The VAT Calculation Excel Template for Freelancers simplifies the process of tracking and calculating value-added tax for freelance professionals. It offers easy-to-use fields for income, expenses, and VAT rates, enabling accurate and efficient tax reporting. This template ensures compliance with tax regulations while saving time on manual calculations.

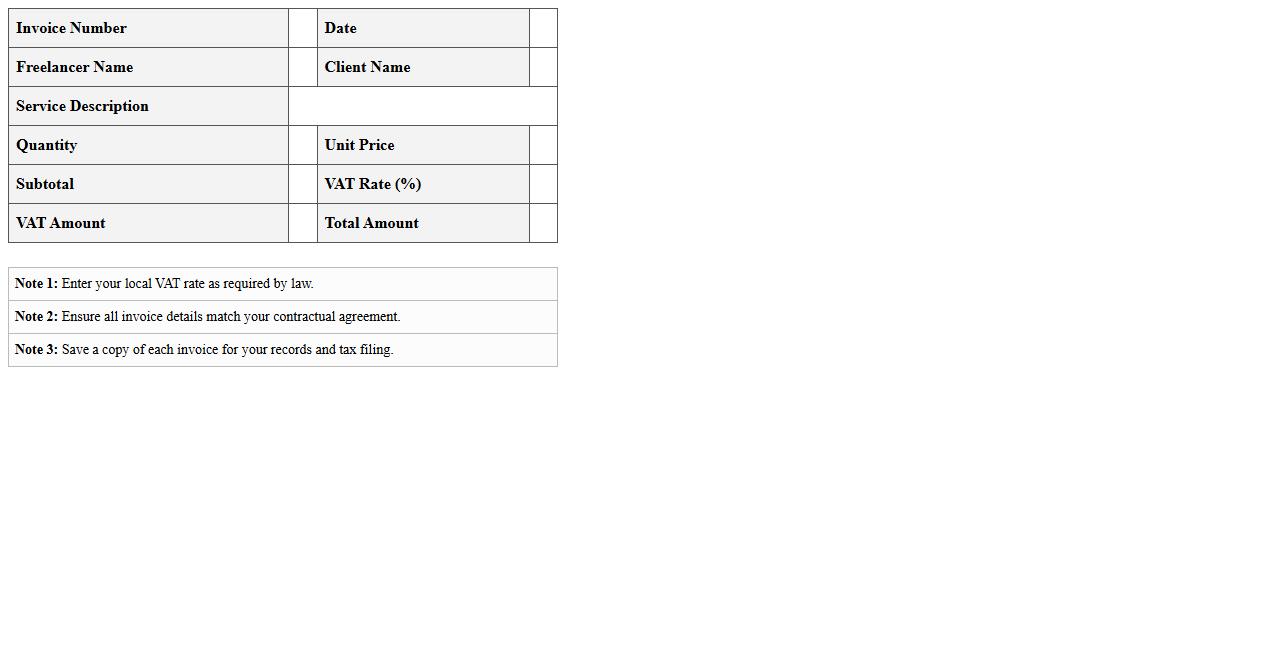

Simple VAT Invoice Calculator for Freelancers

A

Simple VAT Invoice Calculator for Freelancers document is a practical tool designed to help freelancers accurately calculate the Value Added Tax (VAT) on their invoices. It streamlines the process of determining the correct VAT amount, ensuring compliance with tax regulations and preventing errors in billing. This document saves time, improves financial accuracy, and supports freelancers in maintaining clear, professional invoicing records.

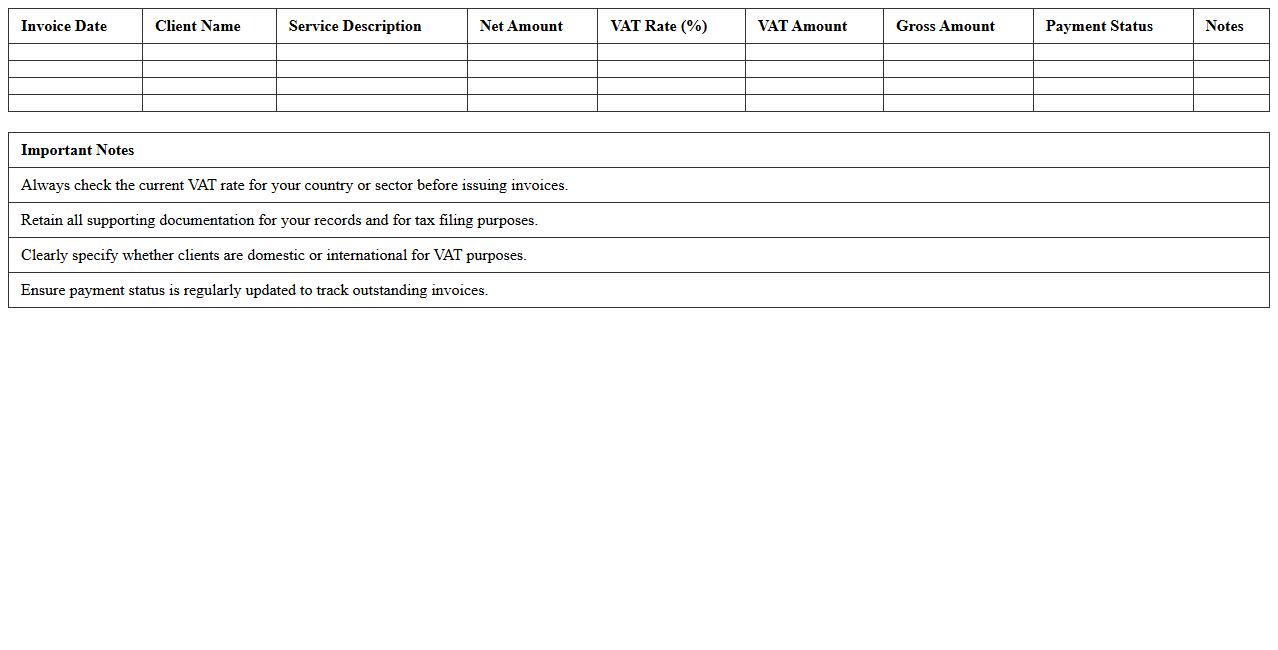

Freelance Service VAT Breakdown Spreadsheet

A

Freelance Service VAT Breakdown Spreadsheet document organizes and calculates the Value Added Tax (VAT) on freelance services, ensuring accurate tax reporting. It helps freelancers track VAT collected and paid on invoices, simplifying tax filing and compliance with tax authorities. By clearly breaking down VAT components, it minimizes errors and aids in financial planning and audit preparedness.

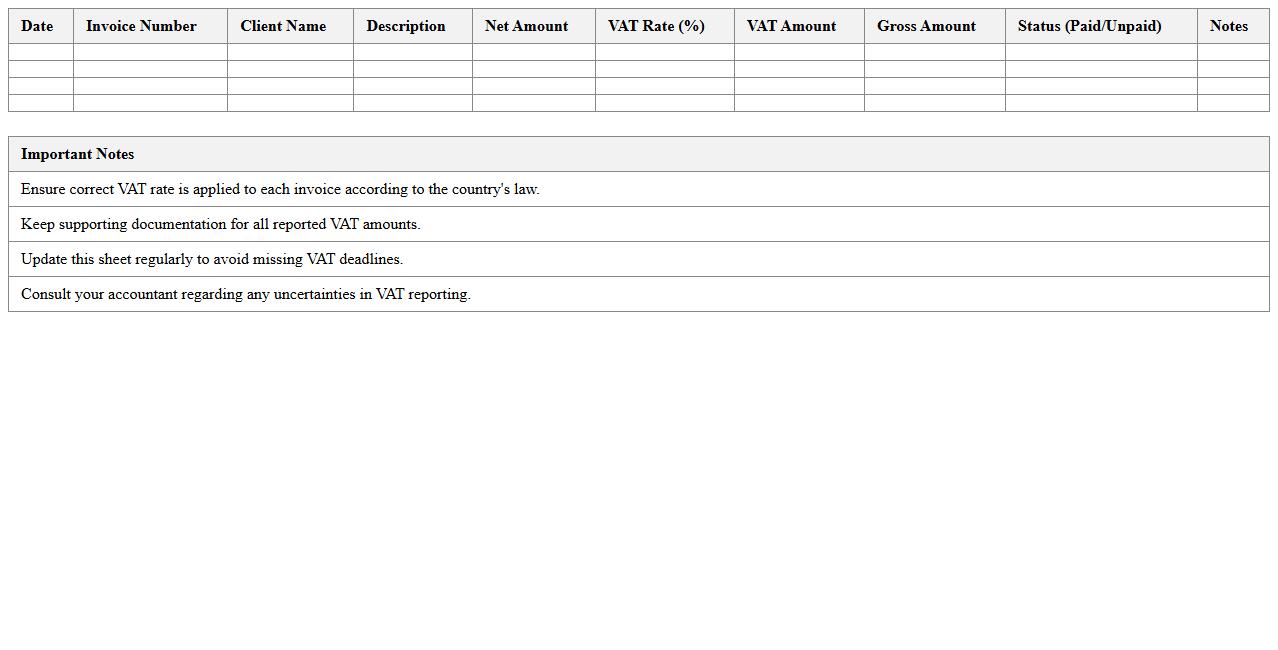

Automated VAT Tracker for Self-Employed Professionals

The

Automated VAT Tracker for Self-Employed Professionals is a digital tool designed to simplify VAT management by automatically recording and calculating VAT obligations based on real-time income and expenses data. It ensures accurate VAT returns, reduces manual errors, and helps maintain compliance with tax regulations, saving time and avoiding potential penalties. This document acts as a reliable record that supports efficient tax filing and financial planning for self-employed individuals.

VAT Summary and Reporting Sheet for Freelancers

The

VAT Summary and Reporting Sheet for Freelancers is a comprehensive financial document designed to track and summarize all VAT-related transactions, including taxable sales and purchases. It helps freelancers ensure accurate VAT calculations, timely submissions, and compliance with tax regulations by providing organized data for quarterly or annual VAT returns. This sheet simplifies tax management, reduces errors, and aids in maintaining transparent records for audits or financial reviews.

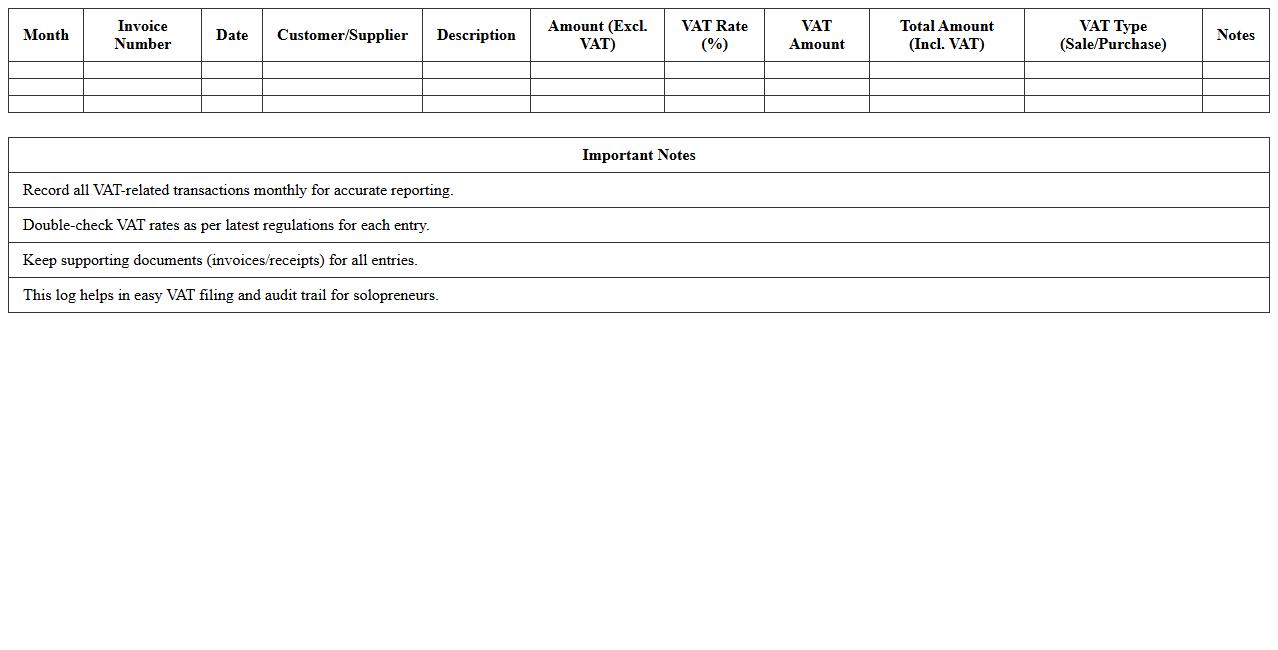

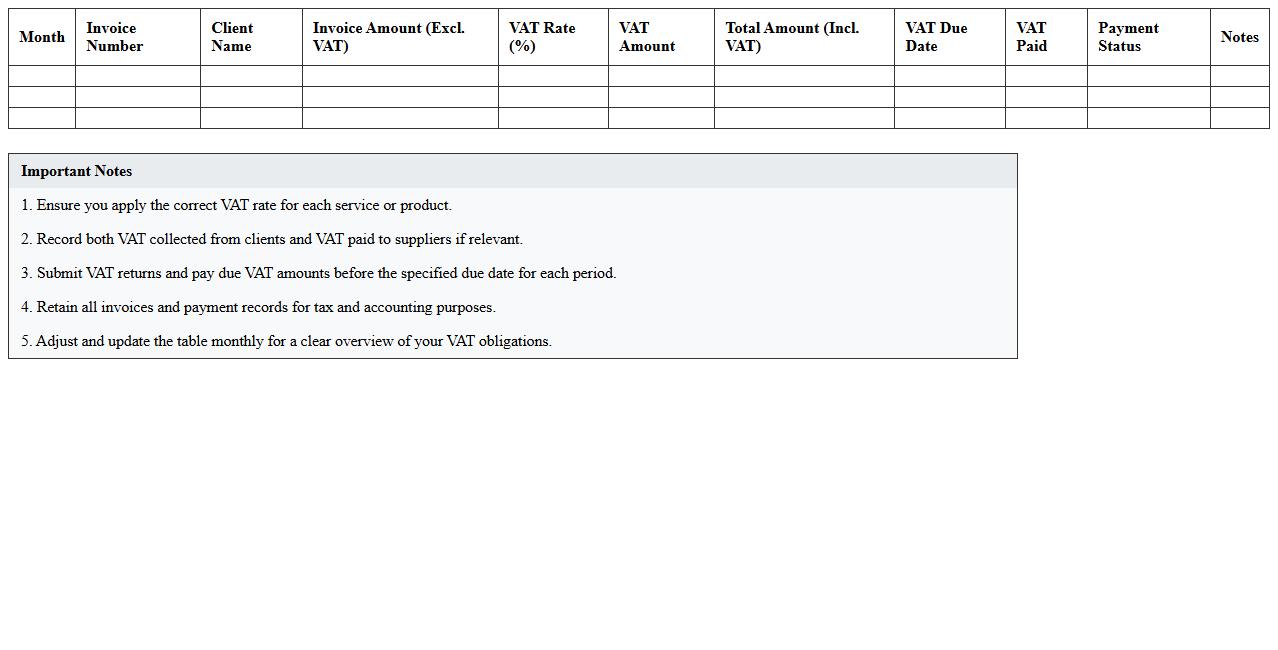

Monthly VAT Calculation Log for Solopreneurs

The

Monthly VAT Calculation Log for solopreneurs is a detailed record that tracks VAT collected and paid throughout the month to ensure accurate tax reporting and compliance. This document helps solopreneurs monitor their tax obligations, avoid penalties, and simplify the process of filing VAT returns by organizing all relevant financial data in one place. Maintaining this log supports better financial management and provides a clear audit trail for tax authorities.

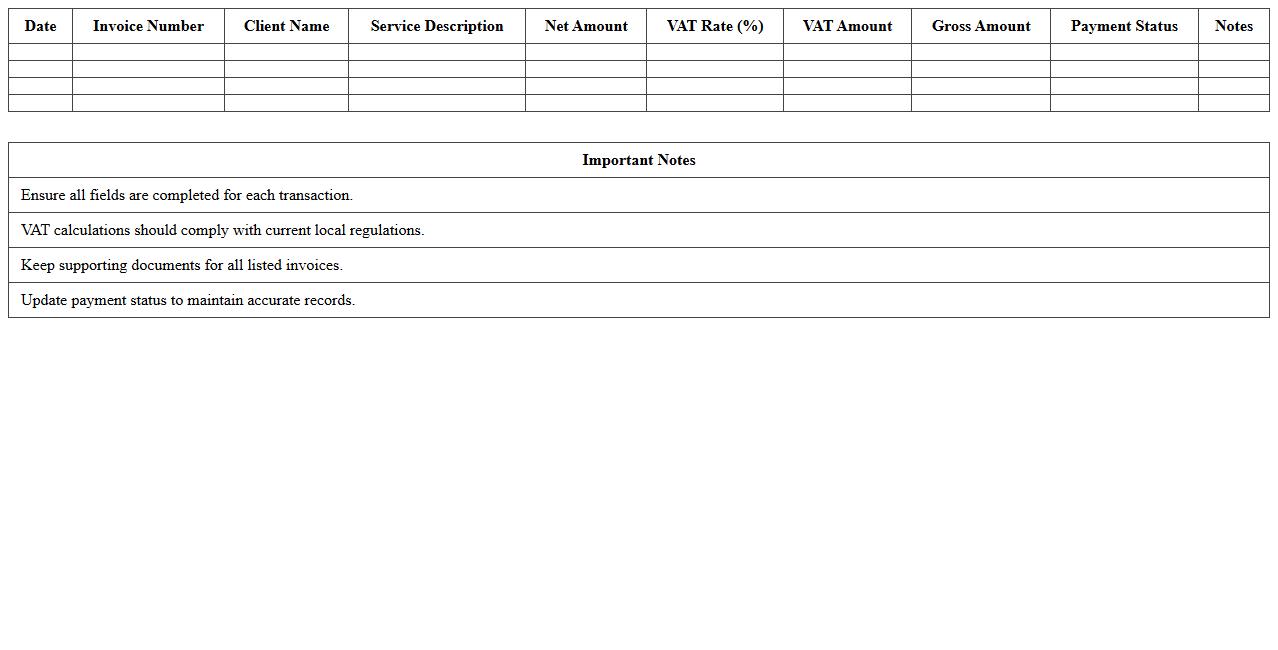

Detailed VAT Record Template for Consultants

A

Detailed VAT Record Template for Consultants is a structured document designed to systematically track all Value Added Tax transactions related to consulting services. It assists consultants in maintaining accurate financial records, ensuring compliance with tax regulations by capturing input tax, output tax, and VAT liabilities clearly. This template streamlines VAT reporting processes, reduces errors, and facilitates timely submission of tax returns, ultimately improving financial management and audit readiness.

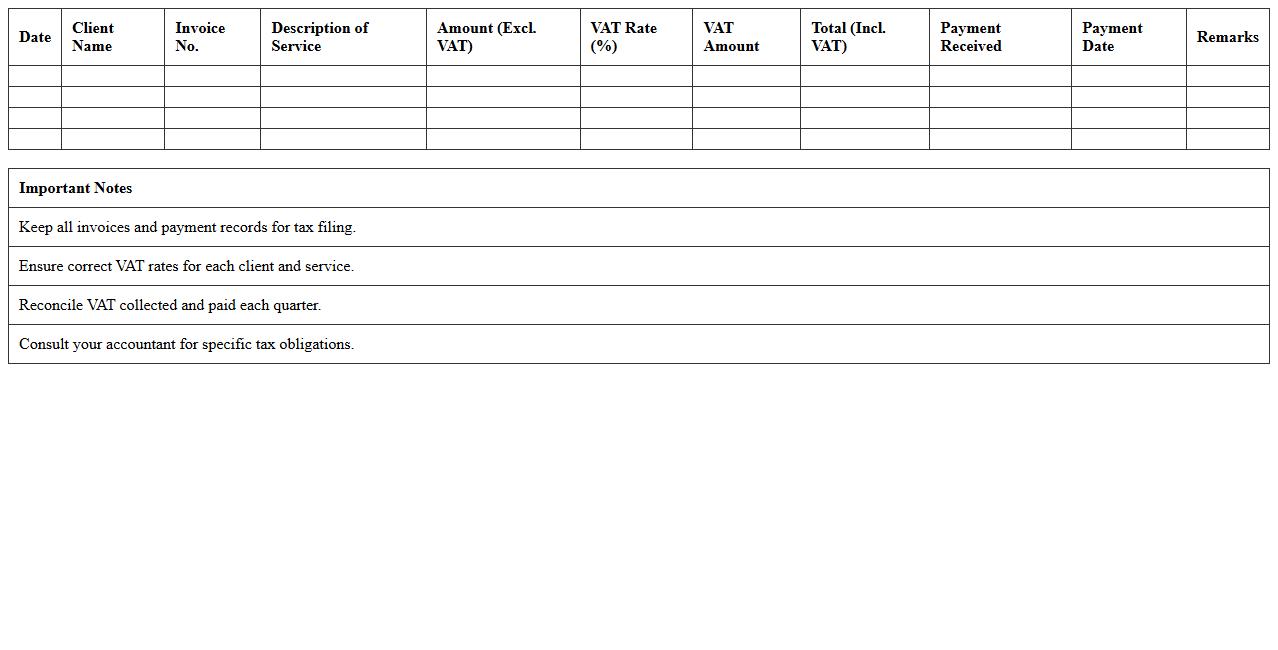

Freelance Income & VAT Management Worksheet

The

Freelance Income & VAT Management Worksheet is a specialized document designed to help freelancers systematically track their earnings alongside VAT obligations. It provides a clear overview of income streams, VAT collected, and payable amounts, ensuring accurate tax compliance and avoiding penalties. By organizing financial data efficiently, this worksheet aids in timely tax filings, better cash flow management, and financial planning.

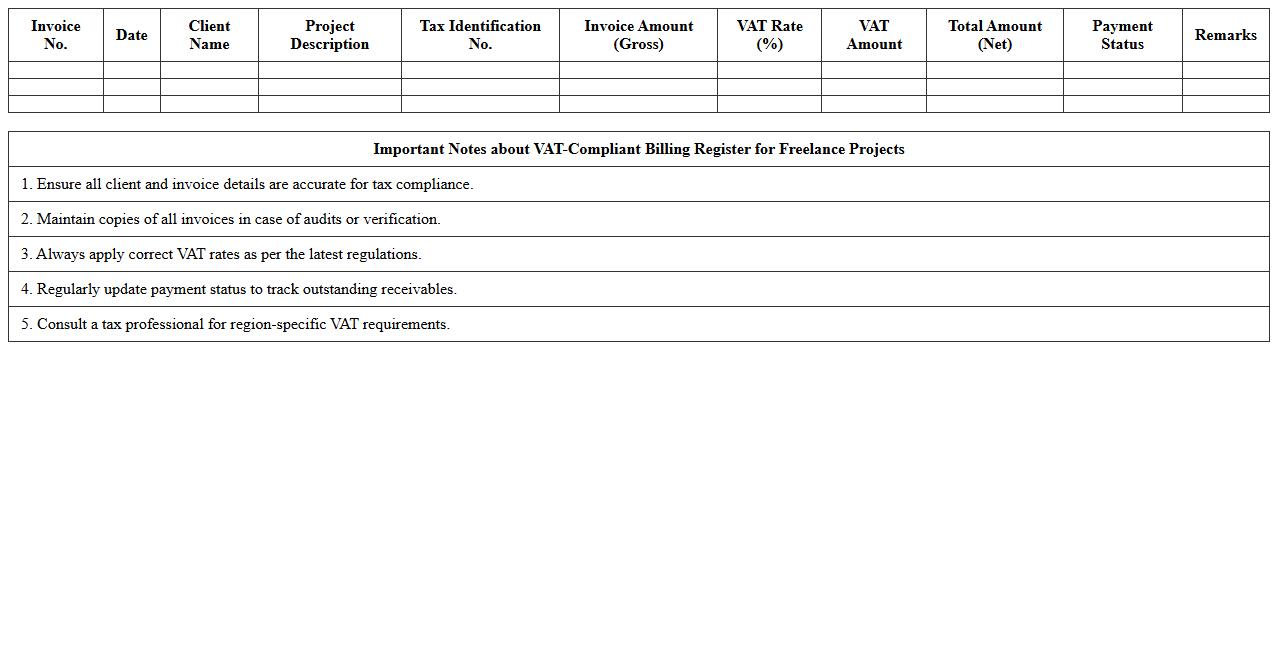

VAT-Compliant Billing Register for Freelance Projects

The

VAT-Compliant Billing Register for Freelance Projects is a detailed financial document that tracks all invoices and payments in accordance with VAT regulations, ensuring accurate tax reporting and compliance. It helps freelancers maintain transparent records, avoid tax penalties, and streamline the filing process by clearly documenting taxable transactions. This register is essential for managing VAT obligations effectively, improving financial accuracy and professional credibility in freelance business operations.

VAT Calculation and Payment Planner for Freelancers

The

VAT Calculation and Payment Planner for Freelancers document streamlines the process of tracking VAT liabilities by providing clear formulas and schedules tailored to freelancer income patterns. It helps ensure accurate VAT charges and timely payments, minimizing the risk of penalties and cash flow issues. This planner serves as an essential tool for efficient tax management and financial organization in freelance businesses.

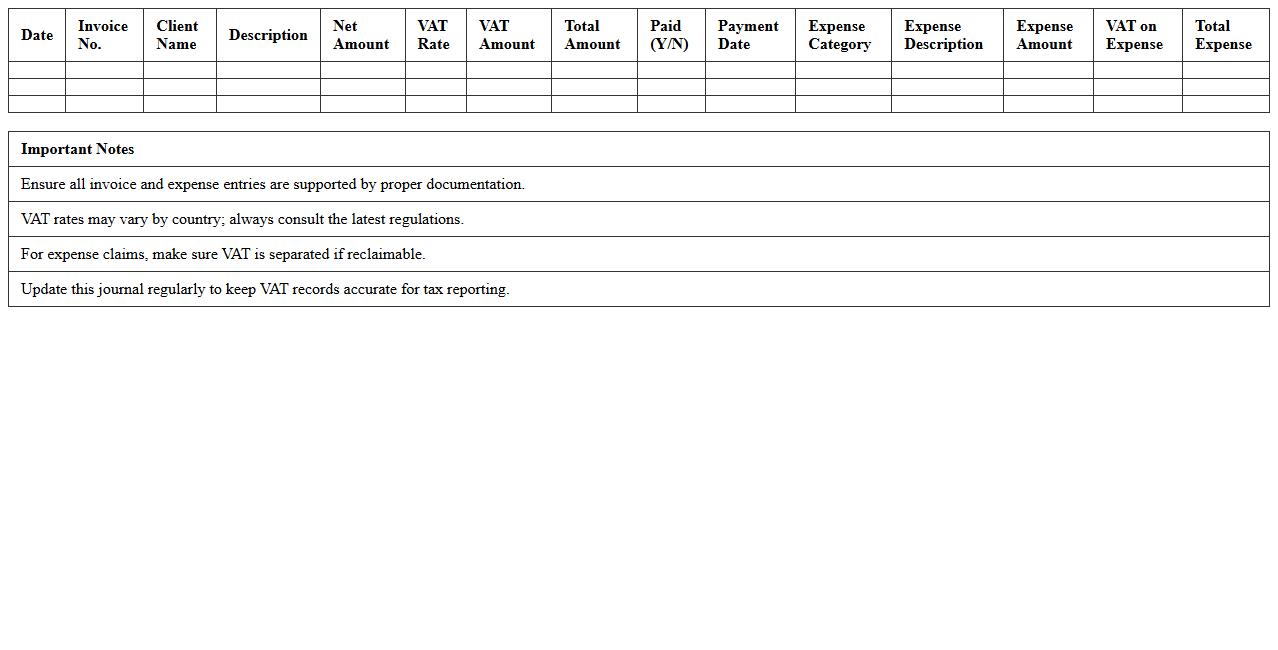

Freelance VAT Invoice & Expenses Journal Template

A

Freelance VAT Invoice & Expenses Journal Template is a structured document designed to help freelancers systematically record and manage their VAT invoices and related expenses. This template ensures accurate tracking of taxable sales and deductible costs, simplifying VAT calculations and compliance with tax authorities. By organizing financial data efficiently, it aids in timely VAT returns submission and improves overall financial management for freelance professionals.

How to automate reverse charge VAT in Excel for cross-border freelance invoices?

To automate reverse charge VAT in Excel, create a formula that identifies the client's country and applies the reverse charge rule when the country differs from yours. Use conditional functions like IF combined with country codes to flag invoices needing reverse charge application. Incorporate drop-down lists for client VAT status to streamline data entry and ensure compliance with cross-border VAT regulations.

Which Excel formulas best track varying VAT rates for multi-country freelance projects?

The VLOOKUP and INDEX-MATCH functions are ideal for tracking different VAT rates based on each country. Maintain a reference table of countries and their respective VAT rates, then use these formulas to dynamically retrieve the correct rate for each project. This approach allows seamless updating of rates and accurate VAT calculations across various jurisdictions.

How to create a VAT summary dashboard in Excel for quarterly freelancer tax filing?

Create a dashboard by summarizing VAT amounts using SUMIFS to aggregate input and output VAT based on invoice dates within each quarter. Use PIVOT TABLES to visualize VAT liabilities and credits, giving a clear overview for tax filing. Add slicers for filtering projects or clients, enhancing the dashboard's interactivity and providing detailed fiscal insights.

What is the template structure for separating input and output VAT in freelance services spreadsheets?

Design a spreadsheet with separate columns for input VAT (VAT paid on expenses) and output VAT (VAT charged on invoices). Include columns for invoice date, client country, VAT rate applied, and the net amount to ensure clarity in reporting. Structured separation helps accurately calculate VAT payable or reclaimable, simplifying tax reconciliation.

How to flag VAT-exempt clients in a freelancer's VAT calculation Excel sheet?

Use a dedicated column to mark clients as VAT-exempt by applying a dropdown list with options like 'Yes' or 'No'. Incorporate conditional formatting to highlight VAT-exempt rows, ensuring easy identification during VAT calculations. Adjust formulas to exclude these clients from VAT charges, maintaining compliance and accuracy in invoicing.

More Calculation Excel Templates