The Rental Yield Calculation Excel Template for Real Estate Agents simplifies the process of evaluating property investments by calculating potential rental returns accurately. This user-friendly tool allows agents to input purchase price, rental income, and expenses to generate precise yield percentages, aiding in informed decision-making. Designed for efficiency, it streamlines financial analysis and enhances client presentations in the real estate market.

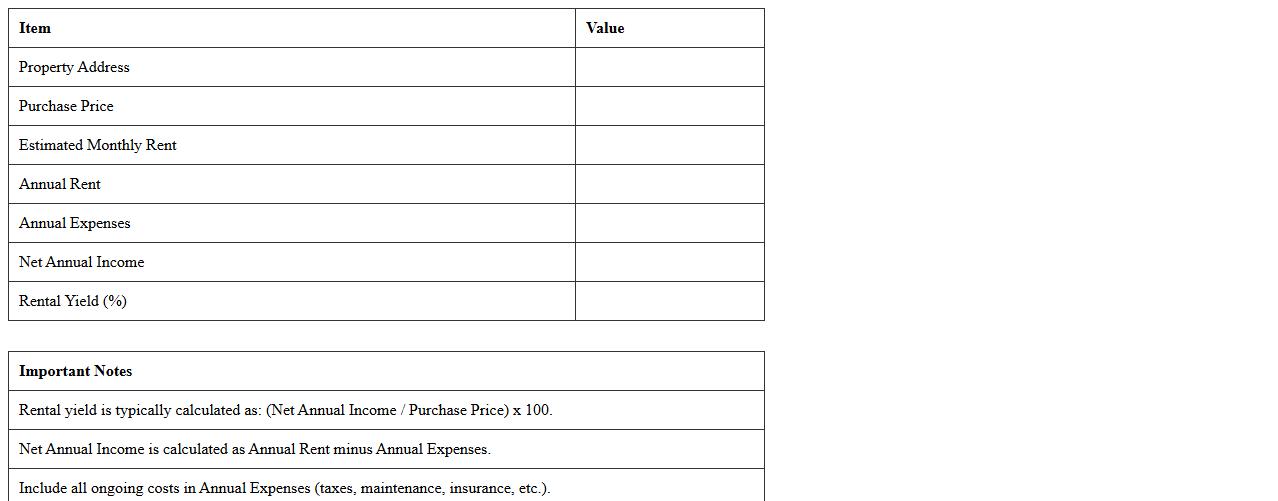

Residential Property Rental Yield Calculator Excel

A

Residential Property Rental Yield Calculator Excel document is a specialized tool designed to compute the rental yield of residential properties by analyzing rental income against property value. This calculator helps investors and homeowners assess the profitability of rental investments by providing precise yield percentages based on inputs like purchase price, rental income, and expenses. Using such an Excel model enhances decision-making for property acquisitions and portfolio management through accurate financial projections and scenario analysis.

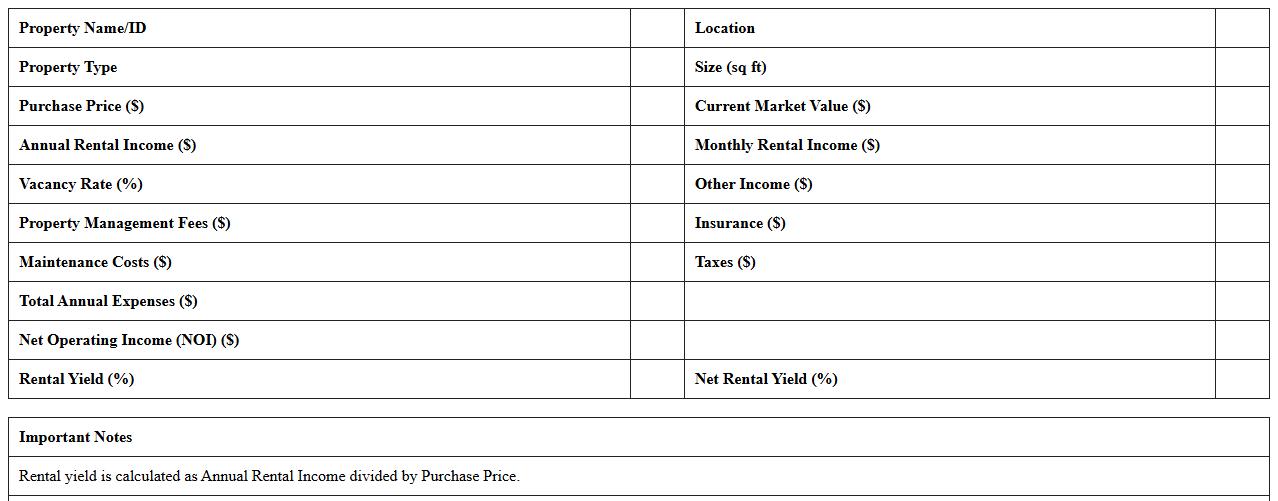

Commercial Rental Yield Analysis Template

A

Commercial Rental Yield Analysis Template is a structured document designed to calculate the return on investment for commercial properties by comparing rental income against property costs. It helps investors and property managers assess profitability, identify potential cash flow issues, and make informed decisions on purchasing or leasing commercial real estate. Utilizing this template streamlines financial analysis, ensuring accurate yield projections and enhancing strategic planning for maximizing rental income.

Simple Rental Yield Tracking Spreadsheet

A

Simple Rental Yield Tracking Spreadsheet is a powerful financial tool designed to calculate and monitor the return on investment for rental properties by comparing rental income against property value and expenses. It helps landlords and investors identify profitable properties, track monthly cash flow, and make informed decisions based on accurate yield metrics. Using this spreadsheet enhances portfolio management efficiency and supports strategic growth in real estate investments.

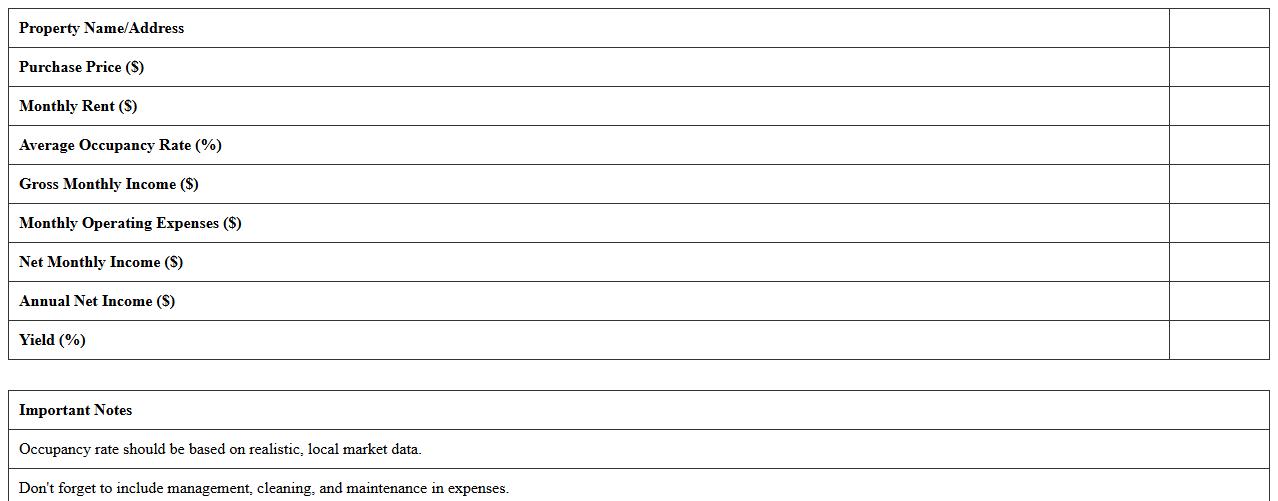

Short-Term Rental Yield Comparison Excel

A

Short-Term Rental Yield Comparison Excel document is a powerful tool designed to analyze and compare potential returns on investment properties by calculating rental yields from short-term rentals. It allows users to input various variables such as property price, rental income, occupancy rates, and expenses to provide a clear financial overview. This document helps investors make informed decisions by identifying the most profitable properties and optimizing short-term rental strategies.

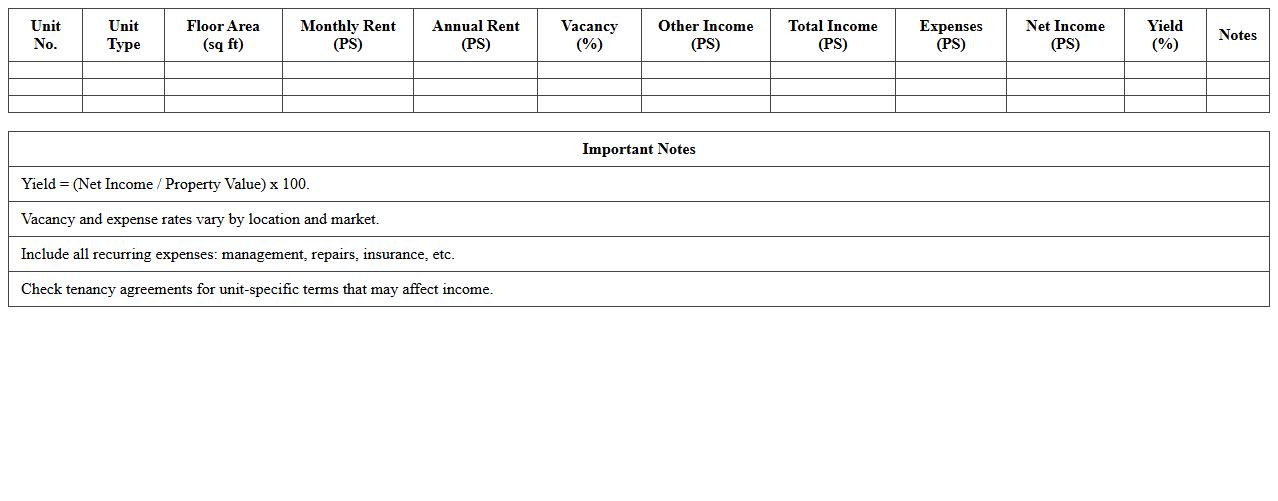

Multi-Unit Property Yield Assessment Template

The

Multi-Unit Property Yield Assessment Template is a structured document designed to evaluate the financial performance and potential returns of multi-unit real estate investments. It allows investors and property managers to systematically analyze rental income, expenses, vacancy rates, and capital appreciation across multiple units, providing a clear overview of yield metrics. This template enhances decision-making by streamlining data comparison, identifying profitable opportunities, and optimizing property portfolio management.

Detailed Rental Income Yield Estimator Spreadsheet

The

Detailed Rental Income Yield Estimator Spreadsheet is a comprehensive tool designed to calculate potential rental income and analyze property investment returns by factoring in expenses, vacancy rates, and market trends. It enables investors and property managers to make data-driven decisions by providing clear projections of rental yields and cash flow. This spreadsheet enhances financial planning accuracy and supports strategic real estate investment choices.

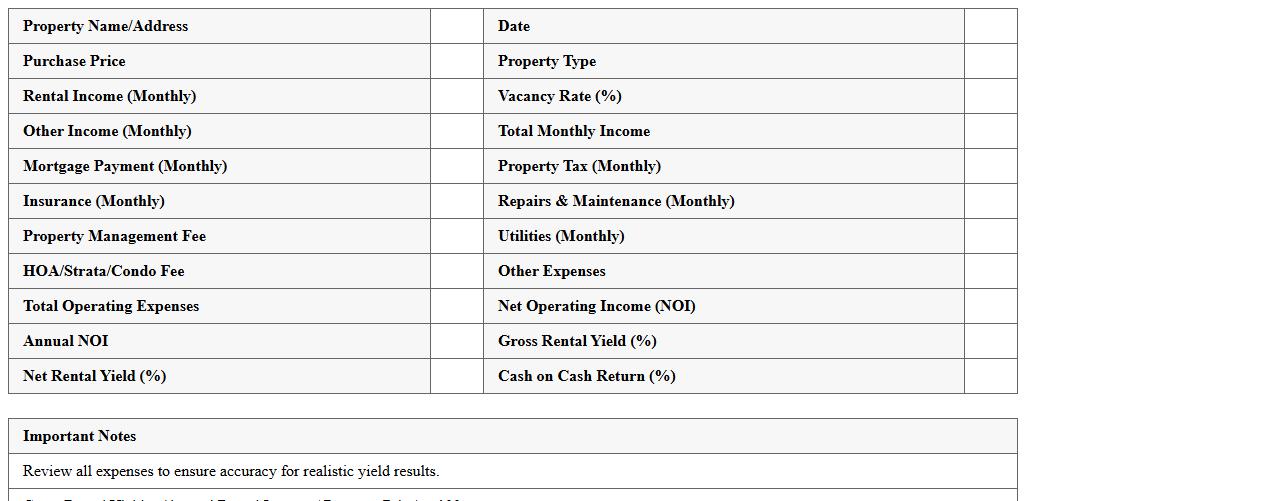

Monthly Rental Yield Tracker for Agents Excel

The

Monthly Rental Yield Tracker for Agents Excel document is a specialized tool designed to monitor and analyze rental income against property values on a monthly basis. It helps real estate agents accurately calculate rental yields, identify trends, and optimize investment strategies by providing clear, organized financial data. This tracker enhances decision-making by enabling agents to compare rental performance across multiple properties efficiently.

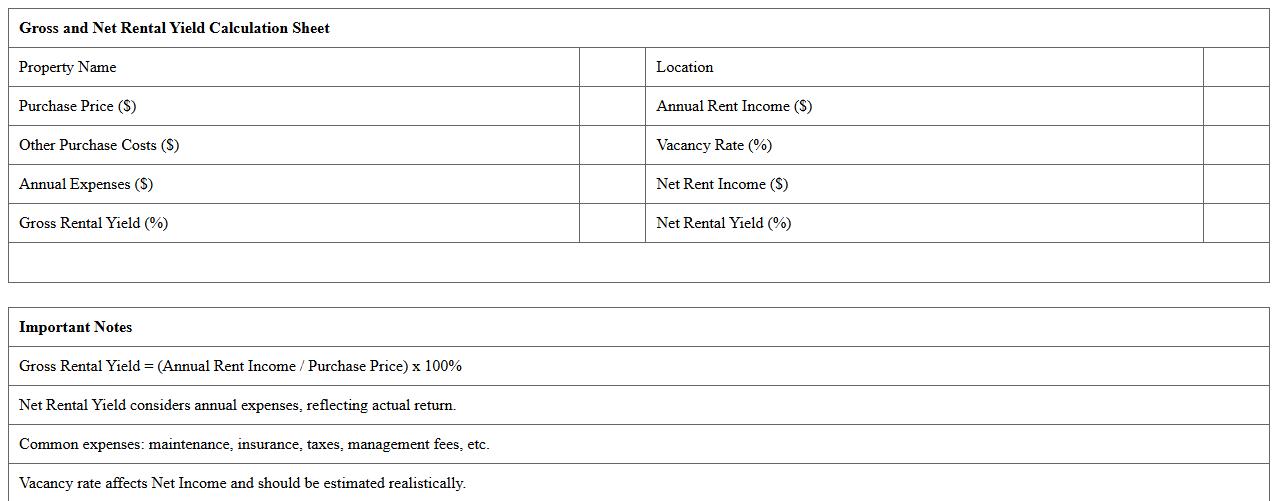

Gross and Net Rental Yield Calculation Sheet

A

Gross and Net Rental Yield Calculation Sheet is a financial tool designed to help property investors evaluate the profitability of rental properties by calculating gross and net rental yields. It systematically inputs rental income, property price, and expenses such as maintenance, taxes, and insurance, providing a clear snapshot of investment returns. This document is useful for comparing potential investments, budgeting accurately, and making informed decisions to maximize rental income and overall property value.

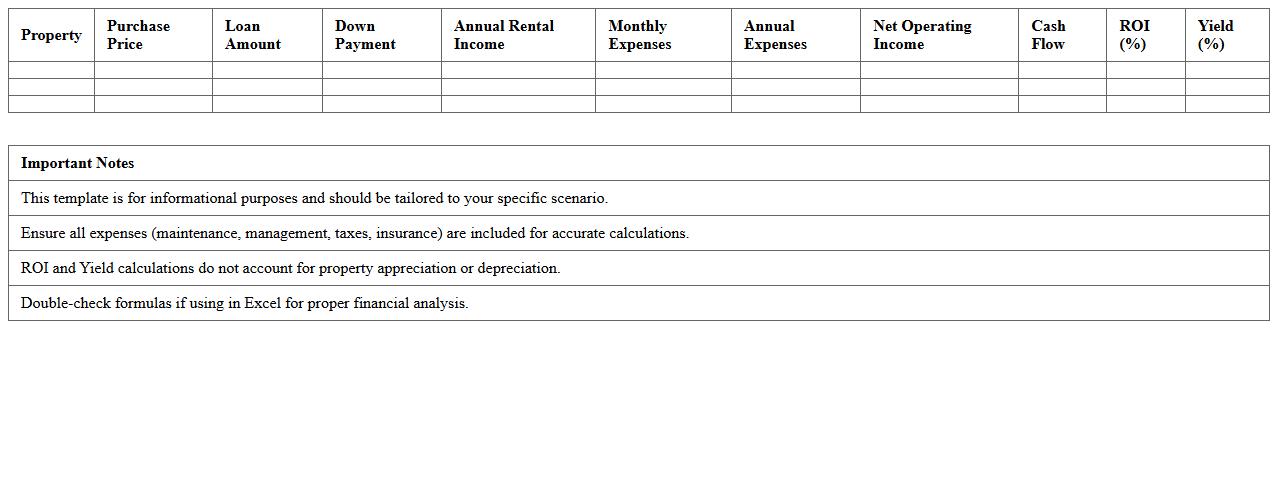

Rental Property ROI and Yield Excel Template

A

Rental Property ROI and Yield Excel Template is a powerful financial tool designed to calculate the return on investment (ROI) and rental yield for real estate properties. It helps investors analyze profitability by inputting data such as purchase price, rental income, expenses, and financing details to provide accurate performance metrics. This template streamlines decision-making, enabling users to compare properties efficiently and optimize their investment strategies.

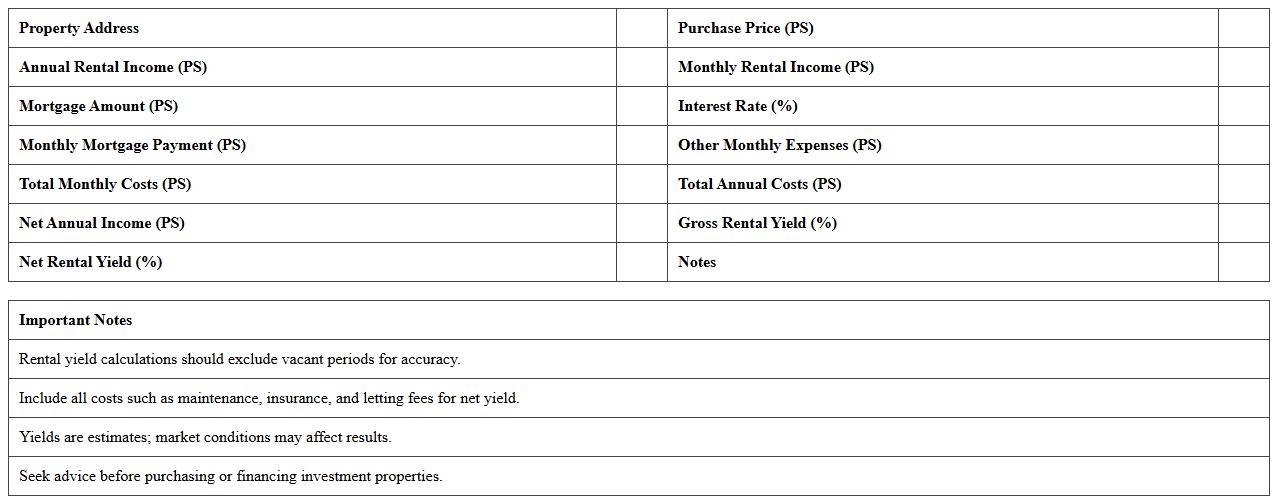

Buy-to-Let Rental Yield Summary Spreadsheet

A

Buy-to-Let Rental Yield Summary Spreadsheet document provides a detailed analysis of rental income compared to property purchase price, simplifying the evaluation of investment profitability. It offers landlords and investors a clear overview of expected returns, helping to identify high-yield properties and optimize their property portfolio. Using this spreadsheet enhances decision-making by organizing financial data like rental income, expenses, and yield percentages in a concise, accessible format.

How can I automate gross and net rental yield calculations in Excel for multiple properties?

To automate gross and net rental yield calculations, create a standardized template with property purchase price, rental income, and expenses. Use formulas such as =RentalIncome/PropertyValue for gross yield and =(RentalIncome - Expenses)/PropertyValue for net yield. Apply these formulas across rows representing multiple properties to streamline analysis.

What advanced Excel formulas best track variable rental income and fluctuating expenses?

SUMIFS and OFFSET formulas effectively handle variable rental income by summing values based on dynamic date ranges or categories. The IFERROR function helps manage fluctuating expenses by preventing calculation errors. Combining these with INDEX MATCH enhances accuracy when tracking changing financial data.

Which Excel data validation techniques prevent input errors in rental yield analysis sheets?

Use Data Validation rules such as dropdown lists for predefined property types and numeric limits for income and expenses to reduce input errors. Implement custom validation formulas like =ISNUMBER(Cell) to ensure only numeric entries in critical fields. Additionally, error alerts guide users to correct input mistakes immediately.

How do you integrate property appreciation rates into rental yield models in Excel?

Incorporate property appreciation rates by adding a column for annual appreciation percentages and calculating future property values using compound growth formulas. Use =InitialValue*(1+AppreciationRate)^Years to forecast asset value increases over time. This adjustment provides a more comprehensive rental yield model including capital gains.

What visualization tools in Excel best present rental yield comparisons for clients?

Clustered bar charts and line graphs are ideal for comparing gross and net rental yields across multiple properties. Utilize PivotCharts to summarize data dynamically and enhance interactivity for clients. Conditional formatting also highlights top-performing assets visually for quick insights.

More Calculation Excel Templates