The Tax Deduction Calculation Excel Template for Freelancers simplifies tracking income and expenses to accurately determine deductible amounts. This user-friendly tool helps freelancers organize financial data, ensuring compliance with tax regulations while maximizing deductions. Customizable formulas and clear layouts enable efficient tax preparation and reduce the risk of errors.

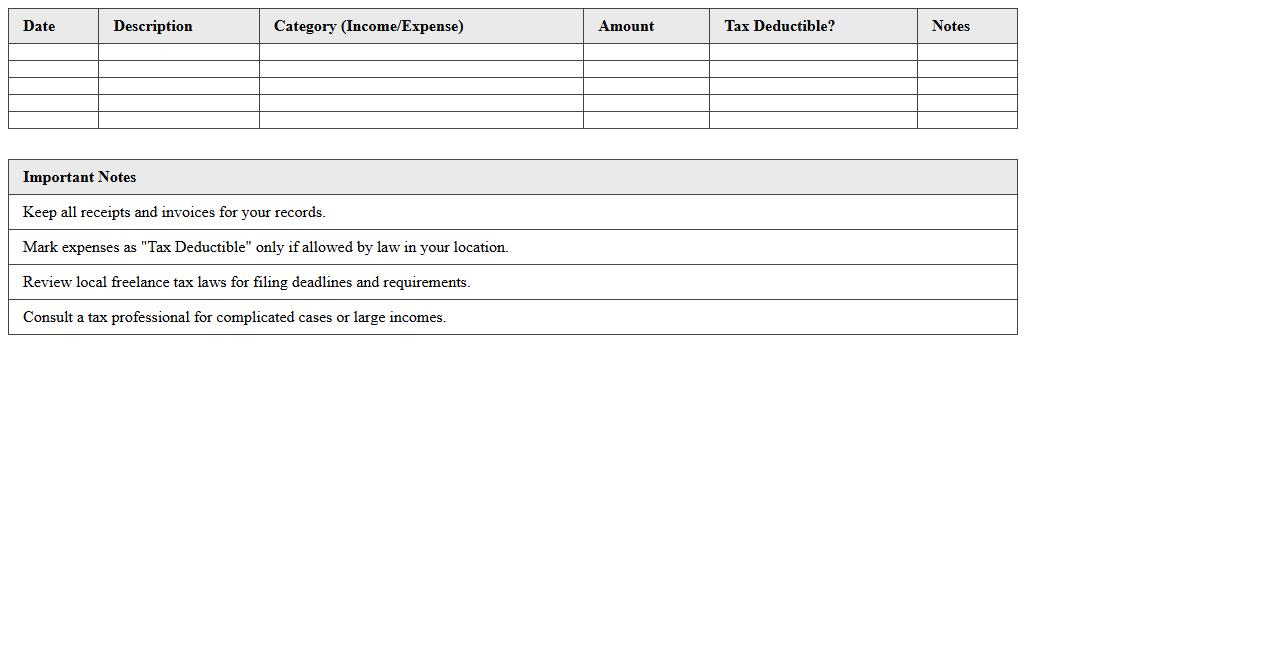

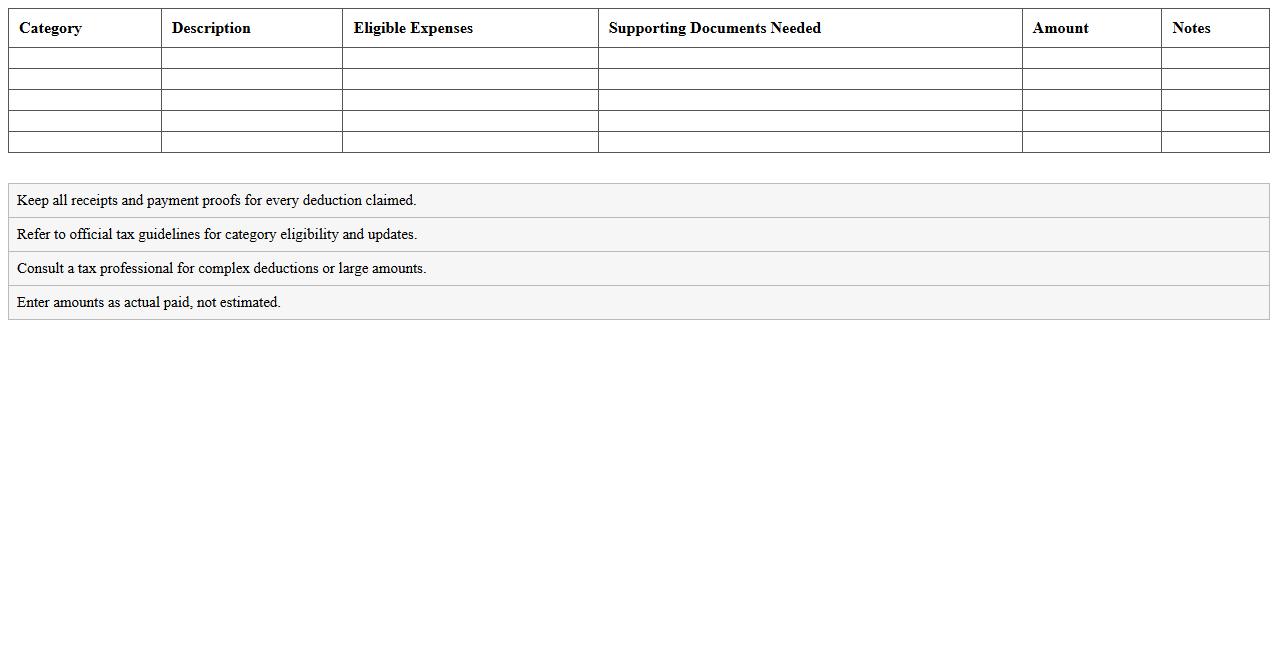

Tax Deduction Tracking Sheet for Freelancers

A

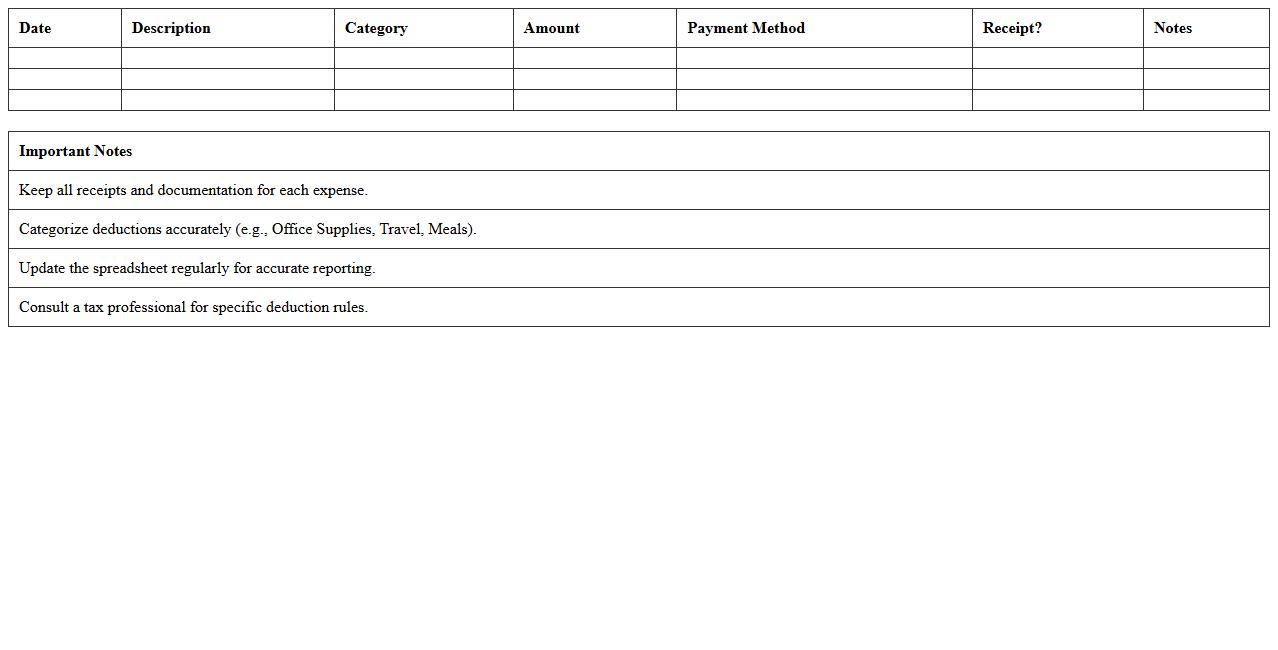

Tax Deduction Tracking Sheet for Freelancers is a detailed document designed to record and monitor expenses eligible for tax deductions throughout the fiscal year. This sheet helps freelancers systematically organize receipts, categorize deductible costs such as office supplies, software subscriptions, and travel expenses, ensuring accurate tax filing and maximizing potential savings. By maintaining this document, freelancers can reduce errors, streamline tax preparation, and confidently substantiate deductions during tax audits.

Freelance Income & Expense Tax Calculator

A

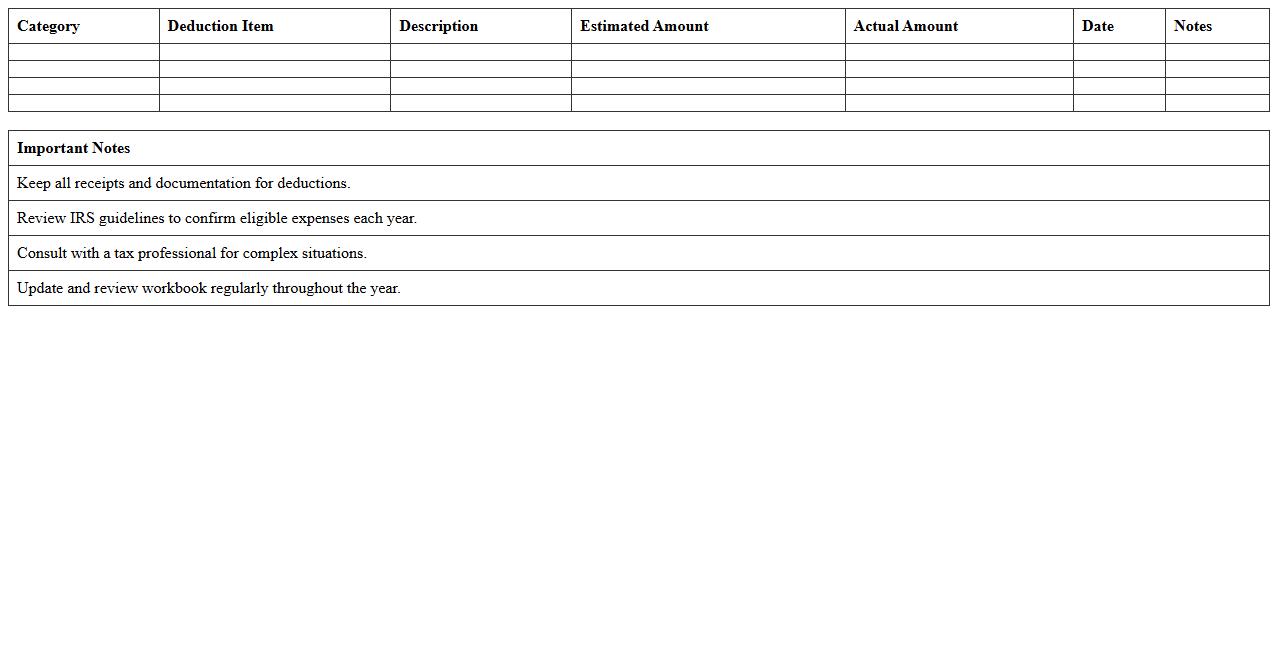

Freelance Income & Expense Tax Calculator document is a specialized tool designed to help freelancers accurately track and calculate their taxable income and deductible expenses. By organizing financial data, it simplifies tax preparation, ensuring compliance with tax regulations while maximizing eligible deductions. This document is essential for managing finances efficiently and avoiding costly errors during tax filing.

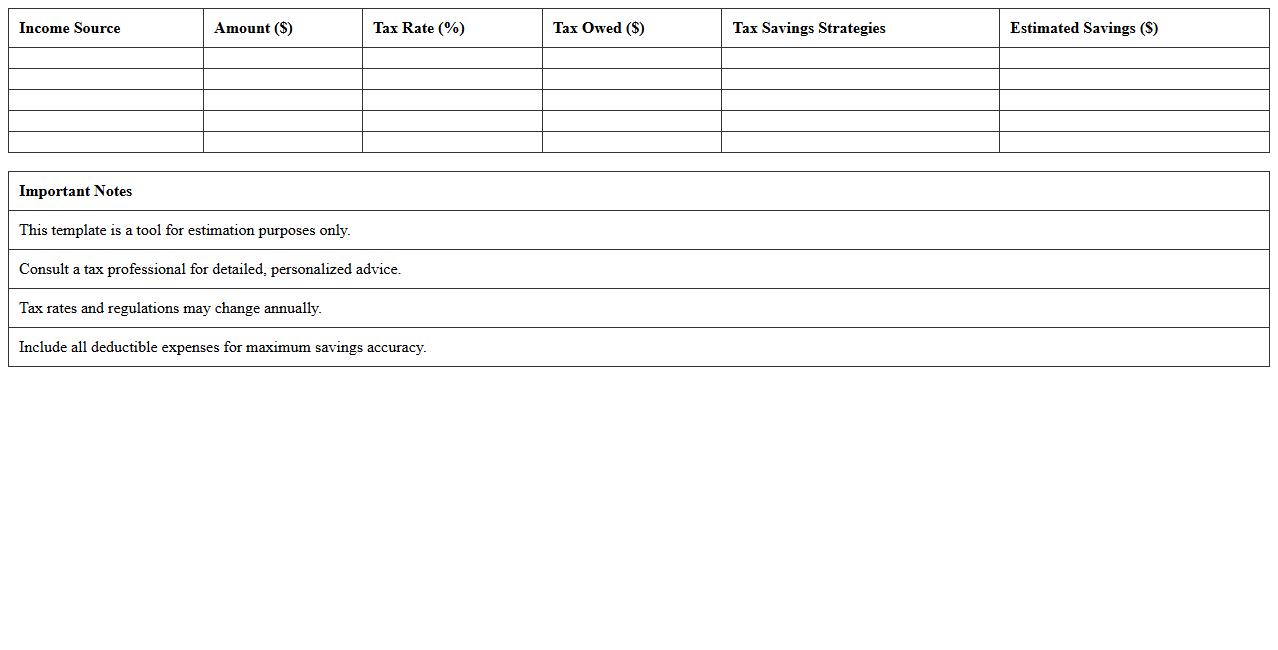

Freelancer Tax Savings Estimator Excel

The

Freelancer Tax Savings Estimator Excel document is a specialized tool designed to help freelancers calculate potential tax deductions and savings based on their income and expenses. By inputting relevant financial data, users can gain a clear estimate of their taxable income and identify opportunities to reduce tax liabilities effectively. This tool streamlines tax planning, allowing freelancers to manage finances proactively and optimize their tax outcomes.

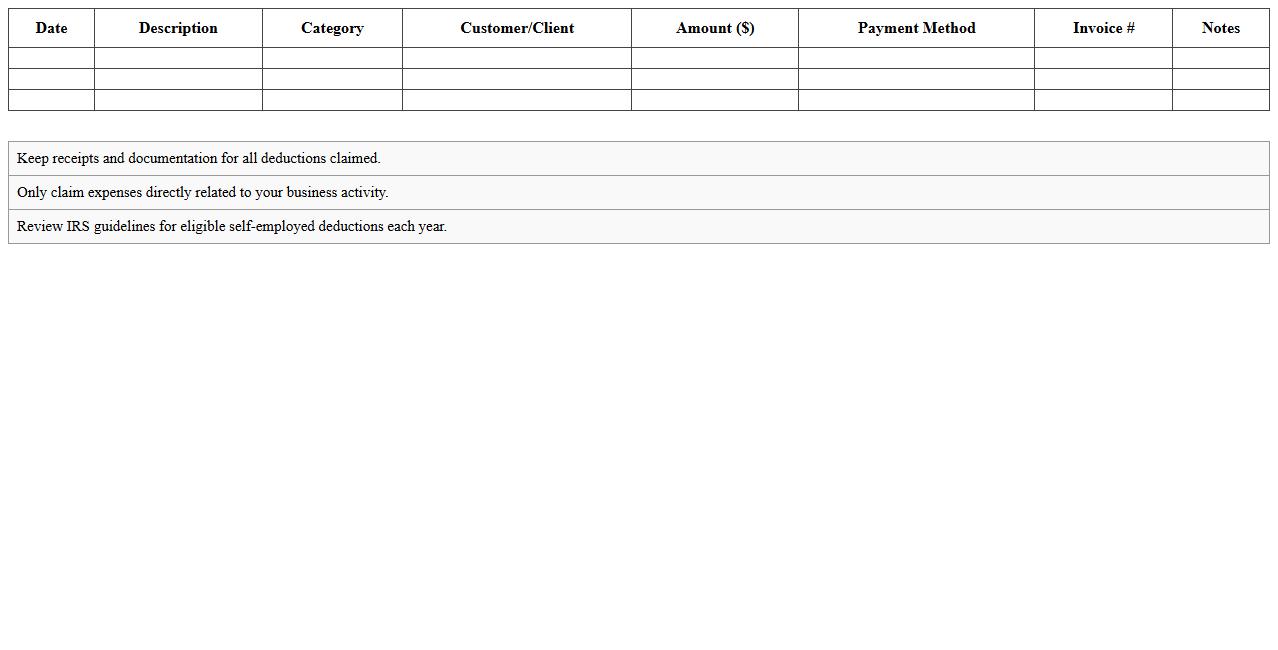

Self-Employed Tax Deduction Log Template

The

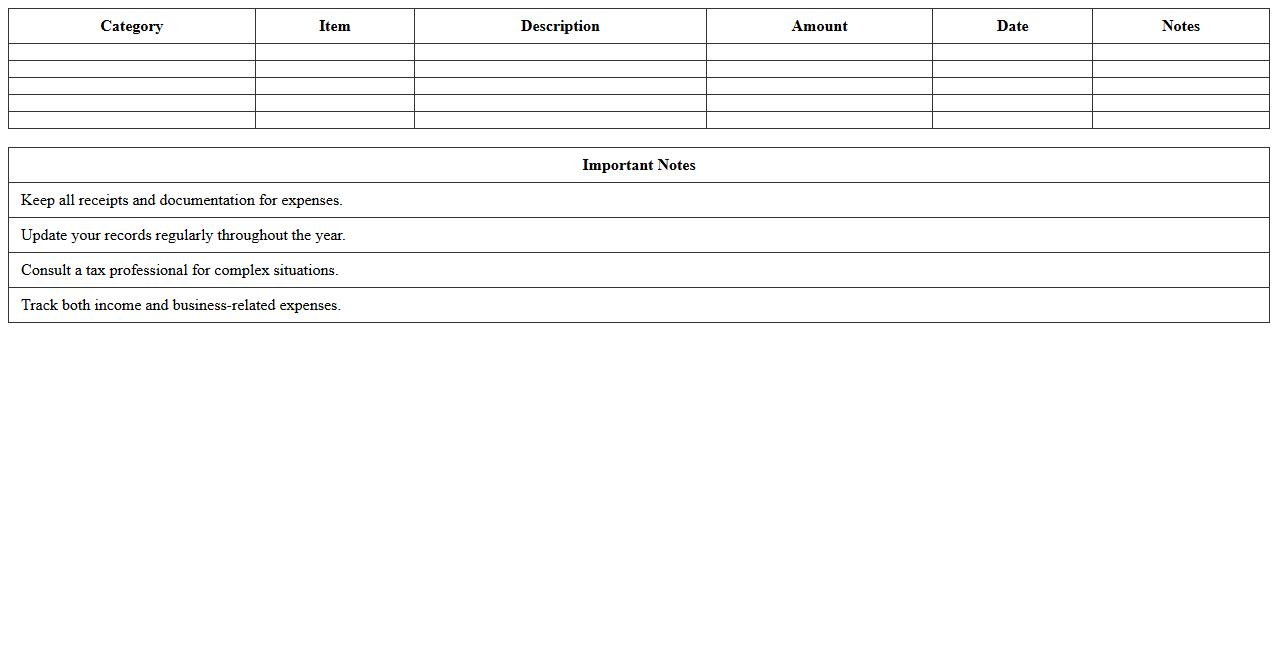

Self-Employed Tax Deduction Log Template is a structured document designed to record and categorize business expenses for accurate tax deduction tracking. It helps self-employed individuals maintain organized financial records, ensuring they claim all eligible deductions and reduce taxable income effectively. Using this template simplifies the tax filing process and enhances compliance with IRS requirements by providing clear documentation of deductible expenses.

Freelance Business Tax Deduction Spreadsheet

A

Freelance Business Tax Deduction Spreadsheet is a specialized document designed to organize and track deductible expenses related to freelance work, such as office supplies, travel costs, and software subscriptions. It simplifies the process of calculating tax deductions by categorizing expenses and maintaining accurate records throughout the fiscal year. Using this spreadsheet helps freelancers maximize their tax savings while ensuring compliance with IRS requirements.

Annual Tax Deduction Planning Workbook for Freelancers

The

Annual Tax Deduction Planning Workbook for Freelancers is a comprehensive tool designed to help self-employed individuals systematically track and categorize deductible expenses throughout the fiscal year. By organizing income and expenses in one place, it simplifies tax filing, ensures maximum allowable deductions are claimed, and reduces the risk of errors or missed opportunities. This workbook ultimately enhances financial planning, helping freelancers optimize tax savings and maintain accurate records for audits or tax consultations.

Freelancer Quarterly Tax Estimate Excel

The

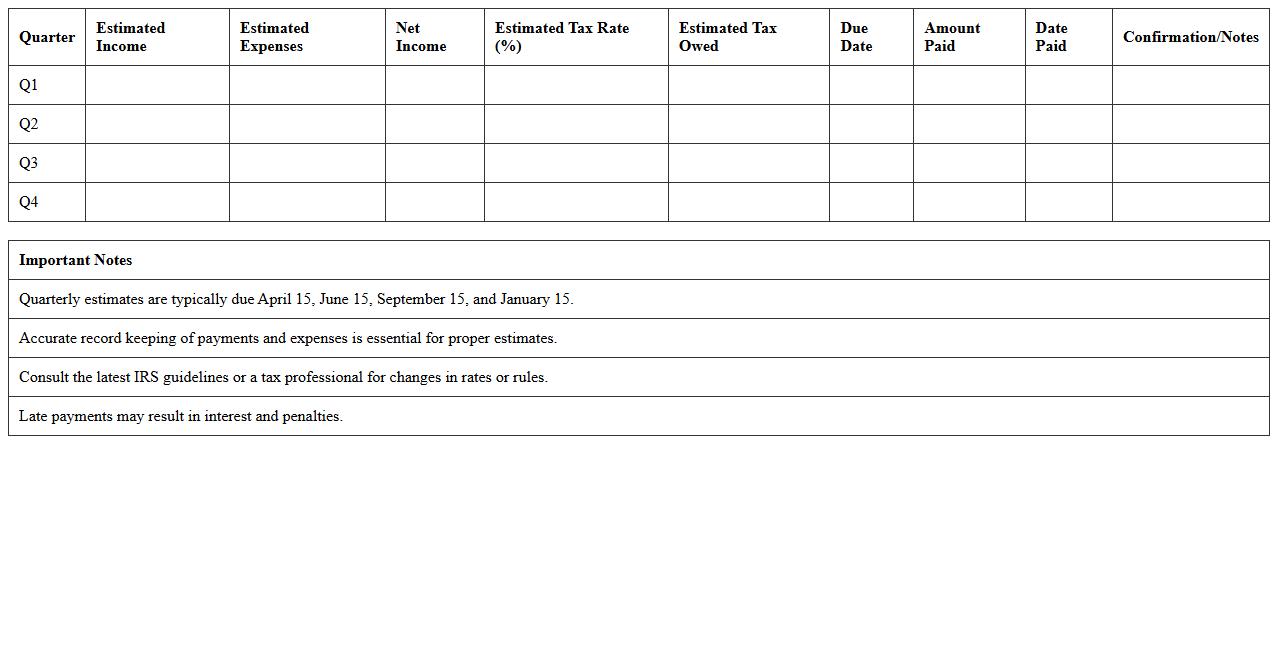

Freelancer Quarterly Tax Estimate Excel document is a specialized spreadsheet designed to help self-employed individuals accurately calculate their estimated tax payments every quarter. It streamlines the process by automating income tracking, expense deductions, and tax rate applications, ensuring freelancers avoid underpayment penalties. This tool provides clear projections of tax liabilities, making financial planning and cash flow management more efficient.

Freelance Receipts & Deductible Expenses Tracker

The

Freelance Receipts & Deductible Expenses Tracker document is designed to help freelancers systematically record and organize their income and business-related expenses. By maintaining detailed receipts and tracking deductible expenses, freelancers can accurately calculate their taxable income, ensure compliance with tax regulations, and maximize potential tax deductions. This tool streamlines financial management, making tax filing more efficient and reducing the risk of missing important deductions.

Freelancer Tax Preparation Checklist Spreadsheet

A

Freelancer Tax Preparation Checklist Spreadsheet is a structured document designed to organize and track all necessary tax-related information specific to freelancers. It helps ensure accurate reporting of income, deductible expenses, and estimated payments, minimizing errors and potential audits. Using this checklist streamlines the tax filing process, saving time and maximizing tax deductions for better financial management.

Freelance Tax Deduction Category Summary Excel

The

Freelance Tax Deduction Category Summary Excel document organizes and categorizes deductible expenses specific to freelancers, enabling clear tracking and efficient management of tax-related data. It simplifies tax preparation by summarizing all relevant deductions in one structured format, reducing errors and saving time during filing. This tool empowers freelancers to maximize their tax benefits by ensuring no deductible expenses are overlooked.

What Excel formulas efficiently automate tax deduction calculations for freelance income?

SUMIFS is a powerful formula that allows freelancers to total expenses based on multiple criteria, such as date range and category. Using IF statements can automate tax rate applications depending on income thresholds. Additionally, VLOOKUP or XLOOKUP help fetch specific deduction rates or categories, streamlining calculations.

How can freelancers track deductible expenses in Excel for accurate tax reporting?

Create a detailed spreadsheet with columns for date, expense type, amount, and notes to maintain clarity. Use drop-down lists for categories to ensure consistent data entry and easy filtering. Incorporate monthly or quarterly totals with SUMIF functions to monitor deductible expenses accurately.

Which Excel templates best organize quarterly freelance tax deduction data?

Templates designed specifically for expense tracking and income summaries work best to manage quarterly data. Look for templates that include sections for income, expenses, mileage, and estimated tax payments. Many free and premium Excel templates offer built-in formulas and visual dashboards for comprehensive quarterly review.

How to set up conditional formatting in Excel to flag missing receipts for deductions?

Use conditional formatting rules to highlight cells in the receipt column that are blank or contain specific keywords like "missing." Apply a rule based on the formula =ISBLANK(Cell) to identify missing data automatically. This visual cue helps freelancers quickly recognize and address incomplete expense documentation.

What are key tax categories freelancers should include in their Excel deduction tracker?

Essential categories include office supplies, travel expenses, equipment purchases, and professional services, all vital for maximizing deductions. Don't forget categories like internet and phone bills, meals, and home office expenses, which frequently qualify as deductions. Proper classification simplifies tax filing and ensures compliance with tax regulations.

More Calculation Excel Templates