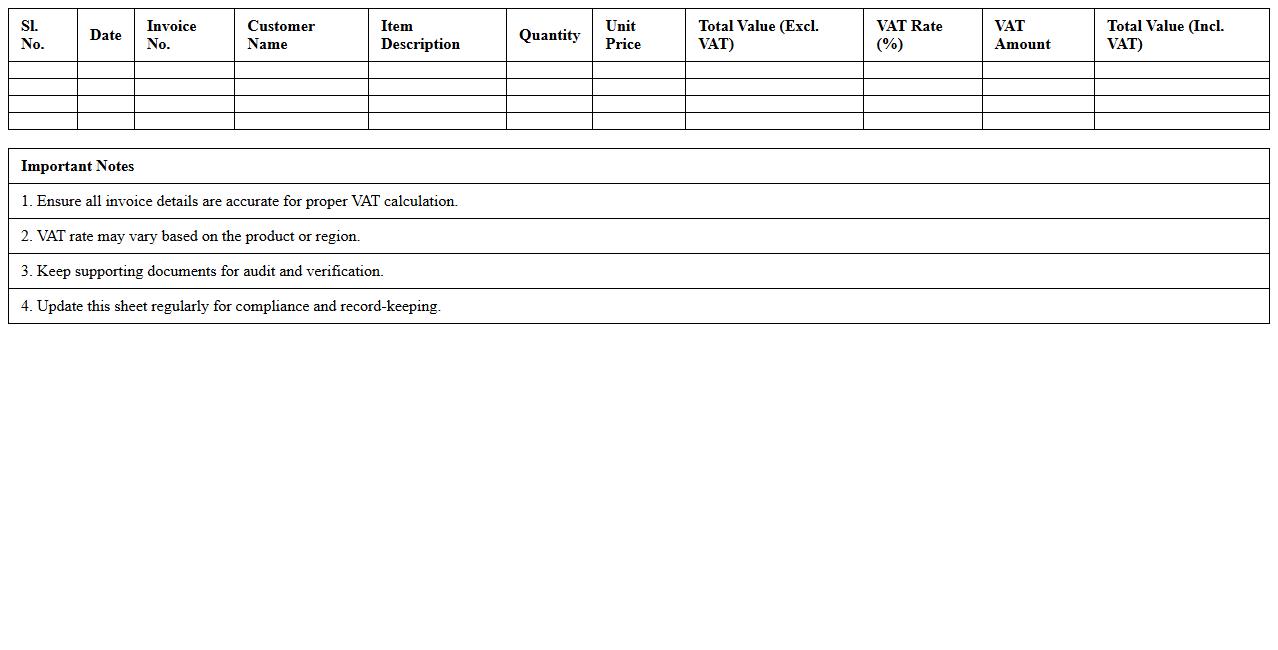

Simple VAT Calculation Sheet for Retail Stores

The

Simple VAT Calculation Sheet for Retail Stores is a practical tool designed to help retail businesses accurately compute their Value Added Tax obligations based on sales and purchase data. It streamlines the process of tracking taxable transactions, ensuring compliance with tax regulations while minimizing errors and saving time. This sheet aids retailers in maintaining clear financial records, facilitating smoother audits and better financial planning.

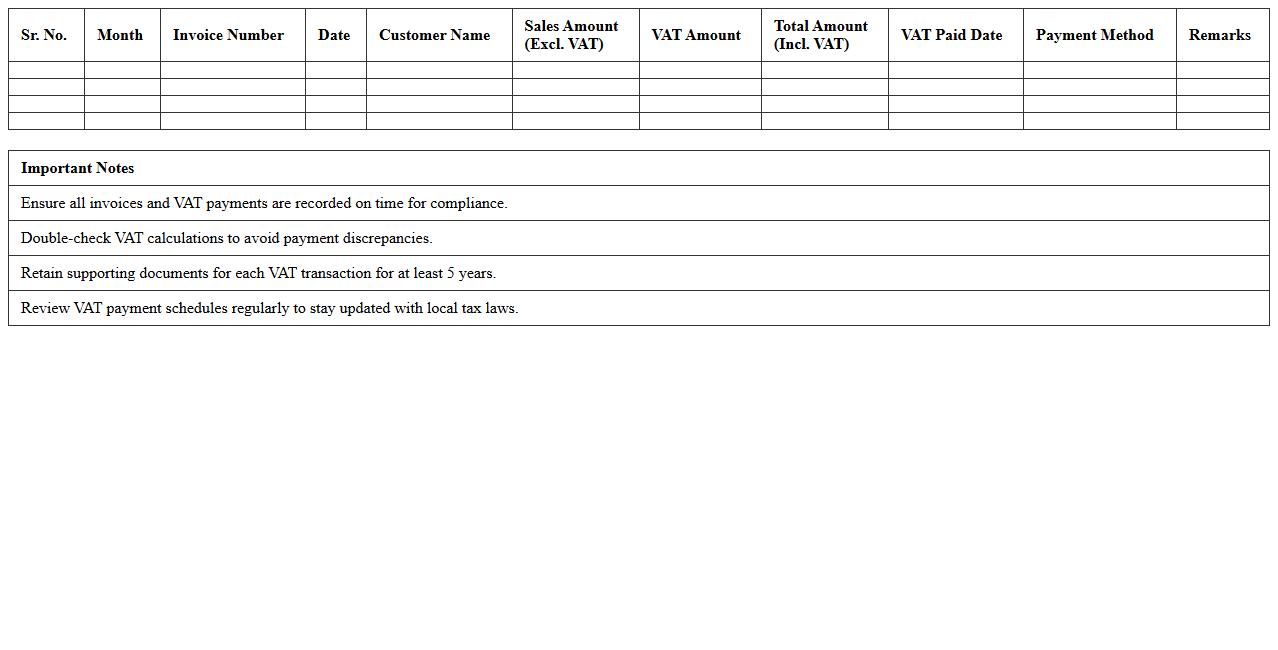

Retail Store VAT Invoice Tracker

A

Retail Store VAT Invoice Tracker is a document designed to systematically record and monitor all VAT invoices generated or received by a retail store, ensuring accurate tax reporting and compliance with legal requirements. This tracker helps businesses maintain organized records, simplifies VAT return preparation, and aids in identifying discrepancies or missing invoices. By using this tool, retailers can streamline tax audits, optimize cash flow management, and reduce the risk of penalties related to VAT filing errors.

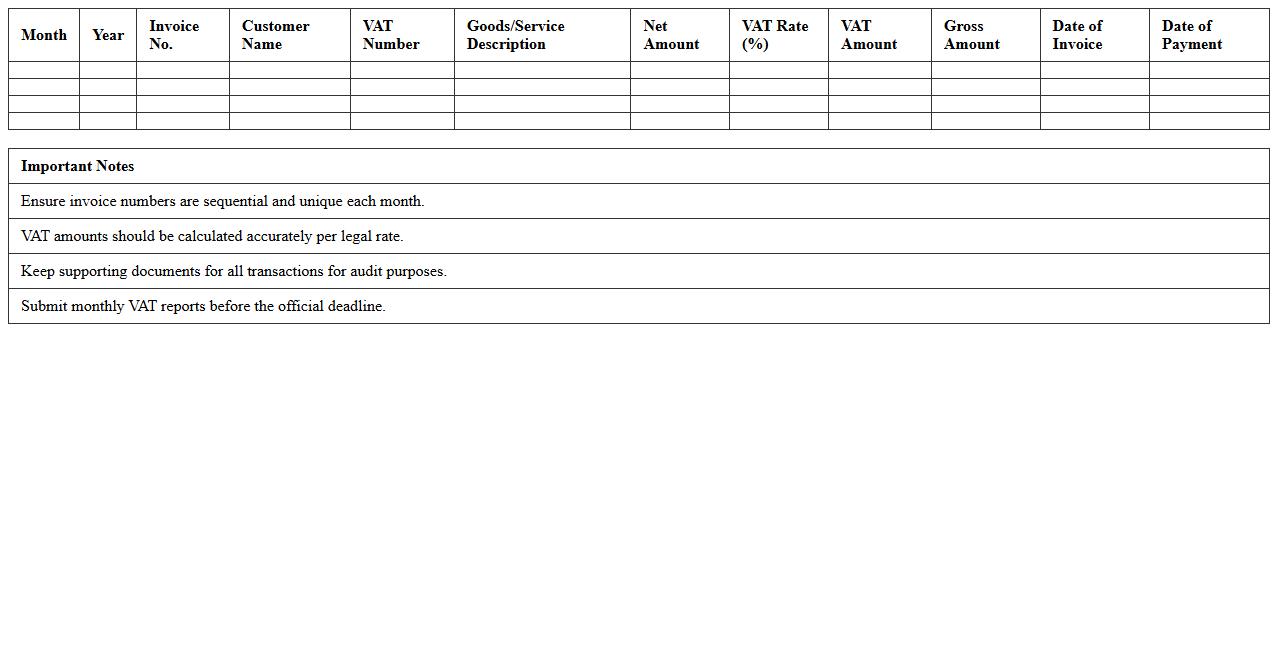

Monthly VAT Reporting Excel Template

The

Monthly VAT Reporting Excel Template document is a structured tool designed to simplify the process of tracking and reporting value-added tax (VAT) liabilities each month. It helps businesses accurately compile taxable sales, purchases, and VAT amounts, ensuring compliance with government tax regulations while minimizing errors. Utilizing this template enhances financial organization, streamlines tax filing, and saves time during VAT return preparation.

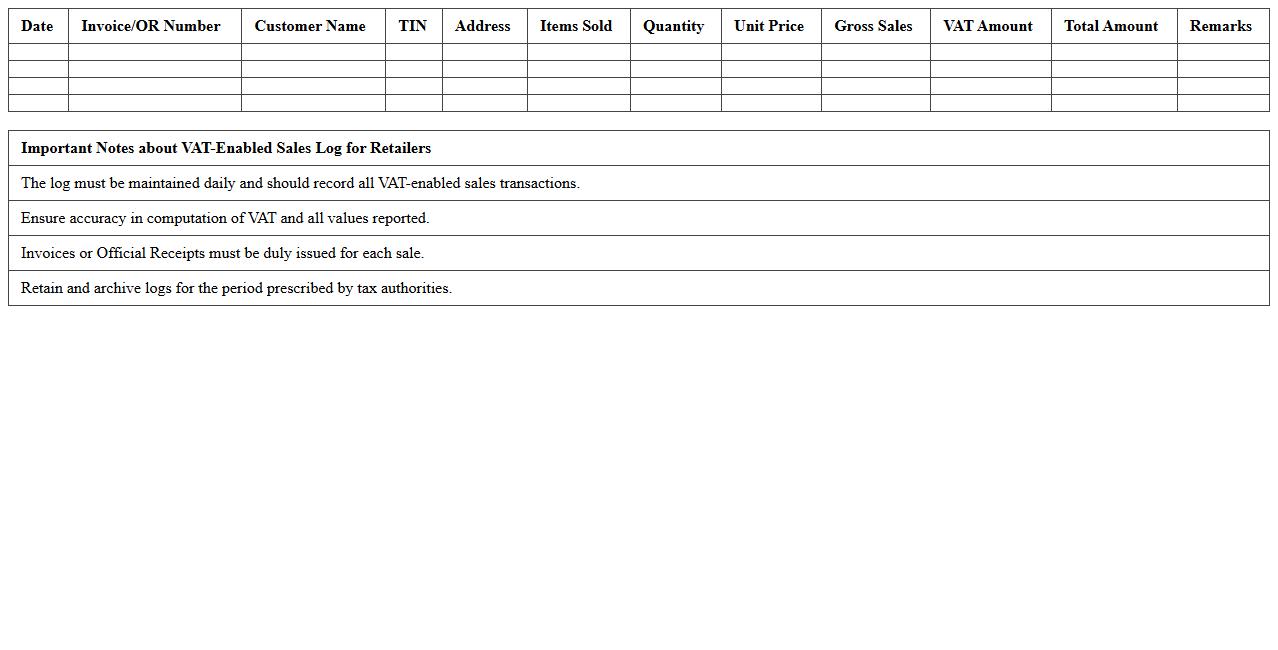

VAT-Enabled Sales Log for Retailers

The

VAT-Enabled Sales Log for Retailers document is a detailed record that tracks all sales transactions subject to Value Added Tax (VAT), ensuring accurate tax compliance and reporting. This log helps retailers maintain transparency in their financial records, simplifies audit processes, and supports timely VAT submissions to tax authorities. By offering clear visibility into taxable sales, it aids in optimizing tax management and reducing the risk of penalties.

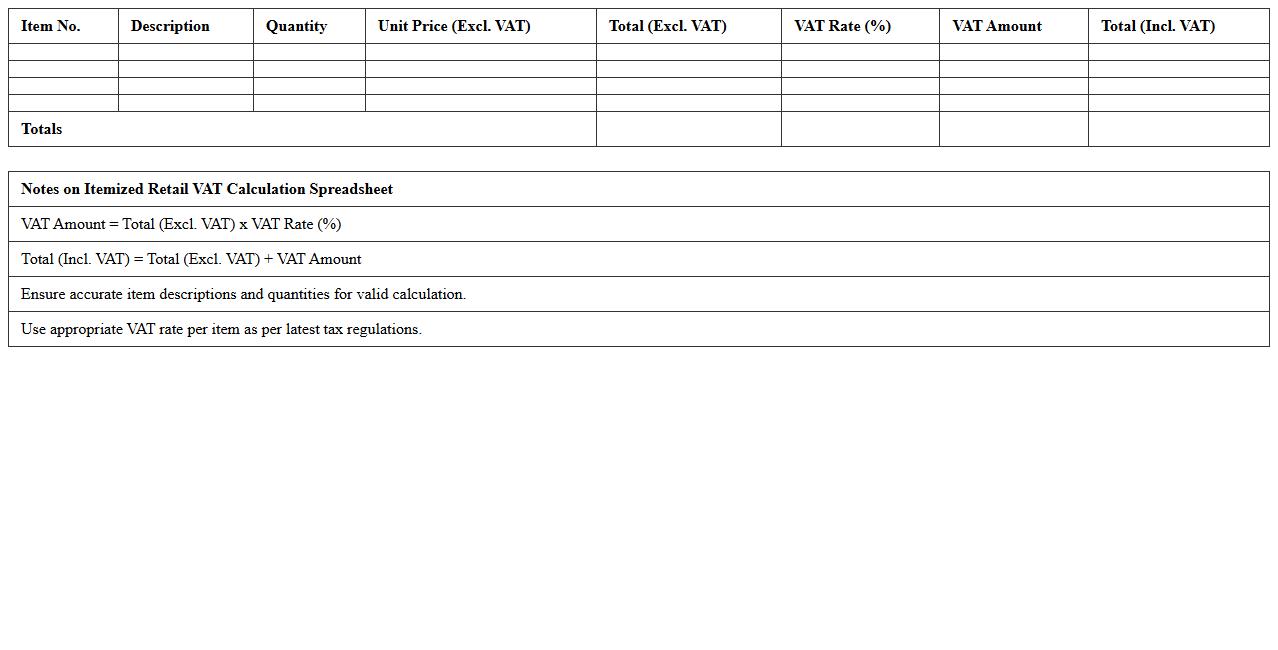

Itemized Retail VAT Calculation Spreadsheet

An

Itemized Retail VAT Calculation Spreadsheet is a detailed financial tool designed to track and calculate Value Added Tax (VAT) on individual retail transactions. It helps businesses ensure accurate tax reporting by breaking down each item's price, VAT amount, and total cost, facilitating compliance with tax regulations. This spreadsheet streamlines VAT management, reduces errors, and improves financial transparency for retailers.

Retail Store VAT Payment Schedule Template

A

Retail Store VAT Payment Schedule Template is a structured document designed to track and manage Value Added Tax (VAT) payments for retail businesses. It helps store owners organize payment dates, amounts due, and compliance deadlines, ensuring timely and accurate VAT submissions to tax authorities. Using this template minimizes errors, streamlines financial record-keeping, and supports efficient cash flow management in retail operations.

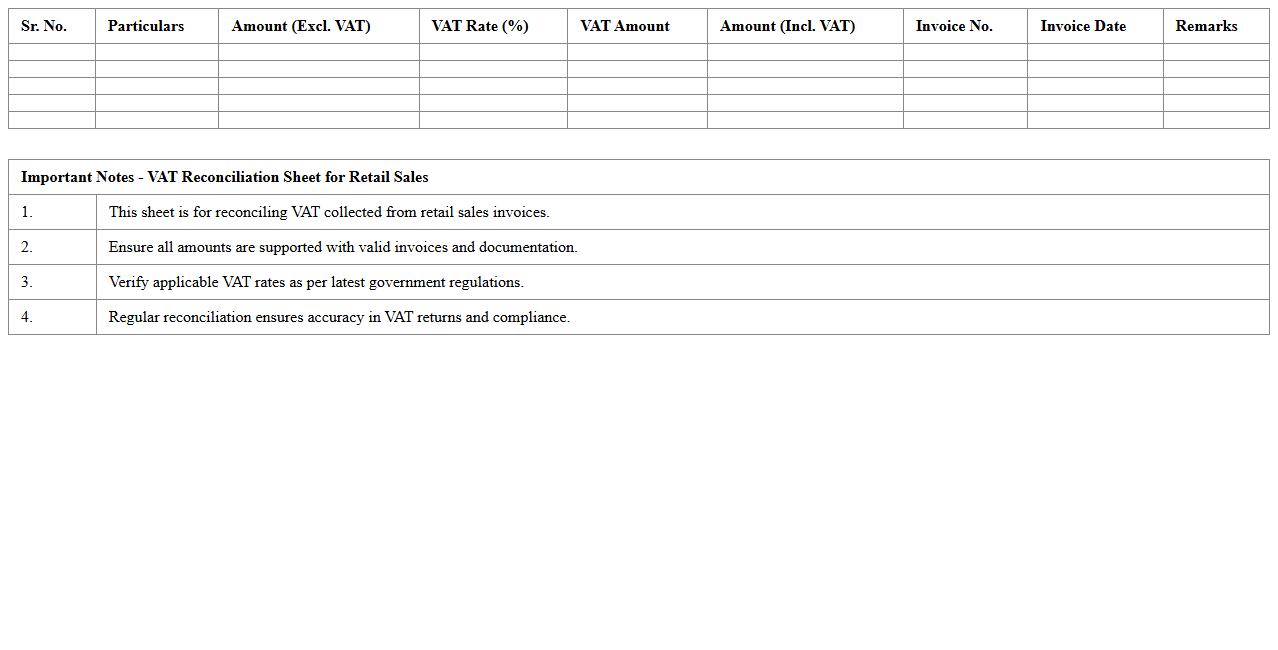

VAT Reconciliation Sheet for Retail Sales

The

VAT Reconciliation Sheet for Retail Sales is a detailed financial document that summarizes the value-added tax collected from sales transactions within a specific period. It helps businesses ensure accuracy by matching VAT reported in sales records with amounts declared to tax authorities, reducing discrepancies and potential penalties. This sheet supports compliance with tax regulations and provides clear insights for auditing and financial reporting.

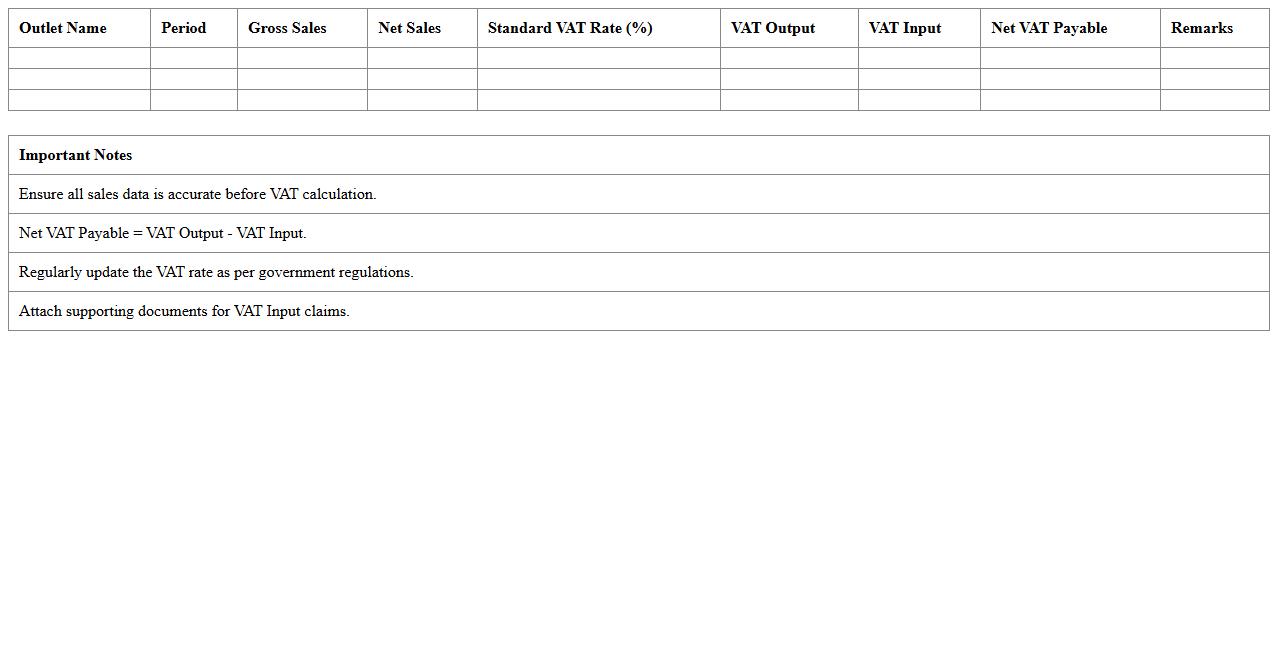

VAT Summary Dashboard for Retail Outlets

The

VAT Summary Dashboard for Retail Outlets is a comprehensive document that consolidates all value-added tax transactions, providing a clear overview of VAT collected and paid across multiple retail locations. It enables businesses to monitor VAT liabilities efficiently, ensuring accurate tax reporting and compliance with government regulations. This dashboard is useful for identifying discrepancies, streamlining tax audit preparation, and optimizing cash flow management through timely VAT data analysis.

Daily Sales and VAT Tracker for Retail Shops

The

Daily Sales and VAT Tracker for Retail Shops document is a comprehensive tool that records daily sales transactions and calculates the applicable Value Added Tax (VAT) for retail businesses. It helps ensure accurate financial reporting, simplifies tax compliance, and enables efficient monitoring of sales performance. By maintaining organized and up-to-date records, retail shops can avoid errors in VAT submissions and make informed business decisions.

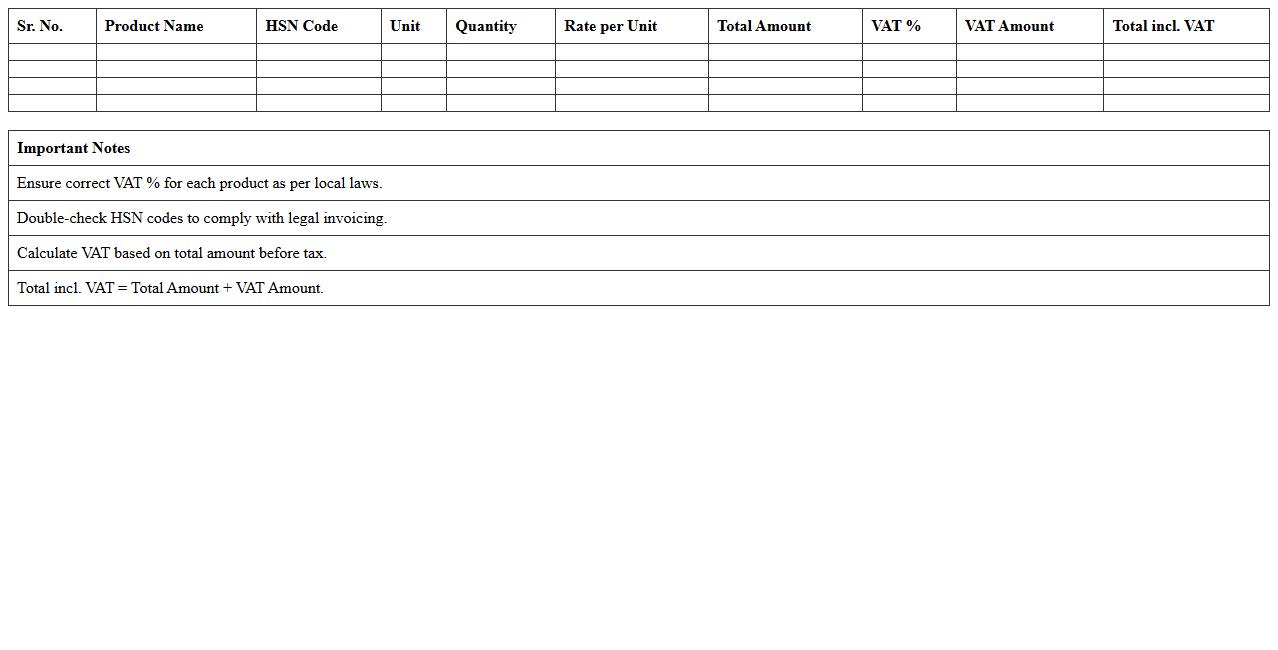

Product-Wise VAT Calculation Excel for Retail

The

Product-Wise VAT Calculation Excel for Retail is a specialized spreadsheet designed to systematically calculate Value Added Tax (VAT) on individual products sold in retail businesses. This tool enables precise tracking and reporting of VAT liabilities per product, streamlining tax compliance and financial analysis. Retailers benefit by ensuring accurate VAT submissions, optimizing tax management, and improving inventory cost assessments.

How to automate VAT calculation formulas in Excel for multi-rate retail products?

To automate VAT calculation for products with multiple rates, use the IF function combined with product category codes to assign the correct VAT rate. Implement a formula like =Price*(IF(Category="Food", 0.05, IF(Category="Clothing", 0.12, 0.20))) to apply variable rates dynamically. This approach ensures precise VAT computation across different product categories in your spreadsheet.

What Excel functions best track VAT exemptions in retail transactions?

Excel functions like COUNTIF and SUMIF efficiently track VAT exemptions by filtering sales marked as exempt. Use SUMIF to total sales under exemption criteria, for example, =SUMIF(ExemptionRange, "Yes", SalesRange). Leveraging these functions enables clear identification and management of VAT-exempt transactions.

How can you design an Excel template to handle VAT returns for small retail chains?

Create a structured template with input sections for sales, VAT collected, and exemptions, incorporating dropdown lists for product categories. Use formulas to automatically calculate VAT payable and summarize totals by period, enhancing accuracy for small retail chains. Incorporate data validation and summary sheets for ease of compiling VAT returns efficiently.

Which pivot table techniques summarize VAT collected from multiple retail outlets?

Use pivot tables to group sales data by outlet and VAT rate, summarizing VAT collected efficiently with aggregation functions like Sum. Set up rows for retail locations and columns for VAT categories to compare values easily. Adding slicers allows dynamic filtering by date or outlet, enhancing data visualization.

How to integrate barcode scanning data with VAT calculation spreadsheets in Excel?

Import barcode scan data into Excel using CSV files or direct input modules, ensuring product codes match with corresponding VAT rates. Use VLOOKUP or INDEX-MATCH functions to link barcode entries to product details and apply the correct VAT formulas automatically. This integration streamlines VAT calculation by reducing manual data entry and errors.

More Calculation Excel Templates