The Compound Interest Calculation Excel Template for investment advisors streamlines the process of projecting investment growth by accurately calculating compound interest over time. This template enables advisors to input principal amounts, interest rates, and compounding frequency to generate detailed reports and visual charts. It enhances client presentations by providing clear, precise financial forecasting tailored to various investment scenarios.

Annual Compound Interest Investment Tracker Template

The

Annual Compound Interest Investment Tracker Template document is a tool designed to monitor and calculate the growth of investments over time by applying compound interest annually. It helps investors visualize their earning progress, estimate future values, and make informed financial decisions by providing accurate, periodic updates. This template simplifies tracking multiple investments, ensuring clear insights into accrued interest and principal, which supports effective portfolio management.

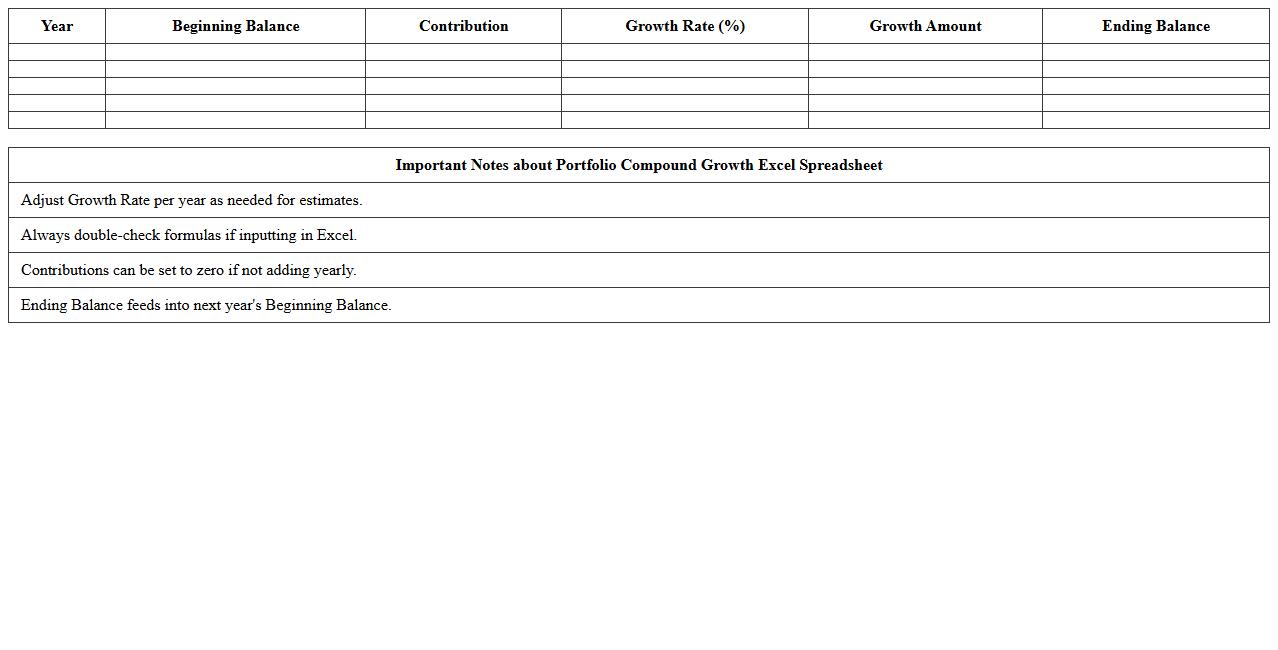

Portfolio Compound Growth Excel Spreadsheet

A

Portfolio Compound Growth Excel Spreadsheet document is a financial tool designed to track and project the growth of investment portfolios by calculating compound interest over time. It allows users to input initial capital, periodic contributions, expected rates of return, and time horizons to visualize the potential value of investments, making it easier to plan for long-term financial goals. This spreadsheet enhances decision-making by providing clear projections and enabling scenario analysis for different investment strategies.

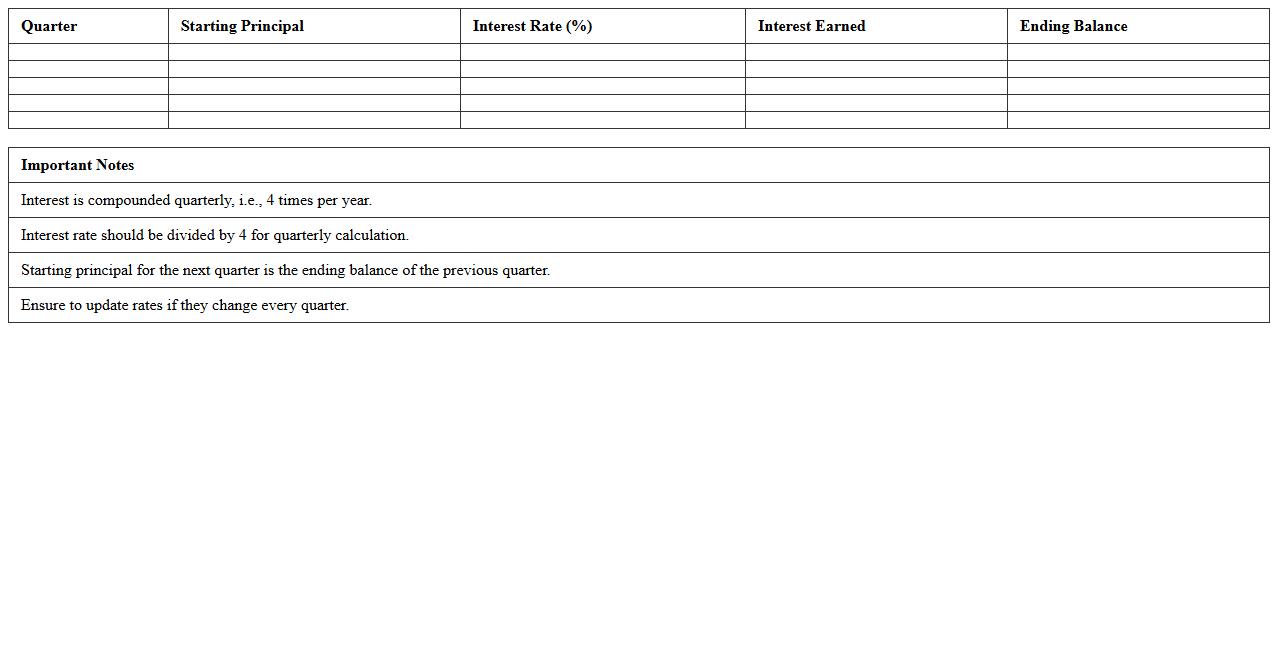

Quarterly Compound Interest Calculator Sheet

A

Quarterly Compound Interest Calculator Sheet is a spreadsheet tool designed to compute interest accrued on investments or loans compounded every quarter, allowing users to input principal amount, interest rate, and time period for accurate calculations. It helps individuals and businesses project future values of investments, optimize financial planning, and compare different compound interest scenarios with ease and precision. This document saves time by automating complex calculations and provides clear, organized data for informed financial decision-making.

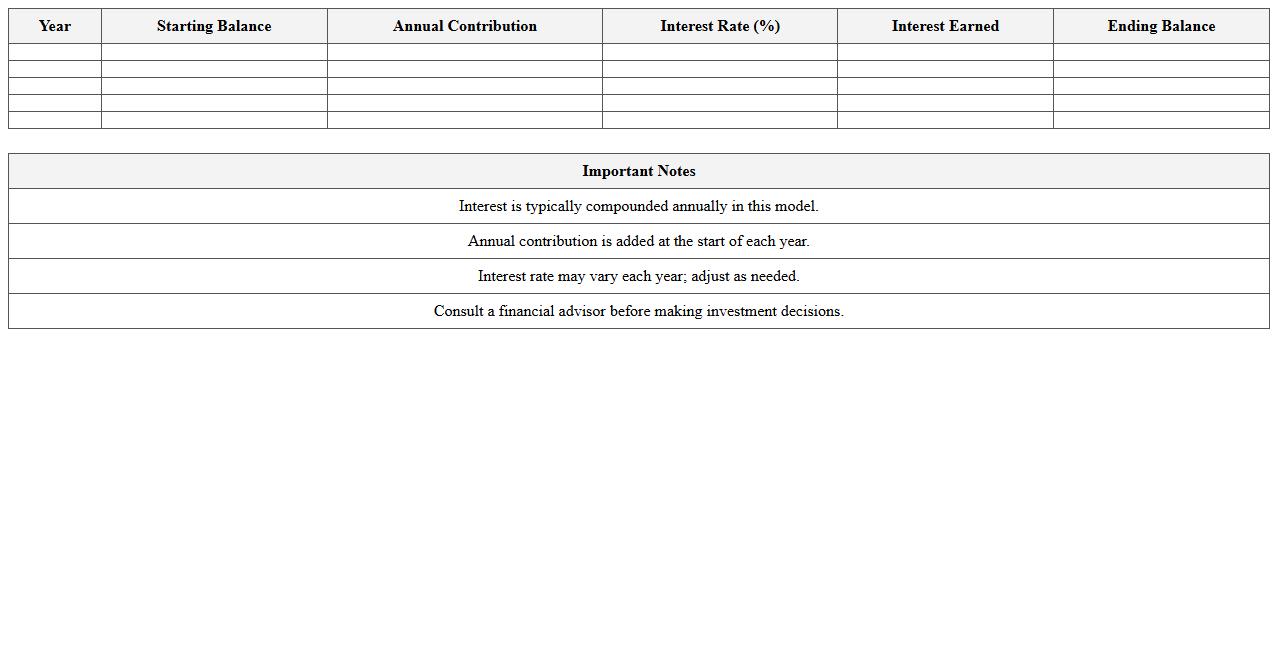

Investment Projection Compound Interest Model

An

Investment Projection Compound Interest Model document outlines the anticipated growth of an investment over time by applying compound interest calculations. It helps investors understand the potential accumulation of their funds by factoring in interest earned on both the initial principal and the accumulated interest from previous periods. This model is useful for making informed financial decisions, setting realistic investment goals, and comparing different investment options based on projected returns.

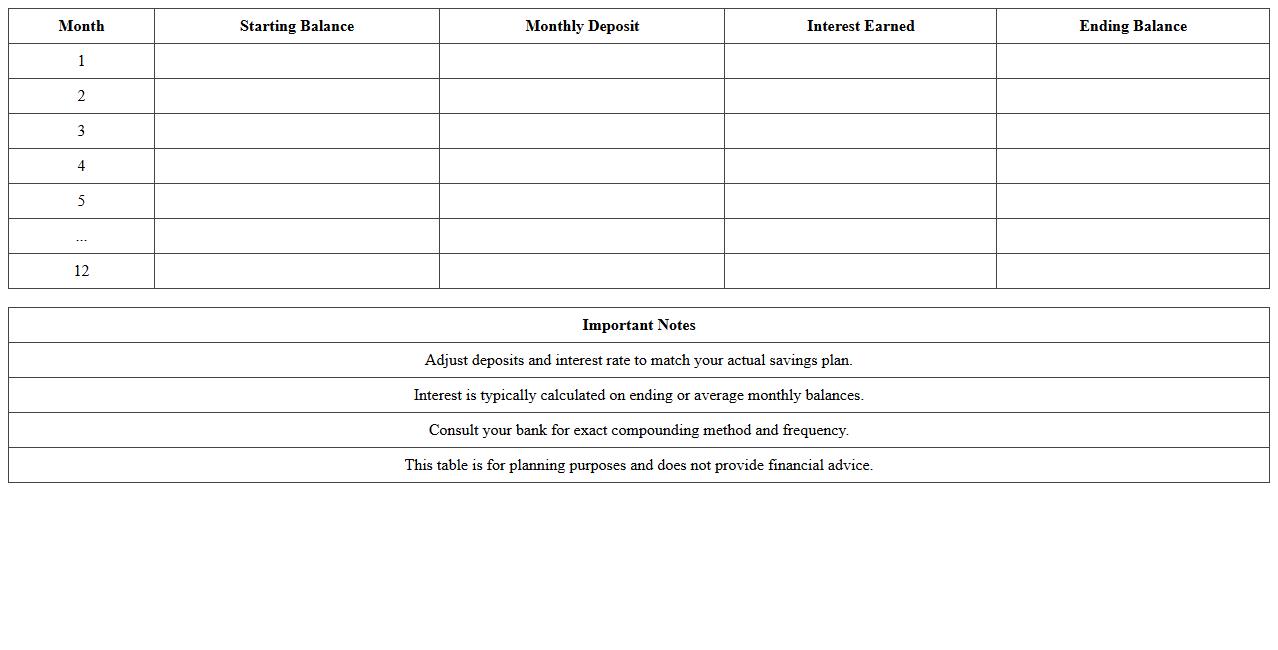

Monthly Compound Interest Savings Planner

A

Monthly Compound Interest Savings Planner document is a financial tool designed to help individuals track and forecast the growth of their savings based on monthly compound interest calculations. It provides detailed projections of accumulated interest over time, enabling users to visualize the benefits of consistent saving and reinvestment. This planner is useful for setting realistic financial goals, optimizing investment strategies, and enhancing long-term wealth accumulation.

Retirement Fund Compound Interest Worksheet

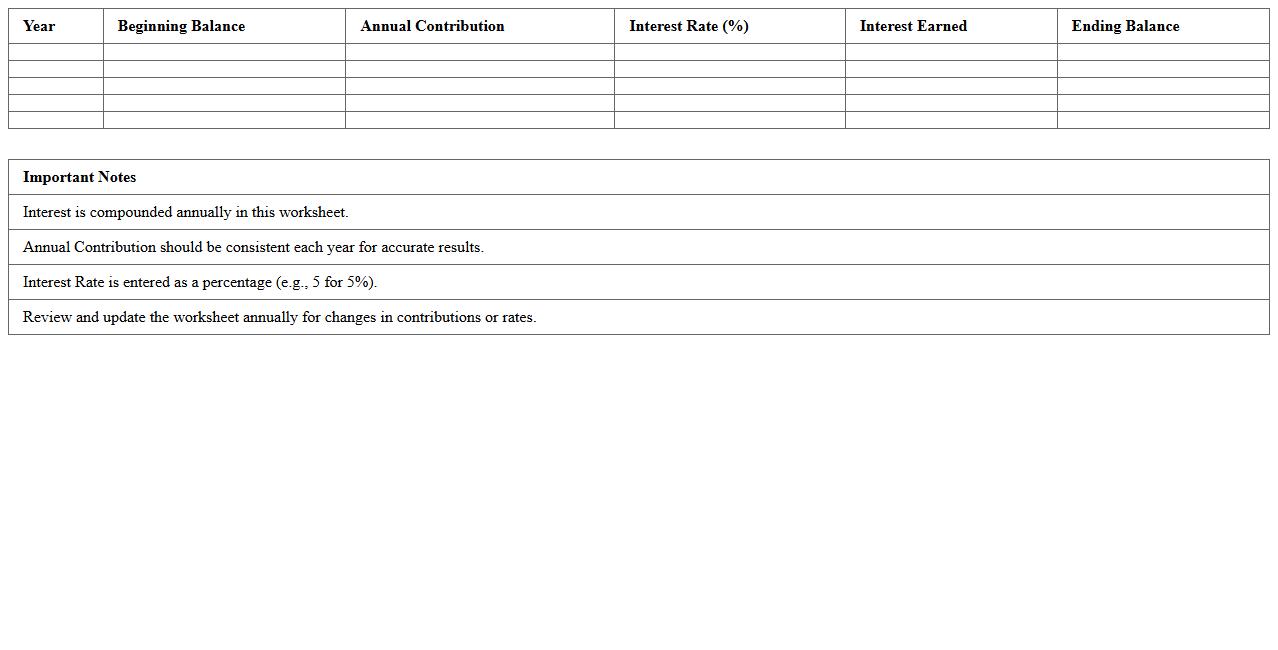

The

Retirement Fund Compound Interest Worksheet is a financial tool designed to help individuals calculate the growth of their retirement savings over time using compound interest formulas. By inputting variables such as initial investment, contribution amount, interest rate, and investment duration, users can project future fund values more accurately. This worksheet aids in strategic planning and ensures informed decision-making for achieving long-term retirement goals.

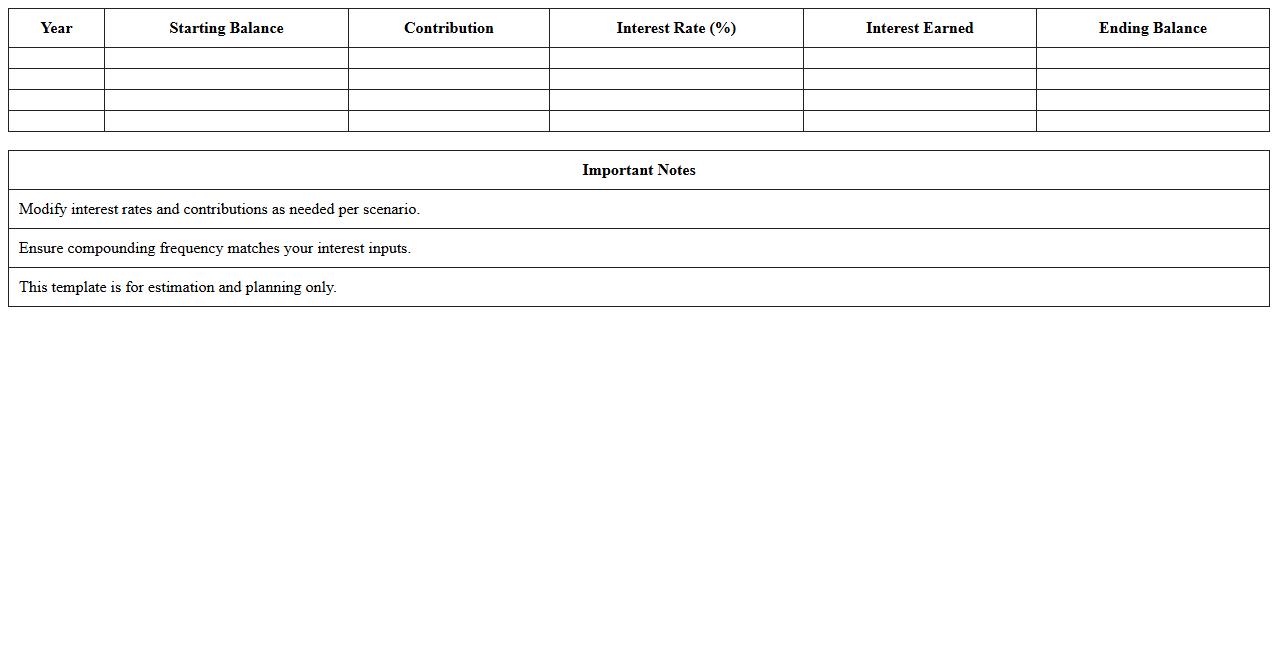

Multi-Account Compound Interest Schedule Template

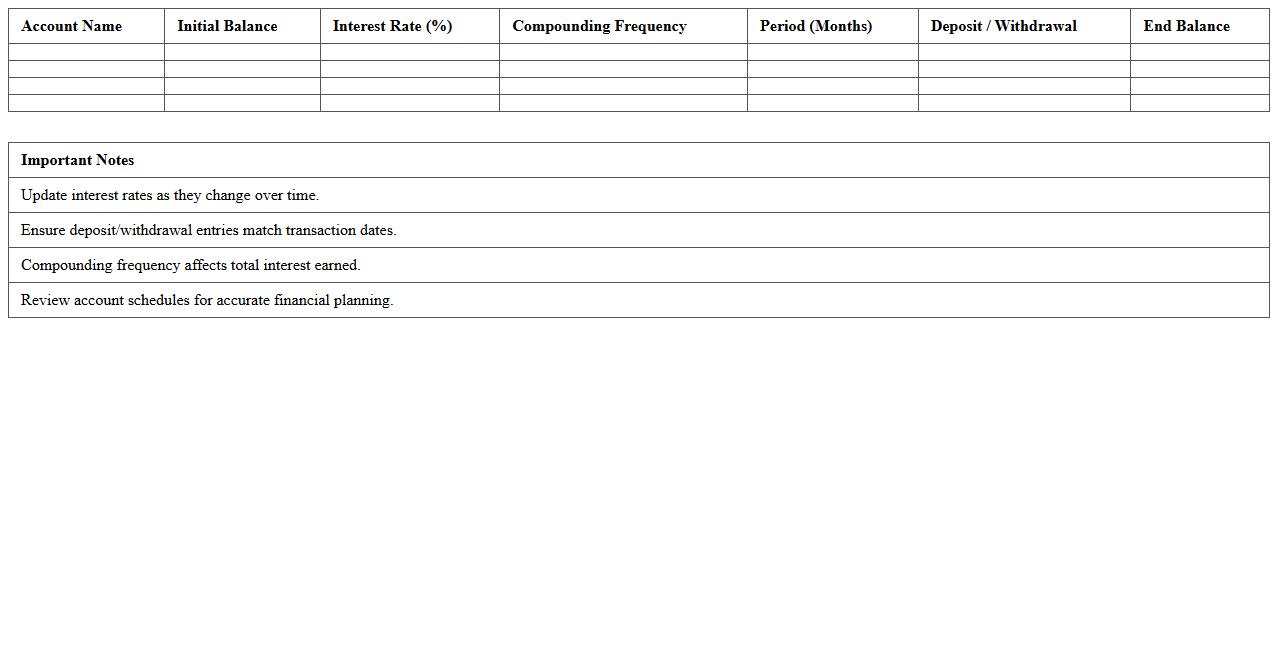

A

Multi-Account Compound Interest Schedule Template is a tool that helps track and calculate the growth of multiple investment accounts over time by applying compound interest formulas. It provides a clear overview of interest accrual, principal balance, and total returns for each account, enabling efficient financial planning and comparison. Using this template enhances accuracy in forecasting investment growth and supports informed decision-making for wealth management.

Client Investment Compound Interest Statement

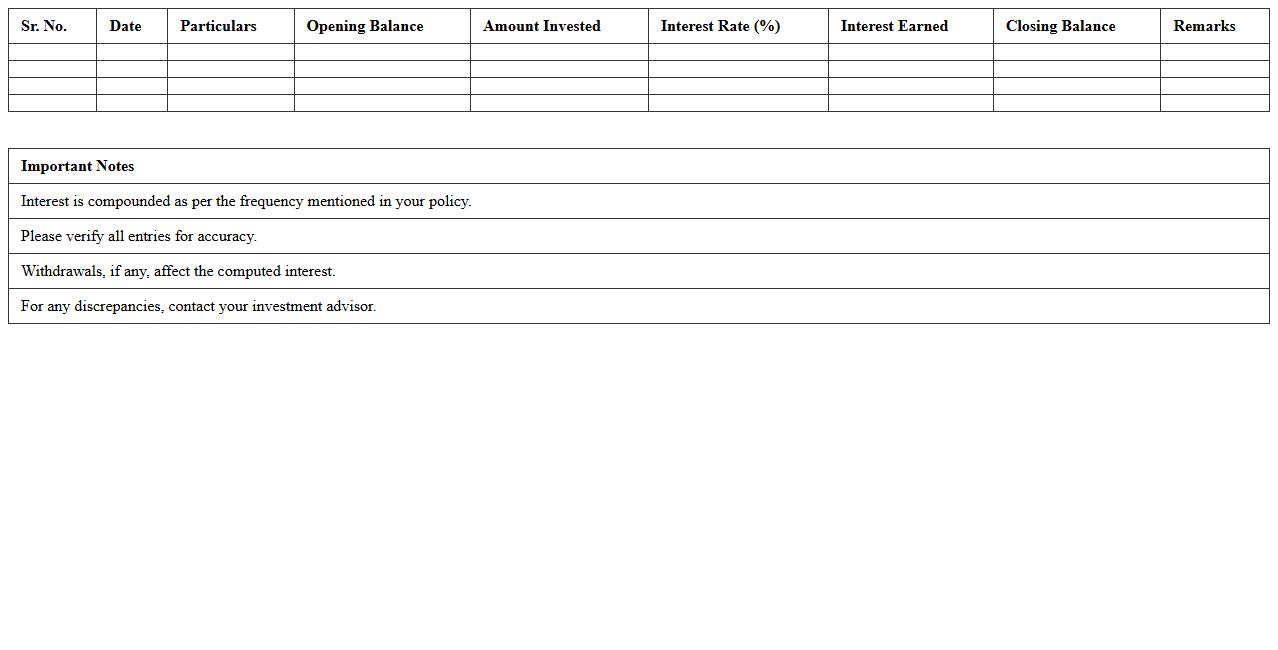

A

Client Investment Compound Interest Statement is a detailed financial document that outlines the accrued interest on an investment over a specific period, calculated using compound interest methods. This statement provides clarity on how the investment's value appreciates by reinvesting earned interest, offering a transparent view of growth potential and returns. Investors and financial advisors utilize this document to make informed decisions, track performance, and plan future investment strategies effectively.

Yearly Compound Interest Returns Analyzer

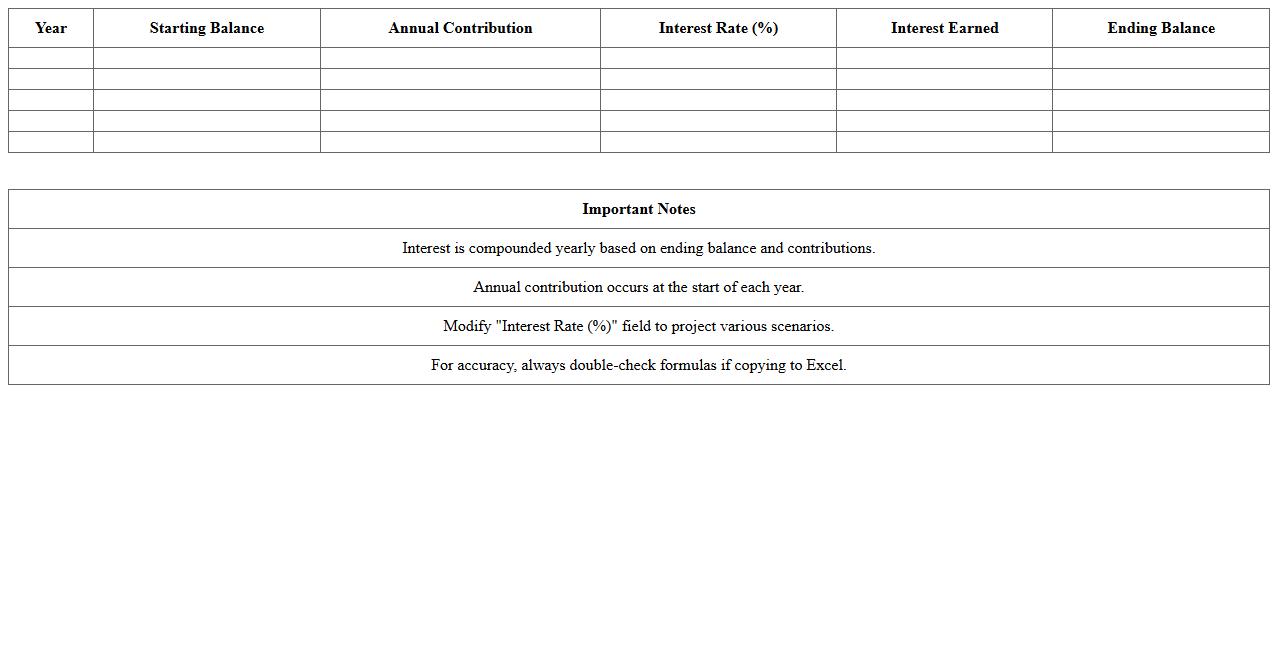

The

Yearly Compound Interest Returns Analyzer document provides a detailed evaluation of investment growth by calculating compound interest over multiple years, allowing users to track the annual returns accurately. It helps investors and financial planners understand the impact of compounding on their investments, identify trends, and make informed decisions based on projected future earnings. This document is essential for optimizing investment strategies and enhancing long-term financial planning through precise return analysis.

Customizable Compound Interest Forecast Template

A

Customizable Compound Interest Forecast Template is a dynamic spreadsheet tool designed to calculate and project investment growth by applying compound interest formulas over customizable time periods, interest rates, and principal amounts. It allows users to visualize potential earnings, compare different investment scenarios, and make informed financial decisions by adjusting parameters to reflect personal or market conditions. This template streamlines complex calculations, saves time, and enhances accuracy in financial planning and forecasting processes.

How to automate compound interest schedules in Excel using dynamic formulas for client portfolios?

To automate compound interest schedules in Excel, use dynamic formulas like FV, PMT, and IPMT that adjust based on input variables. Employ Excel's table feature to automatically extend calculations as new client data is added, ensuring schedules update seamlessly. Linking these formulas with named ranges enhances clarity and flexibility across multiple client portfolios.

What advanced Excel functions best model varying investment periods and rates for compound interest?

The advanced functions INDEX, MATCH, and OFFSET enable dynamic handling of varying investment periods and interest rates. Utilize LET and array formulas to simplify complex models and accommodate fluctuating parameters in compound interest computations. Combining these with DATA VALIDATION ensures accurate inputs for flexible forecasting.

How to generate individualized compound interest statements with mail merge in Excel?

To create personalized compound interest statements, export client data from Excel to Word and use Mail Merge for automated document generation. Integrate dynamic fields referencing Excel cells to populate portfolio details and interest calculations in each client statement. This process streamlines communication and enhances client reporting efficiency.

What Excel templates optimize compound interest projections for multi-asset portfolios?

Excel templates designed for multi-asset portfolios leverage pivot tables and slicers to analyze compound interest across different assets dynamically. Built-in dashboards with data visualization tools help track growth and compare asset performance over variable time frames. These templates reduce manual work and provide comprehensive insights into portfolio projections.

How to audit and track changes in compound interest calculations for client compliance reports?

Use Excel's Track Changes and Sheet Protection features to monitor edits in compound interest formulas, ensuring transparency and accuracy. Employ formula auditing tools like TRACE DEPENDENTS and ERROR CHECKING to validate calculations before report finalization. Keeping detailed version histories aids compliance and provides accountability in client reporting processes.

More Calculation Excel Templates