The Pension Fund Calculation Excel Template for Retirement Planners streamlines the process of estimating retirement savings by allowing precise input of variables such as contributions, interest rates, and retirement age. This customizable tool provides clear projections of future pension fund value, aiding planners in making informed decisions. Its user-friendly interface enhances accuracy and efficiency in retirement financial planning.

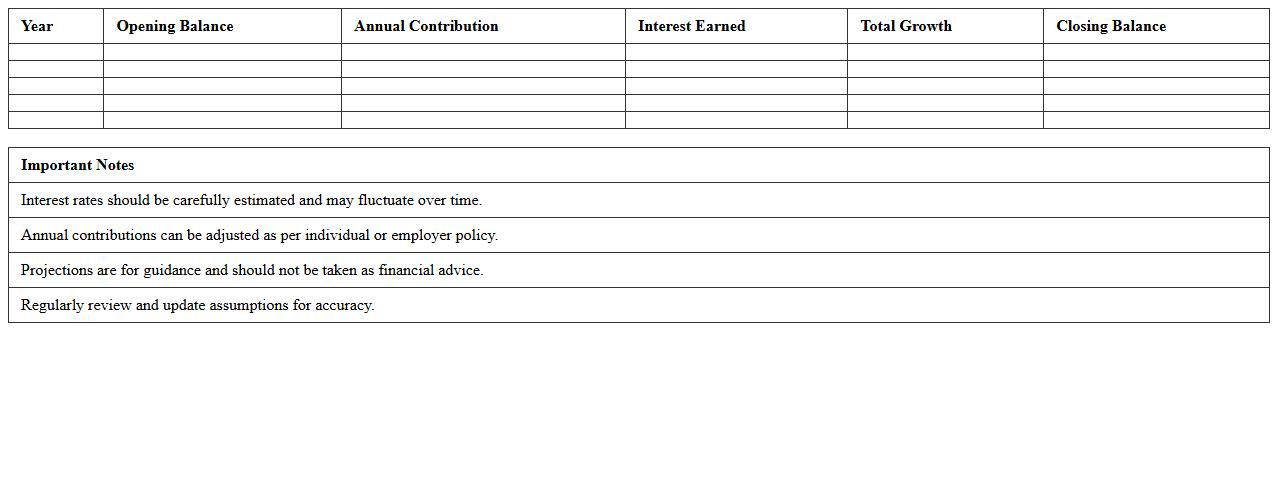

Pension Fund Growth Projection Excel Template

The

Pension Fund Growth Projection Excel Template is a financial tool designed to estimate the future value of pension investments based on variables such as contribution amounts, interest rates, and time horizons. It provides users with a clear forecast of their retirement fund's growth, enabling informed decision-making and strategic planning for long-term financial security. This template simplifies complex calculations, saving time and reducing errors in pension planning processes.

Retirement Contributions Tracking Spreadsheet

A

Retirement Contributions Tracking Spreadsheet is a document designed to help individuals monitor and record their contributions to retirement accounts such as 401(k), IRA, or Roth IRA. It provides detailed tracking of monthly or annual deposits, employer matches, and investment growth, enabling users to assess progress toward their retirement goals. This tool is essential for maintaining accurate financial records, identifying trends in contributions, and ensuring compliance with contribution limits set by regulatory authorities.

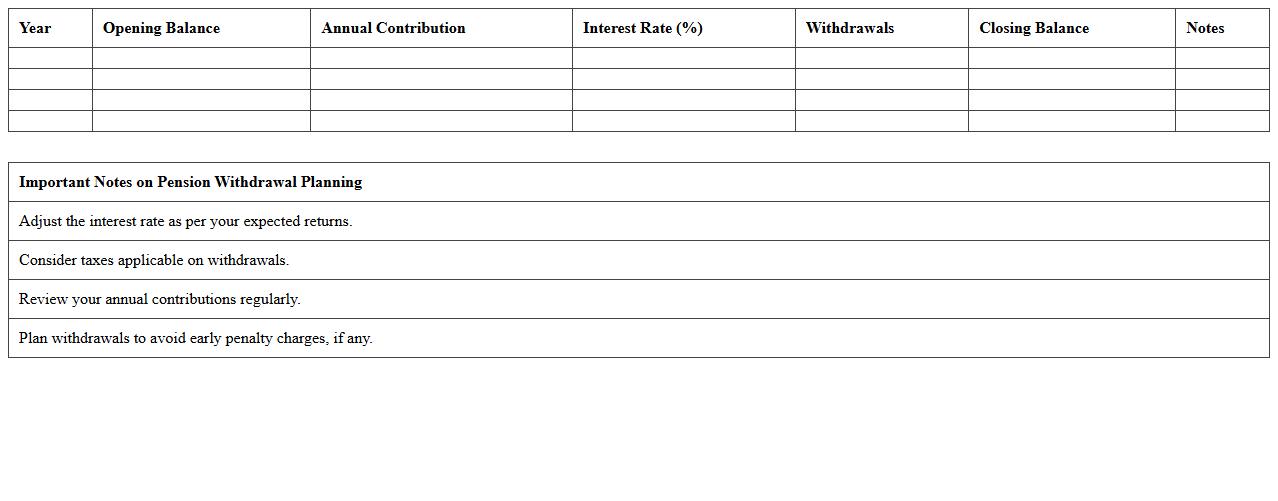

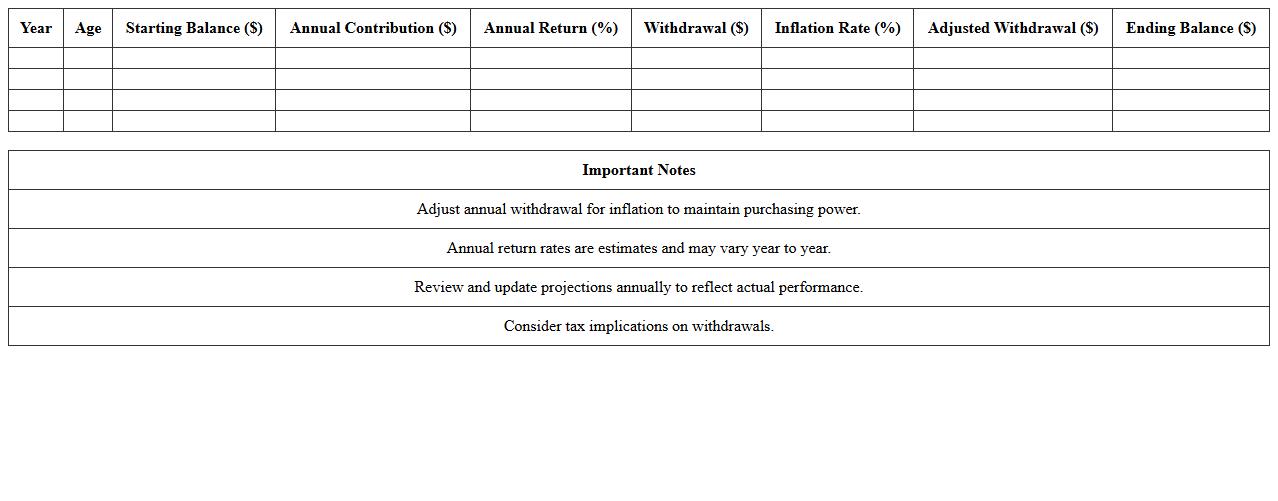

Pension Withdrawal Planning Excel Sheet

A

Pension Withdrawal Planning Excel Sheet is a structured financial tool designed to help individuals strategize their retirement income withdrawals efficiently. It helps users calculate optimal withdrawal amounts, project available funds over time, and assess tax implications, ensuring sustainable financial management during retirement. This document is essential for creating a personalized, data-driven plan that maximizes pension benefits and minimizes the risk of outliving savings.

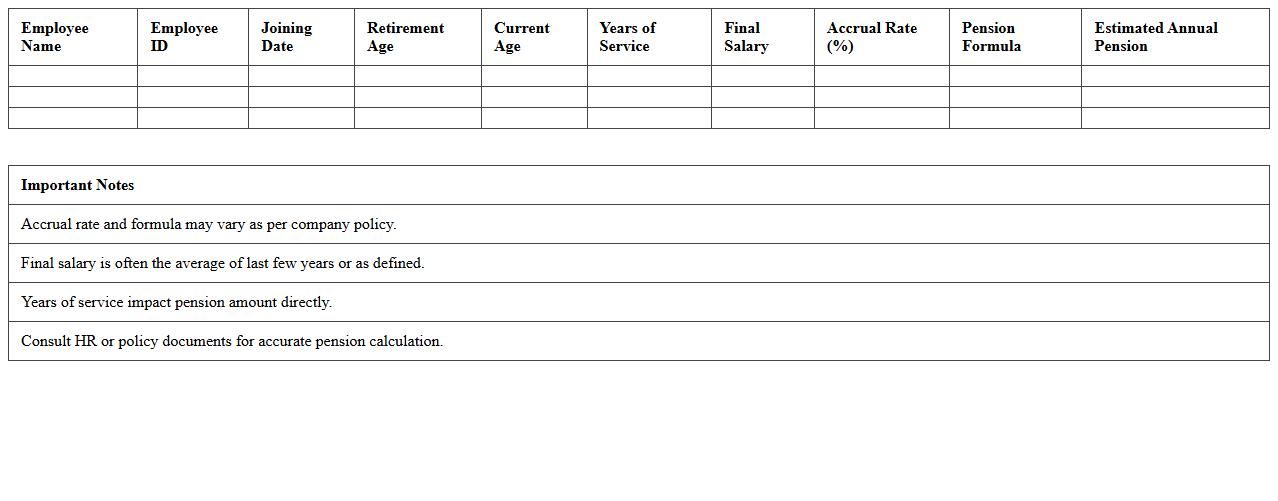

Defined Benefit Pension Fund Calculator

A

Defined Benefit Pension Fund Calculator document provides a detailed method to estimate retirement benefits based on factors such as salary history, years of service, and accrual rates. It helps individuals and financial planners project future pension income, enabling better retirement planning and financial security. Using this calculator ensures informed decisions about pension contributions and retirement timing.

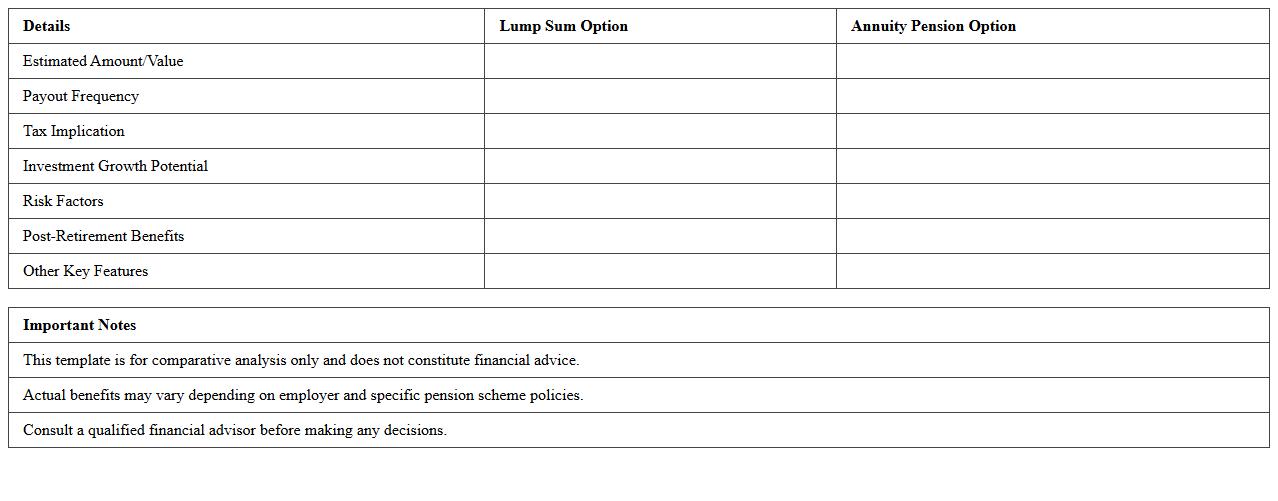

Lump Sum vs Annuity Pension Comparison Template

The

Lump Sum vs Annuity Pension Comparison Template document provides a structured format to evaluate pension payout options by comparing the immediate cash lump sum against periodic annuity payments. This template helps individuals make informed decisions about retirement planning by clearly outlining financial implications, tax effects, and long-term income stability. Utilizing this comparison ensures a comprehensive analysis tailored to personal financial goals and risk tolerance.

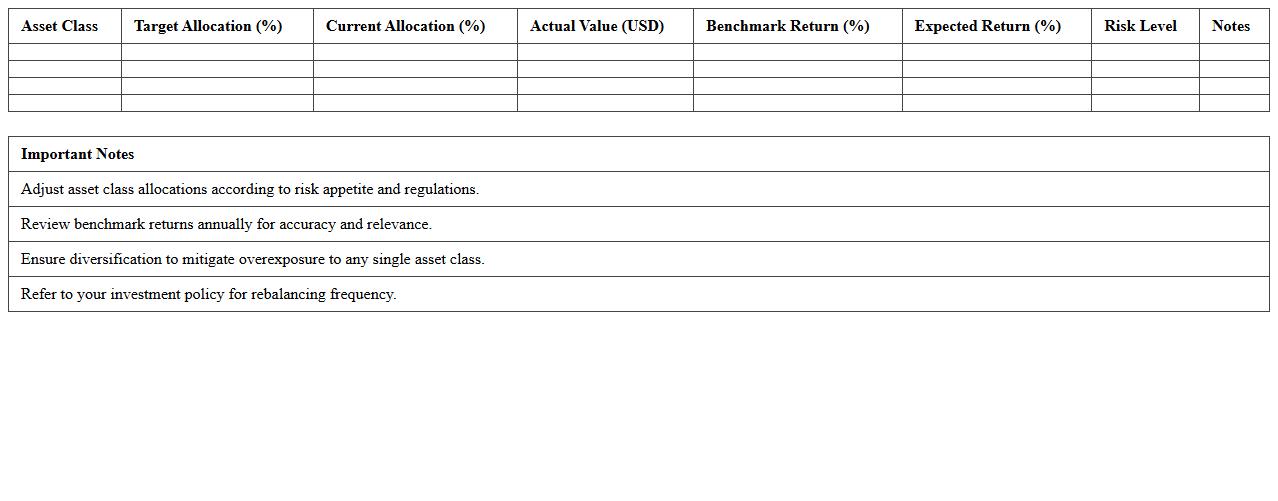

Pension Fund Asset Allocation Excel Model

The

Pension Fund Asset Allocation Excel Model is a sophisticated financial tool designed to help pension fund managers strategically distribute assets across various investment classes such as equities, bonds, and real estate. This model facilitates scenario analysis, risk assessment, and optimization of returns to ensure long-term fund sustainability and meet future pension liabilities. By providing a clear, data-driven framework, it enables informed decision-making and enhances the ability to balance growth objectives with risk management.

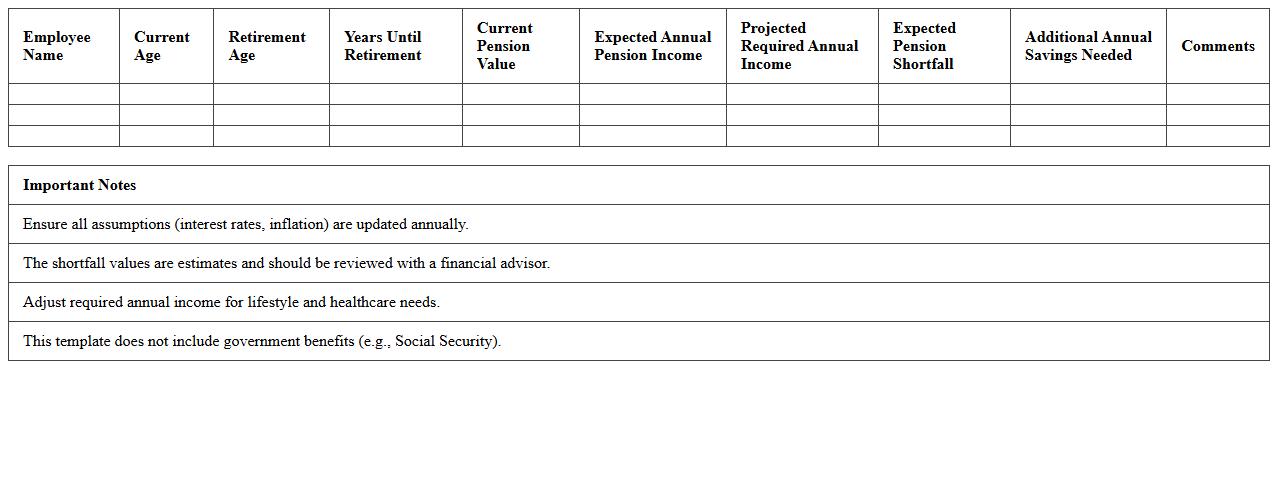

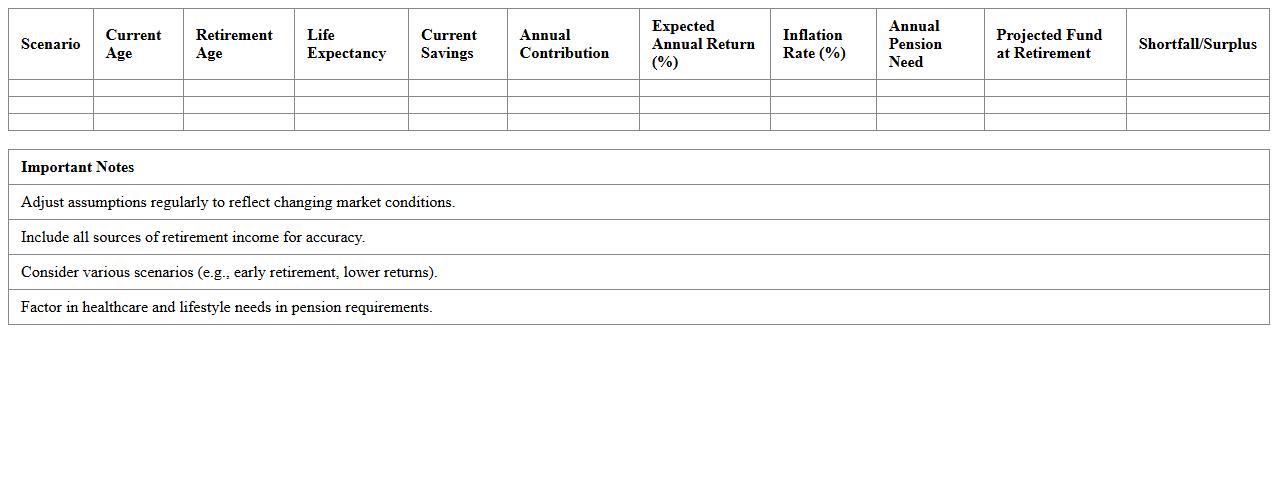

Retirement Pension Shortfall Analysis Template

The

Retirement Pension Shortfall Analysis Template is a financial tool designed to identify gaps between expected pension income and retirement funding needs. It helps individuals and financial planners quantify potential shortfalls by comparing projected retirement expenses against current savings and pension benefits. This analysis enables more informed decision-making to adjust savings strategies and secure a financially stable retirement.

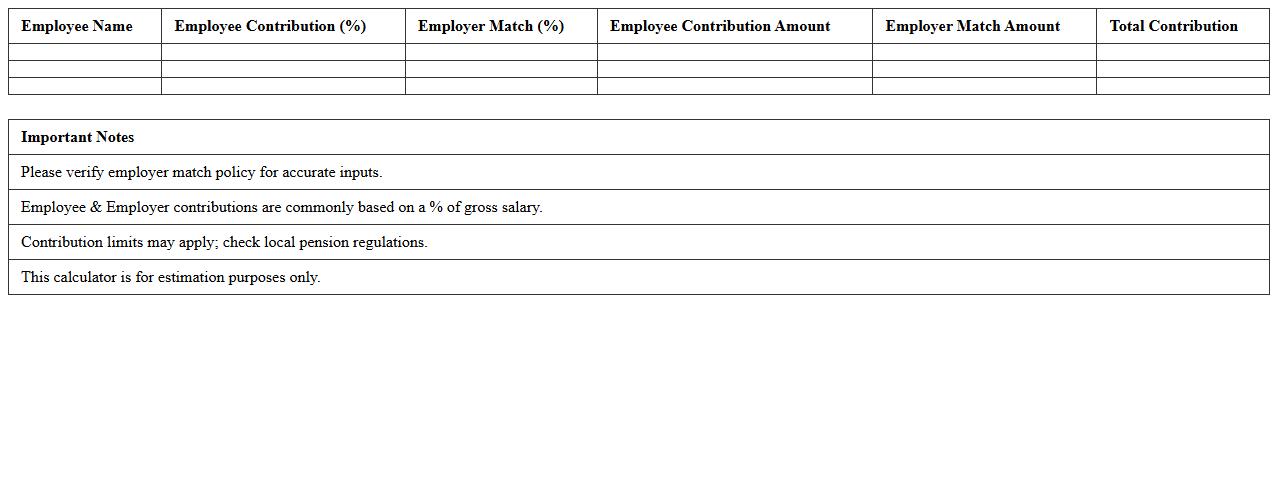

Employer Pension Match Calculator Spreadsheet

An

Employer Pension Match Calculator Spreadsheet is a tool designed to help employees accurately estimate the total contributions to their pension fund, combining their own input with the employer's matching contributions. This spreadsheet enables users to project future retirement savings by adjusting variables such as contribution rates, employer match percentages, and salary growth. By providing clear insights into the compound growth of matched pension contributions, it supports better financial planning and maximizes retirement benefits.

Inflation-Adjusted Retirement Fund Projection

An

Inflation-Adjusted Retirement Fund Projection document estimates the future value of retirement savings by accounting for inflation's impact on purchasing power. It helps individuals plan more accurately for retirement expenses, ensuring they maintain their desired lifestyle despite rising costs. By incorporating inflation rates, the projection provides a realistic view of how much money will be needed to sustain financial security over time.

Multi-Scenario Pension Fund Planning Excel Sheet

The

Multi-Scenario Pension Fund Planning Excel Sheet is a dynamic financial tool designed to project and analyze various retirement funding outcomes based on different contribution rates, investment returns, and retirement ages. It enables users to compare multiple pension scenarios, helping to optimize savings strategies and secure financial stability in retirement. By visualizing potential future balances and cash flows, this Excel sheet assists in making informed decisions and adjusting plans proactively.

How to automate interest rate adjustments in a pension fund Excel calculator?

To automate interest rate adjustments in a pension fund Excel calculator, use the IF and INDEX functions to reference dynamic rates based on date or market changes. Create a data table with historical or projected rates linked to specific time periods. This enables your model to update interest rates automatically and reflect real-time pension fund growth assumptions.

What formulas best project longevity risk in pension planning spreadsheets?

The survival probability and life expectancy formulas are essential to project longevity risk in pension planning. Use the VLOOKUP or INDEX-MATCH combos to incorporate actuarial life table data for beneficiaries. This statistical approach helps estimate the expected duration of payouts, thus quantifying longevity risk systematically.

How can lump-sum withdrawal scenarios be modeled in Excel for pension funds?

Model lump-sum withdrawal scenarios using conditional formulas like IF and SUMPRODUCT to calculate the impact on future cash flows and fund balances. Incorporate inputs for withdrawal size, timing, and tax impact to simulate various scenarios. This enhances decision-making by showing how lump-sum payouts affect pension sustainability.

Which Excel functions calculate tax impacts on retirement payouts?

Excel functions such as IF, VLOOKUP, and SUMPRODUCT can model different tax brackets and deductions to calculate tax impacts on retirement payouts. Create tax tables linked with payout amounts to dynamically compute tax liabilities. This provides a clear, automated breakdown of net vs. gross pension income.

How to integrate inflation indexing for pension disbursements in Excel models?

Integrate inflation indexing by linking pension disbursement amounts to an inflation rate input using formulas like =PreviousPayout*(1+InflationRate). Use Excel's PV and FV functions to adjust cash flow projections over time reflecting inflation adjustments. This ensures pension payouts maintain purchasing power throughout retirement.

More Calculation Excel Templates