The Retirement Corpus Calculation Excel Template for Financial Advisors provides a comprehensive tool to accurately estimate the total savings required for a client's retirement. It incorporates variables such as inflation, expected returns, and retirement duration, helping advisors create tailored financial plans. This template streamlines the retirement planning process, ensuring precise and efficient analysis for optimal investment strategies.

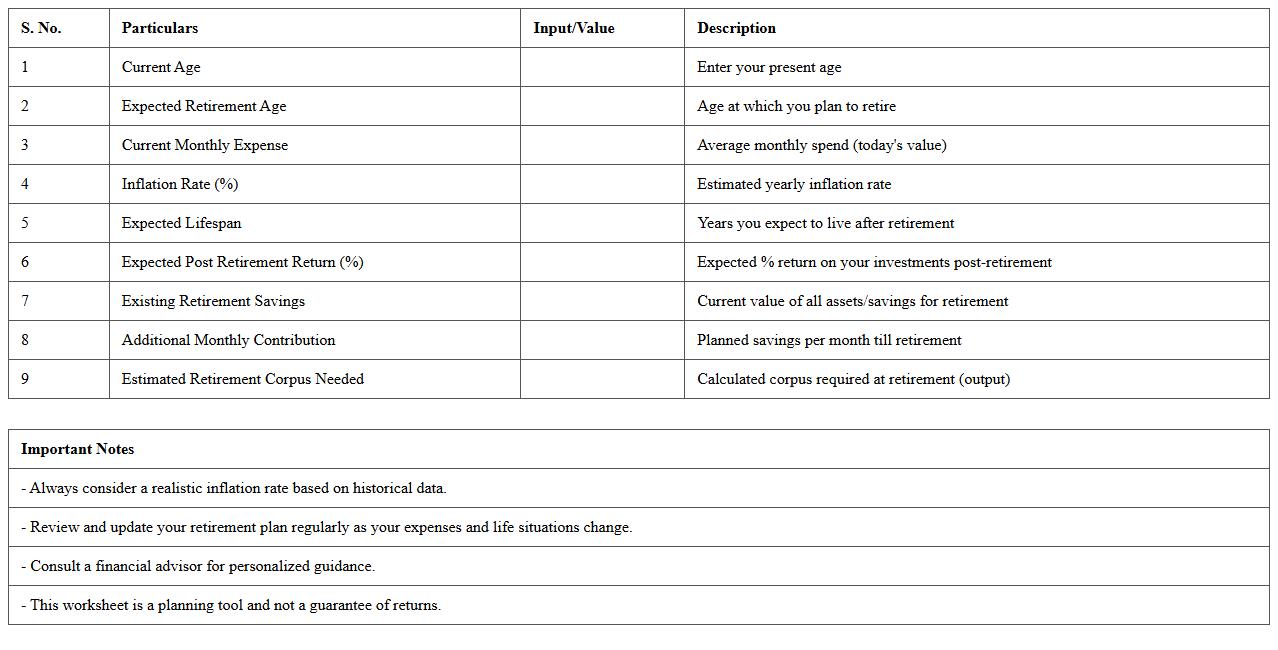

Retirement Corpus Estimation Worksheet Excel Template

The

Retirement Corpus Estimation Worksheet Excel Template is a financial planning tool designed to calculate the amount of money required for a comfortable retirement based on various factors such as current savings, expected inflation, and future expenses. This template helps users forecast the retirement corpus by incorporating personalized inputs, enabling more accurate and data-driven retirement planning. Utilizing this tool allows individuals to make informed decisions about savings goals and investment strategies to ensure long-term financial security.

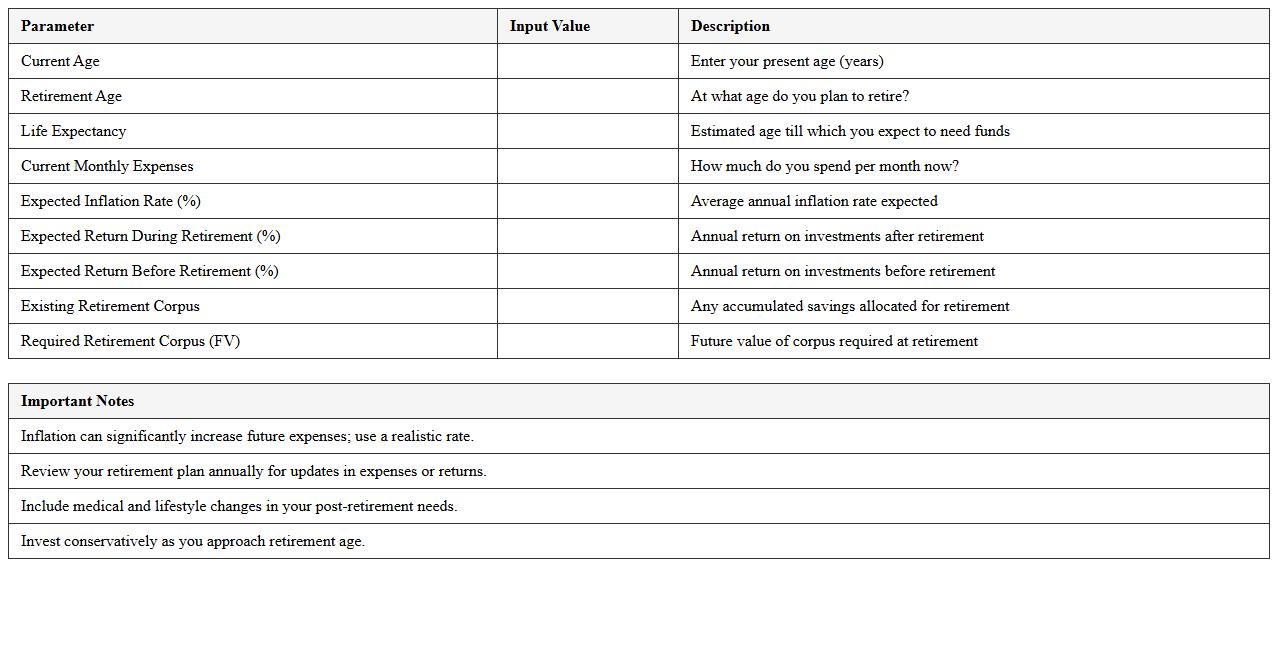

Future Value Retirement Corpus Calculator Excel

The

Future Value Retirement Corpus Calculator Excel document is a powerful financial tool designed to estimate the amount of money one will accumulate by retirement based on current savings, expected contributions, and assumed rates of return. It helps users visualize the growth of their investments over time, enabling better planning and informed decision-making for retirement goals. This tool is essential for individuals seeking to ensure they meet their long-term financial objectives by providing a clear projection of their retirement corpus.

Customized Retirement Savings Projection Template Excel

A

Customized Retirement Savings Projection Template Excel is a dynamic financial tool designed to forecast your retirement savings based on personalized inputs like current age, savings rate, investment returns, and retirement age. It enables users to visualize potential retirement outcomes, adjust variables to see different scenarios, and make informed decisions to optimize their savings strategy. This template is invaluable for planning a secure financial future by providing clear, data-driven insights tailored to individual retirement goals.

Lump Sum Retirement Corpus Planning Sheet Excel

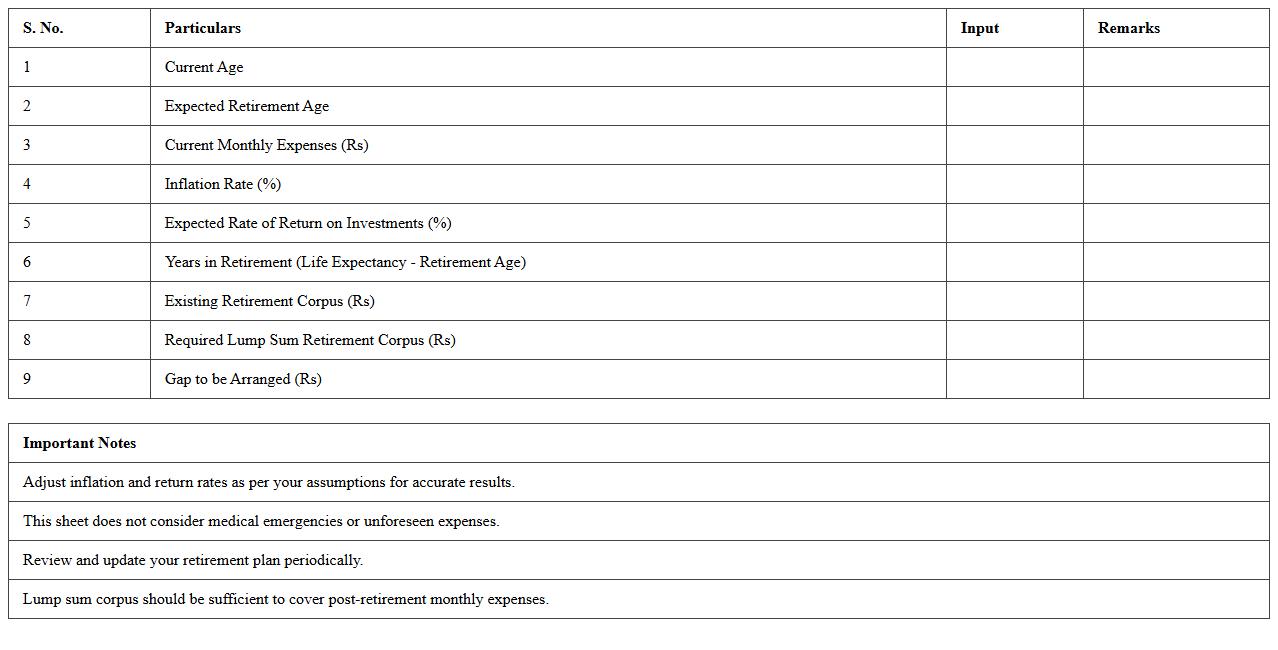

The

Lump Sum Retirement Corpus Planning Sheet Excel document is a financial tool designed to help individuals estimate the total amount of money needed at retirement to sustain their desired lifestyle. By inputting variables such as current savings, expected returns, inflation rate, and retirement duration, users can project the future corpus required for withdrawal. This sheet aids in strategic retirement planning by enabling precise calculations and adjustments, ensuring better preparedness for financial independence.

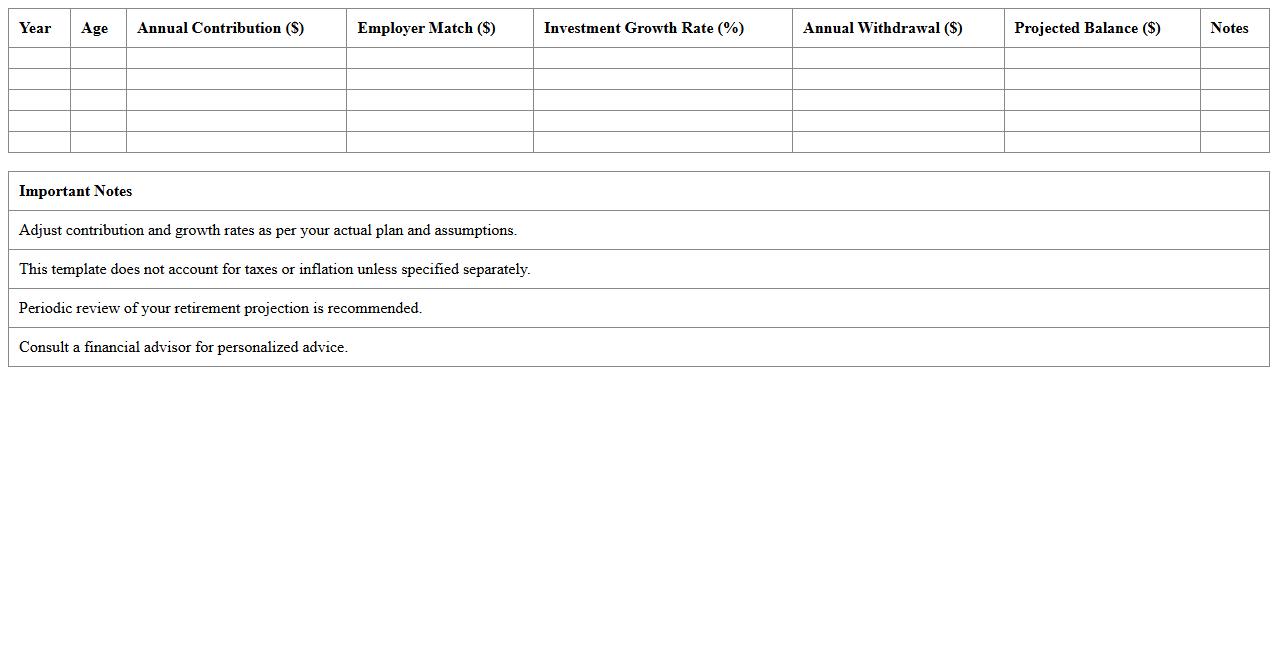

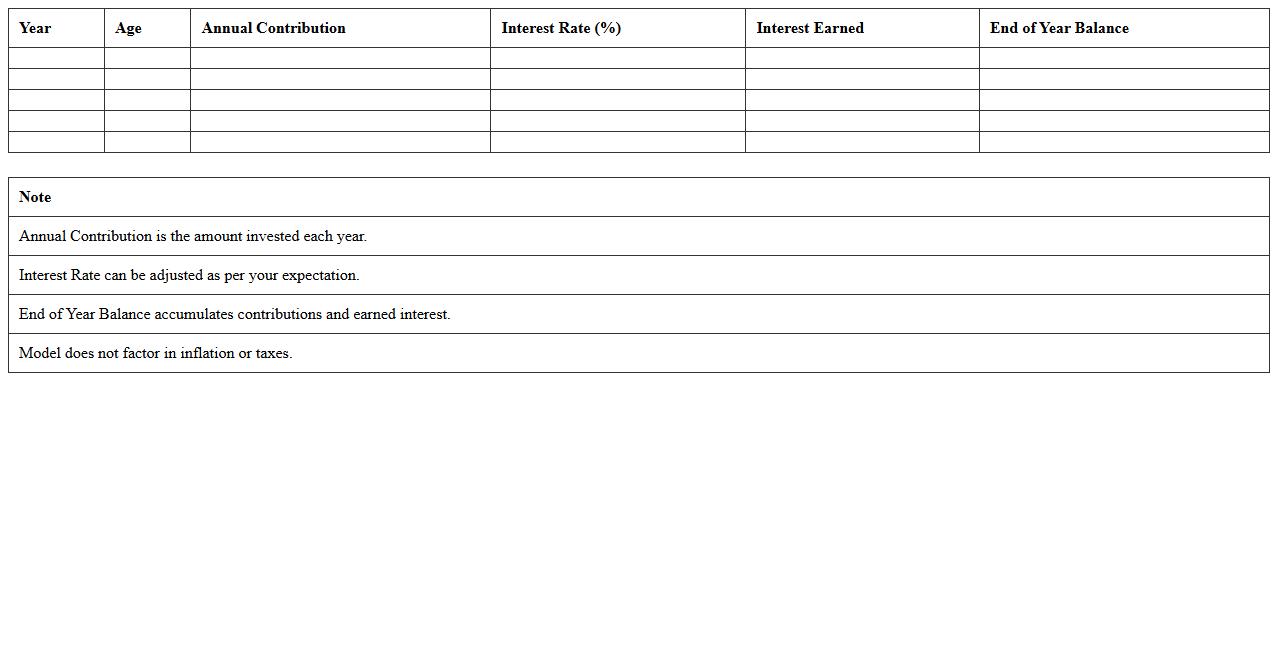

Annual Contribution Retirement Corpus Model Excel

The

Annual Contribution Retirement Corpus Model Excel document is a financial planning tool designed to calculate the growth of retirement savings based on yearly contributions and expected investment returns. It helps users project their retirement corpus by factoring in variables such as contribution amount, rate of return, and investment duration. This model is useful for making informed decisions about how much to save annually to achieve specific retirement goals and ensuring financial security in later years.

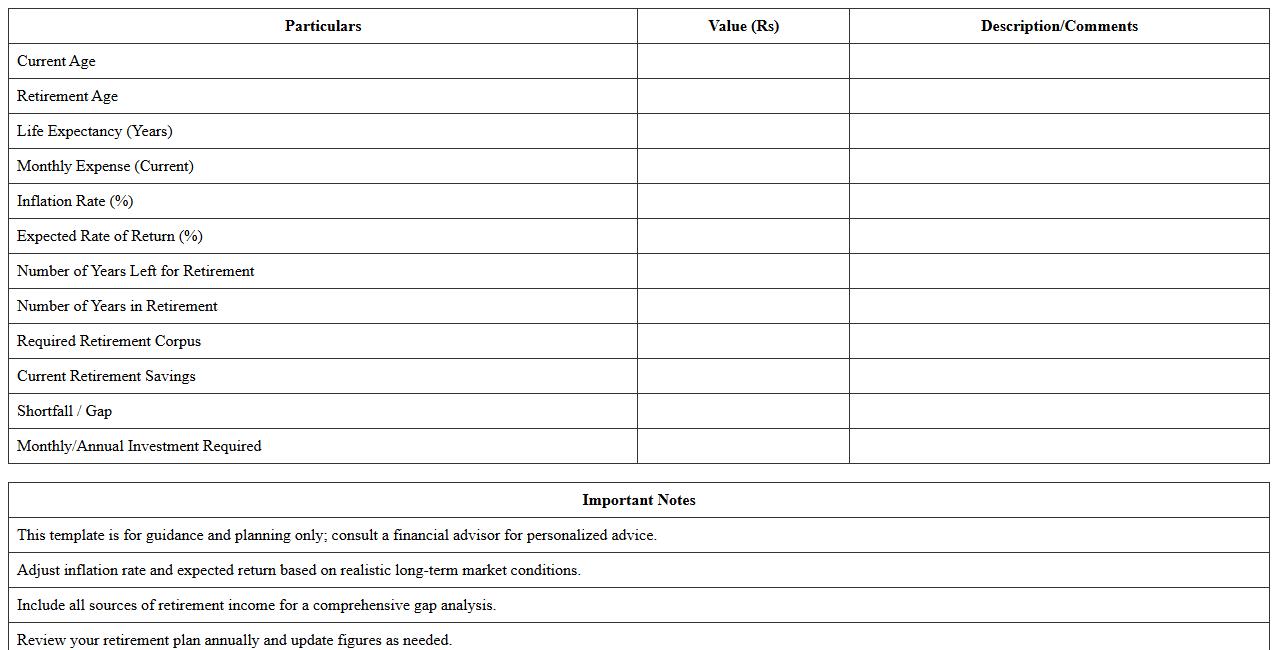

Retirement Corpus Goal Gap Analysis Excel Template

The

Retirement Corpus Goal Gap Analysis Excel Template is a financial planning tool designed to help individuals evaluate the difference between their current retirement savings and the desired retirement corpus. It enables users to input variables such as current savings, expected inflation, investment returns, and retirement age to calculate the shortfall or surplus in meeting retirement goals. This template facilitates informed decision-making by clearly identifying the gap, allowing users to adjust savings plans and investment strategies accordingly.

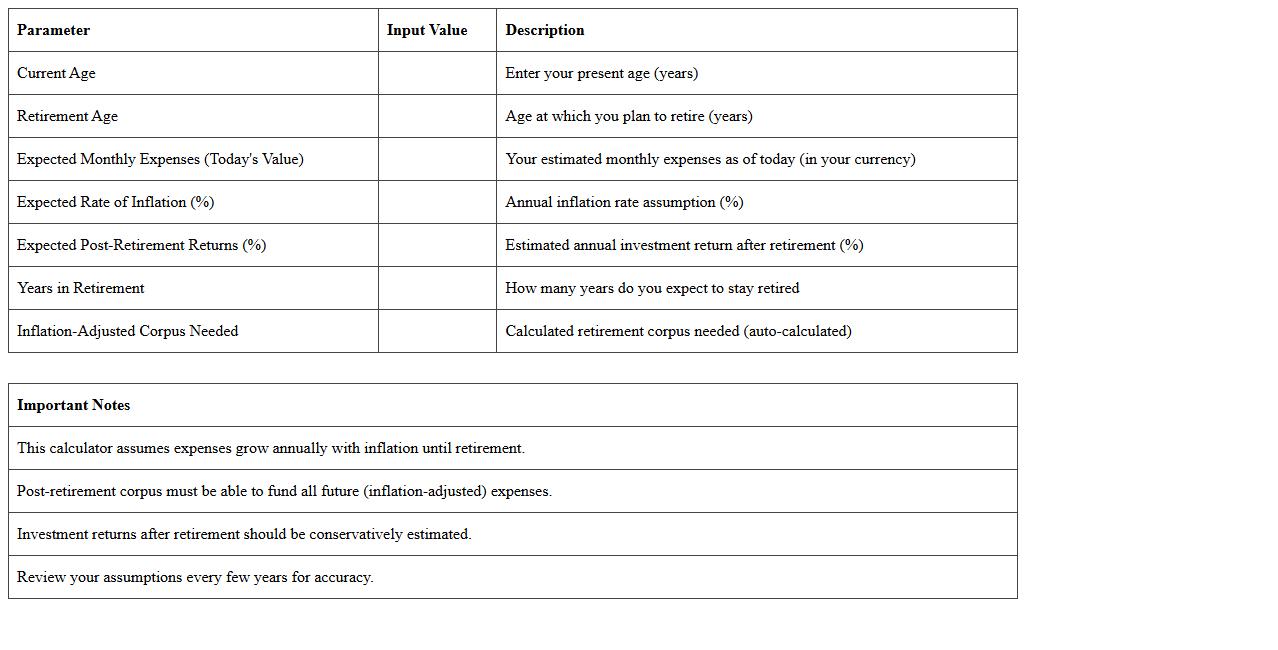

Inflation-Adjusted Retirement Corpus Calculator Excel

The

Inflation-Adjusted Retirement Corpus Calculator Excel document is a financial tool designed to estimate the amount of savings required for retirement while accounting for future inflation rates. This calculator helps users project the real value of their retirement corpus, ensuring their purchasing power is maintained over time despite rising living costs. By inputting variables like current expenses, expected inflation rate, and retirement duration, individuals can create a more accurate and personalized retirement plan.

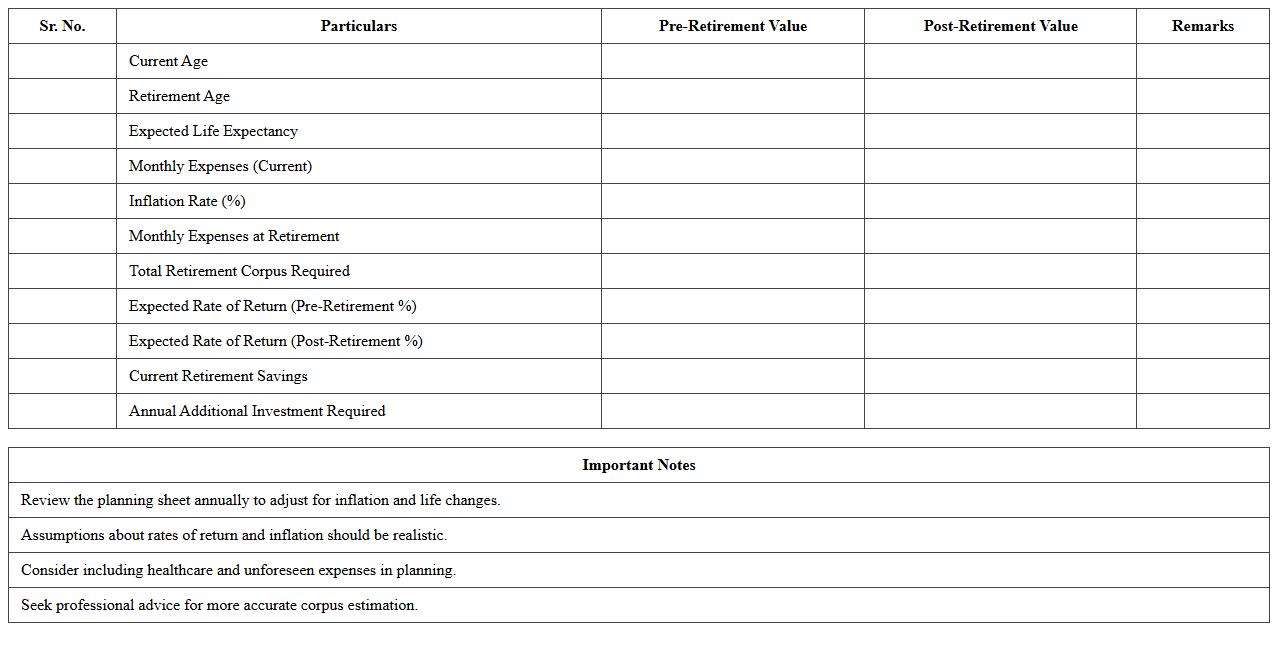

Pre- and Post-Retirement Corpus Planning Sheet Excel

The

Pre- and Post-Retirement Corpus Planning Sheet Excel document is a comprehensive financial tool designed to help individuals systematically estimate and manage their retirement savings. It enables users to calculate the required corpus before retirement to sustain their lifestyle and project post-retirement expenses, considering factors like inflation, expected returns, and withdrawal rates. This planning sheet is useful for ensuring financial security by providing a clear roadmap for accumulating and efficiently utilizing retirement funds.

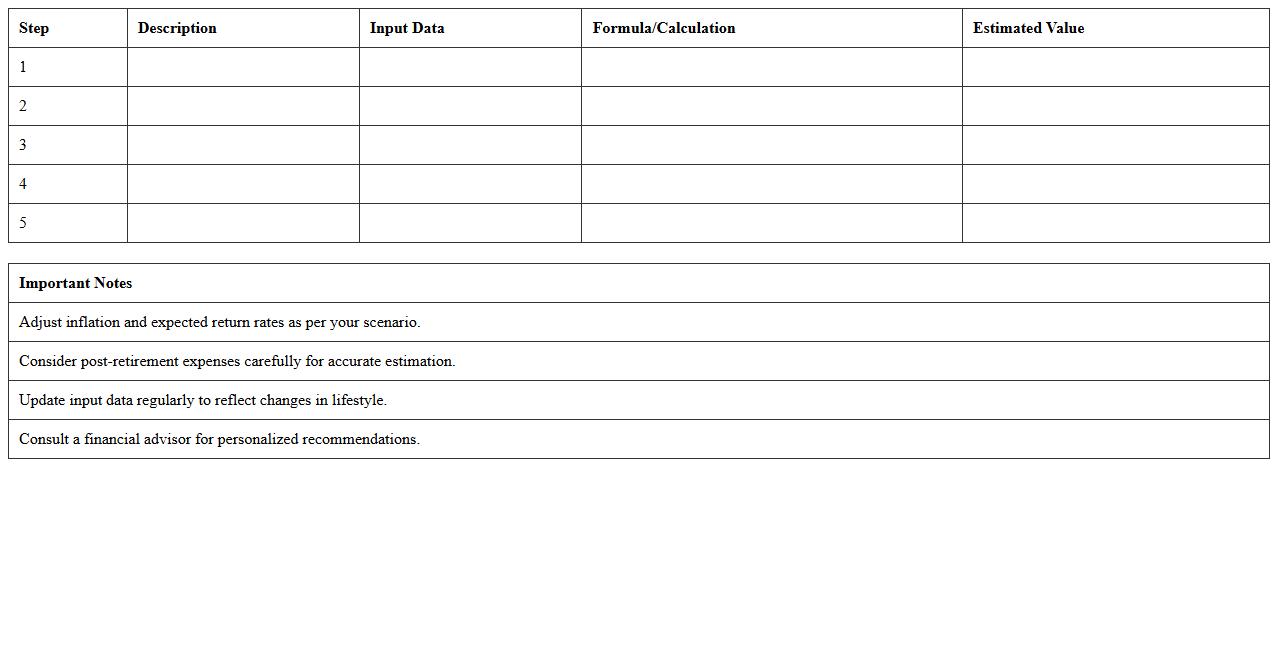

Step-by-Step Retirement Corpus Estimation Excel

The

Step-by-Step Retirement Corpus Estimation Excel document is a detailed financial planning tool designed to calculate the total amount of savings needed for retirement based on individual inputs like current age, expected retirement age, inflation rate, and monthly expenses. This Excel sheet helps users create a personalized retirement plan by projecting future expenses and adjusting for factors like inflation and investment growth, making it easier to understand how much money to set aside. It is especially useful for individuals seeking clarity on their retirement goals and for financial advisors assisting clients with systematic savings strategies.

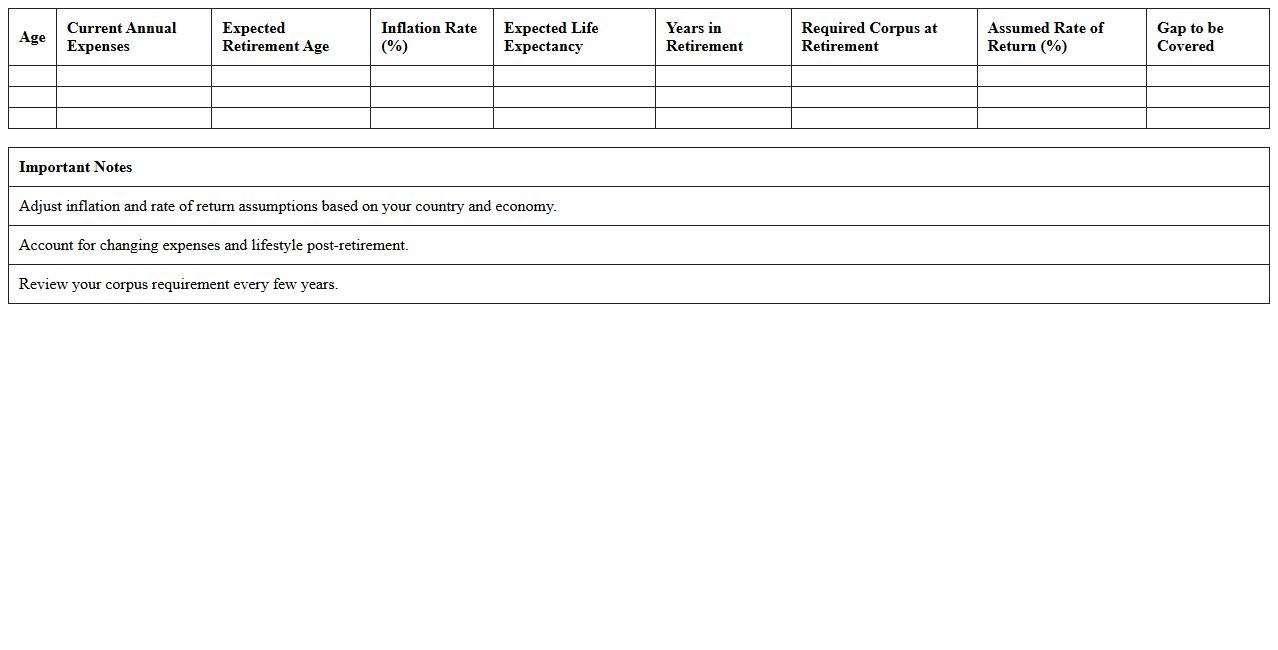

Age-Wise Retirement Corpus Requirement Template Excel

The

Age-Wise Retirement Corpus Requirement Template Excel document is a structured financial planning tool designed to estimate the retirement corpus needed at various ages to sustain desired post-retirement lifestyles. By inputting variables such as current age, expected retirement age, inflation rate, and anticipated expenses, users can generate a detailed corpus projection tailored to their unique financial goals. This template helps individuals make informed decisions on savings and investments to ensure sufficient funds are available throughout retirement.

How can I automate inflation-adjusted projections in my Retirement Corpus Calculation Excel sheet?

To automate inflation-adjusted projections, use Excel's built-in functions like FV (Future Value) combined with a fixed inflation rate cell reference. This setup allows your retirement corpus to grow in real terms by factoring in inflation over time. You can easily update the inflation rate cell to see updated projections without manual recalculations.

What Excel functions best optimize tax implication modeling for retirement withdrawals?

Excel functions such as IF, VLOOKUP, and nested formulas are key to tax implication modeling for retirement withdrawals. Using these, you can create tax brackets and calculate tax liabilities dynamically based on withdrawal amounts. Incorporating these functions improves accuracy and allows specific tax scenarios to be modeled directly within the sheet.

How do I integrate dynamic life expectancy assumptions into the calculation model?

Dynamic life expectancy assumptions can be integrated using Excel's data validation and lookup tables. Create a dropdown list to select different life expectancy values, and tie this selection into your formula calculations to adjust the retirement horizon automatically. This approach enables flexible scenario planning based on user-defined longevity assumptions.

Which inputs are essential for customizing client-specific expense categories in the corpus template?

Essential inputs for customizing client-specific expense categories include housing, healthcare, leisure, and unexpected expenses. Each category should have editable fields for monthly or annual amounts to reflect the client's unique spending patterns accurately. Proper categorization ensures that the retirement corpus model is personalized and comprehensive.

Can I create scenario analysis (e.g., market downturns) within the Retirement Corpus Excel file?

Yes, you can create scenario analysis in Excel using tools like Data Tables, Scenario Manager, or What-If Analysis. Define different market conditions, such as downturns or booms, with varying rates of return to observe their impact on your retirement corpus. This capability is crucial for stress-testing financial plans against uncertain market fluctuations.

More Calculation Excel Templates