The Loan Interest Calculation Excel Template for Personal Finances simplifies tracking loan repayments and interest accrual by providing a clear, customizable spreadsheet. Users can input loan details such as principal, interest rate, and payment schedule to automatically calculate monthly interest and outstanding balances. This template enhances financial planning by offering accurate projections and helping manage personal debt effectively.

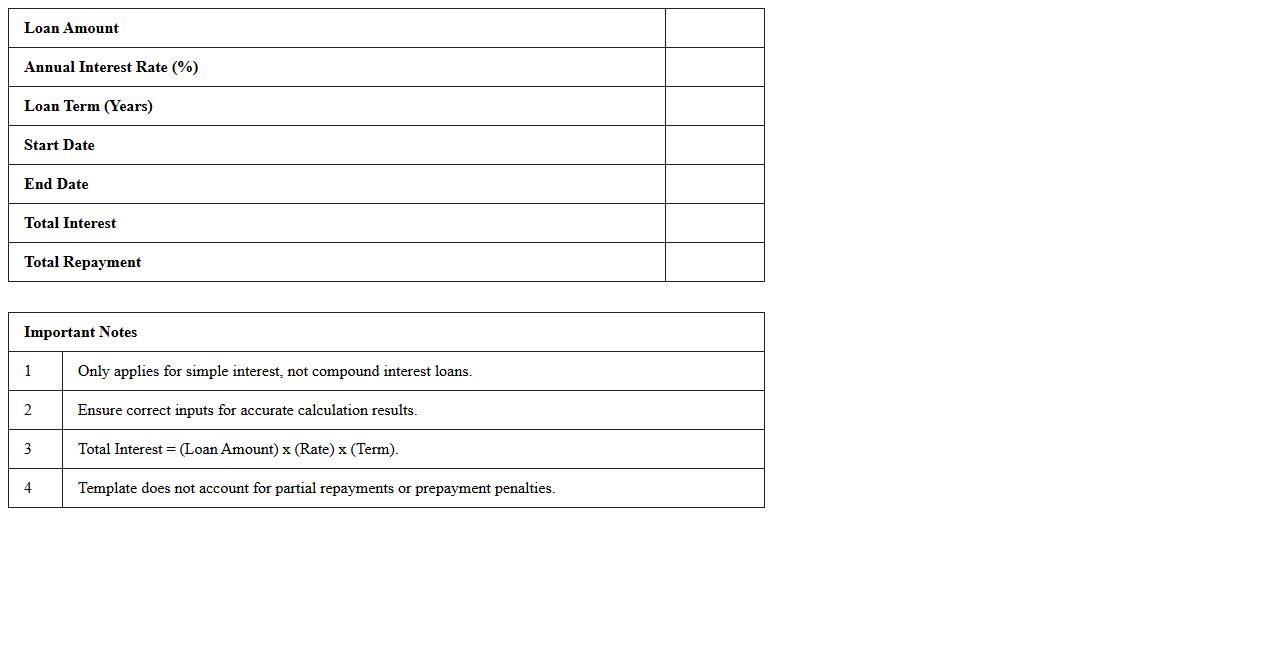

Personal Loan Interest Amortization Excel Template

The

Personal Loan Interest Amortization Excel Template is a pre-designed spreadsheet that calculates and displays the breakdown of loan payments into principal and interest over time. This document helps users track their loan repayment schedule, visualize interest costs, and manage finances more effectively by providing clear, organized amortization tables. It is especially useful for budgeting personal loans, understanding payment impact, and planning early repayments to save on interest.

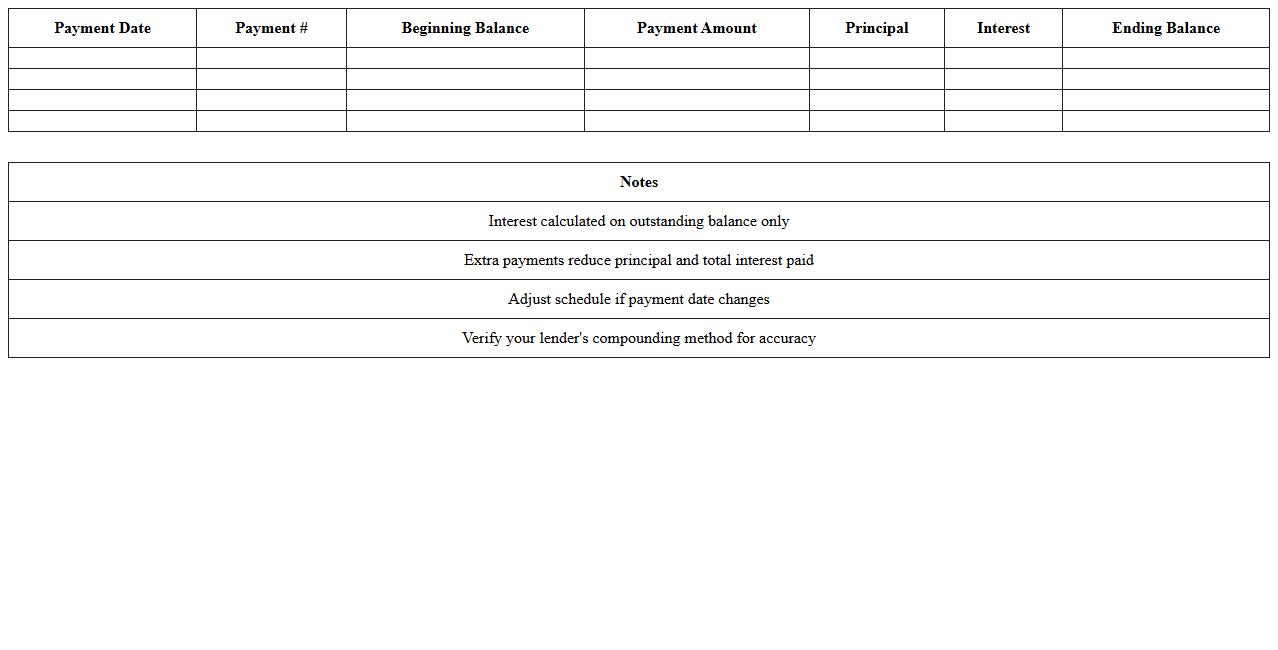

Simple Interest Loan Calculator Excel Sheet

A

Simple Interest Loan Calculator Excel Sheet document is a spreadsheet tool designed to calculate the interest accrued on a loan based on principal, interest rate, and loan duration. This document helps users quickly determine the total interest and repayment amount without complex manual calculations, making financial planning and budgeting more efficient. By inputting loan details, borrowers and lenders can easily assess loan costs and make informed decisions.

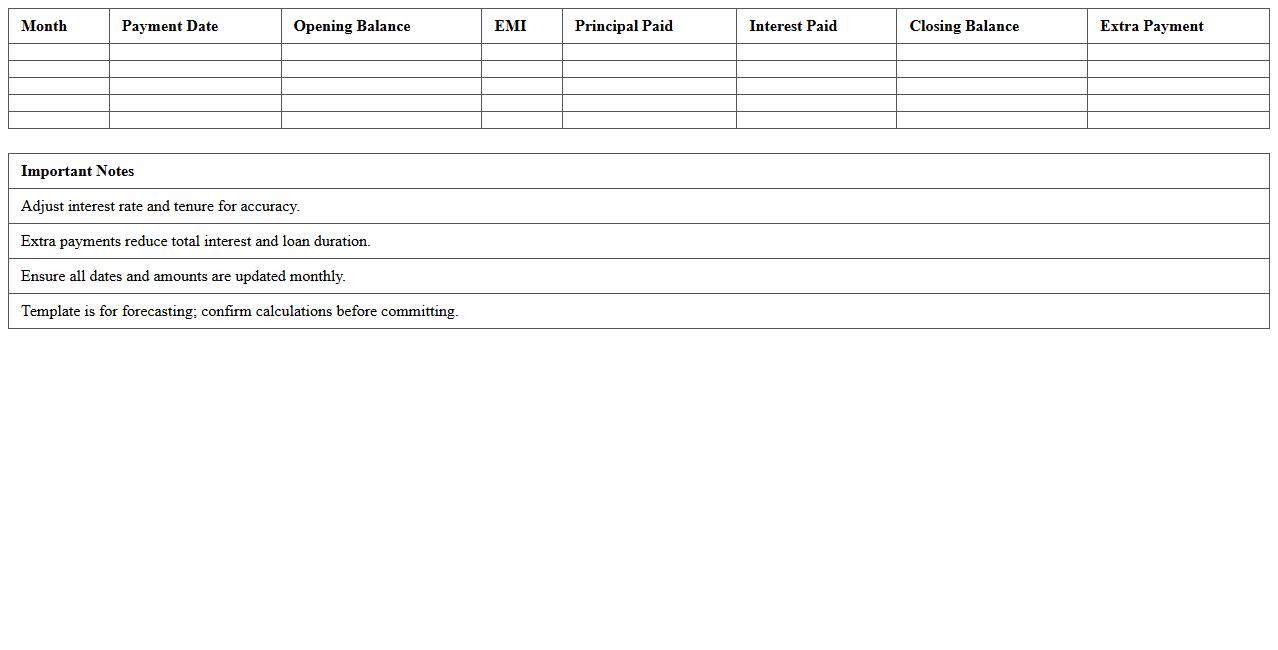

Personal Loan EMI & Interest Tracker Spreadsheet

A

Personal Loan EMI & Interest Tracker Spreadsheet is a digital tool designed to systematically record and calculate monthly Equated Monthly Installments (EMIs) and accrued interest on personal loans. It helps users monitor repayment schedules, track outstanding balances, and estimate total interest paid over the loan tenure. Utilizing this spreadsheet enhances financial planning by providing clear visibility into debt management and facilitating timely loan repayments.

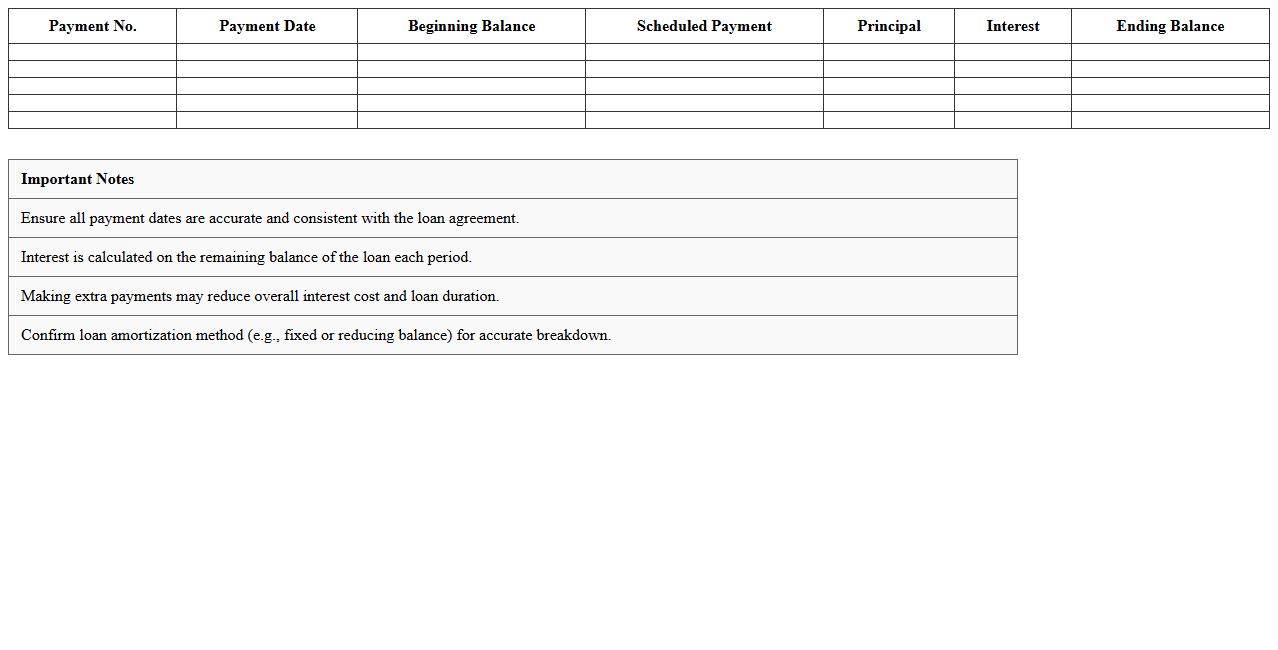

Loan Payment Schedule with Interest Breakdown Excel

A

Loan Payment Schedule with Interest Breakdown Excel document is a detailed spreadsheet that outlines each loan installment, specifying the principal and interest portions for every payment period. This tool helps borrowers understand how much of each payment reduces the loan principal versus the interest accrued, enabling better financial planning and budget management. By providing clear visibility into payment timelines and amounts, it supports informed decisions about loan repayment strategies and potential refinancing options.

Personal Finance Loan Interest Planner Template

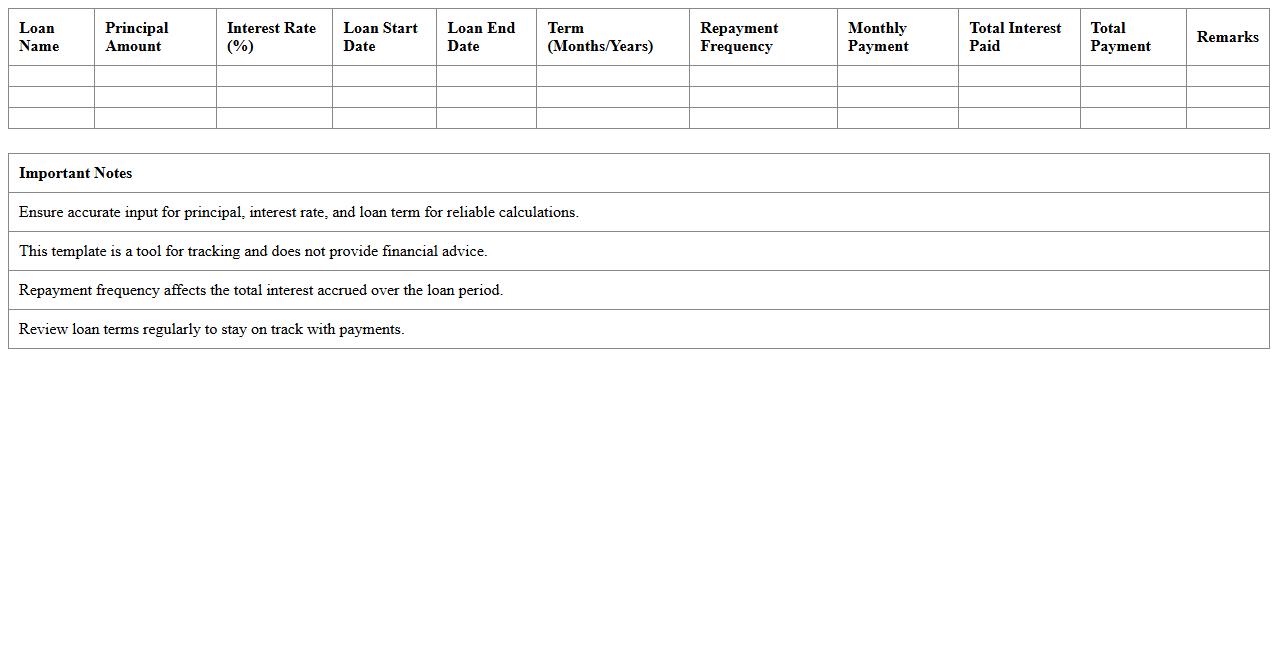

The

Personal Finance Loan Interest Planner Template is a structured document designed to help users calculate and track loan interest payments efficiently. It enables individuals to plan repayment schedules, compare interest rates, and forecast total loan costs, improving financial decision-making and budgeting accuracy. By organizing loan details and interest calculations in one place, this template helps reduce financial stress and promotes smart borrowing habits.

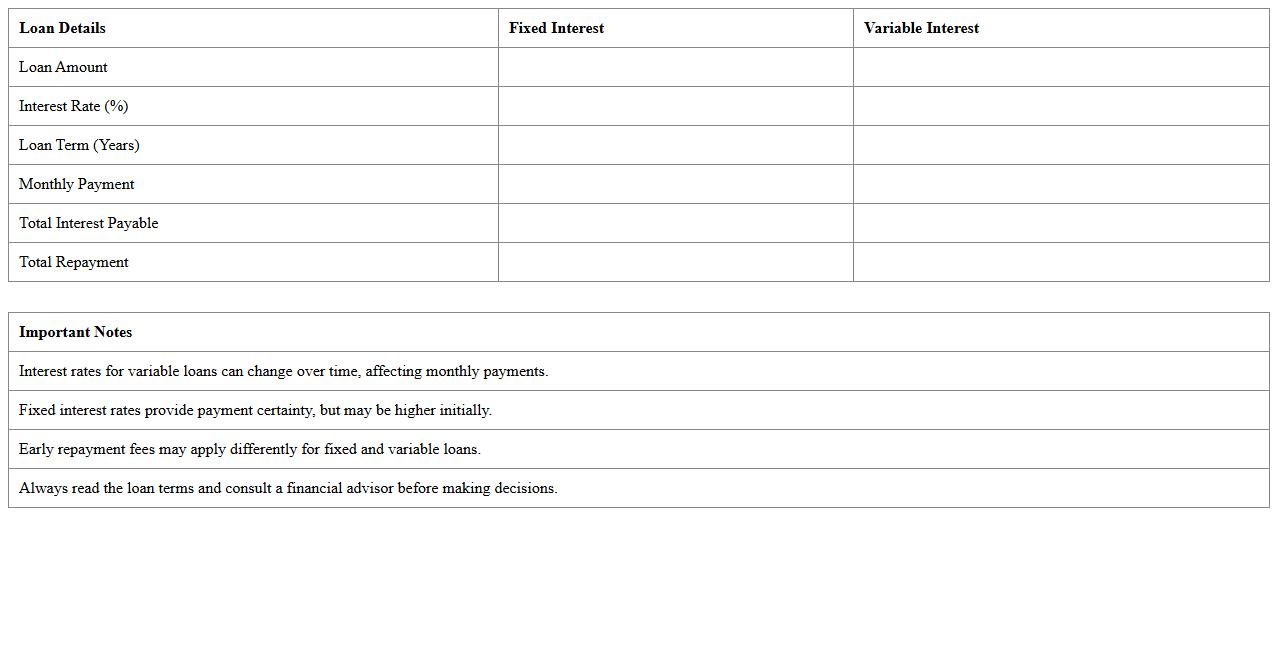

Fixed & Variable Loan Interest Comparison Excel

The

Fixed & Variable Loan Interest Comparison Excel document is a powerful financial tool designed to analyze and compare the impact of fixed versus variable interest rates on loan repayments. By inputting loan terms, interest rates, and durations, users can visualize repayment schedules and total interest paid under both scenarios, enabling informed decision-making. This tool helps borrowers understand potential cost fluctuations and choose the most suitable loan structure based on market trends and personal financial plans.

Personal Loan Repayment Forecast Excel Template

The

Personal Loan Repayment Forecast Excel Template is a financial tool designed to help users accurately predict and manage their loan repayment schedules by inputting loan amount, interest rates, and tenure. This template enables detailed tracking of monthly installment amounts, outstanding balance, and interest payments, improving budgeting and financial planning. It supports informed decisions by offering clear visibility into future liabilities and repayment progress.

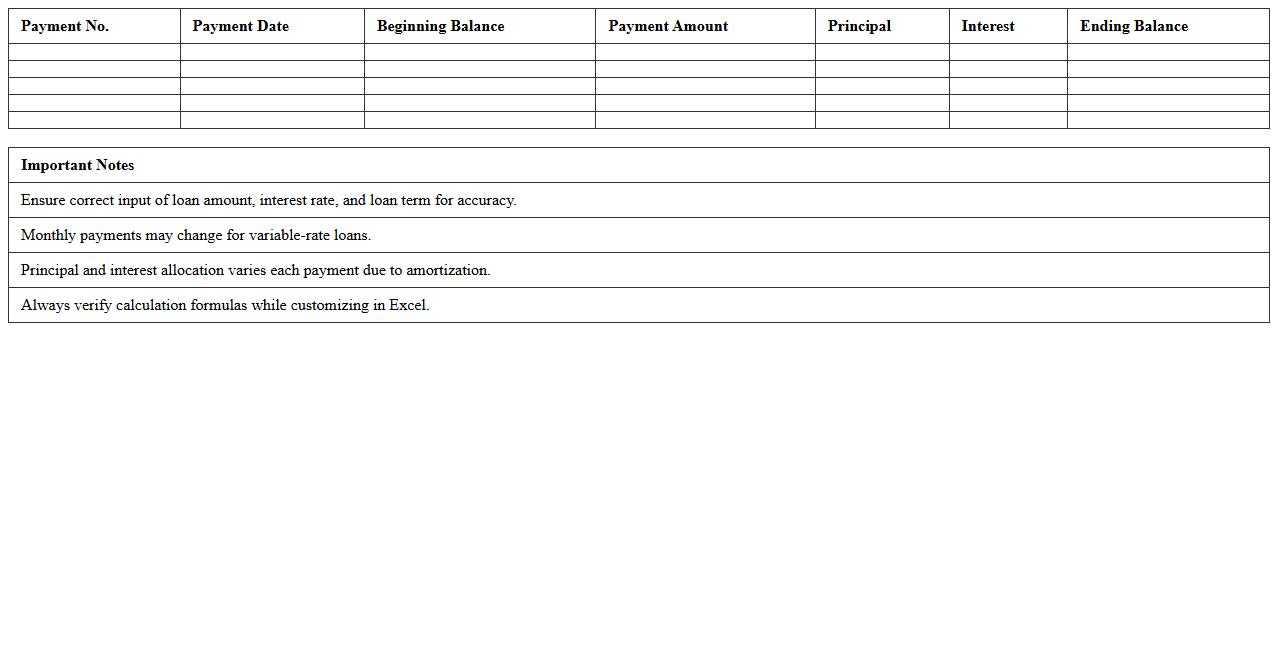

Loan Principal and Interest Split Calculator Excel

A

Loan Principal and Interest Split Calculator Excel document is a tool designed to break down each loan payment into principal and interest components accurately over the loan term. It helps users understand how much of their payment reduces the loan balance versus the interest cost, enabling better financial planning and budgeting. This calculator is essential for tracking loan amortization schedules, optimizing repayment strategies, and managing loan-related expenses efficiently.

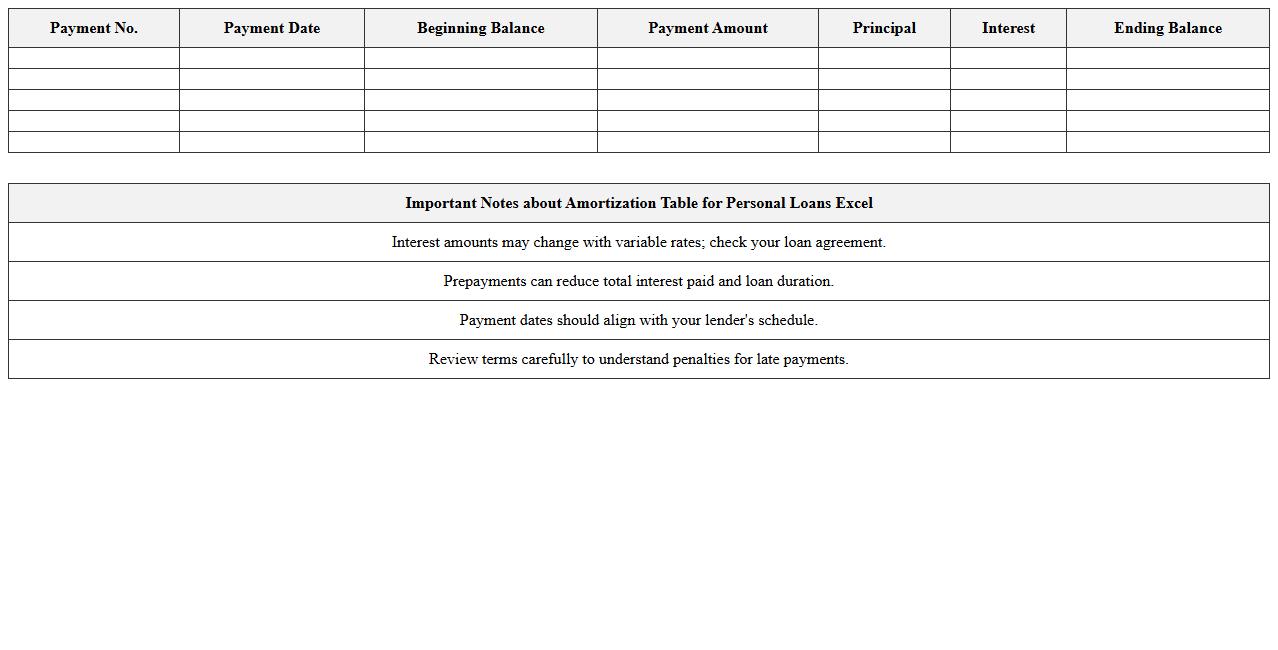

Amortization Table for Personal Loans Excel

An

Amortization Table for Personal Loans Excel document provides a detailed breakdown of each loan payment, showing principal and interest allocation over time. This helps borrowers understand how their monthly payments reduce the loan balance, enabling better financial planning and early payoff strategies. Using this tool improves loan management by offering clear visibility into payment schedules and total interest costs.

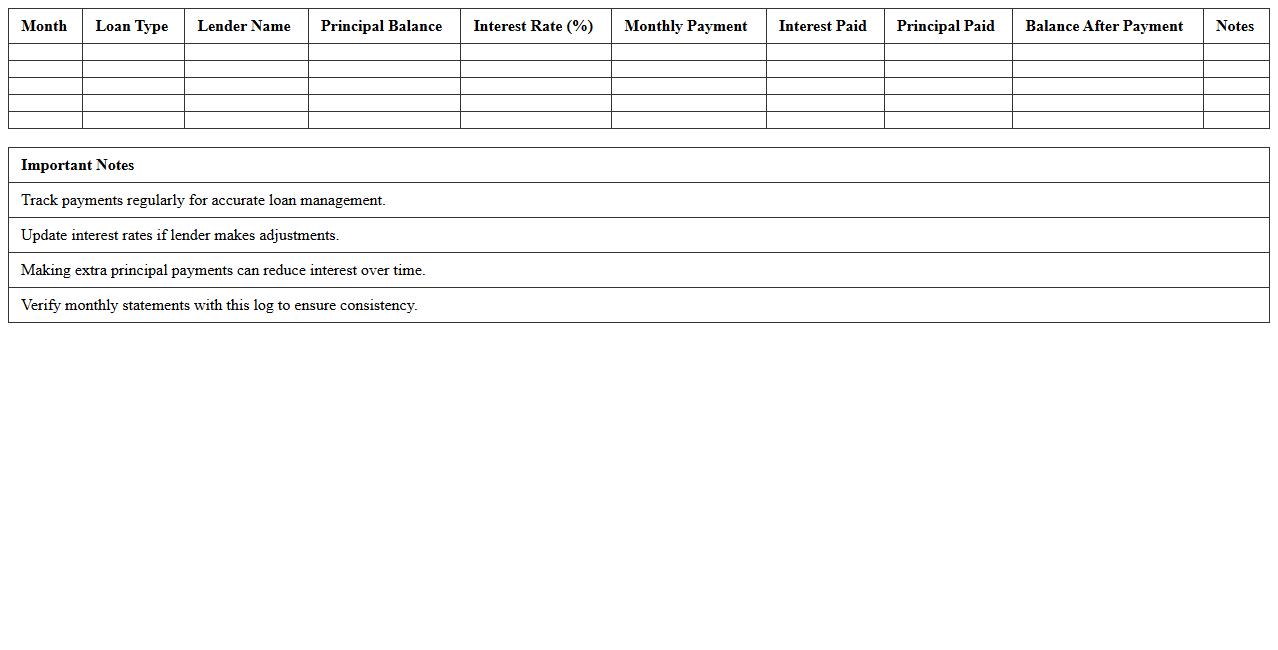

Personal Finance Monthly Loan Interest Log Excel

A

Personal Finance Monthly Loan Interest Log Excel document is a tool designed to track and calculate monthly interest payments on loans, providing a clear overview of loan amortization schedules. It helps users monitor outstanding loan balances, interest costs, and payment history, facilitating more informed financial planning and budgeting. By organizing loan data efficiently, it enables timely payments and better management of personal debts to avoid penalties and optimize financial health.

How to automate variable interest rates in Excel loan calculation sheets?

To automate variable interest rates in Excel, use a dynamic reference table that updates rates over time. Incorporate the VLOOKUP or INDEX-MATCH functions to link these rates to specific loan periods. This setup ensures your loan calculation sheet adjusts interest rates automatically based on the defined schedule.

What formula tracks daily vs monthly loan interest accruals in Excel?

For daily interest accruals, use the formula: =Principal*Rate/365*Days, where 'Days' counts the number of days in the period. For monthly interest accruals, modify it as =Principal*Rate/12 to reflect monthly compounding. These formulas accurately track interest by adjusting periods for precise loan management.

How to generate an amortization schedule for irregular payments in Excel?

Create an amortization schedule for irregular payments by listing payment dates and amounts in separate columns. Use formulas to calculate interest between payments based on the exact days elapsed, such as =PreviousBalance*Rate*(DaysBetween/365). This method tailors the schedule to reflect non-standard payment intervals effectively.

What Excel functions highlight missed loan payments and penalties?

Utilize the IF function combined with TODAY() to identify missed payments, e.g., =IF(PaymentDatevisibly highlighted for quick action.

How to compare multiple loan scenarios using Excel lookup and what-if tools?

Use data tables and the VLOOKUP or INDEX-MATCH functions to create a flexible framework for loan scenarios. Incorporate Excel's What-If Analysis tools such as Goal Seek and Scenario Manager to evaluate different rates, terms, and payments. This combination supports comprehensive comparison of multiple loan options efficiently.

More Calculation Excel Templates