The Retirement Savings Calculation Excel Template for Financial Advisors simplifies complex financial planning by providing customizable tools to project clients' retirement savings accurately. It integrates variables such as contribution rates, investment growth, and inflation adjustments to deliver clear insights for personalized strategies. This template enhances efficiency, allowing financial advisors to focus on tailoring optimal retirement plans.

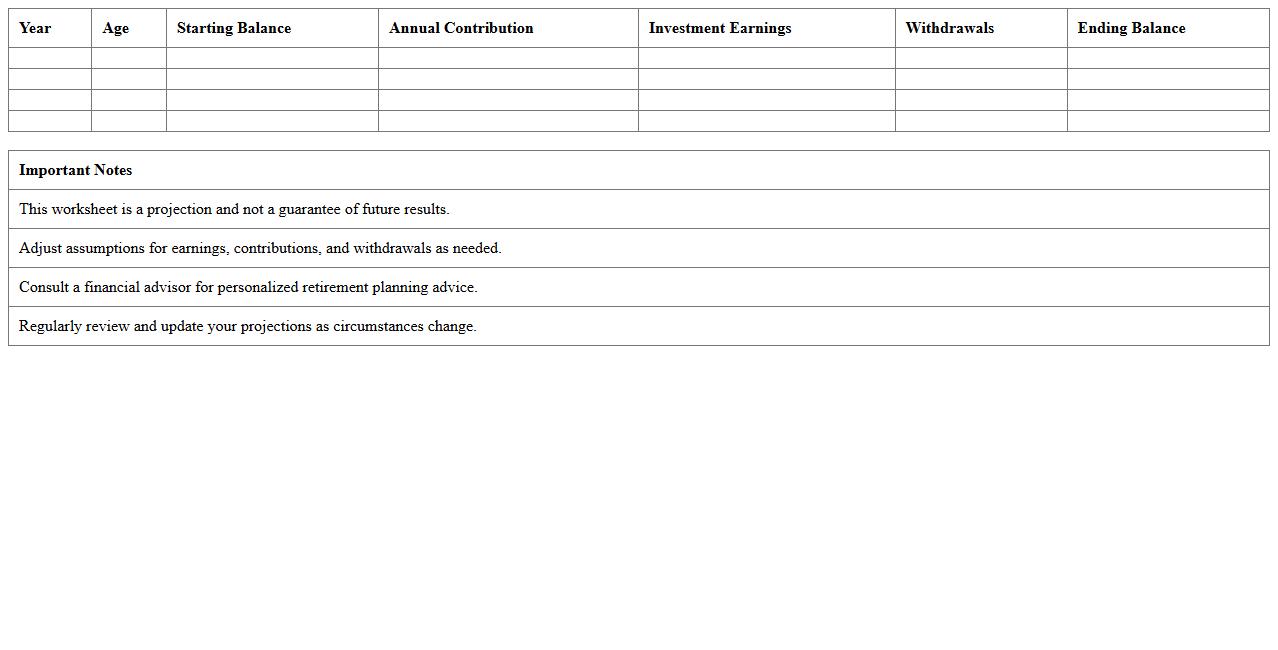

Retirement Income Projection Worksheet Template

The

Retirement Income Projection Worksheet Template is a financial tool designed to estimate future income sources and expenses during retirement, helping individuals plan for a secure financial future. It organizes data such as pensions, Social Security benefits, investments, and expected retirement expenses, providing a clear overview of potential income streams. Using this worksheet, users can identify income gaps, make informed saving decisions, and adjust retirement goals to ensure long-term financial stability.

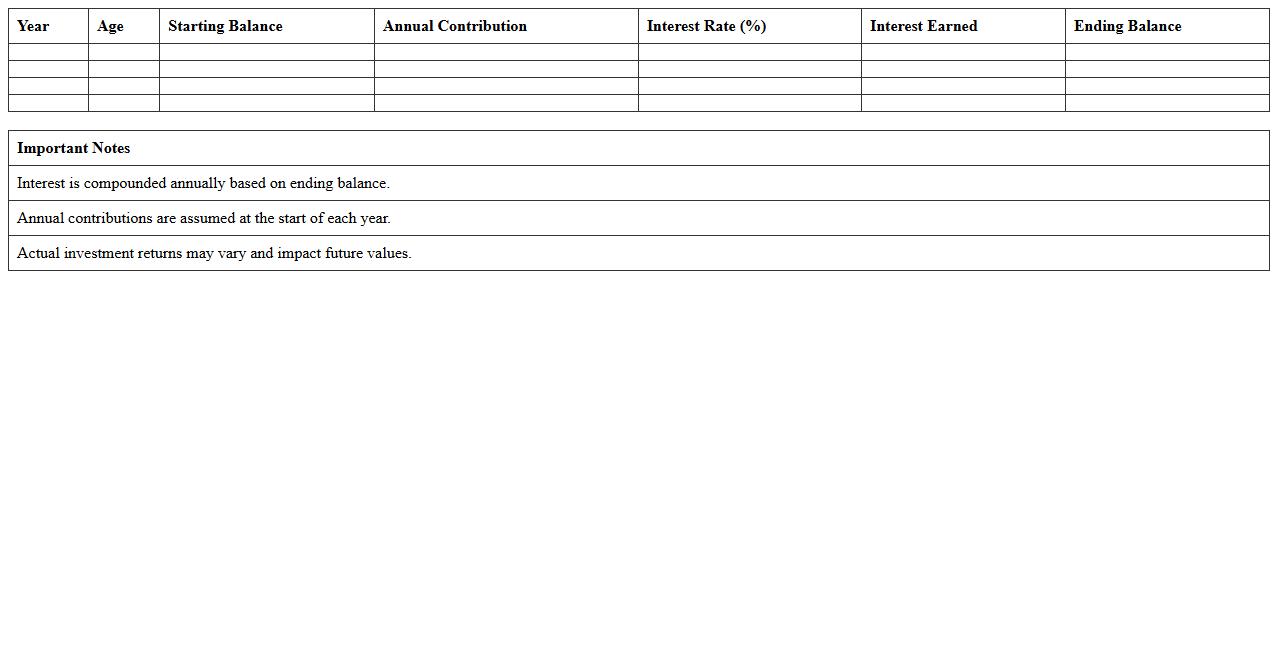

Pension Fund Growth Estimator Spreadsheet

The

Pension Fund Growth Estimator Spreadsheet is a powerful tool designed to project the future value of retirement savings by inputting variables such as initial investment, contribution amounts, and expected rate of return. It enables users to visualize potential growth scenarios, helping in strategic planning for retirement goals. By offering customizable parameters and detailed forecasts, this spreadsheet supports informed decision-making for long-term financial security.

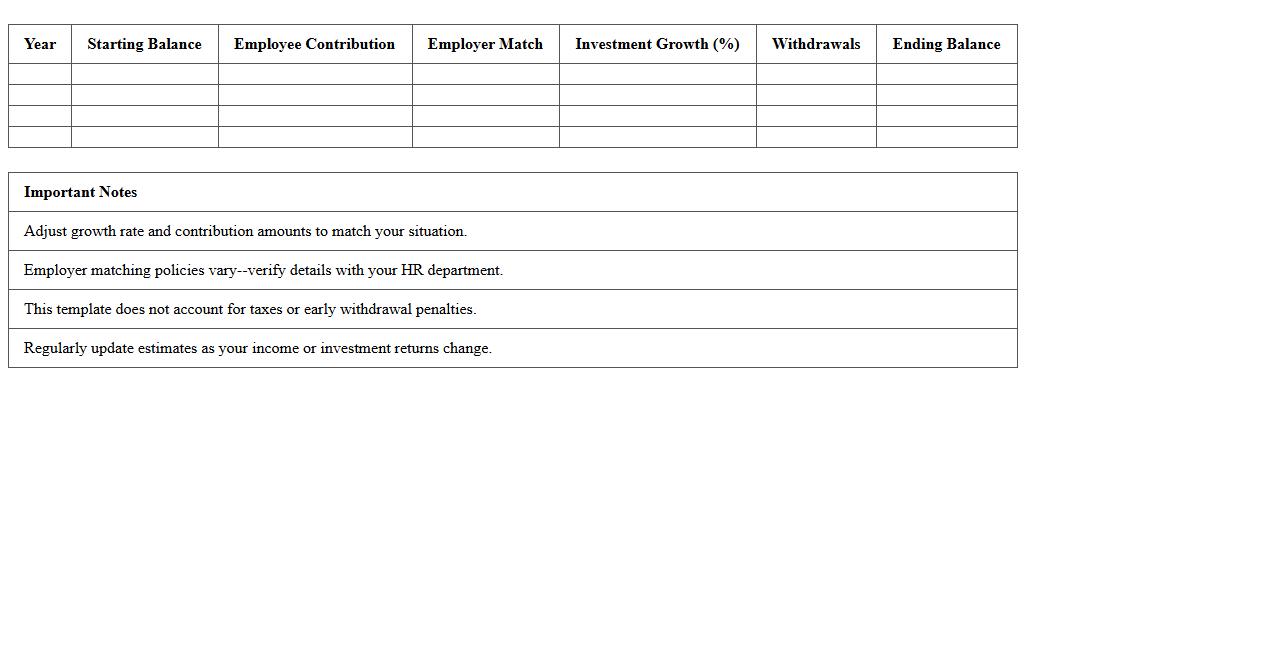

401(k) Balance Forecasting Excel Template

A

401(k) Balance Forecasting Excel Template is a financial planning tool designed to help individuals estimate the future value of their retirement savings based on current contributions, expected returns, and time horizons. This template allows users to input personalized data such as contribution rates, employer matches, and projected interest rates to generate a clear forecast of their retirement account balance. Utilizing this tool aids in making informed decisions about saving strategies, ensuring a more secure and well-planned retirement.

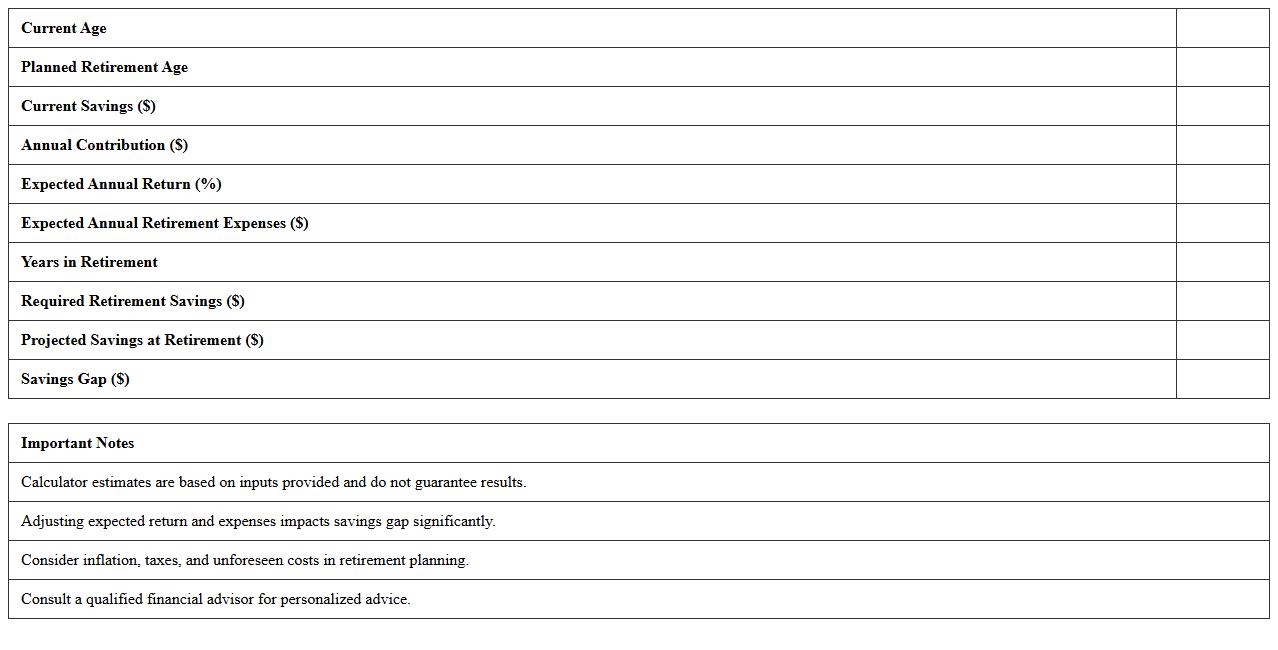

Retirement Age and Savings Gap Calculator

The

Retirement Age and Savings Gap Calculator document is a valuable financial planning tool that estimates the optimal retirement age and identifies any shortfall between current savings and retirement goals. It helps users make informed decisions by projecting future income needs against existing assets and contributions. This calculator is essential for creating a realistic roadmap to financial security in retirement.

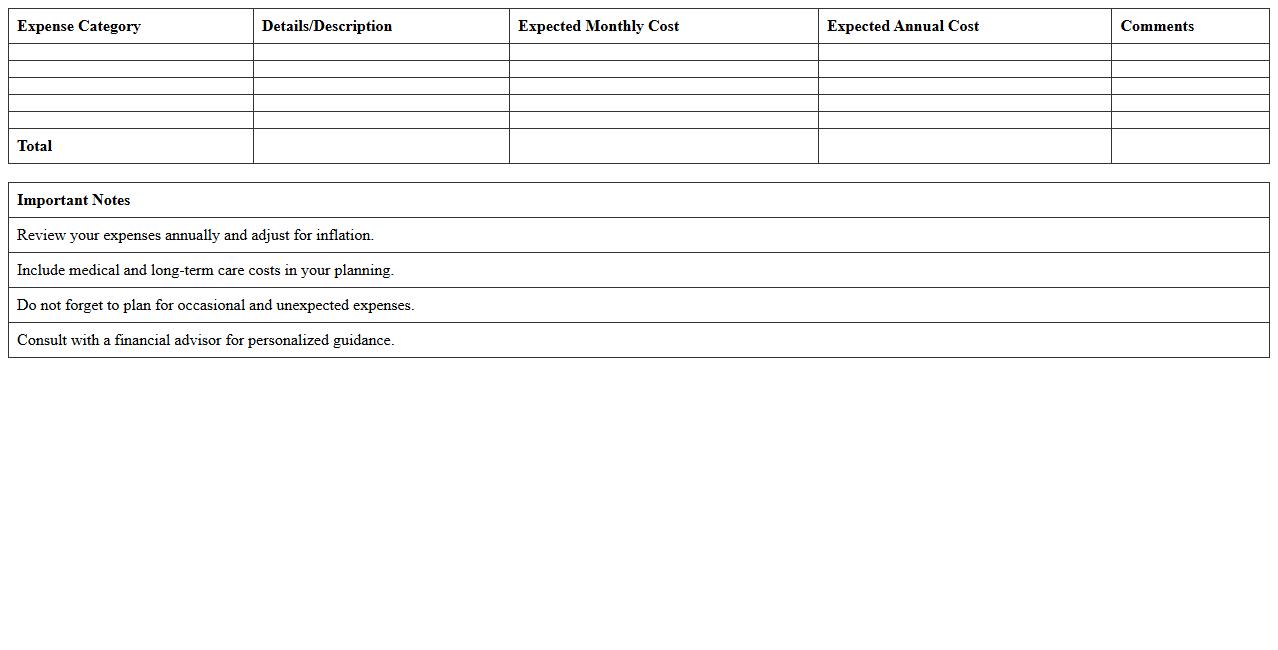

Post-Retirement Expense Planning Sheet

A

Post-Retirement Expense Planning Sheet is a financial tool designed to help individuals estimate and organize their expenses after retirement, ensuring a clear understanding of future financial needs. By detailing expected costs such as healthcare, housing, and daily living, it enables retirees to create a realistic budget and avoid financial shortfalls. This document is useful for maintaining financial stability and making informed decisions about savings, investments, and lifestyle adjustments during retirement.

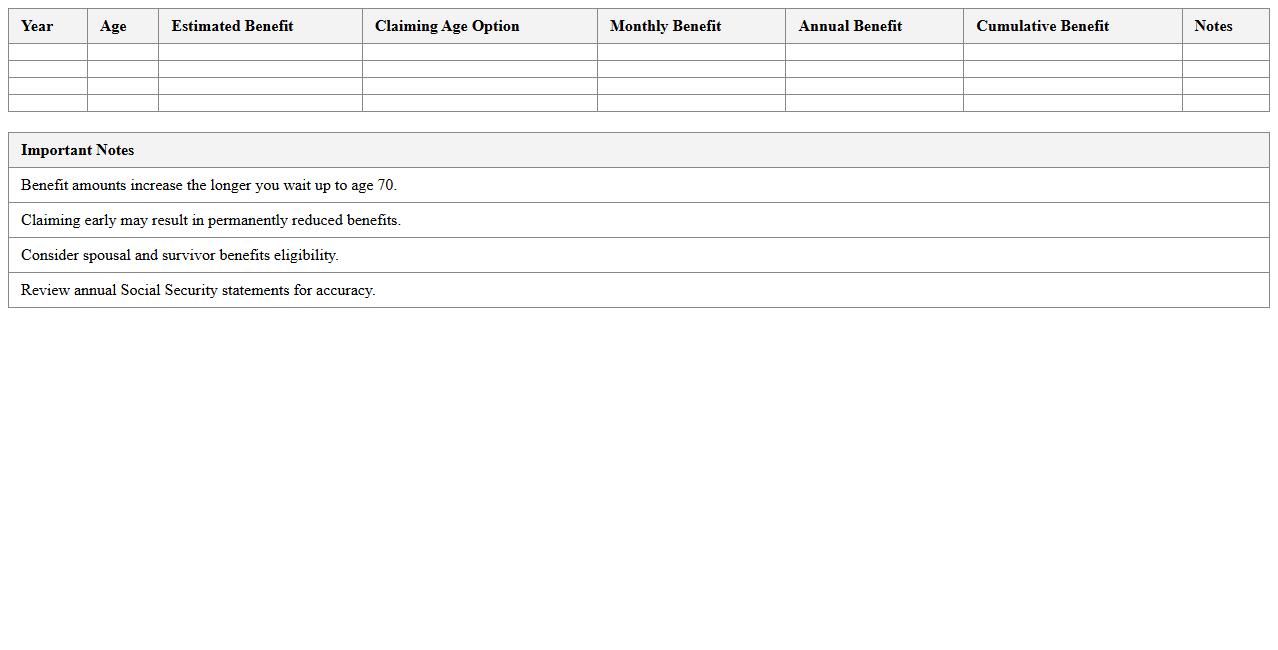

Social Security Benefit Planning Excel

The

Social Security Benefit Planning Excel document is a powerful tool designed to help individuals analyze and optimize their Social Security retirement benefits based on various claiming strategies. It allows users to input personal data such as birth dates, earnings history, and anticipated retirement ages, enabling precise calculations of monthly and lifetime benefits. By visualizing different scenarios, this document aids in maximizing Social Security income and making informed financial decisions for retirement planning.

IRA Contribution Tracker Spreadsheet

The

IRA Contribution Tracker Spreadsheet is a digital tool designed to monitor and record individual retirement account contributions, ensuring compliance with annual limits set by the IRS. This spreadsheet helps users efficiently track their deposits, avoid excess contributions, and optimize their retirement savings strategy. By maintaining accurate records, individuals can maximize tax benefits while planning for future financial security.

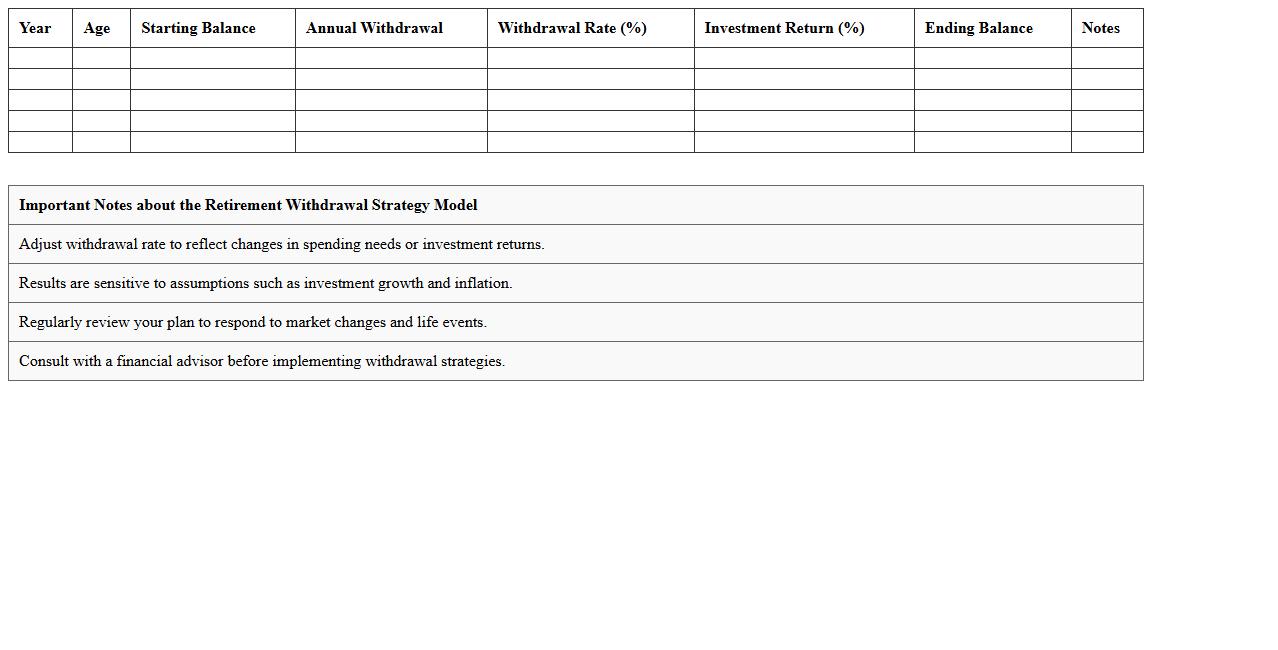

Retirement Withdrawal Strategy Model

The

Retirement Withdrawal Strategy Model document outlines systematic approaches to efficiently manage retirement savings by determining optimal withdrawal rates and timing. It helps retirees minimize the risk of depleting their funds prematurely while maintaining a sustainable income stream throughout retirement. This model is useful for creating personalized financial plans that adjust withdrawals based on market performance, inflation, and lifespan projections.

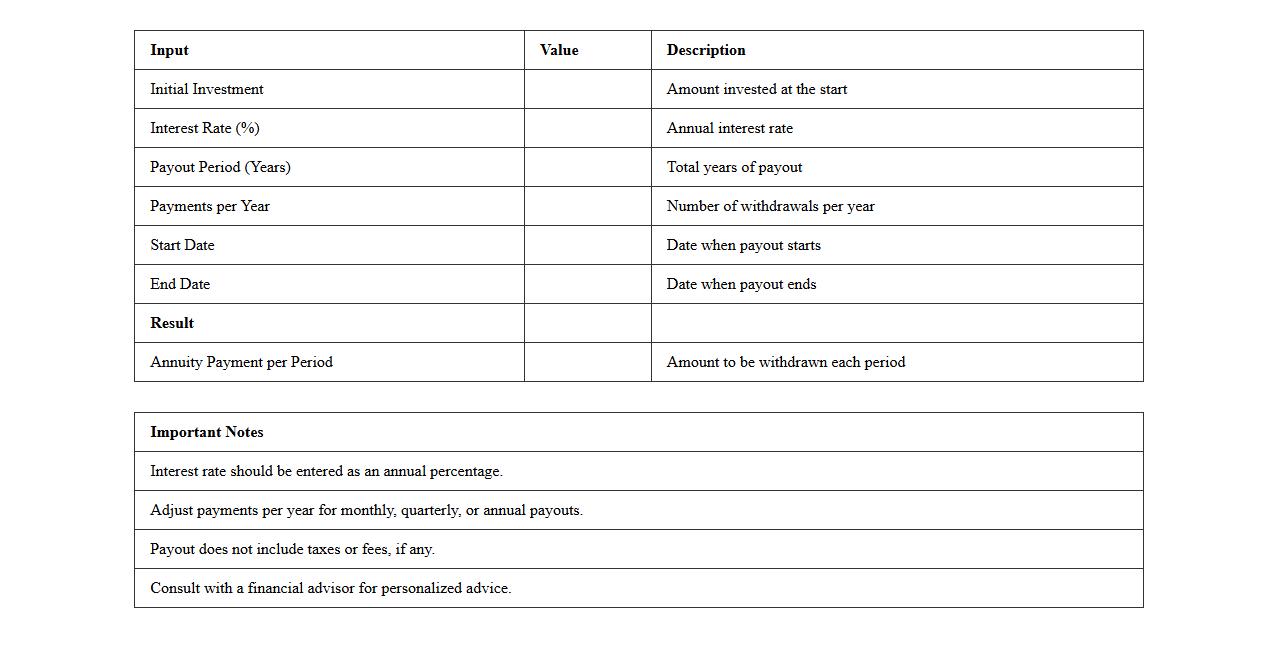

Annuity Payout Calculator Template

An

Annuity Payout Calculator Template document is a structured tool designed to estimate periodic payments from an annuity based on variables such as principal amount, interest rate, and payout duration. This template helps individuals and financial planners project accurate income streams from retirement funds, ensuring better financial planning and decision-making. Utilizing this document streamlines complex calculations and provides clear, customizable results for tailored annuity payout scenarios.

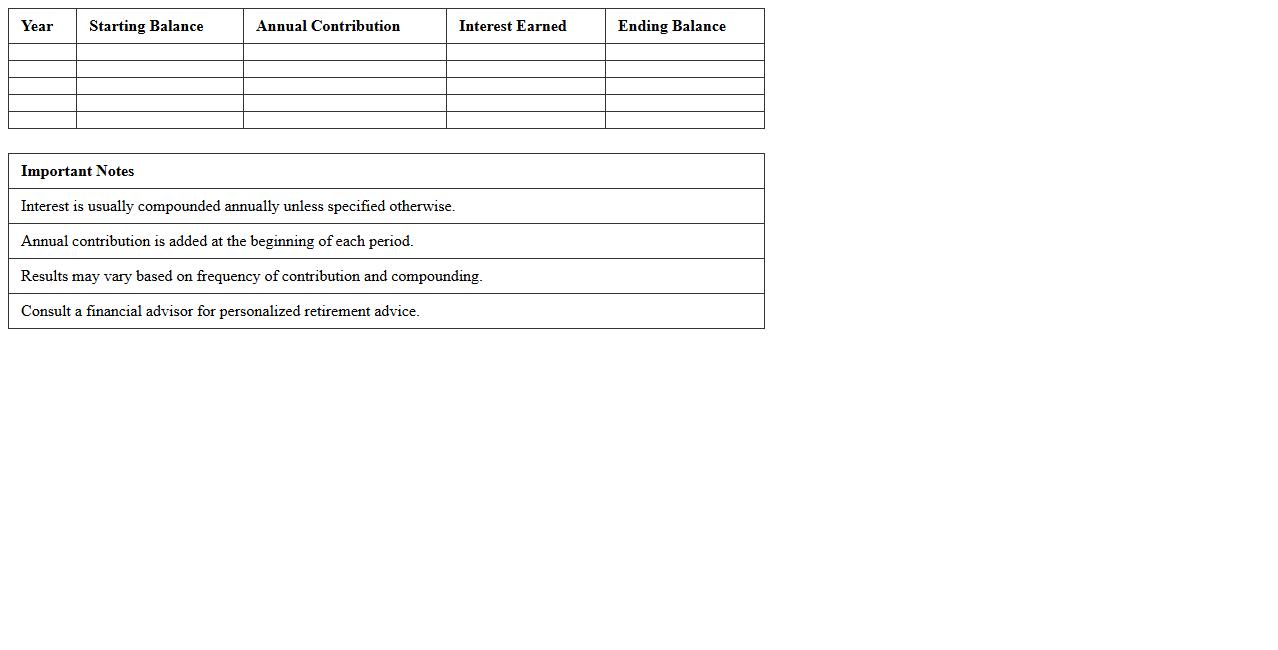

Compound Interest Retirement Calculator

The

Compound Interest Retirement Calculator document provides a detailed tool for projecting retirement savings growth by factoring in interest compounding over time. It helps users estimate how much their investments will grow based on variables such as initial principal, interest rate, compounding frequency, and investment duration. This document is useful for financial planning, enabling individuals to make informed decisions about saving strategies and retirement goals.

How can Excel automate tax-adjusted retirement savings projections for clients?

Excel can automate tax-adjusted retirement savings projections by using built-in financial and logical functions to model different tax scenarios. By incorporating variables such as tax rates, deductions, and investment growth, spreadsheets dynamically adjust projections based on user's inputs. Using macros or VBA scripts can further enhance automation, allowing regular updates with minimal manual intervention.

What formulas best estimate inflation impact on future retirement withdrawals in Excel?

To estimate the inflation impact on future retirement withdrawals, Excel commonly uses the FV (Future Value) and PV (Present Value) functions combined with an inflation rate variable. The formula adjusts withdrawal amounts by compounding inflation over the years until retirement. Multiplying current withdrawal needs by (1 + inflation rate) ^ number of years gives accurate projections.

How to structure a multi-account retirement savings tracker for couples in Excel?

A structured multi-account retirement savings tracker involves creating separate sheets or tables for each individual's accounts and aggregating them into a summary dashboard. Categories like account type, balance, contributions, growth rate, and beneficiary details ensure detailed tracking. Using Excel's data validation and conditional formatting improves organization and visual clarity for couples' combined retirement planning.

Which Excel functions calculate required minimum distributions (RMDs) for various ages?

The RMD (Required Minimum Distribution) can be calculated in Excel by using the VLOOKUP or INDEX-MATCH functions to reference IRS life expectancy tables based on the individual's age. The distribution amount is derived by dividing the retirement account balance by the life expectancy factor. Combining these functions allows dynamic and accurate RMD calculations for any age.

How to create scenario analysis for early vs. delayed retirement using Excel pivot tables?

Creating a scenario analysis for early vs. delayed retirement starts with organizing input data such as retirement age, account balances, and expected withdrawals in a structured table. Excel PivotTables summarize and compare key metrics across defined scenarios by filtering and slicing data. Adding slicers and timelines enables interactive analysis to evaluate the financial impacts of different retirement timing options.

More Calculation Excel Templates